J & J Snack Foods Corp. (NASDAQ-JJSF) today announced sales and

earnings for the third quarter ended June 26th, 2021.

Sales increased 51% to $324.3 million from $214.6 million in

last year’s third quarter. Net earnings were $28.9 million in the

current quarter compared to a $12.6 million loss last year.

Earnings per diluted share was $1.51 for the third quarter, a

significant increase compared to the $0.67 loss per diluted share

last year. Operating income increased to $38.1 million in the

current quarter versus a $19.4 million loss last year.

For the nine months ended June 26, 2021, sales

were $821.5 million, a 7% increase from the same period last year

when sales were $769.5 million. Net earnings were $36.7 million for

the nine months compared to $11.7 million last year. Earnings per

diluted share was $1.92 for the nine-month period compared to $0.62

last year. Operating income increased 246% to $46.0 million this

year from $13.3 million last year. Operating income was impacted by

$2.1 million of Covid-19 related costs during this nine-month

period.

The overall sales environment improved

significantly this quarter benefiting our business across all three

segments. Food service venues are approaching pre-Covid capacity

levels and more confident consumers are getting out of the house

and spending more as the market normalizes. Our Food Service

segment rebounded with 68% growth versus last year and exceeded

fiscal 2019 sales by 1% led by strength in soft pretzels, churros,

handhelds and bakery. Even as our food service business rebounds,

we continue to see strength in our Retail segment where sales were

just 6% below last year despite lapping a 38% growth in the prior

year. Benchmarked against a pre-Covid fiscal 2019, retail sales

grew 29% even as consumer trends shift out of the home. The Frozen

Beverages business was 83% above prior year for the quarter which

was a significant improvement when compared to Q2 of this year

where sales were still 32% below the prior year. This growth was

led by the amusement, c-store and mass merchandise channels. While

theater attendance continues to lag 2019 levels, traffic and

average ticket are improving and should further benefit our

business down the road. Improved sales volume, product mix and a

strong focus on cost efficiencies helped drive improved gross

margins and profitability.

Dan Fachner, J&J’s President, commented, “I

am so proud of our employees across the business for helping

deliver a strong quarter. Our business performance is starting to

benefit from an economy that is moving much closer to pre-Covid

activities. The strength of our product and brand portfolio enables

us to quickly leverage consumer traffic across multiple food

service and retail customers. Consumers are embracing the

opportunities they missed over the last year whether that is

enjoying a SUPERPRETZEL at the game or sipping on an ICEE at the

beach with their family. I remain extremely confident

in our business and future growth opportunities.”

J&J Snack Foods Corp. (NASDAQ: JJSF) is a leader and

innovator in the snack food industry, providing innovative, niche

and affordable branded snack foods and beverages to foodservice and

retail supermarket outlets. Manufactured and distributed

nationwide, our principal products include SUPERPRETZEL,

the #1 soft pretzel brand in the world, as well as

internationally known ICEE and SLUSH PUPPIE frozen beverages,

LUIGI’S Real Italian Ice, MINUTE MAID* frozen ices, WHOLE FRUIT

sorbet and frozen fruit bars, SOUR PATCH KIDS** Flavored Ice Pops,

Tio Pepe’s & CALIFORNIA CHURROS, and THE FUNNEL CAKE FACTORY

funnel cakes and several bakery brands within DADDY RAY’S, COUNTRY

HOME BAKERS and HILL & VALLEY. J&J Snack Foods Corp. has

approximately twenty manufacturing facilities and generates more

than $1 billion in annual revenue. The Company has a history of

strong sales growth and financial performance and remains focused

on opportunities to expand its unique niche market product offering

while bringing smiles to families worldwide. For more information,

please visit http://www.jjsnack.com.

