Company Closes on the Sale of Revolution Wind

and South Fork Wind to Global Infrastructure Partners

Eversource Energy (NYSE: ES) today announced that it has

completed the sale of its 50 percent interest in the 132-megawatt

South Fork Wind project (South Fork Wind) and the 704-megawatt

Revolution Wind project (Revolution Wind) to Global Infrastructure

Partners (GIP). Adjusted gross proceeds from the transaction were

$745 million.

Adjusted gross proceeds from the sale were reduced by

approximately $375 million as compared with the expected purchase

price of approximately $1.12 billion. This reduction reflects

approximately $150 million due to lower capital spending between

announcing the transaction and closing, and lower proceeds of

approximately $225 million related to the final terms of the sale

transaction, primarily due to the delay of the commercial

operations date of Revolution Wind.

“We have reached an important milestone today in our commitment

as a pure-play regulated pipes and wires utility that delivers

superior service and value to our customers,” said Eversource

Chairman, President and Chief Executive Officer Joe Nolan. “We are

proud of the role we have played to advance offshore wind projects,

and we will continue to be a leader in employing our transmission

expertise to conduct onshore work that supports the clean energy

transition and enables the continued development of renewable

resources for our region.”

With the completion of this sale and the previously completed

sale of the Company’s 50 percent interest in the Sunrise Wind

project (Sunrise Wind) to Ørsted announced on July 9, 2024,

Eversource expects to record an aggregate net loss on the

completion of its offshore wind divesture of approximately $520

million in the third quarter of 2024. This aggregate net loss

includes the final gain on the sale of Sunrise Wind of $370 million

and anticipated increases in Revolution Wind construction costs and

other project related charges. This estimate is subject to change

as Eversource finalizes results for the third quarter ended

September 30, 2024. Eversource expects to recognize a liability of

approximately $360 million, that is included as part of the

aggregate net loss of $520 million on the sale, in the third

quarter of 2024. The majority of this liability is expected to be

settled in 2026.

“We have completed an important step in our journey to

strengthen our balance sheet and improve our credit metrics, with

the closing of this transaction and resulting proceeds,” said

Eversource Executive Vice President and Chief Financial Officer

John Moreira. “Our equity issuance plan of up to $1.3 billion over

the next several years is unchanged, and we look forward to working

with Ørsted and GIP to complete the onshore construction of these

projects to enable clean energy in the New England region. In

addition, this transaction is not expected to have a material

impact to our targeted FFO/Debt ratio of 14% to 15% by 2025.”

The following factors were included in the aggregate net loss of

$520 million on sale and related expected liability:

- A gain on the sale of Eversource’s 50 percent interest in

Sunrise Wind to Ørsted of approximately $370 million.

Offsets include:

- Lower proceeds related to final terms of the sale transaction

to GIP of approximately $225 million related to non-construction

costs for the Revolution Wind and South Fork Wind projects.

- Forecasted higher capital construction costs as a result of a

delay in the anticipated commercial operation date related to

Revolution Wind of approximately $350 million.

- Anticipated post-closing adjustments of approximately $315

million as a result of final economics of the Revolution Wind and

South Fork Wind projects, which include Eversource’s obligations to

meet GIP’s requirements until the projects reach commercial

operations date, as specified in the definitive transaction

agreement with GIP.

Proceeds related to this sale may be further adjusted due to

final construction costs and updated project economics as of the

commercial operation date of Revolution Wind. South Fork Wind has

achieved commercial operations and, as a result, Eversource does

not expect a material financial impact related to this project.

With the previously announced sale of Sunrise Wind to Ørsted,

Eversource has no ongoing financial obligations associated with

Sunrise Wind. With the completion of this sale, Eversource has now

divested all its ownership interests in the offshore wind business.

Eversource will maintain its previously announced tax equity

investment in South Fork Wind. The sale of the offshore wind

projects has no impact on Eversource’s regulated entities.

Factors that could cause Eversource’s total net proceeds to be

higher or lower at Revolution Wind’s commercial operations date

include the following:

- Revolution Wind’s eligibility for federal investment tax

credits at other than the anticipated 40 percent level;

- The ultimate cost of construction for Revolution Wind. Under

the purchase and sale agreement, Eversource and GIP will share the

difference between a base construction forecast and the aggregate

cost of the two projects up to an effective cap of approximately

$240 million. Eversource will have responsibility for GIP’s

obligations for any additional costs in excess of the cap amount

consistent with the existing joint venture terms;

- Further delays in constructing Revolution Wind, that would

impact the economics associated with the purchase price adjustment;

and

- Lower operation costs or higher availability of the projects.

Eversource can benefit, but not be harmed, from lower costs of

operations and/or higher availability as compared to a base level

assumed in the projects’ financial models through the period that

is four years following commercial operation date of the Revolution

Wind project.

Under the agreement, Eversource’s existing and certain

additional credit support obligations for Revolution Wind are

expected to roll off as the project completes construction.

