UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material under § 240.14a-12

TSR, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than

the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11

TSR, INC.

400 OSER AVENUE, SUITE 150

HAUPPAUGE, NY 11788

Dear Stockholders,

The fiscal year ended May 31, 2023 was a year

of consistent progress for TSR, Inc. (“TSR” or the “Company”).

As you know, in late

2019 and early 2020, TSR reconstituted its Board of Directors (the “Board”) and a new management team was put in place.

The new Board went to immediate work with the team to focus on finding ways to profitably grow, both organically and through acquisitions.

Throughout the two years with new management, we also updated processes and invested in infrastructure to scale the company profitability.

The results of these

efforts have borne fruit and can be seen in the results for the most recent fiscal year ending May 31, 2023. For the fiscal year, the

company recorded revenues in excess of $100 million dollars for the first time in the company’s history. Furthermore, the Board

was pleased to show that the company achieved consistent profitability and cash flow.

In the most recent fiscal year, we have continued

to focus on servicing our existing clients and finding new ones. We finished the fiscal year with approximately 543 consultants serving

our clients, a change from the 717 consultants serving our clients at May 31, 2022.

Since the Board was reconstituted on December 31,

2019, the price per share of common stock has increased from $3.59 to $7.20 as of October 24, 2022 to $8.65

on October 23, 2023. Over that same period, the Russell Microcap Index (RMIC) increased from 622.05 at December

31, 2019 to 672.46 at October 24, 2022 and then fell to 579.15 October 23, 2023.

I have written in previous letters that the staffing

business is a competitive business. Our primary assets are our employees and our customers. We continue to work to provide a dynamic and

healthy workplace for the former, and the best programmers and IT professionals for the latter.

In August of 2023,

the Company announced that its Board of Directors initiated a process to identify and evaluate potential strategic alternatives to maximize

shareholder value. The Company expects to consider a range of options, which may include a sale of or acquisitions by the Company or a

special dividend, as well as other potential alternatives. The Company has retained financial advisors and legal advisors to assist the

Board in the evaluation process.

The Company has not

adopted a timeline for the Board’s strategic review process and there can be no assurance if or when the process will result in

a transaction, or of the timing or outcome of any transaction that is undertaken. The Company does not intend to make further announcements

regarding the review unless and until the Board has approved a specific transaction or otherwise determines that additional disclosure

is appropriate or required.

Our annual stockholder meeting will be held virtually

on December 7, 2023 at 11:00 a.m., Eastern Time, and we invite you to participate. The following items will be on the agenda:

| 1. | To elect one Class II Director for a term to expire at the

2026 annual stockholder meeting; |

| 2. | To ratify the appointment of CohnReznick LLP as the independent

registered public accountants of the Company for the fiscal year ending May 31, 2024; |

| 3. | To hold a non-binding advisory vote on the compensation program

for the Company’s named executive officers as disclosed in the proxy statement; |

| 4. | To approve an amendment to the Company’s Certificate

of Incorporation to eliminate the personal liability of directors and executive officers for monetary damages for breach of the fiduciary

duty of care; and |

| 5. | To transact other business that may properly come before

the annual meeting, including any adjournment or postponement thereof. |

Our Board has fixed the close of business on November

1, 2023 as the record date for determining those stockholders entitled to receive notice of and vote at the annual meeting and any adjournments

or postponements thereof.

The Board and management team are committed to

increasing shareholder value at TSR. In every decision, we are accountable to you, the stockholders.

I look forward to discussing our plans and progress

at the meeting and in the years to come.

Bradley Tirpak

Chairman of the Board

Hauppauge, New York

November 6, 2023

TSR, INC.

400 OSER AVENUE, SUITE 150

HAUPPAUGE, NY 11788

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

to be held on December 7, 2023

NOTICE IS HEREBY GIVEN that

the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of TSR, Inc., a Delaware corporation (“TSR” or

the “Company”), will be held on December 7, 2023 at 11:00 a.m., Eastern Time. The Annual Meeting will be a virtual meeting

of stockholders, which means that you will be able to participate in the Annual Meeting, vote and submit your questions during the Annual

Meeting via live webcast by visiting https://www.cstproxy.com/tsrconsulting/2023. You will not be

able to attend the Annual Meeting in person. Please read carefully the sections in the proxy statement on attending via webcast and voting

at the Annual Meeting to ensure that you comply with these requirements.

The purposes of the meeting

are:

| 1. | To elect one Class II Director for a term to expire at the

2026 annual stockholder meeting; |

| 2. | To ratify the appointment of CohnReznick LLP as the independent

registered public accountants of the Company for the fiscal year ending May 31, 2024; |

| 3. | To hold a non-binding advisory vote on the compensation program

for the Company’s named executive officers as disclosed in the proxy statement; |

| 4. | To vote on a proposal to approve an amendment to the Company’s

Certificate of Incorporation to eliminate the personal liability of directors and executive officers for monetary damages for breach

of the fiduciary duty of care; and |

| 5. | To transact other business that may properly come before the

Annual Meeting, including any adjournment or postponement thereof. |

These matters are more fully

described in the proxy statement. The Board recommends that you vote “FOR” the nominated director, “FOR” the ratification

of the Company’s independent registered public accounting firm, “FOR” the approval of the compensation program for the

Company’s named executive officers, and “FOR” the proposal to amend the Company’s Certificate of Incorporation

to eliminate the personal liability of directors and executive officers for monetary damages for breach of the fiduciary duty of care.

The Board knows of no other matters at this time that may be properly brought before the meeting.

Stockholders of record at

the close of business on November 1, 2023 will be entitled to vote at the Annual Meeting or any adjournments thereof. A list of stockholders

entitled to vote at the Annual Meeting will be available at the virtual Annual Meeting and during the ten-day period prior to the date

of the Annual Meeting, at the Company’s principal executive offices for inspection by stockholders during ordinary business hours

for any purpose germane to the Annual Meeting.

| |

By Order of the Board of Directors, |

| |

|

| |

John G. Sharkey, Secretary |

| |

|

| |

Hauppauge, New York |

| |

November 6, 2023 |

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL

MEETING VIA WEBCAST, PLEASE ENSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING BY VOTING IN ONE OF THE FOLLOWING

WAYS:

