UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 6K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a16 OR 15d16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 For February 28, 2024 Harmony Gold Mining Company Limited Randfontein Office Park Corner Main Reef Road and Ward Avenue Randfontein, 1759 South Africa (Address of principal executive offices) *- (Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20 F or Form 40F.) Form 20F ☒ Form 40F ☐ (Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g32(b) under the Securities Exchange Act of 1934.) Yes ☐ No ☒

SALIENT FEATURES (H1FY24 vs H1FY23^) Harmony Gold Mining Company Limited Incorporated in the Republic of South Africa Registration number: 1950/038232/06 JSE share code: HAR NYSE share code: HMY ISIN: ZAE000015228 (“Harmony” or “the company”) INTERIM RESULTS FY24* for the six-month period ended 31 December 2023 (H1FY24) • Safety continues to improve with group LTIFR1 at 5.19, from 5.38 per million hours worked • 226% increase in headline earnings per share to 956 SA cents (51 US cents) per share from 293 SA cents (17 US cents) per share • Record operating free cash flow, up 265% to R7 112 million (US$381 million) driven by operational excellence and higher recovered grades • A record interim dividend2,3 declared of 147 SA cents (7.61 US cents) per share • 11% increase in underground recovered grades to 6.29g/t from 5.68g/t • 5% decrease in group all-in sustaining costs (AISC) to R843 043/kg (US$1 403/oz) from R890 048/kg (US$1 598/oz) • 35% increase in group revenue to R31 415 million (US$1 681 million) from R23 259 million (US$1 343 million) • 14% increase in total gold production to 25 889kg (832 349oz) from 22 809kg (733 325oz) • 30% increase in production from Mponeng as a result of improved underground recovered grades • Mponeng extension project approved, extending mine life from 7 to 20 years and increasing margins • Hidden Valley generated operating free cash flow of R1 769 million (US$95 million), due to excellent recovered grades, compared to -R69 million (-US$4 million) • 18% increase in average gold price received to R1 141 424/kg (US$1 900/oz) from R963 464/kg (US$1 730/oz) • Strong, flexible balance sheet now in a net cash position of R74 million (US$4 million) • FY24 production, grade, cost and capital guidance remains unchanged MESSAGE FROM THE CHIEF EXECUTIVE OFFICER OVERVIEW Harmony delivered an exceptional set of results in H1FY24 on the back of improved safety and a strong operational performance. Quality mining practices and operational discipline have ensured that we have the necessary flexibility to maintain production at all our mines. The stellar results in this reporting period were a result of our ongoing investment in safety, higher quality ounces, a stable and predictable cost structure and operational excellence across the entire group. The strong partnerships we have with our stakeholders enable us to operate successfully. We are now well-positioned to take advantage of the strong gold price, enabling us to generate record operating free cash flows. Basic earnings per share increased by 221% to 956 SA cents (51 US cents) compared to 298 SA cents (17 US cents) per share in the previous reporting period. Headline earnings per share increased by 226% to 956 SA cents (51 US cents) per share compared to 293 SA cents (17 US cents) per share in H1FY23. Harmony’s dividend policy is to pay a return of 20% of net free cash generated4 to shareholders at the discretion of the board of directors. Therefore, we are pleased to announce an interim dividend of 147 SA cents (7.61 US cents) per share for this reporting period, rewarding our shareholders alongside our investment in our portfolio. With our robust, flexible balance sheet and excellent cash-generation, Harmony remains well-positioned to continue growing its Mineral Reserves as we transition into a quality, global gold-copper producer. Safety remains our primary focus. Significant progress has been made and importantly, we are moving in the right direction. This journey requires daily commitment and we are confident we will ultimately achieve our goal of zero loss of life. We are embedding a proactive culture of safety and care at all levels through our ongoing Thibakotsi humanistic cultural transformation programme. Our lost time injury frequency rate (LTIFR) is trending lower and indicates the incredible amount of work we have put into improving safety throughout Harmony. Group LTIFR improved to 5.19 per million hours worked in H1FY24 from 5.38 per million hours worked in H1FY23, demonstrating that a safe mine is a productive mine. There is an abundance of opportunities within our portfolio. As leaders in the South African underground gold mining sector, we continue to convert these opportunities into value. We are allocating capital towards our high-grade underground assets, high-margin surface source operations and international copper projects as we grow our Mineral Reserves and deliver an improved return on capital. I am delighted to announce that we have received board approval to commence with the life-of-mine extension project at Mponeng in the West Wits region. Mponeng is an incredible mine with existing world- class infrastructure. It also has access to two excellent orebodies, both with exceptional grades. This major project will add 3.05Moz Mineral Reserves, over the life of the mine, delivering average expected steady state production of approximately 260 000oz per annum. Recovered grades will exceed 9g/t, resulting in an attractive real all-in sustaining cost (AISC) of R768 000/kg (US$1 290/oz) based * The condensed consolidated interim financial statements for the six months ended 31 December 2023 on pages 15 to 34 have been reviewed by our external auditors, Ernst & Young Inc. ^ The six-month period ended 31 December 2022 (H1FY23) 1 LTIFR – lost time injury frequency rate 2 See dividend notice on page 8 for the details 3 Illustrative equivalent based on the closing exchange rate of R19.31/US$1 as at 23 February 2024 4 Net free cash is defined as operating free cash flow after capital, interest, tax, corporate and other expenses OPERATIONAL EXCELLENCE DELIVERS RECORD OPERATING FREE CASH FLOWS AS HARMONY REMAINS ON TRACK TO MEET FULL-YEAR GUIDANCE MPONENG LIFE-OF-MINE EXTENSION APPROVED Johannesburg, South Africa. Wednesday, 28 February 2024. Harmony Gold Mining Company Limited (Harmony or the Company) is pleased to report our financial and operational results for H1FY24.

2 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 on current assumptions and estimates. The life of mine will be extended from 7 to 20 years, ensuring Mponeng remains a top performing asset in our portfolio until at least 2044. With substantial Mineral Resources of 24Moz, this is another example of how we continue to extend our production profile by converting Mineral Resources into Mineral Reserves. This project will have a significant positive social impact as the capital we allocate towards these quality ounces will ultimately benefit all our stakeholders. This is a perfect example of environment, social and governance (ESG) in action and embodies how Harmony creates long-term value for its shareholders and stakeholders. More details on this project are provided under the operational and financial results section below. Major projects currently in execution include the Moab Khotsong life-of-mine extension (Zaaiplaats), the Hidden Valley extension and the Mine Waste Solutions tailings surface facility extension (Kareerand), all of which are on track. Harmony's integrated approach to risk management ensures we proactively manage ongoing global supply chain and country-specific risks, thereby mitigating any potential negative impacts on safety and production. We did not experience any meaningful impact on production as a result of global geopolitical instability. However, we may benefit from a stronger gold price on the back of continued economic uncertainty globally. We are also continuously managing our electricity demand and implementing further energy-saving initiatives to ensure production is not negatively impacted by the ongoing energy supply risks in South Africa. We are pleased to announce that group production for this reporting period increased by 14% to 25 889kg (832 349oz) from 22 809kg (733 325oz) in H1FY23. This was mainly due to higher recovered grades at Mponeng, Moab Khotsong, Hidden Valley and Mine Waste Solutions. The South African underground operations delivered an 11% increase in underground recovered grade of 6.29g/t in H1FY24 from 5.68g/t in H1FY23. The primary contributor was Mponeng which saw recovered grades increase by 30% to 10.34g/t from 7.98g/t. Recovered grades at Hidden Valley increased by 78% to 1.78g/t from 1.00g/t. Gold revenue for this reporting period increased by 32% to R29 705 million (US$1 590 million) compared to R22 532 million (US$1 301 million) in H1FY23. This increase was mainly as a result of higher recovered grades and an 18% increase in the average gold price received to R1 141 424/kg (US$1 900/oz) from R963 464/kg (US$1 730/oz) in H1FY23. Group operating free cash flows increased by 265% to a record R7 112 million (US$381 million), driven mainly by the higher recovered grades and a higher average gold price received. Hidden Valley generated R1 769 million (US$95 million) in positive operating free cash flows compared to -R69 million (-US$4 million) utilisation in the previous reporting period. Our costs continue to be well-managed and we are pleased that our key cost metrics per unit continue to trend lower year-on-year – in both rand and US dollar terms. This is as a result of our diversified and lower-risk sources of production, higher recovered grades and higher by-product credits from silver and uranium. • Cash operating costs in H1FY24 decreased by 3% to R715 617/kg (US$1 191/oz) from R738 788/kg (US$1 327/oz) • AISC decreased by 5% to R843 043/kg (US$1 403/oz) from R890 048/kg (US$1 598/oz) • All-in costs (AIC) decreased by 3% to R903 619/kg (US$1 504/oz) from R931 736/kg (US$1 673/oz) Silver production from Hidden Valley increased by 74% to 64 383kg (2 069 963oz), from 37 101kg (1 192 813oz) in H1FY23. The average silver price received also increased by 26% to R14 153/kg (US$23.56/oz), from R11 235/kg (US$18.70/oz) in H1FY23. As a result, we generated R935 million (US$50 million) in silver revenue in H1FY24 compared to R428 million (US$23 million) in the comparable reporting period. Uranium production for this reporting period increased by 37% to 139 715kg (308 018lb) from 101 897kg (224 644lb) in H1FY23. Uranium sold increased by 272% to 160 118kg (353 000lb) from 43 091kg (95 000lb). Year-on-year, the average uranium price received increased by 45% to US$65.95/lb from US$45.57/lb, resulting in uranium revenue of R435 million (US$23 million) compared to R81 million (US$4 million) in the previous reporting period. Uranium is a by-product from the gold extraction process at Moab Khotsong. We are exploring opportunities to source further value from the uranium in our portfolio. Effective capital allocation remains key to delivering positive total shareholder returns, growing our reserves and operating sustainably. Our capital allocation framework aims to balance our growth aspirations alongside shareholder returns to create long-term value. Therefore, it is critical that we continue investing in our business. Group capital expenditure for H1FY24 increased by 5% to R3 826 million (US$205 million) from R3 630 million (US$210 million) in H1FY23 to advance Zaaiplaats, the Moab Khotsong extension project and Kareerand, the Mine Waste Solutions extension project. We expect to deploy the majority of our forecast capital expenditure of R9 530 million (US$521 million)** during the remainder of FY24. With R9 840 million (US$538 million) in available headroom through cash and undrawn facilities, our balance sheet is strong and we are well positioned to execute on our project pipeline. We aim to keep our net debt to EBITDA below 1 times, but now have a net cash position of R74 million (US$4 million) as at the end of December 2023. MESSAGE FROM THE CHIEF EXECUTIVE OFFICER continued Note: ** This amount was converted using the forecast short-term exchange rate of R18.28. HEALTH AND SAFETY We are making good progress in our journey towards achieving our goal of zero loss-of-life. Our best-in-class humanistic culture transformation programme is changing the hearts and minds of our employees, ensuring a positive relationship with safety. The vast amounts of data we generate from over 9 million golden control data points is being used to proactively manage safety throughout Harmony. These efforts have made a meaningful difference towards ensuring our employees return home safely after work every day. There are also various healthcare initiatives to ensure we maintain a healthy and engaged workforce. Mental wellness and the prevention of work-related illness remain of critical importance. It is therefore with much sadness and regret that three of our colleagues lost their lives in mine-related incidents in H1FY24 and one colleague in January (Q3FY24), which falls outside of this reporting period. We pay our deepest respects and send our condolences to the families and loved ones of the following colleagues: • Mlandelwa Zide (scraper winch operator at Tshepong North) • Amahle Nodangala (rock drill operator at Kusasalethu) • Luvuyo Sangeni (development team member at Kusasalethu) • Santos Ernesto Uenzane (mine overseer at Mponeng) For the South African operations, LTIFR improved to 5.40 per million hours worked in H1FY24 compared to 5.74 in H1FY23. The loss-of-life injury frequency rate was 0.07 per million hours worked in H1FY24 compared to 0.07 in H1FY23. Hidden Valley’s LTIFR for the reporting period increased to 0.69 per million hours worked from zero in H1FY23.

