As filed with the

Securities and Exchange Commission on November 18, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CINCINNATI FINANCIAL CORPORATION

(Exact name of registrant as specified in its

charter)

| Ohio |

|

|

|

31-0746871 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

|

|

(I.R.S. Employer

Identification No.) |

6200

S. Gilmore Road

Fairfield, Ohio 45014-5141

(Address of Principal Executive Offices)

Cincinnati Financial Corporation 2024 Stock

Compensation Plan

(Full Title of the Plans)

Thomas C. Hogan, Esq.

Executive Vice President, Chief Legal Counsel and Corporate Secretary

6200 S. Gilmore Road

Fairfield, Ohio 45014-5141

(513) 603-5786

(Name, Address and Telephone Number, Including

Area Code, of Agent for Service)

Copies to:

Amy M. Shepherd, Esq.

Baker & Hostetler LLP

200 Civic Center Drive, Suite 1200

Columbus, Ohio 43215

Telephone: (614) 462-4712

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

| |

|

|

|

| Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

| |

|

|

|

| |

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

documents containing the information specified in Part I of Form S-8 will be sent or given to participants as specified by Rule 428(b)(1) of

the Securities Act of 1933, as amended (the “Securities Act”). Such

documents are not required to be, and are not, filed with the Securities and Exchange Commission (the “SEC”) either as part

of this registration statement or as a prospectus or prospectus supplement pursuant to Rule 424 under the Securities Act.

These documents and the documents incorporated by reference into this registration statement pursuant to Item 3 of Part II of this

registration statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities

Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

In this registration statement, Cincinnati

Financial Corporation is sometimes referred to as “Registrant,” “we,” “us” or “our.”

Item 3. Incorporation of Documents by Reference.

The Securities and Exchange Commission (“SEC”)

allows us to “incorporate by reference” the information we file with them, which means that we can disclose important information

to you by referring you to those documents. The information incorporated by reference is considered to be part of this registration statement,

and later information filed with the SEC will update and supersede this information. We hereby incorporate by reference into this registration

statement the following documents previously filed with the SEC:

| (g) | The description of the Registrant’s common stock set forth in Exhibit 4.8 to the Company’s Annual Report on Form 10-K

for the year ended December 31, 2023, including any amendments or reports filed for the purpose of updating such description. |

In addition, all documents filed by the Registrant

pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the filing of this registration statement and

prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which de-registers

all securities then remaining unsold shall be deemed to be incorporated by reference into this registration statement and to be a part

hereof from the date of filing such documents, except as to specific sections of such statements as set forth therein. Any statement contained

in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes

of this registration statement to the extent that a statement contained herein or in any other subsequently filed document which also

is incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement contained herein

shall be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained in any

subsequently filed document which also is incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration

statement.

Under no circumstances shall any information furnished

under Item 2.02 or 7.01 of Form 8-K be deemed incorporated herein by reference unless such Form 8-K expressly provides to the

contrary.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Section 1701.13(E) of the Ohio Revised

Code provides that a corporation may indemnify or agree to indemnify any person who was or is a party or is threatened to be made a party

to any threatened, pending, or completed action, suit, or proceeding whether civil, criminal, administrative, or investigative, other

than an action by or in the right of the corporation, by reason of the fact that the person is or was a director, officer, employee, or

agent of the corporation, or is or was serving at its request as a director, trustee, officer, employee, or agent of another corporation,

partnership, joint venture, trust, or other enterprise, against expenses, including attorneys' fees, judgments, fines and amounts paid

in settlement actually and reasonably incurred by the person in connection with such action, suit, or proceeding if the person is determined

under the procedure described in the Section to have (a) acted in good faith and in a manner the person reasonably believed

to be in or not opposed to the best interests of the corporation, and (b) had no reasonable cause to believe the conduct was unlawful

in the case of any criminal action or proceeding. However, with respect to expenses actually and reasonably incurred in connection with

the defense or settlement of any action or suit by or in the right of the corporation to procure a judgment in its favor, no indemnification

is to be made (i) in respect of any claim, issue, or matter as to which such person was adjudged liable for negligence or misconduct

in the performance of such person's duty to the corporation unless, and only to the extent that, it is determined by the court upon application

that, despite the adjudication of liability, such person is fairly and reasonably entitled to indemnity for such expenses as the court

deems proper, or (ii) in respect of any action or suit in which the only liability asserted against a director is in connection with

the alleged making of an unlawful loan, dividend or distribution of corporate assets. The Section also provides that such person

shall be indemnified against expenses actually and reasonably incurred by the person to the extent successful in defense of the actions

referred to above, or in defense of any claim, issue, or matter therein.

