AABB GOLD STOCK EXCEPTIONALLY

UNDERVALUED AND POISED FOR SHARP REVALUATION

September 6, 2019 -- InvestorsHub NewsWire -- via BioResearch

Alert

Sep. 5, 2019 8:59 PM ET|About: Asia Broadband, Inc. (AABB), Includes: AXU, GPL, HMY, SAND

Asia Metals, a wholly owned

subsidiary of Asia Broadband, Inc. (AABB:

OTC) is an outstanding and highly undervalued candidate in the

hot gold mining sector. AABB has already begun or accomplished

every single bullet listed above and is expected to announce

further news throughout 2019 and beyond that will likely impact the

share price dramatically.

Readers are encouraged to click on

the links in the bullets above.

Management recently announced that there will

soon be an update of existing gold mine activity and on that

acquisition pipeline.

Asia Broadband Inc. (AABB),

through its wholly owned subsidiary Asia Metals Inc. plans to

publish a management update next week on Thursday, September 5,

2019. The update will include on the latest developments with the

company's high-density, shallow goldmine in Guerrero, Mexico and on

the company's recently announced gold

mine acquisition campaign targeting properties that have historic

gold production in South America, Central America and

Mexico.

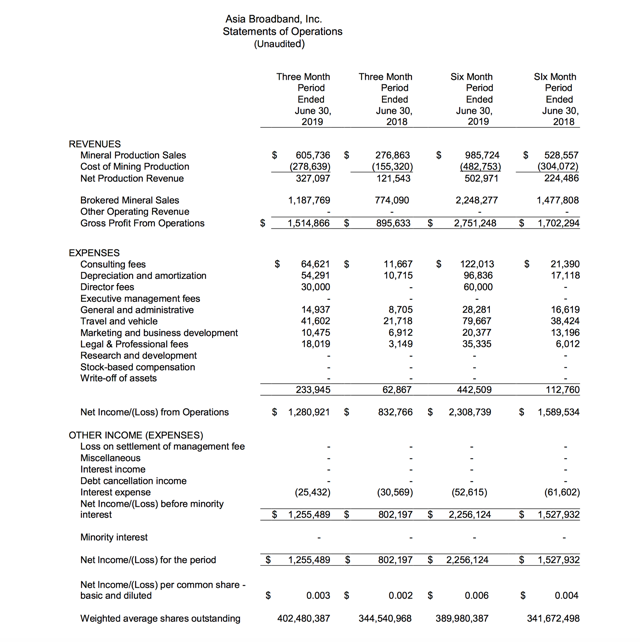

The company recently reported $2.75

million in 2019 YTD gross profits from its overall operations and

the update next week will include further details on the company's

previously disclosed $5 million gross profit target for year-end

2019. Learn more about ongoing operations, the Guerrero gold mine,

and the new gold mine acquisition campaign next week in the

management update.

Asia Broadband Inc. (AABB),

through its wholly owned subsidiary Asia Metals Inc., is a resource

company focused on the production, supply and sale of precious and

base metals, primarily to Asian markets. The Company utilizes its

specific geographic expertise, experience and extensive industry

contacts to facilitate its innovative distribution process from the

production and supply of precious and base metals in Guerrero,

Mexico, to our client sales networks in Asia. This vertical

integration approach to sales transactions is the unique strength

of Asia Broadband and differentiates the Company to its

shareholders.

Market

Comps

Emerging MicroCaps reviewed 4

comparable junior gold mining stocks and concluded that AABB is

highly undervalued and unrecognized. Given the current run rate of

about $5 million per year in sales, the following table concludes

that AABB shares would be selling at about 25.78 times sales, or

about $128 million. With a total outstanding of 402 million shares,

that translates to a fair market price of $.32 per

share.

Company Symbol Price/Sales

Ratio

Alexco Resource Corp. AXU: NYSE

14.65

Great Panther Mining Limited GPL:

NYSE 4.13

Harmony Gold Mining Company Ltd.

HMY: NYSE 70

Sandstrom Gold Ltd. SAND: NYSE

14.34

Total 103.12

Average Price to Sales Ratio 103.12

divided by 4 = 25.78

Asia Broadband, Inc.

2019 sales $5,000,000

P/S ratio of 25.78 = Mkt Cap -

$128,900,000

$128,900,000 divided by 402 million

shares equals $.32 per share

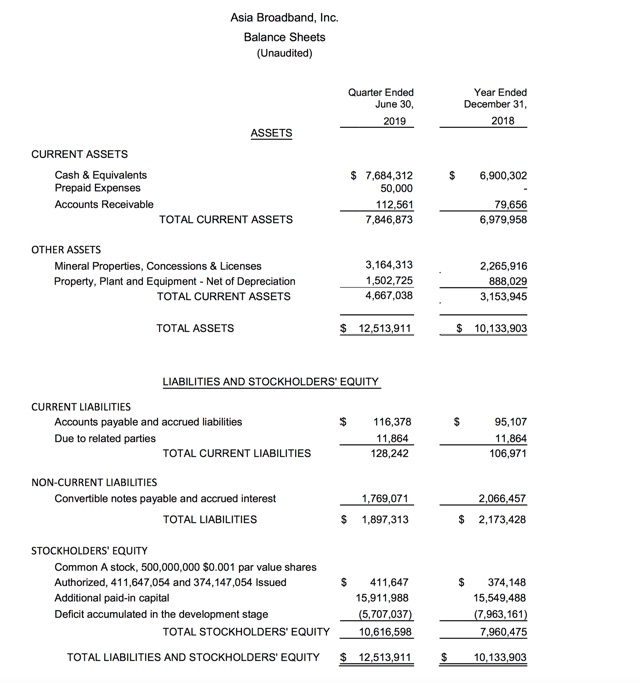

CURRENT

FINANCIALS

Conclusion:

AABB is already over half way to

the $5 million in sales as of June 30, 2019 and management is

forecasting that they will beat $5 million.

When sales of $5 million are

reported, expect investors to take notice that will value shares

closer to current market comparison values.

Emerging MicroCaps places AABB

12-month target at $.32 per share.

Legal

Disclosure:

Except for the historical

information presented herein, matters discussed in this release

contain forward-looking statements that are subject to certain

risks and uncertainties that could cause actual results to differ

materially from any future results, performance or achievements

expressed or implied by such statements. Emerging MicroCaps or

BioResearchAlert or its principals may have been compensated for

its services. The Information contains forward-looking statements,

i.e. statements or discussions that constitute predictions,

expectations, beliefs, plans, estimates, or projections as

indicated by such words as ''expects,'' ''will,'' ''anticipates,''

and ''estimates''; therefore, you should proceed with extreme

caution in relying upon such statements and conduct a full

investigation of the Information and the Profiled Issuer as well as

any such forward-looking statements.

Disclosure: I/we have no

positions in any stocks mentioned, and no plans to initiate any

positions within the next 72 hours.

Original Article Published On Seeking Alpha:

https://seekingalpha.com/instablog/21922151-bioresearch-alert/5348322-aabb-gold-stock-exceptionally-undervalued-poised-sharp-revaluation

Source: BioResearch Alert

Grafico Azioni Harmony Gold Mining (NYSE:HMY)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Harmony Gold Mining (NYSE:HMY)

Storico

Da Dic 2023 a Dic 2024