TIDMWPP

RNS Number : 3046I

WPP PLC

04 August 2023

4 August 2023

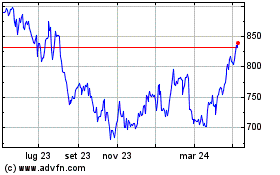

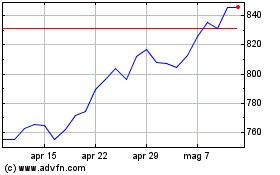

2023 Interim Results

Resilient performance with second quarter impacted by lower

revenues in the US from technology clients and delays in spend

on technology projects. Now expect 2023 LFL growth of 1.5-3.0%.

Margin guidance remains at around 15% at 2022 rates

Key figures

+/(-) % +/(-) %

GBPm H1 2023 reported(1) LFL(2) H1 2022

================================ ======= ============ ======= =======

Revenue 7,221 6.9 3.5 6,755

================================ ======= ============ ======= =======

Revenue less pass-through costs 5,811 5.5 2.0 5,509

================================ ======= ============ ======= =======

Reported:

================================ ======= ============ ======= =======

Operating profit 306 (43.2) - 539

================================ ======= ============ ======= =======

Profit before tax 204 (51.2) - 419

================================ ======= ============ ======= =======

Diluted EPS (p) 10.3 (54.6) - 22.7

================================ ======= ============ ======= =======

Dividends per share (p) 15.0 - - 15.0

================================ ======= ============ ======= =======

Headline(3) :

================================ ======= ============ ======= =======

Operating profit 666 4.3 2.7 639

================================ ======= ============ ======= =======

Operating profit margin 11.5 % (0.1pt*) 0.1 pt* 11.6 %

================================ ======= ============ ======= =======

Profit before tax 546 (2.9) - 562

================================ ======= ============ ======= =======

Diluted EPS 33.1p 0.3 - 33.0 p

================================ ======= ============ ======= =======

* Margin points

H1 and Q2 financial highlights

-- H1 reported revenue +6.9%, LFL revenue +3.5% (Q2 +2.3%)

-- H1 revenue less pass-through costs +5.5%, LFL revenue less

pass-through costs +2.0% (Q2 +1.3%)

-- In Q2, ex-US growth accelerated to mid-single digits, with

China growing albeit less strongly than expected. North America

declined in Q2, primarily due to lower revenues from technology

clients

-- H1 headline operating profit margin 11.5%, down 0.1pt, and on

a constant FX basis improved by 0.1pt. Efficiency benefits offset

by investment in IT and higher severance costs

-- Trade working capital favourable movement of GBP165m

year-on-year. Non-trade working capital adverse movement of

GBP316m

-- Adjusted net debt at 30 June 2023 GBP3.5bn, up GBP0.3bn

year-on-year, GBP0.4bn lower than Q1 2023. Expect year end net debt

to be flat year-on-year

Performance, strategic progress and outlook

-- Global Integrated Agencies H1 LFL revenue less pass-through

costs growth +2.2% (Q2 +1.5%): within which GroupM, our media

planning and buying business +6.1% (Q2 +6.1%), partially offset by

a 0.8% LFL decline at other Global Integrated Agencies (Q2

-2.3%)

-- Solid new business performance: $2.0bn net new billings in H1

with the pipeline of potential new business larger than at the same

point in 2022

-- Acquisitions of Goat and Obviously in the fast-growth area of

influencer marketing and an investment in Majority, a diversity-led

creative agency

-- Transformation programme on track to deliver at least GBP450m

of annual savings this year over a 2019 base

-- Planned review of our property portfolio resulting in a

consolidation of our office space with an impairment charge for the

full year of approximately GBP220m which is largely non-cash (H1

2023: GBP180m)

-- 2023 interim dividend of 15.0p declared (2022: 15.0p)

-- Full year 2023 LFL growth of 1.5-3.0% (previously 3-5%); FY

2023 headline operating profit margin around 15.0% (excluding the

impact of FX)

Mark Read, Chief Executive Officer of WPP, said:

"Our performance in the first half has been resilient with Q2

growth accelerating in all regions except the USA, which was

impacted in the second quarter by lower spending from technology

clients and some delays in technology-related projects. This was

felt primarily in our integrated creative agencies. China returned

to growth in the second quarter albeit more slowly than expected.

In the near term, we expect the pattern of activity in the first

half to continue into the second half of the year.

"Our media business, GroupM, grew consistently across the first

six months as did our businesses in the UK, Europe, Latin America

and Asia-Pacific. Client spending in consumer packaged goods,

financial services and healthcare remained good and, despite

short-term challenges, our technology clients represent an

important driver of long-term growth. Our agencies performed

extremely well at the Cannes Lions Festival winning five Grand Prix

and 165 Lions with Mindshare recognised as the most-awarded media

agency. We won major new business assignments with clients

including: Reckitt, Mondelēz, easyJet, Lloyds Banking Group, Pernod

Ricard and India's second largest advertiser, Maruti Suzuki.

"We have exciting future plans in AI that build on our

acquisition of Satalia in 2021 and our use of AI across WPP. We are

leveraging our efforts with partnerships with the leading players

including Adobe, Google, IBM, Microsoft, Nvidia and OpenAI. We are

delivering work powered by AI for many clients including Nestlé,

Nike and Mondelēz. AI will be fundamental to WPP's future success

and we are committed to embracing it to drive long-term growth and

value."

This announcement contains information that qualifies or may

qualify as inside information. The person responsible for arranging

the release of this announcement on behalf of WPP plc is Balbir

Kelly-Bisla, Company Secretary.

For further information:

Investors and analysts

Tom Waldron +44 7788 695864

Anthony Hamilton +44 7464 532903

Caitlin Holt +44 7392 280178

irteam@wpp.com

Media

Chris Wade +44 20 7282 4600

Richard Oldworth +44 7710 130 634

Buchanan Communications +44 20 7466 5000

wpp.com/investors

(1) Percentage change in reported sterling.

(2) Like-for-like. LFL comparisons are calculated as follows:

current year, constant currency actual results (which include

acquisitions from the relevant date of completion) are compared

with prior year, constant currency actual results from continuing

operations, adjusted to include the results of acquisitions and

disposals for the commensurate period in the prior year. Both

periods exclude results from Russia.

(3) In this press release not all of the figures and ratios used

are readily available from the unaudited interim results included

in Appendix 1. Management believes these non-GAAP measures,

including constant currency and like-for-like growth, revenue less

pass-through costs and headline profit measures, are both useful

and necessary to better understand the Group's results. Where

required, details of how these have been arrived at are shown in

Appendix 2.