The Company’s Amended and Restated

Articles of Incorporation provide for the indemnification of officers and directors of the Registrant to the fullest extent

permitted by law. The above is a general summary of certain provisions of the Ohio Revised Code and is subject in all cases to the

specific provisions thereof.

The Company maintains an insurance policy covering

its directors and officers against certain civil liabilities, including liabilities under the Securities Act.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to our directors, officers, and controlling persons pursuant to the foregoing provisions, or

otherwise, we have been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities

Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment of

expenses incurred or paid by a director, officer or controlling person in a successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of

its counsel the matter has been settled by controlling precedent, submit to the court of appropriate jurisdiction the question whether

such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication

of such issue.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

Item 9. Undertakings.

| (a) | The undersigned Registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement, |

| (i) | to include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) | to reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in this registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total

dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated

maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate,

the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation

of Filing Fee Tables” table in the effective registration statement; and |

| (iii) | to include any material information with respect to the plan of distribution not previously disclosed in this registration statement

or any material change to such information in this registration statement; |

provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if this registration statement is on Form S-8

and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished

to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference

in this registration statement.

| (2) | That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| (b) | The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing

of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where

applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that

is incorporated by reference in this registration statement shall be deemed to be a new registration statement, relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (h) | Insofar as indemnification for liabilities arising under

the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions,

or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed

in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other

than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with

the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as

expressed in the Securities Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities

Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, on November 15,

2024.

| |

CINCINNATI FINANCIAL

CORPORATION |

| |

|

|

| |

By: |

/s/

Stephen M. Spray |

| |

|

Stephen

M. Spray |

| |

|

President

and Chief Executive Officer |

SIGNATURES AND POWER OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Stephen M. Spray, Michael

J. Sewell and Thomas C. Hogan, and each of them, his or her true and lawful attorneys-in-fact and agents, each with full power of substitution

and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments

(including post-effective amendments) to this registration statement (or any other registration statement for the same offering that is

to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933), and to file the same, with all exhibits

thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact

and agents, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done

in and about the premises, as full to all intents and purposes as he might or could do in person, hereby ratifying and confirming all

that said attorneys-in-fact and agents or any of them, or their or his substitute or substitutes, may lawfully do or cause to be done

by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities held on the dates indicated.

| Name |

|

Position |

|

Date |

| |

|

|

|

/s/ Stephen

M. Spray |

|

President, Chief Executive Officer and Director

(principal executive officer) |

|

November 15, 2024 |

| Stephen M. Spray |

| |

|

|

|

/s/ Michael

J. Sewell, CPA |

|

Chief Financial Officer, Executive Vice President

and Treasurer

(principal financial and accounting officer) |

|

November 15, 2024 |

| Michael J. Sewell, CPA |

| |

|

|

|

/s/ Nancy C.

Benacci |

|

Director |

|

November 15, 2024 |

| Nancy C. Benacci |

| |

|

|

/s/ Linda W. Clement-Holmes

|

|

Director |

|

November 15, 2024 |

|

Linda W. Clement-Holmes |

| |

|

|

|

/s/ Dirk J.

Debbink |

|

Director |

|

November 15, 2024 |

| Dirk J. Debbink |

| |

|

|

|

/s/ Steven J.

Johnston |

|

Director and Chairman |

|

November 15, 2024 |

| Steven J. Johnston |

| |

|

|

|

/s/ Jill P.

Meyer |

|

Director |

|

November 15, 2024 |

| Jill P. Meyer |

|

/s/ David P.

Osborn |

|

Director |

|

November 15, 2024 |

| David P. Osborn |

| |

|

|

|

/s/ Gretchen

W. Schar |

|

Director |

|

November 15, 2024 |

| Gretchen W. Schar |

| |

|

|

|

/s/ Charles

O. Schiff |

|

Director |

|

November 15, 2024 |

| Charles O. Schiff |

| |

|

|

|

/s/ Douglas

S. Skidmore |

|

Director |

|

November 15, 2024 |

| Douglas S. Skidmore |

| |

|

|

|

/s/ John F.

Steele, Jr. |

|

Director |

|

November 15, 2024 |

| John F. Steele, Jr. |

| |

|

|

|

/s/ Larry R.