3 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 Some of the notable safety milestones achieved in H1FY24 included: • 2 million loss-of-life free shifts achieved at Tshepong South (810 days), Doornkop (643 days) and Moab Khotsong (431 days) • Seven out of nine Harmony underground operations achieved over 1 million loss-of-life free shifts SUSTAINABILITY Sustainability and ethical mining is integral to our operating model at Harmony. We continue to receive positive external recognition for our embedded approach to sustainability and transparency. Harmony has once again been included in the FTSE4Good Index. Our inclusion in the Bloomberg Gender-Equality Index for five consecutive years demonstrates we foster gender diversity and inclusivity, and treat all our employees fairly, without bias or prejudice of any kind. The Company again achieved a score of ‘A’ from the CDP for our best practice water management strategy in 2023. Phase 1 of our renewable energy programme is fully integrated into our operations, generating 30MW in renewable solar energy in the Free State. Phase 2 of our renewable programme consists of two phases, namely 2A and 2B, which will add a further 137MW of photovoltaic solar power. In Phase 2A, we will build a 100MW solar plant at Moab Khotsong using the R1.5 billion (US$80 million) green loan with construction now expected to commence in early 2025 financial year (FY25). Planning is underway for Phase 2B which will deliver an additional 37MW in solar renewable energy through a power purchase agreement. More information is available in our FY23 ESG and TCFD reports that are available on our website at www.harmony.co.za. OPERATIONAL AND FINANCIAL RESULTS FOR H1FY24 (COMPARED TO H1FY23) Our gold and gold equivalents come from a diverse range of sources, ensuring an overall positive contribution to our strategy of safe, profitable ounces and improving margins. Our investment in high-grade mines and high-margin surface source operations is delivering as planned. Our operations are grouped into four business areas, and are discussed below. 1. South African underground operations: high-grade Our high-grade mines, Mponeng and Moab Khotsong, delivered another excellent operational performance, driven mainly by the improvement in underground recovered grades. Production for H1FY24 increased by 21% to 8 045kg (258 652oz) compared to 6 631kg (213 191oz) in H1FY23. At Mponeng, underground recovered grades increased by 30% to 10.34g/t in H1FY24 from 7.98g/t in H1FY23. This resulted in a 30% increase in gold production to 4 499kg (144 646oz) from 3 473kg (111 659oz) in H1FY23. The high recovered grades at Mponeng will continue for the remainder of the financial year as we mine through the high-grade areas as planned. We continue to see excellent development grades at this quality asset. As part of the acquisition of Mponeng and related assets in October 2020, it was agreed that the purchase price would comprise various elements including a US$200 million cash payment, the assumption of prescribed liabilities and two deferred considerations. The deferred components of the agreement are: 1. US$260/oz payable on all underground production sourced within the West Wits mineral rights (comprising the Mponeng, Savuka and TauTona mines) in excess of 250 000 ounces per calendar year for six years (commencing 1 January 2021) 2. US$20/oz in relation to underground production sourced within the West Wits mineral rights below the datum of infrastructure that existed on or before closing of the transaction, if it is developed Production at Mponeng in the 2023 calendar year was 272 487oz. This was more than 250 000oz as per the first deferred consideration. Therefore an amount of R108 million relating to the deferred consideration liability has been classified as current and will be paid to the previous owner. At Moab Khotsong, underground recovered grades increased by 20% to 8.00g/t from 6.69g/t in H1FY23. Production therefore increased by 12% to 3 546kg (114 006 oz) from 3 158kg (101 532 oz) in the previous reporting period. AISC for our high-grade operations decreased by 7% to R754 758/kg (US$1 256/oz) in H1FY24 from R814 011/kg (US$1 462/oz) in H1FY23. Operating free cash flow from these two mines increased threefold to R3 181 million (US$170 million) in H1FY24 from R1 043 million (US$60 million) in H1FY23. Operating free cash flow margins increased to 34% from 16% in the previous reporting period, mainly due to the improved underground recovered grades and increased production at these operations along with the higher average gold price received. Zaaiplaats, the Moab Khotsong extension project, is progressing well. Development of the decline has started and we have commenced with semi-mechanised development and face drilling with trackless mobile machines to mitigate any further delays. Mponeng life-of-mine extension project Studies to determine the feasibility of extending Mponeng's life-of-mine and the pillar extraction at TauTona have now been completed. Mponeng is a world-class mine with two excellent, well-defined orebodies, namely the Carbon Leader Reef and Ventersdorp Contact Reef. With average face grades over 14g/t and recovered grades in excess of 9g/t, this mine will continue operating as one of our lowest cost per unit operations. First gold from this project is expected after four years while average steady state production is envisaged to be approximately 8 200kg or 264 000oz per annum. Due to the high grades, this mine will have an attractive real AISC of R768 000/kg (US$1 290/oz) based on current assumptions and estimates. The capital intensity is low with capital expenditure of R7.9 billion required over the life of the project. As result, we estimate an additional R1 billion (US$54 million) in capital expenditure from FY25 once this project commences. This project will be internally funded through Mponeng's excess operating free cash flows. Mponeng's mine life extension has been designed in a manner that takes every element of ESG into account, especially safety and health. Not only will our people and communities benefit, but it will allow us to invest more in renewable energy, surface retreatment and water in the region. The Mponeng extension project is part of our DNA and an example of how sustainable mining creates long-term value for all. Not only will it create jobs and sustain employment, it will nurture and develop skills while benefiting our host communities and suppliers. This project secures the mine as one of the strongest contributors to group operating free cash flows and demonstrates our commitment to invest in high-grade underground mines. MESSAGE FROM THE CHIEF EXECUTIVE OFFICER continued

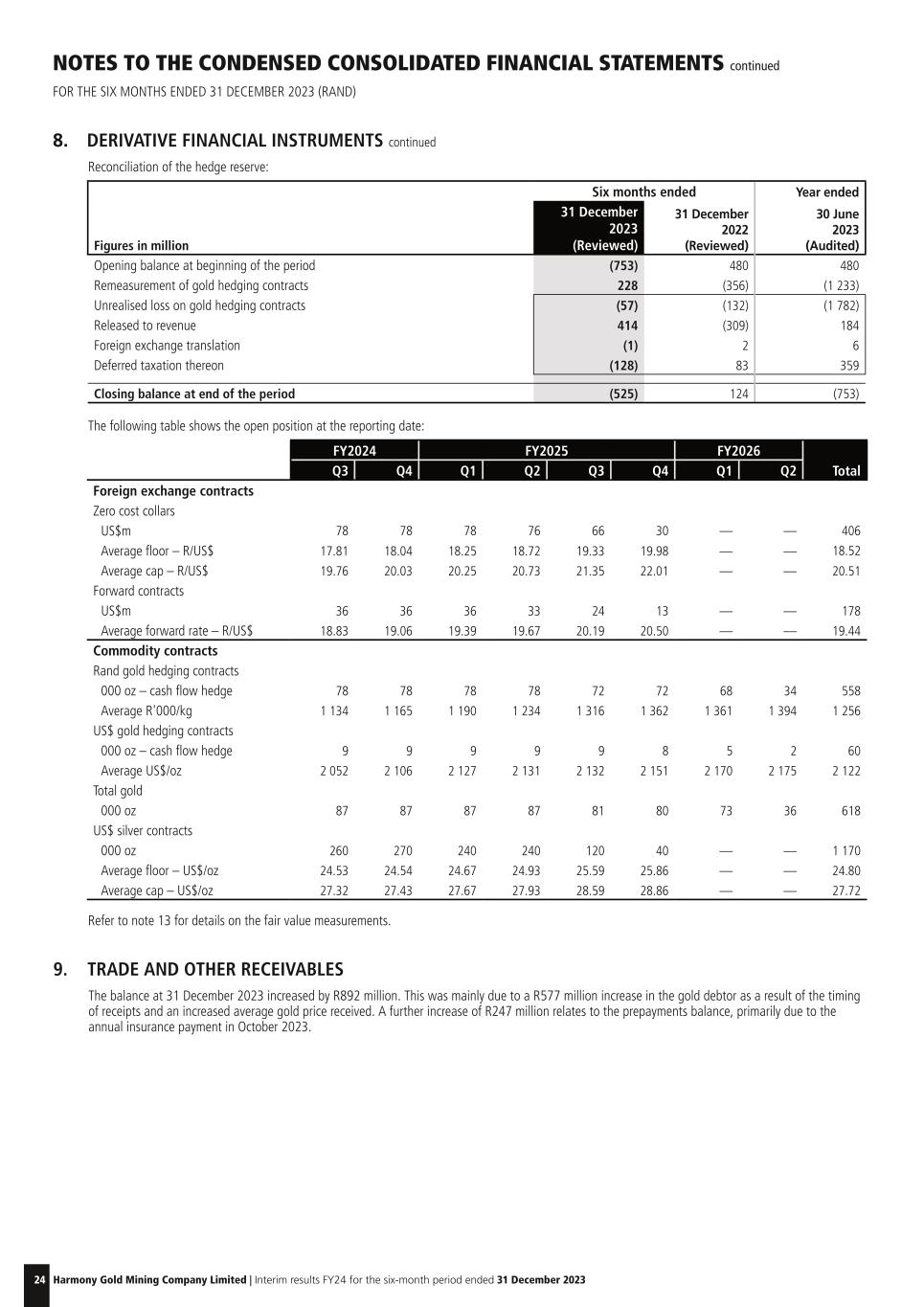

4 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 MESSAGE FROM THE CHIEF EXECUTIVE OFFICER continued 2. South African underground operations: optimised Our South African optimised operations comprise Tshepong North, Tshepong South, Joel, Target 1, Masimong, Doornkop and Kusasalethu. These operations delivered a steady operating performance in H1FY24 driven mainly by Tshepong North, Tshepong South and Kusasalethu on the back of higher underground recovered grades. Production in H1FY24 from these operations was down 2% year-on-year at 10 307kg (331 378oz) compared to 10 548kg (339 125oz). Average underground recovered grades at these operations increased to 5.05g/t in H1FY24 from 4.98g/t in the previous reporting period. The AISC for the South African underground optimised operations increased by 12% to R1 027 718/kg (US$1 711/oz) in H1FY24 from R915 392/kg (US$1 645/oz) in H1FY23. This increase was mainly due to the optimisation project at Target 1, lower-than-planned underground recovered grades at Doornkop and general inflationary cost increases. Operating free cash flows from these operations increased by 71% to R1 361 million (US$73 million) from R796 million (US$47 million) in the previous reporting period. The optimisation project at Target 1 is now complete. Margins and profitability at Target 1 are expected to improve in the fourth quarter of the 2024 financial year, on the back of higher volumes and lower costs. 3. South African surface operations H1FY24 production from surface sources, which include Mine Waste Solutions, Phoenix, Central Plant Reclamation, Savuka tailings, the rock dumps and Kalgold, increased by 24% to 4 526kg (145 514oz) from 3 647kg (117 254oz). This was mainly due to improvements in recovered grades from the reclamation sites and recovery efficiencies at Mine Waste Solutions and a solid performance from Kalgold. Recovered grades at Mine Waste Solutions increased by 43% to 0.167g/t from 0.117g/t in H1FY23. South African surface operations' AISC for H1FY24 decreased by 10% to R711 421/kg (US$1 184/oz) compared to R790 355/kg (US$1 419/oz) in the previous reporting period. Mine Waste Solutions' AISC in H1FY24 decreased by 15% to R607 176/kg (US$1 011/oz) from R716 154 (US$1 286/oz) in H1FY23. This was our lowest cost operation per unit. Despite the major project underway at Mine Waste Solutions, the surface source business generated operating free cash flows of R802 million (US$43 million) in H1FY24 compared to R160 million (US$9 million) in the previous reporting period. R792 million (US$42 million) in major capital was deployed at Mine Waste Solutions for the Kareerand tailings extension project in this reporting period. This project is progressing as planned. Deposition in Phase 1 of the Kareerand extension is scheduled to begin towards the end of this calendar year. The project is anticipated to be completed in FY25. Harmony’s subsidiary, Chemwes, the owner of Mine Waste Solutions has a contract with Franco-Nevada Barbados (Franco-Nevada) where Franco- Nevada is entitled to receive 25% of all the gold produced through Mine Waste Solutions. Currently we are selling this gold at approximately $450/oz. Once this contract ends in FY25, approximately 25 000 ounces will be available for sale at prevailing gold prices. This will result in a significant unlock of operating free cash flows at Mine Waste Solutions. 4. International Hidden Valley Hidden Valley's gold production in H1FY24 increased by 52% to 3 011kg (96 805oz) against 1 983kg (63 755oz) in H1FY23 due to higher recovered grades. Recovered grade in H1FY24 improved by 78% to 1.78g/t from 1.00g/t in the comparable reporting period as we mined through the high-grade areas at Kaveroi and Big Red. As planned, recovered grades at Hidden Valley will be lower for the remainder of FY24 as mining of the high-grade Big Red lode is now complete. AISC for H1FY24 decreased by 46% to R646 287/kg (US$1 072/oz), from R1 204 686/kg (US$2 162/oz), due to the higher recovered grades and the weakening of the rand against major currencies. Hidden Valley generated R1 769 million (US$95 million) in operating free cash flows in this reporting period compared to -R69 million (-US$4 million) utilisation in H1FY23. The Hidden Valley extension project is progressing well, with additional studies on mine life extension, including the Kerimenge heap leach project, underway. Wafi-Golpu Project Negotiations are continuing between Harmony, our joint venture partner Newmont Corporation and the Papua New Guinea Government regarding the terms of a Mining Development Contract (which is required for a Special Mining Lease). Harmony remains committed to permitting this Tier 1 copper-gold asset. Eva Copper Project The feasibility study update for the Eva Copper project in Queensland, Australia, is continuing as planned. During the second quarter, an additional 20 166 metres were drilled with positive drilling outcomes continuing to grow the project's resource base. Renewable energy options, consisting of a hybrid mix of solar, battery and longer-term wind, are being evaluated as the preferred power solution for the project. Study outcomes will require amendments to the existing environmental permits which are in place. We are proactively engaging with the Queensland Government about these environmental permit amendments. Cost management Total cash operating costs increased by 10% to R18 527 million (US$992 million) from R16 851 million (US$973 million) in H1FY23. This increase was in line with plan and mainly due to annual inflationary increases. The main drivers during the reporting period were: • Electricity costs for South Africa, which increased by 19% to R3 724 million (US$199 million) from R3 132 million (US$181 million) • South African labour costs which increased by 9% to R7 803 million (US$418 million) from R7 128 million (US$412 million) due to annual increases and incentives • Royalties for South African operations, which increased by 266% to R534 million (US$29 million) from R146 million (US$8 million) due to the improved profitability at our operations However, due to the increase in total production, cash operating costs per unit decreased by 3% to R715 617/kg (US$1 191/oz) from R738 788/kg (US$1 327/oz) in H1FY23. Derivatives and hedging We continue to maintain our hedging strategy to protect the group against adverse commodity and currency market fluctuations, reducing our financial risk and supporting our capital and growth commitments. During the period under review, our gold hedge cover level remained stable at 20% of expected production over a 24-month period. The average hedge cover stood at R1 256 000/kg for our South African operations and US$2 122/oz for our Hidden Valley operation. Refer to notes 2 and 8 in the financial statements for details on the derivative programme.

