0000040545false00000405452024-01-232024-01-230000040545us-gaap:CommonStockMember2024-01-232024-01-230000040545ge:A0.875NotesDue2025Member2024-01-232024-01-230000040545ge:A1.875NotesDue2027Member2024-01-232024-01-230000040545ge:A1.500NotesDue2029Member2024-01-232024-01-230000040545ge:A7.5GuaranteedSubordinatedNotesDue2035Member2024-01-232024-01-230000040545ge:A2.125NotesDue2037Member2024-01-232024-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 23, 2024

General Electric Company

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| New York | | 001-00035 | | 14-0689340 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | |

| One Financial Center, Suite 3700 | Boston, | MA | | | | 02111 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | | | |

(Registrant’s telephone number, including area code) (617) 443-3000

_______________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock, par value $0.01 per share | GE | New York Stock Exchange |

0.875% Notes due 2025 | GE 25 | New York Stock Exchange |

1.875% Notes due 2027 | GE 27E | New York Stock Exchange |

1.500% Notes due 2029 | GE 29 | New York Stock Exchange |

7 1/2% Guaranteed Subordinated Notes due 2035 | GE /35 | New York Stock Exchange |

2.125% Notes due 2037 | GE 37 | New York Stock Exchange |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On January 23, 2024, General Electric Company (the "Company") released its fourth-quarter and full year 2023 financial results on its investor relations website at www.ge.com/investor. A copy of these is attached as Exhibit 99 and incorporated by reference herein.

The information provided pursuant to this Item 2.02, including Exhibit 99, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Description

104 The cover page of this Current Report on Form 8-K formatted as Inline XBRL.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | General Electric Company | |

| | | (Registrant) | |

| | |

| |

Date: January 23, 2024 | | /s/ Rahul Ghai | |

| | | Rahul Ghai Senior Vice President and Chief Financial Officer (Principal Financial Officer) | |

GE ANNOUNCES FOURTH QUARTER 2023 RESULTS

Excellent 2023 supported by solid fourth quarter; GE Aerospace and GE Vernova ready to launch in early April

Fourth quarter 2023:

•Total orders of $21.7B, +8%; organic orders +7%

•Total revenues (GAAP) of $19.4B, +15%; adjusted revenues* $18.5B, +13% organically*

•Profit margin (GAAP) of 10.3%, +90 bps; adjusted profit margin* 9.6%, +50 bps organically*

•Continuing EPS (GAAP) of $1.44, $(0.09); adjusted EPS* $1.03, +$0.37

•Cash from Operating Activities (GAAP) of $3.2B, $(0.4)B; free cash flow* $3.0B, $(0.4)B

Full year 2023:

•Total orders of $79.2B, +25%; organic orders +25%

•Total revenues (GAAP) of $68.0B, +17%; adjusted revenues* $64.6B, +17% organically*

•Profit margin (GAAP) of 15.0%, +1,640 bps; adjusted profit margin* 8.8%, +310 bps organically*

•Continuing EPS (GAAP) of $7.98, +$8.98; adjusted EPS* $2.81, +$2.04

•Cash from Operating Activities (GAAP) of $5.6B, +$1.5B; free cash flow* $5.2B, +$2.1B

BOSTON — January 23, 2024 — GE (NYSE:GE) announced results today for the fourth quarter ending December 31, 2023.

GE Chairman and CEO and GE Aerospace CEO H. Lawrence Culp, Jr. said, "2024 will be a momentous year as GE Aerospace and GE Vernova plan to launch as independent public companies in early April. Both companies will carry forward GE's commitment to innovation and continuous improvement, with even sharper focus on their vital, growing industries. They serve vast and valuable installed bases with enviable service franchises that keep them close to customers, day in and day out. I am proud of what our teams have accomplished and excited for our next chapter as GE Aerospace invents the future of flight and GE Vernova leads the energy transition."

Culp continued, "In 2023, our teams delivered an excellent year, more than tripling earnings and generating almost 70 percent more free cash flow. At GE Aerospace, we drove solid revenue and operating profit improvement in the fourth quarter and double-digit revenue, profit, and cash growth for the year, reflecting ongoing strength in Commercial Engines and Services. At GE Vernova, Renewable Energy and Power together delivered meaningfully better results, with double-digit revenue growth in the quarter and positive profit and free cash flow for the year. We expect further revenue, profit, and free cash flow growth for both GE Aerospace and GE Vernova in 2024."

GE Aerospace1

•Delivered higher orders, revenue, and operating profit in the quarter. For the year, delivered double-digit growth in orders, revenue, operating profit, and cash due to commercial momentum and strength in services, which represent approximately 70 percent of revenue.

•Announced an order for 202 GE9X engines and spares by Emirates to power its upcoming fleet of Boeing 777X, bringing Emirates' total order for GE9X engines to 460.

•Named the GE Directors who will continue as members of GE Aerospace's Board of Directors, including two new additions with deep aerospace experience who joined in December.

GE Vernova

•Renewable Energy and Power drove double-digit revenue growth in the quarter. For the year, together they delivered strong revenue growth, operating profit improvement of over $1 billion, and positive free cash flow, with services representing approximately 65 percent of backlog.

•Secured 2.4 GW order to support Pattern Energy's SunZia wind project in New Mexico—expected to be the largest wind project in U.S. history—with 674 onshore wind turbines and a long-term services award.

•Reached key milestones toward its spin-off, including naming its Board of Directors, filing its Form 10 registration statement on a confidential basis, and achieving operational readiness.

* Non-GAAP Financial Measure

1Following the planned spin-off, in which GE will distribute the common stock of GE Vernova on a pro rata basis to holders of GE common stock, General Electric Company will be known as GE Aerospace. In current financial reporting and guidance, GE Aerospace refers to our existing reporting segment.

1

Total Company Results

We present both GAAP and non-GAAP financial measures to provide investors with additional information. We believe that providing these non-GAAP financial measures along with GAAP measures allows for increased comparability of our ongoing performance from period to period. Please see pages 8-11 for explanations of why we use these non-GAAP financial measures and the reconciliation to the most comparable GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31 | | Twelve months ended December 31 |

| Dollars in millions; per-share amounts in dollars, diluted | 2023 | 2022 | Year on Year | | 2023 | 2022 | Year on Year |

| GAAP Metrics | | | | | | | |

| Cash from Operating Activities (CFOA) | $3,216 | $3,664 | (12) | % | | $5,570 | $4,043 | 38 | % |

| Continuing EPS | 1.44 | 1.53 | (6) | % | | 7.98 | (1.00) | F |

| Net EPS | 1.45 | 1.90 | (24) | % | | 8.36 | 0.05 | F |

| Total Revenues | 19,423 | 16,828 | 15 | % | | 67,954 | 58,100 | 17 | % |

| Profit Margin | 10.3 | % | 9.4 | % | 90 bps | | 15.0 | % | (1.4) | % | 1,640 bps |

| Non-GAAP Metrics | | | | | | | |

Free Cash Flow (FCF)-a) | $2,961 | $3,338 | (11) | % | | $5,150 | $3,059 | 68 | % |

Adjusted EPS-b) | 1.03 | 0.66 | 56 | % | | 2.81 | 0.77 | F |

| Organic Revenues | 18,182 | 16,043 | 13 | % | | 64,336 | 55,150 | 17 | % |

Adjusted Profit-c) | 1,773 | 1,366 | 30 | % | | 5,662 | 3,159 | 79 | % |

Adjusted Profit Margin-c) | 9.6 | % | 8.5 | % | 110 bps | | 8.8 | % | 5.7 | % | 310 bps |

