TheWorks.co.uk PLC Full Year Trading Update (7908Z)

18 Maggio 2023 - 8:00AM

UK Regulatory

TIDMWRKS

RNS Number : 7908Z

TheWorks.co.uk PLC

18 May 2023

18 May 2023

TheWorks.co.uk plc

("The Works", the "Company" or the "Group")

Trading update for the 52 weeks ended 30 April 2023

Robust sales growth in FY23; Adjusted EBITDA expected to be in

line with market forecast; ended the year in a strong financial

position.

TheWorks.co.uk plc, the family-friendly value retailer of arts,

crafts, toys, books and stationery, announces a trading update for

the 52 weeks ended 30 April 2023 (the "Period" or "FY23").

Trading performance

The Works delivered a resilient performance in FY23 against a

challenging backdrop, with total sales(1) increasing by 6.1 % to

GBP316.6m (FY22: GBP298.4m). Stores, which represented 88.8% of

total sales, delivered an LFL sales increase of 7.5 %. Online sales

declined by 15.0%, resulting in overall LFL sales growth of

4.2%.

Trading since the previous update(2) has been broadly as

anticipated, with stores continuing to deliver positive LFL sales

growth and online LFLs being negative. Store LFL sales increased by

12.1% over the 15 weeks, and online sales declined by 12.5%, giving

an overall LFL increase of 9.3% during this period. The FY22

comparatives weakened in April 2023, due to the aftermath of the

March 2022 cyber security incident, which is reflected in the

slight increase in the recent rate of sales growth.

The Company expects to report an Adjusted EBITDA result for FY23

in line with its compiled estimate of the market's forecast, which

is approximately GBP9.0m.

Financial position

The Group ended the Period in a strong financial position, with

net cash(3) of GBP10.2m (FY22: GBP16.3m). As previously noted, the

FY22 comparative included higher than normal creditor balances,

which unwound as expected during FY23. At the Period end the Group

had liquidity availability of GBP40m, including its undrawn

GBP30.0m bank facility(4) .

Dividend and publication of results

As noted in the interim results report issued in January 2023,

the Board will consider the level of dividend for FY23 alongside

completion of the audited final results, which will be announced on

Friday 21 July 2023.

Outlook

Notwithstanding the ongoing challenging market conditions, the

Board remains confident in the future prospects of the business due

to the underlying appeal and relevance of The Works' proposition,

the opportunity to grow sales profitably through the implementation

of its strategy , and the Group's strong financial position. The

Board notes that the compiled estimate of the market's forecast for

FY24 is an Adjusted EBITDA of approximately GBP10.0m, which it is

comfortable with at the present time.

Appointment of broker

The Group is pleased to announce that Singer Capital Markets has

been appointed as the Company's sole corporate broker with

immediate effect.

Gavin Peck, Chief Executive Officer of The Works, commented:

"Our performance in FY23 was delivered against a challenging

backdrop. The business traded well through difficult external

conditions, most notably the inflationary environment, and the

recovery from the cyber security incident at the start of the year.

The store performance was strong throughout the period,

demonstrating the enduring value of our store network in

communities across the UK and Ireland. Online sales continued to

lag behind, partially reflecting the normalisation trend seen more

widely. We delivered good strategic progress in the second half of

FY23 and have now laid the foundations to continue on this

trajectory in the year ahead . This progress is testament to the

passion and commitment of our brilliant colleagues, who continue to

go above and beyond to deliver for our customers."

Enquiries: via Sanctuary

Counsel

TheWorks.co.uk

plc

Gavin Peck CEO

Steve Alldridge

CFO

Sanctuary Counsel 0207 340 0395 theworks@sanctuarycounsel.com

Ben Ullmann

Rachel Miller

Kitty Ryder

(1) "Total sales" include VAT and are stated prior to deducting the cost of loyalty points which

are excluded from statutory revenue. A reconciliation between total sales and statutory revenue

will be included in the Group's Annual Report.

(2) i.e. during the 15 week period from Monday 16 January 2023 to Sunday 30 April 2023.

(3) Net cash at bank excluding finance leases, and on a non-IFRS 16 basis.

(4) The Group's bank facility at the Period end comprised a committed RCF of GBP30.0m with an

expiry date of 30 November 2025.

The Group is in discussions with its bank (HSBC) about reducing the size of the facility,

which was undrawn throughout most of FY23, to GBP20.0m, and extending its term so that it

would expire instead on 30 November 2026. This would save approximately GBP0.15m in annual

cash interest costs, and would continue to provide liquidity availability significantly in

excess of the actual anticipated requirement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKOBPABKDNPD

(END) Dow Jones Newswires

May 18, 2023 02:00 ET (06:00 GMT)

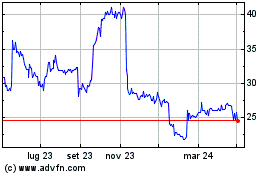

Grafico Azioni Theworks.co.uk (LSE:WRKS)

Storico

Da Mar 2024 a Apr 2024

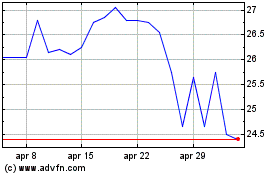

Grafico Azioni Theworks.co.uk (LSE:WRKS)

Storico

Da Apr 2023 a Apr 2024