First half overview

First half revenue was GBP7.2bn, up 6.9% from GBP6.8bn in H1

2022, and up 3.5% like-for-like. Revenue less pass-through costs

was GBP5.8bn, up 5.5% from GBP5.5bn in H1 2022, and up 2.0%

like-for-like.

Q2 2023 % % % %

GBPm reported M&A FX LFL

-------------------------- ------- --------- ---- ------------- ----

Revenue 3,761 2.7 1.1 (0.7) 2.3

-------------------------- ------- --------- ---- ------------- ----

Revenue less pass-through

costs 2,982 1.6 0.9 (0.6) 1.3

-------------------------- ------- --------- ---- ------------- ----

H1 2023 % % % %

GBPm reported M&A FX LFL

-------------------------- ------- --------- ---- --- ----

Revenue 7,221 6.9 0.9 2.5 3.5

-------------------------- ------- --------- ---- --- ----

Revenue less pass-through

costs 5,811 5.5 0.9 2.6 2.0

-------------------------- ------- --------- ---- --- ----

Business segment review (4)

Business segments - revenue less pass-through costs

Global Public Relations Specialist Agencies

% LFL +/(-) Integrated Agencies

------------ -------------------- ---------------- -------------------

Q2 2023 1.5 2.0 (1.6)

------------ -------------------- ---------------- -------------------

H1 2023 2.2 2.1 0.2

------------ -------------------- ---------------- -------------------

Global Integrated Agencies : GroupM, our media planning and

buying business, grew consistently during the half and across all

regions, benefiting from continued client investment in media, with

like-for-like growth in revenue less pass-through costs of +6.1%

(Q2 +6.1%), partially offset by a 0.8% LFL decline at other Global

Integrated Agencies (Q2 -2.3%).

Ogilvy grew well, supported by recent new business wins

including Verizon and SC Johnson. Hogarth, our creative production

agency, continued to deliver good growth as it expands its

collaboration with other WPP agencies.

Other Global Integrated Agencies, Wunderman Thompson, VMLY&R

and AKQA Group, felt the greatest impact from reduced spend across

the technology sector and delays in technology-related projects. As

anticipated, revenue less pass-through costs in the retail sector

was impacted by known 2022 client losses.

Revenue less pass-through costs from our offer in experience,

commerce and technology was around 39% of our Global Integrated

Agencies, excluding GroupM, compared to around 35% in 2019 and

unchanged from H1 2022, impacted by the previously referenced

delays in technology-related projects. Our digital billings mix

within GroupM increased to 49%, compared to 48% in FY 2022.

Public Relations : FGS Global continued to grow strongly in the

first half. H+K Strategies delivered solid growth, lapping

double-digit growth in the first half 2022. BCW saw a small decline

in revenue less pass-through costs in the first half.

Specialist Agencies : good growth in design agency Landor &

Fitch, and our specialist healthcare media planning and buying

agency, CMI Media Group, was offset by declines at smaller agencies

affected by delays in client projects.

Regional review

Regional segments - revenue less pass-through costs

Western Continental

% LFL +/(-) North America United Kingdom Europe Rest of World

------------ ------------- -------------- ------------------- -------------

Q2 2023 (4.1) 9.0 3.9 4.3

------------ ------------- -------------- ------------------- -------------

H1 2023 (1.2) 8.2 3.7 3.1

------------ ------------- -------------- ------------------- -------------

North America declined by 1.2% in the first half reflecting the

lower revenues from technology clients, which predominantly

impacted our integrated creative agencies, and the expected impact

of 2022 client losses in the retail sector. This was partially

offset by growth in spending from consumer packaged goods,

healthcare and financial services. GroupM continued to grow well in

the region.

The United Kingdom grew strongly led by GroupM. CPG and

healthcare were the strongest client sectors. In Western

Continental Europe, strong performances in Germany and Spain offset

declines in France due to client losses.

The Rest of World saw good growth in the half. China grew 4.8%

in the second quarter, as that market continued to recover from

Covid-related impacts, albeit at a slower pace than anticipated.

India moved into growth in Q2 against a strong comparative of 48%

growth in Q2 2022.

Top five markets - revenue less pass-through costs

% LFL +/(-) USA UK Germany China India

------------ ----- --- ------- ----- -----

Q2 2023 (4.5) 9.0 6.6 4.8 2.5

------------ ----- --- ------- ----- -----

H1 2023 (1.2) 8.2 5.4 (4.0) 0.8

------------ ----- --- ------- ----- -----

Client sector review

Client sector - revenue less pass-through costs

H1 2023 % share % growth +/(-)

--------------------------------------- ------- --------------

CPG 26.1 15.1

--------------------------------------- ------- --------------

Tech & Digital Services 17.8 (4.9)

--------------------------------------- ------- --------------

Healthcare & Pharma 12.5 4.2

--------------------------------------- ------- --------------

Automotive 10.2 (0.2)

--------------------------------------- ------- --------------

Retail 9.5 (7.9)

--------------------------------------- ------- --------------

Telecom, Media & Entertainment 6.2 (1.4)

--------------------------------------- ------- --------------

Financial Services 6.1 10.0

--------------------------------------- ------- --------------

Other 5.5 (0.3)

--------------------------------------- ------- --------------

Travel & Leisure 3.6 8.9

--------------------------------------- ------- --------------

Government, Public Sector & Non-profit 2.5 3.6

--------------------------------------- ------- --------------

Strategic progress

There have never been more opportunities for advertisers to

reach consumers, reflected in the plethora of marketing channels

available. In this increasingly complex world, WPP's unique

position and offer is more relevant than ever. Our clients continue

to invest in their brands and seek our support as they navigate

this complexity.

Clients: We have won $2.0bn of net new business billings in the

first half (H1 2022: $3.4bn) including the potential loss of

certain Pfizer assignments currently held by WPP integrated

creative agencies. Key assignment wins included Maruti Suzuki

(media), Pernod Ricard (creative), Reckitt (media), Beko

(creative), and Costa Coffee (PR).

Our Vantage global client satisfaction survey has shown the key

measure of "Likely To Recommend" has remained at all-time high

levels with an increase in scores related to world-class

creativity.

Creativity and awards : Creativity is at the heart of our offer,

and we continue to be recognised for our creative excellence. WPP

had another successful year at Cannes Lions International Festival

of Creativity, winning a total of 165 Lions including one Titanium

Lion, five Grand Prix, and 24 Gold awards. Mindshare was also named

Media Network of the Year.

Earlier in the year, WARC named WPP the top company in all three

of their rankings, the Creative 100, Effective 100 and Media 100

lists. Ogilvy ranked as the top network of the year in both the

Creative 100 and Effective 100 while EssenceMediacom took first

place in the Media 100. In addition, the Effie Awards named WPP the

most effective communication company in the world, with Ogilvy

placing first in the most effective agency network rankings.