5 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 FY24 GROUP PRODUCTION, COST AND GRADE GUIDANCE FY24 production guidance for the group remains unchanged at between 1 380 000 ounces to 1 480 000 ounces. FY24 AISC guidance also remains unchanged at less than R975 000/kg. Underground grade guidance remains unchanged at 5.60g/t to 5.75g/t. We anticipate annual production and grade to be at the upper end of guidance, while costs will remain well below the guided level. LOOKING AHEAD Through resilience, dedication and focus, we are improving our safety performance, driving operational excellence, increasing the quality of our ounces and delivering as promised. We have built a solid foundation that will enable Harmony to continue on this upwards trajectory. While strong commodity prices have provided Harmony with good tailwinds, improved safety, good mining discipline and operational flexibility with a stable and a predictable cost structure remain fundamental to creating the long-term value expected by our stakeholders. Harmony presents a substantial opportunity to invest in an exciting gold-copper story. This comes at an opportune time given the global transition towards a low-carbon economy. Eva Copper moves Harmony into a Tier 1 jurisdiction, while Wafi-Golpu is a Tier 1 copper-gold project. These projects will be truly transformative and we are committed to taking these projects up the value curve. With our portfolio of long-life assets and a strong project pipeline, Harmony has an exciting future and remains the employer and partner of choice. As we grow, our capital allocation decisions are ranked and informed by risk-adjusted returns and our commitment to mining safely, sustainably and ethically. Extending the lives of our mines is therefore more than a commercial decision. Our projects deliver countless direct and indirect social benefits. Whether it is the jobs and skills we provide, the corporate taxes we pay or our substantial investment in renewable energy – sustainability is at the heart of what we do. Harmony has again demonstrated that we are an excellent operator and a global gold mining leader. We will continue to use our skills and strong understanding of our orebodies to extract further value – wherever we operate. MESSAGE FROM THE CHIEF EXECUTIVE OFFICER continued OPERATING RESULTS Six months ended 31 December 2023 Six months ended 31 December 2022 % Change Six months ended 30 June 2023 % change for six months ended June 2023 vs December 2023 Underground recovered grade g/t 6.29 5.68 11 5.89 7 Gold price received R/kg 1 141 424 963 464 18 1 103 957 3 US$/oz 1 900 1 730 10 1 885 1 Gold produced total kg 25 889 22 809 14 22 842 13 oz 832 349 733 325 14 734 390 13 SA high-grade underground kg 8 045 6 631 21 7 486 7 oz 258 652 213 191 21 240 680 7 SA optimised underground kg 10 307 10 548 (2) 9 093 13 oz 331 378 339 125 (2) 292 349 13 SA surface operations kg 4 526 3 647 24 3 876 17 oz 145 514 117 254 24 124 618 17 International (Hidden Valley) kg 3 011 1 983 52 2 387 26 oz 96 805 63 755 52 76 743 26 Group cash operating costs R/kg 715 617 738 788 3 732 484 2 US$/oz 1 191 1 327 10 1 251 5 Group all-in sustaining costs (AISC) R/kg 843 043 890 048 5 889 475 5 US$/oz 1 403 1 598 12 1 519 8 Group all-in cost (AIC) R/kg 903 619 931 736 3 946 482 5 US$/oz 1 504 1 673 10 1 616 7 Group operating free cash flow R million 7 112 1 949 265 4 082 74 US$ million 381 113 237 224 70 Average exchange rate R:US$ 18.68 17.32 8 18.21 3 As we continue mining with purpose, we would like to thank our shareholders and stakeholders for their ongoing support and confidence in the Harmony story. Peter Steenkamp Chief executive officer

6 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 FORWARD-LOOKING STATEMENTS This booklet contains forward-looking statements within the meaning of the safe harbour provided by Section 21E of the Exchange Act and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), with respect to our financial condition, results of operations, business strategies, operating efficiencies, competitive positions, growth opportunities for existing services, plans and objectives of management, markets for stock and other matters. These forward-looking statements, including, among others, those relating to our future business prospects, revenues, and the potential benefit of acquisitions (including statements regarding growth and cost savings) wherever they may occur in this booklet, are necessarily estimates reflecting the best judgment of our senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward-looking statements should be considered in light of various important factors, including those set forth in our integrated annual report. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances and should be considered in light of various important factors, including those set forth in this disclaimer. Readers are cautioned not to place undue reliance on such statements. Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include, without limitation: overall economic and business conditions in South Africa, Papua New Guinea, Australia and elsewhere; the impact from, and measures taken to address, Covid-19 and other contagious diseases, such as HIV and tuberculosis; high and rising inflation, supply chain issues, volatile commodity costs and other inflationary pressures exacerbated by the Russian invasion of Ukraine and subsequent sanctions; estimates of future earnings, and the sensitivity of earnings to gold and other metals prices; estimates of future gold and other metals production and sales; estimates of future cash costs; estimates of future cash flows, and the sensitivity of cash flows to gold and other metals prices; estimates of provision for silicosis settlement; increasing regulation of environmental and sustainability matters such as greenhouse gas emission and climate change, and the impact of climate change on our operations; estimates of future tax liabilities under the Carbon Tax Act (South Africa); statements regarding future debt repayments; estimates of future capital expenditures; the success of our business strategy, exploration and development activities and other initiatives; future financial position, plans, strategies, objectives, capital expenditures, projected costs and anticipated cost savings and financing plans; estimates of reserves statements regarding future exploration results and the replacement of reserves; the ability to achieve anticipated efficiencies and other cost savings in connection with past and future acquisitions, as well as at existing operations; fluctuations in the market price of gold and other metals; the occurrence of hazards associated with underground and surface gold mining; the occurrence of labour disruptions related to industrial action or health and safety incidents; power cost increases as well as power stoppages, fluctuations and usage constraints; ageing infrastructure, unplanned breakdowns and stoppages that may delay production, increase costs and industrial accidents; supply chain shortages and increases in the prices of production imports and the availability, terms and deployment of capital; our ability to hire and retain senior management, sufficiently technically-skilled employees, as well as our ability to achieve sufficient representation of historically disadvantaged persons in management positions or sufficient gender diversity in management positions or at Board level; our ability to comply with requirements that we operate in a sustainable manner and provide benefits to affected communities; potential liabilities related to occupational health diseases; changes in government regulation and the political environment, particularly tax and royalties, mining rights, health, safety, environmental regulation and business ownership including any interpretation thereof; court decisions affecting the mining industry, including, without limitation, regarding the interpretation of mining rights; our ability to protect our information technology and communication systems and the personal data we retain; risks related to the failure of internal controls; our ability to meet our environmental, social and corporate governance targets; the outcome of pending or future litigation or regulatory proceedings; fluctuations in exchange rates and currency devaluations and other macroeconomic monetary policies, as well as the impact of South African exchange control regulations; the adequacy of the Group’s insurance coverage; any further downgrade of South Africa’s credit rating and socio-economic or political instability in South Africa, Papua New Guinea, Australia and other countries in which we operate; changes in technical and economic assumptions underlying our mineral reserves estimates; geotechnical challenges due to the ageing of certain mines and a trend toward mining deeper pits and more complex, often deeper underground, deposits; and actual or alleged breach or breaches in governance processes, fraud, bribery or corruption at our operations that leads to censure, penalties or negative reputational impacts. The foregoing factors and others described under “Risk Factors” in our Integrated Annual Report (www.har.co.za) and our Form 20-F should not be construed as exhaustive. We undertake no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events, except as required by law. All subsequent written or oral forward-looking statements attributable to Harmony or any person acting on its behalf, are qualified by the cautionary statements herein. The forward-looking financial information has not been reviewed and reported on by the company’s auditors. FINANCIAL RESULTS Six months ended 31 December 2023 (Reviewed) Six months ended 31 December 2022 (Reviewed) % Change Basic earnings per share SA cents 956 298 221 US cents 51 17 200 Headline earnings R million 5 919 1 804 228 US$ million 317 104 205 Headline earnings per share SA cents 956 293 226 US cents 51 17 200 Please refer to our website for the full results presentation: https://www.harmony.co.za/investors/presentations-briefs/2024/

7 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 PAGE 1 Message from the chief executive officer 6 Forward-looking statements 7 Shareholder information 8 Notice of interim gross cash ordinary dividend no 94 9 Operating results – six monthly (Rand/Metric) 11 Operating results – six monthly (US$/Imperial) 13 Independent auditor's review report 15 Condensed consolidated income statement (Rand) 16 Condensed consolidated statement of comprehensive income (Rand) 16 Condensed consolidated statement of changes in equity (Rand) 17 Condensed consolidated balance sheet (Rand) 18 Condensed consolidated cash flow statement (Rand) 19 Notes to the condensed consolidated financial statements 33 Segment report (Rand/Metric) 35 Condensed consolidated income statement (US$) 36 Condensed consolidated statement of comprehensive income (US$) 36 Condensed consolidated statement of changes in equity (US$) 37 Condensed consolidated balance sheet (US$) 38 Condensed consolidated cash flow statement (US$) 39 Segment report (US$/Imperial) 41 Development results – Metric and Imperial 43 Competent person's declaration 43 Directorate and administration PAGE CONTENTS Issued ordinary share capital 31 December 2023 619 982 888 Issued ordinary share capital 30 June 2023 618 071 972 MARKET CAPITALISATION As at 31 December 2023 (ZARm) 74 144 As at 31 December 2023 (US$m) 4 054 As at 30 June 2023 (ZARm) 48 982 As at 30 June 2023 (US$m) 2 593 HARMONY ORDINARY SHARES AND ADR PRICES 12-month high (1 January 2023 – 31 December 2023) for ordinary shares (ZAR) 119.59 12-month low (1 January 2023 – 31 December 2023) for ordinary shares (ZAR) 54.97 12-month high (1 January 2023 – 31 December 2023) for ADRs (US$) 6.36 12-month low (1 January 2023 – 31 December 2023) for ADRs (US$) 2.95 FREE FLOAT 100% American Depositary Receipt ("ADR") RATIO 1:1 SHAREHOLDER INFORMATION JSE LIMITED HAR Average daily volume for the year (1 January 2023 – 31 December 2023) 2 363 680 Average daily volume for the previous year (1 January 2022 – 31 December 2022) 2 619 096 NEW YORK STOCK EXCHANGE HMY Average daily volume for the year (1 January 2023 – 31 December 2023) 4 071 947 Average daily volume for the previous year (1 January 2022 – 31 December 2022) 6 272 602 INVESTORS' CALENDAR H1FY24 results presentation 28 February 2024

