EDAP TMS Reports Third Quarter 2017 Results

- EDAP's HIFU patient treatment revenues grew 29% compared to

third quarter 2016.

- EDAP received FDA clearance for its Ablatherm Fusion® late

in the quarter.

- EDAP's cash position remains strong at US $21.3 million on

September 30, 2017

LYON, France, November 15, 2017 -- EDAP TMS SA (Nasdaq: EDAP),

the global leader in therapeutic ultrasound, today announced

financial results for the third quarter ended September 30, 2017

and an update on strategic and operational accomplishments.

Marc Oczachowski, EDAP's Chief Executive Officer, stated, "Our

team has executed another successful quarter. Physicians

and patients are clearly responding to the advantages of HIFU for

prostate cancer as evidenced by our 29% growth in treatment driven

revenues compared to the third quarter of 2016."

"EDAP received clearance for the Ablatherm Fusion late in the

quarter. Our current Ablatherm users are initiating the upgrade

process, excited for the increased accuracy provided by Ablatherm

Fusion's proprietary imaging software. In the meantime, we continue

to work with the FDA for the clearance of Focal One®."

Third Quarter 2017 Results

Total revenue for the third quarter of 2017 was EUR 7.1 million

(USD 8.4 million), compared to EUR 8.0 million (USD 8.9 million)

for the third quarter of 2016.

For the three months ended September 30, 2017, total revenue for

the Lithotripsy division was EUR 5.3 million (USD 6.3 million),

compared to EUR 5.4 million (USD 6.1 million) during the year-ago

period. During the third quarter of 2017, EDAP sold 6 lithotripsy

devices compared to 11 lithotripsy devices sold during the third

quarter of 2016.

Total revenue in the HIFU business for the third quarter was EUR

1.8 million (USD 2.2 million) compared to EUR 2.5 million (USD 2.8

million) for the third quarter of 2016. During the third quarter of

2017, EDAP sold no HIFU devices compared to 2 Focal One devices

during the third quarter of 2016.

Gross profit for the third quarter of 2017 was EUR 2.8 million

(USD 3.3 million), compared to EUR 3.5 million (USD 3.9 million)

for the year-ago period. Gross profit margin on net sales

was 39.4% in the third quarter of 2017, compared to 43.2% in

the prior year period, primarily due to a lower revenue.

Operating expenses for the third quarter of 2017 totaled EUR 3.8

million (USD 4.5 million) for the third quarter of 2017, compared

to EUR 3.8 million (USD 4.2 million) for the same period in

2016.

Operating loss for the third quarter of 2017 was EUR 1.0 million

(USD 1.2 million), compared to an operating loss of EUR 0.3 million

(USD 0.4 million) in the third quarter of 2016. '

Net loss for the third quarter of 2017 was EUR 0.5 million (USD

0.6 million), or loss of EUR 0.02 per diluted share, as compared to

net income of EUR 1.3 million (USD 1.4 million), or earnings of EUR

0.04 per diluted share in the year-ago period. Net loss during the

third quarter of 2017 included a non-cash interest income of EUR

0.8 million to adjust the accounting fair value of the outstanding

warrants

First Nine Months 2017 Results

Total revenue for the first nine months of 2017 was EUR 25.1

million (USD 28.2 million) up 1% compared to 24.9 million (USD 27.8

million) during the first nine months of 2016.

For the nine months ended September 30, 2017, total revenue for

the Lithotripsy division was EUR 18.1 million (USD 20.3 million), a

growth of 15% compared to EUR 15.7 million (USD 17.5 million).

During the first nine months of 2017 EDAP sold 21 Lithotripsy

devices compared to 27 Lithotripsy devices during the year ago

period.

HIFU revenue for the nine months ended September 30, 2017 was

EUR 7.1 (USD 7.9 million) compared to EUR 9.2 million (USD 10.3

million) during the first nine months of 2016. During the first

nine months of 2017, EDAP sold 4 HIFU devices, compared to 10 HIFU

devices sold during the first nine months of 2016.

Gross profit for the first nine months of 2017 was EUR 10.4

million (USD 11.7 million) and gross profit margin on net sales was

41.4% compared to EUR 11.2 million (USD 12.5 million) and gross

profit margin of 45.0% during the first nine months of 2016.

