false

0001055160

0001055160

2024-05-06

2024-05-06

0001055160

us-gaap:CommonStockMember

2024-05-06

2024-05-06

0001055160

us-gaap:SeriesBPreferredStockMember

2024-05-06

2024-05-06

0001055160

us-gaap:SeriesCPreferredStockMember

2024-05-06

2024-05-06

0001055160

MFA:Senior8.875PercentNotesDue2029Member

2024-05-06

2024-05-06

0001055160

MFA:Senior9.000PercentNotesDue2029Member

2024-05-06

2024-05-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 6, 2024

MFA

FINANCIAL, INC.

(Exact name of registrant as specified in its

charter)

| Maryland |

|

1-13991 |

|

13-3974868 |

(State or

other jurisdiction

of incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| One

Vanderbilt Avenue, 48th Floor |

|

|

| New

York, New York |

|

10017 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's

telephone number, including area code: (212)

207-6400

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| |

|

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

Symbols:

|

|

Name

of each exchange on which registered:

|

| Common

Stock, par value $0.01 per share |

|

MFA |

|

New

York Stock Exchange |

7.50%

Series B Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

|

MFA/PB |

|

New

York Stock Exchange |

| 6.50% Series C Fixed-to-Floating Rate

Cumulative Redeemable Preferred Stock, par value $0.01 per share |

|

MFA/PC |

|

New York Stock Exchange |

| 8.875% Senior Notes due 2029 |

|

MFAN |

|

New York Stock Exchange |

| 9.000% Senior Notes due 2029 |

|

MFAO |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition and

Item 7.01 Regulation FD Disclosure

MFA Financial, Inc. (“MFA”) issued a press release,

dated May 6, 2024, announcing its financial results for the quarter ended March 31, 2024, which is attached hereto as Exhibit 99.1

and is incorporated herein by reference. In addition, in conjunction with the announcement of its financial results, MFA issued additional

information relating to its 2024 first quarter financial results. Such additional information is attached to this report as Exhibit 99.2

and is incorporated herein by reference.

The information referenced in this Current Report on Form 8-K

(including Exhibits 99.1 and 99.2) is being “furnished” and, as such, shall not be deemed to be “filed” for the

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section. The information set forth in this Current Report on Form 8-K (including Exhibits 99.1 and 99.2)

is and will not be incorporated by reference into any registration statement or other document filed by MFA pursuant to the Securities

Act of 1933, as amended (the “Securities Act”), except as may be expressly set forth by specific reference in such filing.

As discussed therein, the press release contains forward-looking statements

within the meaning of the Securities Act and the Exchange Act and, as such, may involve known and unknown risks, uncertainties and assumptions.

These forward-looking statements relate to MFA’s current expectations and are subject to the limitations and qualifications set

forth in the press release as well as in MFA’s other documents filed with the SEC, including, without limitation, that actual events

and/or results may differ materially from those projected in such forward-looking statements.

Exhibit

| 104 | Cover Page Interactive Data

File (formatted as Inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MFA FINANCIAL, INC. |

| |

(REGISTRANT) |

| |

|

| |

By: |

/s/ Harold E. Schwartz |

| |

|

Name: Harold E. Schwartz |

| |

|

Title: Senior Vice President and General Counsel |

Date: May 6, 2024

EXHIBIT INDEX

| 104 |

| Cover

Page Interactive Data File (formatted as Inline XBRL). |

Exhibit 99.1

MFA

FINANCIAL, INC.

One Vanderbilt Ave.

New York, New York 10017

| PRESS RELEASE | |

|

|

FOR IMMEDIATE RELEASE |

| May 6, 2024 |

| |

|

NEW YORK METRO |

| INVESTOR CONTACT: | |

InvestorRelations@mfafinancial.com | |

NYSE: MFA |

| | |

212-207-6488 | |

|

| | |

www.mfafinancial.com | |

|

| MEDIA CONTACT: | |

H/Advisors Abernathy |

| | |

Tom Johnson |

| | |

212-371-5999 |

MFA Financial, Inc.

Announces First Quarter 2024 Financial Results

NEW YORK - MFA

Financial, Inc. (NYSE:MFA) today provided its financial results for the first quarter ended March 31, 2024:

| · | MFA

generated GAAP net income for the first quarter of $15.0 million, or $0.14 per basic and

diluted common share. |

| · | Distributable

earnings, a non-GAAP financial measure, were $36.1 million, or $0.35 per common share. MFA

paid a regular cash dividend of $0.35 per common share on April 30, 2024. |

| · | GAAP

book value at March 31, 2024 was $13.80 per common share. Economic book value, a non-GAAP