Investment for growth: We have invested in strategically

important areas and growth markets. We acquired Goat, a

London-based, data-driven influencer marketing agency; Obviously, a

New York-based, technology-led influencer marketing agency; 3K

Communication, a Frankfurt-based healthcare PR agency; and amp, one

of the world's leading sonic branding companies. We also made a

minority investment in Majority, a diversity-focused US creative

agency.

In July, KKR completed their minority investment to become a 29%

shareholder in FGS Global, after acquiring all of Golden Gate

Capital's equity and a proportion of the interests of WPP and FGS

Global management. WPP remains the majority owner at 51%. The

transaction valued FGS Global at $1.425bn.

We have invested organically in new technology platforms to

provide a future-facing offer to clients and innovate for the

medium term. The main areas of investment are in Choreograph, our

data company, and WPP Open, our AI-powered technology platform.

We believe that AI will be fundamental to WPP's business and are

excited by its transformational potential. Our expertise in the

application of AI to marketing is based on investments that we have

been making over many years, including the appointment of a Head of

Creative AI in 2019 and the acquisition of Satalia in 2021.

AI is used extensively across our business today, particularly

in GroupM and in Hogarth, our creative production business. Our

application of AI includes automation of workflows, speeding up the

process of ideation and concepting, and producing innovative

creative work for clients. An example is our work for Cadbury's in

India which used AI to allow Bollywood superstar Shah Rukh Khan to

produce personalised ads for local businesses which won a Titanium

Lion for Creativity at the 2022 Cannes Lions festival and won again

at the festival in 2023, securing a Grand Prix for Creative

Effectiveness.

We are working with technology from all the main AI companies,

including Adobe, Google, IBM, Microsoft, Nvidia, and OpenAI, with

dedicated enterprise platforms, proprietary to WPP, to deliver work

to clients that protects their information. We recognise the

challenges of AI to society and have implemented legal and ethical

guidelines to help us responsibly deploy this technology.

In May, WPP and Nvidia announced plans to develop a content

engine that harnesses NVIDIA Omniverse(TM) and AI to enable

creative teams to produce high-quality commercial content faster,

more efficiently and at scale while staying fully aligned with a

client's brand.

The new engine connects an ecosystem of 3D design, manufacturing

and creative supply chain tools, including those from Adobe and

Getty Images, letting WPP's artists and designers integrate 3D

content creation with generative AI. This enables our clients to

reach consumers in highly personalised and engaging ways, while

preserving the quality, accuracy and fidelity of their company's

brand identity, products and logos.

T alent : Our success is driven by our exceptional talent. We

have continued to invest to attract, engage and develop the best

talent in our industry. In May, we hired Corey duBrowa, one of the

industry's most highly regarded communications leaders, as Chief

Executive of BCW.

We have invested in education and training, including through

our Future Readiness Academies, a bespoke global learning programme

available to everyone across WPP. We also launched the second

cohort of our Creative Technology Apprenticeship, a nine-month

intensive programme where apprentices learn creative technology

skills using the latest software and hardware to prepare them for a

career in today's creative technology field. In addition, we

sponsored a cohort of WPP leaders through a Postgraduate Diploma in

AI for Business at Oxford University's Sa d Business School, with

28 senior executives graduating earlier this year.

Transformation: We are making progress on our transformation

plan which we set out in December 2020, designed to achieve GBP600m

in gross annual cost efficiencies by 2025. We are on target to

achieve our annual run-rate of GBP450m in efficiencies this year,

against a 2019 baseline.

We opened five new campuses, in Atlanta, Austin, Guangzhou,

Manchester and Paris, in the half, taking the total to 38 campuses.

By the end of the year, we intend to open two further campuses and

will accommodate around 60,000 of our people in campus

buildings.

A review of our property portfolio has led to ongoing actions

including the further consolidation of our operations in campuses

across the US, in New York and other cities.

Purpose and ESG

WPP's purpose is to use the power of creativity to build better

futures for our people, planet, clients and communities. During the

first six months of the year we have made good progress in

fulfilling our commitments in each pillar of our purpose

statement.

People : We are committed to our $30m pledge, set out in June

2020, to fund inclusion programmes within WPP and to support

external organisations, as part of our Racial Equity Programme. WPP

agencies globally apply to receive resources to create and run

impactful programmes to advance racial equity. During the quarter,

the programme received applications for its fourth round of

funding.

Planet: In 2021, we announced our commitment to reduce carbon

emissions from our own operations to net zero by 2025 and across

our supply chain by 2030. Our net zero pledges are backed by

science-based reduction targets, which have been verified by the

Science-Based Targets initiative. We have committed to reducing our

absolute Scope 1 and 2 emissions by at least 84% by 2025 and reduce

Scope 3 emissions by at least 50% by 2030, both from a 2019 base

year.

In April, our 2022 Sustainability Report reported that we have

delivered a reduction in Scope 1 and 2 emissions of 71% in absolute

terms since our 2019 baseline.

WPP maintained a low risk rating in the 2023 Sustainalytics risk

rating, which scores the ESG performance of companies. WPP has the

lowest risk rating of its peer group and saw an improvement in its

score from 12.1 in 2022 to 10.6 in 2023.

Clients: We are proud to enable our clients in their own

sustainability journeys and ensure client work is inclusive and

accessible. At the Cannes Lions Festival of Creativity 2023 we were

recognised for our purpose-driven client work including a Titanium

Lion for Corona's Extra Lime campaign in which Corona partnered

with local governments to equip and educate farmers to expand their

lime yield, and a Grand Prix for Dove's #TurnYourBack campaign

which raised awareness of the harmful impact of toxic beauty

content.

Communities: We make a positive contribution to the communities

in which we live and work. WPP collaborated with The One Club for

Creativity to introduce ONE School UK, a free intensive portfolio

programme spanning 16 weeks, aiming to provide opportunities for

promising Black creatives based in the UK. Funded by WPP's Racial

Equity Programme, the virtual ONE School UK welcomed its inaugural

cohort in March 2023.

