Hamilton Insurance Group, Ltd. (NYSE: HG; “Hamilton” or “The

Company”) today announced financial results for the fourth quarter

ended December 31, 2023.

Consolidated Highlights – Fourth Quarter

- Net income of $126.9 million;

- Annualized return on average equity of 26.4%;

- Income tax benefit of $35.1 million, or 7.1% annualized return

on average equity, reflecting the enactment of the Bermuda

Corporate Income Tax Act of 2023;

- Gross premiums written of $433.8 million and net premiums

earned of $366.1 million;

- Combined ratio of 90.2%, including 1.8 points of catastrophe

losses;

- Underwriting income of $36.0 million;

- Net investment income of $113.8 million comprised of fixed

income, short term and cash and cash equivalents return of $77.1

million and Two Sigma Hamilton Fund return of $36.7 million;

and

- Corporate expenses of $44.9 million, which includes $18.9

million of compensation costs related to the Value Appreciation

Pool, and $12.9 million of other compensation costs.

Consolidated Highlights – Full Year

- Net income of $258.7 million;

- Return on average equity of 13.9%;

- Income tax benefit of $35.1 million, or 1.8% return on average

equity, reflecting the enactment of the Bermuda Corporate Income

Tax Act of 2023;

- Gross premiums written of $1,951.0 million and net premiums

earned of $1,318.5 million;

- Combined ratio of 90.1%, including 2.8 points of catastrophe

losses;

- Underwriting income of $129.9 million;

- Net investment income of $218.3 million comprised of Two Sigma

Hamilton Fund return of $122.1 million, and fixed income, short

term and cash and cash equivalents return of $96.2 million;

and

- Corporate expenses of $76.7 million, which includes $30.3

million of compensation costs related to the Value Appreciation

Pool.

Commenting on the financial results, Pina Albo, CEO of Hamilton,

said:

“2023 was a year that truly exemplified the transformation of

Hamilton’s business. Our talented team demonstrated our ability to

deliver strong results and grow at the right time and in the right

lines, all while strengthening our relationships with brokers and

clients.”

For the Three Months

Ended

($ in thousands, except for per share

amounts and percentages)

December 31, 2023

December 31, 2022

Change

Gross premiums written

$

433,791

$

341,252

$

92,539

Net premiums written

363,666

283,376

80,290

Net premiums earned

366,135

312,247

53,888

Underwriting income (loss)

$

36,028

$

38,605

$

(2,577

)

Combined ratio

90.2

%

87.6

%

2.6

%

Net income (loss) attributable to common

shareholders

$

126,865

$

(59,017

)

$

185,882

Income (loss) per share attributable to

common shareholders - diluted

$

1.15

$

(0.57

)

Book value per common share

$

18.58

$

16.14

Change in book value per share

7.1

%

(3.4

%)

Return on average common equity -

annualized

26.4

%

(13.9

%)

For the Three Months

Ended

Key Ratios

December 31, 2023

December 31, 2022

Change

Attritional loss ratio - current year

53.2

%

57.8

%

(4.6

%)

Attritional loss ratio - prior year

(1.7

%)

(4.7

%)

3.0

%

Catastrophe loss ratio - current year

1.9

%

(0.7

%)

2.6

%

Catastrophe loss ratio - prior year

(0.1

%)

(0.8

%)

0.7

%

Loss and loss adjustment expense ratio

53.3

%

51.6

%

1.7

%

Acquisition cost ratio

24.2

%

24.5

%

(0.3

%)

Other underwriting expense ratio

12.7

%

11.5

%

1.2

%

Combined ratio

90.2

%

87.6

%

2.6

%

- Gross premiums written increased by $92.5 million, or 27.1%, to

$433.8 million with an increase of $39.2 million, or 16.7% in the

International Segment, and $53.3 million, or 49.9% in the Bermuda

Segment.

- Net premiums written increased by $80.3 million, or 28.3%, to

$363.7 million with an increase of $27.5 million, or 14.5% in the

International Segment, and $52.8 million, or 56.0% in the Bermuda

Segment.

- Net premiums earned increased by $53.9 million, or 17.3%, to

$366.1 million with an increase of $25.9 million, or 15.0% in the

International Segment, and $28.0 million, or 20.1% in the Bermuda

Segment.

- Catastrophe losses (current and prior year), net of

reinsurance, were $6.5 million, or 1.8 points, driven by the Hawaii

wildfires and the March Storms, partially offset by favorable prior

year development.