Adjusted Organic Profit Margin-c) | 10.0 | % | 9.5 | % | 50 bps | | 9.2 | % | 6.1 | % | 310 bps |

(a- Includes gross additions to PP&E and internal-use software. Excludes Insurance CFOA, separation cash expenditures, and other items

(b- Excludes Insurance, non-operating benefit costs, gains (losses) on retained and sold ownership interests and other equity securities, restructuring & other charges, and other items

(c- Excludes Insurance, interest and other financial charges, non-operating benefit costs, gains (losses) on retained and sold ownership interests and other equity securities, restructuring & other charges, and other items, with Energy Financial Services (EFS) on a net earnings basis

In addition, GE:

•Received total proceeds of $2.0 billion in the quarter from the sale of its remaining AerCap shares. During 2023, GE monetized approximately $9 billion in proceeds from exiting its Baker Hughes and AerCap stakes and a portion of its GE HealthCare shares.

•Repurchased, under our $3 billion authorized repurchase program, approximately 2.2 million common shares for $0.3 billion in the fourth quarter, bringing the total common shares repurchased under the program in 2023 to approximately 10.6 million shares for $1.1 billion. In addition, the company redeemed all outstanding preferred stock for $5.8 billion during 2023.

•Incurred separation costs of $0.3 billion in the quarter and $1.0 billion for the year, primarily related to employees, establishing standalone functions and IT systems, and professional fees.

2024 Guidance

For the first quarter of 2024, GE expects to deliver high-single-digit revenue growth, adjusted EPS* of $0.60 to $0.65, and free cash flow* in line with net income growth.

For the full year, GE's 2024 guidance reflects GE Vernova and GE Aerospace operating independently, incorporating standalone and other costs that each will incur separately. GE Vernova expects to deliver revenue of $34 billion to $35 billion; adjusted EBITDA* margin of mid single digits, toward the higher end of the range; and free cash flow* of $0.7 billion to $1.1 billion. GE Aerospace expects adjusted revenue* to grow low double digits or more, operating profit* of $6.0 billion to $6.5 billion, and free cash flow* of greater than $5 billion.

GE Vernova and GE Aerospace will hold Investor Days in New York, NY, on Wednesday, March 6 and Thursday, March 7, 2024, respectively, where they will provide additional details on their outlooks. In addition, the businesses announced their planned quarterly earnings calls for 2024. GE Aerospace will host its calls on April 23, July 23, and October 22. GE Vernova will host its calls on April 25, July 24, and October 23.

* Non-GAAP Financial Measure

2

Results by Reporting Segment

The following segment discussions and variance explanations are intended to reflect management’s view of the relevant comparisons of financial results.

GE Aerospace

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31 | | Twelve months ended December 31 |

| (In millions) | 2023 | 2022 | Year on Year | | 2023 | 2022 | Year on Year |

| Orders | $10,620 | $9,682 | 10 | % | | $38,077 | $31,106 | 22 | % |

| Revenues | 8,520 | 7,615 | 12 | % | | 31,770 | 26,050 | 22 | % |

| Segment Profit/(Loss) | 1,598 | 1,434 | 11 | % | | 6,115 | 4,775 | 28 | % |

| Segment Profit/(Loss) Margin | 18.8 | % | 18.8 | % | 0 bps | | 19.2 | % | 18.3 | % | 90 bps |

Orders of $10.6 billion increased 10% on a reported and organic basis, with continued services strength and strong commercial engine orders. Revenues of $8.5 billion grew 12% on a reported and organic* basis, led by Commercial Engines and Services. Segment margin of 18.8% was flat on a reported basis and contracted (70) basis points organically*. Services volume and pricing, net of inflation, was offset by unfavorable equipment mix and investments.

For the year, orders of $38.1 billion were up 22% reported and organically. Revenues of $31.8 billion increased 22% reported and organically* with growth in all businesses. Segment margin of 19.2% expanded 90 basis points reported and 50 basis points organically*. Services growth and pricing, net of inflation, more than offset negative mix from higher equipment deliveries and increased investments. Free cash flow* of $5.7 billion was up approximately $800 million from earnings growth and working capital improvement. Overall, GE Aerospace is driving growth with robust demand & operational improvements, climbing even higher in 2024.

Renewable Energy

Part of GE Vernova

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31 | | Twelve months ended December 31 |

| (In millions) | 2023 | 2022 | Year on Year | | 2023 | 2022 | Year on Year |

| Orders | $5,069 | $5,029 | 1 | % | | $22,627 | $14,657 | 54 | % |

| Revenues | 4,213 | 3,413 | 23 | % | | 15,050 | 12,977 | 16 | % |

| Segment Profit/(Loss) | (347) | (454) | 24 | % | | (1,437) | (2,240) | 36 | % |

| Segment Profit/(Loss) Margin | (8.2) | % | (13.3) | % | 510 bps | | (9.5) | % | (17.3) | % | 780 bps |

Orders of $5.1 billion increased 1% on a reported and organic basis, including the cancellation of a large Offshore Wind order originally booked in the second quarter of 2023. Excluding this cancellation, orders grew over 20%, led by stronger Onshore Wind equipment and repower. Revenues of $4.2 billion increased 23% reported and 19% organically* driven by Grid and Offshore Wind. Segment margin of (8.2)% improved by 510 basis points reported and 550 basis points organically*, with Onshore Wind and Grid both profitable again this quarter from better price and productivity, more than offsetting pressure at Offshore Wind.

For the year, orders of $22.6 billion were up 54% on a reported and organic basis. Revenues of $15.0 billion increased 16% reported and 17% organically* across Offshore Wind, Grid and Onshore Wind equipment. Segment margin of (9.5)% expanded 780 basis points reported and 920 basis points organically* with Onshore and Grid improvement more than offsetting Offshore Wind pressure. Grid achieved full-year profitability and Onshore Wind was profitable in the second half of 2023. Free cash flow* of ($1.5) billion improved by $585 million from better earnings and higher down payments. Overall, Renewable Energy's operational turnaround produced sizable improvement in 2023 with further acceleration expected in these businesses in 2024, supported by growing energy transition demand and continued price and productivity.

* Non-GAAP Financial Measure

3

Power

Part of GE Vernova

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31 | | Twelve months ended December 31 |

| (In millions) | 2023 | 2022 | Year on Year | | 2023 | 2022 | Year on Year |

| Orders | $5,728 | $5,442 | 5 | % | | $18,479 | $17,826 | 4 | % |

| Revenues | 5,786 | 5,030 | 15 | % | | 17,731 | 16,262 | 9 | % |

| Segment Profit/(Loss) | 759 | 692 | 10 | % | | 1,449 | 1,217 | 19 | % |

| Segment Profit/(Loss) Margin | 13.1 | % | 13.8 | % | (70) bps | | 8.2 | % | 7.5 | % | 70 bps |

Orders of $5.7 billion grew 5% reported and 4% organically with double-digit services growth in Gas Power, while equipment orders declined due to our exit from Steam new builds, partially offset by higher Aeroderivatives. Revenues of $5.8 billion grew 15% reported and 12% organically*, driven by Gas Power with equipment revenue growth from both Aeroderivative and heavy-duty gas turbines, as well as strength in services due to higher contractual outages and upgrades. Segment margin of 13.1% contracted (70) basis points reported and (210) basis points organically*, driven by higher equipment volume.

