UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

| For

the month of: March 2024 |

| |

| Commission

File Number: 001-15160 |

Brookfield

Corporation

(Name of Registrant)

Brookfield

Place

Suite 100

181 Bay Street, P.O. Box 762

Toronto, Ontario, Canada M5J 2T3

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Exhibits 99.1, 99.2 and 99.3 of this Form 6-K

shall be incorporated by reference as exhibits to the Registration Statement of Brookfield Corporation and Brookfield Finance Inc. on

Form F-10 (File Nos. 333-267243 and 333-267243-02).

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

BROOKFIELD

CORPORATION |

| |

|

| Date: March 4,

2024 |

By: |

/s/

Swati Mandava |

| |

|

Name: |

Swati

Mandava |

| |

|

Title: |

Managing Director,

Legal & Regulatory |

Exhibit 99.1

BROOKFIELD FINANCE INC.

AND

BROOKFIELD CORPORATION

AND

COMPUTERSHARE TRUST COMPANY OF CANADA

Tenth Supplemental

Indenture

Dated as of March 4, 2024

THIS

TENTH SUPPLEMENTAL INDENTURE, dated as of March 4, 2024 between Brookfield Finance Inc. (the “Issuer”),

a corporation incorporated under the laws of Ontario, Canada, Brookfield Corporation (formerly, Brookfield Asset Management Inc.) (the

“Company”), a corporation organized under the laws of Ontario, Canada, and Computershare Trust Company of Canada (the

“Trustee”), a trust company organized under the laws of Canada, as trustee, to the Indenture, dated as of June 2,

2016, by and among the Issuer, the Company and the Trustee (the “Original Indenture”, the Original Indenture, as supplemented

hereby, being referred to herein as the “Indenture”).

WITNESSETH

WHEREAS,

the Issuer has duly authorized, as a separate series of Securities under the Indenture, its 5.968% Notes due 2054 (the “Notes”),

and the Company has consented to and approved the issuance of the Notes;

WHEREAS,

the Issuer and the Company have duly authorized the execution and delivery of this Tenth Supplemental Indenture to establish the Notes

as a separate series of Securities under the Original Indenture and to provide for, among other things, the issuance by the Issuer of

and the form and terms of the Notes and additional covenants for purposes of the Notes and the Holders thereof;

WHEREAS,

the Issuer and the Company are not in default under the Original Indenture;

WHEREAS,

all things necessary to make this Tenth Supplemental Indenture a valid agreement according to its terms have been done; and

WHEREAS,

the foregoing recitals are made as statements of fact by the Issuer and the Company and not by the Trustee;

NOW, THEREFORE, THIS TENTH

SUPPLEMENTAL INDENTURE WITNESSETH:

For and in consideration

of the premises and the purchase of the Notes by the Holders thereof, it is mutually agreed, for the equal and proportionate benefit

of all Holders of the Notes, as follows:

Article 1

DEFINITIONS AND OTHER PROVISIONS

OF GENERAL APPLICATION

Section 1.1 Definitions

For all purposes of this

Tenth Supplemental Indenture and the Notes, except as otherwise expressly provided or unless the subject matter or context otherwise

requires:

“Additional Amounts”

means Company Additional Amounts and any Other Additional Amounts.

“Below Investment

Grade Rating Event” means that on any day within the 60-day period (which shall be extended during an Extension Period) after

the earlier of (1) the occurrence of a Change of Control or (2) the first public notice of the occurrence of a Change of

Control or the intention by the Company to effect a Change of Control, the Notes are rated below an Investment Grade Rating by at least

three out of four of the Rating Agencies if there are four Rating Agencies or all of the Rating Agencies if there are fewer than four

Rating Agencies. Notwithstanding the foregoing, a Below Investment Grade Rating Event otherwise arising by virtue of a particular reduction

or reductions in rating shall not be deemed to have occurred in respect of a particular Change of Control (and thus shall not be deemed

a Below Investment Grade Rating Event for purposes of the definition of Change of Control Triggering Event hereunder) if the Rating Agencies

making the reduction(s) in rating to which this definition would otherwise apply do not announce or publicly confirm or inform

the Trustee in writing at its request that the reduction(s) were the result, in whole or in part, of any event or circumstance

comprised of or arising as a result of, or in respect of, the applicable Change of Control (whether or not the applicable Change of Control

shall have occurred at the time of the ratings event) (the “Change of Control Event”). For the purpose of this definition,

an “Extension Period” shall occur and continue for so long as the aggregate of (i) the number of Rating Agencies

that have placed the Notes on publicly announced consideration for possible downgrade during the initial 60-day period as a result, in

whole or in part, of the applicable Change of Control Event and (ii) the number of Rating Agencies that have downgraded the Notes

to below an Investment Grade Rating as a result, in whole or in part, of the applicable Change of Control Event during either the initial

60-day period or the Extension Period provided for in clause (i) would be sufficient to result in a Change of Control Triggering

Event should one or more of the Rating Agencies that have placed the Notes on publicly announced consideration for possible downgrade

subsequently downgrade the Notes to below an Investment Grade Rating. The Extension Period shall terminate on the earlier of (A) the

date on which the Rating Agencies that placed the Notes on publicly announced consideration for possible downgrade within the initial

60-day period referred to in subclause (i) of this definition make their determinations with respect to the impact of the Change

of Control Event on the rating of the Notes, and (B) the date on which two of the Rating Agencies (if there are four Rating Agencies)

or one of the Rating Agencies (if there are fewer than four Rating Agencies) has confirmed that the Notes will not be downgraded or are

not subject to consideration for a possible downgrade to below an Investment Grade Rating as a result of the applicable Change of Control

Event.

“Change of Control”

means the consummation of any transaction including, without limitation, any merger, amalgamation, arrangement or consolidation the result

of which is that any person or group of related persons, other than any one or more of the Company, the Company’s Subsidiaries,

the Company’s or any of its Subsidiaries’ employee benefit plans, or Management and/or any entity or group of entities controlled

by Management (provided that upon the consummation of a transaction by Management and/or an entity or group of entities controlled by

Management, the Company’s Class A limited voting shares or other Voting Stock into which the Company’s Class A

limited voting shares are reclassified, consolidated, exchanged or changed continue to be listed and posted for trading on a national

securities exchange in the United States, Canada or Europe), becomes the beneficial owner (as defined in Rules 13d-3 and 13d-5

under the Exchange Act), directly or indirectly, of (i) more than 50% of the voting power of each class of the Company’s

Voting Stock (or other Voting Stock into which the Company’s Voting Stock is reclassified, consolidated, exchanged or changed in

connection with such transaction) measured by voting power rather than number of shares or (ii) Voting Stock sufficient to enable

it to elect a majority of the members of the Company’s board of directors. For the purposes of this provision, “person”

and “group” have the meanings attributed thereto in Sections 13(d) and 14(d) of the Exchange Act.

For the purposes of the Indenture,

a Person will be deemed to be controlled by Management if the individuals comprising Management are the beneficial owners, directly or

indirectly, of, in aggregate, (i) more than 50% of the voting power of such Person’s Voting Stock measured by voting power

rather than number of shares or (ii) such Person’s Voting Stock sufficient to enable them to elect a majority of the members

of such Person’s board of directors (or similar body).

“Change of Control

Event” has the meaning specified in the definition of “Below Investment Grade Rating Event” in this Tenth Supplemental

Indenture.