- Net favorable attritional prior year reserve development was

$6.4 million.

For the Years Ended

($ in thousands, except for per share

amounts and percentages)

December 31, 2023

December 31, 2022

Change

Gross premiums written

$

1,951,038

$

1,646,673

$

304,365

Net premiums written

1,480,438

1,221,864

258,574

Net premiums earned

1,318,533

1,143,714

174,819

Underwriting income (loss)

$

129,851

$

(31,717

)

$

161,568

Combined ratio

90.1

%

102.8

%

(12.7

%)

Net income (loss) attributable to common

shareholders

$

258,727

$

(97,999

)

$

356,726

Income (loss) per share attributable to

common shareholders - diluted

$

2.44

$

(0.95

)

Book value per common share

$

18.58

$

16.14

Change in book value per share

15.1

%

(5.6

%)

Return on average common equity

13.9

%

(5.7

%)

For the Years Ended

Key Ratios

December 31, 2023

December 31, 2022

Change

Attritional loss ratio - current year

52.2

%

51.8

%

0.4

%

Attritional loss ratio - prior year

(0.8

%)

(0.3

%)

(0.5

%)

Catastrophe loss ratio - current year

3.2

%

16.3

%

(13.1

%)

Catastrophe loss ratio - prior year

(0.4

%)

(1.5

%)

1.1

%

Loss and loss adjustment expense ratio

54.2

%

66.3

%

(12.1

%)

Acquisition cost ratio

23.4

%

23.7

%

(0.3

%)

Other underwriting expense ratio

12.5

%

12.8

%

(0.3

%)

Combined ratio

90.1

%

102.8

%

(12.7

%)

- Gross premiums written increased by $304.4 million, or 18.5%,

to $2.0 billion with an increase of $172.3 million, or 18.5% in the

International Segment, and $132.1 million, or 18.5% in the Bermuda

Segment.

- Net premiums written increased by $258.6 million, or 21.2%, to

$1.5 billion with an increase of $134.6 million, or 21.2% in the

International Segment, and $123.9 million, or 21.1% in the Bermuda

Segment.

- Net premiums earned increased by $174.8 million, or 15.3%, to

$1.3 billion with an increase of $80.5 million, or 12.9% in the

International Segment, and $94.4 million, or 18.1% in the Bermuda

Segment.

- Catastrophe losses (current and prior year), net of

reinsurance, were $36.9 million, or 2.8 points, driven by the

Hawaii wildfires, the March Storms, the severe convective storms in

June 2023, Hurricane Idalia and the Vermont Floods, partially

offset by favorable prior year development.

- Net favorable attritional prior year reserve development was

$10.4 million.

Segment Underwriting Results – Fourth Quarter

International Segment

For the Three Months

Ended

($ in thousands, except for

percentages)

December 31, 2023

December 31, 2022

Change

Gross premiums written

$

273,472

$

234,273

$

39,199

Net premiums written

216,712

189,195

27,517

Net premiums earned

198,725

172,846

25,879

Underwriting income (loss)

$

1,867

$

15,650

$

(13,783

)

Key ratios

Attritional loss ratio - current year

54.5

%

60.0

%

(5.5

%)

Attritional loss ratio - prior year

(1.4

%)

(8.1

%)

6.7

%

Catastrophe loss ratio - current year

0.0

%

(1.2

%)

1.2

%

Catastrophe loss ratio - prior year

0.4

%

(1.2

%)

1.6

%

Loss and loss adjustment expense ratio

53.5

%

49.5

%

4.0

%

Acquisition cost ratio

27.7

%

27.8

%

(0.1

%)

Other underwriting expense ratio

17.9

%

13.6

%

4.3

%

Combined ratio

99.1

%

90.9

%

8.2

%

- Gross premiums written increased by $39.2 million, or 16.7%, to

$273.5 million, primarily driven by growth in specialty insurance

and reinsurance classes and casualty insurance classes.

- Catastrophe losses (current and prior year), net of

reinsurance, were $0.8 million, driven by prior year catastrophe

losses.

- Net favorable attritional prior year reserve development was

$2.7 million or 1.4 points driven by reserve releases on our

property and casualty classes of business.

- The acquisition cost ratio decreased by 0.1 points in the

fourth quarter, compared to the same period in 2022.

- The other underwriting expense ratio increased by 4.3 points in

the fourth quarter, compared to the same period in 2022, resulting

from higher incentive compensation costs.