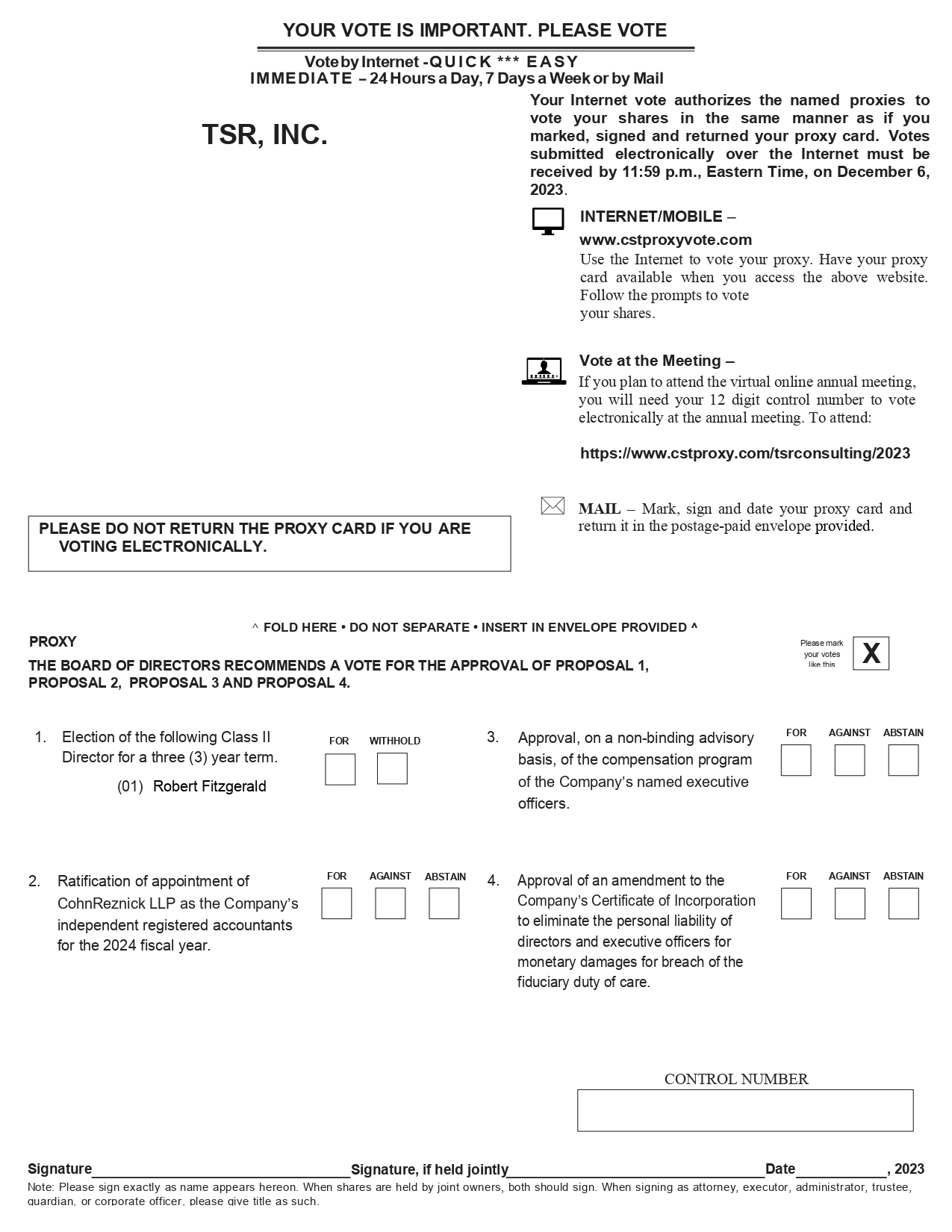

| (1) | VIA THE INTERNET – GO TO THE WEBSITE DESIGNATED ON THE ENCLOSED PROXY CARD. |

| (2) | BY MAIL – COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT IN THE ENCLOSED, SELF-ADDRESSED ENVELOPE. NO POSTAGE

IS NEEDED IF THE PROXY CARD IS MAILED WITHIN THE UNITED STATES. |

YOUR PROMPT RESPONSE IS HELPFUL AND YOUR COOPERATION

WILL BE APPRECIATED.

TABLE OF CONTENTS

TSR, INC.

400 Oser Avenue, Suite 150

Hauppauge, NY 11788

2023 ANNUAL MEETING OF STOCKHOLDERS

to be held on December 7, 2023

PROXY STATEMENT

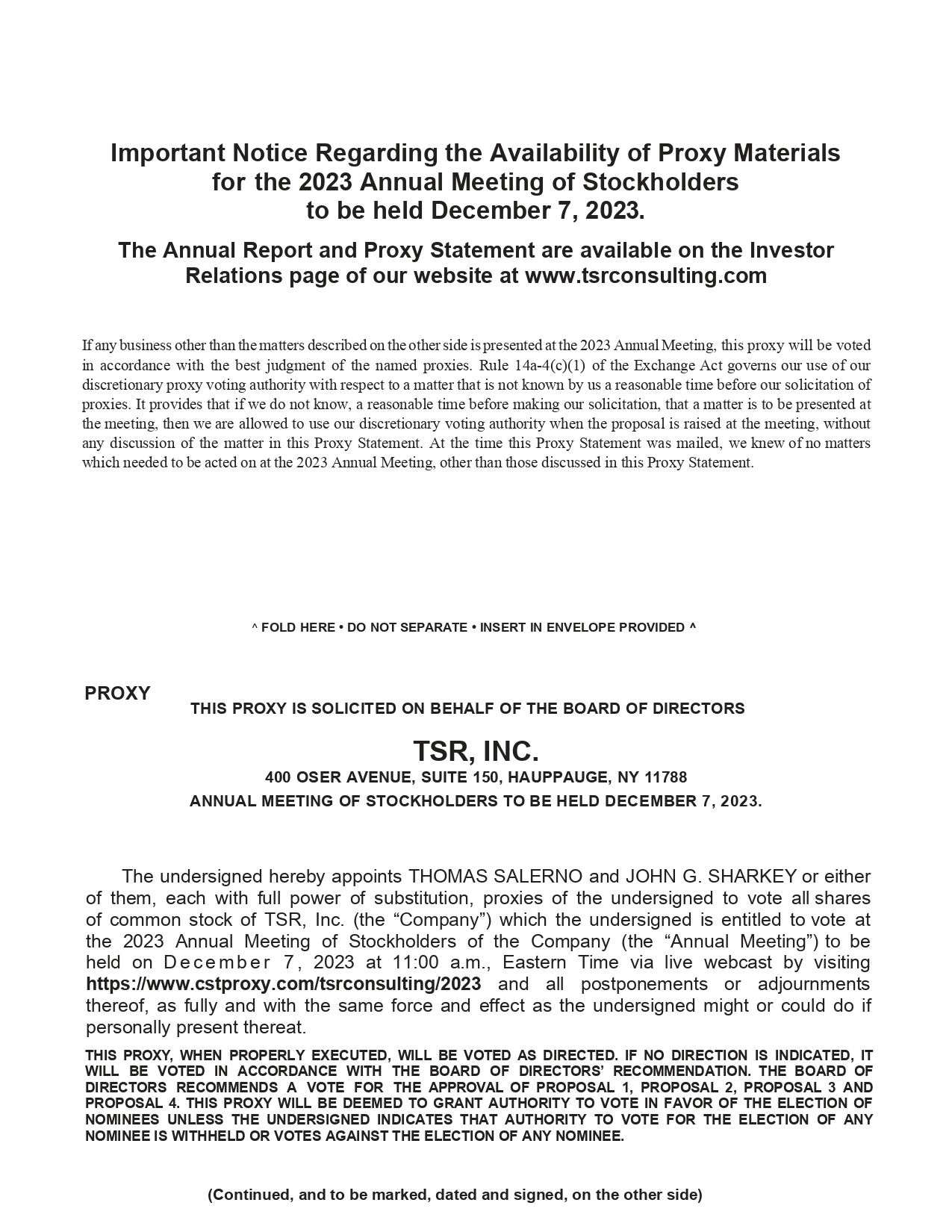

This solicitation of proxies

is being made by the Board of Directors (the “Board”) of TSR, Inc. (“TSR” or the “Company”) for use

at the 2023 Annual Meeting of the Stockholders of the Company (the “Annual Meeting”) on December 7, 2023 at 11:00 a.m., Eastern

Time, or at any postponement or adjournment thereof. The Annual Meeting will be a virtual meeting via live webcast on the Internet. You

will be able to attend the meeting, vote and submit your questions during the meeting by visiting https://www.cstproxy.com/tsrconsulting/2023

and entering your control number included on the proxy card you receive. You will not be able to attend the meeting in person.

The Board and officers and employees of the Company will solicit proxies by mail, telephone and personal contact for no additional compensation.

This Proxy Statement (“Proxy

Statement”), the enclosed form of proxy and the Company’s Annual Report for the fiscal year ended May 31, 2023 shall be mailed

on or about November 6, 2023 to holders of record of shares of the Company’s common stock, par value $0.01 per share (“Common

Stock”), as of November 1, 2023, using the full set delivery option pursuant to Rule 14a-16(n) under the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). Only Stockholders of record at the close of business on November 1, 2023 are entitled

to vote at the Annual Meeting. On November 1, 2023, there were 2,143,712 shares of Common Stock issued and outstanding.

Important Notice Regarding the Internet Availability

of Proxy Materials

for the Stockholders Meeting to be held on

December 7, 2023

This Proxy Statement, a copy

of the form of proxy and the Company’s Annual Report for the fiscal year ended May 31, 2023 are also available on the Investor Relations

page of our website at www.tsrconsulting.com.

QUESTIONS & ANSWERS ABOUT THIS PROXY

SOLICITATION

The following are some of

the questions that you may have about this Proxy Statement and the answers to those questions. The information in this section does not

provide all of the information that may be important to you with respect to this Proxy Statement. Therefore, we encourage you to read

the entire Proxy Statement, which was first distributed beginning on or about November 6, 2023, for more information about these topics.

Why am I receiving these

materials?

TSR has made these materials

available to you in connection with the Company’s solicitation of proxies for use at the Annual Meeting to be held via webcast,

on December 7, 2023 at 11:00 a.m., Eastern Time, or at any postponement or adjournment thereof. The Company, on behalf of the Board, is

soliciting your proxy to vote your shares at the Annual Meeting. We solicit proxies to give stockholders of record an opportunity to vote

on matters that will be presented at the Annual Meeting. You are invited to attend the Annual Meeting via webcast and are requested to

vote on the proposals described in this Proxy Statement.

How do I participate in the Virtual Annual Meeting?

