Blackstone, Canada Pension Plan in $1.2 Billion Joint Venture With FDIC

15 Dicembre 2023 - 12:24AM

Dow Jones News

By Stephen Nakrosis

Two units of Blackstone Real Estate Debt Strategies, Blackstone

Real Estate Income Trust, Canada Pension Plan Investment Board and

funds affiliated with Rialto Capital on Thursday entered a newly

formed joint venture with the Federal Deposit Insurance Corp.

The groups paid $1.2 billion for a 20% equity interest in the

JV, the FDIC said.

The FDIC will retain an 80% ownership in the JV, SIG CRE 2023

Venture LLC, which holds a $16.8 billion senior mortgage loan

portfolio that was retained in receivership after the failure of

Signature Bank, the agency said. The FDIC also said it will provide

financing equal to 50% of the venture's value.

"The commercial real estate loan portfolio comprises more than

2,600 first mortgage loans on retail, market rate multifamily and

office properties primarily located in the New York metropolitan

area," Blackstone said. It added that about 90% of the loans are

"fixed rate with low in-place coupons and strong in-place debt

service coverage."

Canada Pension Plan Investment Board is participating through

its subsidiary CPPIB Credit Investments III Inc.

Write to Stephen Nakrosis at stephen.nakrosis@wsj.com

(END) Dow Jones Newswires

December 14, 2023 18:09 ET (23:09 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

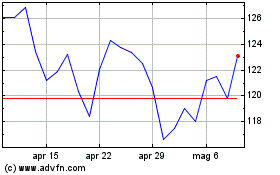

Grafico Azioni Blackstone (NYSE:BX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Blackstone (NYSE:BX)

Storico

Da Apr 2023 a Apr 2024