Bermuda Segment

For the Three Months

Ended

($ in thousands, except for

percentages)

December 31, 2023

December 31, 2022

Change

Gross premiums written

$

160,319

$

106,979

$

53,340

Net premiums written

146,954

94,181

52,773

Net premiums earned

167,410

139,401

28,009

Underwriting income (loss)

$

34,161

$

22,955

$

11,206

Key ratios

Attritional loss ratio - current year

51.8

%

55.1

%

(3.3

%)

Attritional loss ratio - prior year

(2.2

%)

(0.5

%)

(1.7

%)

Catastrophe loss ratio - current year

4.1

%

0.0

%

4.1

%

Catastrophe loss ratio - prior year

(0.7

%)

(0.3

%)

(0.4

%)

Loss and loss adjustment expense ratio

53.0

%

54.3

%

(1.3

%)

Acquisition cost ratio

20.1

%

20.4

%

(0.3

%)

Other underwriting expense ratio

6.5

%

8.9

%

(2.4

%)

Combined ratio

79.6

%

83.6

%

(4.0

%)

- Gross premiums written increased by $53.3 million, or 49.9%, to

$160.3 million, primarily attributable to increases related to

expanded participation and improved pricing on the renewed casualty

reinsurance classes and new business.

- Catastrophe losses (current and prior year), net of

reinsurance, were $5.7 million, driven by the Hawaii wildfires and

the March storms, partially offset by favorable prior year

development.

- Net favorable attritional prior year reserve development was

$3.7 million or 2.2 points driven by specialty classes of

business.

- The acquisition cost ratio decreased by 0.3 points in the

fourth quarter, compared to the same period in 2022.

- The other underwriting expense ratio decreased by 2.4 points in

the fourth quarter compared to the same period in 2022. The

decrease was primarily driven by performance based management fees

generated by our third party capital manager, Ada Capital

Management Limited, partially offset by higher incentive

compensation costs.

Segment Underwriting Results – Full Year

International Segment

For the Years Ended

($ in thousands, except for

percentages)

December 31, 2023

December 31, 2022

Change

Gross premiums written

$

1,105,522

$

933,241

$

172,281

Net premiums written

770,399

635,773

134,626

Net premiums earned

703,508

623,047

80,461

Underwriting income (loss)

$

36,956

$

20,183

$

16,773

Key ratios

Attritional loss ratio - current year

53.2

%

50.9

%

2.3

%

Attritional loss ratio - prior year

(3.5

%)

(4.8

%)

1.3

%

Catastrophe loss ratio - current year

1.5

%

7.2

%

(5.7

%)

Catastrophe loss ratio - prior year

0.3

%

0.5

%

(0.2

%)

Loss and loss adjustment expense ratio

51.5

%

53.8

%

(2.3

%)

Acquisition cost ratio

26.5

%

27.4

%

(0.9

%)

Other underwriting expense ratio

16.7

%

15.5

%

1.2

%

Combined ratio

94.7

%

96.7

%

(2.0

%)

- Gross premiums written increased by $172.3 million, or 18.5%,

to $1.1 billion, primarily driven by growth in specialty insurance

and reinsurance classes and casualty insurance classes.

- Catastrophe losses (current and prior year), net of

reinsurance, were $12.6 million, driven by the Vermont Floods,

Hurricane Idalia, the Hawaii wildfires, the severe convective

storms in June 2023 and prior year catastrophe losses.

- Net favorable attritional prior year reserve development was

$24.4 million or 3.5 points driven by reserve releases on our

property and specialty classes of business.

- The acquisition cost ratio decreased by 0.9 points compared to

the same period in 2022 primarily driven by a change in business

mix.

- The other underwriting expense ratio increased by 1.2 points

compared to the same period in 2022, resulting from higher

incentive compensation costs.

