FY 2024 Earnings Per Share Increased 25% to

$14.01

FY 2025 Guidance for Revenue Growth of 8% to

10% and EPS of $15.00 to $15.50

Company Plans to Increase Quarterly Dividend

by 17% to $0.82 Per Common Share

American Express Company (NYSE: AXP) today reported full year

net income of $10.1 billion, or $14.01 per share, compared with net

income of $8.4 billion, or $11.21 per share, a year ago.

(Millions, except per share

amounts, and where indicated)

Quarters Ended

December 31,

Percentage Inc/(Dec)

Years Ended

December 31,

Percentage Inc/(Dec)

2024

2023

2024

2023

Billed Business (Billions)

$408.4

$379.8

8%

$1,550.9

$1,459.6

6%

FX-adjusted1

$376.7

8%

$1,453.1

7%

Total Revenues Net of Interest Expense

$17,179

$15,799

9%

$65,949

$60,515

9%

FX-adjusted1

$15,644

10%

$60,179

10%

Net Income

$2,170

$1,933

12%

$10,129

$8,374

21%

Diluted Earnings Per Common Share

(EPS)2

$3.04

$2.62

16%

$14.01

$11.21

25%

Full Year Adjusted EPS Excluding

Transaction Gain3

$13.35

$11.21

19%

Average Diluted Common Shares

Outstanding

704

726

(3)%

713

736

(3)%

“2024 was another strong year for American Express. We delivered

record revenues of $65.9 billion, up 10 percent on an FX-adjusted

basis, record net income of $10.1 billion, and earnings per share

of $14.01, up 25 percent year-over-year,” said Stephen J. Squeri,

Chairman and Chief Executive Officer.

“We also saw record levels of annual Card Member spending,

record net card fee revenues, and a record 13 million new card

acquisitions, and we continued to add millions of merchant

locations to our network globally. We exited the year with

increased momentum, with billings growth accelerating to 8 percent

in the fourth quarter, driven by stronger spending from our

consumer and commercial customers during the holiday season. We

maintained our best-in-class credit performance and disciplined

expense management throughout the year.

“As we prepare to celebrate the 175th anniversary of American

Express in March, we will continue to build on our history of

growth and innovation by investing in our premium value

propositions, coverage, marketing, technology, and talent. For the

full year 2025, we expect revenue growth of between 8 to 10 percent

and EPS in the range of $15.00 to $15.50, and we plan to increase

our quarterly common stock dividend by 17 percent.

“I am confident that we can sustain our strong momentum over the

long term, driven by the many attractive opportunities we see

across our premium customer base, particularly with Millennial and

Gen Z consumers and in key international markets, along with our

operating expense leverage which enables us to continue investing

at high levels to drive growth.”

Full Year 2024 Results

Consolidated total revenues net of interest expense for the full

year were $65.9 billion, up 9 percent year-over-year, or 10 percent

on an FX-adjusted basis. The increase was primarily driven by

higher net interest income supported by growth in revolving loan

balances, increased Card Member spending, and continued strong card

fee growth.

Consolidated provisions for credit losses for the full year were

$5.2 billion, compared with $4.9 billion a year ago. The increase

reflected higher net write-offs driven by growth in Total loans and

Card Member receivables, partially offset by a lower reserve build

year-over-year. The full year net write-off rate was 2.0 percent,

compared to 1.8 percent a year ago.4

Consolidated expenses for the full year were $47.9 billion, up 6

percent year-over-year. The increase primarily reflected higher

variable customer engagement costs driven by higher Card Member

spending and usage of travel-related benefits, as well as increased

marketing investments, partially offset by lower operating expenses

due to the gain on sale of Accertify in the second quarter.

The consolidated effective tax rate for the full year was 21.5

percent, up from 20.3 percent a year ago, primarily reflecting

discrete tax benefits recognized in the prior year.

Fourth Quarter 2024 Results

For the fourth quarter of 2024, the company reported net income

of $2.2 billion, or $3.04 per share, compared with net income of

$1.9 billion, or $2.62 per share, a year ago.

Fourth quarter consolidated total revenues net of interest

expense were $17.2 billion, up 9 percent year-over-year, or 10

percent on an FX-adjusted basis. The increase was primarily driven

by strong Card Member spending, higher net interest income

supported by growth in revolving loan balances, and accelerated

card fee growth.

Consolidated provisions for credit losses were $1.3 billion,

compared with $1.4 billion a year ago. The decrease reflected a

lower net reserve build year-over-year, partially offset by higher

net write-offs. The fourth quarter net write-off rate was 1.9

percent, compared to 2.0 percent a year ago.4

Consolidated expenses were $13.1 billion, up 11 percent

year-over-year. The increase was driven by higher variable customer

engagement costs and marketing investments, partially offset by a

decrease in operating expenses.

The consolidated effective tax rate was 21.3 percent, down from

23.0 percent a year ago, primarily reflecting discrete tax charges

in the prior year.