“Change of Control

Offer” has the meaning specified in Section 2.8 of this Tenth Supplemental Indenture.

“Change of Control

Payment” has the meaning specified in Section 2.8 of this Tenth Supplemental Indenture.

“Change of Control

Payment Date” has the meaning specified in Section 2.8 of this Tenth Supplemental Indenture.

“Change of Control

Triggering Event” means the occurrence of both a Change of Control and a Below Investment Grade Rating Event.

“Co-Obligor”

has the meaning specified in Section 2.14 of this Tenth Supplemental Indenture.

“Company Additional

Amounts” has the meaning specified in Section 2.15 of this Tenth Supplemental Indenture.

“Consolidated Net

Worth” means the consolidated equity of the Company and its Subsidiaries determined on a consolidated basis in accordance with

generally accepted accounting principles (including all preferred equity and all equity securities that are classified as liabilities

for purposes of generally accepted accounting principles but are convertible, either at the option of the issuer or the holder of such

securities, into equity and are not redeemable at the sole option of the holder for consideration other than equity), plus, without duplication,

Qualifying Subordinated Debt and Deferred Credits.

“DBRS”

means DBRS Limited, and its successors.

“Deferred Credits”

means the deferred credits of the Company and its Subsidiaries determined on a consolidated basis in accordance with generally accepted

accounting principles.

“Fitch”

means Fitch Ratings, Inc., and its successors.

“Guarantee Obligations”

means the guarantee obligations of the Company pursuant to Article 5 of the Original Indenture but solely in respect of the Notes.

“H.15”

means each statistical release published by the Board of Governors of the Federal Reserve System designated as “Selected Interest

Rates (Daily) – H.15” (or any successor designation or publication).

“Investment Grade

Rating” means a rating equal to or higher than Baa3 (or the equivalent) by Moody’s, BBB- (or the equivalent) by S&P,

BBB- (or the equivalent) by Fitch and BBB (low) (or the equivalent) by DBRS.

“Management”

means any one or more of the Company’s directors, officers or employees (or directors, officers or employees of any one or more

of the Company’s Subsidiaries) immediately prior to the consummation of any transaction that would constitute a Change of Control,

acting individually or together.

“Moody’s”

means Moody’s Investors Service, Inc., and its successors.

“Non-U.S. Co-Obligor”

has the meaning specified in Section 2.14 of this Tenth Supplemental Indenture.

“Notes”

has the meaning ascribed to it in the recitals.

“Other Additional

Amounts” has the meaning specified in Section 2.14 of this Tenth Supplemental Indenture.

“Par Call Date”

has the meaning specified in Section 2.7 of this Tenth Supplemental Indenture.

“Qualifying Subordinated

Debt” means Debt of the Company and its Subsidiaries which by its terms provides that the payment of principal of (and premium,

if any) and interest on and all other payment obligations in respect of such Debt shall be subordinate to the prior payment in full of

the Company’s obligations in respect of the Notes to at least the extent that no payment of principal of (or premium, if any) or

interest on or otherwise due in respect of such Debt may be made for so long as there exists any default in the payment of principal

(or premium, if any) or interest on the Notes.

“Rating Agencies”

means (1) each of Moody’s, S&P, Fitch and DBRS and (2) if any of the foregoing Rating Agencies ceases to rate the

Notes or fails to make a rating of the Notes publicly available for reasons outside of the Issuer’s or the Company’s control,

a “nationally recognized statistical rating organization” within the meaning of Section 3(a)(62) under the Exchange

Act, selected by the Issuer (as certified by a Board Resolution) as a replacement agency for Moody’s, S&P, Fitch or DBRS, or

some or all of them, as the case may be.

“Remaining Life”

means the period from any Redemption Date to the Par Call Date.

“S&P”

means S&P Global Ratings, acting through Standard & Poor’s Financial Services LLC, and its successors.

“Treasury Rate”

means, with respect to any Redemption Date, the yield determined by the Issuer in accordance with the following paragraphs (1) and

(2):

| (1) | The yield determined by the Issuer after

4:15 p.m., New York City time (or after such time as yields on U.S. government securities

are posted daily by the Board of Governors of the Federal Reserve System), on the third Business

Day preceding the Redemption Date based upon the yield or yields for the most recent day

that appear after such time on such day in the most recent H.15 under the caption “U.S.

government securities–Treasury constant maturities–Nominal” (or any successor

caption or heading). In determining the Treasury Rate, the Issuer shall select, as applicable:

(a) the yield for the Treasury constant maturity on H.15 exactly equal to the Remaining

Life; or (b) if there is no such Treasury constant maturity on H.15 exactly equal to

the Remaining Life, the two yields – one yield corresponding to the Treasury constant

maturity on H.15 immediately shorter than and one yield corresponding to the Treasury constant

maturity on H.15 immediately longer than the Remaining Life – and shall interpolate

to the Par Call Date on a straight-line basis (using the actual number of days) using such

yields and rounding the result to three decimal places; or (c) if there is no such

Treasury constant maturity on H.15 shorter than or longer than the Remaining Life, the yield

for the single Treasury constant maturity on H.15 closest to the Remaining Life. For purposes

of this paragraph, the applicable Treasury constant maturity or maturities on H.15 shall

be deemed to have a maturity date equal to the relevant number of months or years, as applicable,

of such Treasury constant maturity from the Redemption Date. |

| (2) | If on the third Business Day preceding

the Redemption Date H.15 or any successor designation or publication is no longer published,

the Issuer shall calculate the Treasury Rate based on the rate per annum equal to the semi-annual

equivalent yield to maturity at 11:00 a.m., New York City time, on the second Business Day

preceding such Redemption Date of the United States Treasury security maturing on, or with

a maturity that is closest to, the Par Call Date, as applicable. If there is no United States

Treasury security maturing on the Par Call Date but there are two or more United States Treasury

securities with a maturity date equally distant from the Par Call Date, one with a maturity

date preceding the Par Call Date and one with a maturity date following the Par Call Date,

the Issuer shall select the United States Treasury security with a maturity date preceding

the Par Call Date. If there are two or more United States Treasury securities maturing on

the Par Call Date or two or more United States Treasury securities meeting the criteria of

the preceding sentence, the Issuer shall select from among these two or more United States

Treasury securities the United States Treasury security that is trading closest to par based

upon the average of the bid and asked prices for such United States Treasury securities at

11:00 a.m., New York City time. In determining the Treasury Rate in accordance with the terms

of this paragraph, the semi-annual yield to maturity of the applicable United States Treasury

security shall be based upon the average of the bid and asked prices (expressed as a percentage

of principal amount) at 11:00 a.m., New York City time, of such United States Treasury security,

and rounded to three decimal places. |

The definitions of “Consolidated

Net Worth”, “Qualifying Subordinated Debt” and “Deferred Credits” in this Tenth Supplemental Indenture

(and not the corresponding definitions of such terms in Section 1.1 of the Original Indenture) shall apply to the Notes. The definition

of “Offer to Purchase” in Section 1.1 of the Original Indenture is hereby deleted in its entirety with respect to the

Notes. All other terms and expressions used herein shall have the same meanings as corresponding expressions defined in the Original

Indenture.

Section 1.2 To Be Read with

Original Indenture

The Tenth Supplemental Indenture

is a supplemental indenture within the meaning of the Original Indenture, and the Original Indenture and this Tenth Supplemental Indenture

shall be read together and shall have effect, so far as practicable, as though all the provisions of the Original Indenture and this

Tenth Supplemental Indenture were contained in one instrument.