For the year, orders of $18.5 billion were up 4% reported and 3% organically. Revenues of $17.7 billion increased 9% reported and 7% organically* driven by deliveries of 58 heavy-duty gas turbines including 14 HAs and strength in services, which was up mid-single digits, led by Gas Power. Segment margin of 8.2% expanded 70 basis points reported and 20 basis points organically*, with services strength, productivity and price more than offsetting inflation and higher equipment volume. Free cash flow* of $2.0 billion was up approximately 11%, demonstrating that Power is a strong and growing business, generating significant free cash flow* while innovating decarbonization technologies.

* Non-GAAP Financial Measure

4

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GENERAL ELECTRIC COMPANY CONDENSED STATEMENT OF EARNINGS (LOSS) (UNAUDITED) |

| (In millions; per-share amounts in dollars) | Three months ended December 31 | | Twelve months ended December 31 |

| 2023 | | 2022 | | V% | | 2023 | | 2022 | | V% |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Sales of equipment and services | $ | 18,514 | | | $ | 16,046 | | | 15 | % | | $ | 64,565 | | | $ | 55,143 | | | 17 | % |

| Insurance revenues | 909 | | | 783 | | | | | 3,389 | | | 2,957 | | | |

| Total revenues | 19,423 | | | 16,828 | | | 15 | % | | 67,954 | | | 58,100 | | | 17 | % |

| | | | | | | | | | | |

| Cost of sales | 14,396 | | | 12,440 | | | | | 50,392 | | | 44,272 | | | |

| Selling, general and administrative expenses | 2,524 | | | 2,664 | | | | | 9,195 | | | 9,173 | | | |

| Separation costs | 320 | | | 296 | | | | | 978 | | | 715 | | | |

| Research and development | 551 | | | 518 | | | | | 1,907 | | | 1,786 | | | |

| Interest and other financial charges | 296 | | | 347 | | | | | 1,118 | | | 1,477 | | | |

| Debt extinguishment costs | — | | | 465 | | | | | — | | | 465 | | | |

| Insurance losses, annuity benefits and other costs | 758 | | | 799 | | | | | 2,886 | | | 2,592 | | | |

| | | | | | | | | | | |

| Non-operating benefit cost (income) | (402) | | | (107) | | | | | (1,585) | | | (409) | | | |

| | | | | | | | | | | |

| Total costs and expenses | 18,442 | | | 17,421 | | | 6 | % | | 64,891 | | | 60,071 | | | 8 | % |

| | | | | | | | | | | |

| Other income (loss) | 1,029 | | | 2,172 | | | | | 7,129 | | | 1,172 | | | |

| | | | | | | | | | | |

| Earnings (loss) from continuing operations before income taxes | 2,009 | | | 1,580 | | | 27 | % | | 10,191 | | | (799) | | | F |

| Benefit (provision) for income taxes | (421) | | | 206 | | | | | (1,162) | | | 3 | | | |

| Earnings (loss) from continuing operations | 1,589 | | | 1,786 | | | (11) | % | | 9,029 | | | (795) | | | F |

| Earnings (loss) from discontinued operations, net of taxes | 3 | | | 427 | | | | | 414 | | | 1,202 | | | |

| Net earnings (loss) | 1,591 | | | 2,213 | | | (28) | % | | 9,443 | | | 407 | | | F |

| Less net earnings (loss) attributable to noncontrolling interests | — | | | 16 | | | | | (37) | | | 67 | | | |

| Net earnings (loss) attributable to the Company | 1,591 | | | 2,197 | | | (28) | % | | 9,481 | | | 339 | | | F |

| Preferred stock dividends | — | | | (97) | | | | | (295) | | | (289) | | | |

| Net earnings (loss) attributable to GE common shareholders | $ | 1,591 | | | $ | 2,100 | | | (24) | % | | $ | 9,186 | | | $ | 51 | | | F |

| Amounts attributable to GE common shareholders: | | | | | | | | | | | |

| Earnings (loss) from continuing operations | $ | 1,589 | | | $ | 1,786 | | | (11) | % | | $ | 9,029 | | | $ | (795) | | | F |

| Less net earnings (loss) attributable to noncontrolling interests, continuing operations | — | | | (3) | | | | | (38) | | | 16 | | | |

| Earnings (loss) from continuing operations attributable to the Company | 1,589 | | | 1,789 | | | (11) | % | | 9,067 | | | (811) | | | F |

| Preferred stock dividends | — | | | (97) | | | | | (295) | | | (289) | | | |

| Earnings (loss) from continuing operations attributable to GE common shareholders | 1,589 | | | 1,692 | | | (6) | % | | 8,772 | | | (1,100) | | | F |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Earnings (loss) from discontinued operations attributable to GE common shareholders | 3 | | | 408 | | | | | 414 | | | 1,151 | | | |

| Net earnings (loss) attributable to GE common shareholders | $ | 1,591 | | | $ | 2,100 | | | (24) | % | | $ | 9,186 | | | $ | 51 | | | F |

| | | | | | | | | | | |

| Per-share amounts - earnings (loss) from continuing operations | | | | | | | | | | | |

| Diluted earnings (loss) per share | $ | 1.44 | | | $ | 1.53 | | | (6) | % | | $ | 7.98 | | | $ | (1.00) | | | F |

| Basic earnings (loss) per share | $ | 1.46 | | | $ | 1.55 | | | (6) | % | | $ | 8.06 | | | $ | (1.00) | | | F |

| Per-share amounts - net earnings (loss) | | | | | | | | | | | |

| Diluted earnings (loss) per share | $ | 1.45 | | | $ | 1.90 | | | (24) | % | | $ | 8.36 | | | $ | 0.05 | | | F |

| Basic earnings (loss) per share | $ | 1.46 | | | $ | 1.93 | | | (24) | % | | $ | 8.44 | | | $ | 0.05 | | | F |

| Total average equivalent shares | | | | | | | | | | | |

| Diluted | 1,100 | | | 1,097 | | | — | % | | 1,099 | | | 1,096 | | | — | % |

| Basic | 1,088 | | | 1,091 | | | — | % | | 1,089 | | | 1,096 | | | (1) | % |

| | | | | | | | | | | |

Amounts may not add due to rounding

* Non-GAAP Financial Measure

5

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GENERAL ELECTRIC COMPANY | | | | | | | | |

| SUMMARY OF REPORTABLE SEGMENTS (UNAUDITED) | Three months ended December 31 | | Twelve months ended December 31 |

| (In millions) | 2023 | | 2022 | | V% | | 2023 | | 2022 | | V% |

| Aerospace | $ | 8,520 | | | $ | 7,615 | | | 12 | % | | $ | 31,770 | | | $ | 26,050 | | | 22 | % |

| Renewable Energy | 4,213 | | | 3,413 | | | 23 | % | | 15,050 | | | 12,977 | | | 16 | % |

| Power | 5,786 | | | 5,030 | | | 15 | % | | 17,731 | | | 16,262 | | | 9 | % |

| Total segment revenues(a) | 18,518 | | | 16,058 | | | 15 | % | | 64,551 | | | 55,289 | | | 17 | % |