Our Annual Meeting will be

held in a virtual meeting format only. We have designed our virtual format to enhance, rather than constrain, stockholder access, participation

and communication. Stockholders will have multiple opportunities to submit questions to the Company for the Annual Meeting. Stockholders

who wish to submit a question in advance may do so beginning on November 30, 2023 by pre-registering and then selecting the chat box link.

Stockholders also may submit questions live during the meeting. Questions pertinent to the Annual Meeting matters may be recognized and

answered during the meeting in our discretion, subject to time constraints. We reserve the right to edit or reject questions that are

inappropriate for Annual Meeting matters.

Any stockholder can listen

to and participate in the Annual Meeting live via the Internet at https://www.cstproxy.com/tsrconsulting/2023. The webcast

will start at 11:00 a.m., Eastern Time, on December 7, 2023. Stockholders may vote and submit questions while connected to the Annual

Meeting on the Internet.

Instructions on how to connect

and participate in the Annual Meeting, including how to demonstrate proof of ownership of our Common Stock, are posted at https://www.cstproxy.com/tsrconsulting/2023.

If you do not have your 12-digit control number that is printed in the box on your proxy card, you will only be able to listen to

the Annual Meeting.

If you do not have Internet

capabilities, you can attend the Annual Meeting via a listen-only format by dialing 1 800-450-7155 (toll-free) within the U.S. and Canada,

or 1 857-999-9155 (standard rates apply) outside of the U.S. and Canada, and entering the pin number (5870269#) when prompted. You will

not be able to vote or submit questions through the listen-only format.

What is being voted on at

the Annual Meeting?

The Company is aware of four

(4) matters that stockholders may vote on at the Annual Meeting. These matters are listed on the Company’s proxy card. The four

matters listed on the Company’s proxy card are as follows:

| 1. | The election to the Board of the Class II Director nominee (Proposal No. 1); |

| 2. | The ratification of the appointment of CohnReznick LLP as the Company’s independent registered public accounting firm for the

fiscal year ending May 31, 2024 (Proposal No. 2); |

| 3. | A non-binding advisory vote on the compensation program for the Company’s named executive officers

as disclosed herein (Proposal No. 3); and |

| 4. | To vote on a proposal to approve an amendment to the Company’s Certificate of Incorporation to eliminate

the personal liability of directors and executive officers for monetary damages for breach of the fiduciary duty of care (Proposal No.

4). |

How does the Board of TSR

recommend that I vote?

At the Annual Meeting, the Board of TSR recommends

that you vote your shares:

| 1. | “FOR” the election of the Class II Director nominee (Proposal No. 1); |

| 2. | “FOR” the ratification of the appointment of CohnReznick LLP as the Company’s independent registered public accounting

firm for the fiscal year ending May 31, 2024 (Proposal No. 2); |

| 3. | “FOR” the approval of the compensation program for our named executive officers as described herein (Proposal No. 3);

and |

| 4. | “FOR” the approval of an amendment to the Company’s Certificate of Incorporation to eliminate the personal liability

of directors and executive officers for monetary damages for breach of the fiduciary duty of care (Proposal No. 4). |

Who is entitled to vote at

the Annual Meeting?

Stockholders of record of

shares of Common Stock, at the close of business on November 1, 2023 (the “Record Date”) are entitled to vote at the Annual

Meeting or any postponement or adjournment thereof. Each share of Common Stock is entitled to one vote on each matter to be voted on.

As of the Record Date, there were 2,143,712 shares of Common Stock issued and outstanding. There are no other voting securities of the

Company outstanding.

What is the difference between

a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of Record.

If your shares are registered directly in your name with the Company’s transfer agent, Continental Stock Transfer & Trust Company,

you are considered the stockholder of record with respect to those shares, and the notice for the Annual Meeting (“Notice”)

was sent directly to you by the Company.

Beneficial Owner of Shares

Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization,

then you are the “beneficial owner” of shares held in “street name,” and a Notice was forwarded to you by that

organization. As a beneficial owner, you have the right to instruct your broker, bank, trustee, or nominee how to vote your shares. Your

broker is required to vote your shares in accordance with your instructions. If you do not give instructions to your broker, your broker

will not be able to vote your shares on any proposals other than Proposal No. 2 and Proposal No. 3. It is very important to instruct your

broker how to vote your shares by following their voting instructions.

How do I vote?

Stockholder of Record.

If you are a stockholder of record you can vote in any one of four ways:

| 1. | Via the Internet Prior to the Meeting. You may vote

by proxy via the Internet prior to the Annual Meeting by following the instructions provided on the enclosed proxy card. |

| 2. | By Mail. You may vote by proxy by filling out the proxy

card and returning it in the envelope provided. |

| 3. | At the Meeting. If you attend the virtual Annual Meeting,

you may vote during the meeting by visiting https://www.cstproxy.com/tsrconsulting/2023, and entering your control number included

on the proxy card you receive. |

Beneficial Owner of Shares

Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization,

then you are the “beneficial owner” of shares held in “street name” and you can vote in any one of two ways:

| 1. | Broker Instructions. A Notice was forwarded to you by a brokerage firm, bank, broker-dealer, or

other similar organization. As a beneficial owner, you have the right to instruct your broker, bank, trustee, or nominee how to vote your

shares. Your broker is required to vote your shares in accordance with your instructions. If you do not give instructions to your broker,

your broker will not be able to vote your shares for Proposal No. 1 or Proposal No. 4. It is very important to instruct your broker how

to vote your shares by following their voting instructions. |

| 2. | At the Meeting. If you are a beneficial owner of shares held in street name and wish to vote at

the Annual Meeting, you must obtain a “legal proxy” from the organization that holds your shares. A legal proxy is a written

document that will authorize you to vote your shares held in street name at the Annual Meeting. Please contact the organization that holds

your shares for instructions regarding obtaining a legal proxy. Once you have received your legal proxy, you will need to contact Continental

Stock Transfer & Trust Company to have a control number generated. Please allow up to 72 hours for processing your request for a control

number. To vote during the Annual Meeting, please visit https://www.cstproxy.com/tsrconsulting/2023 and enter your control number you

receive. |

How many votes are required

to approve each proposal?

| 1. | Proposal No. 1 – Election to the Company’s

Board of one (1) Class II Director nominee named in this Proxy Statement. The Candidate for election as a member of the Board who receive

the highest number of votes shall stand elected; an absolute majority of the votes cast is not a prerequisite to the election of any

candidate to the Board, nor is it a prerequisite to election for a candidate to receive more affirmative votes than authority withheld

votes. A proxy that withholds authority with respect to the election of any nominee will be counted for purposes of determining whether

there is a quorum, but, with respect to any specific nominee, will not be considered to have been voted for such nominee. Broker non-votes,

if any, will have no effect. |

| 2. | Proposal No. 2 – Ratification of the appointment

of CohnReznick LLP as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2024. Adoption

of this proposal requires the affirmative vote of the holders of a majority of the stock having voting power present in person or represented

by proxy at the Annual Meeting and entitled to vote. Abstentions will be counted as represented and entitled to vote and will have the

effect of a negative vote on the proposal. |

| 3. | Proposal No. 3 – A non-binding advisory vote

on the compensation program for the Company’s named executive officers as disclosed in the proxy statement. The Company will consider

the affirmative vote of the holders of a majority of the stock having voting power present in person or represented by proxy at the Annual

Meeting and entitled to vote as approval of the compensation of the Company’s named executive officers. Abstentions will be counted

as represented and entitled to vote and will have the effect of a negative vote on the proposal. Broker non-votes, if any, will have

no effect. As an advisory vote, this proposal is not binding. However, our Board and Compensation Committee will consider the outcome

of the vote when making future compensation decisions for the Company’s named executive officers. |

| 4. | Proposal No. 4 – Approval of an amendment to

the Company’s Certificate of Incorporation to eliminate the personal liability of directors and executive officers for monetary

damages for breach of the fiduciary duty of care. Under our Certificate of Incorporation, as amended, approval of this proposal requires

the affirmative vote of the holders of not less than two-thirds of the stock having voting power and entitled to vote. Abstentions

and broker non-votes will have the same effect as votes “against” this proposal. |

What is the deadline for

submitting proxies?

Proxies can be submitted until

the polls are closed at the Annual Meeting. If you are voting via the Internet prior to the meeting, you must submit your proxy by 11:59

p.m., Eastern Time, the day prior to the Annual Meeting. However, to be sure that the Company receives your proxy in time to utilize it,

please provide your proxy as early as possible.