Webb |

|

Director |

|

November 15, 2024 |

| Larry R. Webb |

| |

|

|

|

/s/ Cheng-sheng

Peter Wu |

|

Director |

|

November 15, 2024 |

| Cheng-sheng Peter Wu |

Exhibit 5.1

November 15, 2024

Cincinnati Financial Corporation

6200 S. Gilmore Road

Fairfield, Ohio 45014-5141

Re: Registration Statement on Form S-8; 9,000,000 shares

of Common Stock, par value $2.00 per share

To the addressee set forth above:

We have acted as counsel to Cincinnati Financial

Corporation, an Ohio corporation (the “Company”), in connection with the proposed issuance of an aggregate of 9,000,000 shares

of common stock, $2.00 par value per share (the “Shares”), of the Company, pursuant to the Company’s 2024 Stock Compensation

Plan (the “2024 Plan”). The Shares are included in a Registration Statement on Form S-8 under the Securities Act of 1933,

as amended (the “Act”), filed with the Securities and Exchange Commission (the “Commission”) on November 18,

2024 (the “Registration Statement”). This opinion is being furnished in connection with the requirements of Item 601(b)(5) of

Regulation S-K under the Act, and no opinion is expressed herein as to any matter pertaining to the contents of the Registration Statement

or related prospectus, other than as expressly stated herein with respect to the issuance of the Shares.

As such counsel, we have examined such matters

of fact and questions of law as we have considered appropriate for purposes of this letter. With your consent, we have relied upon certificates

and other assurances of officers of the Company and others as to factual matters without having independently verified such factual matters. We

are opining herein as to the General Corporation Law of the State of Ohio and we express no opinion with respect to any other laws. In

our examination, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals and

the conformity to authentic original documents of all documents submitted to us as copies.

Subject to the foregoing and the other matters

set forth herein, it is our opinion that, as of the date hereof, subject to the Company completing all actions and proceedings required

on its part to be taken prior to the issuance of the Shares, and when the Shares have been issued by the Company in the circumstances

contemplated by the Plan for legal consideration in excess of par value, the issuance of the Shares will have been duly authorized by

all necessary corporate action of the Company, and the Shares will be validly issued, fully paid and nonassessable.

This opinion is for your benefit in connection

with the Registration Statement and may be relied upon by you and by persons entitled to rely upon it pursuant to the applicable provisions

of the Act. We consent to your filing this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby

admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations

of the Commission thereunder.

| Very truly yours, |

| |

| /s/ Baker & Hostetler LLP |

Exhibit 10.1

Cincinnati Financial Corporation 2024 Stock Compensation

Plan

| 1. | Purpose. The purpose of the Plan is to support the Company’s ongoing efforts to attract, develop, retain and motivate

Associates and to provide them with incentives that are directly linked to the profitability of the Company’s businesses and to

increases in shareholder value. |

| 2. | Definitions. For purposes of the Plan, the following terms are defined as set forth below: |

| |

a. |

“Associate” means employee of the Company or its operating subsidiaries and affiliates. |

| |

|

|

| |

b. |

“Award” means a grant under the Plan of Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, or Other Stock-Based Awards. |

| |

|

|

| |

c. |

“Board” means the Board of Directors of the Company. |

| |

|

|

| |

d. |

“Code” means the Internal Revenue Code of 1986, as amended from time to time, and any successor thereto. |

| |

|

|

| |

e. |

“Commission” means the Securities and Exchange Commission or any successor agency. |

| |

|

|

| |

f. |

“Committee” means the compensation committee of the Board or a subcommittee thereof, any successor thereto or such other committee or subcommittee as may be designated by the Board to administer the Plan, which, in any case, shall include as members at least two “nonemployees” within the meaning of Rule 16b-3 of the SEC, two “outside directors” for purposes of Code Section 162(m), and which is otherwise in compliance with any other requirements of applicable laws or regulations or the requirements of The Nasdaq Global Select Market. |

| |

|

|

| |

g. |

“Common Stock” or “Stock” means the common stock of the Company. |

| |

|

|

| |

h. |

“Company” means Cincinnati Financial Corporation, a corporation organized under the laws of the State of Ohio, or any successor thereto. |

| |

|

|

| |

i. |

“Exchange Act” means the Securities Exchange Act of 1934, as amended from time to time, and any successor thereto. |

| |

|

|

| |

j. |

“Fair Market Value” means, as of any given date, the mean between the highest and lowest reported sales prices of the Common Stock on The Nasdaq Global Select Market, or, if no such sale of Common Stock is reported on such date, the fair market value of the Stock as determined by the Committee in good faith. |

| |

|

|

| |

k. |

“Incentive Stock Option” means any Stock Option that complies with Section 422 (or any amended or successor provision) of the Code. |

| |

|

|

| |

l. |

“Nonqualified Stock Option” means any Stock Option that is not an Incentive Stock Option. |

