Instil Bio, Inc. (“Instil”) (Nasdaq: TIL), a clinical-stage

biopharmaceutical company focused on developing a pipeline of novel

therapies, today reported its first quarter 2024 financial results

and provided a corporate update.

Recent Highlights:

- With successful completion of feasibility studies, preparations

are underway with collaborator for a potential

investigator-initiated trial (IIT) in non-small cell lung cancer

with folate receptor α (FRα)-CoStAR TIL

- Exploring opportunities to in-license/acquire and develop novel

therapeutic candidates in diseases with significant unmet medical

need

- Cash runway expected beyond 2026

First Quarter

2024 Financial and Operating

Results:

As of March 31, 2024, Instil had cash, cash equivalents,

marketable securities and long-term investments of

$161.5 million, which consisted of $5.5 million in cash

and cash equivalents, $148.3 million in marketable securities

and $7.7 million in long-term investments, compared to

$175.0 million in total cash, cash equivalents, restricted

cash, marketable securities and long-term investments, which

consisted of $9.2 million in cash and cash equivalents,

$1.5 million in restricted cash, $141.2 million

marketable securities and $23.2 million in long-term

investments as of December 31, 2023. Instil expects that its

cash, cash equivalents, marketable securities and long-term

investments as of March 31, 2024 will enable it to fund its

current operating plan beyond 2026.

Research and development expenses were $7.3 million for the

three months ended March 31, 2024, compared to $20.7 million

for the three months ended March 31, 2023.

General and administrative expenses were $12.4 million for the

three months ended March 31, 2024, compared to $13.2 million

for the three months ended March 31, 2023.

Restructuring and impairment charges were $4.3 million for the

three months ended March 31, 2024, compared to $24.6 million

for the three months ended March 31, 2023.

Net loss per share, basic and diluted were $3.74 for the three

months ended March 31, 2024, compared to $8.77 for the three

months ended March 31, 2023. Non-GAAP net loss per share,

basic and diluted were $2.39 for the three months ended

March 31, 2024, compared to $4.29 for the three months ended

March 31, 2023.

Note Regarding Use of Non-GAAP Financial

Measures

In this press release, Instil has presented certain financial

information that has not been prepared in accordance with U.S.

generally accepted accounting principles (“GAAP”). These non-GAAP

financial measures include non-GAAP net loss and non-GAAP net loss

per share, which are defined as net loss and net loss per share,

respectively, excluding non-cash stock-based compensation expense

and restructuring and impairment charges. Instil believes that

these non-GAAP financial measures, when considered together with

the GAAP figures, can enhance an overall understanding of Instil’s

financial performance. The non-GAAP financial measures are included

with the intent of providing investors with a more complete

understanding of Instil’s operating results. In addition, these

non-GAAP financial measures are among the indicators Instil’s

management uses for planning purposes and to measure Instil’s

performance. These non-GAAP financial measures should be considered

in addition to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. The non-GAAP

financial measures used by Instil may be calculated differently

from, and therefore may not be comparable to, non-GAAP financial

measures used by other companies. Please refer to the below

reconciliation of these non-GAAP financial measures to the

comparable GAAP financial measures.

About Instil Bio

Instil Bio, Inc. (Nasdaq: TIL) is a clinical-stage

biopharmaceutical company focused on developing a pipeline of novel

therapies. Instil seeks to in-license/acquire and develop novel

therapeutic candidates in diseases with significant unmet medical

need. For more information visit www.instilbio.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Words such as “anticipates,” “believes,” “expects,”

"expected,” “exploring” “future,” “intends,” “may,” “plans,”