*MINUTE MAID is a registered trademark of The Coca-Cola

Company**SOUR PATCH KIDS is a registered trademark of Mondelēz

International group, used under license.

|

J & J SNACK FOODS CORP. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF EARNINGS |

|

(Unaudited) |

|

(in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Nine months ended |

|

|

June 26, |

|

June 27, |

|

June 26, |

|

June 27, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

$ |

324,344 |

|

|

$ |

214,563 |

|

|

$ |

821,519 |

|

|

$ |

769,502 |

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

228,170 |

|

|

|

177,367 |

|

|

|

614,324 |

|

|

|

585,002 |

|

|

Gross Profit |

|

96,174 |

|

|

|

37,196 |

|

|

|

207,195 |

|

|

|

184,500 |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

Marketing |

|

20,502 |

|

|

|

21,952 |

|

|

|

56,995 |

|

|

|

68,532 |

|

|

Distribution |

|

27,311 |

|

|

|

21,272 |

|

|

|

75,643 |

|

|

|

69,648 |

|

|

Administrative |

|

10,348 |

|

|

|

8,374 |

|

|

|

29,004 |

|

|

|

28,166 |

|

|

Plant shutdown impairment costs |

|

- |

|

|

|

5,072 |

|

|

|

- |

|

|

|

5,072 |

|

|

Other general (income) expense |

|

(131 |

) |

|

|

(54 |

) |

|

|

(399 |

) |

|

|

(183 |

) |

|

Total Operating Expenses |

|

58,030 |

|

|

|

56,616 |

|

|

|

161,243 |

|

|

|

171,235 |

|

|

|

|

|

|

|

|

|

|

|

Operating Income (loss) |

|

38,144 |

|

|

|

(19,420 |

) |

|

|

45,952 |

|

|

|

13,265 |

|

|

|

|

|

|

|

|

|

|

|

Other (expense) income |

|

|

|

|

|

|

|

|

Investment income (loss) |

|

470 |

|

|

|

1,300 |

|

|

|

2,419 |

|

|

|

2,673 |

|

|

Interest (expense) & other |

|

(8 |

) |

|

|

(7 |

) |

|

|

(19 |

) |

|

|

(60 |

) |

|

|

|

|

|

|

|

|

|

|

Earnings (loss) before income taxes |

|

38,606 |

|

|

|

(18,127 |

) |

|

|

48,352 |

|

|

|

15,878 |

|

|

|

|

|

|

|

|

|

|

|

Income taxes (benefit) |

|

9,713 |

|

|

|

(5,480 |

) |

|

|

11,620 |

|

|

|

4,157 |

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS (LOSS) |

$ |

28,893 |

|

|

$ |

(12,647 |

) |

|

$ |

36,732 |

|

|

$ |

11,721 |

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per diluted share |

$ |

1.51 |

|

|

$ |

(0.67 |

) |

|

$ |

1.92 |

|

|

$ |

0.62 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of diluted shares |

|

19,185 |

|

|

|

18,888 |

|

|

|

19,116 |

|

|

|

19,036 |

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per basic share |

|

1.52 |

|

|

$ |

(0.67 |

) |

|

$ |

1.93 |

|

|

$ |

0.62 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of basic shares |

|

19,045 |

|

|

|

18,888 |

|

|

|

18,996 |

|

|

|

18,902 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these

statements.

