NeuroMetrix, Inc. (“NeuroMetrix” or the “Company”) (Nasdaq: NURO)

today announced it has entered into a definitive merger agreement

whereby electroCore, Inc. (“electroCore”) (Nasdaq: ECOR), a

commercial stage bioelectronic medicine and wellness company, will

acquire NeuroMetrix. The transaction has been unanimously approved

by the Boards of Directors of both companies and is expected to

close late in the first quarter of 2025.

Under the terms of the merger agreement, a

subsidiary of electroCore will merge with NeuroMetrix and

NeuroMetrix will become a wholly owned subsidiary of electroCore.

The shareholders of NeuroMetrix will be entitled to receive the

equivalent of the balance of NeuroMetrix’s net cash at the closing

of the transaction, subject to certain adjustments and deductions.

Assuming the transaction closes on March 31, 2025, NeuroMetrix

estimates that the balance of net cash to be paid to its

shareholders, after deduction of, among other things, transaction

expenses, severance costs, and accrued liabilities, will be

approximately $9M in the aggregate. The final balance of net cash

will be determined at the time of closing and will be based on a

formula set out in the merger agreement.

NeuroMetrix shareholders will also receive one

non-tradeable contingent value right (a “CVR”) per share of

NeuroMetrix common stock. Each CVR will represent the right to

receive (i) certain future net proceeds from any divestiture of the

Company’s DPNCheck® platform that is consummated prior to the

closing of the transaction with electroCore and (ii) certain

royalties, up to an aggregate maximum of $500,000, on net sales of

prescription Quell® products over the first two years following the

closing of the transaction.

“This announcement represents the culmination of

our strategic review process announced in February 2024, and marks

a positive outcome for the Company’s shareholders. Through this

transaction, we will efficiently return balance sheet cash to our

shareholders while providing potential upside through the CVR,”

said Shai N. Gozani, M.D., Ph.D., Chairman and CEO of NeuroMetrix.

“A further advantage of this transaction is that we expect patients

with chronic pain to have expanded access to our novel and

proprietary Quell wearable neuromodulation technology through the

commercial channel that electroCore has built. Although the

DPNCheck platform is not included in the acquisition, we expect to

divest this business such that patients and physicians continue to

benefit from its unique and important diagnostic capabilities.”

Consummation of the transaction is subject to

approval by the shareholders of NeuroMetrix, NeuroMetrix having at

least $8 million of net cash at closing, and the filing of

NeuroMetrix’s Form 10-K with respect to the fiscal year ended

December 31, 2024, in addition to certain customary closing

conditions.

About NeuroMetrix

NeuroMetrix is a commercial stage healthcare

company that develops and commercializes neurotechnology devices to

address unmet needs in the chronic pain and diabetes markets. The

Company's products are wearable or hand-held medical devices

enabled by proprietary consumables and software solutions that

include mobile apps, enterprise software and cloud-based systems.

The Company has two commercial brands. Quell® is a wearable

neuromodulation platform. DPNCheck® is a point-of-care screening

test for peripheral neuropathy. For more information, visit

www.neurometrix.com.

About electroCore

electroCore is a commercial stage bioelectronic

medicine and wellness company dedicated to improving health through

its non-invasive vagus nerve stimulation (“nVNS”) technology

platform. Its focus is the commercialization of medical devices for

the management and treatment of certain medical conditions and

consumer product offerings utilizing nVNS to promote general

wellbeing and human performance in the United States and select

overseas markets.

Safe Harbor Statement

The statements contained in this press release

include forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. Such

forward-looking statements include information concerning possible

or assumed future results of operations of the Company, the

expected completion and timing of the transaction and other

information relating to the transaction. Without limiting the

foregoing, the words “believes,” “anticipates,” “plans,” “expects,”

“intends,” “forecasts,” “should,” “estimates,” “contemplate,”

“future,” “goal,” “potential,” “predict,” “project,” “projection,”

“may,” “will,” “could,” “should,” “would,” “assuming” and similar

expressions are intended to identify forward-looking statements.

