Will Hain Celestial Beat in 2Q13? - Analyst Blog

04 Febbraio 2013 - 10:10AM

Zacks

We expect The Hain

Celestial Group, Inc. (HAIN), the distributor, marketer

and seller of various natural and organic foods as well as personal

care products, to beat expectations when it reports second-quarter

fiscal 2013 results on Feb 5, 2013.

Why a Likely Positive

Surprise?

Our proven model shows that Hain

Celestial is likely to beat earnings because it has the right

combination of two key components.

Positive Zacks

ESP: Hain Celestial currently has an Earnings ESP (Read:

Zacks Earnings ESP: A Better Method) of +2.90%. This is because the

Most Accurate Estimate stands at 71 cents, while the Zacks

Consensus Estimate is pegged at 69 cents.

Zacks Rank #2

(Buy): Note that stocks with Zacks Ranks of #1, #2 and #3

have a significantly higher chance of beating earnings estimates.

The sell-rated stocks (Zacks Rank #4 and #5) should never be

considered going into an earnings announcement.

The combination of Hain Celestial’s

Zacks Rank #2 (Buy) and +2.90% ESP makes us very confident

regarding a positive earnings beat on Feb 5.

What is Driving the

Better than Expected Earnings?

A leader in natural food and

personal care products with an array of well-known brands, Hain

Celestial offers investors one of the strongest growth profiles in

the industry. The company’s strategic investments plus continued

efforts to contain costs, increase productivity, and enhance cash

flows and margins have enabled it to deliver healthy results. Rise

in consumption, innovative marketing and expanded distribution

facilitated the company to post healthy sales and earnings numbers

during first quarter 2013. The positive trend is seen in the

trailing four-quarter average surprise of 5.3%.

Other Stocks to

Consider

Here are some other companies you

may want to consider as our model shows they have the right

combination of elements to post an earnings beat:

Flowers Foods,

Inc. (FLO), Earnings ESP of +4.00% and Zacks Rank #1

(Strong Buy)

J&J Snack Foods

Corp. (JJSF), Earnings ESP of +5.00% and Zacks Rank #1

(Strong Buy)

The Hershey

Company (HSY), Earnings ESP of +0.95% and Zacks Rank #2

(Buy)

FLOWERS FOODS (FLO): Free Stock Analysis Report

HAIN CELESTIAL (HAIN): Free Stock Analysis Report

HERSHEY CO/THE (HSY): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

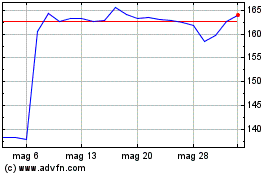

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2023 a Lug 2024