Outlook

We are updating our guidance for 2023 as follows:

Like-for-like revenue less pass-through costs growth of 1.5-3.0%

for FY 2023 (previously 3-5%); guidance for FY 2023 headline operating

margin of around 15% (excluding the impact of FX) maintained

Other 2023 financial guidance:

-- Mergers and acquisitions will add 0.5-1.0% to revenue less pass-through costs growth

-- FX impact: current rates (at 31 July 2023) imply a c.2.0%

drag on FY 2023 revenues less pass-through costs and a c.0.25pt

drag on FY 2023 headline operating margin

-- Headline income from associates is expected to be around 40m (5)

-- Effective tax rate (measured as headline tax as a % of

headline profit before tax) of around 27%

-- Capex of around GBP250m (previously GBP300m)

-- Restructuring and property costs of around GBP400m,

consisting of costs of GBP180m detailed in prior guidance with the

addition of GBP220m of cost relating to the 2023 property review

(of which GBP200m is non-cash)

-- Trade working capital expected to be broadly flat

year-on-year, with operational improvement offsetting increased

client focus on cash management

-- Non-trade working capital expected to be an outflow of GBP150m

-- Average adjusted net debt/headline EBITDA within the range of 1.5x-1.75x

-- Year-end adjusted net debt flat year-on-year

Medium-term guidance

We remain confident in our ability to deliver annual revenue

less pass-through costs growth of 3-4% and headline operating

profit margin of 15.5-16%, as a result of the actions we have taken

to broaden and strengthen our services, to increase our exposure to

attractive industry segments and to leverage our global scale.

Financial results

Unaudited headline income statement(6) :

Six months ended (GBPm) 30 June 30 June +/(-) % +/(-) %

2023 2022 reported LFL

------------------------------------ ------- ------- --------- -------

Revenue 7,221 6,755 6.9 3.5

------------------------------------ ------- ------- --------- -------

Revenue less pass-through

costs 5,811 5,509 5.5 2.0

------------------------------------ ------- ------- --------- -------

Operating profit 666 639 4.3 2.7

------------------------------------ ------- ------- --------- -------

Operating profit margin

% 11.5% 11.6% (0.1pt*) 0.1 pt*

------------------------------------ ------- ------- --------- -------

Income from associates 8 12 (38.2)

------------------------------------ ------- ------- --------- -------

PBIT 674 651 3.5

------------------------------------ ------- ------- --------- -------

Net finance costs (128) (89) (43.5)

------------------------------------ ------- ------- --------- -------

Profit before tax 546 562 (2.9)

------------------------------------ ------- ------- --------- -------

Tax (148) (143) (3.1)

------------------------------------ ------- ------- --------- -------

Profit after tax 398 419 (5.0)

------------------------------------ ------- ------- --------- -------

Non-controlling interests (37) (43) 13.7

------------------------------------ ------- ------- --------- -------

Profit attributable to shareholders 361 376 (4.0)

------------------------------------ ------- ------- --------- -------

Diluted EPS 33.1p 33.0p 0.3

------------------------------------ ------- ------- --------- -------

*margin points

Reconciliation of profit before tax to headline operating

profit:

Six months ended (GBPm) 30 June 30 June

2023 2022

=================================================== ======= =======

Profit before taxation 204 419

=================================================== ======= =======

Finance and investment income (102) (56)

=================================================== ======= =======

Finance costs 231 145

=================================================== ======= =======

Revaluation and retranslation of financial

instruments (26) (33)

=================================================== ======= =======

Profit before interest and taxation 307 475

=================================================== ======= =======

(Earnings)/loss from associates - after interest

and tax (1) 64

=================================================== ======= =======

Operating profit 306 539

=================================================== ======= =======

Goodwill impairment 53 -

=================================================== ======= =======

Amortisation and impairment of acquired intangible

assets 36 31

=================================================== ======= =======

Investment and other impairment charges 11 -

=================================================== ======= =======

Losses on disposal of investments and subsidiaries 3 48

=================================================== ======= =======

Gains on remeasurement of equity interests

arising from a change in scope of ownership - (60)

=================================================== ======= =======

Litigation settlement (10) -

=================================================== ======= =======

Restructuring and transformation costs 87 81

=================================================== ======= =======

Property related costs 180 -

=================================================== ======= =======

Headline operating profit 666 639

=================================================== ======= =======

Business sector review(7)

Revenue analysis

Q2 H1

===================== ========================== ==========================

GBPm +/(-) +/(-) GBPm +/(-) +/(-)

% reported % LFL % reported % LFL

===================== ===== =========== ====== ===== =========== ======

Global Int. Agencies 3,211 3.3 2.9 6,107 7.2 4.0

===================== ===== =========== ====== ===== =========== ======

Public Relations 311 2.2 1.7 618 7.6 2.7

===================== ===== =========== ====== ===== =========== ======

Specialist Agencies 239 (4.7) (4.6) 496 3.0 (1.3)

===================== ===== =========== ====== ===== =========== ======

Total Group 3,761 2.7 2.3 7,221 6.9 3.5

===================== ===== =========== ====== ===== =========== ======

Revenue less pass-through costs analysis

Q2 H1

===================== ========================== ==========================

GBPm +/(-) +/(-) GBPm +/(-) +/(-)