| |

|

|

| |

m. |

“Other Stock-Based Award” means an Award made pursuant to Section 6(a)(v). |

| |

|

|

| |

n. |

“Participant” means any eligible Associate as set forth in Section 4 to whom an Award is granted. |

| |

|

|

| |

o. |

“Performance Cycle” means the period selected by the Committee during which the performance of the Company or of any subsidiary, affiliate or of unit thereof or any individual is measured for the purpose of determining the extent to which an Award subject to Performance Goals has been earned. |

| |

|

|

| |

p. |

“Performance Goals” mean the objectives for the Company or any subsidiary or affiliate or any unit thereof or any individual that may be established by the Committee for a Performance Cycle with respect to any performance-based Awards contingently awarded under the Plan. The Performance Goals for Awards shall be derived from one or more of the following criteria: earnings per share, total shareholder return, operating income, net income, adjusted net earnings, cash flow, return on equity, return on capital, the combined ratio, premium growth, investment performance, and/or value creation ratio. |

| |

|

|

| |

q. |

“Plan” means this Cincinnati Financial Corporation 2024 Stock Compensation Plan, as amended from time to time. |

| |

|

|

| |

r. |

“Repricing” means any of the following actions taken by the Committee with respect to an Option or Stock Appreciation Right: (i) lowering or reducing its exercise price, (ii) cancelling, exchanging or surrendering it in exchange for: (A) cash or another award for the purpose of repricing the award or (B) an Option or Stock Appreciation Right with an exercise price that is less than the exercise price of the original award; and (iii) taking any other action that constitutes a “repricing” under applicable laws; provided that a Repricing shall not include any action taken with stockholder approval or any adjustment of an Option or Stock Appreciation Right pursuant to Section 5(b). |

| |

|

|

| |

s. |

“Restricted Period” means the period during which an Award may not be sold, assigned, transferred, pledged or otherwise encumbered. |

| |

|

|

| |

t. |

“Restricted Stock” means an Award of shares of Common Stock pursuant to Section 6(a)(iii). |

| |

|

|

| |

u. |

“Restricted Stock Unit” means an Award described in Section 6(a)(iv). |

| |

|

|

| |

v. |

“Spread Value” means, with respect to a share of Common Stock subject to an Award, an amount equal to the excess of the Fair Market Value, on the date such value is determined, over the Award’s exercise or grant price, if any. |

| |

|

|

| |

w. |

“Stock Appreciation Right” or “SAR” means a right granted pursuant to Section 6(a)(ii). |

| |

|

|

| |

x. |

“Stock Option” means an Incentive Stock Option or a Nonqualified Stock Option granted pursuant to Section 6(a)(i). |

| |

|

|

| |

y. |

“Value Creation Ratio” means the total of 1) rate of growth in book value per share plus 2) the ratio of dividends declared per share to beginning book value per share. |

| 3. | Administration. The Plan shall be administered by the Committee, which shall have the power to

interpret the Plan and to adopt such rules and guidelines for carrying out the Plan as it may deem appropriate. The Committee shall have

the authority to adopt such modifications, procedures and sub-plans as may be necessary or desirable to comply with all applicable laws,

regulations, and accounting principles. Subject to the terms of the Plan, the Committee shall have the authority to determine those Associates

who shall receive Awards and the amount, type and terms of each Award, and to establish and administer any Performance Goals applicable

to such Awards. The Committee may delegate its authority and power under the Plan to one or more officers of the Company, subject

to guidelines prescribed by the Committee, but only with respect to Participants who are not subject to either Section 16 of the Exchange

Act or Section 162(m) (or any amended or successor provision) of the Code. Any determination made by the Committee or by one or more officers

pursuant to delegated authority in accordance with the provisions of the Plan with respect to any Award shall be made in the sole discretion

of the Committee or such delegate, and all decisions made by the Committee or any appropriately designated officer pursuant to the provisions

of the Plan shall be final, binding and conclusive on all persons, including the Company and Plan Participants. Notwithstanding anything

to the contrary herein, in no event shall the Committee effect any Repricing of any Option or Stock Appreciation Right. |

| 4. | Eligibility. All Associates of the Company and its subsidiaries and affiliates are eligible to be granted Awards under the

Plan. No Associate shall have at any time the right to receive an Award, or having previously received an Award, to receive any further

Awards. |

| 5. | Common Stock Subject to the Plan. |

| a. | Common Stock Available. The total number of shares of Common Stock reserved and available

for distribution pursuant to Awards granted under the Plan shall be 9,000,000; provided, however, that any shares of Common Stock issued

to Participants pursuant to Awards in any form other than Stock Options and Stock Appreciation Rights shall be counted against such 9,000,000

share limit as three shares for every one share of Common Stock actually issued. Each Stock Appreciation Right Award granted under the