May I change or revoke my

vote after I return my proxy card?

If you give us your proxy,

you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

| ● | if

you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed

above; |

| ● | by

re-voting by the Internet as instructed above; |

| ● | by

notifying the Corporate Secretary of TSR in writing before the Annual Meeting that you have revoked your proxy; or |

| ● | by

attending the Annual Meeting virtually. Attending the meeting virtually will not in and of itself revoke a previously submitted proxy.

You must specifically request at the meeting that it be revoked. |

Your most current vote, whether

by the Internet or proxy card, is the one that will be counted.

How many shares are required

to be present to hold the Annual Meeting?

A quorum is necessary to hold

a valid meeting of stockholders. The presence, in person or by proxy, of a majority of the issued and outstanding shares of Common Stock

entitled to vote as of the Record Date constitutes a quorum at the Annual Meeting. Abstentions will be counted as shares that are present

and entitled to vote for purposes of determining the presence of a quorum with respect to any matter, but will not be counted as votes

in favor of such matter. If a broker holding stock in “street name” indicates on the proxy card that it does not have discretionary

authority as to certain shares to vote on a matter, those shares will not be considered as present and entitled to vote with respect to

that matter.

What happens if I do not

give specific voting instructions?

If you are a stockholder of

record and submit your signed and dated proxy card but do not make specific choices with respect to the proposals, your proxy will follow

the Board’s recommendations and your shares will be voted:

| ● | “FOR”

the election of the Class II Director nominee (Proposal No. 1); |

| ● | “FOR”

the ratification of the appointment of CohnReznick LLP as the Company’s independent registered public accounting firm for the fiscal

year ending May 31, 2024 (Proposal No. 2); |

| ● | “FOR”

the approval of the compensation program for the Company’s named executive officers as described herein (Proposal No. 3); and |

| ● | “FOR”

the approval of an amendment to the Company’s Certificate of Incorporation to eliminate the personal liability of directors and

executive officers for monetary damages for breach of the fiduciary duty of care (Proposal No. 4). |

If you are a beneficial owner

of shares held in street name and do not provide the organization that holds your shares with specific voting instructions then, under

applicable rules, the organization that holds your shares may generally vote on “routine” matters but cannot vote on “non-routine”

matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine

matter, that organization will inform the inspector of election that it does not have the authority to vote on that matter with respect

to your shares. This is generally referred to as a “broker non-vote.”

Which ballot measures are

considered “routine” or “non-routine”?

The approvals of an amendment

to the Company’s Certificate of Incorporation to eliminate the personal liability of directors and executive officers for monetary

damages for breach of the fiduciary duty of care (Proposal No. 4) is considered a non-routine matter under applicable rules. A broker

cannot vote without instructions on non-routine matters, and therefore broker non-votes may exist in connection with these proposals.

Broker non-votes will have no effect on these proposals except that they will be deemed as votes “against” Proposal No. 4.

The election of directors

(Proposal No.1), the proposal to ratify the appointment of CohnReznick LLP as the Company’s independent registered public accounting

firm for the fiscal year ending May 31, 2024 (Proposal No. 2) and the approval of the compensation program for the Company’s named

executive officers (Proposal No. 3) are considered routine matters under applicable rules. A broker may generally vote on routine matters,

and therefore no broker non-votes are expected to exist in connection with Proposal Nos. 1, 2 and 3.

Who will count the vote?

All votes will be tabulated

by the inspector of election appointed for the Annual Meeting. The inspector of election will separately tabulate (i) the affirmative

votes, authority withheld and broker non-votes with regard to the election of directors under Proposal No. 1 (ii) the affirmative votes,

negative votes, abstentions and broker non-votes with regard to the approval of an amendment to the Company’s Certificate of Incorporation

to eliminate the personal liability of directors and executive officers for monetary damages for breach of the fiduciary duty of care

under Proposal No. 4; and (iii) the affirmative votes, negative votes, and abstentions with regard to the votes to approve the ratification

of the appointment of CohnReznick LLP as the Company’s independent registered public accountants for the fiscal year ending May

31, 2024 under Proposal No. 2 and the compensation program for the Company’s named executive officers under Proposal No. 3.

When will the voting results

be disclosed?

The Company will publish voting

results in a current report on Form 8-K that we will file with the Securities and Exchange Commission (“SEC”) within four

business days following the Annual Meeting. If on the date of this filing the inspector of election for the Annual Meeting has not certified

the voting results as final, the Company will announce that the results are not final and publish the final results in a subsequent amended

Form 8-K filing within four business days after the final voting results are known.

Whom should I contact if

I have any questions regarding this proxy solicitation?

Generally, stockholders who

have questions or concerns and wish to communicate with the Board should follow the instructions contained under the section of this Proxy

Statement entitled “Stockholder Communications with Directors.”

If you have questions or

require assistance in voting your shares, you should call John G. Sharkey, TSR’s corporate secretary, at (631) 231-0333.

INTEREST OF CERTAIN PERSONS IN MATTERS TO

BE ACTED UPON

No director or executive officer, other than in

his role as nominee, director or executive officer, associate of any director or executive officer or any other person has any substantial

interest, direct or indirect by security holdings or otherwise, in the matters described herein which, to the extent such director, executive

officer or associate of such director or executive officer is a stockholder of the Company, is not shared by all other stockholders pro

rata and in accordance with their respective stock ownership interests.

PROPOSAL 1 - ELECTION OF DIRECTOR

At the Annual Meeting, one

(1) Class II Director will be elected for a three-year term expiring at the Company’s 2026 annual stockholder meeting or until his

successor has been elected and qualified.

If the nominee listed below

is unavailable for election at the date of the Annual Meeting, the shares represented by the proxy will be voted for such nominee as the

person or persons designated to vote shall, in their judgment, designate. Management at this time has no reason to believe that the nominee

will not be available or will not serve if elected.

Set forth below is certain

information with respect to the director nominated by the Company.

| Name of Director and Nominee for Election |

|

Age |

|

Nominee

for Class

of Director |

|

Nominee

for Term

Expiring |

| Robert Fitzgerald |

|

59 |

|

Class II |

|

2026 |

Mr. Robert Fitzgerald was appointed as

a Class II director of the Company by the Board on December 30, 2019. Mr. Fitzgerald is a seasoned business executive with over 25 years

of experience helping companies grow. From 1999 through 2008, he served as the CEO of YDI/Proxim Wireless, an early pioneer of the wireless

networking equipment industry. From 2009 through 2010, he served as a consultant and later the President of Ubiquiti Networks, now Ubiquiti,

Inc. (NYSE: UI), a world leading provider of wireless and non-wireless networking equipment. He currently holds majority interest and

provides executive management services to Long Wave, Inc., a service provider to the defense industry, and Starline Costume, LLC, a provider

of Halloween costumes, and is CEO of QAR Industries, Inc., an investment company that holds interests in a portfolio of public and private

companies, including Antenna Products Corporation and SeeView Securities, Inc. Mr. Fitzgerald earned a B.A. in Economics and a J.D. from

the University of California, Los Angeles.

The Company believes that Mr. Fitzgerald’s

extensive experience in and knowledge of the information technology (“IT”) industry and career serving in management-level

positions for public and private companies make him a valuable member of the Board.

The Board unanimously recommends a vote FOR

the election of Mr. Fitzgerald as Class II Director to serve until our 2026 annual stockholder meeting.

