UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant ☒ |

| |

| Filed by a Party other than the Registrant ☐ |

| |

| Check the appropriate box: |

| |

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under §240.14a-12 |

| |

| Carrols Restaurant Group, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The following e-mail was sent by Deborah Derby, the President

and Chief Executive Officer of Carrols Restaurant Group, Inc., (“Carrols”) to Carrols employees on January 16, 2024.

Good morning. I hope everyone had a nice holiday weekend.

I am writing to share some exciting news. This morning, we issued a

press release announcing that Carrols Restaurant Group has entered into an agreement to be acquired by Restaurant Brands International,

Inc., the parent company of our franchisors, Burger King and Popeyes. I am excited about this combination and optimistic that the merger

of these two great companies will bring new opportunities and growth for Carrols and its people.

I realize that this news may come as a surprise to many of you, and

that you likely have a lot of questions. I will be hosting a Town Hall this morning at 11:00a EST with Tom Curtis, President, Burger King

U.S. & Canada, to try and answer some of those questions. An email invitation will appear in your inboxes shortly.

While the press release provides the strategic and shareholder rationale

for the transaction that Carrols’ and RBI’s Boards of Directors unanimously approved, I wanted to share with you why I am

excited about it from a team member and Guest perspective:

| |

● |

Provides greater career opportunities for our team members – combining with RBI will present additional opportunities across multiple brands for team members to grow their careers. |

| |

● |

Accelerates the pace of remodeling – RBI plans to significantly accelerate the pace of remodels, which will result in more locations being upgraded to Burger King’s new Sizzle prototype (or other modern image) in the next few years, which will enhance our team member and Guest experience sooner, rather than later. |

| |

● |

Refranchising opportunities – as the remodels are completed, RBI will look to refranchise those locations to great operators, including Carrols team members who may be interested in becoming franchisees themselves. |

This transaction is a testament to the operational legacy and strength

of the Carrols team, the performance you were able to deliver in 2023, as well as your unwavering commitment to put the Guest first, each

and every day.

I look forward to discussing this exciting announcement further during

our Town Hall and to addressing any questions you may have.

It is important to note that only authorized spokespeople should speak

with investors or reporters. If you are contacted by an investor or a member of the media, please refer the person to Jeff Priester (Jeff.Priester@icrinc.com).

It is critical that we speak with one voice, and directing all inbound inquiries to a single source will help us to achieve this.

I want to thank you once again for all your efforts that have brought

us to this point. While this is an exciting announcement, it is business as usual for the immediate future, and we must continue to maintain

our focus on delivering this year’s initiatives, as well as on providing the same high-quality food and service that our Guests

have come to know.

Best,

Deborah Derby

President & CEO

Carrols Restaurant Group, Inc.

Special Note Regarding Forward-Looking

Statements

This communication includes certain disclosures which contain

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including but not

limited to those statements related to that certain Agreement and Plan of Merger, dated of as January 16, 2024, by and among Carrols Restaurant

Group, Inc., a Delaware corporation (“Carrols”), Restaurant Brands International Inc., a corporation existing under

the laws of Canada (“RBI”), and BK Cheshire Corp, a Delaware corporation and subsidiary of RBI (“Merger Sub”),

providing for the merger of Merger Sub with and into Carrols, with Carrols continuing as the surviving corporation (the “Merger”),

including financial estimates and statements as to the expected timing, completion and effects of the Merger. We refer to all of these

as forward-looking statements. Forward-looking statements are forward-looking in nature and, accordingly, are subject to risks and uncertainties.

These forward-looking statements can generally be identified by the use of words such as “believe”, “anticipate”,

“expect”, “intend”, “estimate”, “plan”, “continue”, “will”, “may”,

“could”, “would”, “target”, “potential” and other similar expressions. Forward-looking

statements, including statements regarding the Merger, are based on Carrols’ current expectations and assumptions, including Carrols’

beliefs and expectations about the value achieved in RBI’s proposed acquisition of Carrols. Because forward-looking statements relate

to the future, they are subject to inherent uncertainties, risks and uncertainties.