% reported % LFL % reported % LFL

===================== ===== =========== ====== ===== =========== ======

Global Int. Agencies 2,474 1.8 1.5 4,782 5.4 2.2

===================== ===== =========== ====== ===== =========== ======

Public Relations 292 2.3 2.0 584 6.7 2.1

===================== ===== =========== ====== ===== =========== ======

Specialist Agencies 216 (1.8) (1.6) 445 4.5 0.2

===================== ===== =========== ====== ===== =========== ======

Total Group 2,982 1.6 1.3 5,811 5.5 2.0

===================== ===== =========== ====== ===== =========== ======

Headline operating profit analysis

GBPm 2023 % margin* 2022 % margin*

--------------------- ---- --------- ---- ---------

Global Int. Agencies 540 11.3 507 11.2

--------------------- ---- --------- ---- ---------

Public Relations 88 15.0 83 15.2

--------------------- ---- --------- ---- ---------

Specialist Agencies 38 8.6 49 11.4

--------------------- ---- --------- ---- ---------

Total Group 666 11.5 639 11.6

* Headline operating profit as a percentage of revenue less

pass-through costs

Regional review

Revenue analysis

Q2 H1

================== ======================== =======================

GBPm % reported % GBPm % reported %

LFL LFL

================== ===== ========== ===== ===== ========== ====

N. America 1,376 (1.6) (2.1) 2,744 6.1 0.4

================== ===== ========== ===== ===== ========== ====

United Kingdom 567 14.6 12.7 1,065 11.3 10.4

================== ===== ========== ===== ===== ========== ====

W Cont. Europe 781 6.8 4.3 1,477 9.3 5.0

================== ===== ========== ===== ===== ========== ====

AP, LA, AME, CEE* 1,037 (0.2) 2.3 1,935 4.0 3.6

================== ===== ========== ===== ===== ========== ====

Total Group 3,761 2.7 2.3 7,221 6.9 3.5

* Asia Pacific, Latin America, Africa & Middle East and

Central & Eastern Europe

Revenue less pass-through costs analysis

Q2 H1

================= ======================== ========================

GBPm % reported % GBPm % reported %

LFL LFL

================= ===== ========== ===== ===== ========== =====

N. America 1,134 (3.3) (4.1) 2,284 4.4 (1.2)

================= ===== ========== ===== ===== ========== =====

United Kingdom 419 9.0 9.0 796 8.0 8.2

================= ===== ========== ===== ===== ========== =====

W Cont. Europe 621 7.3 3.9 1,179 8.5 3.7

================= ===== ========== ===== ===== ========== =====

AP, LA, AME, CEE 808 1.2 4.3 1,552 3.6 3.1

================= ===== ========== ===== ===== ========== =====

Total Group 2,982 1.6 1.3 5,811 5.5 2.0

Headline operating profit analysis

GBPm 2023 % margin* 2022 % margin*

--------------- ---- --------- ---- ---------

N. America 287 12.6 300 13.7

--------------- ---- --------- ---- ---------

United Kingdom 98 12.3 67 9.1

--------------- ---- --------- ---- ---------

W Cont. Europe 111 9.4 99 9.1

--------------- ---- --------- ---- ---------

AP, LA, AME,

CEE 170 11.0 173 11.6

--------------- ---- --------- ---- ---------

Total Group 666 11.5 639 11.6

* Headline operating profit as a percentage of revenue less

pass-through costs

Operating profitability

Reported profit before tax was GBP204m, compared to GBP419m in

the prior period, principally reflecting the impairment taken as a

result of the 2023 property review.

Reported profit after tax was GBP149m compared to GBP301m in the

prior period.

Headline EBITDA (including IFRS 16 depreciation) for the first

half was up 2.9% to GBP767m. Headline operating profit was up 4.3%

to GBP666m.

Headline operating profit margin was down 10 basis points to

11.5% and up 10 basis points year on year on a constant currency

basis. Total operating costs were up 5.7% to GBP5.1bn. Staff costs,

excluding incentives, were up 5.4% year-on-year to GBP4.0bn,

including severance costs of GBP40m (H1 2022: GBP17m), partially

offset by good control over our freelance spend. Severance costs

increased as we aligned headcount to market conditions. Incentive

costs were GBP172m, compared to GBP164m in the first half of

2022.

Establishment costs were up 3.6% at GBP272m while IT costs were

up 13.6% at GBP350m, reflecting investment in our IT

infrastructure, cyber security and a move to cloud computing.

Personal costs rose 16.3% to GBP112m, reflecting higher

client-related business travel, and other operating expenses were

down 1.0% at GBP270m.

On a like-for-like basis, the average number of people in the

Group in the first half was 115,000 compared to 113,000 in the

first half of 2022. The total number of people as at 30 June 2023

was 114,000 compared to 115,000 as at 30 June 2022.

Adjusting items

The Group incurred GBP360m of adjusting items in the first half

of 2023, mainly relating to restructuring and transformation costs

and property and goodwill impairments. This compares with net

adjusting items in the first half of 2022 of GBP100m.

Restructuring costs related to IT and other transformation were

GBP87m in the first half of 2023 (H1 2022: GBP81m), in line with

expectations and as guided. Charges related to the 2023 property

review were GBP180m and relate to lease impairments, primarily in

the US, all of which are non-cash. For the full year 2023 we expect

adjusting items of around GBP400m, consisting of GBP180m detailed

in prior guidance with the addition of GBP220m of charges relating

to the 2023 property review (of which GBP200m is non-cash).

Goodwill impairment, amortisation of acquired intangibles and

investment write-downs were GBP101m in the first half (H1 2022:

GBP31m) .

Interest and taxes

Net finance costs (excluding the revaluation of financial

instruments) were GBP128m, an increase of GBP39m year-on-year, due

to higher levels of debt and lower investment income partially

offset by higher interest earned on cash.

The headline tax rate (based on headline profit before tax) was

27.0% (2022: 25.5%) and on reported profit before tax was 26.9%

(2022: 28.1%). The increase in the headline tax rate is driven by

changes in tax rates or tax bases in the markets in which we

operate. Given the Group's geographic mix of profits and the

changing international tax environment, the tax rate is expected to

increase over the next few years.

Earnings and dividend

Reported profit before tax was down 51.2% to GBP204m. Headline

profit before tax was down 2.9% to GBP546m.

Profits attributable to share owners were GBP112m, compared to a

profit of GBP258m in the prior period.

Headline diluted earnings per share from continuing operations

rose by 0.3% to 33.1p. Reported diluted earnings per share, on the

same basis, was 10.3p, compared to 22.7p in the prior period.

For 2023, the Board is declaring an interim dividend of 15.0p

(2022: 15.0p). The record date for the interim dividend is 13

October 2023, and the dividend will be payable on 3 November

2023.

Further details of WPP's financial performance are provided in

Appendix 1.

Cash flow highlights

Six months ended (GBP million) 30 June 30 June

2023 2022

======================================= ======= =======

Operating profit 306 539

======================================= ======= =======

Depreciation and amortisation 259 255

======================================= ======= =======

Impairments and investment write-downs 204 8

======================================= ======= =======

Lease payments (inc interest) (184) (190)

======================================= ======= =======

Non-cash compensation 76 67

======================================= ======= =======

Net interest paid (47) (60)

======================================= ======= =======

Tax paid (171) (163)

======================================= ======= =======

Capex (104) (117)

======================================= ======= =======

Earnout payments (12) (63)

======================================= ======= =======

Other (37) (9)

======================================= ======= =======

Trade working capital (522) (1,015)

======================================= ======= =======

Other receivables, payables

and provisions (523) (726)

======================================= ======= =======

Adjusted free cash flow (755) (1,474)

======================================= ======= =======

Disposal proceeds 14 34

======================================= ======= =======

Net initial acquisition payments (203) (46)

======================================= ======= =======

Share purchases (37) (681)

======================================= ======= =======

Net cash flow (981) (2,167)

Net cash outflow for the first half was GBP1.0bn, compared to

GBP2.2bn in the first half of 2022. The main drivers of the cash

flow performance year-on-year were lower reported operating profit

and higher consideration for acquisitions offset by a continued

focus on working capital management and lower share purchases. A

summary of the Group's unaudited cash flow statement and notes for

the six months to 30 June 2023 is provided in Appendix 1.

Balance sheet highlights

As at 30 June 2023 we had cash and cash equivalents of GBP1.5bn

(H1 2022: GBP1.5bn) and total liquidity, including undrawn credit

facilities, of GBP3.6bn. Average adjusted net

debt(8) in the first half was GBP3.6bn, compared to GBP2.6bn in

the prior period, at 2023 exchange rates. On 30 June 2023 adjusted

net debt was GBP3.5bn, against GBP3.1bn on 30 June 2022, an

increase of GBP0.3bn on reported basis and at 2023 exchange

rates.

We spent GBP37m on share purchases in the first half of the year

to offset dilution from share-based payments.