Directors and Executive Officers of the Company

Set forth below are the names,

ages and positions and offices held with the Company of each director and executive officer of the Company. Directors are currently classified

as either Class I, Class II or Class III directors, with each class serving for a term of three (3) years. The term of Class I directors

is set to expire at the 2024 annual stockholder meeting. There is currently no Class III director on the Board. Executive officers serve

until such time as their successor is duly elected and qualified.

| Name | |

Age | |

Position | |

Year First

Officer or

Director |

| Bradley M. Tirpak(1)(2)(3) | |

54 | |

Chairman of the Board and Class I Director | |

2019 |

| Thomas Salerno | |

55 | |

Chief Executive Officer, President and Treasurer

| |

2020 |

| John G. Sharkey | |

64 | |

Senior Vice President, Chief Financial Officer and Secretary

| |

1990 |

| H. Timothy Eriksen(1)(2)(3)(4)(6) | |

54 | |

Class I Director | |

2019 |

| Robert Fitzgerald(1)(2)(3)(5) | |

59 | |

Class II Director | |

2019 |

| (1) | Member of the Compensation Committee of the Board. |

| (2) | Member of the Audit Committee of the Board. |

| (3) | Member of the Nominating Committee of the Board. |

| (4) |

Mr. Eriksen is the Chairman of the Audit Committee of the Board and the Chairman of the Nominating Committee of the Board. |

| (5) | Mr. Fitzgerald is the Chairman of the Compensation Committee of the Board. |

| (6) | Lead independent director. |

There are no family relationships between any

of the Company’s executive officers and directors. None of the Company’s directors currently serves, or has served during

the past five years, as a director of any company with a class of securities registered pursuant to Section 12 of the Exchange Act or

subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under the Investment

Company Act of 1940. There is no arrangement between any director or director nominee and any other person pursuant to which he was or

is to be selected as a director or director nominee except that Mr. Eriksen and Mr. Tirpak were nominated by Zeff Capital, L.P. as Class

I directors at the Company’s 2018 annual stockholder meeting held on October 22, 2019 in accordance with the terms and conditions

of that certain settlement and release agreement, dated August 30, 2019, between the Company and certain investor parties, including Zeff

Capital, L.P., Zeff Holding Company, LLC and Daniel Zeff, QAR Industries, Inc. and Robert Fitzgerald, and Fintech Consulting, LLC and

Tajuddin Haslani (the “Settlement Agreement”). The terms of the Settlement Agreement are more fully described in the Company’s

Current Report on Form 8-K filed with the SEC on September 3, 2019. Mr. Eriksen and Mr. Tirpak were subsequently elected as directors

at the annual stockholder meeting on October 22, 2019.

Biographical Information

Mr. Bradly M. Tirpak was elected as

a Class I director of the Company at the 2018 annual meeting of stockholders on October 22, 2019. He was appointed as the Chairman

of the Board on December 30, 2019. Mr. Tirpak is a professional investor with more than 25 years of investing experience. From October

of 2019 through June of 2023, Mr. Tirpak served as a director, Chairman, and then CEO of Liberated Syndication Inc., a leading provider

of podcast hosting and advertising services. Since September of 2016, he has served as a portfolio manager and Managing Director of Palm

Active Partners, LLC, a private investment company. He also previously served as a portfolio manager at Credit Suisse First Boston, Caxton

Associates, Sigma Capital Management, Chilton Investment Company and Locke Partners. Mr. Tirpak served as a director of Full House

Resorts, Inc., a publicly trading gaming and lodging company, from December of 2014 through January of 2021, as a director at Applied

Minerals, Inc., a publicly traded specialty materials company, from April 2015 to March 2017, as a director at Flowgroup plc, an energy

supply and services business in the United Kingdom, from June 2017 to October 2018 and as a director at Birner Dental Management

Services, Inc., a publicly traded dental service organization, from December 2017 to January 2019. From April of 2020 through April

of 2023, he served as a director of Barnwell Industries Inc., a publicly traded company engaged in real estate development and oil and

gas exploration. Mr. Tirpak also currently serves as trustee of The Halo Trust, the world’s largest humanitarian mine clearance

organization focused on clearing the debris of war which currently operates in over 25 countries including Afghanistan, Ukraine and Iraq.

Mr. Tirpak earned a B.S.M.E. from Tufts University and an M.B.A. from Georgetown University.

The Company believes that Mr. Tirpak is a valuable member of the Board due to his knowledge and experience in investing, capital allocation

and corporate governance, as well as his experience serving on the boards of publicly traded companies.

Mr. H. Timothy Eriksen was elected

as a Class I director of the Company at the 2018 annual meeting of stockholders on October 22, 2019. He was appointed by the Board as

the Chairman of the Audit Committee of the Board on December 30, 2019. Mr. Eriksen founded Eriksen Capital Management, an investment advisory

firm (“ECM”), in 2005. Mr. Eriksen is the President of ECM. Mr. Eriksen is the Chief Executive Officer and Chief

Financial Officer of, and since July 2015 has been a director of, Solitron Devices, Inc. (“Solitron”). Solitron designs, develops,

manufactures and markets solid-state semiconductor components and related devices primarily for the military and aerospace markets.

From April 2018 through August 2021, Mr. Eriksen was a director of Novation Companies, Inc. (“Novation”). Novation owned

Healthcare Staffing, Inc., which, among other activities, provided outsourced healthcare staffing and related services. From August 2021

through August 2023, Mr. Eriksen was a director of PharmChem, Inc., which offers a sweat patch device to test for drug abuse. On September

1, 2023, Mr. Eriksen rejoined the board of PharmChem and was named Chairman of the Board. Prior to founding ECM, Mr. Eriksen worked

for Walker’s Manual, Inc., a publisher of books and newsletters on micro-cap stocks, unlisted stocks and community banks. Earlier

in his career, Mr. Eriksen worked for Kiewit Pacific Co, a subsidiary of Peter Kiewit Sons, as an administrative engineer on the

Benicia Martinez Bridge project. Mr. Eriksen received a B.A. from The Master’s University and an M.B.A. from Texas A&M

University.

The Company believes that Mr. Eriksen is a valuable

member of the Board based on his strong business and financial background, and his experience serving in leadership- and management-level

roles with responsibility for formulating business and operational strategy.

Mr. Robert Fitzgerald was appointed as

a Class II director of the Company by the Board on December 30, 2019. Mr. Fitzgerald is a seasoned business executive with over 25 years

of experience helping companies grow. From 1999 through 2008, he served as the CEO of YDI/Proxim Wireless, an early pioneer of the wireless

networking equipment industry. From 2009 through 2010, he served as a consultant and later the President of Ubiquiti Networks, now Ubiquiti,

Inc. (NYSE: UI), a world leading provider of wireless and non-wireless networking equipment. He currently serves as the CEO of QAR Industries,

Inc., an investment company that holds interests in a portfolio of public and private companies, primarily the Company and Antenna Products

Corporation, a provider of antennas and towers. Mr. Fitzgerald earned a Bachelor of Arts in Economics and Juris Doctorate from the University

of California, Los Angeles.

The Company believes that Mr. Fitzgerald’s

extensive experience in and knowledge of the information technology (“IT”) industry and career serving in management-level

positions for public and private companies make him a valuable member of the Board.

Mr. Thomas Salerno was appointed President,

Chief Executive Officer and Treasurer of the Company effective as of March 23, 2020. Since 2011, Mr. Salerno had served as the Managing

Director of TSR Consulting Services, Inc., the Company’s IT consulting services subsidiary and largest business unit. Mr. Salerno

has over 20 years of experience in the technology consulting industry. Prior to joining the Company, Mr. Salerno spent eight years at

Open Systems Technology as Associate Director, two years as Vice President of Sales and Recruiting for Versatech Consulting, and three

years as an Account Representative for Robert Half Technologies. Mr. Salerno holds a bachelor’s degree from Johnson and Wales University.

Mr. John G. Sharkey was appointed Senior

Vice President, Chief Financial Officer and Secretary of the Company effective June 1, 2019. He had served as the Vice President, Finance,

Controller and Secretary of the Company since 1990. Mr. Sharkey received a master’s degree in Finance from Adelphi University and

received his Certified Public Accountant certification from the State of New York. From 1987 until joining the Company in October 1990,

Mr. Sharkey was Controller of a publicly held electronics manufacturer. From 1984 to 1987, he served as Deputy Auditor of a commercial

bank, having responsibility over the internal audit department. Prior to 1984, Mr. Sharkey was employed by KPMG LLP as a senior accountant.

Corporate Governance and Board Matters

The Company maintains the

following committees of the Board: the Audit Committee, the Compensation Committee, and the Nominating Committee. Each of these committees

is separately described below.

The Board of Directors currently

consists of Bradley M. Tirpak (Chairman), H. Timothy Eriksen and Robert Fitzgerald. Bradley M. Tirpak, H. Timothy Eriksen and Robert Fitzgerald

qualify as “independent directors” under NASDAQ rules.

The Board also has determined

that the current Chair and members of the Audit Committee, H. Timothy Eriksen, Bradley M. Tirpak and Robert Fitzgerald all meet the requirements

of an “audit committee financial expert” as such term is defined in applicable regulations of the SEC.

During the fiscal year ended

May 31, 2023, the Board met with management weekly, held four meetings and acted by unanimous written consent on three occasions; the

Audit Committee held four meetings; the Compensation Committee held one meeting; and the Nominating Committee did not meet as no directors

were up for election. During the 2023 fiscal year, no director attended fewer than 75% of the aggregate of the total number of meetings

of the Board and the total number of meetings of all committees of the Board of which such director was a member. The Company does not

have a formal policy regarding attendance of directors at the Annual Meeting of Stockholders, but the Company encourages all directors

to attend. All of the directors who served in office on the date of the 2022 annual meeting of stockholders attended the 2022 annual stockholder

meeting.