8 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 NOTICE OF INTERIM GROSS CASH ORDINARY DIVIDEND NO 94 Our dividend declaration for the six months ended 31 December 2023 is as follows: Declaration of interim gross cash ordinary dividend no. 94 The Board has approved, and notice is hereby given, that a interim gross cash dividend of 147 SA cents (7.61264 US cents*) per ordinary share in respect of the six months ended 31 December 2023, has been declared payable to the registered shareholders of Harmony on Monday, 15 April 2024. In accordance with paragraphs 11.17(a)(i) to (x) and 11.17(c) of the JSE Listings Requirements the following additional information is disclosed: • The dividend has been declared out of income reserves; • The local Dividend Withholding Tax rate is 20%; • The gross local dividend amount is 147.00000 SA cents (7.61264 US cents*) per ordinary share for shareholders exempt from the Dividend Withholding Tax; • The net local dividend amount is 117.60000 SA cents per ordinary share for shareholders liable to pay the Dividend Withholding Tax; • Harmony currently has 619 982 888 ordinary shares in issue (which includes 47 381 treasury shares); and • Harmony’s income tax reference number is 9240/012/60/0. A dividend No. 94 of 147.00000 SA cents (7.61264 US cents*) per ordinary share, being the dividend for the six months ended 31 December 2023, has been declared payable on Monday, 15 April 2024 to those shareholders recorded in the share register of the company at the close of business on Friday, 12 April 2024. The dividend is declared in the currency of the Republic of South Africa. Any change in address or dividend instruction to apply to this dividend must be received by the company’s transfer secretaries or registrar not later than Friday, 5 April 2024. Dividends received by non-resident shareholders will be exempt from income tax in terms of section 10(1)(k)(i) of the Income Tax Act. The dividends withholding tax rate is 20%, accordingly, any dividend will be subject to dividend withholding tax levied at a rate of 20%, unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation (DTA) between South Africa and the country of residence of the shareholder. Should dividend withholding tax be withheld at a rate of 20%, the net dividend amount due to non-resident shareholders is 117.60000 SA cents per share. A reduced dividend withholding rate in terms of the applicable DTA may only be relied on if the non-resident shareholder has provided the following forms to their CSDP or broker, as the case may be in respect of uncertificated shares or the company, in respect of certificated shares: (a) a declaration that the dividend is subject to a reduced rate as a result of the application of a DTA; and (b) a written undertaking to inform the CSDP or broker, as the case may be, should the circumstances affecting the reduced rate change or the beneficial owner cease to be the beneficial owner, both in the form prescribed by the Commissioner for the South African Revenue Service. Non-resident shareholders are advised to contact their CSDP or broker, as the case may be, to arrange for the abovementioned documents to be submitted prior to the payment of the distribution if such documents have not already been submitted. In compliance with the requirements of Strate Proprietary Limited (Strate) and the JSE Listings Requirements, the salient dates for payment of the dividend are as follows: Last date to trade ordinary shares cum-dividend is Tuesday, 9 April 2024 Ordinary shares trade ex-dividend Wednesday, 10 April 2024 Record date Friday, 12 April 2024 Payment date Monday, 15 April 2024 No dematerialisation or rematerialisation of share certificates may occur between Wednesday, 10 April 2024 and Friday, 12 April 2024 both dates inclusive, nor may any transfers between registers take place during this period. On payment date, dividends due to holders of certificated securities on the SA share register will either be electronically transferred to such shareholders' bank accounts or, in the absence of suitable mandates, dividends will be held in escrow by Harmony until suitable mandates are received to electronically transfer dividends to such shareholders. Dividends in respect of dematerialised shareholdings will be credited to such shareholders' accounts with the relevant Central Securities Depository Participant (CSDP) or broker. The holders of American Depositary Receipts (ADRs) should confirm dividend details with the depository bank. Assuming an exchange rate of R19.31/US$1* the dividend payable on an ADR is equivalent to 7.61264 US cents for ADR holders before dividend tax. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion. * Based on an exchange rate of R19.31/US$1 at 23 February 2024. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion.

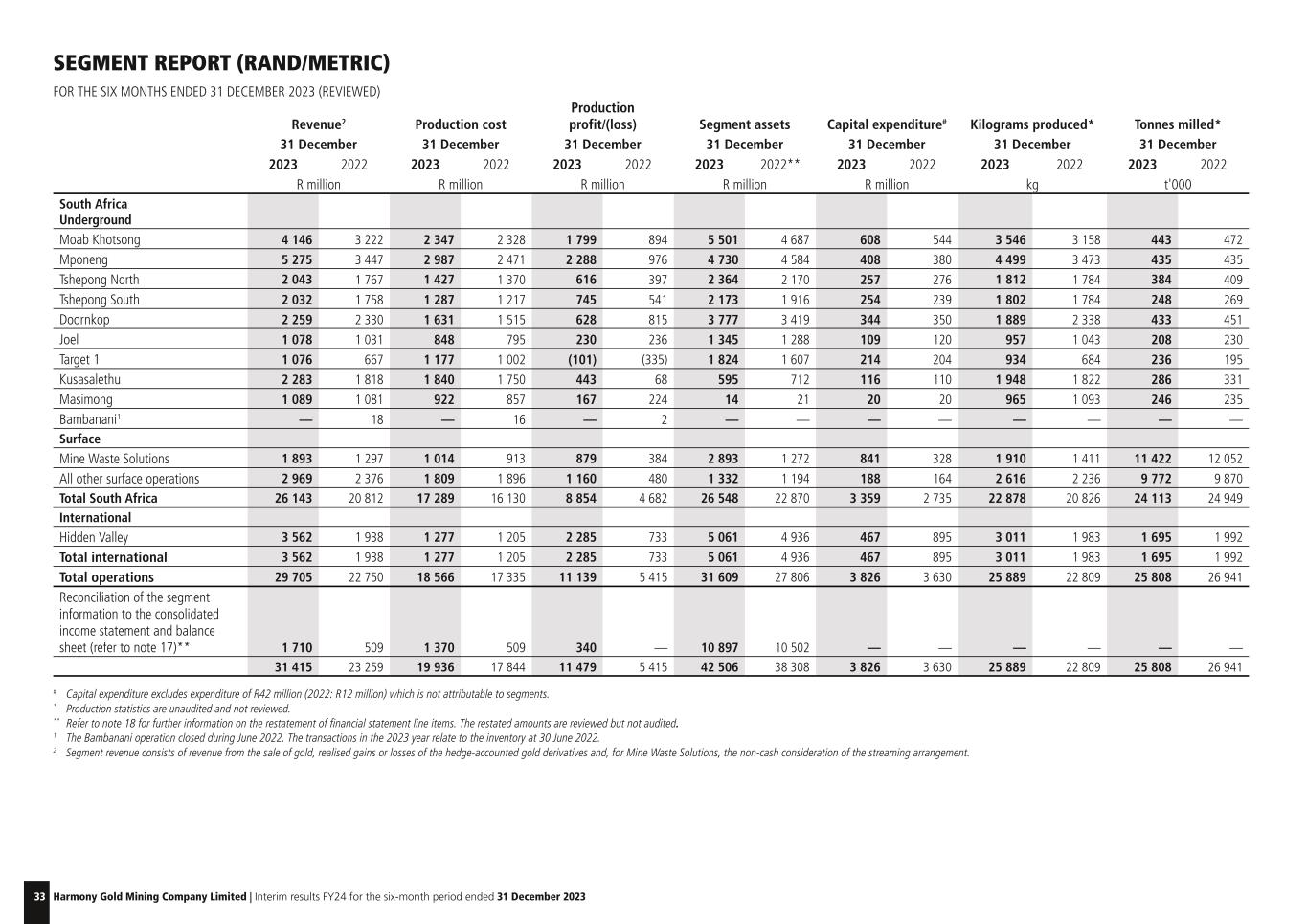

9 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 Six months ended SOUTH AFRICA UNDERGROUND PRODUCTION Moab Khotsong Mponeng Tshepong North Tshepong South Doornkop Joel Target 1 Kusasalethu Masimong Bambanani* TOTAL UNDER- GROUND Ore milled t'000 Dec-23 443 435 384 248 433 208 236 286 246 — 2 919 Dec-22 472 435 409 269 451 230 195 331 235 — 3 027 Yield g/tonne Dec-23 8.00 10.34 4.72 7.27 4.36 4.60 3.96 6.81 3.92 — 6.29 Dec-22 6.69 7.98 4.36 6.63 5.18 4.53 3.51 5.50 4.65 — 5.68 Gold produced kg Dec-23 3 546 4 499 1 812 1 802 1 889 957 934 1 948 965 — 18 352 Dec-22 3 158 3 473 1 784 1 784 2 338 1 043 684 1 822 1 093 — 17 179 Gold sold kg Dec-23 3 594 4 566 1 771 1 762 1 952 935 934 1 977 944 — 18 435 Dec-22 3 304 3 550 1 814 1 805 2 393 1 057 682 1 864 1 109 19 17 597 Gold price received R/kg Dec-23 1 153 549 1 155 287 1 153 566 1 153 131 1 157 021 1 152 718 1 152 412 1 154 895 1 153 905 — 1 154 372 Dec-22 975 178 971 039 974 153 974 198 973 570 975 102 977 487 975 375 974 946 962 579 973 996 Gold revenue¹ R'000 Dec-23 4 145 855 5 275 040 2 042 965 2 031 817 2 258 505 1 077 791 1 076 353 2 283 228 1 089 286 — 21 280 840 Dec-22 3 221 987 3 447 190 1 767 113 1 758 427 2 329 754 1 030 683 666 646 1 818 099 1 081 215 18 289 17 139 403 Cash operating cost (net of by-product credits) R'000 Dec-23 2 297 087 2 926 663 1 466 842 1 325 546 1 581 746 867 251 1 179 701 1 818 960 944 421 — 14 408 217 Dec-22 2 272 948 2 428 576 1 343 415 1 196 530 1 455 718 782 749 1 007 004 1 704 650 847 116 — 13 038 706 Inventory movement R'000 Dec-23 49 865 59 950 (39 538) (38 296) 49 229 (19 619) (2 255) 21 298 (22 183) — 58 451 Dec-22 55 045 42 732 26 689 20 820 58 708 11 705 (4 761) 45 448 10 008 15 728 282 122 Operating costs R'000 Dec-23 2 346 952 2 986 613 1 427 304 1 287 250 1 630 975 847 632 1 177 446 1 840 258 922 238 — 14 466 668 Dec-22 2 327 993 2 471 308 1 370 104 1 217 350 1 514 426 794 454 1 002 243 1 750 098 857 124 15 728 13 320 828 Production profit R'000 Dec-23 1 798 903 2 288 427 615 661 744 567 627 530 230 159 (101 093) 442 970 167 048 — 6 814 172 Dec-22 893 994 975 882 397 009 541 077 815 328 236 229 (335 597) 68 001 224 091 2 561 3 818 575 Capital expenditure2 R'000 Dec-23 608 144 408 110 257 381 254 105 343 976 109 303 214 373 115 538 19 789 — 2 330 719 Dec-22 543 919 380 429 275 617 239 386 349 503 119 778 203 698 110 002 20 392 — 2 242 724 Cash operating costs R/kg Dec-23 647 797 650 514 809 515 735 597 837 346 906 218 1 263 063 933 758 978 675 — 785 103 Dec-22 719 743 699 273 753 035 670 701 622 634 750 478 1 472 228 935 593 775 038 — 758 991 Cash operating costs R/tonne Dec-23 5 185 6 728 3 820 5 345 3 653 4 169 4 999 6 360 3 839 — 4 936 Dec-22 4 816 5 583 3 285 4 448 3 228 3 403 5 164 5 150 3 605 — 4 307 Cash operating cost and Capital R/kg Dec-23 819 298 741 225 951 558 876 610 1 019 440 1 020 433 1 492 585 993 069 999 181 — 912 104 Dec-22 891 978 808 812 907 529 804 886 772 122 865 318 1 770 032 995 967 793 694 — 889 541 All-in sustaining cost R/kg Dec-23 744 199 763 068 966 937 875 703 976 385 1 055 409 1 499 978 1 021 564 1 049 838 — 906 896 Dec-22 802 651 824 584 921 910 809 502 734 594 862 636 1 741 456 1 024 391 833 303 827 789 876 252 Operating free cash flow margin3 % Dec-23 30% 37% 16% 22% 15% 9% (30)% 15% 11% —% 21% Dec-22 13% 19% 8% 18% 23% 12% (82)% —% 20% 100% 11% *The Bambanani operation closed in June 2022. OPERATING RESULTS – SIX MONTHLY (RAND/METRIC)