Section 1.3 Currency

Except where expressly provided,

all amounts in this Tenth Supplemental Indenture are stated in United States currency.

Article 2

THE NOTES

Section 2.1 Designation

There is hereby authorized

to be issued under the Original Indenture a separate series of Securities designated as “5.968% Brookfield Finance Inc. Notes due

2054”.

Section 2.2 Limit of Aggregate

Principal Amount

The aggregate principal amount

of Notes that may be authenticated and delivered pursuant to this Tenth Supplemental Indenture (except for Notes authenticated and delivered

upon registration of transfer of, or in exchange for, or in lieu of, other Notes pursuant to Section 3.4, 3.5, 3.6, 10.6 or 12.7

of the Original Indenture and except for any Notes which, pursuant to the last sentence of Section 3.3 of the Original Indenture,

are deemed never to have been authenticated and delivered) shall initially be limited to $750,000,000, all of which have been issued

hereunder. The Issuer may from time to time, without the consent of the holders of the Notes but with the consent of the Company, create

and issue further notes having the same terms and conditions in all respects as the Notes being offered hereby except for the issue date,

the issue price and the first payment of interest thereon. Additional notes issued in this manner will be consolidated with and will

form a single series with the Notes, as the case may be, being offered hereby.

Section 2.3 Date of Payment

of Principal

The principal of the Notes

shall be payable on March 4, 2054.

Section 2.4 Payments; Registration

of Transfers

All payments in respect of

the Notes shall be made in immediately available funds. Computershare Trust Company, N.A. has been initially appointed to act as Paying

Agent for the Notes. The “Place of Payment” for the Notes shall be at the address of the Paying Agent, currently located

at 6200 S. Quebec St., Greenwood Village, Colorado 80111.

For purposes of Section 1.14

of the Original Indenture, the Issuer shall make, or cause to be made, payments on any Interest Payment Date, Redemption Date, Purchase

Date, Change of Control Payment Date or Stated Maturity whether or not such date is a Business Day in Toronto, Ontario, unless such date

shall not be a Business Day in New York, New York, notwithstanding the definition of “Business Day” in Section 1.1

of the Original Indenture.

For such Notes (if any) as

are not represented by a Global Security, payments of principal (and premium, if any) and interest on any Notes will be made at the Place

of Payment, except that, at the option and expense of the Issuer, payment of interest may be made by (a) cheque mailed to the address

of the Person entitled thereto as such address shall appear on the Security Register or (b) wire transfer to an account maintained

by the Person entitled thereto as specified in the Security Register. The registration of transfers and exchanges of Notes will be made

at the Corporate Trust Office of the Trustee currently located at 100 University Avenue, 8th Floor, Toronto, Canada M5J 2Y1 and the Place

of Payment.

Section 2.5 Interest

(1) The

Notes will be issued in initial denominations of $2,000 and multiples of $1,000 in excess thereof and shall bear interest at the rate

of 5.968% per annum, payable semi-annually in arrears; provided, that any principal and premium and any installment of interest which

is overdue shall bear interest at the rate of 5.968% per annum plus 1% (to the extent that the payment of such interest shall be legally

enforceable).

(2) Interest

in respect of the Notes shall accrue from and including March 4, 2024 or from and including the most recent Interest Payment Date

to which interest has been paid or duly provided for.

(3) The

Interest Payment Dates on which interest shall be payable in respect of the Notes shall be March 4 and September 4 in each

year, commencing on September 4, 2024.

(4) The

Regular Record Dates for interest in respect of the Notes shall be February 15 and August 15 (whether or not a Business Day)

in respect of the interest payable semi-annually in arrears on March 4 and September 4, respectively.

Section 2.6 Redemption

(1) Except

as provided in Section 2.7 or Section 2.9 or as contemplated by Section 2.14 of this Tenth Supplemental Indenture,

the Notes are not redeemable prior to maturity.

(2) For

purposes of this Tenth Supplemental Indenture and the Notes, the first sentence of Section 12.4 of the Original Indenture shall

be amended and restated in its entirety with the following sentence:

“Notice of

redemption shall be given by first-class mail, postage prepaid, mailed not less than 10 days nor more than 60 days prior to the Redemption

Date, to each Holder of Securities to be redeemed, at his, her or its address appearing in the Security Register. The Issuer shall provide

the Trustee and any Paying Agent for the Notes written notice of any such redemption at least five Business Days prior to when notice

is due to Holders.”

For avoidance of doubt, this

Section 2.6(2) shall not be deemed to affect any other series of Securities issued under the Original Indenture, except as

may be provided for in respect of any other series of Securities.

Section 2.7 Redemption at the

Issuer’s Option

Prior to September 4,

2053 (the “Par Call Date”), the Issuer may redeem the Notes at its option, in whole or in part, at any time and from

time to time, at a Redemption Price (expressed as a percentage of principal amount and rounded to three decimal places) equal to the

greater of:

| (1) | (a) the sum of the present values of the remaining scheduled payments

of principal and interest thereon discounted to the Redemption Date (assuming the Notes matured on the

Par Call Date) on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at

the Treasury Rate plus 25 basis points less (b) interest accrued to the Redemption Date, and |

| (2) | 100% of the principal amount of the Notes to be redeemed, |

Plus, in either

case, accrued and unpaid interest to, but excluding, the Redemption Date.

On or after the Par Call Date, the Issuer may

redeem the Notes, in whole or in part, at any time and from time to time, at a Redemption Price equal to 100% of the principal amount

of the notes being redeemed, plus accrued and unpaid interest thereon to the Redemption Date.

Notice of any redemption

will be delivered at least 10 days but not more than 60 days before the Redemption Date to each Holder of the Notes to be redeemed and

may be contingent upon such conditions as may be specified in the applicable notice of redemption and in accordance with the provisions

of the Indenture. Unless the Issuer defaults in payment of the Redemption Price, on and after any Redemption Date, interest will cease

to accrue on the Notes or portions thereof called for redemption. The Issuer shall provide the Trustee and any Paying Agent for the Notes

written notice of any such redemption at least five Business Days prior to when notice is due to Holders. On or before any Redemption

Date, the Issuer shall deposit with the Paying Agent (or the Trustee) money sufficient to pay the Redemption Price of the Notes to be

redeemed on such date. If less than all of the Notes are to be redeemed, the Notes to be redeemed shall be selected, in the case of certificated

Notes, by the Trustee at the Issuer’s direction by such method as the Issuer and the Trustee shall designate, or in the case of

Global Securities, by such policies and procedures of the applicable depository. The Redemption Price shall be calculated by the Issuer

and provided in writing to the Trustee and any Paying Agent for the Notes, and the Trustee and any Paying Agent for the Notes shall be

entitled to conclusively rely on such calculation. The Issuer’s actions and determinations in determining the Redemption Price

shall be conclusive and binding for all purposes, absent manifest error.

Section 2.8 Repurchase upon

a Change of Control

If a Change of Control Triggering

Event occurs, unless the Issuer has exercised its right to redeem all of the Notes as described in Section 2.7 above, the Issuer

will be required to make an offer to repurchase all of each Holder’s Notes (or the portion thereof not subject to redemption, if

the Issuer has exercised its right to redeem the Notes in part pursuant to Section 2.7 above) pursuant to the offer described below

(the “Change of Control Offer”) on the terms set forth herein. In the Change of Control Offer, the Issuer will be

required to offer payment in cash equal to 101% of the aggregate principal amount of Notes repurchased plus accrued and unpaid interest,

if any, on the Notes repurchased (the “Change of Control Payment”), to the date of purchase.