The Audit Committee

The Audit Committee’s

current members are H. Timothy Eriksen (Chairman), Bradley M. Tirpak and Robert Fitzgerald. Each of the members of the Audit Committee

is an independent director under the rules of the NASDAQ Capital Market. The Audit Committee’s primary functions are to assist the

Board in monitoring the integrity of the Company’s financial statements and systems of internal control. The Audit Committee has

direct responsibility for the appointment, independence and performance of the Company’s independent auditors. The Audit Committee

is responsible for pre-approving any engagements of the Company’s independent auditors. The Audit Committee operates under a written

charter approved by the Board on September 16, 2004 and amended as of October 10, 2008. A copy of the Audit Committee Charter is available

on the Investor Relations page of the Company’s website at www.tsrconsulting.com.

The Compensation Committee

The Compensation Committee’s

current members are Robert Fitzgerald (Chairman), H. Timothy Eriksen and Bradley M. Tirpak. Each of the members of the Compensation Committee

is an independent director under the rules of the NASDAQ Capital Market. The Compensation Committee assesses the structure of the Company’s

management team and the overall performance of the Company. It evaluates the performance of the Company’s executive officers

on an annual basis and makes recommendations to the Board regarding salary increases and other compensation to executive officers. The

Board has adopted a written charter for the Compensation Committee, a copy of which is available on the Investor Relations page of the

Company’s website at www.tsrconsulting.com. Under its charter, the Compensation Committee has authority to retain and approve

the fees of independent compensation consultants or other advisors. The Compensation Committee did not engage an independent compensation

consultant during the last fiscal year.

According to the charter of

the Compensation Committee, the Compensation Committee may form subcommittees for any purpose that the Compensation Committee deems appropriate

and may delegate to such subcommittees such power and authority as the Compensation Committee deems appropriate; provided, however, that

no subcommittee shall consist of fewer than two members; and provided further that the Compensation Committee shall not delegate to a

subcommittee any power or authority required by any law, regulation or listing standard to be exercised by the Compensation Committee

as a whole. The Board and the Compensation Committee do not discuss or make decisions regarding an executive officer’s compensation

in the presence of such executive officer. Except for consulting from time to time at the Compensation Committee’s request with

our Chairman regarding annual performance projections and targets, our executive officers, including the named executive officers, do

not have any role in determining the form or amount of compensation paid to our named executive officers.

The Nominating Committee

The Nominating Committee’s

current members are H. Timothy Eriksen (Chairman), Bradley M. Tirpak and Robert Fitzgerald. Each of the members of the Nominating Committee

is an independent director under the rules of the NASDAQ Capital Market. A copy of the Nominating Committee Charter is available on the

Investor Relations page of the Company’s website at www.tsrconsulting.com. The Nominating Committee determines the criteria for

nominating new directors and recommends to the Board candidates for nomination to the Board. The Nominating Committee’s process

to identify and evaluate candidates for nomination to the Board includes consideration of candidates for nomination to the Board recommended

by stockholders. Such stockholder recommendations must be delivered to the Corporate Secretary of the Company, together with the information

required to be filed in a proxy statement with the Securities and Exchange Commission regarding director nominees and each such nominee

must consent to serve as a director if elected, no later than the deadline for submission of stockholder proposals as set forth in our

Bylaws and under the section of this Proxy Statement entitled “Stockholder Nominations.” In considering and evaluating such

stockholder proposals that have been properly submitted, the Nominating Committee will apply substantially the same criteria that the

Nominating Committee believes must be met by a nominee recommended by the Nominating Committee as described below.

In addition, certain identification

and disclosure rules apply to director candidate proposals submitted to the Nominating Committee by any single stockholder or group of

stockholders that has beneficially owned more than five percent of the Common Stock for at least one year (a “Qualified Stockholder

Proposal”). If the Nominating Committee receives a Qualified Stockholder Proposal that satisfies the necessary notice, information

and consent provision referenced above, the Proxy Statement will identify the candidate and the stockholder (or stockholder group) that

recommended the candidate and disclose whether the Nominating Committee chose to nominate the candidate. However, no such identification

or disclosure will be made without the written consent of both the stockholder (or stockholder group) and the candidate to be so identified.

In evaluating director nominees,

the Nominating Committee currently considers the following factors:

| ● | the

Company’s needs with respect to the particular talents and experience of our directors; |

| ● | the

knowledge, skills and experience of nominees, including experience in business or finance,

in light of prevailing business conditions and the knowledge, skills and experience already

possessed by other members of the Board; |

| ● | familiarity

with the Company’s business and businesses similar or analogous to that of the Company; |

| ● | experience

with accounting rules and practices and corporate governance principles; and |

| ● | such

other factors as the Nominating Committee deems are in the best interests of the Company

and the best interests of the Company’s stockholders. |

Qualified candidates for membership

on the Board will be considered without a particular focus on the diversity of the Board’s membership, and without regard to race,

color, creed, religion, national origin, age, gender, sexual orientation or disability.

The Nominating Committee identifies

nominees by first evaluating the current members of the Board willing to continue in service. If any member of the Board does not wish

to continue in service or if the Nominating Committee or the Board decides not to re-nominate a member for re-election, the Nominating

Committee identifies the desired skills and experience of a new nominee, and discusses with the Board suggestions as to individuals who

meet the criteria.

Governance, Board Leadership Structure and Risk Oversight

The Board does not currently

have a policy on whether the same person should serve as both the Chief Executive Officer and Chairman of the Board. Periodically, our

Board assesses these roles and the board leadership structure to ensure the interests of the Company and its stockholders are best served.

The Chairman and Chief Executive

Officer positions are currently separately held by Bradley M. Tirpak and Thomas Salerno respectively. Our lead independent director is

H. Timothy Eriksen. In that role, he will consider input from all directors as to the preparation of the agendas for meetings of the Board

and each committee of the Board, and will consult, no less frequently than once each calendar quarter, with the Company’s executive

officers who are responsible for assuring compliance with, and implementation of, all applicable corporate and securities laws and make

any recommendations for further action as necessary to ensure such compliance.

As

of the date of this Proxy Statement, we have determined that the leadership structure of our Board of Directors has permitted our Board

to fulfill its duties effectively and efficiently and is appropriate given the size and scope of our Company and its financial condition.

The Company believes the role

of management is to identify and manage risks confronting the Company. The Board plays an integral part in the Company’s risk oversight,

particularly in reviewing the processes used by management to identify and report risk, and also in monitoring corporate actions so as

to minimize inappropriate levels of risk. The Board as a whole is also responsible for overseeing strategic and enterprise risk. A discussion

of risks that the Company faces is conducted at regularly scheduled meetings of the Board and committee meetings.

Each of our directors is a

member of the National Association of Corporate Directors and receives continuing education on governance best practices through participation

in the organization.

Meetings of Independent Directors

Directors who are independent

under the NASDAQ Capital Market listing standards and applicable laws and regulations have not met in separate committee; rather, the

independent directors hold discussions among them without the presence of management in conjunction with meetings of the Audit Committee,

Compensation Committee, and Nominating Committee, as they deem necessary. Each of these committees is comprised solely of independent

directors.

Code of Ethics

The Company has adopted a

code of ethics that applies to all of its employees, including the chief executive officer and chief financial and accounting officer.

The code of ethics is available on the Investor Relations page of the Company’s website at www.tsrconsulting.com. The Company intends

to post on its website all disclosures that are required by law or NASDAQ Capital Market listing standards concerning any amendments to,

or waivers from, the Company’s code of ethics. Stockholders may request a free copy of the code of ethics by writing to Corporate

Secretary, TSR, Inc., 400 Oser Avenue, Suite 150, Hauppauge, NY 11788. Disclosure regarding any amendments to, or waivers from, provisions

of the code of ethics that apply to the Company’s directors or principal executive and financial officers will be included in a

Current Report on Form 8-K filed with the SEC within four business days following the date of the amendment or waiver, unless website

posting of such amendments or waivers is then permitted by the rules of the NASDAQ Capital Market and the SEC.