10 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 OPERATING RESULTS – SIX MONTHLY (RAND/METRIC) continued Six months ended SOUTH AFRICA Hidden Valley TOTAL HARMONY SURFACE PRODUCTION TOTAL SOUTH AFRICA Mine Waste Solutions Phoenix Central plant reclamation Savuka Tailings Dumps4 Kalgold TOTAL SURFACE Ore milled/tailings processed t'000 Dec-23 11 422 3 028 1 993 2 000 1 964 787 21 194 24 113 1 695 25 808 Dec-22 12 052 3 162 2 021 1 952 2 065 670 21 922 24 949 1 992 26 941 Yield g/tonne Dec-23 0.167 0.146 0.159 0.151 0.403 0.98 0.21 0.95 1.78 1.00 Dec-22 0.117 0.124 0.140 0.150 0.328 0.88 0.17 0.83 1.00 0.85 Gold produced kg Dec-23 1 910 441 316 301 791 767 4 526 22 878 3 011 25 889 Dec-22 1 411 391 283 293 677 592 3 647 20 826 1 983 22 809 Gold sold kg Dec-23 1 840 435 312 296 778 746 4 407 22 842 3 028 25 870 Dec-22 1 403 396 275 299 667 583 3 623 21 220 1 971 23 191 Gold price received R/kg Dec-23 932 567 1 175 589 1 153 269 1 153 169 1 152 995 1 153 799 1 063 360 1 136 812 1 176 213 1 141 424 Dec-22 790 018 961 288 974 098 970 351 976 310 974 499 901 576 961 631 983 193 963 464 Gold revenue¹ R'000 Dec-23 1 892 598 511 381 359 820 341 338 897 030 860 734 4 862 901 26 143 741 3 561 573 29 705 314 Dec-22 1 296 779 380 670 267 877 290 135 651 199 568 133 3 454 793 20 594 196 1 937 874 22 532 070 Cash operating cost (net of by-product credits) R'000 Dec-23 1 029 762 269 892 180 466 181 366 674 095 527 450 2 863 031 17 271 248 1 255 355 18 526 603 Dec-22 924 378 253 231 163 305 154 592 681 067 438 608 2 615 181 15 653 887 1 197 119 16 851 006 Inventory movement R'000 Dec-23 (15 521) (3 976) (1 880) (2 808) (6 991) (10 077) (41 253) 17 198 21 591 38 789 Dec-22 (11 097) 1 639 (5 333) 2 871 (2 535) (9 793) (24 248) 257 874 8 020 265 894 Operating costs R'000 Dec-23 1 014 241 265 916 178 586 178 558 667 104 517 373 2 821 778 17 288 446 1 276 946 18 565 392 Dec-22 913 281 254 870 157 972 157 463 678 532 428 815 2 590 933 15 911 761 1 205 139 17 116 900 Production profit R'000 Dec-23 878 357 245 465 181 234 162 780 229 926 343 361 2 041 123 8 855 295 2 284 627 11 139 922 Dec-22 383 498 125 800 109 905 132 672 (27 333) 139 318 863 860 4 682 435 732 735 5 415 170 Capital expenditure2 R'000 Dec-23 840 951 3 554 27 437 6 730 2 921 146 511 1 028 104 3 358 823 466 805 3 825 628 Dec-22 327 677 27 468 2 703 7 394 (975) 127 976 492 243 2 734 967 895 452 3 630 419 Cash operating costs R/kg Dec-23 539 142 612 000 571 095 602 545 852 206 687 679 632 574 754 928 416 923 715 617 Dec-22 655 123 647 650 577 049 527 618 1 006 007 740 892 717 077 751 651 603 691 738 788 Cash operating costs R/tonne Dec-23 90 89 91 91 343 670 135 716 741 718 Dec-22 77 80 81 79 330 655 119 627 601 625 Cash operating cost and Capital R/kg Dec-23 979 431 620 059 657 921 624 904 855 899 878 698 859 729 901 743 571 956 863 387 Dec-22 887 353 717 900 586 601 552 853 1 004 567 957 068 852 049 882 976 1 055 255 897 954 All-in sustaining cost R/kg Dec-23 607 176 628 433 665 073 625 973 861 215 913 997 711 421 869 124 646 287 843 043 Dec-22 716 154 714 171 589 934 551 361 1 015 828 979 818 790 355 860 823 1 204 686 890 048 Operating free cash flow margin3 % Dec-23 (9)% 47% 42% 45% 25% 22% 17% 21% 50% 24% Dec-22 (13)% 26% 38% 44% (4)% 1% 5% 10% (4)% 9% ¹Includes a non-cash consideration to Franco-Nevada (Dec-23: R176.674m, Dec-22: R188.384m) under Mine Waste Solutions, excluded from the gold price calculation. 2Excludes capital expenditure related to renewables (Dec-23: R14.204m, Dec-22: R0m). 3Excludes run of mine costs for Kalgold (Dec-23:R6.687m, Dec-22:R1.407m) and Hidden Valley (Dec-23:-R70.715m, Dec-22:R85.749m). 4Comparative disclosures for the Dumps have been adjusted to account for the change in toll treatment arrangements subsequent to December 2022.

11 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 Six months ended SOUTH AFRICA UNDERGROUND PRODUCTION Moab Khotsong Mponeng Tshepong North Tshepong South Doornkop Joel Target 1 Kusasalethu Masimong Bambanani* TOTAL UNDER- GROUND Ore milled t'000 Dec-23 488 480 423 273 478 229 261 316 272 — 3 220 Dec-22 521 480 451 296 497 254 215 365 259 — 3 338 Yield oz/ton Dec-23 0.234 0.301 0.138 0.212 0.127 0.134 0.115 0.198 0.114 — 0.183 Dec-22 0.195 0.233 0.127 0.194 0.151 0.132 0.102 0.160 0.136 — 0.165 Gold produced oz Dec-23 114 006 144 646 58 257 57 935 60 732 30 769 30 029 62 630 31 026 — 590 030 Dec-22 101 532 111 659 57 357 57 357 75 168 33 533 21 991 58 579 35 140 — 552 316 Gold sold oz Dec-23 115 550 146 800 56 939 56 649 62 758 30 061 30 029 63 561 30 350 — 592 697 Dec-22 106 226 114 135 58 321 58 032 76 937 33 984 21 927 59 929 35 655 611 565 757 Gold price received $/oz Dec-23 1 920 1 923 1 920 1 920 1 926 1 919 1 918 1 923 1 921 — 1 922 Dec-22 1 751 1 744 1 749 1 750 1 748 1 751 1 755 1 752 1 751 1 728 1 749 Gold revenue¹ $'000 Dec-23 221 896 282 332 109 344 108 748 120 880 57 686 57 609 122 204 58 301 — 1 139 000 Dec-22 186 033 199 036 102 031 101 529 134 517 59 510 38 491 104 975 62 428 1 056 989 606 Cash operating cost (net of by-product credits) $'000 Dec-23 122 945 156 642 78 509 70 947 84 659 46 418 63 140 97 355 50 548 — 771 163 Dec-22 131 237 140 223 77 567 69 086 84 052 45 195 58 143 98 424 48 911 — 752 838 Inventory movement $'000 Dec-23 2 669 3 209 (2 116) (2 050) 2 635 (1 050) (121) 1 140 (1 187) — 3 129 Dec-22 3 178 2 467 1 541 1 202 3 390 676 (275) 2 624 578 908 16 289 Operating costs $'000 Dec-23 125 614 159 851 76 393 68 897 87 294 45 368 63 019 98 495 49 361 — 774 292 Dec-22 134 415 142 690 79 108 70 288 87 442 45 871 57 868 101 048 49 489 908 769 127 Production profit $'000 Dec-23 96 282 122 481 32 951 39 851 33 586 12 318 (5 410) 23 709 8 940 — 364 708 Dec-22 51 618 56 346 22 923 31 241 47 075 13 639 (19 377) 3 927 12 939 148 220 479 Capital expenditure2 $'000 Dec-23 32 550 21 843 13 775 13 600 18 411 5 850 11 473 6 184 1 059 — 124 745 Dec-22 31 405 21 967 15 914 13 822 20 179 6 915 11 761 6 351 1 178 — 129 492 Cash operating costs $/oz Dec-23 1 078 1 083 1 348 1 225 1 394 1 509 2 103 1 554 1 629 — 1 307 Dec-22 1 293 1 256 1 352 1 204 1 118 1 348 2 644 1 680 1 392 — 1 363 Cash operating costs $/t Dec-23 252 326 186 260 177 203 242 308 186 — 239 Dec-22 252 292 172 233 169 178 270 270 189 — 226 Cash operating cost and Capital $/oz Dec-23 1 364 1 234 1 584 1 459 1 697 1 699 2 485 1 653 1 663 — 1 518 Dec-22 1 602 1 453 1 630 1 445 1 387 1 554 3 179 1 789 1 425 — 1 598 All-in sustaining cost $/oz Dec-23 1 239 1 270 1 610 1 458 1 625 1 757 2 497 1 701 1 748 — 1 510 Dec-22 1 441 1 481 1 656 1 454 1 319 1 549 3 127 1 840 1 497 1 486 1 574 Operating free cash flow margin3 % Dec-23 30% 37% 16% 22% 15% 9% (30)% 15% 11% —% 21% Dec-22 13% 19% 8% 18% 23% 12% (82)% —% 20% 100% 11% *The Bambanani operation closed in June 2022. OPERATING RESULTS – SIX MONTHLY (US$/IMPERIAL)

12 Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 2023 OPERATING RESULTS – SIX MONTHLY (US$/IMPERIAL) continued Six months ended SOUTH AFRICA Hidden Valley TOTAL HARMONY SURFACE PRODUCTION TOTAL SOUTH AFRICA Mine Waste Solutions Phoenix Central plant reclamation Savuka Tailings Dumps4 Kalgold TOTAL SURFACE Ore milled/tailings processed t'000 Dec-23 12 595 3 339 2 198 2 205 2 166 868 23 371 26 591 1 869 28 460 Dec-22 13 290 3 487 2 228 2 152 2 277 739 24 173 27 511 2 196 29 707 Yield oz/ton Dec-23 0.005 0.004 0.005 0.004 0.012 0.028 0.006 0.028 0.052 0.029 Dec-22 0.003 0.004 0.004 0.004 0.010 0.026 0.005 0.024 0.029 0.025 Gold produced oz Dec-23 61 407 14 178 10 160 9 677 25 432 24 660 145 514 735 544 96 805 832 349 Dec-22 45 364 12 571 9 099 9 420 21 766 19 034 117 254 669 570 63 755 733 325 Gold sold oz Dec-23 59 158 13 985 10 031 9 516 25 013 23 984 141 687 734 384 97 352 831 736 Dec-22 45 108 12 731 8 842 9 613 21 444 18 744 116 482 682 239 63 369 745 608 Gold price received $/oz Dec-23 1 552 1 957 1 920 1 920 1 919 1 921 1 770 1 892 1 958 1 900 Dec-22 1 419 1 726 1 749 1 743 1 753 1 750 1 619 1 727 1 766 1 730 Gold revenue¹ $'000 Dec-23 101 296 27 370 19 258 18 269 48 011 46 068 260 272 1 399 272 190 624 1 589 896 Dec-22 74 874 21 979 15 467 16 752 37 599 32 803 199 474 1 189 080 111 890 1 300 970 Cash operating cost (net of by-product credits) $'000 Dec-23 55 115 14 445 9 659 9 707 36 079 28 230 153 235 924 398 67 189 991 587 Dec-22 53 373 14 621 9 429 8 926 39 324 25 324 150 997 903 835 69 119 972 954 Inventory movement $'000 Dec-23 (831) (213) (101) (150) (374) (539) (2 208) 921 1 156 2 077 Dec-22 (641) 95 (308) 166 (146) (565) (1 399) 14 890 463 15 353 Operating costs $'000 Dec-23 54 284 14 232 9 558 9 557 35 705 27 691 151 027 925 319 68 345 993 664 Dec-22 52 732 14 716 9 121 9 092 39 178 24 759 149 598 918 725 69 582 988 307 Production profit $'000 Dec-23 47 012 13 138 9 700 8 712 12 306 18 377 109 245 473 953 122 279 596 232 Dec-22 22 142 7 263 6 346 7 660 (1 579) 8 044 49 876 270 355 42 308 312 663 Capital expenditure2 $'000 Dec-23 45 010 191 1 469 361 156 7 842 55 029 179 774 24 984 204 758 Dec-22 18 920 1 586 156 427 (56) 7 388 28 421 157 913 51 703 209 616 Cash operating costs $/oz Dec-23 898 1 019 951 1 003 1 419 1 145 1 053 1 257 694 1 191 Dec-22 1 177 1 163 1 036 948 1 807 1 330 1 288 1 350 1 084 1 327 Cash operating costs $/t Dec-23 4 4 4 4 17 33 7 35 36 35 Dec-22 4 4 4 4 17 34 6 33 31 33 Cash operating cost and Capital $/oz Dec-23 1 631 1 032 1 095 1 040 1 425 1 463 1 431 1 501 952 1 437 Dec-22 1 594 1 289 1 053 993 1 804 1 719 1 530 1 586 1 895 1 613 All-in sustaining cost $/oz Dec-23 1 011 1 046 1 107 1 042 1 434 1 522 1 184 1 447 1 072 1 403 Dec-22 1 286 1 283 1 059 990 1 824 1 760 1 419 1 546 2 162 1 598 Operating free cash flow margin3 % Dec-23 (9)% 47% 42% 45% 25% 22% 17% 21% 50% 24% Dec-22 (13)% 26% 38% 44% (4)% 1% 5% 10% (4)% 9% ¹Includes a non-cash consideration to Franco-Nevada (Dec-23: US$9.456m, Dec-22: US$10.877m), under Mine Waste Solutions excluded from the gold price calculation. ²Excludes capital expenditure related to renewables (Dec-23: US$0.76m, Dec-22: US$0m). ³Excludes run of mine costs for Kalgold (Dec-23: US$0.358m, Dec-22: US$0.081m) and Hidden Valley (Dec-23: -US$3.785m, Dec-22: US$4.951m). 4Comparative disclosures for the Dumps have been adjusted to account for the change in toll treatment arrangements subsequent to December 2022.