| Corporate | 905 | | | 770 | | | 18 | % | | 3,403 | | | 2,812 | | | 21 | % |

| Total revenues | $ | 19,423 | | | $ | 16,828 | | | 15 | % | | $ | 67,954 | | | $ | 58,100 | | | 17 | % |

| | | | | | | | | | | |

| Aerospace | $ | 1,598 | | | $ | 1,434 | | | 11 | % | | $ | 6,115 | | | $ | 4,775 | | | 28 | % |

| Renewable Energy | (347) | | | (454) | | | 24 | % | | (1,437) | | | (2,240) | | | 36 | % |

| Power | 759 | | | 692 | | | 10 | % | | 1,449 | | | 1,217 | | | 19 | % |

| Total segment profit (loss)(a) | 2,010 | | | 1,672 | | | 20 | % | | 6,126 | | | 3,751 | | | 63 | % |

| Corporate(b) | (73) | | | 658 | | | U | | 3,785 | | | (2,875) | | | F |

| | | | | | | | | | | |

| Interest and other financial charges | (287) | | | (337) | | | 15 | % | | (1,073) | | | (1,423) | | | 25 | % |

| Debt extinguishment costs | — | | | (465) | | | F | | — | | | (465) | | | F |

| Non-operating benefit income (cost) | 402 | | | 107 | | | F | | 1,585 | | | 409 | | | F |

| Benefit (provision) for income taxes | (462) | | | 153 | | | U | | (1,357) | | | (210) | | | U |

| Preferred stock dividends | — | | | (97) | | | F | | (295) | | | (289) | | | (2) | % |

Earnings (loss) from continuing operations attributable to GE common shareholders | 1,589 | | | 1,692 | | | (6) | % | | 8,772 | | | (1,100) | | | F |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Earnings (loss) from discontinued operations attributable to GE common shareholders | 3 | | | 408 | | | (99) | % | | 414 | | | 1,151 | | | (64) | % |

Net earnings (loss) attributable to GE common shareholders | $ | 1,591 | | | $ | 2,100 | | | (24) | % | | $ | 9,186 | | | $ | 51 | | | F |

(a)Segment revenues include sales of equipment and services related to the segment. Segment profit excludes results reported as discontinued operations, significant, higher-cost restructuring programs and other charges, the portion of earnings or loss attributable to noncontrolling interests of consolidated subsidiaries, and as such only includes the portion of earnings or loss attributable to our share of the consolidated earnings or loss of consolidated subsidiaries. Interest and other financial charges, income taxes and non-operating benefit costs are excluded in determining segment profit. Other income (loss) is included in segment profit. Interest and other financial charges and income taxes for EFS are included within Corporate costs. Certain corporate costs, including those related to shared services, employee benefits, and information technology, are allocated to our segments based on usage or their relative net cost of operations.

(b)Includes interest and other financial charges of $9 million and $9 million and $45 million and $54 million, and benefit for income taxes of $41 million and $53 million and $195 million and $213 million related to EFS within Corporate for the three and twelve months ended December 31, 2023 and 2022, respectively.

Amounts may not add due to rounding

* Non-GAAP Financial Measure

6

| | | | | | | | | | | | | | |

| GENERAL ELECTRIC COMPANY STATEMENT OF FINANCIAL POSITION (UNAUDITED) | | | | |

| (In millions) | | December 31, 2023 | | December 31, 2022 |

| Cash, cash equivalents and restricted cash(a)(b) | | $ | 16,967 | | | $ | 15,810 | |

| Investment securities | | 5,706 | | | 7,609 | |

| Current receivables | | 15,466 | | | 14,831 | |

| Inventories, including deferred inventory costs | | 16,528 | | | 14,891 | |

| Current contract assets | | 1,500 | | | 2,467 | |

| All other current assets | | 1,647 | | | 1,400 | |

| Assets of businesses held for sale | | 1,985 | | | 1,374 | |

| Current assets | | 59,799 | | | 58,384 | |

| | | | |

| Investment securities | | 38,000 | | | 36,027 | |

| Property, plant and equipment – net | | 12,494 | | | 12,192 | |

| Goodwill | | 13,385 | | | 12,999 | |

| Other intangible assets – net | | 5,695 | | | 6,105 | |

| Contract and other deferred assets | | 5,406 | | | 5,776 | |

| All other assets | | 15,997 | | | 15,477 | |

| Deferred income taxes | | 10,575 | | | 10,001 | |

| Assets of discontinued operations | | 1,695 | | | 31,890 | |

| Total assets | | $ | 163,045 | | | $ | 188,851 | |

| | | | |

| Short-term borrowings | | $ | 1,253 | | | $ | 3,739 | |

| Accounts payable and equipment project payables | | 15,408 | | | 15,399 | |

| Progress collections and deferred income | | 19,677 | | | 16,216 | |

| All other current liabilities | | 12,712 | | | 12,130 | |

| Liabilities of businesses held for sale | | 1,826 | | | 1,944 | |

| Current liabilities | | 50,876 | | | 49,428 | |

| | | | |

| Deferred income | | 1,339 | | | 1,409 | |

| Long-term borrowings | | 19,711 | | | 20,320 | |

| Insurance liabilities and annuity benefits | | 39,624 | | | 36,845 | |

| Non-current compensation and benefits | | 11,214 | | | 10,400 | |

| All other liabilities | | 10,508 | | | 11,063 | |

| Liabilities of discontinued operations | | 1,193 | | | 24,474 | |

| GE shareholders’ equity | | 27,378 | | | 33,696 | |

| Noncontrolling interests | | 1,202 | | | 1,216 | |

| Total liabilities and equity | | $ | 163,045 | | | $ | 188,851 | |

(a)Excluded $0.8 billion and $0.6 billion at December 31, 2023 and December 31, 2022, respectively, in our run-off Insurance business, which is subject to regulatory restrictions. This balance is included in All other assets.

(b)At December 31, 2023 and 2022, Cash, cash equivalents and restricted cash included $1.7 billion and $1.7 billion of cash held in countries with currency control restrictions and $0.4 billion and $0.7 billion of restricted use cash, respectively.

Amounts may not add due to rounding

* Non-GAAP Financial Measure

7

GENERAL ELECTRIC COMPANY

Financial Measures That Supplement GAAP

We believe that presenting non-GAAP financial measures provides management and investors useful measures to evaluate performance and trends of the total company and its businesses. This includes adjustments in recent periods to GAAP financial measures to increase period-to-period comparability following actions to strengthen our overall financial position and how we manage our business.

In addition, management recognizes that certain non-GAAP terms may be interpreted differently by other companies under different circumstances. In various sections of this report we have made reference to the following non-GAAP financial measures in describing our (1) revenues, specifically organic revenues by segment; organic revenues, (2) profit, specifically organic profit and profit margin by segment; Adjusted profit and profit margin; Adjusted organic profit and profit margin; Adjusted earnings (loss) and Adjusted earnings (loss) per share (EPS), (3) cash flows, specifically free cash flows (FCF), and (4) guidance, specifically first quarter 2024 Adjusted EPS, 2024 GE Vernova FCF, 2024 GE Aerospace adjusted operating profit and 2024 GE Aerospace FCF.