|

J & J SNACK FOODS CORP. AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

(in thousands, except share amounts) |

|

|

June 26, |

|

|

|

|

2021 |

|

September 26, |

|

|

(unaudited) |

|

2020 |

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

276,268 |

|

|

$ |

195,809 |

|

|

Marketable securities held to maturity |

|

9,902 |

|

|

|

51,151 |

|

|

Accounts receivable, net |

|

154,845 |

|

|

|

126,587 |

|

|

Inventories |

|

114,822 |

|

|

|

108,923 |

|

|

Prepaid expenses and other |

|

11,547 |

|

|

|

17,087 |

|

|

Total current assets |

|

567,384 |

|

|

|

499,557 |

|

|

|

|

|

|

|

Property, plant and equipment, at cost |

|

|

|

|

Land |

|

2,494 |

|

|

|

2,494 |

|

|

Buildings |

|

26,582 |

|

|

|

26,582 |

|

|

Plant machinery and equipment |

|

340,693 |

|

|

|

330,168 |

|

|

Marketing equipment |

|

253,199 |

|

|

|

250,914 |

|

|

Transportation equipment |

|

10,232 |

|

|

|

9,966 |

|

|

Office equipment |

|

34,291 |

|

|

|

33,878 |

|

|

Improvements |

|

45,349 |

|

|

|

43,264 |

|

|

Construction in progress |

|

28,134 |

|

|

|

19,995 |

|

|

Total Property, plant and equipment, at cost |

|

740,974 |

|

|

|

717,261 |

|

|

Less accumulated depreciation and amortization |

|

482,056 |

|

|

|

455,645 |

|

|

Property, plant and equipment, net |

|

258,918 |

|

|

|

261,616 |

|

|

|

|

|

|

|

Other assets |

|

|

|

|

Goodwill |

|

121,833 |

|

|

|

121,833 |

|

|

Other intangible assets, net |

|

79,676 |

|

|

|

81,622 |

|

|

Marketable securities held to maturity |

|

7,568 |

|

|

|

16,927 |

|

|

Marketable securities available for sale |

|

11,273 |

|

|

|

13,976 |

|

|

Operating lease right-of-use assets |

|

51,811 |

|

|

|

58,110 |

|

|

Other |

|

3,083 |

|

|

|

2,912 |

|

|

Total other assets |

|

275,244 |

|

|

|

295,380 |

|

|

Total Assets |

$ |

1,101,546 |

|

|

$ |

1,056,553 |

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

Current Liabilities |

|

|

|

|

Current finance lease liabilities |

$ |

252 |

|

|

$ |

349 |

|

|

Accounts payable |

|

97,117 |

|

|

|

73,135 |

|

|

Accrued insurance liability |

|

15,764 |

|

|

|

13,039 |

|

|

Accrued liabilities |

|

6,890 |

|

|

|

7,420 |

|

|

Current operating lease liabilities |

|

12,780 |

|

|

|

13,173 |

|

|

Accrued compensation expense |

|

15,000 |

|

|

|

16,134 |

|

|

Dividends payable |

|

12,064 |

|

|

|

10,876 |

|

|

Total current liabilities |

|

159,867 |

|

|

|

134,126 |

|

|

|

|

|

|

|

Noncurrent finance lease liabilities |

|

417 |

|

|

|

368 |

|

|

Noncurrent operating lease liabilities |

|

41,573 |

|

|

|

47,688 |

|

|

Deferred income taxes |

|

64,284 |

|

|

|

64,413 |

|

|

Other long-term liabilities |

|

375 |

|

|

|

460 |

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

Preferred stock, $1 par value; authorized |

|

|

|

|

10,000,000 shares; none issued |

|

- |

|

|

|

- |

|

|

Common stock, no par value; authorized, |

|

|

|

|

50,000,000 shares; issued and outstanding |

|

|

|

|

19,061,000 and 18,915,000 respectively |

|

69,572 |

|

|

|

49,268 |

|

|

Accumulated other comprehensive loss |

|

(13,182 |

) |

|

|

(15,587 |

) |

|

Retained Earnings |

|

778,640 |

|

|

|

775,817 |

|

|

Total stockholders' equity |

|

835,030 |

|

|

|

809,498 |

|

|

Total Liabilities and Stockholders' Equity |

$ |

1,101,546 |

|

|

$ |

1,056,553 |

|

|

|

|

|

|

The accompanying notes are an integral part of these

statements.