Our bond portfolio at 30 June 2023 had an average maturity of

5.8 years.

In May 2023, we refinanced the November 2023 EUR750m bond as

planned, issuing a May 2028 EUR750m bond priced at 4.125%.

The average adjusted net debt to EBITDA ratio in the 12 months

to 30 June 2023 is 1.68x, which excludes the impact of IFRS 16.

A summary of the Group's unaudited balance sheet and notes as at

30 June 2023 is provided in Appendix 1.

(4) Prior year figures have been re-presented to reflect the

reallocation of a number of businesses between Global Integrated

Agencies and Public Relations.

(5) In accordance with IAS 28: Investments in Associates and

Joint Ventures once an investment in an associate reaches zero

carrying value, the Group does not recognise any further losses,

nor income, until the cumulative share of income returns the

carrying value to above zero. WPP's cumulative reported share of

losses in Kantar reduced the carrying value of the investment to

zero at the end of December 2022.

(6) Non-GAAP measures in this table are reconciled in Appendix

1

(7) Prior year figures have been re-presented to reflect the

reallocation of a number of businesses between Global Integrated

Agencies and Public Relations.

(8) Average adjusted net debt calculated based on a month-end

average

Unaudited condensed consolidated interim income statement for

the six months ended 30 June 2023

Six months Six months

ended ended

GBP million Notes 30 June 2023 30 June 2022

=========================================== ===== ============================= ============================

Revenue 7 7,221.2 6,755.3

=========================================== ===== ============================= ============================

Costs of services 4 (6,157.0) (5,708.1)

=========================================== ===== ============================= ============================

Gross profit 1,064.2 1,047.2

=========================================== ===== ============================= ============================

General and administrative costs 4 (758.1) (508.5)

=========================================== ===== ============================= ============================

Operating profit 306.1 538.7

=========================================== ===== ============================= ============================

Earnings/(loss) from associates - after

interest and tax 5 1.0 (63.8)

=========================================== ===== ============================= ============================

Profit before interest and taxation 307.1 474.9

=========================================== ===== ============================= ============================

Finance and investment income 6 102.4 55.5

=========================================== ===== ============================= ============================

Finance costs 6 (230.7) (144.9)

=========================================== ===== ============================= ============================

Revaluation and retranslation of financial

instruments 6 25.5 33.1

=========================================== ===== ============================= ============================

Profit before taxation 204.3 418.6

=========================================== ===== ============================= ============================

Taxation 8 (55.0) (117.5)

=========================================== ===== ============================= ============================

Profit for the period 149.3 301.1

=========================================== ===== ============================= ============================

Attributable to:

=========================================== ===== ============================= ============================

Equity holders of the parent 112.0 257.9

=========================================== ===== ============================= ============================

Non-controlling interests 37.3 43.2

=========================================== ===== ============================= ============================

149.3 301.1

=========================================== ===== ============================= ============================

Earnings per share

=========================================== ===== ============================= ============================

Basic earnings per ordinary share 10 10.5p 23.1p

=========================================== ===== ============================= ============================

Diluted earnings per ordinary share 10 10.3p 22.7p

=========================================== ===== ============================= ============================

The accompanying notes form an integral part of this unaudited

condensed consolidated interim income statement.

Unaudited condensed consolidated interim statement of

comprehensive income for the six months ended 30 June 2023

Six months Six months

ended ended

GBP million 30 June 2023 30 June 2022

================================================== ============================== ==============================

Profit for the period 149.3 301.1

=================================================== ============================== ==============================

Items that may be reclassified subsequently

to profit or loss:

================================================== ============================== ==============================

Foreign exchange differences on translation

of foreign operations (285.0) 459.7

=================================================== ============================== ==============================

Gain/(loss) on net investment hedges 77.8 (129.9)

=================================================== ============================== ==============================

Cash flow hedges:

================================================== ============================== ==============================

Fair value (loss)/gain arising on hedging

instruments (23.8) 18.7

=================================================== ============================== ==============================

Less: gain/(loss) reclassified to profit

or loss 24.4 (18.7)

=================================================== ============================== ==============================

Share of other comprehensive income of associates

undertakings - 30.7

=================================================== ============================== ==============================

(206.6) 360.5

================================================== ============================== ==============================

Items that will not be reclassified subsequently

to profit or loss:

================================================== ============================== ==============================

Movements on equity investments held at

fair value through other comprehensive income (3.8) (5.2)

=================================================== ============================== ==============================

(3.8) (5.2)

================================================== ============================== ==============================

Other comprehensive (loss)/income relating

to the period (210.4) 355.3

=================================================== ============================== ==============================

Total comprehensive (loss)/income relating

to the period (61.1) 656.4

=================================================== ============================== ==============================

Attributable to:

================================================== ============================== ==============================

Equity holders of the parent (76.0) 593.3

=================================================== ============================== ==============================

Non-controlling interests 14.9 63.1

=================================================== ============================== ==============================

(61.1) 656.4

================================================== ============================== ==============================

The accompanying notes form an integral part of this unaudited

condensed consolidated interim statement of comprehensive

income.

Unaudited condensed consolidated interim cash flow statement for

the six months ended 30 June 2023

Six months Six months

ended ended

30 June 30 June

GBP million Notes 2023 2022

=================================================== ===== ============================ ============================

Net cash outflow from operating activities

(1) 11 (444.1) (1,132.5)

=================================================== ===== ============================ ============================

Investing activities

=================================================== ===== ============================ ============================

Acquisitions (1) 11 (197.9) (81.0)

=================================================== ===== ============================ ============================

Disposals of investments and subsidiaries 11 10.3 29.2

=================================================== ===== ============================ ============================

Purchases of property, plant and equipment (80.7) (102.4)

=================================================== ===== ============================ ============================

Purchases of other intangible assets

(including capitalised computer software) (23.1) (14.6)

=================================================== ===== ============================ ============================

Proceeds on disposal of property, plant

and equipment 3.4 4.5

=================================================== ===== ============================ ============================

Net cash outflow from investing activities (288.0) (164.3)

=================================================== ===== ============================ ============================

Financing activities

=================================================== ===== ============================ ============================

Repayment of lease liabilities (135.1) (146.3)

=================================================== ===== ============================ ============================

Share option proceeds 0.7 1.1

Cash consideration for purchase of non-controlling

interests 11 (16.0) (6.2)

=================================================== ===== ============================ ============================

Share repurchases and buy-backs 11 (37.0) (680.5)

=================================================== ===== ============================ ============================

Proceeds from borrowings and issue of

bonds 11 1,044.5 247.2

=================================================== ===== ============================ ============================

Repayment of borrowings 11 (469.8) (220.6)

=================================================== ===== ============================ ============================

Financing and share issue costs (5.7) -

=================================================== ===== ============================ ============================

Dividends paid to non-controlling interests

in subsidiary undertakings (61.2) (37.2)

=================================================== ===== ============================ ============================

Net cash inflow/(outflow) from financing

activities 320.4 (842.5)

=================================================== ===== ============================ ============================

Net decrease in cash and cash equivalents (411.7) (2,139.3)

=================================================== ===== ============================ ============================

Translation of cash and cash equivalents (59.0) 88.0

=================================================== ===== ============================ ============================

Cash and cash equivalents at beginning

of period 1,985.8 3,540.6

=================================================== ===== ============================ ============================

Cash and cash equivalents at end of

period 12 1,515.1 1,489.3

=================================================== ===== ============================ ============================

The accom panying notes form an integral part of this unaudited

condensed consolidated interim cash flow statement.

