Brookfield Asset Management Closes Transaction to Broaden Shareholder Ownership and Enhance Index Eligibility

04 Febbraio 2025 - 11:00PM

Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) and

Brookfield Corporation (NYSE: BN, TSX: BN) today announced the

completion of the previously-announced arrangement to enhance BAM’s

corporate structure and broaden shareholder ownership (the

“Arrangement”).

In the transaction, BAM acquired approximately

73% of the outstanding common shares of Brookfield’s asset

management business, from BN in exchange for 1,194,021,145

newly-issued Class A Limited Voting Shares (“Class A Shares”) of

BAM, on a one-for-one basis. As a result, today BAM has a total of

1,637,198,026 Class A Shares issued and outstanding, of which BN

retains an approximately 73% interest. Based on BAM’s closing price

on the NYSE on February 3, 2025 of $58.19, the company’s market

capitalization is $95.3 billion.

The Arrangement was approved by BAM shareholders

at a special meeting held on January 27, 2025. The Supreme Court of

British Columbia issued a final order approving the Arrangement on

January 30, 2025.

Connor Teskey, President of BAM, said: “This

transaction paves the way for the stock’s inclusion in some of the

most widely followed U.S. market indices, which should broaden our

shareholder base and increase the liquidity of our shares.”

About Brookfield Asset

Management

Brookfield Asset Management Ltd. (NYSE: BAM,

TSX: BAM) is a leading global alternative asset manager,

headquartered in New York, with over $1 trillion of assets under

management across renewable power and transition, infrastructure,

private equity, real estate, and credit. We invest client capital

for the long-term with a focus on real assets and essential service

businesses that form the backbone of the global economy. We offer a

range of alternative investment products to investors around the

world — including public and private pension plans, endowments and

foundations, sovereign wealth funds, financial institutions,

insurance companies and private wealth investors. We draw on

Brookfield’s heritage as an owner and operator to invest for value

and generate strong returns for its clients, across economic

cycles.

For more information, please visit BAM’s website

at www.bam.brookfield.com or contact:

|

Media:Simon MaineTel: +44 739 890 9278Email:

simon.maine@brookfield.com |

Investor Relations:Jason FooksTel: (212)

417-2442Email: jason.fooks@brookfield.com |

|

|

|

About Brookfield Corporation

Brookfield Corporation is a leading global

investment firm focused on building long-term wealth for

institutions and individuals around the world. We have three core

businesses: Alternative Asset Management, Wealth Solutions, and our

Operating Businesses which are in renewable power, infrastructure,

business and industrial services, and real estate.

We have a track record of delivering 15%+

annualized returns to shareholders for over 30 years, supported by

our unrivaled investment and operational experience. Our

conservatively managed balance sheet, extensive operational

experience, and global sourcing networks allow us to consistently

access unique opportunities. At the center of our success is the

Brookfield Ecosystem, which is based on the fundamental principle

that each group within Brookfield benefits from being part of the

broader organization. Brookfield Corporation is publicly traded in

New York and Toronto (NYSE: BN, TSX: BN).

For more information, please visit our website

at bn.brookfield.com or contact:

|

Media:Kerrie McHughTel: (212) 618-3469Email:

kerrie.mchugh@brookfield.com |

Investor Relations: Angela YuloTel: (416)

943-7955Email: angela.yulo@brookfield.com |

|

|

|

Early Warning Disclosure

This press release is being issued pursuant to

National Instrument 62-103 – The Early Warning System and Related

Take-Over Bid and Insider Reporting Issues (“NI 62-103”), which

requires a report to be filed under BAM’s profile on SEDAR+

(www.sedarplus.com) containing additional information respecting

the foregoing matters. BAM’s head office address is 250 Vesey

Street, 15th Floor, New York, New York, 10281-0221, United

States.

BN has filed on SEDAR+ an early warning report

in compliance with NI 62-103 to disclose changes in its ownership

of securities of BAM as a result of the Arrangement.

BN holds Class A Shares for investment purposes.

BN has no definitive plans or future intentions as of the date of

this press release that relate to, or would result in, acquiring

additional securities of BAM, disposing of securities of BAM, or

any of the other actions enumerated in paragraphs (a) through (k)

of Item 5 of BN’s early warning report filed on SEDAR+. BN will

continue to review its investment alternatives and may acquire

additional Class A Shares or other securities of BAM or may,

subject to market conditions, applicable securities laws and other

relevant factors, sell Class A Shares or other securities of BAM it

now holds in the open market (where such a market exists) or in

privately negotiated transactions to one or more persons in

accordance with the provisions of applicable securities

legislation.

For further information, including a copy of the

corresponding report filed with Canadian securities regulators,

please visit www.sedarplus.ca or contact the office of the

Corporate Secretary of Brookfield Corporation at Brookfield Place,

Suite 100, 181 Bay Street, Toronto, Ontario, Canada, M5J 2T3,

Telephone: (416) 363-9491.

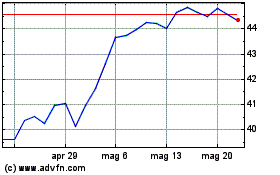

Grafico Azioni Brookfield (NYSE:BN)

Storico

Da Gen 2025 a Feb 2025

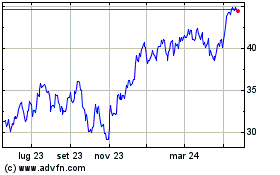

Grafico Azioni Brookfield (NYSE:BN)

Storico

Da Feb 2024 a Feb 2025