Within 30 days following

any Change of Control Triggering Event, the Issuer will be required to deliver a notice to Holders of Notes, with a copy to the Trustee,

describing the transaction or transactions that constitute the Change of Control Triggering Event and offering to repurchase the Notes

on the date specified in the notice, which date will be no earlier than 30 days and no later than 60 days from the date such notice is

delivered (the “Change of Control Payment Date”), pursuant to the procedures required herein and described in such

notice. The Issuer must comply with the requirements of Rule 14e-1 under the Exchange Act and any other securities laws and regulations

thereunder to the extent those laws and regulations are applicable in connection with the repurchase of the Notes as a result of a Change

of Control Triggering Event. To the extent that the provisions of any securities laws or regulations conflict with this Section 2.8,

the Issuer will be required to comply with the applicable securities laws and regulations and will not be deemed to have breached its

obligations under this Section 2.8 by virtue of such conflicts.

On the Change of Control

Payment Date, the Issuer will be required, to the extent lawful, to:

| (a) | accept for payment all Notes or portions

of Notes properly tendered pursuant to the Change of Control Offer; |

| (b) | deposit with the Paying Agent or the Trustee

an amount equal to the Change of Control Payment in respect of all Notes or portions of Notes

properly tendered; and |

| (c) | deliver or cause to be delivered to the

Trustee the Notes properly accepted together with an Officers’ Certificate stating

the aggregate principal amount of Notes or portions of Notes being purchased by the Issuer. |

The Paying Agent will deliver

to each Holder who properly tendered Notes the purchase price for such Notes, and, upon written order of the Issuer, the Trustee will

authenticate and deliver (or cause to be delivered) to each such Holder a new Note equal in principal amount to any unpurchased portion

of the Notes surrendered, if any; provided that each new Note will be in a principal amount of $2,000 or an integral multiple of $1,000

in excess thereof.

The Issuer will not be required

to make a Change of Control Offer upon a Change of Control Triggering Event if another Person makes such an offer in the manner, at the

times and otherwise in compliance with the requirements for an offer made by the Issuer and such other Person purchases all Notes properly

tendered and not withdrawn under its offer.

Section 2.9 Redemption for

Changes in Canadian Withholding Taxes

The Notes will be subject

to redemption as a whole, but not in part, at the option of the Issuer at any time at a Redemption Price equal to 100% of the principal

amount, together with accrued and unpaid interest thereon to the applicable Redemption Date, in the event the Issuer shall have received

an opinion from independent tax counsel experienced in such matters to the effect that the Issuer has become, or would become, obligated

to pay, on the next date on which any amount would be payable with respect to the Notes, any Additional Amounts as a result of a change

in the laws of Canada or any political subdivision or taxing authority thereof or therein (including any regulations promulgated thereunder),

or any change in any official position regarding the application or interpretation of such laws or regulations, which change is announced

or becomes effective on or after the date of this Tenth Supplemental Indenture.

Section 2.10 Form

The Notes and the certificate

of the Trustee endorsed thereon shall each be issuable initially as one or more Global Securities and shall be substantially in the form

set forth in Annex A hereto. The Depositary for Global Securities shall be The Depository Trust Company.

Section 2.11 Events of Default

(1) In

addition to the Events of Default contained in Section 6.1 of the Original Indenture (subject to clause (3) below), the following

additional Events of Default apply with respect to the Notes:

(a) the

failure by the Issuer to comply with its obligations pursuant to Section 2.8 of this Tenth Supplemental Indenture in the event

of a Change of Control Triggering Event; and

(b) default

by the Company in the payment of principal of, premium, if any, or interest on, any obligation for borrowed money indebtedness (other

than an obligation payable on demand or maturing less than 12 months from the creation or issue thereof) in an outstanding principal

amount in excess of 5% of Consolidated Net Worth in the aggregate at the time of default, or any failure in the performance of any other

covenant of the Company contained in any instrument under which such obligations are created or issued, provided that in each such case

all cure periods relating to such default have expired and the holders of such borrowed money indebtedness or a trustee for such holders

(if any) declares such indebtedness to be due and payable prior to its stated maturity, and provided further that if any such default

is waived at any time by such holders or trustee in accordance with the terms of such instrument, then this Event of Default shall be

deemed to be waived without further action on the part of the Trustee or the Holders.

(2) If

any Event of Default with respect to the Notes shall occur and be continuing, the principal of the Notes may be declared due and payable

in the manner and with the effect provided in the Original Indenture.

(3) The

Events of Default contained in Section 6.1(c) and Section 6.1(g) of the Original Indenture shall not apply to

the Notes.

Section 2.12 Additional Provisions

in Respect of the Notes

(1) The

covenants contained in Article 3 of this Tenth Supplemental Indenture shall apply to the Notes in addition to the covenants contained

in the Original Indenture (subject to clause (3) below).

(2) Notwithstanding

Section 3.3 of the Original Indenture, a certificate of authentication on the Notes substantially in the form provided herein may

be executed by the Trustee by manual, facsimile or other electronic signature.

(3) None

of Sections 3.12, 11.5, 11.6, 11.7, 11.8 or 11.9 of the Original Indenture shall apply to the Notes.

(4) For

purposes of Article 5 of the Original Indenture, the term “Issuer” shall include any Co-Obligor and the term “Obligations”

shall include the Obligations of any Co-Obligor, in respect of the Notes (and not any other series of Securities under the Indenture).

(5) In

addition to the clauses set forth in Section 10.1 of the Original Indenture, without the consent of any Holders, the Issuer, when

authorized by a Board Resolution, the Company and the Trustee, at any time and from time to time, may enter into one or more indentures

supplemental to this Tenth Supplemental Indenture (solely in respect of the Notes and not any other series of Securities under the Indenture),

and in form satisfactory to the Trustee, to evidence the addition of a Co-Obligor in respect of the Notes.

Section 2.13 Affiliate Purchase

on Maturity

For purposes of this Tenth

Supplemental Indenture and the Notes, Section 3.11 of the Original Indenture shall be amended and restated in its entirety with

the following:

“Notwithstanding

the other provisions of this Indenture, the Issuer may, by providing written notice to the Trustee at least three Business Days prior

to the Maturity of any Securities, elect to have one or more Affiliates of the Issuer or the Company purchase all, but not less than

all, of the Securities so to be redeemed or repaid at a price equal to the Redemption Price (excluding accrued and unpaid interest),

in the case of Securities called for redemption, or at a price equal to the principal amount, in the case of Securities coming due at

the Stated Maturity (in each case, the “Repayment Price”); provided that any accrued and unpaid interest thereon

will be paid by the Issuer. Upon payment therefor of an amount equal to the Repayment Price, and payment by the Issuer of accrued interest

and premium, if any, such Securities shall be cancelled by the Trustee and a new certificate in the name of such Affiliate will be issued

by the Trustee upon receipt by the Trustee of an Issuer Order, provided however, that such cancellation and reissuance of certificates

shall be deemed not to represent a novation of the debt represented by such Securities, but rather such Securities shall be deemed transferred

to such Affiliate and such debt shall continue to remain outstanding on the same terms subject to such modifications, if any, as may

be agreed by the Issuer and such Affiliate in writing. Such Affiliate shall not be permitted to vote such Securities in connection with

any matter put before Holders for approval, unless 100% of the Securities of each series entitled to be voted in respect of such matter

are held by the Issuer, the Company or their respective Affiliates. Should such Affiliate and the Issuer, if applicable, fail to make

full payment of the Repayment Price and accrued interest and premium, if any, on Maturity, then such Securities shall become due and

payable as otherwise provided for but for this Section 3.11. The Trustee may request, and the Issuer and its counsel shall provide

upon such request, any additional supporting documentation in connection with this Section 3.11, including but not limited to an

Opinion of Counsel addressed to the Trustee in support of the Affiliate purchase herein described.”