|

J & J SNACK FOODS CORP. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(Unaudited) (in thousands) |

|

|

Nine Months Ended |

|

|

June 26, |

|

June 27, |

|

|

|

2021 |

|

|

|

2020 |

|

|

Operating activities: |

|

|

|

|

Net earnings |

$ |

36,732 |

|

|

$ |

11,721 |

|

|

Adjustments to reconcile net earnings to net cash provided by

operating activities: |

|

|

|

|

Depreciation of fixed assets |

|

36,278 |

|

|

|

37,353 |

|

|

Amortization of intangibles and deferred costs |

|

2,096 |

|

|

|

2,516 |

|

|

Share-based compensation |

|

3,252 |

|

|

|

3,421 |

|

|

Deferred income taxes |

|

(188 |

) |

|

|

(426 |

) |

|

(Gain) loss on marketable securities |

|

(926 |

) |

|

|

1,746 |

|

|

Plant shutdown impairment costs |

|

- |

|

|

|

5,072 |

|

|

Other |

|

(305 |

) |

|

|

(309 |

) |

|

Changes in assets and liabilities net of effects from purchase of

companies |

|

|

|

|

(Increase) decrease in accounts receivable |

|

(27,940 |

) |

|

|

24,634 |

|

|

Increase in inventories |

|

(5,964 |

) |

|

|

(3,751 |

) |

|

(Increase) decrease in prepaid expenses |

|

5,710 |

|

|

|

(7,879 |

) |

|

Increase (decrease) in accounts payable and accrued

liabilities |

|

24,823 |

|

|

|

(7,478 |

) |

|

Net cash provided by operating activities |

|

73,568 |

|

|

|

66,620 |

|

|

Investing activities: |

|

|

|

|

Payments for purchases of companies, net of cash acquired |

|

- |

|

|

|

(57,197 |

) |

|

Purchases of property, plant and equipment |

|

(34,456 |

) |

|

|

(47,637 |

) |

|

Purchases of marketable securities |

|

- |

|

|

|

(6,103 |

) |

|

Proceeds from redemption and sales of marketable securities |

|

54,191 |

|

|

|

54,125 |

|

|

Proceeds from disposal of property and equipment |

|

2,079 |

|

|

|

2,852 |

|

|

Other |

|

42 |

|

|

|

(72 |

) |

|

Net cash provided by (used in) investing activities |

|

21,856 |

|

|

|

(54,032 |

) |

|

Financing activities: |

|

|

|

|

Payments to repurchase common stock |

|

- |

|

|

|

(8,972 |

) |

|

Proceeds from issuance of stock |

|

17,178 |

|

|

|

6,300 |

|

|

Payments on capitalized lease obligations |

|

(48 |

) |

|

|

(272 |

) |

|

Payment of cash dividend |

|

(32,719 |

) |

|

|

(31,193 |

) |

|

Net cash used in financing activities |

|

(15,589 |

) |

|

|

(34,137 |

) |

|

Effect of exchange rate on cash and cash equivalents |

|

624 |

|

|

|

(885 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

80,459 |

|

|

|

(22,434 |

) |

|

Cash and cash equivalents at beginning of period |

|

195,809 |

|

|

|

192,395 |

|

|

Cash and cash equivalents at end of period |

$ |

276,268 |

|

|

$ |

169,961 |

|

|

|

|

|

|

The accompanying notes are an integral part of these

statements.

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Nine months ended |

|

|

June 26, |

|

June 27, |

|

June 26, |

|

June 27, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales to External Customers: |