financial measure, was $14.32 per common share. |

| · | Total

economic return was 0.7% for the first quarter. |

| · | Net

interest spread averaged 2.06% and net interest margin was 2.88%. |

| · | MFA

closed the quarter with unrestricted cash of $306.3 million. |

Commenting on the

quarter, Craig Knutson, MFA’s CEO and President, stated: “Although our book value was modestly impacted by higher interest

rates, we are pleased to report strong distributable earnings for the opening months of 2024. We acquired or originated $652 million

of residential mortgage loans during the quarter with an average coupon of approximately 10%. This includes over $400 million of new

business purpose loans originated by our wholly-owned subsidiary Lima One Capital. We completed one securitization during the quarter

and again benefited from our $3.2 billion interest rate swap position, which generated a net positive carry of $29 million. As a result

of our disciplined risk management strategies, our net interest spread and net interest margin each remained healthy at 2.06% and 2.88%,

respectively.”

Mr. Knutson

continued: “During the quarter, we repurchased $40 million of our convertible senior notes due in June, reducing the outstanding

balance to less than $170 million. In January, we issued $115 million of 8.875% senior unsecured notes due in February 2029. Last

month, we issued an additional $75 million of 9.00% senior unsecured notes due in August 2029. We continue to maintain a substantial

cash position in order to protect our balance sheet from further interest rate or credit spread volatility. We believe we are well-situated

to take advantage of market opportunities that may arise.”

Q1 2024 Portfolio Activity

| · | Loan

acquisitions were $651.8 million, including $465.4 million of funded originations

of business purpose loans (including draws on Transitional loans) and $186.4 million

of Non-QM loan acquisitions, bringing MFA’s residential whole loan balance to $9.1