Section 2.14 Co-Obligors and/or

Additional Guarantors

Without the consent of any

Holders, the Issuer, when authorized by a Board Resolution, the Company and the Trustee, may enter into an indenture supplemental to

the Indenture in respect of the Notes, in form satisfactory to the Trustee, for the purpose of adding as a co-obligor (whether as an

additional issuer or guarantor) of the Notes, an Affiliate of the Issuer or the Company (each, a “Co-Obligor”); provided

that any such Co-Obligor shall be organized or formed under the laws of (1) any state of the United States, (2) Canada

or any province or territory thereof, (3) the United Kingdom, (4) Australia or (5) any country that is a member of

the European Union; and provided, further, that the Issuer may only add a Co-Obligor if the Issuer determines that adding

such Co-Obligor would not result in a deemed sale or exchange of the Notes by any holder for U.S. federal income tax purposes under applicable

U.S. Treasury Regulations or a disposition of the Notes by any holder or beneficial owner of the Notes for Canadian federal income tax

purposes. Any such supplemental indenture entered into for the purpose of adding a Co-Obligor formed under any jurisdiction other than

a state of the United States (each, a “Non-U.S. Co-Obligor”) shall include a provision for (i) the payment of

additional amounts (“Other Additional Amounts”) in the form substantially similar to that provided in Section 2.15

of this Tenth Supplemental Indenture, with such modifications as the Company and such Non-U.S. Co-Obligor reasonably determine are customary

and appropriate for U.S. and Canadian bondholders to address then-applicable (or potentially applicable future) taxes, duties, levies,

imposts, assessments or other governmental charges imposed or levied by or on behalf of the applicable governmental authority in respect

of payments made by such Non-U.S. Co-Obligor under or with respect to the Notes, including any exceptions thereto as the Company and

such Non-U.S. Co-Obligor shall reasonably determine would be customary and appropriate for U.S. and Canadian bondholders and (ii) the

right of any issuer to redeem the Notes at 100% of the aggregate principal amount thereof plus accrued interest thereon in the event

that Other Additional Amounts become payable by a Non-U.S. Co-Obligor in respect of the Notes as a result of any change in law or official

position regarding the application or interpretation of any law that is announced or becomes effective after the date of such supplemental

indenture.

Any such Co-Obligor shall be jointly and severally

liable with the Issuer or the Company (as applicable) to pay the principal, premium, if any, and interest on the Notes.

Section 2.15 Payment of Company

Additional Amounts

All payments made by the

Issuer or the Company under or with respect to the Notes will be made free and clear of, and without withholding or deduction for or

on account of, any present or future tax, duty, levy, impost, assessment or other governmental charge imposed or levied by or on behalf

of the Government of Canada or of any province or territory thereof or therein or by any authority or agency therein or thereof having

power to tax (hereinafter “Taxes”), unless the Issuer or the Company (as applicable) is required to withhold or deduct

Taxes by law or by the interpretation or administration thereof. If the Issuer or the Company is so required to withhold or deduct any

amount for or on account of Taxes from any payment made by it under or with respect to the Notes and the Notes are not redeemed in accordance

with the provisions of Section 2.9 of this Tenth Supplemental Indenture, the Issuer or the Company (as applicable) will pay such

additional amounts (“Company Additional Amounts”) as may be necessary so that the net amount received (including Company

Additional Amounts) by each Holder (including, as applicable, the beneficial owners in respect of any such Holder) after such withholding

or deduction will not be less than the amount the Holder (including, as applicable, the beneficial owners in respect of any such Holder)

would have received if such Taxes had not been withheld or deducted; provided that no Company Additional Amounts will be payable with

respect to: (a) any payment to a Holder or beneficial owner who is liable for such Taxes in respect of such Note (i) by reason

of such Holder or beneficial owner, or any other person entitled to payments on the Note, being a person with whom the Issuer or the

Company does not deal at arm’s length (within the meaning of the Income Tax Act (Canada) (the “Tax Act”)),

(ii) by reason of the existence of any present or former connection between such Holder or beneficial owner (or between a fiduciary,

settlor, beneficiary, member or shareholder of, or possessor of power over, such Holder or beneficial owner, if such Holder or beneficial

owner is an estate, trust, partnership, limited liability company or corporation) and Canada or any province or territory thereof or

therein other than the mere ownership, or receiving payments under or enforcing any rights in respect of such Note as a non-resident

or deemed non-resident of Canada or any province or territory thereof or therein, (iii) as a consequence of the payment being deemed

to be a dividend pursuant to subsection 214(16) or 214(17) of the Tax Act, or (iv) by reason of such Holder or beneficial owner

being an entity in respect of which the Issuer or the Company is a “specified entity” as defined in proposed subsection 18.4(1) of

the Tax Act contained in proposals to amend the Tax Act released on November 28, 2023 with respect to “hybrid mismatch arrangements”

or substantially analogous provisions enacted as an amendment to the Tax Act; (b) any Tax that is levied or collected other than

by withholding from payments on or in respect of the Notes; (c) any Note presented for payment (where presentation is required)

more than 30 days after the later of (i) the date on which such payment first becomes due or (ii) if the full amount of the

monies payable has not been paid to the Holders or beneficial owners of the Notes on or prior to such date, the date on which the full

amount of such monies has been paid to the Holders or beneficial owners of the Notes, except to the extent that the Holder or beneficial

owner of the Notes would have been entitled to such Company Additional Amounts on presentation of the same for payment on the last day

of such period of 30 days; (d) any estate, inheritance, gift, sales, transfer, excise or personal property Tax or any similar Tax;

(e) any Tax imposed as a result of the failure of a Holder or beneficial owner to comply with certification, identification, declaration,

filing or similar reporting requirements concerning the nationality, residence, identity or connection with Canada or any province or

territory thereof or therein of such Holder or beneficial owner, if such compliance is required by statute or by regulation, as a precondition

to reduction of, or exemption, from such Tax; (f) any (i) tax, assessment, withholding or deduction required pursuant to

Sections 1471 to 1474 of the U.S. Internal Revenue Code of 1986, as amended (“FATCA”), or any successor version thereof,

or any similar legislation imposed by any other governmental authority, or (ii) Tax or penalty arising from the Holder’s

or beneficial owner’s failure to properly comply with the Holder’s or beneficial owner’s obligations imposed under

the Canada United States Enhanced Tax Information Exchange Agreement Implementation Act (Canada) or any treaty, law or regulation or

other official guidance enacted by Canada implementing FATCA or an intergovernmental agreement with respect to FATCA or any similar legislation

imposed by any other governmental authority including, for greater certainty, Part XVIII and Part XIX of the Tax Act; or

(g) any combination of the foregoing clauses (a) to (f).

