FBR Closes $297.5 Million Public Offering for Aames Investment Corporation

08 Novembre 2004 - 10:15PM

PR Newswire (US)

FBR Closes $297.5 Million Public Offering for Aames Investment

Corporation 35 Million Common Shares Placed ARLINGTON, Va., Nov. 8

/PRNewswire-FirstCall/ -- Friedman, Billings, Ramsey Group, Inc.

(NYSE:FBR) today announced that its subsidiary, Friedman, Billings,

Ramsey & Co., Inc., has closed a $297.5 million public offering

for Aames Investment Corporation (NYSE:AIC), a mortgage real estate

investment trust (REIT). The transaction involved the offering of

35 million common shares priced at $8.50 per share. Aames

Investment Corporation has granted the underwriters the option to

purchase 5.25 million additional shares of common stock to cover

over- allotments. Friedman, Billings, Ramsey & Co., Inc. served

as sole book- running manager for the offering. Credit Suisse First

Boston and Flagstone Securities, Inc. acted as co-managers.

Concurrent with the close of the public offering, Friedman,

Billings, Ramsey Group, Inc. closed on its previously announced

purchase of five million shares of Aames Investment Corporation in

a private placement transaction. The shares were purchased at a

price of $8.50 per share less certain discounts, for aggregate

proceeds of $39.5 million. "The success of this offering shows that

there are opportunities for well- structured lending companies to

access the financial markets. This capital will serve Aames and the

borrowers who rely on the company for critical financing needs,"

said Emanuel Friedman, Co-Chairman and Co-Chief Executive Officer

of FBR. "We are pleased to have assisted Aames with this

transaction." Aames Investment Corporation is a mortgage real

estate investment trust, providing first and second mortgage

products to sub-prime borrowers nationwide through its operating

subsidiary, Aames Financial Corporation, a 50-year old sub-prime

lender. To find out more about Aames Investment, please visit

http://www.aames.net/. Friedman, Billings, Ramsey Group, Inc.

provides investment banking*, institutional brokerage*, asset

management, and private client services through its operating

subsidiaries and invests in mortgage-backed securities and merchant

banking opportunities. FBR focuses capital and financial expertise

on eight industry sectors: consumer, diversified industrials,

energy, financial institutions, healthcare, insurance, real estate,

and technology, media and telecommunications. FBR, headquartered in

the Washington, D.C. metropolitan area, with offices in Arlington,

Va. and Bethesda, Md., also has offices in Atlanta, Boston,

Chicago, Cleveland, Dallas, Denver, Houston, Irvine, London, New

York, Portland, San Francisco, Seattle, and Vienna. For more

information, please see http://www.fbr.com/. *Friedman, Billings,

Ramsey & Co., Inc. This press release shall not constitute an

offer to sell or a solicitation of an offer to buy, nor shall there

be any sale of these securities in any state or jurisdiction in

which such an offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or jurisdiction. DATASOURCE: Friedman, Billings, Ramsey

Group, Inc. CONTACT: Bill Dixon, +1-703-469-1092, or , for

Friedman, Billings, Ramsey Group, Inc. Web site:

http://www.fbr.com/ http://www.aames.net/

Copyright

Grafico Azioni Arlington Asset Investment (NYSE:AIC)

Storico

Da Apr 2024 a Mag 2024

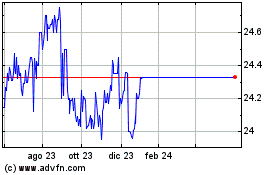

Grafico Azioni Arlington Asset Investment (NYSE:AIC)

Storico

Da Mag 2023 a Mag 2024