MetLife Investment Management Names Jude Driscoll President

19 Agosto 2024 - 10:15PM

Business Wire

MetLife Investment Management (MIM), the institutional asset

management business of MetLife, Inc. (NYSE: MET), today announced

that it has named Jude Driscoll its president, effective Sept.

1.

Previously serving as MIM’s global head of Fixed Income and

Private Capital, Driscoll will continue to report to John

McCallion, MetLife’s chief financial officer and head of MetLife

Investment Management. The two will collaborate in driving MIM’s

strategy and business operations.

“Jude is the ideal leader to assume the role of president and

support MIM in continuing to enhance its client service and

offerings, and realize its growth ambitions,” said McCallion.

“Jude’s deep understanding of our clients’ needs and his leadership

will help accelerate our strategy, leveraging the investment

insight of our organization.”

Driscoll joined MIM in 2017 following its acquisition of Logan

Circle Partners, where he was founder, chief executive officer and

chief investment officer. Prior to Logan Circle, Driscoll was

president and chief executive officer of Delaware Investments.

“I am honored to be named MIM president and look forward to

expanding our leadership position as one of the premier fixed

income, private capital and real estate investment firms in the

world,” Driscoll said. “With our exceptional team, robust

investment processes, and world-class platform, MIM is

well-positioned for sustained success.”

About MetLife Investment

Management

MetLife Investment Management, the institutional asset

management business of MetLife, Inc. (NYSE: MET), is a global

public fixed income, private capital and real estate investment

manager providing tailored investment solutions to institutional

investors worldwide. MetLife Investment Management provides public

and private pension plans, insurance companies, endowments, funds

and other institutional clients with a range of bespoke investment

and financing solutions that seek to meet a range of long-term

investment objectives and risk-adjusted returns over time. MetLife

Investment Management has over 150 years of investment experience

and, as of June 30, 2024, had $587.6 billion in total assets under

management.1

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (“MetLife”), is one of the world’s leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help individual and institutional

customers build a more confident future. Founded in 1868, MetLife

has operations in more than 40 markets globally and holds leading

positions in the United States, Asia, Latin America, Europe and the

Middle East. For more information, visit www.metlife.com.

Forward-Looking Statements

The forward-looking statements in this news release, using words

such as “continue,” “look forward,” “seek,” “well-positioned” and

“will” are based on assumptions and expectations that involve risks

and uncertainties, including the “Risk Factors” MetLife, Inc.

describes in its U.S. Securities and Exchange Commission filings.

MetLife’s future results could differ, and it does not undertake

any obligation to publicly correct or update any of these

statements.

Endnotes

1Total assets under management is comprised of all MetLife

general account and separate account assets and unaffiliated/third

party assets, at estimated fair value, managed by MIM. For more

information, see the total assets under management fact sheet for

the quarter ended June 30, 2024 available on MetLife’s Investor

Relations webpage (https://investor.metlife.com).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819835803/en/

For Media: Dave Franecki +1 (973) 264-7465

dave.franecki@metlife.com

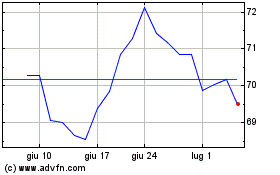

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Gen 2025 a Feb 2025

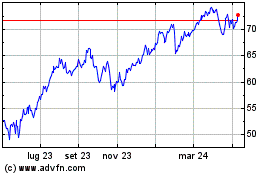

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Feb 2024 a Feb 2025