The Issuer or the Company

(as applicable) will also (1) make such withholding or deduction and (2) remit the full amount deducted or withheld by it

to the relevant authority in accordance with applicable law. The Issuer or the Company (as applicable) will furnish to the Holders of

the Notes, within 30 days after the date the payment of any Taxes by it is due pursuant to applicable law, certified copies of tax receipts

evidencing such payment by it. The Issuer and the Company will indemnify and hold harmless each Holder (including, as applicable, the

beneficial owners in respect of any such Holder) and, upon written request, will reimburse each such Holder (including, as applicable,

the beneficial owners in respect of any such Holder) for the amount of (i) any Taxes (other than any Taxes for which Company Additional

Amounts would not be payable pursuant to clauses (a) through (g) above) levied or imposed and paid by such Holder (including,

as applicable, the beneficial owners in respect of any such Holder) as a result of payments made under or with respect to the Notes which

have not been withheld or deducted and remitted by the Issuer or the Company (as applicable) in accordance with applicable law, (ii) any

liability (including penalties, interest and expenses) arising therefrom or with respect thereto, and (iii) any Taxes (other than

any Taxes for which Company Additional Amounts would not be payable pursuant to clauses (a) through (g) above) imposed with

respect to any reimbursement under clause (i) or (ii) above, but excluding any such Taxes on such Holder’s (including,

as applicable, the beneficial owners in respect of any such Holder’s) net income.

At least 30 days prior to

each date on which any payment under or with respect to the Notes is due and payable, if the Issuer will be obligated to pay Company

Additional Amounts with respect to such payment, the Issuer will deliver to the Trustee and the Paying Agent an Officers’ Certificate

stating the fact that such Company Additional Amounts will be payable and the amounts so payable and will set forth such other information

necessary to enable the Trustee and the Paying Agent to pay such Company Additional Amounts to Holders (including in respect of beneficial

owners in respect of such Holders) on the payment date. Whenever in the Indenture there is mentioned, in any context, the payment of

principal (and premium, if any), Redemption Price, Purchase Price, Change of Control Payment, interest or any other amount payable under

or with respect to any Note, such mention shall be deemed to include mention of the payment of Company Additional Amounts provided for

in this Section 2.15 to the extent that, in such context, Company Additional Amounts are, were or would be payable in respect thereof

pursuant to the provisions of this Section 2.15 and express mention of the payment of Company Additional Amounts (if applicable)

in any provisions hereof shall not be construed as excluding Company Additional Amounts in those provisions hereof where such express

mention is not made (if applicable).

The obligations of the Issuer

and the Company under this Section 2.15 shall survive the termination of this Indenture and the payment of all amounts under or

with respect to the Notes.

Section 2.16 Defeasance

The Notes shall be defeasible

pursuant to both of Section 14.2 and Section 14.3 of the Original Indenture.

In the event the Issuer exercises

its defeasance option with respect to the Notes pursuant to Section 14.2 of the Original Indenture, the Issuer’s obligations

with respect to the Notes under Section 2.15 of this Tenth Supplemental Indenture shall survive.

Section 2.17 Consent and Acknowledgement

of the Company

Pursuant to Section 3.1

of the Original Indenture, the Company hereby consents to the issuance of the Notes by the Issuer and acknowledges and confirms that

its obligations with respect to the Notes constitute Guarantee Obligations.

Article 3

COVENANTS OF COMPANY APPLICABLE TO THE NOTES

Section 3.1 Negative Pledge

Neither the Issuer nor the

Company will create any Lien on any of their property or assets to secure any indebtedness for borrowed money without in any such case

effectively providing that the Notes, in the case of the Issuer, and the Guarantee Obligations, in the case of the Company (together

with, if the Issuer or the Company, as applicable, shall so determine, any other indebtedness of the Issuer or the Company, as applicable,

which is not subordinate to the Notes or the Guarantee Obligations, as applicable), shall be secured equally and ratably with (or prior

to) such secured indebtedness, so long as such secured indebtedness shall be so secured; provided, however, that the foregoing restrictions

shall not apply to:

| (a) | Liens on any property or assets existing

at the time of acquisition thereof (including acquisition through merger or consolidation)

to secure, or securing, the payment of all or any part of the purchase price, cost of improvement

or construction cost thereof or securing any indebtedness incurred prior to, at the time

of or within 120 days after, the acquisition of such property or assets or the completion

of any such improvement or construction, whichever is later, for the purpose of financing

all or any part of the purchase price, cost of improvement or construction cost thereof or

to secure or securing the repayment of money borrowed to pay, in whole or in part, such purchase

price, cost of improvement or construction cost or any vendor’s privilege or lien on

such property securing all or any part of such purchase price, cost of improvement or construction

cost, including title retention agreements and leases in the nature of title retention agreements

(provided such Liens are limited to such property or assets and to improvements on such property); |

| (b) | Liens arising by operation of law; |

| (c) | any other Lien arising in connection with

indebtedness if, after giving effect to such Lien and any other Lien created pursuant to

this paragraph (c), the aggregate principal amount of indebtedness secured thereby would

not exceed 5% of Consolidated Net Worth; and |

| (d) | any extension, renewal, substitution or

replacement (or successive extensions, renewals, substitutions or replacements), as a whole

or in part, of any of the Liens referred to in paragraphs (a) and (b) above or

any indebtedness secured thereby; provided that such extension, renewal, substitution

or replacement Lien shall be limited to all or any part of substantially the same property

or assets that secured the Lien extended, renewed, substituted or replaced (plus improvements

on such property) and the principal amount of indebtedness secured by such Lien at such time

is not increased. |

Section 3.2 Status of the Issuer

(1) Subject

to Article 9 of the Original Indenture, each of the Issuer and the Company will do or cause to be done all things necessary to

preserve and keep in full force and effect its existence.

(2) The

Issuer shall at all times remain a Subsidiary of the Company.

Article 4

miscellaneous

Section 4.1 Ratification of

Original Indenture

The Original Indenture, as

supplemented by this Tenth Supplemental Indenture, is in all respects ratified and confirmed, and this Tenth Supplemental Indenture shall

be deemed part of the Indenture in the manner and to the extent herein and therein provided.

Section 4.2 Governing Law

This Tenth Supplemental Indenture

and the Notes shall be governed by and construed in accordance with the laws of the State of New York. Notwithstanding the preceding

sentence of this Section 4.2, the exercise, performance or discharge by the Trustee of any of its rights, powers, duties or responsibilities

hereunder shall be construed in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable thereto.

Section 4.3 Separability

In case any one or more of

the provisions contained in this Tenth Supplemental Indenture or in the Notes shall for any reason be held to be invalid, illegal or

unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other provisions of this Tenth Supplemental

Indenture or of the Notes, but this Tenth Supplemental Indenture and the Notes shall be construed as if such invalid or illegal or unenforceable

provision had never been contained herein or therein.

Section 4.4 Counterparts

This instrument may be executed

in any number of counterparts, each of which so executed shall be deemed to be an original, but all such counterparts shall together

constitute but one and the same instrument. This instrument may be executed and delivered by facsimile or other electronic transmission

of a counterpart hereof bearing a manual, facsimile or other electronic signature.

Section 4.5 Disclaimer

The Trustee and the Paying

Agent shall not be responsible in any manner whatsoever for or in respect of the validity or sufficiency of this Tenth Supplemental Indenture.