The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures follow. Certain columns, rows or percentages within these reconciliations may not add or recalculate due to the use of rounded numbers. Totals and percentages presented are calculated from the underlying numbers in millions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ORGANIC REVENUES, PROFIT (LOSS) AND PROFIT MARGIN BY SEGMENT (NON-GAAP) |

| (In millions) | Revenues | | Segment profit (loss) | | Profit margin |

| Three months ended December 31 | 2023 | | 2022 | | V% | | 2023 | | 2022 | | V% | | 2023 | | 2022 | V pts |

| Aerospace (GAAP) | $ | 8,520 | | | $ | 7,615 | | | 12 | % | | $ | 1,598 | | | $ | 1,434 | | | 11 | % | | 18.8 | % | | 18.8 | % | 0 bps |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Less: acquisitions and business dispositions | — | | | — | | | | | — | | | — | | | | | | | | |

| Less: foreign currency effect | 10 | | | (9) | | | | | 8 | | | (43) | | | | | | | | |

| Aerospace organic (Non-GAAP) | $ | 8,510 | | | $ | 7,624 | | | 12 | % | | $ | 1,590 | | | $ | 1,477 | | | 8 | % | | 18.7 | % | | 19.4 | % | (70) bps |

| | | | | | | | | | | | | | | | |

| Renewable Energy (GAAP) | $ | 4,213 | | | $ | 3,413 | | | 23 | % | | $ | (347) | | | $ | (454) | | | 24 | % | | (8.2) | % | | (13.3) | % | 510 bps |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Less: acquisitions and business dispositions | — | | | — | | | | | — | | | — | | | | | | | | |

| Less: foreign currency effect | 159 | | | 19 | | | | | (52) | | | (21) | | | | | | | | |

| Renewable Energy organic (Non-GAAP) | $ | 4,053 | | | $ | 3,394 | | | 19 | % | | $ | (295) | | | $ | (433) | | | 32 | % | | (7.3) | % | | (12.8) | % | 550 bps |

| | | | | | | | | | | | | | | | |

| Power (GAAP) | $ | 5,786 | | | $ | 5,030 | | | 15 | % | | $ | 759 | | | $ | 692 | | | 10 | % | | 13.1 | % | | 13.8 | % | (70) bps |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Less: acquisitions and business dispositions | 66 | | | — | | | | | 16 | | | — | | | | | | | | |

| Less: foreign currency effect | 93 | | | (8) | | | | | 2 | | | (77) | | | | | | | | |

| Power organic (Non-GAAP) | $ | 5,627 | | | $ | 5,038 | | | 12 | % | | $ | 741 | | | $ | 769 | | | (4) | % | | 13.2 | % | | 15.3 | % | (210) bps |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ORGANIC REVENUES, PROFIT (LOSS) AND PROFIT MARGIN BY SEGMENT (NON-GAAP) |

| (In millions) | Revenues | | Segment profit (loss) | | Profit margin |

| Twelve months ended December 31 | 2023 | | 2022 | | V% | | 2023 | | 2022 | | V% | | 2023 | | 2022 | V pts |

| Aerospace (GAAP) | $ | 31,770 | | | $ | 26,050 | | | 22 | % | | $ | 6,115 | | | $ | 4,775 | | | 28 | % | | 19.2 | % | | 18.3 | % | 90 bps |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Less: acquisitions and business dispositions | — | | | — | | | | | — | | | — | | | | | | | | |

| Less: foreign currency effect | 15 | | | (18) | | | | | 78 | | | (38) | | | | | | | | |

| Aerospace organic (Non-GAAP) | $ | 31,755 | | | $ | 26,067 | | | 22 | % | | $ | 6,037 | | | $ | 4,813 | | | 25 | % | | 19.0 | % | | 18.5 | % | 50 bps |

| | | | | | | | | | | | | | | | |

| Renewable Energy (GAAP) | $ | 15,050 | | | $ | 12,977 | | | 16 | % | | $ | (1,437) | | | $ | (2,240) | | | 36 | % | | (9.5) | % | | (17.3) | % | 780 bps |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Less: acquisitions and business dispositions | — | | | — | | | | | — | | | — | | | | | | | | |

| Less: foreign currency effect | (6) | | | 57 | | | | | (200) | | | 5 | | | | | | | | |

| Renewable Energy organic (Non-GAAP) | $ | 15,056 | | | $ | 12,920 | | | 17 | % | | $ | (1,237) | | | $ | (2,245) | | | 45 | % | | (8.2) | % | | (17.4) | % | 920 bps |

| | | | | | | | | | | | | | | | |

| Power (GAAP) | $ | 17,731 | | | $ | 16,262 | | | 9 | % | | $ | 1,449 | | | $ | 1,217 | | | 19 | % | | 8.2 | % | | 7.5 | % | 70 bps |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Less: acquisitions and business dispositions | 152 | | | — | | | | | 21 | | | — | | | | | | | | |

| Less: foreign currency effect | 65 | | | (48) | | | | | (74) | | | (152) | | | | | | | | |

| Power organic (Non-GAAP) | $ | 17,514 | | | $ | 16,310 | | | 7 | % | | $ | 1,503 | | | $ | 1,369 | | | 10 | % | | 8.6 | % | | 8.4 | % | 20 bps |

| We believe these measures provide management and investors with a more complete understanding of underlying operating results and trends of established, ongoing operations by excluding the effect of acquisitions, dispositions and foreign currency, which includes translational and transactional impacts, as these activities can obscure underlying trends. |

* Non-GAAP Financial Measure

8

| | | | | | | | | | | | | | | | | | | | | | | |

| ORGANIC REVENUES (NON-GAAP) | Three months ended December 31 | | Twelve months ended December 31 |

| (In millions) | 2023 | 2022 | V% | | 2023 | 2022 | V% |

| Total revenues (GAAP) | $ | 19,423 | | $ | 16,828 | | 15 | % | | $ | 67,954 | | $ | 58,100 | | 17 | % |

| Less: Insurance revenues (Note 12) | 909 | | 783 | | | | 3,389 | | 2,957 | | |

| Adjusted revenues (Non-GAAP) | $ | 18,514 | | $ | 16,045 | | 15 | % | | $ | 64,565 | | $ | 55,143 | | 17 | % |

| Less: acquisitions and business dispositions | 68 | | — | | | | 155 | | 1 | | |

| Less: foreign currency effect | 265 | | 2 | | | | 74 | | (8) | | |

| Organic revenues (Non-GAAP) | $ | 18,182 | | $ | 16,043 | | 13 | % | | $ | 64,336 | | $ | 55,150 | | 17 | % |

| | | | | | | |

| We believe these measures provide management and investors with a more complete understanding of underlying operating results and trends of established, ongoing operations by excluding the effect of revenues from our run-off Insurance business, acquisitions, dispositions and foreign currency, which includes translational and transactional impacts, as these activities can obscure underlying trends. |

| | | | | | | | | | | | | | | | | | | | | | | |

| ADJUSTED PROFIT AND PROFIT MARGIN (NON-GAAP) | Three months ended December 31 | | Twelve months ended December 31 |