|

|

|

|

|

|

|

|

Food Service |

|

|

|

|

|

|

|

|

Soft pretzels |

$ |

50,895 |

|

|

$ |

21,384 |

|

|

$ |

120,359 |

|

|

$ |

116,985 |

|

|

Frozen juices and ices |

|

13,927 |

|

|

|

8,688 |

|

|

|

30,812 |

|

|

|

25,222 |

|

|

Churros |

|

20,096 |

|

|

|

7,321 |

|

|

|

46,358 |

|

|

|

38,466 |

|

|

Handhelds |

|

18,971 |

|

|

|

7,448 |

|

|

|

56,574 |

|

|

|

22,084 |

|

|

Bakery |

|

85,706 |

|

|

|

69,237 |

|

|

|

257,580 |

|

|

|

255,016 |

|

|

Other |

|

6,884 |

|

|

|

2,543 |

|

|

|

14,546 |

|

|

|

13,628 |

|

|

Total Food Service |

$ |

196,478 |

|

|

$ |

116,621 |

|

|

$ |

526,226 |

|

|

$ |

471,401 |

|

|

|

|

|

|

|

|

|

|

|

Retail Supermarket |

|

|

|

|

|

|

|

|

Soft pretzels |

$ |

11,193 |

|

|

$ |

12,716 |

|

|

$ |

40,871 |

|

|

$ |

34,874 |

|

|

Frozen juices and ices |

|

36,898 |

|

|

|

33,322 |

|

|

|

71,600 |

|

|

|

59,279 |

|

|

Biscuits |

|

4,562 |

|

|

|

8,151 |

|

|

|

18,717 |

|

|

|

21,759 |

|

|

Handhelds |

|

1,191 |

|

|

|

3,257 |

|

|

|

6,215 |

|

|

|

9,135 |

|

|

Coupon redemption |

|

(513 |

) |

|

|

(807 |

) |

|

|

(2,196 |

) |

|

|

(2,216 |

) |

|

Other |

|

526 |

|

|

|

863 |

|

|

|

1,652 |

|

|

|

1,668 |

|

|

Total Retail Supermarket |

$ |

53,857 |

|

|

$ |

57,502 |

|

|

$ |

136,859 |

|

|

$ |

124,499 |

|

|

|

|

|

|

|

|

|

|

|

Frozen Beverages |

|

|

|

|

|

|

|

|

Beverages |

$ |

42,279 |

|

|

$ |

16,456 |

|

|

$ |

76,663 |

|

|

$ |

83,606 |

|

|

Repair and maintenance service |

|

22,789 |

|

|

|

17,259 |

|

|

|

59,903 |

|

|

|

61,524 |

|

|

Machines revenue |

|

8,404 |

|

|

|

6,363 |

|

|

|

20,556 |

|

|

|

27,254 |

|

|

Other |

|

536 |

|

|

|

362 |

|

|

|

1,312 |

|

|

|

1,218 |

|

|

Total Frozen Beverages |

$ |

74,009 |

|

|

$ |

40,440 |

|

|

$ |

158,434 |

|

|

$ |

173,602 |

|

|

|

|

|

|

|

|

|

|

|

Consolidated Sales |

$ |

324,344 |

|

|

$ |

214,563 |

|

|

$ |

821,519 |

|

|

$ |

769,502 |

|

|

|

|

|

|

|

|

|

|

|

Depreciation and Amortization: |

|

|

|

|

|

|

|

|

Food Service |

$ |

6,817 |

|

|

$ |

7,050 |

|

|

$ |

20,334 |

|

|

$ |

21,208 |

|

|

Retail Supermarket |

|

378 |

|

|

|

468 |

|

|

|

1,147 |

|

|

|

1,156 |

|

|

Frozen Beverages |

|

5,469 |

|

|

|

5,864 |

|

|

|

16,893 |

|

|

|

17,505 |

|

|

Total Depreciation and Amortization |

$ |

12,664 |

|

|

$ |

13,382 |

|

|

$ |

38,374 |

|

|

$ |

39,869 |

|

|

|

|

|

|

|

|

|

|

|

Operating Income: |

|

|

|

|

|

|

|

|

Food Service |

$ |

17,644 |

|

|

$ |

(18,242 |

) |

|

$ |

29,879 |

|

|

$ |

7,743 |

|

|

Retail Supermarket |

|

9,080 |

|

|

|

7,910 |

|

|

|

20,167 |

|

|

|

14,464 |

|

|

Frozen Beverages |

|

11,420 |

|

|

|

(9,088 |

) |

|

|

(4,094 |

) |

|

|

(8,942 |

) |

|

Total Operating Income (Loss) |

$ |

38,144 |

|

|

$ |

(19,420 |

) |

|

$ |

45,952 |

|

|

$ |

13,265 |

|

|

|

|

|

|

|

|

|

|

|

Capital Expenditures: |

|

|

|

|

|

|

|

|

Food Service |

$ |

10,383 |

|

|

$ |

7,865 |