The recitals of fact contained herein shall be taken as the statements of the Issuer and neither the Trustee nor the Paying Agent assumes

any responsibility for the correctness thereof. The Issuer hereby authorizes and directs the Trustee to execute and deliver this Tenth

Supplemental Indenture. All rights, powers, protections, immunities and indemnities afforded to the Trustee and Paying Agent under the

Original Indenture shall apply to the Trustee and Paying Agent as if the same were set forth herein mutatis mutandis.

[THE REMAINDER OF THIS

PAGE INTENTIONALLY LEFT BLANK]

IN

WITNESS WHEREOF, the parties hereto have caused this Tenth Supplemental Indenture to be duly executed as of the day and year

first above written.

| |

BROOKFIELD FINANCE INC. |

| |

|

| |

By: |

/s/

Patrick Taylor |

| |

|

Name: |

Patrick Taylor |

| |

|

Title: |

Vice President |

| |

BROOKFIELD CORPORATION |

| |

|

| |

By: |

/s/

Nicholas Goodman |

| |

|

Name: |

Nicholas Goodman |

| |

|

Title: |

President and Chief Financial Officer |

| |

COMPUTERSHARE TRUST COMPANY OF CANADA |

| |

|

| |

By: |

/s/

Shelley McGarrity |

| |

|

Name: |

Shelley McGarrity |

| |

|

Title: |

Corporate Trust Officer |

| |

|

|

| |

By: |

/s/

Milan Tepic |

| |

|

Name: |

Milan Tepic |

| |

|

Title: |

Corporate Trust Officer |

ANNEX A

[Face of Note]

[Insert if the Security is a Global Security

— THIS SECURITY IS A GLOBAL NOTE WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF A

DEPOSITARY OR A NOMINEE THEREOF. THIS SECURITY MAY NOT BE EXCHANGED IN WHOLE OR IN PART FOR A SECURITY REGISTERED, AND NO

TRANSFER OF THIS SECURITY IN WHOLE OR IN PART MAY BE REGISTERED, IN THE NAME OF ANY PERSON OTHER THAN SUCH DEPOSITARY

OR A NOMINEE THEREOF, EXCEPT IN THE LIMITED CIRCUMSTANCES DESCRIBED IN THE INDENTURE.

Unless this certificate is presented by an authorized

representative of The Depository Trust Company (“DTC”), a New York corporation, to Brookfield Finance Inc. or its

agent for registration of transfer, exchange or payment, and any certificate issued in respect thereof is registered in the name of Cede &

Co., or in such other name as is requested by an authorized representative of DTC (and any payment is made to Cede & Co. or

to such other entity as is requested by an authorized representative of DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE

BY OR TO ANY PERSON IS WRONGFUL since the registered owner hereof, Cede & Co., has an interest herein.]

BROOKFIELD FINANCE INC.

5.968% Notes due 2054

| |

CUSIP: 11271L AL6

ISIN: US11271LAL62 |

| |

|

| No. I-■ |

US$■ |

Brookfield Finance Inc.,

a corporation incorporated under the laws of Ontario, Canada (herein called the “Issuer”, which term includes any successor

Person under the Indenture hereinafter referred to), for value received, hereby promises to pay to ■, or registered assigns, the

principal sum of ■ (■) United States Dollars on March 4, 2054 and to pay interest thereon from and including March 4,

2024 or from and including the most recent Interest Payment Date to which interest has been paid or duly provided for, semi-annually

in arrears on March 4 and September 4 in each year, commencing on September 4, 2024 at a rate of 5.968% per annum,

until the principal hereof is paid or made available for payment, calculated as set forth above, provided that any principal and premium,

and any such installment of interest, which is overdue shall bear interest at the rate of 5.968% per annum plus 1% (to the extent that

the payment of such interest shall be legally enforceable), from the dates such amounts are due until they are paid or made available

for payment, and such interest shall be payable on demand. As provided in the Indenture, interest shall be computed on the basis of a

360-day year consisting of twelve 30-day months. Interest shall accrue from and including March 4, 2024.

The interest so payable,

and punctually paid or duly provided for, on any Interest Payment Date will, as provided in such Indenture, be paid to the Person in

whose name this Security (or one or more Predecessor Securities) is registered at the close of business on the Regular Record Date for

such interest, which shall be February 15 or August 15 (whether or not a Business Day), as the case may be, next preceding

such Interest Payment Date. Any such interest not so punctually paid or duly provided for will forthwith cease to be payable to the Holder

on such Regular Record Date and may either be paid to the Person in whose name this Security (or one or more Predecessor Securities)

is registered at the close of business on a Special Record Date for the payment of such Defaulted Interest to be fixed by the Trustee,

notice whereof shall be given to Holders of Securities of this series not less than 10 days prior to such Special Record Date, or be

paid at any time in any other lawful manner not inconsistent with the requirements of any securities exchange on which the Securities

of this series may be listed, and upon such notice as may be required by such exchange, all as more fully provided in the Indenture.

Payment of the principal

of (and premium, if any) and interest on this Security will be made at the Place of Payment in such coin or currency of the United States

of America as at the time of payment is legal tender for payment of public and private debt; provided, however, that, at the option and

expense of the Issuer, payment of interest may be made by (i) cheque mailed to the address of the Person entitled thereto as such

address shall appear in the Security Register or (ii) by wire transfer to an account maintained by the Person entitled thereto

as specified in the Security Register.

Reference is hereby made

to the further provisions of this Security set forth on the reverse hereof, which further provisions shall, for all purposes, have the

same effect as if set forth at this place.

Unless the certificate of

authentication hereon has been executed by the Trustee referred to on the reverse hereof by manual, facsimile or other electronic signature,

this Security shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

[The balance of this

page is intentionally left blank; signature page follows]

IN WITNESS WHEREOF, the Issuer has caused this

instrument to be duly executed under its corporate seal.

Dated: ■

| |

BROOKFIELD FINANCE INC. |

| |

|

| |

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

(FORM OF TRUSTEE’S CERTIFICATE OF

AUTHENTICATION)

TRUSTEE’S CERTIFICATE OF AUTHENTICATION

This Note is one of the

Notes referred to in the Indenture referred to above.

| |

COMPUTERSHARE TRUST COMPANY OF

CANADA, as Trustee |

| |

|

| |

|

| |

By: Authorized Officer |

(FORM OF REGISTRATION PANEL)

(NO WRITING HEREON EXCEPT BY THE TRUSTEE OR

OTHER REGISTRAR)

DATE OF

REGISTRY |

IN WHOSE NAME

REGISTERED |

SIGNATURE OF TRUSTEE

OR OTHER REGISTRAR |

| |

|

|

| |

|

|

| |

|

|

[Reverse of Note.]

This Security is one of a

duly authorized issue of securities of the Issuer (herein called the “Securities”), issued and to be issued in one or more

series under an Indenture, dated as of June 2, 2016 (the “Original Indenture”), as supplemented by the Tenth Supplemental

Indenture, dated as of March 4, 2024 (the “Tenth Supplemental Indenture”) (the Original Indenture and the Tenth Supplemental

Indenture together herein called the “Indenture”, which term shall have the meaning assigned to it in such instrument), between

the Issuer, Brookfield Corporation (formerly, Brookfield Asset Management Inc.) (the “Company”), as guarantor, and Computershare

Trust Company of Canada, as trustee (herein called the “Trustee”, which term includes any successor trustee under the Indenture),

and reference is hereby made to the Indenture for a statement of the respective rights, limitations of rights, duties and immunities

thereunder of the Issuer, the Company, the Trustee and the Holders of the Securities and of the terms upon which the Securities are,

and are to be, authenticated and delivered. This Security is one of the series designated on the face hereof, initially limited in aggregate

principal amount to US$750,000,000, all of which are issued under the Tenth Supplemental Indenture. The Issuer may from time to time,

without the consent of the holders of the Securities, create and issue further securities having the same terms and conditions in all

respects as the Securities issued on the date hereof, except for the issue date, the issue price and the first payment of interest thereon.