Plan that may be settled in shares of Common Stock shall be counted in full (i.e., to the extent of the face number of shares originally

granted) against the maximum number of shares of Common Stock available for award under the Plan, regardless of the actual number of shares

of Common Stock that are actually issued to the Participant upon settlement of the Stock Appreciation Right. Shares issued under the Plan

may be either authorized but unissued shares or treasury shares, as designated by the Committee. To the extent any Award under this Plan

terminates, expires or is forfeited without a distribution being made to the Participant in the form of Common Stock, the shares subject

to such Award that were not so issued, if any, shall again become available for distribution in connection with Awards under the Plan.

Any shares of Common Stock that are used by a Participant as full or partial payment of withholding or other taxes or as payment for the

exercise or conversion price of an Award under the Plan shall not be available for subsequent distribution in connection with Awards under

the Plan. |

| b. | Adjustments for Certain Corporate Transactions. In the event of any merger, share exchange,

reorganization, consolidation, recapitalization, reclassification, distribution, stock dividend, stock split, reverse stock split, split-up,

spin-off, issuance of rights or warrants or other similar transaction or event affecting the Common Stock after adoption of the Plan,

the Committee is authorized to make such adjustments or substitutions with respect to the Plan and to Awards granted hereunder as it deems

appropriate to reflect the occurrence of such event, including, but not limited to, adjustments

(A) to the aggregate number and kind of securities reserved for issuance under the Plan, (B) to the Award limits set forth in Section

6, (C) to the Performance Goals or Performance Cycles of any outstanding Performance-Based Awards, and (D) to the number and kind of securities

subject to outstanding Awards and, if applicable, the grant or exercise price or Spread Value of outstanding Awards. In connection with

any of the events described in this Section 5(b), the Committee is also authorized to provide for the payment of any outstanding Awards

in cash, including, but not limited to, payment of cash in lieu of any fractional Awards. In the event of any conflict between this Section

5(b) and other provisions of the Plan, the provisions of this section shall control. |

| a. | General. The types of Awards that may be granted under the Plan are set forth below. Awards

may be granted singly, in combination or in tandem with other Awards. |

| i. | Stock Options. A Stock Option represents the right to purchase a share of stock at a predetermined

grant price. Stock Options granted under the Plan may be in the form of Incentive Stock Options or Nonqualified Stock Options, as specified

in the Award agreement. The term of each Stock Option shall be set forth in the Award agreement, but no Stock Option shall be exercisable

more than 10 years after the grant date. The grant price per share of Common Stock purchasable under a Stock Option shall not be less

than 100 percent of the Fair Market Value on the date of grant. Subject to the applicable Award agreement, Stock Options may be exercised,

in whole or in part, by giving written or electronic notice of exercise to the Company specifying the number of shares to be purchased.

Such notice shall be accompanied by payment in full of the purchase price in a manner prescribed in the applicable Award agreement. Except

for a beneficiary designation as permitted by the terms of the applicable Award agreement or as designated by a Participant by will or

as prescribed by the laws of descent and distribution, Stock Options may not be sold, assigned, transferred, pledged or otherwise encumbered.

|

| ii. | Stock Appreciation Rights. A SAR represents the right to receive a cash payment, shares of Common

Stock, or both (as determined by the Committee), with a value equal to the Spread Value on the date the SAR is exercised. The grant price

of a SAR shall be set forth in the applicable Award agreement and shall not be less than 100 percent of the Fair Market Value on the date

of grant. Subject to the terms of the applicable Award agreement, a SAR shall be exercisable, in whole or in part, by giving written or

electronic notice of exercise to the Company in the manner prescribed in the applicable Award agreement. The term of each SAR shall be

set forth in the Award agreement, but no SAR shall be exercisable more than 10 years after the

grant date. Except for a beneficiary designation as permitted by the terms of the applicable Award agreement or as designated by a Participant

by will or prescribed by the laws of descent and distribution, SARs may not be sold, assigned, transferred, pledged or otherwise encumbered.

|

| iii. | Restricted Stock. Shares of Restricted Stock are shares of Common Stock that are awarded to a

Participant and that during the Restricted Period may be forfeitable to the Company upon such conditions as may be set forth in the applicable