(In millions) | 2023 | 2022 | V% | | 2023 | 2022 | V% |

| Total revenues (GAAP) | $ | 19,423 | | $ | 16,828 | | 15% | | $ | 67,954 | | $ | 58,100 | | 17 | % |

| Less: Insurance revenues | 909 | | 783 | | | | 3,389 | | 2,957 | | |

| Adjusted revenues (Non-GAAP) | $ | 18,514 | | $ | 16,045 | | 15% | | $ | 64,565 | | $ | 55,143 | | 17 | % |

| | | | | | | |

| Total costs and expenses (GAAP) | $ | 18,442 | | $ | 17,421 | | 6% | | $ | 64,891 | | $ | 60,071 | | 8 | % |

| Less: Insurance cost and expenses | 810 | | 842 | | | | 3,057 | | 2,753 | | |

| Less: interest and other financial charges | 287 | | 337 | | | | 1,073 | | 1,423 | | |

| Less: non-operating benefit cost (income) | (402) | | (107) | | | | (1,585) | | (409) | | |

| Less: restructuring & other | 241 | | 660 | | | | 679 | | 836 | | |

| Less: debt extinguishment costs | — | | 465 | | | | — | | 465 | | |

| Less: separation costs | 320 | | 296 | | | | 978 | | 715 | | |

| Less: Steam asset sale impairment | — | | (1) | | | | — | | 824 | | |

| Less: Russia and Ukraine charges | — | | — | | | | 190 | | 263 | | |

| Add: noncontrolling interests | — | | (3) | | | | (38) | | 16 | | |

| Add: EFS benefit from taxes | (41) | | (53) | | | | (195) | | (213) | | |

| Adjusted costs (Non-GAAP) | $ | 17,145 | | $ | 14,872 | | 15% | | $ | 60,268 | | $ | 53,004 | | 14 | % |

| | | | | | | |

| Other income (loss) (GAAP) | $ | 1,029 | | $ | 2,172 | | (53) | % | | $ | 7,129 | | $ | 1,172 | | F |

| Less: gains (losses) on retained and sold ownership interests and other equity securities | 621 | | 1,935 | | | | 5,773 | | 76 | | |

| Less: restructuring & other | — | | 28 | | | | — | | 31 | | |

Less: gains (losses) on purchases and sales of business interests | 4 | | 17 | | | | (9) | | 45 | | |

| Adjusted other income (loss) (Non-GAAP) | $ | 404 | | $ | 192 | | F | | $ | 1,365 | | $ | 1,020 | | 34 | % |

| | | | | | | |

| Profit (loss) (GAAP) | $ | 2,009 | | $ | 1,580 | | 27 | % | | $ | 10,191 | | $ | (799) | | F |

| Profit (loss) margin (GAAP) | 10.3 | % | 9.4 | % | 90 bps | | 15.0 | % | (1.4) | % | 1,640 bps |

| | | | | | | |

| Adjusted profit (loss) (Non-GAAP) | $ | 1,773 | | $ | 1,366 | | 30 | % | | $ | 5,662 | | $ | 3,159 | | 79 | % |

| Adjusted profit (loss) margin (Non-GAAP) | 9.6 | % | 8.5 | % | 110 | bps | | 8.8 | % | 5.7 | % | 310 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

We believe that adjusting profit to exclude the effects of items that are not closely associated with ongoing operations provides management and investors with a meaningful measure that increases the period-to-period comparability. Gains (losses) and restructuring and other items are impacted by the timing and magnitude of gains associated with dispositions, and the timing and magnitude of costs associated with restructuring and other activities. |

| | | | | | | | | | | | | | | | | | | | | | | |

ADJUSTED ORGANIC PROFIT (NON-GAAP) | Three months ended December 31 | | Twelve months ended December 31 |

(In millions) | 2023 | 2022 | V% | | 2023 | 2022 | V% |

| Adjusted profit (loss) (Non-GAAP) | $ | 1,773 | | $ | 1,366 | | 30% | | $ | 5,662 | | $ | 3,159 | | 79 | % |

| Less: acquisitions and business dispositions | 13 | | — | | | | 12 | | (5) | | |

| Less: foreign currency effect | (57) | | (151) | | | | (294) | | (189) | | |

| Adjusted organic profit (loss) (Non-GAAP) | $ | 1,818 | | $ | 1,517 | | 20% | | $ | 5,944 | | $ | 3,353 | | 77 | % |

| | | | | | | |

| Adjusted profit (loss) margin (Non-GAAP) | 9.6 | % | 8.5 | % | 110 | bps | | 8.8 | % | 5.7 | % | 310 bps |

| Adjusted organic profit (loss) margin (Non-GAAP) | 10.0 | % | 9.5 | % | 50 | bps | | 9.2 | % | 6.1 | % | 310 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| We believe these measures provide management and investors with a more complete understanding of underlying operating results and trends of established, ongoing operations by excluding the effect of acquisitions, dispositions and foreign currency, which includes translational and transactional impacts, as these activities can obscure underlying trends. |

* Non-GAAP Financial Measure

9

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ADJUSTED EARNINGS (LOSS) (NON-GAAP) | Three months ended December 31 | | Twelve months ended December 31 | | | | | | |

(In millions, Per-share amounts in dollars) | 2023 | 2022 | | 2023 | 2022 | | | | |

| Earnings | EPS | Earnings | EPS | | Earnings | EPS | Earnings | EPS | | | | | | |

| Earnings (loss) from continuing operations (GAAP) | $ | 1,589 | $ | 1.44 | $ | 1,680 | $ | 1.53 | | $ | 8,769 | $ | 7.98 | $ | (1,097) | $ | (1.00) | | | | | | |

| Insurance earnings (loss) (pre-tax) | 99 | 0.09 | (59) | (0.05) | | 334 | 0.30 | 210 | 0.19 | | | | | | |

| Tax effect on Insurance earnings (loss) | (20) | (0.02) | 9 | 0.01 | | (74) | (0.07) | (52) | (0.05) | | | | | | |

| Less: Insurance earnings (loss) (net of tax) | 78 | 0.07 | (49) | (0.05) | | 260 | 0.24 | 159 | 0.15 | | | | | | |

| Earnings (loss) excluding Insurance (Non-GAAP) | $ | 1,511 | $ | 1.37 | $ | 1,730 | $ | 1.58 | | $ | 8,509 | $ | 7.74 | $ | (1,255) | $ | (1.15) | | | | | | |

| Non-operating benefit (cost) income (pre-tax) (GAAP) | 402 | 0.37 | 107 | 0.10 | | 1,585 | 1.44 | 409 | 0.37 | | | | | | |

| Tax effect on non-operating benefit (cost) income | (84) | (0.08) | (22) | (0.02) | | (333) | (0.30) | (86) | (0.08) | | | | | | |

| Less: Non-operating benefit (cost) income (net of tax) | 317 | 0.29 | 85 | 0.08 | | 1,252 | 1.14 | 323 | 0.30 | | | | | | |

| Gains (losses) on purchases and sales of business interests (pre-tax) | 4 | — | 17 | 0.02 | | (9) | (0.01) | 45 | 0.04 | | | | | | |

| Tax effect on gains (losses) on purchases and sales of business interests | (1) | — | 1 | — | | (24) | (0.02) | 57 | 0.05 | | | | | | |

| Less: Gains (losses) on purchases and sales of business interests (net of tax) | 3 | — | 18 | 0.02 | | (32) | (0.03) | 102 | 0.09 | | | | | | |

| Gains (losses) on retained and sold ownership interests and other equity securities (pre-tax) | 621 | 0.56 | 1,935 | 1.76 | | 5,773 | 5.25 | 76 | 0.07 | | | | | | |

| Tax effect on gains (losses) on retained and sold ownership interests and other equity securities(a)(b) | — | — | (3) | — | | 1 | — | (17) | (0.02) | | | | | | |

| Less: Gains (losses) on retained and sold ownership interests and other equity securities (net of tax) | 621 | 0.56 | 1,933 | 1.76 | | 5,774 | 5.26 | 58 | 0.05 | | | | | | |

| Restructuring & other (pre-tax) | (241) | (0.22) | (633) | (0.58) | | (679) | (0.62) | (806) | (0.74) | | | | | | |

| Tax effect on restructuring & other | 51 | 0.05 | 139 | 0.13 | | 143 | 0.13 | 176 | 0.16 | | | | | | |

| Less: Restructuring & other (net of tax) | (190) | (0.17) | (494) | (0.45) | | (536) | (0.49) | (630) | (0.58) | | | | | | |