|

|

$ |

25,915 |

|

|

$ |

26,599 |

|

|

Retail Supermarket |

|

93 |

|

|

|

390 |

|

|

|

194 |

|

|

|

1,625 |

|

|

Frozen Beverages |

|

5,151 |

|

|

|

2,397 |

|

|

|

8,347 |

|

|

|

19,413 |

|

|

Total Capital Expenditures |

$ |

15,627 |

|

|

$ |

10,652 |

|

|

$ |

34,456 |

|

|

$ |

47,637 |

|

|

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

Food Service |

$ |

779,730 |

|

|

$ |

729,331 |

|

|

$ |

779,730 |

|

|

$ |

729,331 |

|

|

Retail Supermarket |

|

33,405 |

|

|

|

33,766 |

|

|

|

33,405 |

|

|

|

33,766 |

|

|

Frozen Beverages |

|

288,411 |

|

|

|

294,189 |

|

|

|

288,411 |

|

|

|

294,189 |

|

|

Total Assets |

$ |

1,101,546 |

|

|

$ |

1,057,286 |

|

|

$ |

1,101,546 |

|

|

$ |

1,057,286 |

|

|

|

|

|

|

|

|

|

|

RESULTS OF OPERATIONS

Consolidated J&J Snack Foods net sales increased $109.8

million or 51% to $324.3 million for the three months ended June

26th, 2021.

FOOD SERVICE

Sales to food service customers increased $79.9 million or 68%

in the third quarter to $196.5 million. Food service venues are

approaching pre-COVID capacity levels and more confident consumers

are leaving their homes and spending more as the market normalizes.

Sales accelerated throughout our key channels led by schools,

amusement/recreation, restaurants, c-stores and theaters. Soft

pretzel sales to food service increased 138% to $50.9 million.

Frozen juices and ices sales increased 60% to $13.9 million and

Churro sales increased 174% in the quarter to $20.1 million.

Sales of bakery products increased 24% to $85.7 million in the

third quarter. Sales of handhelds increased 155% to $19.0 million

in the quarter led by the continued success of a new product

developed for one of our larger wholesale club customers.

Sales of new products in the first twelve months since their

introduction were approximately $11.8 million in the quarter led by

the previously noted handheld item. Price increases had a marginal

impact on results in the quarter as traffic and volume drove almost

all the sales increase compared to last year.

Operating income in our Food Service segment was $17.6 million

in the third quarter compared with an operating loss of $18.2

million in the prior year quarter. The increase in operating income

was primarily due to the increase in sales which improved margin

efficiencies and expense leverage.

RETAIL SUPERMARKETS

Sales of products to retail supermarkets decreased $3.6 million

or 6% to $53.9 million in the third quarter. The decrease in

sales in the current quarter was primarily attributable to the

stronger customer demand in the prior year third quarter resulting

from the initial responses to the COVID-19 pandemic. During the

prior year third quarter, a surge in demand and sales was

experienced related to the effects of the rapid changes in consumer

purchasing habits.

Sales of soft pretzels decreased 12% to $11.2 million in the

third quarter. Sales of frozen juices and ices increased 11% to

$36.9 million in the third quarter. Sales of biscuits decreased 44%

to $4.6 million and Handheld sales to retail supermarket customers

decreased 63% to $1.2 million in the third quarter.