Award agreement. Except for a beneficiary designation as permitted by the terms of the applicable Award agreement or as designated by

a Participant by will or prescribed by the laws of descent and distribution, Restricted Stock may not be sold, assigned, transferred,

pledged or otherwise encumbered during the Restricted Period. Except as provided above or in the applicable Award agreement, a Participant

shall have with respect to such Restricted Stock all the rights of a holder of Common Stock during the Restricted Period. |

| iv. | Restricted Stock Units. Restricted Stock Units represent the right to receive shares of Common

Stock, cash, or both (as determined by the Committee) upon satisfaction of such conditions as may be set forth in the applicable Award

agreement. Except for a beneficiary designation as permitted by the terms of the applicable Award agreement or as designated by a Participant

by will or prescribed by the laws of descent and distribution, Restricted Stock Units may not be sold, assigned, transferred, pledged

or otherwise encumbered during the Restricted Period. Except as provided in the applicable Award agreement, a Participant shall have with

respect to such Restricted Stock Units none of the rights of a holder of Common Stock unless and until shares of Common Stock are actually

delivered in satisfaction of the conditions underlying such Restricted Stock Units. |

| v. | Other Stock-Based Awards. Other Stock-Based Awards are Awards, other than Stock Options, SARs,

Restricted Stock, or Restricted Stock Units that are denominated in, valued in whole or in part by reference to, or otherwise based on

or related to, Common Stock. The grant, purchase, exercise, exchange or conversion of Other Stock-Based Awards granted under this subsection

(v) shall be on such terms and conditions and by such methods as shall be specified by the Committee. Where the value of an Other Stock-Based

Award is based on the Spread Value, the grant price for such an Award shall not be less than 100 percent of the Fair Market Value on the

date of grant. |

| b. | Performance-Based Awards. Any Awards granted pursuant to the Plan may be in the form of performance-based

Awards through the application of Performance Goals and Performance Cycles. |

| c. | Award Limitations. Awards granted under the Plan shall be subject to the following limitations: |

| i. | Stock Options. No Participant shall be granted Stock Options of more than 100,000 shares of Common

Stock during any single calendar year. |

| ii. | Incentive Stock Options. The aggregate Fair Market Value (at the grant date) of the Common Stock

with respect to which Incentive Stock Options are first exercisable by any Participant in any one calendar year shall not exceed $100,000. |

| iii. | Restricted Stock and Restricted Stock Units. No Participant shall be granted Restricted Stock

and/or Restricted Stock Units in a total amount exceeding 100,000 shares of Common Stock during any single calendar year. |

| iv. | Stock Appreciation Rights and Other Stock-Based Awards. No Participant shall be granted Stock Appreciation

Rights and/or Other Stock-Based Awards in a total amount exceeding 100,000 shares of Common Stock during any single calendar year. |

| 7. | Change in Control. Unless otherwise expressly provided in an applicable Award agreement and notwithstanding

any other provision of the Plan to the contrary, if a Participant’s employment with the Company is terminated by action of the employing

entity within 12 months after the effective date of a Change in Control, then all Stock Options and Stock Appreciation Rights held

by such Participant as of the date of termination shall become fully vested and exercisable, and the restrictions and other conditions

applicable to any Restricted Stock, Restricted Stock Units, or Other Stock-Based Awards held by such Participant as of the date of termination,

including vesting requirements, shall lapse, and such Awards shall become free of all restrictions and fully vested. For this purpose,

a “Change in Control” means the event which shall be deemed to have occurred after the date this Plan is adopted by the Company’s

shareholders if either (i), any person, entity or group becomes a beneficial owner, directly or indirectly, of securities of the Company

representing 20% or more of the combined voting power of the Company’s then outstanding securities;

or (ii) as a result of, or in connection with, or within two years following, a tender or exchange offer for the voting stock of the Company,

a merger or other business combination to which the Company is a party, the sale or other disposition

of all or substantially all of the assets of the Company, a reorganization of the Company, or a proxy contest in connection with the election

of members of the Board of Directors, the persons who were directors of the Company immediately prior to any such transactions cease to

constitute a majority of the Board of Directors or of the board of directors of any successor to the Company (except for resignation due

to death, disability or normal retirement). For purposes of the definition in the preceding sentence, any terms that are defined by rules

promulgated by the SEC shall have the meanings specified in such definitions from time to time. |

| 8. | Clawback and Forfeiture. Any awards granted under the Plan will be subject to reduction, cancellation,

forfeiture or recoupment to the extent required by applicable laws, regulations, stock exchange rules, the Company’s Policy