Stockholder Nominations

Under the Company’s

Amended and Restated By-laws, as amended, a stockholder must follow certain procedures to nominate persons for election as directors or

to introduce an item of business at an annual meeting of stockholders. Among other requirements, these procedures require any nomination

or proposed item of business to be submitted in writing to the Company’s Corporate Secretary at its principal executive offices.

The Company must receive the notice of a stockholder’s intention to introduce a nomination or proposed item of business at an annual

meeting no later than 120 days prior to the anniversary of the date on which the Company released its proxy statement (the “Anniversary

Date”) in connection with the prior year’s annual meeting to its stockholders; provided, however, in the event the annual

meeting is scheduled to be held on a date more than 30 days before or after the Anniversary Date, the notice can be received not later

than the close of business on the later of the 75th day prior to the scheduled meeting date or the 15th day following

the day on which the public announcement of such annual meeting is first made by the Company.

Stockholder Communications with Directors

Generally, stockholders who

have questions or concerns should contact the Company’s Corporate Secretary at (631) 231-0333. Any stockholder who wishes to

address questions regarding the Company’s business directly with the Board, or any individual director, should direct his or her

questions, in writing, in care of the Company’s Secretary, at the Company’s offices at 400 Oser Avenue, Suite 150, Hauppauge,

NY 11788. Any complaint, concern or reference to a problem or potential problem with the Company’s accounting, accounting policies,

internal control, auditing or financial matters should be addressed to Accounting Complaints, c/o Chair of the Audit Committee, TSR, Inc.,

400 Oser Avenue, Suite 150, Hauppauge, NY 11788.

Certain Relationships and Related Party Transactions

Except as described below,

the Company was not a participant in any transaction since the beginning of the fiscal year ended May 31, 2022 in which any related person

had a direct or indirect material interest and in which the amount involved exceeded the lesser of $120,000 or 1% of the average of the

Company’s total assets at the end of each of the Company’s two prior fiscal years, and no such transactions are currently

proposed.

Fintech Consulting Matter

On January 5, 2021, the members

of the Board of Directors of TSR other than Robert Fitzgerald approved providing a waiver to QAR Industries, Inc. for its contemplated

acquisition of shares owned by Fintech Consulting LLC under the Company’s prior Amended and Restated Rights Agreement so that a

distribution date would not occur as a result of the acquisition. QAR Industries, Inc. and Fintech Consulting LLC were both principal

stockholders of the Company, each owning more than 5% of the Company’s outstanding common stock prior to the consummation of the

acquisition. Robert Fitzgerald is the President and majority shareholder of QAR Industries, Inc. The other directors of the Company are

not affiliated with QAR Industries, Inc.

On February 3, 2021, the acquisition

was completed and QAR Industries, Inc. purchased 348,414 shares of TSR common stock from Fintech Consulting LLC at a price of $7.25 per

share. At the same time, Bradley M. Tirpak, Chairman of TSR, purchased 27,586 shares of TSR common stock from Fintech Consulting LLC at

a price of $7.25 per share.

On December 1, 2021, Fintech

Consulting LLC filed a complaint against the Company in the United States District Court for the District of New Jersey (the “New

Jersey Action”), related to the foregoing transaction. The named Defendants in the complaint were the Company, QAR Industries,

Inc., Robert E. Fitzgerald, a director and a shareholder of QAR Industries, Inc., and Bradley Tirpak. The complaint purported to

assert claims against the Defendants under state law and Section 10(b) of the Exchange Act in connection with a Share Purchase Agreement,

dated January 31, 2021, by and between the Plaintiff, as the seller of shares of TSR's common stock, and QAR Industries, Inc. and

Mr. Tirpak, as the purchasers of such shares (the “SPA”). The plaintiff sought (i) judgment declaring the transactions represented

by the SPA null and void and returning the shares; (ii) judgment cancelling the SPA and returning the shares in exchange for return of

the purchase price; (iii) judgement unwinding the transaction; (iv) compensatory damages; (v) punitive damages; (vi) pre-judgment interest;

(vii) costs of suit including attorneys’ fees; and (viii) such other relief as the Court may find appropriate. Fintech filed its

first amended complaint on March 2, 2022, which Defendants moved to dismiss on April 19, 2022. On December 7, 2022, the court granted

Defendants’ motion and dismissed the New Jersey Action on jurisdictional grounds.

Following the dismissal of

the original lawsuit, the Plaintiff filed another complaint relating to the SPA against the Defendants on January 12, 2023 in the Court

of Chancery of the State of Delaware (the “Delaware Chancery Action”), asserting claims and seeking relief substantially similar

to that which was asserted and sought in the preceding lawsuit. The Delaware Chancery Action was dismissed without prejudice by the court

on January 23, 2023.

On January 22, 2023, Fintech

Consulting LLC filed a complaint against the Company in the United States District Court for the District of Delaware (the “Delaware

Federal Action’). The Delaware Federal Action, in sum and substance, asserted claims and sought relief substantially similar to

that contained in both the New Jersey Action and the Delaware Chancery Action.

Although the Company believed

the Delaware Federal Action described above to be without merit, to avoid the time and expense of litigation, the Company negotiated with

Fintech to settle this matter pursuant to a settlement agreement and release dated April 24, 2023. An amount of $75,000 was paid in the

fourth quarter of fiscal 2023 to settle this matter. Upon the payment of the settlement amount (i) the plaintiffs forever released and

discharged the defendants from any and all claims or liability of any nature whatsoever; (ii) the defendants forever released and discharged

the plaintiffs from any and all claims or liability of any nature whatsoever that relate to the Delaware Federal Action or the SPA; and

(iii) the plaintiffs filed a Stipulation of Dismissal with Prejudice on April 27, 2023.

Zeff Capital, L.P. Matter

On April 1, 2020, the Company

entered into a binding term sheet (“Term Sheet”) with Zeff Capital, L.P. (“Zeff”) pursuant to which it agreed

to pay Zeff an amount of $900,000 over a period of three years in cash or cash and stock in settlement of expenses incurred by Zeff during

its solicitations in 2018 and 2019 in connection with the annual meetings of the Company, the costs incurred in connection with the litigation

initiated by and against the Company as well as negotiation, execution and enforcement of the Settlement and Release Agreement. In exchange

for certain mutual releases, the Term Sheet called for a cash payment of $300,000 on June 30, 2021, a second cash payment of $300,000

on June 30, 2022 and a third payment of $300,000 also on June 30, 2022, which was payable in cash or common stock at the Company’s

option. There was no interest due on these payments. The $300,000 payment due on June 30, 2021 was paid by the due date. The agreement

also has protections to defer such payment dates so that the debt covenants with the Company’s lender were not breached. On August

13, 2020, the Company, Zeff, Zeff Holding Company, LLC and Daniel Zeff entered into a settlement agreement to reflect these terms. Any

installment payment that was deferred as permitted above accrued interest at the prime rate plus 3.75%, and Zeff had the option to convert

such deferred amounts (plus accrued interest if any) into shares of the Company’s stock. The Company accrued $818,000, the estimated

present value of these payments using an effective interest rate of 5%, in the quarter ended February 29, 2020, as the events relating

to the expense occurred prior to such date. The two remaining cash payments of $300,000 each were made by June 30, 2022 in full satisfaction

of the settlement.

Procedures for Approval of Related Party Transactions

Our Board has adopted a written

related party transaction policy to comply with Section 404 of the Exchange Act, which sets forth the policies and procedures for the

review and approval or ratification of related party transactions. This policy covers any transaction, arrangement or relationship, or

any series of similar transactions, arrangements or relationships, in which (i) the Company or any of its subsidiaries is or will be a

participant, (ii) the aggregate amount involved will or may be expected to exceed the lesser of $120,000 or one percent of the average

of the Company’s total assets at year-end for the last two completed fiscal years, and (iii) any related party, including an executive

officer, director or nominee for director of the Company, any stockholder owning more than 5% of any class of the Company’s voting

securities, or an immediate family member of any such person, has or will have a direct or indirect material interest. This policy is

administrated by our Audit Committee. According to this policy, in determining whether or not to recommend the initial approval or ratification

of a related party transaction, the Audit Committee shall consider the relevant facts and circumstances available including, among other

factors it deems appropriate, whether the interested transaction is on terms no less favorable than terms generally available to an unaffiliated

third party under the same or similar circumstances and the extent of the related party’s interest in the transaction.

