Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

26 Febbraio 2024 - 11:17PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Nos. 333-267243 and 333-267243-02

February 26, 2024

BROOKFIELD FINANCE INC.

US$750,000,000 5.968% NOTES DUE 2054

PRICING TERM SHEET

February 26, 2024

| Issuer: |

Brookfield Finance Inc. |

| Guarantor: |

Brookfield Corporation |

| Guarantee: |

The Notes (as defined below) will be fully and unconditionally guaranteed as to payment of principal, premium (if any) and interest and certain other amounts by Brookfield Corporation. |

| Security: |

5.968% Notes due March 4, 2054 (the “Notes”) |

| Expected Ratings*: |

A3 (Stable) (Moody’s Investors Service, Inc.)

A- (Stable) (S&P Global Ratings)

A- (Stable) (Fitch Ratings, Inc.)

A (Stable) (DBRS Limited) |

| Ranking: |

Senior Unsecured |

| Size: |

US$750,000,000

There will be no sales to affiliates of Brookfield Reinsurance Ltd.

in connection with this offering. |

| Trade Date: |

February 26, 2024 |

| Expected Settlement Date: |

March 4, 2024 (T+5)

Under Rule 15c6-1 under the Exchange Act, trades in the secondary

market generally are required to settle in two business days unless the parties to any such trade expressly agree otherwise. Accordingly,

purchasers who wish to trade the Notes prior to the delivery of the Notes hereunder will be required, by virtue of the fact that the Notes

initially will settle in T+5, to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement.

Purchasers of the Notes who wish to trade the Notes prior to their date of delivery hereunder should consult their own advisors. |

| Maturity Date: |

March 4, 2054 |

| Coupon: |

5.968% |

| Interest Payment Dates: |

March 4 and September 4, commencing September 4, 2024 |

| Price to Public: |

100% |

| Benchmark Treasury: |

UST 4.750% due November 15, 2053 |

| Benchmark Treasury Price & Yield: |

105-14+; 4.418% |

| Spread to Benchmark Treasury: |

+ 155 basis points |

| Yield: |

5.968% |

| Denominations: |

Initial denominations of US$2,000 and subsequent multiples of US$1,000 |

| Covenants: |

Change of control (put @ 101%)

Negative pledge

Consolidation, merger, amalgamation and sale of substantial assets |

| Redemption Provisions: |

|

| Make-Whole Call: |

Prior to September 4, 2053 (six months prior to maturity), treasury rate plus 25 basis points |

| Par Call: |

At any time on or after September 4, 2053 (six months prior to maturity), at 100% of the principal amount of the Notes to be redeemed |

| Use of Proceeds: |

The net proceeds from the sale of the Notes will be used for general corporate purposes |

| CUSIP/ISIN: |

11271L AL6 / US11271LAL62 |

| Joint Book-Running Managers: |

Wells Fargo Securities, LLC

SMBC Nikko Securities America, Inc.

Citigroup Global Markets Inc.

Deutsche Bank Securities Inc. |

| Co-Managers: |

Banco Bradesco BBI S.A.

BNP Paribas Securities Corp.

Desjardins Securities Inc.

Itau BBA USA Securities, Inc.

Mizuho Securities USA LLC

MUFG Securities Americas Inc.

National Bank of Canada Financial Inc.

Natixis Securities Americas LLC

Santander US Capital Markets LLC

SG Americas Securities, LLC |

Capitalized terms used and not defined herein have the meanings assigned

in the Issuer and the Guarantor’s Prospectus Supplement, dated February 26, 2024.

* Note: A security rating is not a recommendation to buy, sell or

hold securities and may be subject to revision or withdrawal at any time.

The Issuer and the Guarantor have filed a joint registration statement

(including a prospectus) and a prospectus supplement with the SEC for the offering to which this communication relates. Before you invest,

you should read the prospectus in that registration statement, the prospectus supplement and other documents the Issuer and the Guarantor

have filed with the SEC for more complete information about the Issuer, the Guarantor and this offering.

You may

get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer

participating in the offering will arrange to send you the prospectus if you request it by calling Wells Fargo Securities, LLC

at 1-800-645-3751 or by emailing wfscustomerservice@wellsfargo.com, or by calling SMBC Nikko Securities America, Inc. at 1-888-868-6856

or by emailing prospectus@smbcnikko-si.com.

No PRIIPs or UK PRIIPs key information document (KID) has been prepared

as European Economic Area or UK retail investors are not targeted.

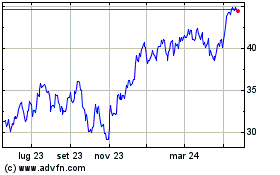

Grafico Azioni Brookfield (NYSE:BN)

Storico

Da Gen 2025 a Feb 2025

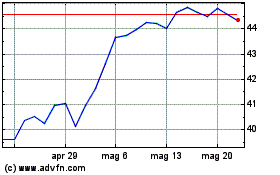

Grafico Azioni Brookfield (NYSE:BN)

Storico

Da Feb 2024 a Feb 2025