Important factors, risks and uncertainties that could cause actual

results to differ materially from such plans, estimates or expectations include but are not limited to: (i) the completion of the

Merger on the anticipated terms and timing, including obtaining required stockholder approval by Carrols’ stockholders, required

regulatory approvals, and the satisfaction of other conditions to the completion of the Merger; (ii) the risk that competing offers or

acquisition proposals will be made; (iii) potential litigation relating to the Merger that could be instituted against RBI, Carrols

or Carrols’ directors, managers or officers, including the effects of any outcomes related thereto; (iv) the ability of Carrols

to retain and hire key personnel; (v) potential adverse reactions or changes to Carrols’ business relationships resulting from

the announcement or completion of the Merger; (vi) legislative, regulatory and economic developments; (vii) potential business

uncertainty, including changes to existing business relationships, during the pendency of the Merger that could affect Carrols’

financial performance; (viii) negative effects from the pendency of the Merger; (ix) the risk that

synergies and other benefits from the Merger may not be fully realized or may take longer to realize than expected, (x) the

possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events;

(xi) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger; and (xii)

the effects and continued impact of the COVID-19 pandemic, the war in Ukraine, conflict in the Middle

East and related macro-economic pressures, such as inflation, rising interest rates and currency fluctuations on our results of operations,

business, liquidity, prospects and restaurant operations and other risks and uncertainties set forth under the headings “Special

Note Regarding Forward Looking Statements” and “Risk Factors” in RBI’s and Carrols’ most recent Annual Reports

on Form 10-K for the fiscal year ended December 31, 2022 and January 1, 2023, respectively, and other materials that we from

time to time file with, or furnish to, the Securities and Exchange Commission (the “SEC”).

There can be no assurance that the Merger

will be completed, or if it is completed, that it will close within the anticipated time period. These factors should not be construed

as exhaustive and should be read in conjunction with the other forward-looking statements. The forward-looking statements relate only

to events as of the date on which the statements are made. Carrols does not undertake any obligation to publicly update or review any

forward-looking statement except as required by law, whether as a result of new information, future developments or otherwise. If one

or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results

may vary materially from what we may have expressed or implied by these forward-looking statements. We caution that you should not place

undue reliance on any of our forward-looking statements. You should specifically consider the factors identified in this communication

that could cause actual results to differ. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for

us to predict those events or how they may affect Carrols.

Important Additional Information and

Where to Find It

This communication does not constitute an offer to sell or

the solicitation of an offer to buy any securities. This communication is being made in connection with the Merger. In connection

with the Merger, certain participants in the Merger will prepare and file with the SEC a Schedule 13E-3 Transaction Statement and certain

other documents regarding the Merger. We make available free of charge on or through the Investor Relations section of our internet website

at www.carrols.com, all materials that we file electronically with the SEC, including the Schedule 13E-3 Transaction Statement and

any amendments thereto, as reasonably practicable after electronically filing or furnishing such material with the SEC. This information

is also available at www.sec.gov, an internet site maintained by the SEC that contains reports, proxy and information statements and other

information regarding issuers that file electronically with the SEC. The references to our website address and the SEC’s website

address do not constitute incorporation by reference of the information contained in these websites and should be not considered part

of this document.

Participants in the Solicitation

RBI, Carrols and their directors, and certain of their executive officers

and employees may be deemed to be participants in the solicitation of proxies from Carrols’ stockholders in respect of the proposed

transaction. Information regarding the directors and executive officers of Carrols who may, under the rules of the SEC, be deemed participants

in the solicitation of Carrols’ stockholders in connection with the proposed transaction, including a description of their direct

or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement when it is filed with the SEC. Information

about these persons is included in each company’s annual proxy statement and in other documents subsequently filed with the SEC,

and will be included in the proxy statement when filed. Free copies of the proxy statement and such other materials may be obtained as

described in the preceding paragraph.

3

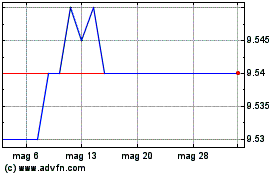

Grafico Azioni Carrols Restaurant (NASDAQ:TAST)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Carrols Restaurant (NASDAQ:TAST)

Storico

Da Dic 2023 a Dic 2024