“potential,” “projects,” and “will” or similar expressions are

intended to identify forward-looking statements. Forward-looking

statements include statements concerning or implying our ability to

acquire and develop new product candidates, the therapeutic

potential of our product candidates, our research, development and

regulatory plans for our product candidates, our expectations

concerning our collaboration and the generation of clinical data

therefrom, our expectations regarding our capital position,

resources, and balance sheet, and the potential impact thereof on

development of any product candidates, and other statements that

are not historical fact. Forward-looking statements are based on

management's current expectations and are subject to various risks

and uncertainties that could cause actual results to differ

materially and adversely from those expressed or implied by such

forward-looking statements, including risks and uncertainties

associated with acquiring product candidates, the costly and

time-consuming product development process and the uncertainty of

clinical success; the risks inherent in successfully manufacturing

cell therapy products and relying on collaborators and other third

parties for manufacturing; the risks and uncertainties related to

successfully initiating, enrolling, completing and reporting data

from clinical studies, including a collaborator-led IIT in China,

as well as the risks that results obtained in clinical trials to

date may not be indicative of results obtained in ongoing or future

trials and that our product candidates may otherwise not be

effective treatments in their planned indications; risks associated

with reliance on third-party collaborators; risks related to

macroeconomic conditions, including as a result of international

conflicts, U.S.-China trade and political tensions, interest rates,

inflation, and other factors, which could materially and adversely

affect our business and operations; the risks and uncertainties

associated with the time-consuming and uncertain regulatory

approval process and the sufficiency of our cash resources; and

other risks and uncertainties affecting Instil and our plans and

development programs, including those discussed in the section

titled “Risk Factors” in our Quarterly Report on Form 10-Q for the

quarter ended March 31, 2024 to be filed with the SEC, as well

as our other filings with the SEC. Additional information will be

made available in other filings that we make from time to time with

the SEC. Accordingly, these forward-looking statements do not

constitute guarantees of future performance, and you are cautioned

not to place undue reliance on these forward-looking statements.

These forward-looking statements speak only as the date hereof, and

we disclaim any obligation to update these statements except as may

be required by law.

Contacts:

Investor Relations:1-972-499-3350

investorrelations@instilbio.comwww.instilbio.com

| |

|

INSTIL BIO, INC.SELECTED FINANCIAL

DATA(Unaudited; in thousands, except share and per share

amounts)Selected Condensed Consolidated Balance Sheet

Data |

| |

|

|

|

| |

March 31, 2024 |

|

December 31, 2023 |

|

Cash, cash equivalents, restricted cash, marketable securities and

long-term investments |

$ |

161,454 |

|

|

$ |

175,018 |

|

| Total assets |

$ |

306,303 |

|

|

$ |

325,630 |

|

| Total liabilities |

$ |

100,476 |

|

|

$ |

99,801 |

|

| Stockholders’ equity |

$ |

205,827 |

|

|

$ |

225,829 |

|

| |

|

|

|

|

|

|

|

| |

|

Condensed Consolidated Statements of

Operations |

|

|

|

| |

Three Months Ended March 31, |

| |

2024 |

|

2023 |

| Operating expenses: |

|

|

|

|

Research and development |

$ |

7,256 |

|

|

$ |

20,670 |

|

|

General and administrative |

|

12,424 |

|

|

|

13,222 |

|

|

Restructuring and impairment charges |

|

4,275 |

|

|

|

24,554 |

|

| Total operating expenses |

|

23,955 |

|

|

|

58,446 |

|

| Loss from operations |

|

(23,955 |

) |

|

|

(58,446 |

) |

| Interest income |

|

2,062 |

|

|

|

2,071 |

|

| Interest expense |

|

(1,981 |

) |

|

|

(636 |

) |

| Other expense, net |

|

(428 |

) |

|

|

(57 |

) |

| Net loss |

$ |

(24,302 |

) |

|

$ |

(57,068 |

) |

| Net loss per share, basic and

diluted |

$ |

(3.74 |

) |

|

$ |

(8.77 |

) |

| Weighted-average shares used in

computing net loss per share, basic and diluted |

|

6,503,913 |

|

|

|

6,503,913 |

|

| |

|

|

|

|

|

|

|

| |

|

INSTIL BIO, INC.Reconciliation of GAAP to

Non-GAAP Net Loss and Net Loss per Share(Unaudited; in

thousands, except share and per share amounts) |

| |

|

| |

Three Months Ended March 31, |

| |

2024 |

|

2023 |

|

Net loss |

$ |

(24,302 |

) |

|

$ |

(57,068 |

) |

| Adjustments: |

|

|

|

|

Non-cash stock-based compensation expense |

|

4,515 |

|

|

|

4,530 |

|

|

Restructuring and impairment charges |

|

4,275 |

|

|

|

24,554 |

|

| Non-GAAP Net loss |

$ |

(15,512 |

) |

|

$ |

(27,984 |

) |

| Net loss per share, basic and

diluted |

$ |

(3.74 |

) |

|

$ |

(8.77 |

) |

| Adjustments: |

|

|

|

|

Non-cash stock-based compensation expense per share |

|

0.69 |

|

|

|

0.70 |

|

|

Restructuring and impairment charges per share |

|

0.66 |

|

|

|

3.78 |

|

| Non-GAAP net loss per share,

basic and diluted* |

$ |

(2.39 |

) |

|

$ |

(4.29 |

) |

| Weighted-average shares

outstanding, basic and diluted |

|

6,503,913 |

|

|

|

6,503,913 |

|

* Non-GAAP net loss per share, basic and diluted may not total

due to rounding.

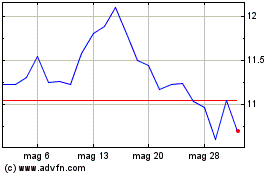

Grafico Azioni Instill Bio (NASDAQ:TIL)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Instill Bio (NASDAQ:TIL)

Storico

Da Mar 2024 a Mar 2025