(1) Earnout payments in excess of the amount determined at

acquisition are recorded as operating activities. Prior year excess

amounts were recorded as investing activities and have been

re-presented as operating activities. See note 11.

Unaudited condensed consolidated interim balance sheet as of 30

June 2023

30 June 31 December

GBP million Notes 2023 2022

=========================================== ===== ========================== ===========================

Non-current assets

=========================================== ===== ========================== ===========================

Intangible assets:

=========================================== ===== ========================== ===========================

Goodwill 13 8,296.8 8,453.4

=========================================== ===== ========================== ===========================

Other 1,500.9 1,451.9

=========================================== ===== ========================== ===========================

Property, plant and equipment 942.7 1,000.7

=========================================== ===== ========================== ===========================

Right-of-use assets 1,454.2 1,528.5

=========================================== ===== ========================== ===========================

Interests in associates and joint ventures 248.1 305.1

=========================================== ===== ========================== ===========================

Other investments 332.9 369.8

=========================================== ===== ========================== ===========================

Deferred tax assets 287.8 322.1

=========================================== ===== ========================== ===========================

Corporate income tax recoverable 102.4 74.1

=========================================== ===== ========================== ===========================

Trade and other receivables 14 156.8 218.6

=========================================== ===== ========================== ===========================

13,322.6 13,724.2

=========================================== ===== ========================== ===========================

Current assets

=========================================== ===== ========================== ===========================

Corporate income tax recoverable 110.8 107.1

=========================================== ===== ========================== ===========================

Trade and other receivables 14 11,058.1 12,499.7

=========================================== ===== ========================== ===========================

Cash and short-term deposits 1,962.6 2,491.5

=========================================== ===== ========================== ===========================

13,131.5 15,098.3

=========================================== ===== ========================== ===========================

Current liabilities

=========================================== ===== ========================== ===========================

Trade and other payables 15 (13,155.8) (15,834.9)

=========================================== ===== ========================== ===========================

Corporate income tax payable (324.1) (422.0)

=========================================== ===== ========================== ===========================

Short-term lease liabilities (298.2) (282.4)

=========================================== ===== ========================== ===========================

Bank overdrafts, bonds and bank loans (1,092.9) (1,169.0)

=========================================== ===== ========================== ===========================

(14,871.0) (17,708.3)

=========================================== ===== ========================== ===========================

Net current liabilities (1,739.5) (2,610.0)

=========================================== ===== ========================== ===========================

Total assets less current liabilities 11,583.1 11,114.2

=========================================== ===== ========================== ===========================

Non-current liabilities

=========================================== ===== ========================== ===========================

Bonds and bank loans (4,338.0) (3,801.8)

=========================================== ===== ========================== ===========================

Trade and other payables 16 (517.4) (490.9)

=========================================== ===== ========================== ===========================

Deferred tax liabilities (339.1) (350.8)

=========================================== ===== ========================== ===========================

Provisions for post-employment benefits (133.8) (137.5)

=========================================== ===== ========================== ===========================

Provisions for liabilities and charges (283.8) (244.6)

=========================================== ===== ========================== ===========================

Long-term lease liabilities (1,905.9) (1,928.2)

=========================================== ===== ========================== ===========================

(7,518.0) (6,953.8)

=========================================== ===== ========================== ===========================

Net assets 4,065.1 4,160.4

=========================================== ===== ========================== ===========================

Equity

=========================================== ===== ========================== ===========================

Called-up share capital 114.1 114.1

=========================================== ===== ========================== ===========================

Share premium account 576.6 575.9

=========================================== ===== ========================== ===========================

Other reserves 104.9 285.2

=========================================== ===== ========================== ===========================

Own shares (1,012.9) (1,054.1)

=========================================== ===== ========================== ===========================

Retained earnings 3,854.5 3,759.7

=========================================== ===== ========================== ===========================

Equity shareholders' funds 3,637.2 3,680.8

=========================================== ===== ========================== ===========================

Non-controlling interests 427.9 479.6

=========================================== ===== ========================== ===========================

Total equity 4,065.1 4,160.4

=========================================== ===== ========================== ===========================

The accompanying notes form an integral part of this unaudited

condensed consolidated interim balance sheet.

Unaudited condensed consolidated interim statement of changes in

equity for the for the six months ended 30 June 2023

Total

equity

Called-up Share share Non-

share premium Other Own Retained holders' controlling

GBP million capital account reserves shares earnings(1) funds interests Total

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Balance at 1 January

2023 114.1 575.9 285.2 (1,054.1) 3,759.7 3,680.8 479.6 4,160.4

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Ordinary shares issued - 0.7 - - - 0.7 - 0.7

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Share cancellations - - - - - - - -

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Treasury shares used

for share option schemes - - - 55.2 (55.2) - - -

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Profit for the period - - - - 112.0 112.0 37.3 149.3

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Foreign exchange

differences

on translation of foreign

operations - - (262.6) - - (262.6) (22.4) (285.0)

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Gain on net investment

hedges - - 77.8 - - 77.8 - 77.8

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Cash flow hedges:

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Fair value loss

arising

on hedging

instruments - - (23.8) - - (23.8) - (23.8)

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Less: gain

reclassified

to profit or loss - - 24.4 - - 24.4 - 24.4

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Share of other

comprehensive

income of associates

undertakings - - - - - - - -

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Movements on equity

investments held at

fair value through other

comprehensive income - - - - (3.8) (3.8) - (3.8)

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Other comprehensive

loss - - (184.2) - (3.8) (188.0) (22.4) (210.4)

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Total comprehensive

(loss)/income - - (184.2) - 108.2 (76.0) 14.9 (61.1)

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Dividends paid - - - - - - (61.2) (61.2)

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Non-cash share-based

incentive plans

(including

share options) - - - - 75.5 75.5 - 75.5

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Tax adjustment on

share-based

payments - - - - 2.4 2.4 - 2.4

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Net movement in own

shares held by ESOP

Trusts - - - (14.0) (23.0) (37.0) - (37.0)

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Recognition/derecognition

of liabilities in respect

of put options - - 3.9 - (1.8) 2.1 - 2.1

Acquisition and disposal

of subsidiaries(2) - - - - (11.3) (11.3) (5.4) (16.7)

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

Balance at 30 June

2023 114.1 576.6 104.9 (1,012.9) 3,854.5 3,637.2 427.9 4,065.1

========================== =================== ==================== ==================== =================== ==================== ==================== ==================== ===================

The accompanying notes form an integral part of this unaudited

condensed consolidated interim statement of changes in equity.