For The Recovery Of Erroneously Awarded Compensation, or to the extent otherwise provided in an Award agreement

at the time of grant. |

| 9. | Plan Amendment and Termination. The Board may amend or terminate the Plan at any time, provided

that no amendment shall be made without shareholder approval if such approval is required under applicable law, regulation, or stock exchange

rule, or if such amendment would (i) decrease the grant or exercise price of any Stock Option, SAR or Other Stock-Based Award to less

than the Fair Market Value on the date of grant, or (ii) increase the total number of shares of Common Stock that may be distributed under

the Plan. The Committee may not, without shareholder approval, cancel any Stock Option, SAR or Other Stock-Based Award and substitute

it with a lower grant price, cash or other awards. Except as set forth in any Award agreement or as necessary to comply with applicable

law or avoid adverse tax consequences to some or all Plan Participants, no amendment or termination of the Plan may materially and adversely

affect any outstanding Award under the Plan without the Award recipient’s consent. |

| 10. | Payments and Payment Deferrals. Payment of Awards may be in the form of cash, Common Stock, other

Awards or combinations thereof as the Committee shall determine, and with such restrictions as it may impose. The Committee, either at

the time of grant or by subsequent amendment, may require or permit deferral of the payment of Awards under such rules and procedures

as it may establish. It also may provide that deferred settlements include the payment or crediting

of interest or other earnings on the deferred amounts, or the payment or crediting of dividend equivalents where the deferred amounts

are denominated in Common Stock equivalents. |

| 11. | Award Agreements. Each Award under the Plan shall be evidenced by a written agreement in a form

prescribed by the Committee that sets forth the terms, conditions and limitations for each Award. Such terms may include, but are not

limited to, the term of the Award, vesting and forfeiture provisions, and the provisions applicable in the event the Participant’s

employment terminates. The Committee may amend an Award agreement, provided that, except as

set forth in any Award agreement or as necessary to comply with applicable law or avoid adverse tax consequences to some or all Plan Participants,

no such amendment may materially and adversely affect an Award without the Participant’s consent. |

| 12. | Shareholder Rights. The Participant shall not have the right to vote any shares of Common Stock

or to receive any cash dividends or dividend equivalents payable with respect to any shares, other than with respect to shares of Restricted

Stock, or otherwise have any rights as a shareholder with respect to any shares, unless and until the shares have actually been issued

to the Participant. For the avoidance of doubt, no dividends or dividend equivalents shall be issued with respect to any unvested

awards under this Plan, other than with respect to shares of Restricted Stock for which dividends shall accrue during the Restricted Period

and only become payable after the Restricted Period. Any dividends accrued on shares of Restricted Stock shall be subject to forfeiture

to the same extent as the Restricted Stock. |

| 13. | Unfunded Status of Plan. It is presently intended that the Plan constitute an “unfunded”

plan for incentive and deferred compensation. The Committee may authorize the creation of trusts or other arrangements to meet the obligations

created under the Plan to deliver Common Stock or make payments; provided, however, that, unless the Committee otherwise determines, the

existence of such trusts or other arrangements is consistent with the “unfunded” status of the Plan. |

| a. | Investment Representations. The Committee may require each person acquiring shares of

Common Stock pursuant to an Award to represent to and agree with the Company in writing that such person is acquiring the shares for investment

and not with a view to the distribution thereof. The certificates for such shares may include any legend that the Committee deems appropriate

to reflect any restrictions on transfer. |

| b. | Not an Employment Obligation. Neither the adoption of the Plan nor the granting of Awards

under the Plan shall confer upon any Associate any right to continued employment nor shall they interfere in any way with the right of

the Company, a subsidiary or an affiliate to terminate the employment of any Associate at any time. |

| c. | Income Tax Withholding. No later than the date as of which an amount first becomes includable

in the gross income of the Participant for income tax purposes with respect to any Award under the Plan, the Participant shall pay to

the Company, or make arrangements satisfactory to the Company for the payment of, any federal, state, local or foreign taxes of any kind

that are required by law or applicable regulation to be withheld with respect to such amount. Unless otherwise determined by the Committee

and except in the case of Incentive Stock Options, withholding obligations arising from an Award may be settled with Common Stock, including

Common Stock that is part of, or is received upon exercise or conversion of, the Award that gives rise to the withholding requirement.