Additional securities issued in this manner will be consolidated with and will form a single series with the Securities; provided that

if any additional securities issued after the date hereof are not fungible with the Securities issued on the date hereof for U.S. federal

income tax purposes, then such additional securities shall be issued with a separate CUSIP or ISIN number so that they are distinguishable

from the Securities.

The Issuer will pay to each

relevant Holder or beneficial owner certain Company Additional Amounts in the event of the withholding or deduction of certain Canadian

taxes as described in the Tenth Supplemental Indenture. In addition, certain Other Additional Amounts may be payable as contemplated

in Section 2.14 of the Tenth Supplemental Indenture and as described in any applicable supplemental indenture.

The Securities are redeemable,

at any time at the Issuer’s option, at the Redemption Price as described in the Tenth Supplemental Indenture. The Securities are

also redeemable (1) in the event of certain changes affecting Canadian withholding tax, as described in Section 2.9 of the

Tenth Supplemental Indenture, and (2) as described in any applicable supplemental indenture as contemplated in Section 2.14

of the Tenth Supplemental Indenture.

Upon the occurrence of a

Change of Control Triggering Event, the Issuer will be required to make an offer to purchase the Securities at a price equal to 101%

of their principal amount, plus accrued and unpaid interest to the date of repurchase.

If an Event of Default with

respect to Securities of this series shall occur and be continuing, the principal of the Securities of this series may be declared due

and payable in the manner and with the effect provided in the Indenture.

In the event of purchase

of this Security in part only, a new Security or Securities of this series and of like tenor for the unpurchased portion hereof will

be issued in the name of the Holder hereof upon the cancellation hereof.

The Indenture contains provisions

for defeasance at any time of the entire indebtedness of this Security or certain restrictive covenants and Events of Default with respect

to this Security, in each case upon compliance with certain conditions set forth in the Indenture.

The Indenture permits, with

certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations of the Issuer and the

rights of the Holders of the Securities of each series to be affected under the Indenture at any time by the Issuer, the Company and

the Trustee with the consent of the Holders of a majority in principal amount of the Securities at the time Outstanding of each series

to be affected. The Indenture also contains provisions permitting the Holders of specified percentages in principal amount of the Securities

of each series at the time Outstanding, on behalf of the Holders of all Securities of such series, to waive compliance by the Issuer

or the Company with certain provisions of the Indenture and certain past defaults under the Indenture and their consequences. Any such

consent or waiver by the Holder of this Security shall be conclusive and binding upon such Holder and upon all future Holders of this

Security and of any Security issued upon the registration of transfer hereof or in exchange hereafter or in lieu hereof, whether or not

notation of such consent or waiver is made upon this Security.

As provided in the Indenture

and subject to certain limitations therein set forth, the transfer of this Security is registrable in the Security Register, upon surrender

of this Security for registration of transfer at the Corporate Trust Office of the Trustee or the Place of Payment, duly endorsed by,

or accompanied by a written instrument of transfer, in form satisfactory to the Issuer and the Security Registrar, duly executed by the

Holder hereof or attorney duly authorized in writing, and, thereupon, one or more new Securities of this series and of like tenor, of

authorized denominations and for the same aggregate principal amount, will be issued to the designated transferee or transferees.

The Securities of this series

are issuable only in registered form without coupons in initial denominations of US$2,000 and multiples of US$1,000 in excess thereof.

As provided in the Indenture and subject to certain limitations therein set forth, Securities of this series are exchangeable for a like

aggregate principal amount of Securities of this series and of like tenor of a different authorized denomination, as requested by the

Holder surrendering the same.

No service charge shall be

made for any such registration of transfer or exchange, but the Issuer may require payment of a sum sufficient to cover any tax or other

governmental charge payable in connection therewith.

Prior to due presentment

of this Security for registration of transfer, the Issuer, the Company, the Trustee and any agent of the Issuer, the Company or the Trustee

may treat the Person in whose name this Security is registered as the owner hereof for all purposes, whether or not this Security be

overdue, and neither the Issuer, the Company, the Trustee nor any such agent shall be affected by notice to the contrary.

THE LAWS OF THE STATE OF

NEW YORK SHALL GOVERN AND BE USED TO CONSTRUE THE INDENTURE AND THE SECURITIES. Notwithstanding the preceding sentence of this paragraph,

the exercise, performance or discharge by the Trustee of any of its rights, powers, duties or responsibilities hereunder shall be construed

in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable thereto.

All terms used in this Security

which are defined in the Indenture shall have the meanings assigned to them in the Indenture.

Exhibit 99.2

| |

79 Wellington St. W., 30th Floor |

| |

Box 270, TD South Tower |

|

Toronto, Ontario M5K 1N2 Canada |

| P. 416.865.0040 | F. 416.865.7380 |

| |

| |

www.torys.com |

March 4, 2024

Brookfield Corporation

Brookfield Finance Inc.

Brookfield Place

181 Bay Street

Suite 100, P.O. Box 762

Toronto, Ontario M5J 2T3

Dear Sirs/Mesdames:

Re: Consent of Torys LLP

We

hereby consent to the reference to our name under the heading “Legal Matters” and to the reference to our name and

to the use of our opinions under the heading “Certain Canadian Federal Income Tax Considerations” in the Prospectus

Supplement dated February 26, 2024 relating to the offering by Brookfield Finance Inc. of US$750,000,000 of aggregate principal

amount of 5.968% Notes due March 4, 2054, which has been filed under the joint registration statement of Brookfield Corporation and

Brookfield Finance Inc. on Form F-10 (File Nos. 333-267243 and 333-267243-02). In giving this consent, we do not admit that we are

in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended.

Yours truly,

/s/ Torys LLP

Exhibit 99.3

March 4, 2024

To: The United States Securities and Exchange

Commission

Brookfield Corporation

Brookfield Finance Inc. (together, the "Company")

We refer to the Company's registration statement

on Form F-10 (File Nos. 333-267243 and 333-267243-02), filed September 2, 2022, and the Amendment No. 1 thereto, filed

September 16, 2022, as the same may hereafter be amended or supplemented.

In connection with the Prospectus Supplement of

the Company dated February 26, 2024 (the “Prospectus Supplement”), we consent to the reference to our firm’s

name under the heading “Legal Matters”, and consent to the use of our firm’s name and reference to our opinion under

the heading “Certain Canadian Federal Income Tax Considerations”.

Yours truly,

/s/ Goodmans LLP

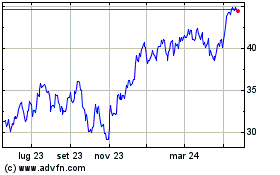

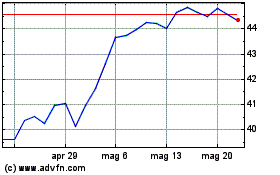

Grafico Azioni Brookfield (NYSE:BN)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Brookfield (NYSE:BN)

Storico

Da Nov 2023 a Nov 2024