Bermuda Segment

For the Years Ended

($ in thousands, except for

percentages)

December 31, 2023

December 31, 2022

Change

Gross premiums written

$

845,516

$

713,432

$

132,084

Net premiums written

710,039

586,091

123,948

Net premiums earned

615,025

520,667

94,358

Underwriting income (loss)

$

92,895

$

(51,900

)

$

144,795

Key ratios

Attritional loss ratio - current year

51.1

%

52.9

%

(1.8

%)

Attritional loss ratio - prior year

2.3

%

5.1

%

(2.8

%)

Catastrophe loss ratio - current year

5.1

%

27.1

%

(22.0

%)

Catastrophe loss ratio - prior year

(1.2

%)

(3.9

%)

2.7

%

Loss and loss adjustment expense ratio

57.3

%

81.2

%

(23.9

%)

Acquisition cost ratio

19.9

%

19.3

%

0.6

%

Other underwriting expense ratio

7.7

%

9.4

%

(1.7

%)

Combined ratio

84.9

%

109.9

%

(25.0

%)

- Gross premiums written increased by $132.1 million, or 18.5%,

to $845.5 million, primarily attributable to new business

opportunities and rate increases in casualty reinsurance classes

and property insurance classes.

- Catastrophe losses (current and prior year), net of

reinsurance, were $24.3 million, driven by the March Storms, the

Hawaii wildfires, the severe convective storms in June 2023,

Hurricane Idalia and the Vermont Floods, offset by favorable prior

year catastrophe losses.

- Net unfavorable attritional prior year reserve development was

$14.0 million or 2.3 points driven by property and casualty classes

of business, partially offset by favorable development in specialty

classes.

- The acquisition cost ratio increased by 0.6 points compared to

the same period in 2022.

- The other underwriting expense ratio decreased by 1.7 points

compared to the same period in 2022. The decrease was primarily

driven by performance based management fees generated by our third

party capital manager, Ada Capital Management Limited, partially

offset by higher incentive compensation costs.

Investments and Shareholders’ Equity as of December 31,

2023

- Total invested assets and cash of $4.0 billion compared to $3.4

billion at December 31, 2022.

- Total shareholders’ equity of $2.0 billion compared to $1.7

billion at December 31, 2022.

- Book value per share of $18.58 compared to $16.14 at December

31, 2022, an increase of 15.1%.

Conference Call Details and Additional Information

Conference Call Information

Hamilton will host a conference call to discuss its financial

results on Thursday, March 7, 2024, at 10:00 a.m. ET. The

conference call can be accessed by dialing 1-855-761-5600 (US toll

free), or 1-646-307-1097, and entering the conference ID

6439207.

A live, audio webcast of the conference call will also be

available through the Investors portal of the Company’s website at

investors.hamiltongroup.com.

A replay of the audio conference call will be available at

investors.hamiltongroup.com or by dialing 1-800-770-2030

(U.S. toll free) and entering the conference ID 6439207.

Additional Information

In addition to the information provided in the Company's

earnings release, we have also made available supplementary

financial information and an investor presentation which may be

referred to during the conference call and will be available on the

Company’s website at investors.hamiltongroup.com.

About Hamilton Insurance Group, Ltd.

Hamilton is a Bermuda-headquartered company that underwrites

specialty insurance and reinsurance risks on a global basis through

its wholly owned subsidiaries. Its three underwriting platforms:

Hamilton Global Specialty, Hamilton Re and Hamilton Select, each

with dedicated and experienced leadership, provide us with access

to diversified and profitable markets around the world.

For more information about Hamilton Insurance Group, visit our

website at www.hamiltongroup.com or on LinkedIn at

Hamilton.

Consolidated Balance Sheet

($ in thousands)

December 31,

2023

December 31,

2022

Assets

Fixed maturity investments, at fair

value

(amortized cost 2023: $1,867,499; 2022:

$1,348,684)

$

1,831,268

$

1,259,476

Short-term investments, at fair value

(amortized cost 2023: $427,437; 2022: $285,130)

428,878

286,111

Investments in Two Sigma Funds, at fair

value (cost 2023: $770,191; 2022: $731,100)

851,470

740,736

Total investments

3,111,616

2,286,323

Cash and cash equivalents

794,509

1,076,420

Restricted cash and cash equivalents

106,351

130,783

Premiums receivable

658,363

522,670

Paid losses recoverable

145,202

90,655

Deferred acquisition costs

156,895

115,147

Unpaid losses and loss adjustment expenses

recoverable

1,161,077

1,177,863

Receivables for investments sold

42,419

371

Prepaid reinsurance

194,306

164,313

Intangible assets

90,996

86,958

Other assets

209,621

167,462

Total assets

$

6,671,355

$

5,818,965

Liabilities, non-controlling interest,

and shareholders' equity

Liabilities

Reserve for losses and loss adjustment

expenses

$

3,030,037

$

2,856,275

Unearned premiums

911,222

718,188

Reinsurance balances payable

272,310

244,320

Payables for investments purchased

66,606

48,095

Term loan, net of issuance costs

149,830

149,715

Accounts payable and accrued expenses

186,887

138,050

Payables to related parties

6,480

20

Total liabilities

4,623,372

4,154,663

Non-controlling interest – TS Hamilton

Fund

133

119

Shareholders’ equity

Common shares:

Class A, authorized (2023: 28,644,807 and

2022: 53,993,690), par value $0.01;

issued and outstanding (2023: 28,644,807

and 2022: 30,520,078)

286

305

Class B, authorized (2023: 72,337,352 and

2022: 50,480,684), par value $0.01;

issued and outstanding (2023: 56,036,067

and 2022: 42,042,155)

560

420

Class C, authorized (2023: 25,544,229 and

2022: 30,525,626), par value $0.01;

issued and outstanding (2023: 25,544,229

and 2022: 30,525,626)

255

305

Additional paid-in capital

1,249,817

1,120,242

Accumulated other comprehensive loss

(4,441

)

(4,441

)

Retained earnings

801,373

547,352

Total shareholders' equity

2,047,850

1,664,183

Total liabilities, non-controlling

interest, and shareholders' equity

$

6,671,355

$

5,818,965

Consolidated Statement of Operations

Three Months Ended December

31,

Years Ended December

31,

($ in thousands, except per share

information)

2023

2022

2023

2022

Revenues

Gross premiums written

$

433,791

$

341,252

$

1,951,038

$

1,646,673

Reinsurance premiums ceded

(70,125

)

(57,876

)

(470,600

)

(424,809

)

Net premiums written

363,666

283,376

1,480,438

1,221,864

Net change in unearned premiums

2,469

28,871

(161,905

)

(78,150

)

Net premiums earned

366,135

312,247

1,318,533

1,143,714

Net realized and unrealized gains (losses)

on investments

107,517

(60,280

)

209,399

86,357

Net investment income (loss)

12,737

695

30,456

(21,487

)

Total net realized and unrealized gains

(losses) on investments and net investment income (loss)

120,254

(59,585

)

239,855

64,870

Net gain on sale of equity method

investment

211

6,991

211

6,991

Other income (loss)

10,792

2,199

18,631

11,316

Net foreign exchange gains (losses)

(2,230

)

(9,245

)

(6,185

)

6,137

Total revenues

495,162

252,607

1,571,045

1,233,028

Expenses

Losses and loss adjustment expenses

195,049

161,318

714,603

758,333

Acquisition costs

88,615

76,394

309,148

271,189

General and administrative expenses

101,781

42,392

259,856

177,682

Impairment of goodwill

—

24,082

—

24,082

Amortization of intangible assets

2,914

2,957

10,783

12,832

Interest expense

5,428

4,485

21,434

15,741

Total expenses

393,787

311,628

1,315,824

1,259,859

Income (loss) before income tax

101,375

(59,021

)

255,221

(26,831

)

Income tax expense (benefit)

(31,974

)

1

(25,066

)

3,104

Net income (loss)

133,349

(59,022

)

280,287

(29,935

)

Net income (loss) attributable to

non-controlling interest

6,484

(5

)

21,560

68,064

Net income (loss) and other

comprehensive income (loss) attributable to common

shareholders

$

126,865

$

(59,017

)

$

258,727

$

(97,999

)

Per share data

Basic income (loss) per share attributable

to common shareholders

$

1.18

$

(0.57

)

$

2.47

$

(0.95

)

Diluted income (loss) per share

attributable to common shareholders

$

1.15

$

(0.57

)

$

2.44

$

(0.95

)

Non-GAAP Financial Measures Reconciliation

We present our results of operations in a way that we believe

will be the most meaningful and useful to investors, analysts,

rating agencies and others who use our financial information to

evaluate our performance. Some of the measurements are considered

non-GAAP financial measures under SEC rules and regulations. In

this press release, we present underwriting income (loss), a

non-GAAP financial measure as defined in Item 10(e) of SEC

Regulation S-K. We believe that non-GAAP financial measures, which

may be defined and calculated differently by other companies, help

explain and enhance the understanding of our results of operations.

However, these measures should not be viewed as a substitute for

those determined in accordance with U.S. GAAP. Where appropriate,

reconciliations of our non-GAAP measures to the most comparable

GAAP figures are included below.