Price increases and sales of new products had a minimum impact

on revenue in the quarter as sales were driven primarily by

consumer traffic and volume trends in retail outlets.

Operating income in our Retail Supermarkets segment increased

$1.2 million or 15% to $9.1 million in this year’s third quarter

driven by improving operating income margins which were

approximately 300 basis points better than prior year.

FROZEN BEVERAGES

Frozen beverage and related product sales increased $33.6

million or 83% to $74.0 million in the third quarter. Beverage

related sales increased 157% to $42.3 million, with the majority of

the increase attributable to the increase in gallon sales. The

increase was led by the amusement channel that experienced sales

above pre-COVID 19 levels and continued traffic increases in the

mass merchandise, QSR and theater channels. The theater channel

continued to show improvement this quarter, and while current

quarter theater channel sales still lagged 2019 sales by over 50%,

it represented a significant improvement over the prior year

quarter.

Service revenue increased 32% to $22.8 million in the third

quarter as customers accelerated equipment maintenance in the

quarter to support the post COVID-19 recovery. Machine revenue

(primarily sales of frozen beverage machines) increased 32% to $8.4

million in the third quarter. Retailers are beginning to re-invest

again which helped to accelerate machine revenues in the

quarter.

Our Frozen Beverage segment generated operating income of $11.4

million in the third quarter compared with an operating loss of

$9.1 million in the prior year third quarter. The comparative

performance was impacted due to the challenging sales environment

in the prior year quarter due to the COVID-19 pandemic.

CONSOLIDATED

Gross profit as a percentage of sales was 29.7% in the

three-month period this year and 17.3% last year with the increase

largely attributable to the benefit of increased sales, favorable

product mix and corresponding margin efficiencies.

Total operating expenses increased $1.4 million in the third

quarter, however, as a percentage of sales, total operating

expenses decreased to 17.9% from 26.4% in the prior year quarter.

Marketing expenses decreased to 6.3% of sales in this year’s

quarter from 10.2% last year. Distribution expenses were 8.4% of

sales in this year’s quarter compared to 9.9% of sales last year.

Administrative expenses were 3.2% of sales this quarter compared to

3.9% last year. Operating expenses in the prior year quarter were

also impacted by $5.1 million of plant shutdown impairment

costs.

Operating income was $38.1 million in the third quarter compared

with an operating loss of $19.4 million in the prior year quarter,

largely the result of the aforementioned items.

Our investments generated before tax income of $0.5 million this

quarter, a decrease of $0.8 million compared to prior year quarter.

The decrease was primarily attributable to the decrease in

investments held between periods.

Net earnings in the third quarter were $28.9 million compared

with a net loss of $12.6 million in the prior year quarter. Our

effective tax rate was 25% in this year’s quarter.

There are many factors which can impact our net earnings from

year to year and in the long run, among which are the supply and

cost of raw materials and labor, insurance costs, factors impacting

sales as noted above, the continuing consolidation of our

customers, our ability to manage our manufacturing, marketing and

distribution activities, our ability to make and integrate

acquisitions and changes in tax laws and interest rates.

The forward-looking statements contained herein

are subject to certain risks and uncertainties that could cause

actual results to differ materially from those projected in the

forward-looking statements. Readers are cautioned not to place

undue reliance on these forward-looking statements, which reflect

management’s analysis only as of the date hereof. The Company

undertakes no obligation to publicly revise or update these

forward-looking statements to reflect events or circumstances that

arise after the date hereof.

|

Contact: |

|

Ken PlunkSenior Vice

PresidentChief Financial

Officer(615) 587-4374 |

|

|

|

|

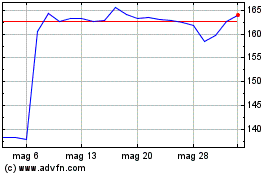

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Set 2024 a Ott 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Ott 2023 a Ott 2024