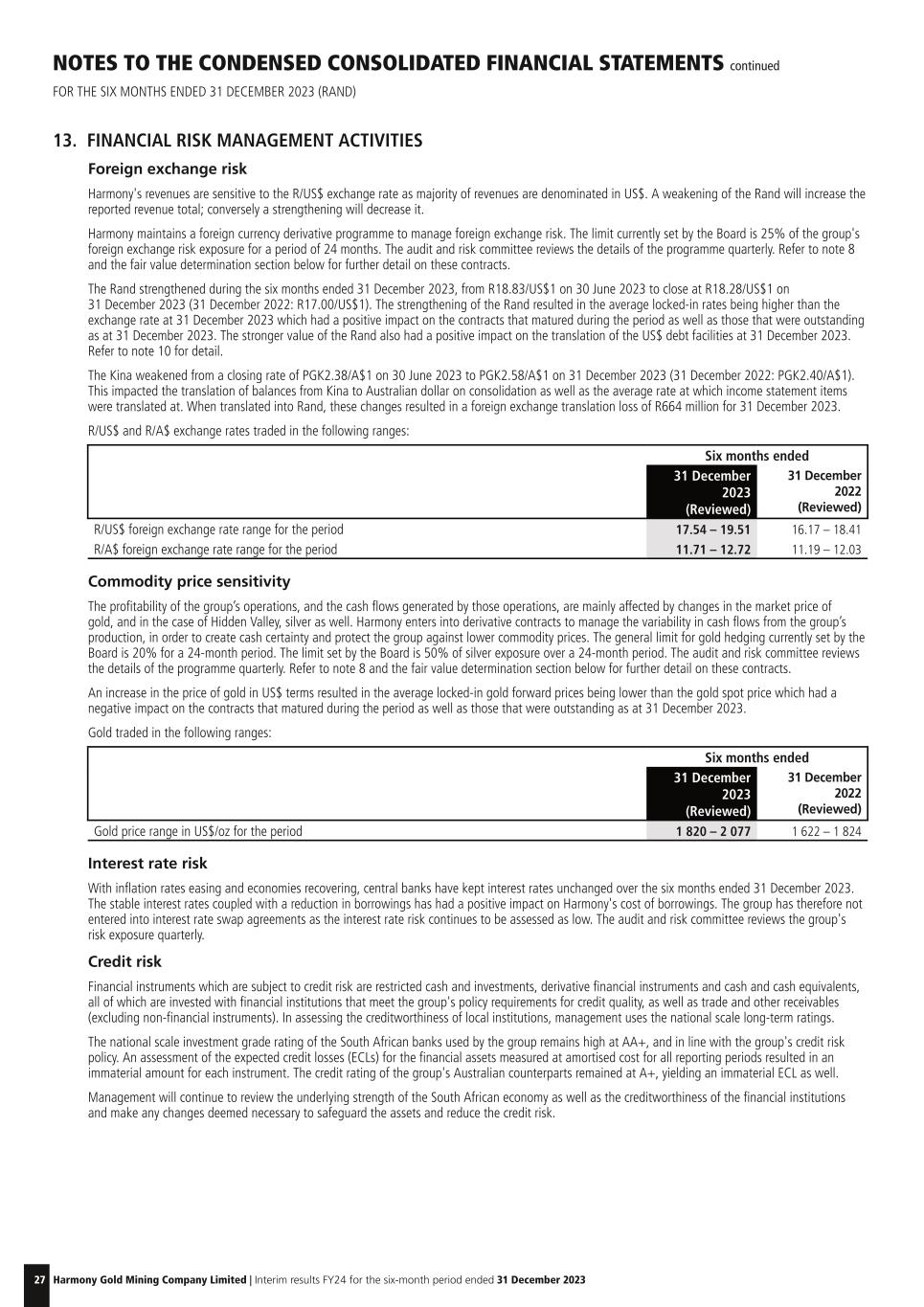

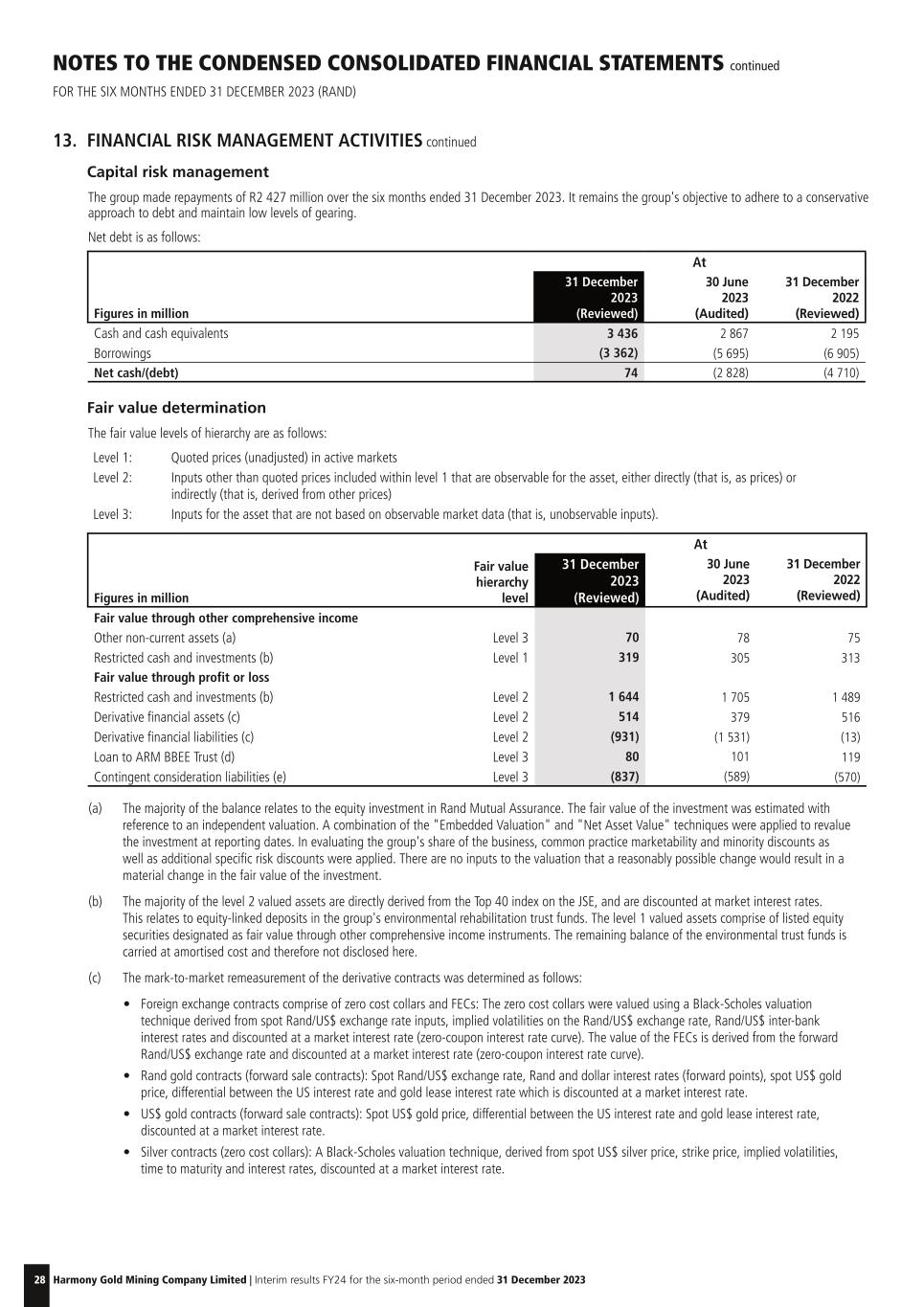

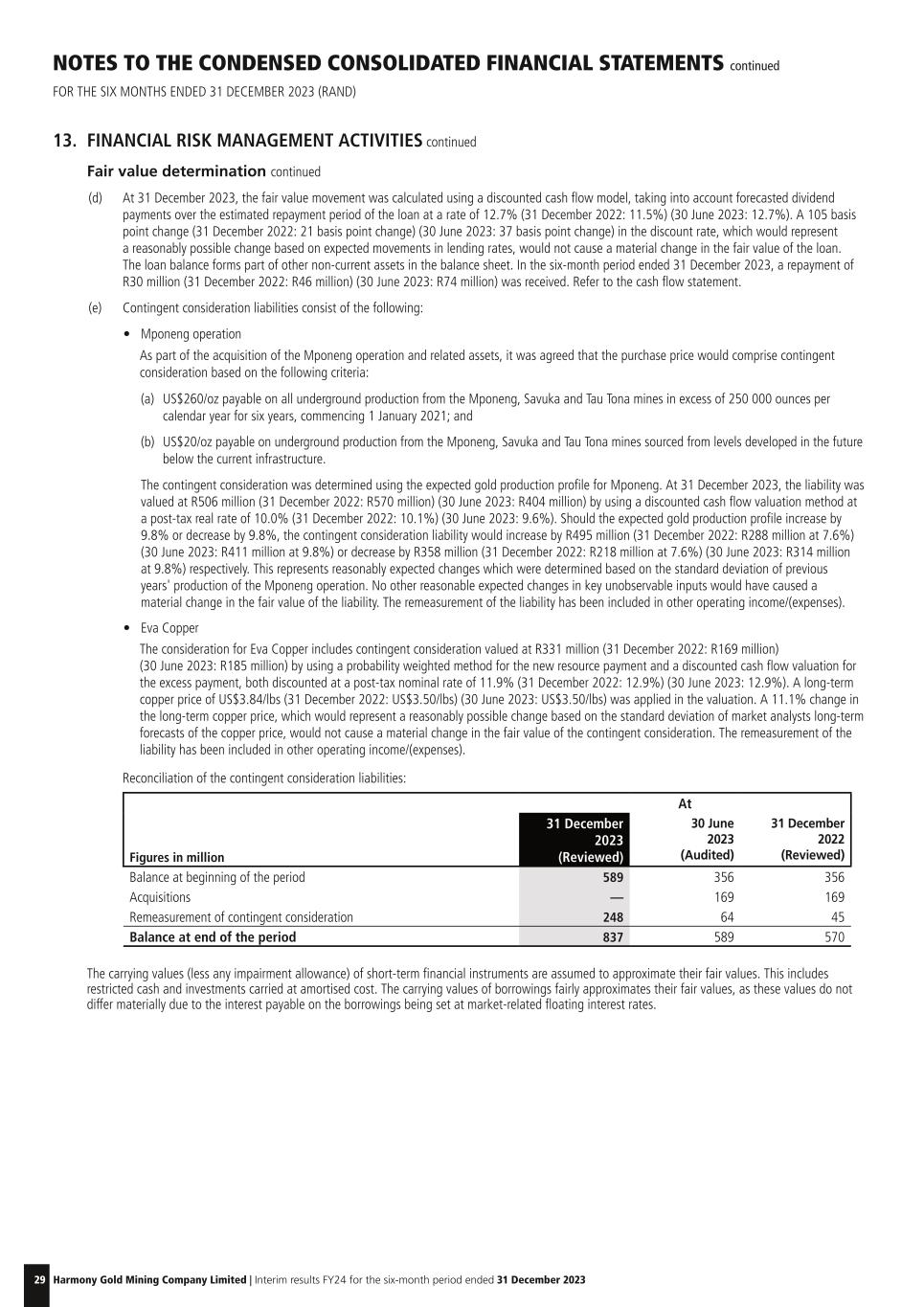

Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 202313 A member firm of Ernst & Young Global Limited. A full list of Directors is available at http://www.ey.com/za/en/home/contact-us_sa-directors Chief Executive: Ajen Sita EY 102 Rivonia Road Sandton Private Bag X14 Sandton 2146 Ernst & Young Incorporated Co. Reg. No. 2005/002308/21 Tel: +27 (0) 11 772 3000 Fax: +27 (0) 11 772 4000 Docex 123 Randburg ey.com INDEPENDENT AUDITOR’S REVIEW REPORT ON THE CONDENSED CONSOLIDTED INTERIM FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED 31 DECEMBER 2023 TO THE SHAREHOLDERS OF HARMONY GOLD MINING COMPANY LIMITED We have reviewed the condensed consolidated interim financial statements of Harmony Gold Mining Company Limited (the Company), in the accompanying interim results report as at 31 December 2023 on pages 15 to 34, which comprise the condensed consolidated income statement and condensed consolidated statement of comprehensive income and the condensed consolidated statement of changes in equity for the six month period ending 31 December 2023, the condensed consolidated balance sheet and the condensed consolidated cash flow statement as at 31 December 2023, and selected explanatory notes. Directors’ Responsibility for the Condensed Consolidated Interim Financial Statements The directors are responsible for the preparation and presentation of these condensed consolidated interim financial statements in accordance with International Financial Reporting Standard (IAS) 34, Interim Financial Reporting, the South African Institute of Chartered Accountants (SAICA) Financial Reporting Guides, as issued by the Accounting Practices Committee and Financial Pronouncements as issued by the Financial Reporting Standards Council and the requirements of the Companies Act of South Africa and for such internal control as the directors determine is necessary to enable the preparation of condensed consolidated interim financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express a conclusion on these condensed consolidated interim financial statements. We conducted our review in accordance with the International Standard on Review Engagements (ISRE) 2410, Review of Interim Financial Information Performed by the Independent Auditor of the Entity. ISRE 2410 requires us to conclude whether anything has come to our attention that causes us to believe that the condensed consolidated interim financial statements are not prepared in all material respects in accordance with the applicable financial reporting framework. This standard also requires us to comply with relevant ethical requirements. A review of condensed consolidated interim financial statements in accordance with ISRE 2410 is a limited assurance engagement. We perform procedures, primarily consisting of making enquiries of management and others within the entity, as appropriate, and applying analytical and other review procedures, and evaluate the evidence obtained. The procedures performed in a review are substantially less than and differ in nature from those performed in an audit conducted in accordance with International Standards on Auditing. Accordingly, we do not express an audit opinion on these condensed consolidated interim financial statements.

Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 202314 A member firm of Ernst & Young Global Limited. A full list of Directors is available at http://www.ey.com/za/en/home/contact-us_sa-directors Chief Executive: Ajen Sita EY 102 Rivonia Road Sandton Private Bag X14 Sandton 2146 Ernst & Young Incorporated Co. Reg. No. 2005/002308/21 Tel: +27 (0) 11 772 3000 Fax: +27 (0) 11 772 4000 Docex 123 Randburg ey.com Conclusion Based on our review, nothing has come to our attention that causes us to believe that the condensed consolidated interim financial statements of Harmony Gold Mining Company Limited, in the accompanying interim results report for the six months ended 31 December 2023 are not prepared, in all material respects, in accordance with the International Financial Reporting Standards, (IAS) 34 Interim Financial Reporting, the SAICA Financial Reporting Guides as issued by the Accounting Practices Committee and Financial Reporting Pronouncements as issued by Financial Reporting Standards Council and the requirements of the Companies Act of South Africa. Other matter – Prior period reviewed/audited by another auditor The condensed consolidated interim financial statements of Harmony Gold Mining Company Limited for the six month period ended 31 December 2022, and the annual financial statements of Harmony Gold Mining Company Limited for the year ended 30 June 2023, were reviewed and audited respectively, by another auditor who expressed an unmodified conclusion and an unmodified opinion on those financial statements on 1 March 2023, and 25 November 2023, respectively. Ernst & Young Incorporated Director – Fatima Norkie Registered Auditor Chartered Accountant (SA) 102 Rivonia Road, Sandton Johannesburg, South Africa 28 February 2024

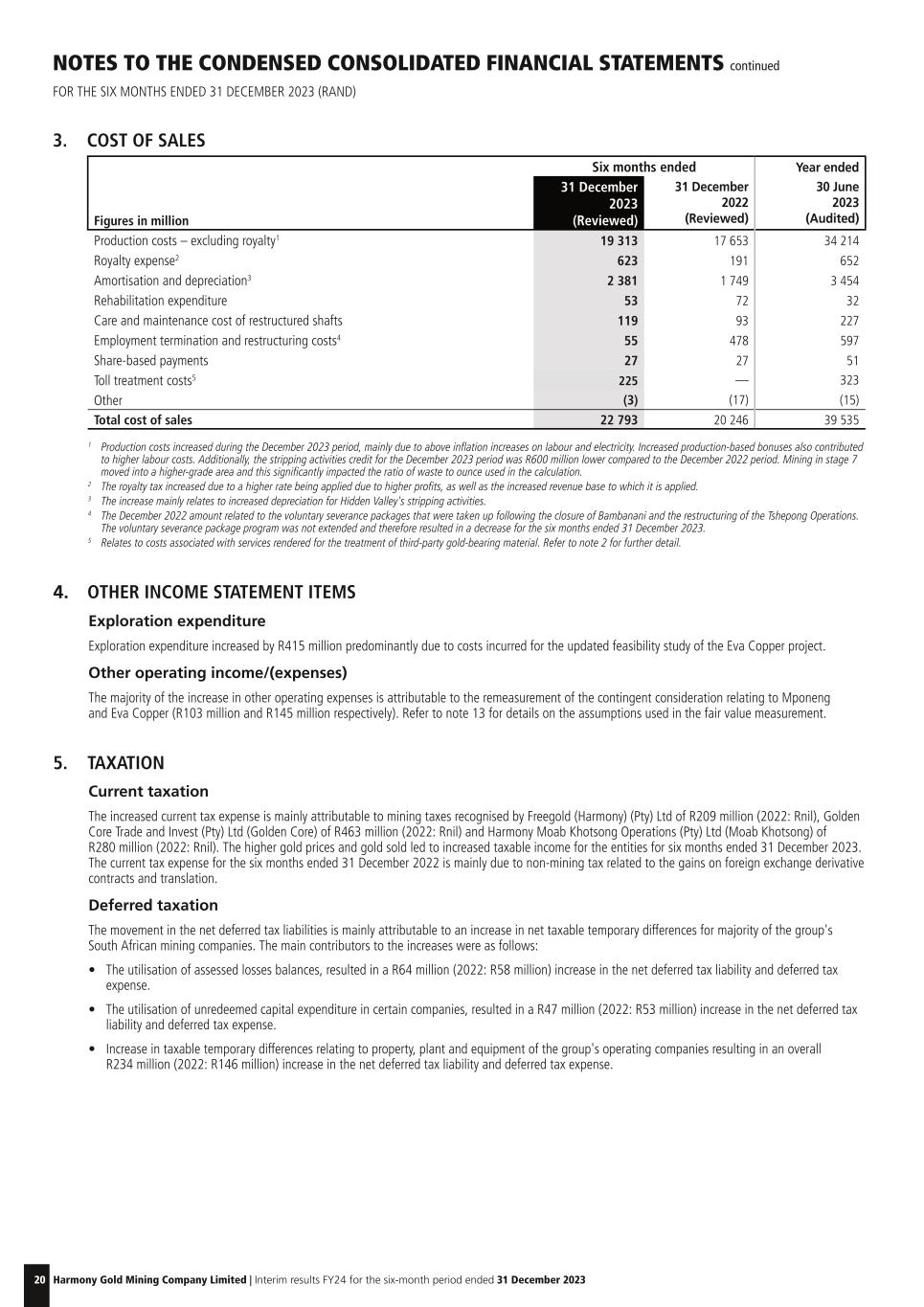

Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 202315 Six months ended Year ended Figures in million Notes 31 December 2023 (Reviewed) 31 December 2022 (Reviewed) 30 June 2023 (Audited) Revenue 2 31 415 23 259 49 275 Cost of sales 3 (22 793) (20 246) (39 535) Production costs (19 936) (17 844) (34 866) Amortisation and depreciation (2 381) (1 749) (3 454) Other items (476) (653) (1 215) Gross profit 8 622 3 013 9 740 Corporate, administration and other expenditure (697) (579) (1 044) Exploration expenditure 4 (573) (158) (506) Gains/(losses) on derivatives 8 353 313 (194) Foreign exchange translation gain/(loss) 10 163 30 (634) Other operating income/(expenses) 4 (299) 42 (268) Operating profit 7 569 2 661 7 094 Acquisition-related costs — (214) (214) Share of profits from associates 36 20 57 Investment income 354 307 663 Finance costs (443) (413) (994) Profit before taxation 7 516 2 361 6 606 Taxation 5 (1 556) (500) (1 723) Current taxation (1 140) (238) (643) Deferred taxation (416) (262) (1 080) Net profit for the period 5 960 1 861 4 883 Attributable to: Non-controlling interest 40 22 63 Owners of the parent 5 920 1 839 4 820 Earnings per ordinary share (cents) 6 Basic earnings 956 298 780 Diluted earnings 953 297 777 The accompanying notes are an integral part of these condensed consolidated financial statements. The condensed consolidated interim financial statements (condensed consolidated financial statements) for the six months ended 31 December 2023 have been prepared by Harmony Gold Mining Company Limited’s corporate reporting team headed by Michelle Kriel CA(SA). This process was supervised by the financial director, Boipelo Lekubo CA(SA) and approved by the board of Harmony Gold Mining Company Limited on 28 February 2024. These condensed consolidated financial statements have been reviewed by the group's external auditors, Ernst & Young Inc. CONDENSED CONSOLIDATED INCOME STATEMENT (RAND)

Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 202316 Six months ended Year ended Figures in million Notes 31 December 2023 (Reviewed) 31 December 2022 (Reviewed) 30 June 2023 (Audited) Net profit for the period 5 960 1 861 4 883 Other comprehensive income for the period, net of income tax (439) (101) (80) Items that may be reclassified subsequently to profit or loss: (436) (121) (110) Foreign exchange translation gain/(loss) (664) 235 1 123 Remeasurement of gold hedging contracts 8 228 (356) (1 233) Items that will not be reclassified to profit or loss (3) 20 30 Total comprehensive income for the period 5 521 1 760 4 803 Attributable to: Non-controlling interest 40 22 63 Owners of the parent 5 481 1 738 4 740 The accompanying notes are an integral part of these condensed consolidated financial statements. Figures in million Share capital and premium Retained earnings/ (Accumulated loss) Other reserves Non- controlling interest Total Balance – 1 July 2023 32 934 (4 955) 6 778 123 34 880 Share-based payments — — 60 — 60 Net profit for the period — 5 920 — 40 5 960 Other comprehensive income for the period — — (439) — (439) Dividends paid1 — (465) — (21) (486) Balance – 31 December 2023 32 934 500 6 399 142 39 975 Balance – 1 July 2022 32 934 (9 639) 6 744 78 30 117 Share-based payments — — 59 — 59 Net profit for the period — 1 839 — 22 1 861 Other comprehensive income for the period — — (101) — (101) Dividends paid — (135) — (10) (145) Balance – 31 December 2022 32 934 (7 935) 6 702 90 31 791 1 On 16 October 2023, Harmony paid an ordinary dividend of 75 cents per share. The accompanying notes are an integral part of these condensed consolidated financial statements. CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (RAND) CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (RAND) FOR THE SIX MONTHS ENDED 31 DECEMBER 2023 (REVIEWED)