DIRECTOR COMPENSATION

The following table sets forth

information concerning the compensation of the non-officer directors of the Company who served as directors during the fiscal year ended

May 31, 2023. Directors of the Company who also serve as executive officers of the Company are not paid any compensation for their service

as directors. There are currently no executive officers also serving as directors.

| Name | |

Fees

Earned

Or Paid

In Cash | | |

Stock

Awards | | |

Option

Awards | | |

Non-Equity

Incentive

Plan

Compensation | | |

Nonqualified

Deferred

Compensation

Earnings | | |

All Other

Compensation | | |

Total | |

| Bradley M. Tirpak (1) | |

$ | 20,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 20,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| H. Timothy Eriksen (1) | |

$ | 20,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 20,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Robert Fitzgerald (2) | |

$ | 20,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 20,000 | |

| (1) | Elected to serve as a director of the Company at the annual

meeting of stockholders on October 22, 2019. |

| (2) | Appointed to serve as a director of the Company by the Board

on December 30, 2019. |

For their service, members

of the Board who are not officers of the Company received a pro-rated amount of an annual retainer of $10,000, payable quarterly, based

on the period of time they respectively served during fiscal 2023.

Bradley M. Tirpak received

an additional annual retainer of $10,000 for his service as Chairman of the Board during fiscal 2023.

H. Timothy Eriksen received

an additional annual retainer of $10,000 for his service as Chairman of the Audit Committee during fiscal 2023. Mr. Eriksen did not receive

any additional retainer for his service as Chairman of the Nominating Committee of the Board or lead independent director during fiscal

2023.

Robert Fitzgerald received

an additional annual retainer of $10,000 for his service as Chairman of the Compensation Committee during fiscal 2023.

EXECUTIVE COMPENSATION

Executive Compensation

The following table sets forth

information concerning the annual and long-term compensation of the Named Executive Officers (as defined below) for services in all capacities

to the Company for the fiscal years ended May 31, 2023 and 2022. The Named Executive Officers for the fiscal years ended May 31, 2023

and 2022 are (1) Thomas Salerno, our President and Chief Executive Officer; (2) John G. Sharkey, our Senior Vice President and Chief Financial

Officer, and (3) Mohammed Shah Syed, our Director of Sales and Recruiting (the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

| Name

and Principal Position | |

Fiscal

Year | | |

Salary | | |

Bonus | | |

Stock

Awards | | |

Option

Awards | | |

Non-

Equity

Incentive

Plan Compen-

sation | | |

Nonqualified

Deferred

Compensation

Earnings | | |

All Other

Compensation | | |

Total | |

| Thomas Salerno, | |

| 2023 | | |

$ | 350,000 | | |

$ | 118,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 2,000 | (4) | |

$ | 470,000 | |

| President and Chief Executive Officer (1) | |

| 2022 | | |

$ | 350,000 | | |

$ | 64,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 2,000 | (4) | |

$ | 416,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| John G. Sharkey, | |

| 2023 | | |

$ | 310,000 | | |

$ | 82,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 8,000 | (4) | |

$ | 400,000 | |

| Senior Vice President and Chief Financial Officer (2) | |

| 2022 | | |

$ | 310,000 | | |

$ | 41,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 8,000 | (4) | |

$ | 359,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mohammed Shah | |

| 2023 | | |

$ | 325,000 | | |

$ | 85,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 4,000 | (4) | |

$ | 414,000 | |

| Syed, Director of Sales and Recruiting

(3) | |

| 2022 | | |

$ | 235,000 | | |

$ | 31,000 | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 4,000 | (4) | |

$ | 270,000 | |

| (1) | Thomas Salerno was appointed as President and Chief Executive

Officer of the Company effective March 23, 2020. |

| (2) | John G. Sharkey was appointed as Senior Vice President and

Chief Financial Officer effective June 1, 2019. Previously, Mr. Sharkey served as Vice President, Finance. |

| (3) | Mohammed Shah Syed was promoted to Director of Sales and

Recruiting effective June 1, 2020. Previously, Mr. Syed served as Recruiting Manager |

| (4) | Amount related to the named executive’s personal use

of an automobile provided by the Company. |

Outstanding Equity Awards

at Fiscal Year End

In October of 2020, the Company adopted the TSR,

Inc. 2020 Equity Incentive Plan (“the Plan”) which was subsequently approved by the Shareholders at the combined 2019 and

2020 Annual Meeting held on November 19, 2020. The Plan allows for a maximum of 200,000 shares in the form of non-qualified stock options,

incentive stock options, restricted awards, stock appreciation rights, cash awards, performance share awards and other equity based awards

to employees, consultants, directors and those individuals whom the Board determines are reasonably expected to become employees, consultants

or directors following the date of grant. The table below sets forth the outstanding equity awards issued under the Plan as of May 31,

2023 with respect to the Named Executive Officers.

| | |

Option Awards | | |

Stock Awards | |

| Name | |

Number of securities underlying

unexercised options

(#)

exercisable | | |

Number of securities underlying

unexercised options

(#)

unexercisable | | |

Equity incentive plan awards:

Number of securities underlying unexercised unearned options

(#) | | |

Option exercise price

($) | | |

Option expiration date | | |

Number of shares or units

of stock that have not vested

(#) | | |

Market value of shares or

units of stock that have not vested

($) | | |

Equity incentive plan awards:

Number of unearned shares, units or other rights that have not vested

(#) | | |

Equity incentive plan awards:

Market or payout value of unearned shares, units or other rights that have not vested

($) | |

| Thomas | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5,000 | (1)(2) | |

$ | 37,450 | |

| Salerno | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 8,334 | (3)(2) | |

$ | 62,422 | |

| John G. | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,334 | (1)(2) | |

$ | 24,972 | |

| Sharkey | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5,000 | (3)(2) | |

$ | 37,450 | |

| Mohammed | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,000 | (1)(2) | |

$ | 4,940 | |

| Shah Syed | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,000 | (3)(2) | |

$ | 22,470 | |

| (1) | Representing shares of common stock under time vesting stock

awards, issued on January 28, 2021, which fully vest on the applicable vesting date, so long as the grantee remains an employee of the

Company. |

| (2) | The vesting date for these shares is January 28, 2024. |

| (3) | Representing shares of common stock under performance vesting

stock awards, issued on January 28, 2021, which, so long as the grantee remains an employee of the Company, will (i) fully vest upon

the satisfaction of the “performance condition” defined in the grant agreements, which relates to the market price of the

Company’s common stock over a stated period of time, and (ii) expire on January 28, 2023 and 2024, respectively, if the performance

condition is not satisfied. The “performance condition” entails the common stock share price trading above the applicable

share target for 30 consecutive trading days between the issue date and the expiration date. If the applicable share target (a) is reached

for 30 consecutive days before the vesting date and (b) the stock is above the applicable share target on the vesting date, the award

shares shall vest on the vesting date. If the applicable share target is reached after the vesting and before the expiration date, the

shares vest upon the stock trading for 30 consecutive days above the applicable share target. |

Employment Agreements and Arrangements

On November 3, 2020, TSR entered into an Employment

Agreement with its Chief Executive Officer, Thomas C. Salerno, as amended by that certain Addendum to Employment Agreement dated July

31, 2023 between the Company and Mr. Salerno (taken together, the “CEO Employment Agreement”), effective as of November 2,

2020.

On November 3, 2020, TSR entered into an Amended

and Restated Employment Agreement with its Chief Financial Officer, John Sharkey, as amended by that certain Addendum to Employment Agreement

dated October 27, 2023 between the Company and Mr. Sharkey (taken together, the “CFO Employment Agreement”, and together with

the CEO Employment Agreement, the “Employment Agreements”), effective as of November 2, 2020.

On January 1, 2023, TSR entered into an Employment

Agreement with its Director of Recruiting and Sales, Mohammed Shah Syed, as amended by that certain Addendum to Employment Agreement dated

August 1, 2023, between the Company and Mr. Syed (collectively, the “R&S Employment Agreement”), effective January 1,

2023.

Employment Term and Position. The term

of employment of each of Messrs. Salerno, Sharkey and Syed expires on November 3, 2026, March 31, 2025 and July 31, 2026, respectively,

and any continued employment following such terms will be on an “at-will” basis. During their respective terms of employment,

Mr. Salerno will serve as Chief Executive Officer of the Company, Mr. Sharkey will serve as Chief Financial Officer of the Company and

Mr. Syed will serve as Director of Recruiting and Sales of the Company.

Base Salary, Annual Bonus Equity Compensation

and Other Benefits.

Pursuant to their Employment Agreements, Messrs.

Salerno and Syed are entitled to annual base salaries of $395,000 and $325,000, respectively, as may be adjusted by the Board. Pursuant