billion. |

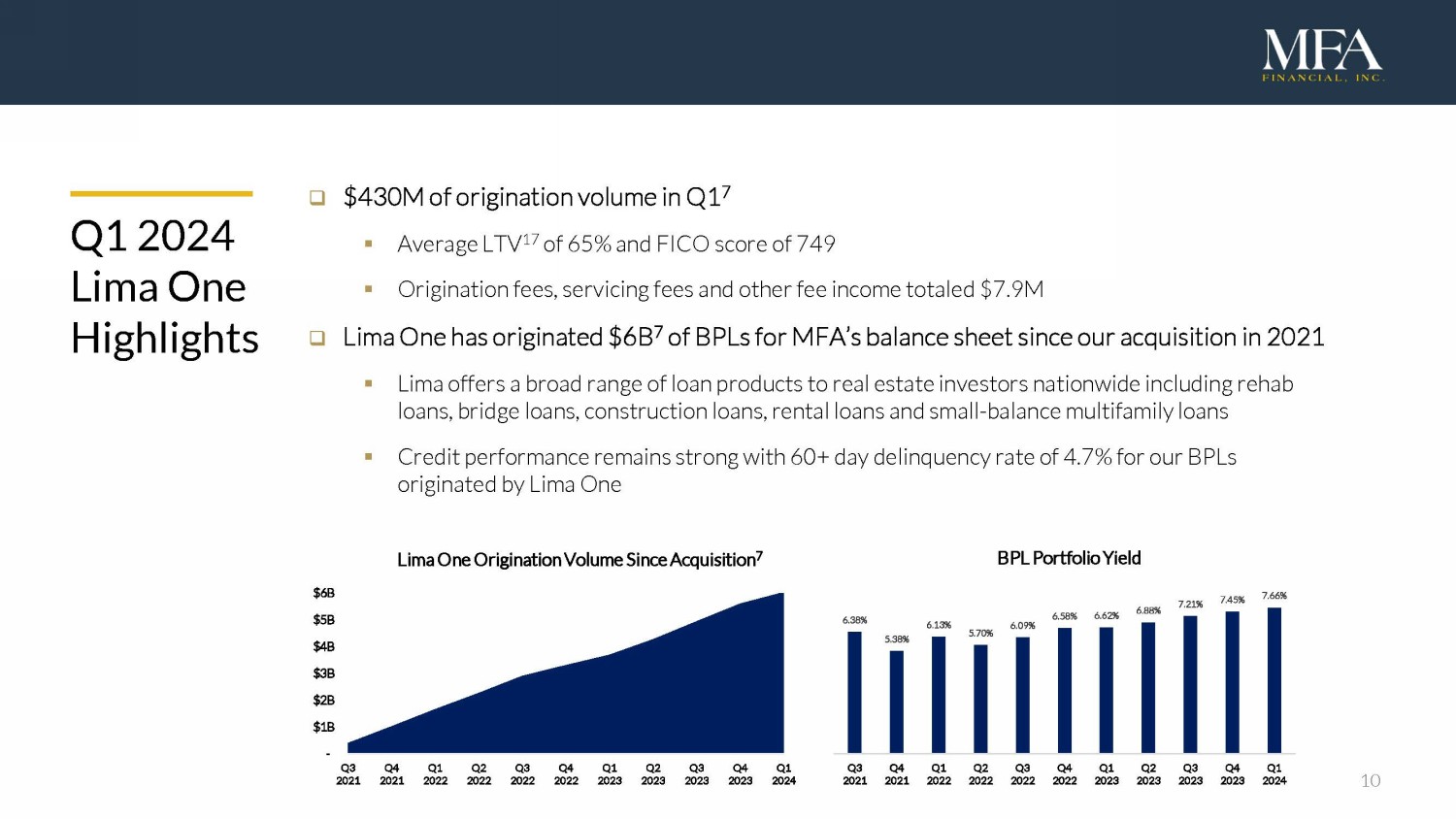

| · | Lima

One funded $301.7 million of new business purpose loans with a maximum loan amount of $429.8

million. Further, $163.7 million of draws were funded on previously originated Transitional

loans. Lima One generated $7.9 million of origination, servicing, and other fee income. |

| · | Asset

dispositions included $60.6 million UPB of Non-QM loans and $110.4 million UPB of SFR loans.

Inclusive of the reversal of previously recognized unrealized losses, the Company recorded

a net gain of $2.0 million. |

| · | MFA

continued to reduce its REO portfolio, selling 73 properties in the first quarter for aggregate

proceeds of $24.2 million and generating $2.0 million of gains. |

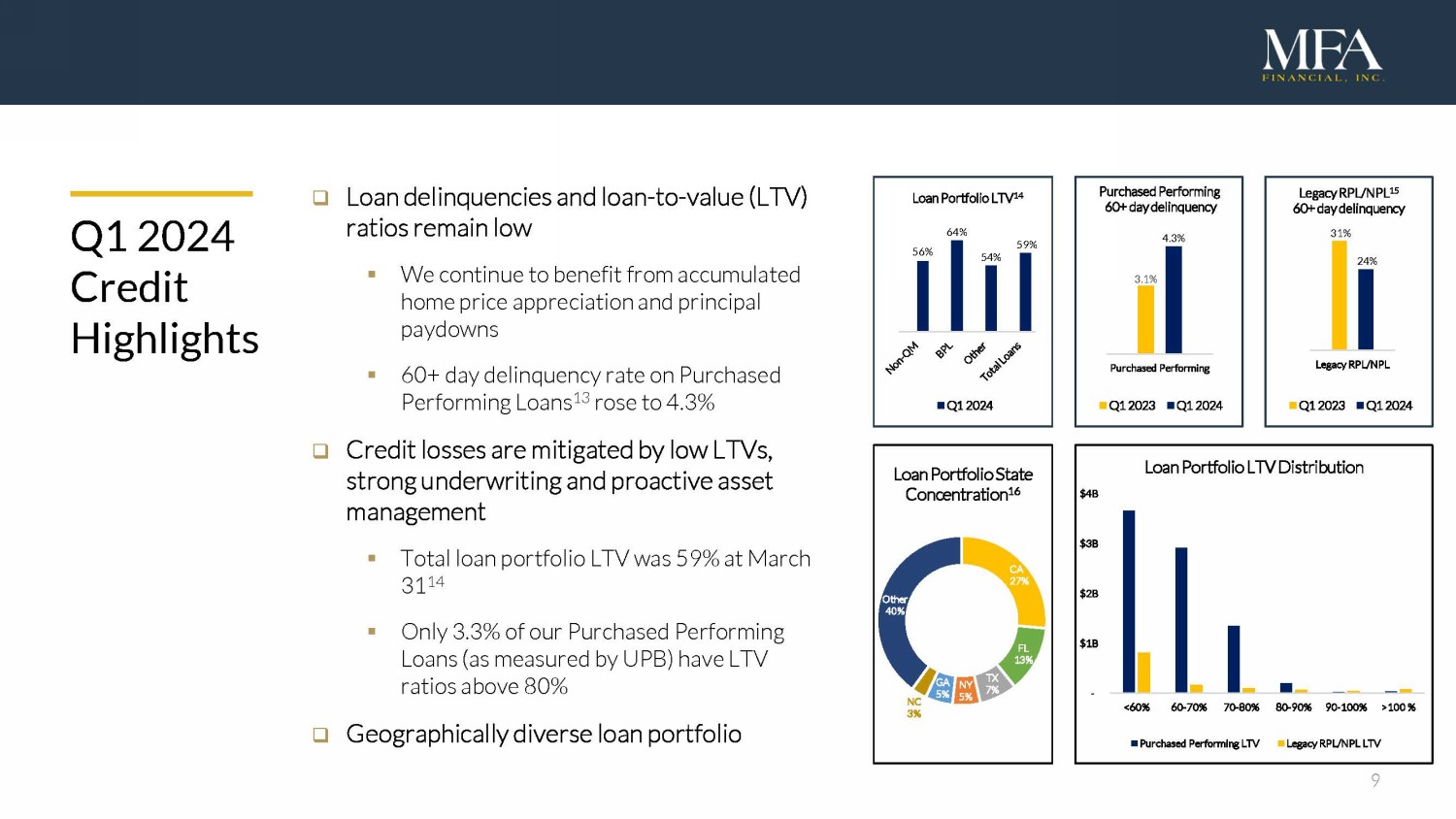

| · | 60+

day delinquencies (measured as a percentage of UPB) for Purchased Performing Loans increased

to 4.3% from 3.8% in the fourth quarter. Combined Purchased Credit Deteriorated and Purchased