Operating loss for the first nine months of 2017 was EUR 1.8

million (USD 2.1 million) compared to an operating profit of EUR

0.1 million (USD 0.1 million) during the same period of

2016.

Net loss for the first nine months of 2017 was EUR 0.6 million

(USD 0.7 million), or loss of EUR 0.02 per share (USD 0.02),

compared to net income of EUR 5.1 million (USD 5.7 million), or

earnings of EUR 0.18 (USD 0.20) per share during the first nine

months of 2016. Net loss for the first nine months of 2017 included

non-cash interest income of EUR 2.2 million to adjust the

accounting fair value of the outstanding warrants.

As of September 30, 2017, cash and cash equivalents, including

short-term treasury investments, were EUR 18.0 million (USD 21.3

million).

Conference Call

An accompanying conference call will be conducted by Philippe

Chauveau, Chairman of the Board, Marc Oczachowski, Chief Executive

Officer; and Francois Dietsch, Chief Financial Officer, to review

the results. The call will be held at 8:30 AM ET, on Thursday,

November 16, 2017. Please refer to the information below for

conference call dial-in information and webcast registration.

Conference Date: Thursday, November 16, 2017, 8:30 AM ET

Conference dial-in: 877-269-7756

International dial-in: 201-689-7817

Conference Call Name: EDAP-TMS Third Quarter 2017 Results

Conference Call

Webcast Registration: Click Here

Following the live call, a replay will be available on the

Company's website, www.edap-tms.com under "Investors

Information."

About EDAP TMS SA

EDAP TMS SA markets today Ablatherm® for high-intensity focused

ultrasound (HIFU) for prostate tissue ablation in the U.S. and for

treatment of localized prostate cancer in the rest of the world.

HIFU treatment is shown to be a minimally invasive and effective

option for prostatic tissue ablation with a low occurrence of side

effects. Ablatherm-HIFU is generally recommended for patients with

localized prostate cancer (stages T1-T2) who are not candidates for

surgery or who prefer an alternative option, or for patients who

failed radiotherapy treatment. Ablatherm-HIFU is approved for

commercial distribution in Europe and some other countries

including Mexico and Canada, and has received 510(k) clearance by

the U.S. FDA. Ablatherm Fusion, next generation of Ablatherm device

is now FDA cleared. The Company also markets an innovative

robot-assisted HIFU device, the Focal One®, dedicated to focal

therapy of prostate cancer. Focal One® is CE marked but is not FDA

approved. In addition, the Company develops its HIFU technology for

the potential treatment of certain other types of tumors. EDAP TMS

SA also produces and distributes medical equipment (the Sonolith®

lithotripters' range) for the treatment of urinary tract stones

using extra-corporeal shockwave lithotripsy (ESWL) in most

countries including Canada and the U.S. For more information on the

Company, please visit http://www.edap-tms.com,

and http://www.hifu-prostate.com.

Forward-Looking Statements In addition to historical

information, this press release may contain forward-looking

statements. Such statements are based on management's current

expectations and are subject to a number of risks and

uncertainties, including matters not yet known to us or not

currently considered material by us, and there can be no assurance

that anticipated events will occur or that the objectives set out

will actually be achieved. Important factors that could cause

actual results to differ materially from the results anticipated in

the forward-looking statements include, among others, the clinical

status and market acceptance of our HIFU devices and the continued

market potential for our lithotripsy device. Factors that may cause

such a difference also may include, but are not limited to, those

described in the Company's filings with the Securities and

Exchange Commission and in particular, in the sections

"Cautionary Statement on Forward-Looking Information" and "Risk

Factors" in the Company's Annual Report on Form 20-F.

Company Contact

Blandine Confort

Investor Relations / Legal Affairs

EDAP TMS SA

+33 4 72 15 31 72

bconfort@edap-tms.com

Investors

Rich Cockrell

CG Capital

877.889.1972

rich@cg.capital

EDAP TMS S.A.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)(Amounts in thousands of

