Hilton Announces Pricing of Senior Notes Offering

22 Marzo 2024 - 10:28PM

Business Wire

Hilton Worldwide Holdings Inc. (NYSE: HLT) (“Hilton”) announced

today that its indirect subsidiary Hilton Domestic Operating

Company Inc. (the “Issuer”) finalized the terms of the Issuer’s

offering of $550 million aggregate principal amount of 5.875%

Senior Notes due 2029 (the “2029 Notes”) and $450 million aggregate

principal amount of 6.125% Senior Notes due 2032 (the “2032 Notes”

and, together with the 2029 Notes, the “Notes”). The Issuer

anticipates that consummation of the offering will occur on March

26, 2024, subject to customary closing conditions, and intends to

use the net proceeds of the offering for general corporate

purposes, including the repayment of $200 million of indebtedness

under the senior secured revolving credit facility, investments and

acquisitions.

The Notes offered have not been registered under the Securities

Act of 1933, as amended (the “Securities Act”), or any state

securities laws. The Notes may not be offered or sold in the United

States except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

and applicable state securities laws. The Notes were offered by the

initial purchasers only to persons reasonably believed to be

“qualified institutional buyers” in reliance on the exemption from

registration provided by Rule 144A under the Securities Act and to

certain non-U.S. persons in offshore transactions in reliance on

Regulation S under the Securities Act.

This press release is being issued pursuant to and in accordance

with Rule 135c under the Securities Act, and it is neither an offer

to sell nor a solicitation of an offer to buy any securities and

shall not constitute an offer to sell or a solicitation of an offer

to buy, or a sale of, the Notes or any other securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act, and Section 21E

of the Securities Exchange Act of 1934, as amended. These

statements include, but are not limited to, statements related to

Hilton’s expectations regarding the performance of its business,

Hilton’s future financial results, liquidity and capital resources

and other non-historical statements. In some cases, you can

identify these forward-looking statements by the use of words such

as “outlook,” “believes,” “expects,” “forecasts,” “potential,”

“continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates” or the

negative version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties including, among others, risks inherent to the

hospitality industry; macroeconomic factors beyond Hilton’s

control, such as inflation, changes in interest rates, challenges

due to labor shortages or disputes and supply chain disruptions;

competition for hotel guests and management and franchise

contracts; risks related to doing business with third-party hotel

owners; performance of Hilton’s information technology systems;

growth of reservation channels outside of Hilton’s system; risks of

doing business outside of the United States; risks associated with

conflicts in Eastern Europe and the Middle East and other

geopolitical events; and Hilton’s indebtedness. Accordingly, there

are or will be important factors that could cause Hilton’s actual

outcomes or results to differ materially from those indicated on

these statements. Hilton believes these factors include, but are

not limited to, those described under the section entitled “Part

I—Item 1A. Risk Factors” of Hilton’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, filed with the Securities

and Exchange Commission (the “SEC”), as such factors may be updated

from time to time in Hilton’s periodic filings with the SEC, which

are accessible on the SEC’s website at www.sec.gov. These factors

should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in this press release and in Hilton’s filings with the SEC. Hilton

undertakes no obligation to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240322213590/en/

Investor Contact Jill Chapman +1 703 883 1000

Media Contact Kent Landers +1 703 883 3246

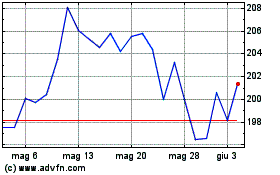

Grafico Azioni Hilton Worldwide (NYSE:HLT)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Hilton Worldwide (NYSE:HLT)

Storico

Da Feb 2024 a Feb 2025