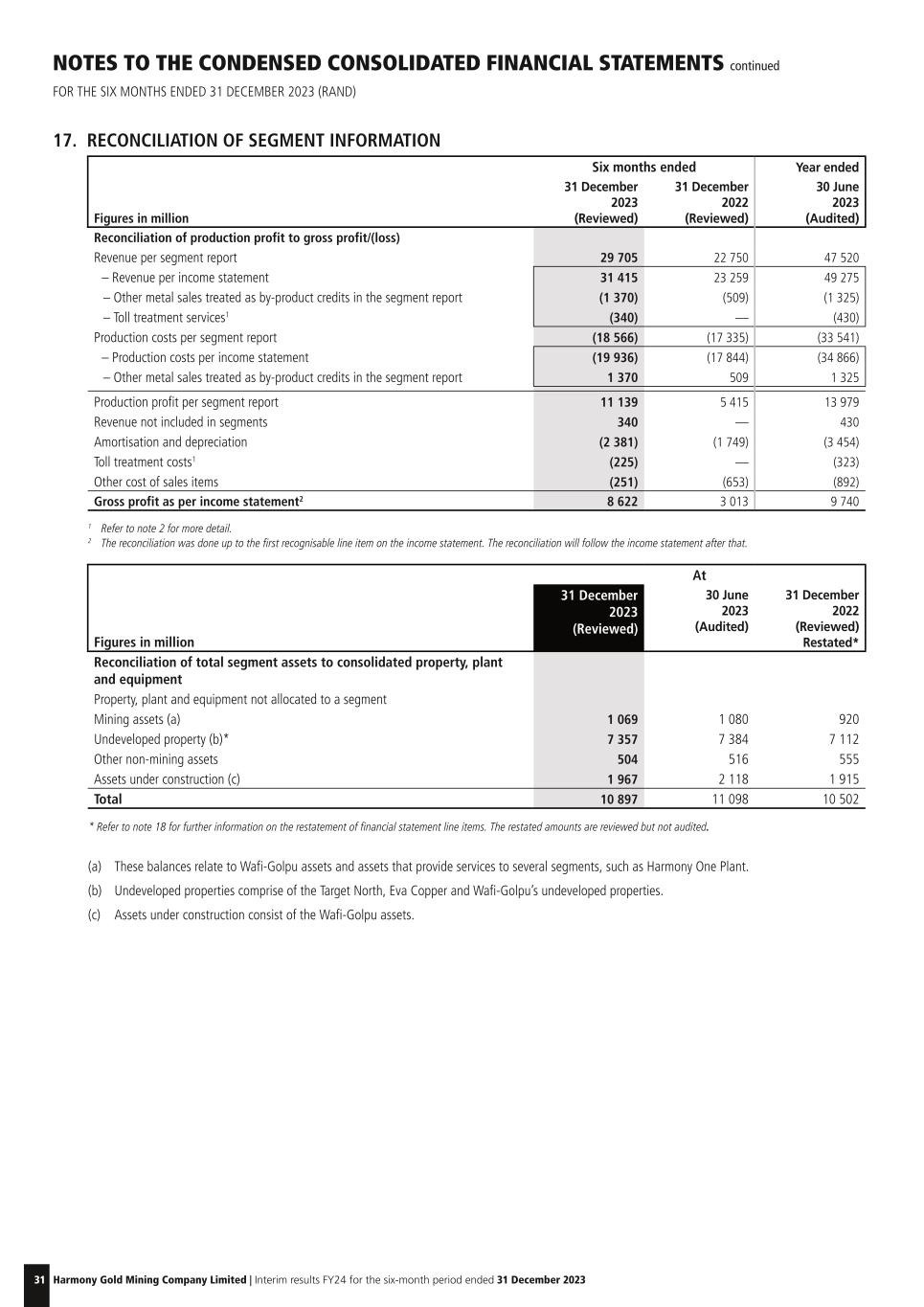

Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 202317 At Figures in million Notes 31 December 2023 (Reviewed) 30 June 2023 (Audited) 31 December 2022 (Reviewed) Restated* ASSETS Non-current assets Property, plant and equipment* 7 42 506 41 507 38 308 Intangible assets 26 33 40 Restricted cash and investments 6 206 6 121 5 935 Investments in associates 120 111 101 Deferred tax assets 126 189 178 Other non-current assets 311 332 342 Derivative financial assets 8 273 269 184 Total non-current assets 49 568 48 562 45 088 Current assets Inventories 3 213 3 265 2 744 Restricted cash and investments 41 41 34 Trade and other receivables* 9 3 287 2 395 2 327 Derivative financial assets 8 241 110 332 Cash and cash equivalents 3 436 2 867 2 195 Total current assets 10 218 8 678 7 632 Total assets 59 786 57 240 52 720 EQUITY AND LIABILITIES Share capital and reserves Attributable to equity holders of the parent company 39 833 34 757 31 701 Share capital and premium 32 934 32 934 32 934 Other reserves 6 399 6 778 6 702 Retained earnings/(Accumulated loss) 500 (4 955) (7 935) Non-controlling interest 142 123 90 Total equity 39 975 34 880 31 791 Non-current liabilities Deferred tax liabilities* 5 2 775 2 294 1 740 Provision for environmental rehabilitation 5 600 5 473 5 302 Other provisions 605 633 861 Borrowings 10 3 348 5 592 6 905 Contingent consideration liabilities 4 729 589 570 Other non-current liabilities 291 337 291 Derivative financial liabilities 8 137 470 — Streaming contract liability 11 — 105 224 Total non-current liabilities 13 485 15 493 15 893 Current liabilities Other provisions 24 180 139 Borrowings 10 14 103 — Trade and other payables 5 161 5 238 4 587 Contingent consideration liabilities 108 — — Derivative financial liabilities 8 794 1 061 13 Streaming contract liability 11 225 285 297 Total current liabilities 6 326 6 867 5 036 Total equity and liabilities 59 786 57 240 52 720 * Refer to note 18 for further information on the restatement of financial statement line items. The restated amounts are reviewed but not audited. The accompanying notes are an integral part of these condensed consolidated financial statements. CONDENSED CONSOLIDATED BALANCE SHEET (RAND)

Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 202318 Six months ended Year ended Figures in million Notes 31 December 2023 (Reviewed) 31 December 2022 (Reviewed) 30 June 2023 (Audited) CASH FLOW FROM OPERATING ACTIVITIES Cash generated by operations 12 8 264 3 262 10 589 Dividends received 27 50 75 Interest received 148 58 165 Interest paid (330) (178) (363) Income and mining taxes paid (1 114) (127) (518) Cash generated from operating activities 6 995 3 065 9 948 CASH FLOW FROM INVESTING ACTIVITIES Increase in restricted cash and investments (12) (122) (138) Amounts refunded from restricted cash and investments 120 — 58 Acquisition of Eva Copper — (2 996) (2 996) ARM BBEE Trust loan repayment 30 46 74 Proceeds from disposal of property, plant and equipment 2 39 46 Additions to property, plant and equipment 12 (3 868) (3 646) (7 640) Cash utilised by investing activities (3 728) (6 679) (10 596) CASH FLOW FROM FINANCING ACTIVITIES Borrowings raised 10 300 3 619 3 619 Borrowings repaid 10 (2 427) (28) (2 071) Lease payments (131) (121) (200) Dividends paid (486) (145) (154) Cash generated/(utilised) by financing activities (2 744) 3 325 1 194 Foreign currency translation adjustments 46 36 (127) Net increase/(decrease) in cash and cash equivalents 569 (253) 419 Cash and cash equivalents – beginning of period 2 867 2 448 2 448 Cash and cash equivalents – end of period 3 436 2 195 2 867 The accompanying notes are an integral part of these condensed consolidated financial statements. CONDENSED CONSOLIDATED CASH FLOW STATEMENT (RAND)

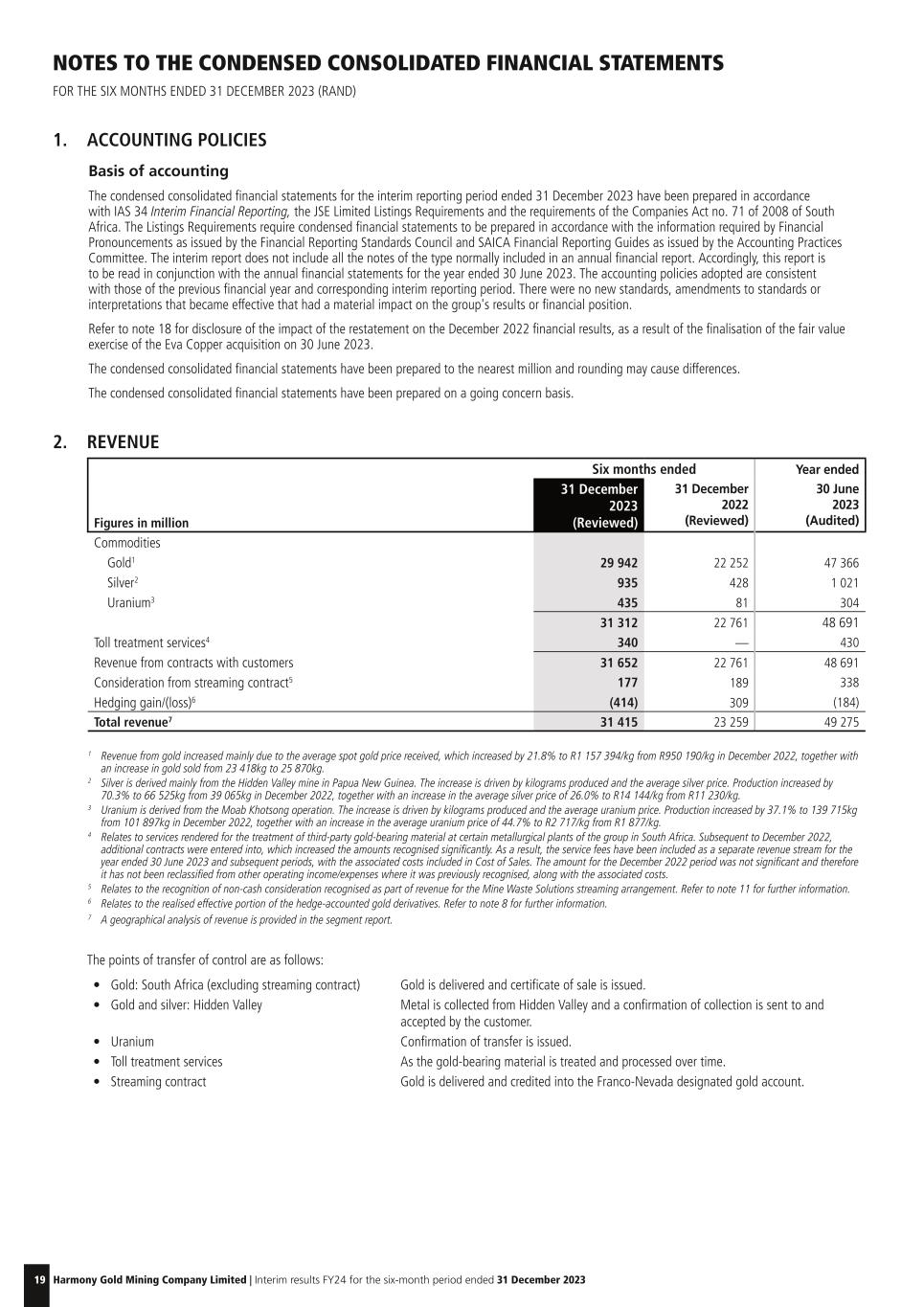

Harmony Gold Mining Company Limited | Interim results FY24 for the six-month period ended 31 December 202319 NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED 31 DECEMBER 2023 (RAND) 1. ACCOUNTING POLICIES Basis of accounting The condensed consolidated financial statements for the interim reporting period ended 31 December 2023 have been prepared in accordance with IAS 34 Interim Financial Reporting, the JSE Limited Listings Requirements and the requirements of the Companies Act no. 71 of 2008 of South Africa. The Listings Requirements require condensed financial statements to be prepared in accordance with the information required by Financial Pronouncements as issued by the Financial Reporting Standards Council and SAICA Financial Reporting Guides as issued by the Accounting Practices Committee. The interim report does not include all the notes of the type normally included in an annual financial report. Accordingly, this report is to be read in conjunction with the annual financial statements for the year ended 30 June 2023. The accounting policies adopted are consistent with those of the previous financial year and corresponding interim reporting period. There were no new standards, amendments to standards or interpretations that became effective that had a material impact on the group's results or financial position. Refer to note 18 for disclosure of the impact of the restatement on the December 2022 financial results, as a result of the finalisation of the fair value exercise of the Eva Copper acquisition on 30 June 2023. The condensed consolidated financial statements have been prepared to the nearest million and rounding may cause differences. The condensed consolidated financial statements have been prepared on a going concern basis. 2. REVENUE Six months ended Year ended Figures in million 31 December 2023 (Reviewed) 31 December 2022 (Reviewed) 30 June 2023 (Audited) Commodities Gold1 29 942 22 252 47 366 Silver2 935 428 1 021 Uranium3 435 81 304 31 312 22 761 48 691 Toll treatment services4 340 — 430 Revenue from contracts with customers 31 652 22 761 48 691 Consideration from streaming contract5 177 189 338 Hedging gain/(loss)6 (414) 309 (184) Total revenue7 31 415 23 259 49 275 1 Revenue from gold increased mainly due to the average spot gold price received, which increased by 21.8% to R1 157 394/kg from R950 190/kg in December 2022, together with an increase in gold sold from 23 418kg to 25 870kg. 2 Silver is derived mainly from the Hidden Valley mine in Papua New Guinea. The increase is driven by kilograms produced and the average silver price. Production increased by 70.3% to 66 525kg from 39 065kg in December 2022, together with an increase in the average silver price of 26.0% to R14 144/kg from R11 230/kg. 3 Uranium is derived from the Moab Khotsong operation. The increase is driven by kilograms produced and the average uranium price. Production increased by 37.1% to 139 715kg from 101 897kg in December 2022, together with an increase in the average uranium price of 44.7% to R2 717/kg from R1 877/kg. 4 Relates to services rendered for the treatment of third-party gold-bearing material at certain metallurgical plants of the group in South Africa. Subsequent to December 2022, additional contracts were entered into, which increased the amounts recognised significantly. As a result, the service fees have been included as a separate revenue stream for the year ended 30 June 2023 and subsequent periods, with the associated costs included in Cost of Sales. The amount for the December 2022 period was not significant and therefore it has not been reclassified from other operating income/expenses where it was previously recognised, along with the associated costs. 5 Relates to the recognition of non-cash consideration recognised as part of revenue for the Mine Waste Solutions streaming arrangement. Refer to note 11 for further information. 6 Relates to the realised effective portion of the hedge-accounted gold derivatives. Refer to note 8 for further information. 7 A geographical analysis of revenue is provided in the segment report. The points of transfer of control are as follows: • Gold: South Africa (excluding streaming contract) Gold is delivered and certificate of sale is issued. • Gold and silver: Hidden Valley Metal is collected from Hidden Valley and a confirmation of collection is sent to and accepted by the customer. • Uranium Confirmation of transfer is issued. • Toll treatment services As the gold-bearing material is treated and processed over time. • Streaming contract Gold is delivered and credited into the Franco-Nevada designated gold account.