Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

27 Dicembre 2023 - 1:49PM

Edgar (US Regulatory)

FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated December, 2023

Commission

File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s

Name)

14401 AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive

offices) (Zip code)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x

Form 40-F o

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by

check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

*

* *

This material

includes certain forward-looking statements that are based principally on current expectations and on projections of future events

and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance.

These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks,

uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could

cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking

statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes

no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and

uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those

described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: December 27,

2023 |

|

| |

|

| |

BRF S.A. |

| |

|

| |

|

| |

By: |

/s/ Fabio Luis Mendes Mariano |

| |

|

Name: |

Fabio Luis Mendes Mariano |

| |

|

Title: |

Chief Financial and Investor Relations Officer

|

EXHIBIT INDEX

BRF

S.A.

PUBLICLY-HELD

COMPANY

CNPJ 01.838.723/0001-27

NIRE

42.300.034.240

CVM

16269-2

ANNOUNCEMENT TO THE MARKET

BRF S.A. (“BRF”

or “Company”) (B3: BRFS3; NYSE: BRFS) hereby informs to its shareholders and the market in general that the Company was been

included in the 19th Corporate Sustainability Index (“ISE”) portfolio and in the 13th Carbon Efficient

Index (“ICO2”) portfolio, both organized by B3 Stock Exchange. The assets comprising each index were announced this Wednesday

(27).

The ISE is a tool for comparative

analysis of the performance of companies listed at B3 as to the aspect of corporate sustainability, based on environmental balance, social

justice, corporate governance, and economic efficiency. The new portfolio will be in place as of January 02, 2024 and is comprised of

shares of 78 companies listed in B3.

In its turn, the ICO2 aims to reinforce

the commitment of listed companies to the transparency of their greenhouse gas (GHG) emissions and analyzes the companies' preparation

for a low-carbon economy. The new portfolio will remain in place from January 2024 through April 2024.

This achievement reinforces the

transparency of the Company's actions as regards sustainable growth and reaffirms its efforts to improve its management practices to create

value for its shareholders and society.

São Paulo, December 27, 2023.

Fábio Luis Mendes Mariano

Chief Financial and Investor Relations

Officer

BRF S.A.

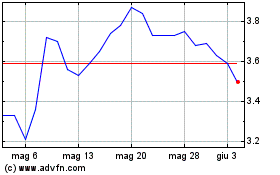

Grafico Azioni BRF (NYSE:BRFS)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni BRF (NYSE:BRFS)

Storico

Da Mag 2023 a Mag 2024