MetLife’s Upwise Helps Drive Up Benefits Enrollment, Engagement and Value

02 Ottobre 2024 - 2:00PM

Business Wire

This year nearly one million employees will

experience this industry-leading personalized decision support and

utilization platform

Today’s workforce values the ability to choose from a diverse

set of benefits—66% of employees say they want more benefits to

choose from, up from 60% in 20231. But while interest in benefits

is clear, lack of benefit comprehension is also on the rise with

more than half of employees (55%) saying that they do not fully

understand their benefits package1.

Open enrollment offers employers a critical opportunity to

address these employee needs and shift their approach to benefit

selection. This open enrollment season, nearly one million U.S.

employees will have the opportunity to experience MetLife’s Upwise,

a proprietary solution designed to help employees choose benefits

wisely and use them seamlessly. Upwise enhances the benefit

experience with personalized benefit recommendations, including a

major medical benefit recommendation that utilizes AI, and guidance

based on an employee’s individual needs and preferences. Informed

benefit election and increased utilization drives employee holistic

health and financial confidence, leading to a more engaged and

productive workforce.

“Today’s employers are facing macro challenges – everything from

rising healthcare costs and mental health concerns to disengaged

workforces,” says Todd Katz, head of Group Benefits at MetLife. “By

helping employees thoughtfully choose and use their benefits,

MetLife has found that employees are healthier, more productive,

and better able to support key business imperatives. It’s only

through proactive and personalized experiences that this is

possible. Upwise delivers such an experience.”

Here’s how it works: Upwise uses permissioned personalized

medical information, financial data, and employee preferences to

develop personalized recommendations across a wide array of

benefits including health and nonmedical insurance plans offered by

an employer. Once employees choose their benefit selections,

Upwise’s engagement capability then provides regular nudges to help

employees use their benefits during applicable moments throughout

the year. According to early results2, deployment of benefits

decision support during open enrollment period yielded solid

double-digit growth in benefits enrollment.

To learn more about how Upwise can increase employee engagement

and drive business outcomes, visit

metlife.com/business-and-brokers/employee-benefits/upwise. For

real-time resources and helpful tips for employees for this year’s

open enrollment season visit metlife.com/open-enrollment.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates (“MetLife”), is one of the world’s leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help individual and institutional

customers build a more confident future. Founded in 1868, MetLife

has operations in more than 40 markets globally and holds leading

positions in the United States, Asia, Latin America, Europe, and

the Middle East. For more information, visit www.metlife.com.

1.

MetLife’s 22nd Annual U.S. Employee

Benefit Trends Study

2.

Findings are based on a pilot study

involving 6,011 users and 6,154 non-users at MetLife conducted

during MetLife’s 2023 open enrollment period, which began 11/6/2023

and closed 11/19/2023. Users that did not actively complete an

enrollment event during MetLife’s 2023 open enrollment period were

excluded from this analysis.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002692082/en/

Media: Liz Harish 929-343-7473 elizabeth.harish@metlife.com

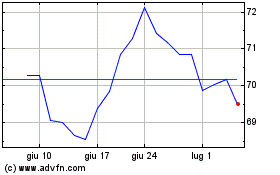

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Nov 2024 a Dic 2024

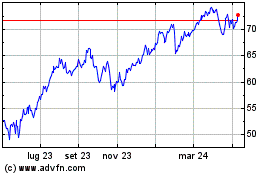

Grafico Azioni MetLife (NYSE:MET)

Storico

Da Dic 2023 a Dic 2024