Ascent Solar Technologies Announces Warrants Repurchase Agreements

14 Marzo 2024 - 2:25PM

Ascent Solar Technologies, Inc. (“Ascent,” or the “Company”)

(Nasdaq: ASTI), a U.S. innovator in the design and manufacturing of

featherweight, flexible thin-film photovoltaic (PV) solutions,

today announced that, as previously disclosed on December 19, 2022,

the Company entered into a Securities Purchase Contract with two

institutional investors. Pursuant to the Purchase Contract, the

Company issued to the investors certain common stock warrants (the

“Warrants”).

The Warrants have certain “full ratchet” anti-dilution

adjustments that are triggered when the Company issues securities

with a purchase or conversion, exercise or exchange price that is

less than the exercise price of the Warrants then in effect at any

time. Under the full ratchet anti-dilution adjustments, if the

Company issues new securities at a price lower than the then

applicable exercise price, (i) the exercise price is reduced to the

lower new issue price and (ii) the number of warrant shares is

proportionately increased. The Warrants have been previously

adjusted following past issuances of Company securities. Currently,

there are 5,596,232 Warrants exercisable at an exercise price of

$1.765.

On March 6, 2024, and March 7, 2024, the Company entered into

Warrant Repurchase agreements (the “Repurchase Agreements”) with

each of the investors. Pursuant to the Repurchase Agreements, if

the Company closes a new capital raising transaction with gross

proceeds in excess of $5 million (“Qualified Financing”), the

Company will repurchase the Warrants from the investors for an

aggregate purchase price of $3.6 million. Following the delivery of

the purchase price to the investors, the investors will relinquish

all rights, title and interest in the Warrants and assign the same

to the Company, and the Warrants will be canceled.

So long as the Repurchase Agreements are in effect, the

investors have agreed not to directly or indirectly sell or assign

the Warrants. The investors retain the right to exercise the

Warrants at the current exercise price (currently $1.765 per share)

at any time proper to the completion of the Qualified Financing. In

the case of any such exercise, the $3.6 million aggregate

repurchase price will be reduced on a pro-rata percentage

basis.

If the closing under the Repurchase Agreements has not occurred

by April 12, 2024, then, at the election of either the Company or

the Investors, by written notice to the other, the Repurchase

Agreements may be terminated. In the event of any termination of

the Repurchase Agreements, the Warrants shall remain outstanding

with all existing terms unchanged.

ABOUT ASCENT SOLAR TECHNOLOGIES, INC.

Backed by 40 years of R&D, 15 years of manufacturing

experience, numerous awards, and a comprehensive IP and patent

portfolio, Ascent Solar Technologies, Inc. is a leading provider of

innovative, high-performance, flexible thin-film solar panels for

use in environments where mass, performance, reliability, and

resilience matter. Ascent’s photovoltaic (PV) modules have been

deployed on space missions, multiple airborne vehicles, agrivoltaic

installations, in industrial/commercial construction as well as an

extensive range of consumer goods, revolutionizing the use cases

and environments for solar power. Ascent Solar’s research and

development center and 4.5-MW nameplate production facility is in

Thornton, Colorado. To learn more, visit

https://www.ascentsolar.com or follow the Company on LinkedIn and X

(formerly Twitter).

FORWARD-LOOKING STATEMENTS

Statements in this press release that are not statements of

historical or current fact constitute "forward-looking statements"

including statements about the financing transaction, our business

strategy, and the potential uses of the proceeds from the

transaction. Such forward-looking statements involve known and

unknown risks, uncertainties and other unknown factors that could

cause the company's actual operating results to be materially

different from any historical results or from any future results

expressed or implied by such forward-looking statements. We have

based these forward-looking statements on our current assumptions,

expectations, and projections about future events. In addition to

statements that explicitly describe these risks and uncertainties,

readers are urged to consider statements that contain terms such as

“will,” "believes," "belief," "expects," "expect," "intends,"

"intend," "anticipate," "anticipates," "plans," "plan," to be

uncertain and forward-looking. No information in this press release

should be construed as any indication whatsoever of our future

revenues, stock price, or results of operations. The

forward-looking statements contained herein are also subject

generally to other risks and uncertainties that are described from

time to time in the company's filings with the Securities and

Exchange Commission including those discussed under the heading

“Risk Factors” in our most recently filed reports on Forms 10-K and

10-Q.

MEDIA CONTACT

Spencer HerrmannFischTank PRascent@fischtankpr.com

INVESTOR CONTACT

ir@ascentsolar.com

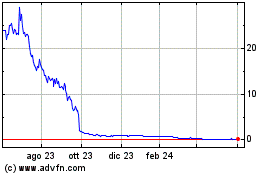

Grafico Azioni Ascent Solar Technologies (NASDAQ:ASTI)

Storico

Da Dic 2024 a Gen 2025

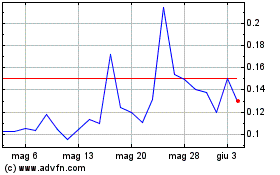

Grafico Azioni Ascent Solar Technologies (NASDAQ:ASTI)

Storico

Da Gen 2024 a Gen 2025