Debt extinguishment costs (pre-tax) | — | — | (465) | (0.42) | | — | — | (465) | (0.42) | | | | | | |

| Tax effect on debt extinguishment costs | — | — | 68 | 0.06 | | — | — | 68 | 0.06 | | | | | | |

| Less: Debt extinguishment costs (net of tax) | — | — | (397) | (0.36) | | — | — | (397) | (0.36) | | | | | | |

| Separation costs (pre-tax) | (320) | (0.29) | (296) | (0.27) | | (978) | (0.89) | (715) | (0.65) | | | | | | |

| Tax effect on separation costs | (59) | (0.05) | (7) | (0.01) | | 197 | 0.18 | 23 | 0.02 | | | | | | |

| Less: Separation costs (net of tax) | (378) | (0.34) | (304) | (0.28) | | (781) | (0.71) | (692) | (0.63) | | | | | | |

| Steam asset sale impairment (pre-tax) | — | — | 1 | — | | — | — | (824) | (0.75) | | | | | | |

| Tax effect on Steam asset sale impairment | — | — | — | — | | — | — | 84 | 0.08 | | | | | | |

| Less: Steam asset sale impairment (net of tax) | — | — | — | — | | — | — | (740) | (0.68) | | | | | | |

| Russia and Ukraine charges (pre-tax) | — | — | — | — | | (190) | (0.17) | (263) | (0.24) | | | | | | |

| Tax effect on Russia and Ukraine charges | — | — | — | — | | (5) | — | 15 | 0.01 | | | | | | |

| Less: Russia and Ukraine charges (net of tax) | — | — | — | — | | (195) | (0.18) | (248) | (0.23) | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Less: Excise tax and accretion of preferred share redemption | — | — | — | — | | (58) | (0.05) | 4 | — | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Less: U.S. and foreign tax law change enactment | — | — | 163 | 0.15 | | — | — | 126 | 0.11 | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Adjusted earnings (loss) (Non-GAAP) | $ | 1,138 | $ | 1.03 | $ | 725 | $ | 0.66 | | $ | 3,085 | $ | 2.81 | $ | 839 | $ | 0.77 | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

|

| (a) Includes tax benefits available to offset the tax on gains (losses) on equity securities. |

| (b) Includes related tax valuation allowances. |

| | | | | | | | | | | | | | | |

| Earnings-per-share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total. |

| The service cost for our pension and other benefit plans are included in Adjusted earnings*, which represents the ongoing cost of providing pension benefits to our employees. The components of non-operating benefit costs are mainly driven by capital allocation decisions and market performance. We believe the retained cost in Adjusted earnings* provides management and investors a useful measure to evaluate the performance of the total company and increases period-to-period comparability. We also use Adjusted EPS* as a performance metric at the company level for our annual executive incentive plan for 2023. |

* Non-GAAP Financial Measure

10

| | | | | | | | | | | | | | | | | | | | | | | |

| FREE CASH FLOWS (FCF) (NON-GAAP) | Three months ended December 31 | | Twelve months ended December 31 |

| (In millions) | 2023 | 2022 | V$ | | 2023 | 2022 | V$ |

| CFOA (GAAP) | $ | 3,216 | | $ | 3,664 | | $ | (448) | | | $ | 5,570 | | $ | 4,043 | | $ | 1,526 | |

| Less: Insurance CFOA | 67 | | 88 | | | | 191 | | 136 | | |

| CFOA excluding Insurance (Non-GAAP) | $ | 3,149 | | $ | 3,576 | | $ | (427) | | | $ | 5,378 | | $ | 3,907 | | $ | 1,471 | |

| Add: gross additions to property, plant and equipment and internal-use software | (531) | | (373) | | | | (1,595) | | (1,174) | | |

| Less: separation cash expenditures | (308) | | (86) | | | | (1,060) | | (158) | | |

| Less: Corporate restructuring cash expenditures | (49) | | (38) | | | | (177) | | (38) | | |

| Less: taxes related to business sales | 15 | | (10) | | | | (130) | | (129) | | |

| | | | | | | |

| | | | | | | |

| Free cash flows (Non-GAAP) | $ | 2,961 | | $ | 3,338 | | $ | (377) | | | $ | 5,150 | | $ | 3,059 | | $ | 2,092 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| We believe investors may find it useful to compare free cash flows* performance without the effects of CFOA related to our run-off Insurance business, separation cash expenditures, Corporate restructuring cash expenditures (associated with the separation-related program announced in October 2022) and taxes related to business sales. We believe this measure will better allow management and investors to evaluate the capacity of our operations to generate free cash flows. |

| | | | | | | | | | | | | | | | | | | | |

2024 GUIDANCE: FIRST QUARTER 2024 ADJUSTED EPS (NON-GAAP) |

| | | | | | |

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for Adjusted EPS* in 2024 without unreasonable effort due to the uncertainty of timing of any gains or losses related to acquisitions & dispositions, the timing and magnitude of the financial impact related to the mark-to-market of our remaining investment in GE HealthCare and the timing and magnitude of restructuring expenses. Although we have attempted to estimate the amount of gains and restructuring charges for the purpose of explaining the probable significance of these components, this calculation involves a number of unknown variables, resulting in a GAAP range that we believe is too large and variable to be meaningful. |

| | | | | |

2024 GUIDANCE: GE VERNOVA 2024 FREE CASH FLOWS (FCF) (NON-GAAP) | |

(In billions) | 2024 |

| CFOA (GAAP) | $1.5 - $1.9 |

| Add: gross additions to property, plant and equipment and internal-use software | ~(0.8) |

| Free cash flows (Non-GAAP) | $0.7 - $1.1 |

| |

| |

| |

We believe investors may find it useful to compare free cash flows* performance including the effects of expenditures related to property, plant and equipment and internal-use software. We believe this measure will better allow management and investors to evaluate the amount of cash generated from our operations after reinvesting in the business. |

| | | | | | | | | | | | | | | | | | | | |

2024 GUIDANCE: 2024 GE AEROSPACE OPERATING PROFIT (NON-GAAP) |

| | | | | | |

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for GE Aerospace operating profit* in 2024 without unreasonable effort due to the uncertainty of timing of any gains or losses related to acquisitions & dispositions, the timing and magnitude of the financial impact related to the mark-to-market of our remaining investment in GE HealthCare and the timing and magnitude of restructuring expenses. Although we have attempted to estimate the amount of gains and restructuring charges for the purpose of explaining the probable significance of these components, this calculation involves a number of unknown variables, resulting in a GAAP range that we believe is too large and variable to be meaningful. |

| | | | | | | | | | | | | | | | | |

2024 GUIDANCE: 2024 GE AEROSPACE FCF (NON-GAAP) |

| | | | |

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for GE Aerospace free cash flows* in 2024 without unreasonable effort due to the uncertainty of timing for separation related cash expenditures. |

* Non-GAAP Financial Measure

11

Caution Concerning Forward Looking Statements:

This release and certain of our other public communications and SEC filings may contain statements related to future, not past, events. These forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," "estimate," "forecast," "target," "preliminary," or "range." Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about planned and potential transactions, including our plan to pursue a spin-off of our portfolio of energy businesses that are planned to be combined as GE Vernova; the impacts of macroeconomic and market conditions and volatility on our business operations, financial results and financial position and on the global supply chain and world economy; our expected financial performance, including cash flows, revenues, organic growth, margins, earnings and earnings per share; our credit ratings and outlooks; our funding and liquidity; our businesses’ cost structures and plans to reduce costs; restructuring, goodwill impairment or other financial charges; or tax rates.