Euros and U.S. Dollars, except per share data)

|

|

Three Months Ended: |

|

Three Months Ended: |

|

|

September 30, 2017 Euros |

|

September 30, 2016 Euros |

|

September 30, 2017 $US |

|

September 30, 2016 $US |

| Net

sales of goods Net sales of RPP and Leases |

3,889 1,277 |

|

5,218 1,098 |

|

4,606 1,512 |

|

5,836 1,228 |

| Net

sales of spare parts andServices |

1,955 |

|

1,674 |

|

2,316 |

|

1,873 |

|

TOTAL NET SALES |

7,121 |

|

7,990 |

|

8,434 |

|

8,936 |

| Other

revenues |

4 |

|

2 |

|

4 |

|

2 |

|

TOTAL REVENUES |

7,124 |

|

7,992 |

|

8,438 |

|

8,938 |

| Cost

of sales |

(4,317) |

|

(4,537) |

|

(5,114) |

|

(5,075) |

|

GROSS PROFIT |

2,807 |

|

3,454 |

|

3,324 |

|

3,864 |

|

Research & development expenses |

(918) |

|

(1,032) |

|

(1,087) |

|

(1,154) |

| S, G

& A expenses |

(2,889) |

|

(2,754) |

|

(3,422) |

|

(3,080) |

| Total

operating expenses |

(3,807) |

|

(3,786) |

|

(4,510) |

|

(4,234) |

|

OPERATING PROFIT (LOSS) |

(1,001) |

|

(332) |

|

(1,185) |

|

(371) |

|

Interest (expense) income, net |

821 |

|

1,502 |

|

972 |

|

1,680 |

|

Currency exchange gains (loss), net |

(325) |

|

130 |

|

(385) |

|

145 |

| Other

income (loss), net |

- |

|

- |

|

- |

|

- |

|

INCOME (LOSS) BEFORE TAXES AND MINORITY INTEREST |

(504) |

|

1,301 |

|

(597) |

|

1,455 |

| Income

tax (expense) credit |

(21) |

|

(40) |

|

(25) |

|

(44) |

| NET

INCOME (LOSS)

|

(525) |

|

1,261 |

|

(622) |

|

1,411 |

| Basic

income (loss) per share |

(0.02) |

|

0.04 |

|

(0.02) |

|

0.05 |

| Basic

weighted average shares outstanding |

28,997,866 |

|

28,727,616 |

|

28,997,866 |

|

28,727,616 |

|

Diluted income (loss) per share |

(0.02) |

|

0.04 |

|

(0.02) |

|

0.05 |

|

Diluted weighted average shares outstanding |

28,997,866 |

|

30,251,966 |

|

28,997,866 |

|

30,251,966 |

NOTE: Translated for convenience of the reader to

U.S. dollars at the 2017 average three months' noon buying rate of

1 Euro = 1.1844USD, and 2016 average three months' noon buying rate

of 1 Euro = 1.1184 USD.

EDAP TMS S.A.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)(Amounts in thousands of

Euros and U.S. Dollars, except per share data)

|

|

Nine Months Ended: |

|

Nine Months Ended: |

|

|

September 30, 2017 Euros |

|

September 30, 2016 Euros |

|

September 30, 2017 $US |

|

September 30, 2016 $US |

| Net

sales of goods Net sales of RPP and leases |

15,367 3,876 |

|

16,480 3,675 |

|

17,276 4,357 |

|

18,356 4,094 |

| Net

sales of spare parts andServices |

5,834 |

|

4,752 |

|

6,559 |

|

5,293 |

|

TOTAL NET SALES |

25,076 |

|

24,907 |

|

28,192 |

|

27,742 |

| Other

revenues |

43 |

|

10 |

|

48 |

|

11 |

|

TOTAL REVENUES |

25,119 |

|

24,917 |

|

28,240 |

|

27,753 |

| Cost

of sales |

(14,745) |

|

(13,709) |

|

(16,576) |

|

(15,269) |

|

GROSS PROFIT |

10,375 |

|

11,208 |

|

11,663 |

|

12,484 |

|

Research & development expenses |

(2,783) |

|

(2,733) |

|

(3,129) |

|

(3,044) |

| S, G

& A expenses |

(9,441) |

|

(8,418) |

|

(10,614) |

|

(9,376) |

| Total

operating expenses |

(12,224) |

|

(11,151) |

|

(13,742) |

|

(12,420) |

|

OPERATING PROFIT (LOSS) |

(1,849) |

|

57 |

|

(2,079) |

|

63 |

|

Interest (expense) income, net |

2,229 |

|

4,393 |

|

2,506 |

|

4,893 |

|

Currency exchange gains (loss), net |

(775) |

|

801 |

|

(871) |

|

892 |

| Other

income (loss), net |

- |

|

- |

|

- |

|

(1) |

|

INCOME (LOSS) BEFORE TAXES AND MINORITY INTEREST |

(394) |

|

5,250 |

|

(443) |

|

5,848 |

| Income

tax (expense) credit |

(196) |

|

(130) |

|

(220) |

|

(145) |

| NET

INCOME (LOSS)