The obligations of the Company under the Plan shall be conditional on such payment or arrangements, and the Company, its subsidiaries

and its affiliates shall, to the extent permitted by law, have the right to deduct any such taxes from any payment otherwise due to the

Participant. The Committee may establish such procedures as it deems appropriate, including the making of irrevocable elections, for the

settling of withholding obligations with Common Stock. |

| d. | Governing Law. The Plan and all Awards made and actions taken thereunder shall be governed

by and construed in accordance with the laws of the State of Ohio, excluding any conflicts or choice of law, rule or principle that might

otherwise refer construction or interpretation of the Plan to the substantive law of another jurisdiction. Unless otherwise provided in

an Award, recipients of an Award under the Plan are deemed to submit to the exclusive jurisdiction and venue of the federal or state courts

of Ohio to resolve any and all issues that may arise out of or relate to the Plan or any related Award. |

| e. | Severability. If any provision of the Plan is held invalid or unenforceable, the invalidity

or unenforceability shall not affect the remaining parts of the Plan, and the Plan shall be enforced and construed as if such provision

had not been included. |

| f. | Successors and Assigns. All obligations of the Company under the Plan with respect to

Awards granted hereunder shall be binding on any successor to the Company, whether the existence of such successor is the result of a

direct or indirect purchase, merger, consolidation, or otherwise, of all or substantially all of the business and/or assets of the Company. |

| g. | Effective Date; Plan Expiration. If approved by the Company shareholders, the Plan shall

become effective on May 4, 2024. Except as otherwise provided by the Board, no Awards shall be made

after May 3, 2034, provided that any Awards granted prior to that date may extend beyond it. |

Exhibit 23.1

| |

Deloitte & Touche LLP |

| |

Suite 1900 |

| |

250 East Fifth St. |

| |

Cincinnati, OH 45201-5340 |

| |

USA |

| |

Tel +1 513 784 7100 |

| |

www.deloitte.com |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration

Statement on Form S-8 of our report dated February 26, 2024, relating to the consolidated financial statements of Cincinnati

Financial Corporation and subsidiaries (the “Company”) and the effectiveness of the Company’s internal control over

financial reporting, appearing in the Annual Report on Form 10-K of the Company for the year ended December 31, 2023.

| DELOITTE & TOUCHE LLP |

|

| |

|

| /s/Deloitte &

Touche LLP |

|

| Cincinnati, OH |

|

| November 18, 2024 |

|

S-8

S-8

EX-FILING FEES

0000020286

CINCINNATI FINANCIAL CORP

Fees to be Paid

0000020286

2024-11-18

2024-11-18

0000020286

1

2024-11-18

2024-11-18

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

CINCINNATI FINANCIAL CORP

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Common Stock

|

457(a)

|

9,000,000

|

$

150.73

|

$

1,356,570,000.00

|

0.0001531

|

$

207,690.87

|

|

Total Offering Amounts:

|

|

$

1,356,570,000.00

|

|

$

207,690.87

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

207,690.87

|

|

1

|

(1) Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the "Securities Act"), this Registration Statement on Form S-8 (the "Registration Statement") shall also cover any additional shares of Common Stock of Cincinnati Financial Corporation (the "Registrant") that may be issued pursuant to the Cincinnati Financial Corporation 2024 Stock Compensation Plan (the "Plan"), by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration which results in an increase in the number of the outstanding shares of common stock of the Registrant.

(2) Estimated solely for the purpose of determining the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act, on the basis of $150.73 per share, which represents the average of the high sales price and the low sales price for the Registrant's Common Stock as reported by The Nasdaq Stock Market LLC on November 15, 2024.

|

|

|

v3.24.3

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Offerings - Offering: 1

|

Nov. 18, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Rule 457(a) |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Stock

|

| Amount Registered | shares |

9,000,000

|

| Proposed Maximum Offering Price per Unit |

150.73

|

| Maximum Aggregate Offering Price |

$ 1,356,570,000.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 207,690.87

|

| Offering Note |

(1) Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the "Securities Act"), this Registration Statement on Form S-8 (the "Registration Statement") shall also cover any additional shares of Common Stock of Cincinnati Financial Corporation (the "Registrant") that may be issued pursuant to the Cincinnati Financial Corporation 2024 Stock Compensation Plan (the "Plan"), by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration which results in an increase in the number of the outstanding shares of common stock of the Registrant.

(2) Estimated solely for the purpose of determining the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act, on the basis of $150.73 per share, which represents the average of the high sales price and the low sales price for the Registrant's Common Stock as reported by The Nasdaq Stock Market LLC on November 15, 2024.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using Rule 457(a) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 457

| Name: |

ffd_Rule457aFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

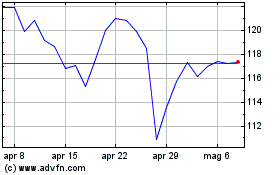

Grafico Azioni Cincinnati Financial (NASDAQ:CINF)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Cincinnati Financial (NASDAQ:CINF)

Storico

Da Dic 2023 a Dic 2024