For us, particular areas where risks or uncertainties could cause our actual results to be materially different than those expressed in our forward-looking statements include:

•our success in executing planned and potential transactions, including our plan to pursue a spin-off of GE Vernova and sales or other dispositions of our remaining equity interest in GE HealthCare, the timing for such transactions, the ability to satisfy any applicable pre-conditions, and the expected proceeds, consideration and benefits to GE;

•changes in macroeconomic and market conditions and market volatility, including risk of recession, inflation, supply chain constraints or disruptions, interest rates, the value of securities and other financial assets (including our equity interest in GE HealthCare), oil, natural gas and other commodity prices and exchange rates, and the impact of such changes and volatility on our business operations, financial results and financial position;

•global economic trends, competition and geopolitical risks, including impacts from the ongoing conflict between Russia and Ukraine and the related sanctions and other measures and risks related to conflict in the Middle East, demand or supply shocks from events such as a major terrorist attack, natural disasters or actual or threatened public health pandemics or other emergencies, or an escalation of sanctions, tariffs or other trade tensions between the U.S. and China or other countries, and related impacts on our businesses' global supply chains and strategies;

•market developments or customer actions that may affect demand and the financial performance of major industries and customers we serve, such as demand for air travel and other commercial aviation sector dynamics; pricing, cost, volume and the timing of investment by customers or industry participants and other factors in renewable energy markets; conditions in key geographic markets; technology developments; and other shifts in the competitive landscape for our products and services;

•our capital allocation plans, including the timing and amount of dividends, share repurchases, acquisitions, organic investments, and other priorities;

•downgrades of our current short- and long-term credit ratings or ratings outlooks, or changes in rating application or methodology, and the related impact on our funding profile, costs, liquidity and competitive position;

•the amount and timing of our cash flows and earnings, which may be impacted by macroeconomic, customer, supplier, competitive, contractual and other dynamics and conditions;

•capital or liquidity needs associated with our run-off insurance operations and mortgage portfolio in Poland (Bank BPH), the amount and timing of any required future capital contributions and any strategic options that we may consider;

•operational execution and improvements by our businesses, including the success at our Renewable Energy business in improving product quality and fleet availability, executing on our product and project cost estimates and delivery schedule projections and other aspects of operational performance, as well as the performance of GE Aerospace amidst market growth and ramping newer product platforms;

•changes in law, regulation or policy that may affect our businesses, such as trade policy and tariffs, regulation and incentives related to climate change (including the impact of the Inflation Reduction Act and other policies), and the effects of tax law changes;

•our decisions about investments in research and development, and new products, services and platforms, and our ability to launch new products in a cost-effective manner;

•the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, including the impact of shareholder and related lawsuits, Alstom, Bank BPH and other investigative and legal proceedings;

•the impact of actual or potential quality issues or failures of our products or third-party products with which our products are integrated, and related costs and reputational effects;

•the impact related to information technology, cybersecurity or data security breaches at GE or third parties; and

•the other factors that are described in the "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2022, as such descriptions may be updated or amended in any future reports we file with the SEC.

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially.

GE’s Investor Relations website at www.ge.com/investor and our corporate blog at www.gereports.com, as well as GE’s LinkedIn and other social media accounts, contain a significant amount of information about GE, including financial and other information for investors. GE encourages investors to visit these websites from time to time, as information is updated and new information is posted.

Additional Financial Information

Additional financial information can be found on the Company’s website at: www.ge.com/investor under Events and Reports.

Conference Call and Webcast

GE will discuss its results during its investor conference call today starting at 7:30 a.m. ET. The conference call will be broadcast live via webcast, and the webcast and accompanying slide presentation containing financial information can be accessed by visiting the Events and Reports page on GE’s website at: www.ge.com/investor. An archived version of the webcast will be available on the website after the call.

About GE

GE (NYSE:GE) rises to the challenge of building a world that works. For more than 130 years, GE has invented the future of industry, and today the company’s dedicated team, leading technology, and global reach and capabilities help the world work more safely, efficiently, and reliably. GE’s people are diverse and dedicated, operating with the highest level of integrity and focus to fulfill GE’s mission and deliver for its customers. www.ge.com

GE Investor Contact:

Steve Winoker, 617.443.3400

swinoker@ge.com

GE Media Contact:

Mary Kate Mullaney, 202.304.6514

marykate.nevin@ge.com

v3.23.4

Cover Page

|

Jan. 23, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 23, 2024

|

| Entity Registrant Name |

General Electric Co

|

| Entity Central Index Key |

0000040545

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NY

|

| Entity File Number |

001-00035

|

| Entity Tax Identification Number |

14-0689340

|

| Entity Address, Address Line One |

One Financial Center, Suite 3700

|

| Entity Address, City or Town |

Boston,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02111

|

| City Area Code |

617

|

| Local Phone Number |

443-3000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

GE

|

| Security Exchange Name |

NYSE

|

| 0.875% Notes Due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Notes due 2025

|

| Trading Symbol |

GE 25

|

| Security Exchange Name |

NYSE

|

| 1.875% Notes Due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.875% Notes due 2027

|

| Trading Symbol |

GE 27E

|

| Security Exchange Name |

NYSE

|

| 1.500% Notes Due 2029 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.500% Notes due 2029

|

| Trading Symbol |

GE 29

|

| Security Exchange Name |

NYSE

|

| 7.5% Guaranteed Subordinated Notes Due 2035 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

7 1/2% Guaranteed Subordinated Notes due 2035

|

| Trading Symbol |

GE /35

|

| Security Exchange Name |

NYSE

|

| 2.125% Notes Due 2037 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.125% Notes due 2037

|

| Trading Symbol |

GE 37

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A0.875NotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A1.875NotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A1.500NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A7.5GuaranteedSubordinatedNotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A2.125NotesDue2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

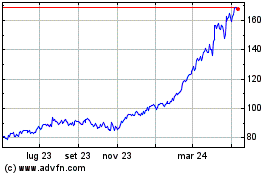

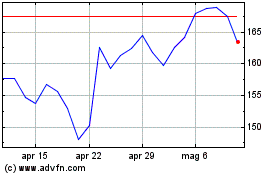

Grafico Azioni GE Aerospace (NYSE:GE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni GE Aerospace (NYSE:GE)

Storico

Da Apr 2023 a Apr 2024