|

(590) |

|

5,120 |

|

(663) |

|

5,703 |

| Basic

income (loss) per share |

(0.02) |

|

0.19 |

|

(0.02) |

|

0.21 |

| Basic

weighted average shares outstanding |

28,947,947 |

|

27,497,107 |

|

28,947,947 |

|

27,497,107 |

|

Diluted income (loss) per share |

(0.02) |

|

0.18 |

|

(0.02) |

|

0.20 |

|

Diluted weighted average shares outstanding |

28,947,947 |

|

29,045,939 |

|

28,947,947 |

|

29,045,939 |

NOTE: Translated for convenience of the reader to

U.S. dollars at the 2017 average six months' noon buying rate of 1

Euro = 1.1242USD, and 2016 average six months' noon buying rate of

1 Euro = 1. 1138 USD.

EDAP TMS S.A.CONSOLIDATED BALANCE

SHEETS HIGHLIGHTS(Amounts in thousands of Euros and U.S.

Dollars)

|

|

Sept. 30, 2017 Euros |

|

June 30, 2017 Euros |

|

Sept. 30, 2017 $US |

|

June 30, 2017 $US |

|

|

|

|

|

|

|

|

|

| Cash,

cash equivalents and short term investments |

18,036 |

|

18,554 |

|

21,306 |

|

21,173 |

| Total

current assets |

37,172 |

|

39,583 |

|

43,912 |

|

45,171 |

| Total

current liabilities |

12,676 |

|

13,372 |

|

14,975 |

|

15,260 |

|

Shareholders' Equity |

24,947 |

|

25,383 |

|

29,471 |

|

28,966 |

NOTE: Translated for convenience of the reader to

U.S. dollars at the noon buying rate of 1 Euro = 1.1813 USD, on

September 30, 2017 and at the noon buying rate of 1 Euro = 1.1412

USD, on June 30, 2017.

EDAP TMS S.A.CONDENSED STATEMENTS OF

OPERATIONS BY DIVISIONNINE MONTHS ENDED SEPTEMBER 30,

2017(Amounts in thousands of Euros)

| |

HIFU Division |

|

UDS Division |

|

Corporate |

|

Total After Consolidation |

|

|

Sales of goods |

3,109 |

|

12,258 |

|

|

|

15,367 |

|

| Sales

of RPPs & leases |

2,891 |

|

984 |

|

|

|

3,876 |

|

| Sales

of spare parts & services |

1,050 |

|

4,784 |

|

|

|

5,834 |

|

|

TOTAL NET SALES |

7,050 |

|

18,026 |

|

|

|

25,076 |

|

| Other

revenues |

8 |

|

35 |

|

|

|

43 |

|

|

TOTAL REVENUES |

7,058 |

|

18,062 |

|

|

|

25,119 |

|

|

GROSS PROFIT(% of Total Revenues) |

3,621 |

51% |

6,754 |

37% |

|

|

10,375 |

41% |

|

|

|

|

|

|

|

|

|

|

|

Research & Development |

(1,814) |

|

(969) |

|

|

|

(2,783) |

|

| Total

SG&A plus depreciation |

(3,627) |

|

(4,711) |

|

(1,103) |

|

(9,441) |

|

|

OPERATING PROFIT (LOSS) |

(1,820) |

|

1,074 |

|

(1,103) |

|

(1,849) |

|

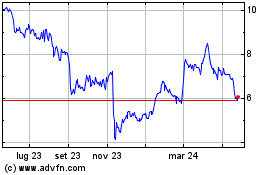

Grafico Azioni EDAP TMS (NASDAQ:EDAP)

Storico

Da Feb 2025 a Mar 2025

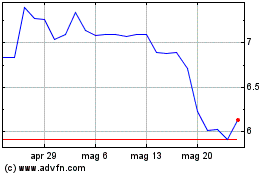

Grafico Azioni EDAP TMS (NASDAQ:EDAP)

Storico

Da Mar 2024 a Mar 2025