Eversource engaged Goldman Sachs as its financial advisor to

assist with the sale. Ropes & Gray LLP served as its legal

counsel.

Eversource (NYSE: ES), celebrated as a national leader for its

corporate citizenship, is among the top energy companies in

Newsweek’s list of America’s Most Responsible Companies for 2024

and recognized as a Five-Year Champion, appearing in every edition

of the list. Eversource transmits and delivers electricity and

natural gas and supplies water to approximately 4.4 million

customers in Connecticut, Massachusetts and New Hampshire. The #1

energy efficiency provider in the nation, Eversource harnesses the

commitment of approximately 10,000 employees across three states to

build a single, united company around the mission of safely

delivering reliable energy and water with superior customer

service. The company is empowering a clean energy future in the

Northeast, with nationally recognized energy efficiency solutions

and successful programs to integrate new clean energy resources

like a first-in-the-nation networked geothermal pilot project,

solar, offshore wind, electric vehicles and battery storage, into

the energy delivery system. For more information, please visit

eversource.com, and follow us on X, Facebook, Instagram, and

LinkedIn. For more information on our water services, visit

aquarionwater.com.

This document includes statements concerning Eversource Energy’s

expectations, beliefs, plans, objectives, goals, strategies,

assumptions of future events, future financial performance or

growth and other statements that are not historical facts,

including anticipated third and fourth quarters of fiscal 2024 and

fiscal 2025 financial impacts of the now-divested offshore wind

investment, the timing of liability settlement, Eversource’s equity

issuance plans and the timing thereof, Eversource’s future onshore

work, and the development of offshore wind in New England. These

statements are “forward-looking statements” within the meaning of

U.S. federal securities laws. Generally, readers can identify these

forward-looking statements through the use of words or phrases such

as “estimate,” “expect,” “anticipate,” “intend,” “plan,” “project,”

“believe,” “forecast,” “would,” “should,” “could” and other similar

expressions. Forward-looking statements involve risks and

uncertainties that may cause actual results or outcomes to differ

materially from those included in the forward-looking statements.

Forward-looking statements are based on the current expectations,

estimates, assumptions or projections of management and are not

guarantees of future performance. These expectations, estimates,

assumptions or projections may vary materially from actual results.

Accordingly, any such statements are qualified in their entirety by

reference to, and are accompanied by, the following important

factors that may cause our actual results or outcomes to differ

materially from those contained in our forward-looking statements,

including, but not limited to: the ability to qualify for

investment tax credits; variability in the costs and projected

returns of the offshore wind projects and the risk of deterioration

of market conditions in the offshore wind industry; cyberattacks or

breaches, including those resulting in the compromise of the

confidentiality of our proprietary information and the personal

information of our customers; disruptions in the capital markets or

other events that make our access to necessary capital more

difficult or costly; changes in economic conditions, including

impact on interest rates, tax policies, and customer demand and

payment ability; ability or inability to commence and complete our

major strategic development projects and opportunities; acts of war

or terrorism, physical attacks or grid disturbances that may damage

and disrupt our electric transmission and electric, natural gas,

and water distribution systems; actions or inaction of local, state

and federal regulatory, public policy and taxing bodies;

substandard performance of third-party suppliers and service

providers; fluctuations in weather patterns, including extreme

weather due to climate change; changes in business conditions,

which could include disruptive technology or development of

alternative energy sources related to our current or future

business model; contamination of, or disruption in, our water

supplies; changes in levels or timing of capital expenditures;

changes in laws, regulations or regulatory policy, including

compliance with environmental laws and regulations; changes in

accounting standards and financial reporting regulations; actions

of rating agencies; and other presently unknown or unforeseen

factors.

Other risk factors are detailed in Eversource Energy’s reports

filed with the Securities and Exchange Commission (SEC). They are

updated as necessary and available on Eversource Energy’s website

at www.eversource.com and on the SEC’s website at www.sec.gov. All

such factors are difficult to predict and contain uncertainties

that may materially affect Eversource Energy’s actual results, many

of which are beyond our control. You should not place undue

reliance on the forward-looking statements, as each speaks only as

of the date on which such statement is made, and, except as

required by federal securities laws, Eversource Energy undertakes

no obligation to update any forward-looking statement or statements

to reflect events or circumstances after the date on which such

statement is made or to reflect the occurrence of unanticipated

events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930672791/en/

Kaitlyn Woods (Media) kaitlyn.woods@eversource.com 603-860-3123

Rima Hyder (Investor Relations) rima.hyder@eversource.com

781-441-8062

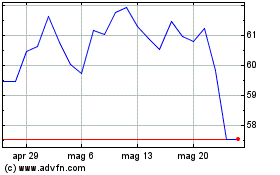

Grafico Azioni Eversource Energy (NYSE:ES)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Eversource Energy (NYSE:ES)

Storico

Da Mar 2024 a Mar 2025