Planned Dividend Increase

The company plans to increase the regular quarterly dividend on

its common shares outstanding by 17 percent, from $0.70 to $0.82

per share, beginning with the first quarter 2025 dividend

declaration.

This earnings release should be read in conjunction with the

company’s statistical tables for the fourth quarter 2024, which

include information regarding our reportable operating segments,

available on the American Express Investor Relations website at

http://ir.americanexpress.com and in a Form 8-K furnished today

with the Securities and Exchange Commission.

An investor conference call will be held at 8:30 a.m. (ET) today

to discuss full year and fourth quarter results. Live audio and

presentation slides for the investor conference call will be

available to the general public on the above-mentioned American

Express Investor Relations website. A replay of the conference call

will be available later today at the same website address.

________________________________

1

As used in this release, FX-adjusted

information assumes a constant exchange rate between the periods

being compared for purposes of currency translations into U.S.

dollars (i.e., assumes the foreign exchange rates used to determine

results for current period apply to the corresponding prior-year

period against which such results are being compared). FX-adjusted

revenues is a non-GAAP measure. The company believes the

presentation of information on an FX-adjusted basis is helpful to

investors by making it easier to compare the company’s performance

in one period to that of another period without the variability

caused by fluctuations in currency exchange rates.

2

Diluted earnings per common share (EPS)

was reduced by the impact of (i) earnings allocated to

participating share awards of $17 million and $14 million for the

three months ended December 31, 2024 and 2023, respectively, and

$76 million and $64 million for the years ended December 31, 2024

and 2023, respectively, and (ii) dividends on preferred shares of

$14 million and $15 million for the three months ended December 31,

2024 and 2023, respectively, and $58 million for both years ended

December 31, 2024 and 2023.

3

Adjusted diluted earnings per common

share, a non-GAAP measure, excludes the $0.66 per share impact of

the gain from the sale of Accertify, Inc. recognized in the second

quarter of 2024. See Appendix I for a reconciliation to EPS on a

GAAP basis. Management believes adjusted EPS is useful in

evaluating the ongoing operating performance of the company.

4

Net write-off rates are based on principal

losses only (i.e., excluding interest and/or fees) and represent

consumer and small business Card Member loans and receivables (net

write-off rates based on principal losses only are unavailable for

corporate). We present a net write-off rate based on principal

losses only to be consistent with industry convention. Net

write-off rates including interest and fees are presented in the

above-mentioned statistical tables available on the American

Express Investor Relations website, as our practice is to include

uncollectible interest and/or fees as part of our total provision

for credit losses.

As used in this release:

- Card Member spending (billed business) represents transaction

volumes, including cash advances, on payment products issued by

American Express.

- Operating expenses represent salaries and employee benefits,

professional services, data processing and equipment, and other,

net.

- Reserve releases and reserve builds represent the portion of

the provisions for credit losses for the period related to

increasing or decreasing reserves for credit losses as a result of,

among other things, changes in volumes, macroeconomic outlook,

portfolio composition, and credit quality of portfolios. Reserve

releases represent the amount by which net write-offs exceed the

provisions for credit losses. Reserve builds represent the amount

by which the provisions for credit losses exceed net

write-offs.

- Variable customer engagement costs represent the aggregate of

Card Member rewards, business development, and Card Member services

expenses.

About American Express

American Express is a globally integrated payments company,

providing customers with access to products, insights and

experiences that enrich lives and build business success. Learn

more at americanexpress.com and connect with us on

facebook.com/americanexpress, instagram.com/americanexpress,

linkedin.com/company/american-express, X.com/americanexpress, and

youtube.com/americanexpress.

Key links to products, services and corporate sustainability

information: personal cards, business cards and services, travel

services, gift cards, prepaid cards, merchant services, Business

Blueprint, Resy, corporate card, business travel, corporate

sustainability, and Environmental, Social, and Governance

reports.

Source: American Express Company

Location: Global

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This release includes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

which are subject to risks and uncertainties. The forward-looking

statements, which address American Express Company’s current

expectations regarding business and financial performance,

including management’s outlook for 2025 and long-term growth

aspiration, among other matters, contain words such as “believe,”

“expect,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,”

“should,” “could,” “would,” “likely,” “continue” and similar

expressions. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

on which they are made. The company undertakes no obligation to

update or revise any forward-looking statements. Factors that could

cause actual results to differ materially from these

forward-looking statements, include, but are not limited to, those

that are set forth under the caption “Cautionary Note Regarding

Forward-Looking Statements” in the company’s current report on Form

8-K filed with the Securities and Exchange Commission (SEC) on

January 24, 2025 (the Form 8-K Cautionary Note), which are

incorporated by reference into this release. Those factors include,

but are not limited to, the following:

- the company’s ability to achieve its 2025 earnings per common

share (EPS) outlook and grow EPS in the future consistent with the

company’s growth aspiration, which will depend in part on revenue

growth, credit performance and the effective tax rate remaining

consistent with current expectations and the company’s ability to

continue investing at high levels in areas that can drive

sustainable growth (including its brand, value propositions,

coverage, marketing, technology and talent), controlling operating

expenses, effectively managing risk and executing its share

repurchase program, any of which could be impacted by, among other

things, the factors identified in the subsequent paragraphs and the

Form 8-K Cautionary Note, as well as the following: macroeconomic

conditions, higher rates of unemployment, changes in interest

rates, effects of inflation, tariffs, supply chain issues, energy

costs and fiscal and monetary policies; geopolitical instability,

hostilities and tensions, such as involving China and the U.S.; the

impact of any future contingencies, including, but not limited to,

legal costs and settlements, the imposition of fines or monetary

penalties, increases in Card Member remediation, investment gains

or losses, restructurings, impairments and changes in reserves;

issues impacting brand perceptions and the company’s reputation;

impacts related to acquisitions, cobrand and other partner

agreements, portfolio sales and joint ventures; and the impact of

regulation and litigation, which may be heightened due to the

uncertain regulatory environment and could affect the profitability

of the company’s business activities, limit the company’s ability

to pursue business opportunities, require changes to business

practices or alter the company’s relationships with Card Members,

partners and merchants;

- the company’s ability to achieve its 2025 revenue growth

outlook and grow revenues net of interest expense in the future

consistent with the company’s growth aspiration, which could be

impacted by, among other things, the factors identified above and

in the Form 8-K Cautionary Note, as well as the following: spending

volumes and the spending environment not being consistent with

expectations, including a decline in spending by U.S. small and

mid-sized enterprise Card Members or slowdowns in U.S. consumer or

international spending volumes; an inability to address competitive

pressures, attract and retain customers, invest in and enhance the

company’s Membership Model of premium products, differentiated

services and partnerships, successfully refresh its card products,

grow spending and lending with customers across age cohorts,

including Millennial and Gen-Z customers, and implement strategies

and business initiatives, including within the premium consumer

space, commercial payments and the global network; the effects of

regulatory initiatives, including pricing and network regulation;

merchant coverage growing less than expected or the reduction of

merchant acceptance or the perception of coverage; increased

surcharging, steering, suppression or differential acceptance of

the company’s products; merchant discount rates changing from the

company’s expectations; and changes in foreign currency exchange

rates; and

- changes affecting the company’s plans regarding the return of

capital to shareholders, including increasing the level of the

dividend, which will depend on factors such as the company’s

capital levels and regulatory capital ratios; changes in the stress

testing and capital planning process and new rulemakings and

guidance from the Federal Reserve and other banking regulators,

including changes to regulatory capital requirements, such as from

Basel III rulemaking; results of operations and financial

condition; credit ratings and rating agency considerations;

required company approvals; and the economic environment and market

conditions in any given period.

A further description of these uncertainties and other risks can

be found in American Express Company’s Annual Report on Form 10-K

for the year ended December 31, 2023, Quarterly Reports on Form

10-Q for the quarters ended March 31, June 30 and September 30,

2024 and the company’s other reports filed with the SEC, including

in the Form 8-K Cautionary Note.

(Preliminary)

American Express Company

Appendix I

Reconciliation of Adjusted EPS

Excluding Transaction Gain

Years Ended

December 31,

2024

2023

YoY% Inc/(Dec)

GAAP Diluted EPS

$

14.01

$

11.21

25%

Accertify Gain on Sale (pretax)

$

0.74

$

—

Tax Impact of Accertify Gain on Sale

$

(0.08

)

$

—

Accertify Gain on Sale (after tax)

$

0.66

$

—

Adjusted Diluted EPS Excluding the Impact

of Accertify Gain on Sale

$

13.35

$

11.21

19%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250123783382/en/

Media Contacts: Melanie Backs, Melanie.L.Backs@aexp.com,

+1.212.640.2164 Deniz Yigin, Deniz.Yigin@aexp.com,

+1.332.999.0836

Investors/Analysts Contacts: Kartik Ramachandran,

Kartik.Ramachandran@aexp.com, +1.212.640.5574 Kristy Ashmawy,

Kristy.Ashmawy@aexp.com, +1.212.640.5574

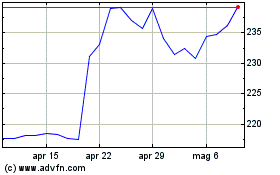

Grafico Azioni American Express (NYSE:AXP)

Storico

Da Dic 2024 a Gen 2025

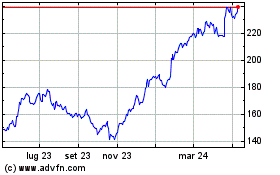

Grafico Azioni American Express (NYSE:AXP)

Storico

Da Gen 2024 a Gen 2025