(1) Accumulated losses on existing equity investments held at

fair value through other comprehensive income are GBP347.2 million

at 30 June 2023 (31 December 2022: GBP343.4 million).

(2) Acquisition and disposal of subsidiaries represents

movements in retained earnings and non-controlling interests

arising from changes in ownership of existing subsidiaries and

recognition of non-controlling interests on new acquisitions.

Unaudited condensed consolidated interim statement of changes in

equity for the six months ended 30 June 2023 (continued)

Total

equity

Called-up Share share Non-

share premium Other Own Retained holders' controlling

GBP million capital account reserves shares earnings funds interests Total

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Balance at 1 January

2022 122.4 574.7 (335.9) (1,112.1) 4,367.3 3,616.4 452.6 4,069.0

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Ordinary shares issued - 1.1 - - - 1.1 - 1.1

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Share cancellations (6.2) - 6.2 - (637.3) (637.3) - (637.3)

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Treasury shares used

for share option schemes - - - - - - - -

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Profit for the period - - - - 257.9 257.9 43.2 301.1

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Foreign exchange

differences

on translation of foreign

operations - - 439.8 - - 439.8 19.9 459.7

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Loss on net investment

hedges - - (129.9) - - (129.9) - (129.9)

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Cash flow hedges:

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Fair value gain arising

on hedging instruments - - 18.7 - - 18.7 - 18.7

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Less: loss reclassified

to profit or loss - - (18.7) - - (18.7) - (18.7)

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Share of other

comprehensive

income of associates

undertakings - - 24.0 - 6.7 30.7 - 30.7

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Movements on equity

investments held at

fair value through other

comprehensive income - - - - (5.2) (5.2) - (5.2)

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Other comprehensive

income - - 333.9 - 1.5 335.4 19.9 355.3

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Total comprehensive

income - - 333.9 - 259.4 593.3 63.1 656.4

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Dividends paid - - - - - - (37.2) (37.2)

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Non-cash share-based

incentive plans

(including

share options) - - - - 67.3 67.3 - 67.3

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Tax adjustments on

share-based

payments - - - - (15.2) (15.2) - (15.2)

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Net movement in own

shares held by ESOP

Trusts - - - 28.8 (72.0) (43.2) - (43.2)

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Recognition/derecognition

of liabilities in respect

of put options - - 58.1 - (47.3) 10.8 - 10.8

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Share purchases - close

period commitments(1) - - 211.7 - - 211.7 - 211.7

Acquisition and disposal

of subsidiaries(2) - - - - (13.0) (13.0) - (13.0)

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

Balance at 30 June

2022 116.2 575.8 274.0 (1,083.3) 3,909.2 3,791.9 478.5 4,270.4

========================== ==================== ==================== ==================== =================== ==================== ==================== =================== ====================

The accompanying notes form an integral part of this unaudited

condensed consolidated interim statement of changes in equity.

(1) During 2021, the Company entered into an arrangement with a

third party to conduct share buybacks on its behalf in the close

period commencing on 16 December 2021 and ending on 18 February

2022, in accordance with UK listing rules. The commitment resulting

from this agreement constituted a liability at 31 December 2021 and

was recognised as a movement in other reserves in the year ended 31

December 2021. After the close period ended on 18 February 2022,

the liability was settled and the amount in other reserves was

reclassified to retained earnings.

(2) Acquisition of subsidiaries represents movements in retained

earnings and non-controlling interests arising from changes in

ownership of existing subsidiaries and recognition of

non-controlling interests on new acquisitions.

Notes to the unaudited condensed consolidated interim financial

statements

1. Basis of accounting

The unaudited condensed consolidated interim financial

statements are prepared under the historical cost convention,

except for the revaluation of certain financial instruments as

disclosed in our accounting policies.

2. Accounting policies

The unaudited condensed consolidated interim financial

statements comply with IAS 34 Interim Financial Reporting as issued

by the International Accounting Standards Board (IASB) and with the

accounting policies of WPP plc and its subsidiaries (the Group),

which were set out on pages 160 - 165 of the 2022 Annual Report and

Accounts. No changes have been made to the Group's accounting

policies in the period ended 30 June 2023.

The Group does not consider that the amendments to standards

adopted during the period have a significant impact on the

financial statements.

Statutory information and Independent Review

The unaudited condensed consolidated interim financial

statements for the six months to 30 June 2023 and 30 June 2022 do

not constitute statutory accounts. The statutory accounts for the

year ended 31 December 2022 have been delivered to the Jersey

Registrar and received an unqualified auditors' report. The interim

condensed consolidated financial statements are unaudited but have

been reviewed by the auditors and their report is set out on page

41.

The announcement of the interim results was approved by the

Board of Directors on 4 August 2023.

3. Currency conversion

The presentation currency of the Group is pounds sterling and

the unaudited condensed consolidated interim financial statements

have been prepared on this basis.

The period ended 30 June 2023 unaudited condensed consolidated

interim income statement is prepared using, among other currencies,

average exchange rates of US$1.23 to the pound (period ended 30

June 2022: US$1.30) and EUR1.14 to the pound (period ended 30 June

2022: EUR1.19). The unaudited condensed consolidated interim

balance sheet as at 30 June 2023 has been prepared using the

exchange rates on that day of US$1.27 to the pound (31 December

2022: US$1.21) and EUR1.16 to the pound (31 December 2022:

EUR1.13).

4. Costs of services and general and administrative costs

Six months Six months

ended ended

GBP million 30 June 2023 30 June 2022

================================= =========================== ===========================

Costs of services 6,157.0 5,708.1

================================= =========================== ===========================

General and administrative costs 758.1 508.5

================================= =========================== ===========================

6,915.1 6,216.6

================================= =========================== ===========================

Costs of services and general and administrative costs

include:

Six months Six months

ended ended

GBP million 30 June 2023 30 June 2022

======================================================= =========================== ===========================

Staff costs 4,141.5 3,930.7

======================================================= =========================== ===========================

Establishment costs 272.1 262.8

======================================================= =========================== ===========================

Media pass-through costs 1,022.8 1,016.7