You should read statements that contain these words carefully. They

discuss the Company’s future expectations or state other

forward-looking information and may involve known and unknown risks

over which the Company has no control. While the company believes

the forward-looking statements contained in this press release are

accurate, there are a number of factors that could cause actual

events or results to differ materially from those indicated by such

forward-looking statements, including, without limitation, (i) the

risk that the transaction may not be completed in a timely manner

or at all, which may adversely affect the Company’s business and

the price of the common stock of the combined company following the

merger, (ii) the failure to satisfy the conditions to the

consummation of the transaction, including the adoption of the

merger agreement by the stockholders of the Company and the receipt

of any required regulatory approvals from various governmental

entities (including any conditions, limitations or restrictions

placed on these approvals) and the risk that one or more

governmental entities may deny approval, (iii) the occurrence of

any event, change or other circumstance that could give rise to the

termination of the merger agreement, (iv) the risk that the merger

agreement may be terminated in circumstances that require the

Company to pay a termination fee; (v) risks regarding the failure

to obtain the necessary financing to complete the merger, (vi) the

effect of the announcement or pendency of the transaction on the

Company’s business relationships, operating results and business

generally, (vii) risks that the proposed transaction disrupts

current plans and operations, (viii) risks related to diverting

management’s attention from the Company’s ongoing business

operations, and (ix) the outcome of any legal proceedings that may

be instituted against the Company related to the merger agreement

or the transaction. . There can be no assurance that future

developments will be those that the company has anticipated.

Further risks that could cause actual results to differ materially

from those matters expressed in or implied by such forward-looking

statements are described in the company’s most recent Annual Report

on Form 10-K, Quarterly Reports on Form 10-Q, as well as other

documents that may be filed from time to time with the Securities

and Exchange Commission (the “SEC”) or otherwise made public. The

company is providing the information in this press release only as

of the date hereof, and expressly disclaims any intent or

obligation to update the information included in this press release

or revise any forward-looking statements.

Additional Information and Where to Find

It

In connection with the transaction, the Company

intends to file relevant materials with the SEC, including a proxy

statement on Schedule 14A. Promptly after filing its definitive

proxy statement with the SEC, the Company will mail the definitive

proxy statement and a proxy card to each stockholder entitled to

vote at the special meeting relating to the transaction. INVESTORS

AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ THESE

MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY

OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT

THE COMPANY OR ELECTROCORE WILL FILE WITH THE SEC WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PARTIES AND THE TRANSACTION. The definitive proxy statement, the

preliminary proxy statement and other relevant materials in

connection with the transaction (when they become available), and

any other documents filed by the Company or electroCore with the

SEC, may be obtained free of charge at the SEC’s website

(http://www.sec.gov). In addition, materials filed by the Company

may be obtained on the Company’s website neurometrix.com, and

materials filed by electroCore may be obtained on electroCore’s

website at www.electroCore.com.

Participants in the

Solicitation

The Company and each of its directors and

executive officers may be deemed to be participants in the

solicitation of proxies from the Company’s stockholders with

respect to the merger. Information about the Company’s directors

and executive officers and their ownership of the Company’s common

stock is set forth in the proxy statement on Schedule 14A filed

with the SEC on March 27, 2024 and the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2023 filed with

the SEC on March 1, 2024. To the extent that such individual’s

holdings of the Company’s common stock have changed since the

amounts included in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2023 filed with the SEC on March

1, 2024, such changes have been or will be reflected on Statements

of Change in Ownership on Form 4 filed with the SEC. Information

regarding the identity of the potential participants, and their

direct or indirect interests in the merger, by security holdings or

otherwise, will be set forth in the proxy statement and other

materials to be filed with SEC in connection with the merger.

Source: NeuroMetrix, Inc.

Thomas T. HigginsSVP and Chief Financial

Officerneurometrix.ir@neurometrix.com

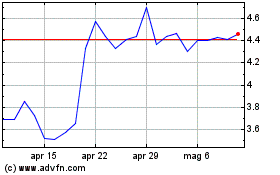

Grafico Azioni NeuroMetrix (NASDAQ:NURO)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni NeuroMetrix (NASDAQ:NURO)

Storico

Da Dic 2023 a Dic 2024