Underwriting Income (Loss)

We calculate underwriting income (loss) on a pre-tax basis as

net premiums earned less losses and loss adjustment expenses,

acquisition costs and other underwriting expenses (net of third

party fee income). We believe that this measure of our performance

focuses on the core fundamental performance of the Company’s

reportable segments in any given period and is not distorted by

investment market conditions, corporate expense allocations or

income tax effects.

The following table reconciles underwriting income (loss) to net

income (loss), the most comparable GAAP financial measure:

For the Three Months

Ended

For the Years Ended

($ in thousands)

December 31, 2023

December 31, 2022

December 31, 2023

December 31, 2022

Underwriting income (loss)

$

36,028

$

38,605

$

129,851

$

(31,717

)

Total net realized and unrealized gains

(losses) on investments and net investment income (loss)

120,254

(59,585

)

239,855

64,870

Net gain on sale of equity method

investment

211

6,991

211

6,991

Other income (loss), excluding third party

fee income

312

(55

)

397

(315

)

Net foreign exchange gains (losses)

(2,230

)

(9,245

)

(6,185

)

6,137

Corporate expenses

(44,858

)

(4,208

)

(76,691

)

(20,142

)

Impairment of goodwill

—

(24,082

)

—

(24,082

)

Amortization of intangible assets

(2,914

)

(2,957

)

(10,783

)

(12,832

)

Interest expense

(5,428

)

(4,485

)

(21,434

)

(15,741

)

Income tax (expense) benefit

31,974

(1

)

25,066

(3,104

)

Net income (loss), prior to

non-controlling interest

$

133,349

$

(59,022

)

$

280,287

$

(29,935

)

Third Party Fee Income

Third party fee income includes income that is incremental

and/or directly attributable to our underwriting operations. It is

primarily comprised of fees earned by the International Segment for

management services provided to third party syndicates and

consortia and by the Bermuda Segment for performance based

management fees generated by our third party capital manager, Ada

Capital Management Limited. We believe that this measure is a

relevant component of our underwriting income (loss).

The following table reconciles third party fee income to other

income, the most comparable GAAP financial measure:

For the Three Months

Ended

For the Years Ended

($ in thousands)

December 31, 2023

December 31, 2022

December 31, 2023

December 31, 2022

Third party fee income

$

10,480

$

2,254

$

18,234

$

11,631

Other income (loss), excluding third party

fee income

312

(55

)

397

(315

)

Other income (loss)

$

10,792

$

2,199

$

18,631

$

11,316

Other Underwriting Expenses

Other underwriting expenses include those general and

administrative expenses that are incremental and/or directly

attributable to our underwriting operations. While this measure is

presented in Note 10, Segment Reporting in the consolidated

financial statements, it is considered a non-GAAP financial measure

when presented elsewhere.

Corporate expenses include holding company costs necessary to

support our reportable segments. As these costs are not incremental

and/or directly attributable to our underwriting operations, these

costs are excluded from other underwriting expenses, and therefore,

underwriting income (loss). General and administrative expenses,

the most comparable GAAP financial measure to other underwriting

expenses, also includes corporate expenses.

The following table reconciles other underwriting expenses to

general and administrative expenses, the most comparable GAAP

financial measure:

For the Three Months

Ended

For the Years Ended

($ in thousands)

December 31, 2023

December 31, 2022

December 31, 2023

December 31, 2022

Other underwriting expenses

$

56,923

$

38,184

$

183,165

$

157,540

Corporate expenses

44,858

4,208

76,691

20,142

General and administrative expenses

$

101,781

$

42,392

$

259,856

$

177,682

Special Note Regarding Forward-Looking Statements

This information may contain forward-looking statements which

reflect the Company's current views with respect to future events

and financial performance and are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are made based on management's current

expectations and beliefs concerning future developments and their

potential effects upon Hamilton. There can be no assurance that

future developments affecting Hamilton will be those anticipated by

management. Forward-looking statements include, without limitation,

all matters that are not historical facts. These forward-looking

statements are not a guarantee of future performance and involve

risk and uncertainties, and there are certain important factors

that could cause actual results to differ, possibly materially,

from expectations or estimates reflected in such forward-looking

statements, including the following:

- our results of operations and financial condition could be

adversely affected by unpredictable catastrophic events, global

climate change or emerging claim and coverage issues;

- our business could be materially adversely affected if we do

not accurately assess our underwriting risk, our reserves are

inadequate to cover our actual losses, our models or assessments

and pricing of risks are incorrect or we lose important broker

relationships;

- the insurance and reinsurance business is historically cyclical

and the pricing and terms for our products may decline, which would

affect our profitability and ability to maintain or grow

premiums;

- we have significant foreign operations that expose us to

certain additional risks, including foreign currency risks and

political risk;

- we do not control the allocations to and/or the performance of

the Two Sigma Hamilton Fund, LLC ("TS Hamilton Fund")’s investment

portfolio, and its performance depends on the ability of its

investment manager, Two Sigma, to select and manage appropriate

investments and we have a limited ability to withdraw our capital

accounts;

- Two Sigma Principals, LLC, Two Sigma and their respective

affiliates have potential conflicts of interest that could

adversely affect us;

- the historical performance of Two Sigma Investments, LP ("Two

Sigma") is not necessarily indicative of the future results of the

TS Hamilton Fund’s investment portfolio or of our future

results;

- our ability to manage risks associated with macroeconomic

conditions resulting from geopolitical and global economic events,

including public health crises, current or anticipated military

conflicts, terrorism, sanctions, rising energy prices, inflation

and interest rates and other global events;

- our ability to compete successfully with more established

competitors and risks relating to consolidation in the reinsurance

and insurance industries;

- downgrades, potential downgrades or other negative actions by

rating agencies;

- our dependence on key executives, including the potential loss

of Bermudian personnel as a result of Bermuda employment

restrictions, and the inability to attract qualified personnel,

particularly in very competitive hiring conditions;

- our dependence on letter of credit facilities that may not be

available on commercially acceptable terms;

- our potential need for additional capital in the future and the

potential unavailability of such capital to us on favorable terms

or at all;

- the suspension or revocation of our subsidiaries’ insurance

licenses;

- risks associated with our investment strategy, including such

risks being greater than those faced by competitors;

- changes in the regulatory environment and the potential for

greater regulatory scrutiny of the Company going forward;

- a cyclical downturn of the reinsurance industry;

- operational failures, failure of information systems or failure

to protect the confidentiality of customer information, including

by service providers, or losses due to defaults, errors or

omissions by third parties or our affiliates;

- we are a holding company with no direct operations, and our

insurance and reinsurance subsidiaries’ ability to pay dividends

and other distributions to us is restricted by law;

- risks relating to our ability to identify and execute

opportunities for growth or our ability to complete transactions as

planned or realize the anticipated benefits of our acquisitions or

other investments;

- our potentially becoming subject to U.S. federal income

taxation, Bermuda taxation or other taxes as a result of a change

of tax laws or otherwise;

- the potential characterization of us and/or any of our

subsidiaries as a passive foreign investment company, or PFIC;

- our potentially becoming subject to U.S. withholding and

information reporting requirements under the U.S. Foreign Account

Tax Compliance Act, or FATCA, provisions;

- our costs will increase as a result of operating as a public

company, and our management will be required to devote substantial

time to complying with public company regulations;

- if we were to identify a material weakness and were unable to

remediate such material weakness, or fail to achieve and maintain

effective internal controls, our operating results and financial

condition could be impacted and the market price of our Class B

common shares may be negatively affected;

- the lack of a prior public market for our Class B common shares

means our share price may be volatile and anti-takeover provisions

contained in our organizational documents could delay management

changes;

- the potential that the market price of our Class B common

shares could decline due to future sales of shares by our existing

shareholders;

- applicable insurance laws, which could make it difficult to

effect a change of control of our company;

- investors may have difficulties in serving process or enforcing

judgments against us in the United States; and

- other factors affecting future results disclosed in the

Company’s filing with the SEC, including the Form 10-K.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306774801/en/

Jon Levenson & Darian Niforatos

Investor.Relations@hamiltongroup.com

Media contact: Kelly Corday Ferris

kelly.ferris@hamiltongroup.com

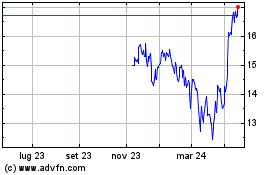

Grafico Azioni Hamilton Insurance (NYSE:HG)

Storico

Da Gen 2025 a Feb 2025

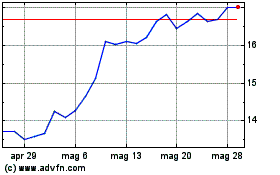

Grafico Azioni Hamilton Insurance (NYSE:HG)

Storico

Da Feb 2024 a Feb 2025