Non-Performing 60+ day delinquencies declined to 24.3% from 24.5% in the fourth quarter. |

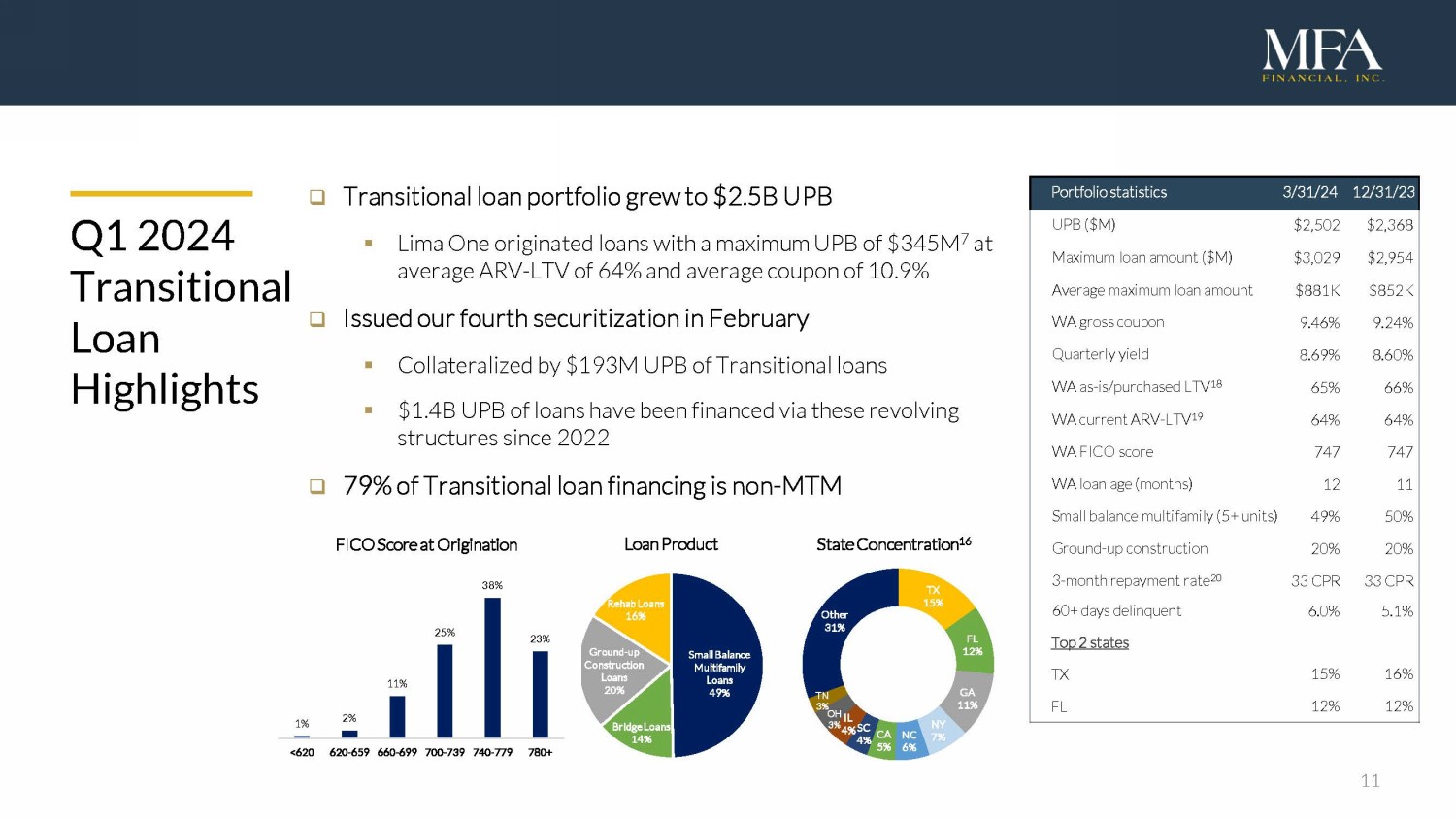

| · | MFA

completed one loan securitization during the quarter, collateralized by $192.5 million

UPB of Transitional loans, bringing its securitized debt to approximately $4.8 billion. |

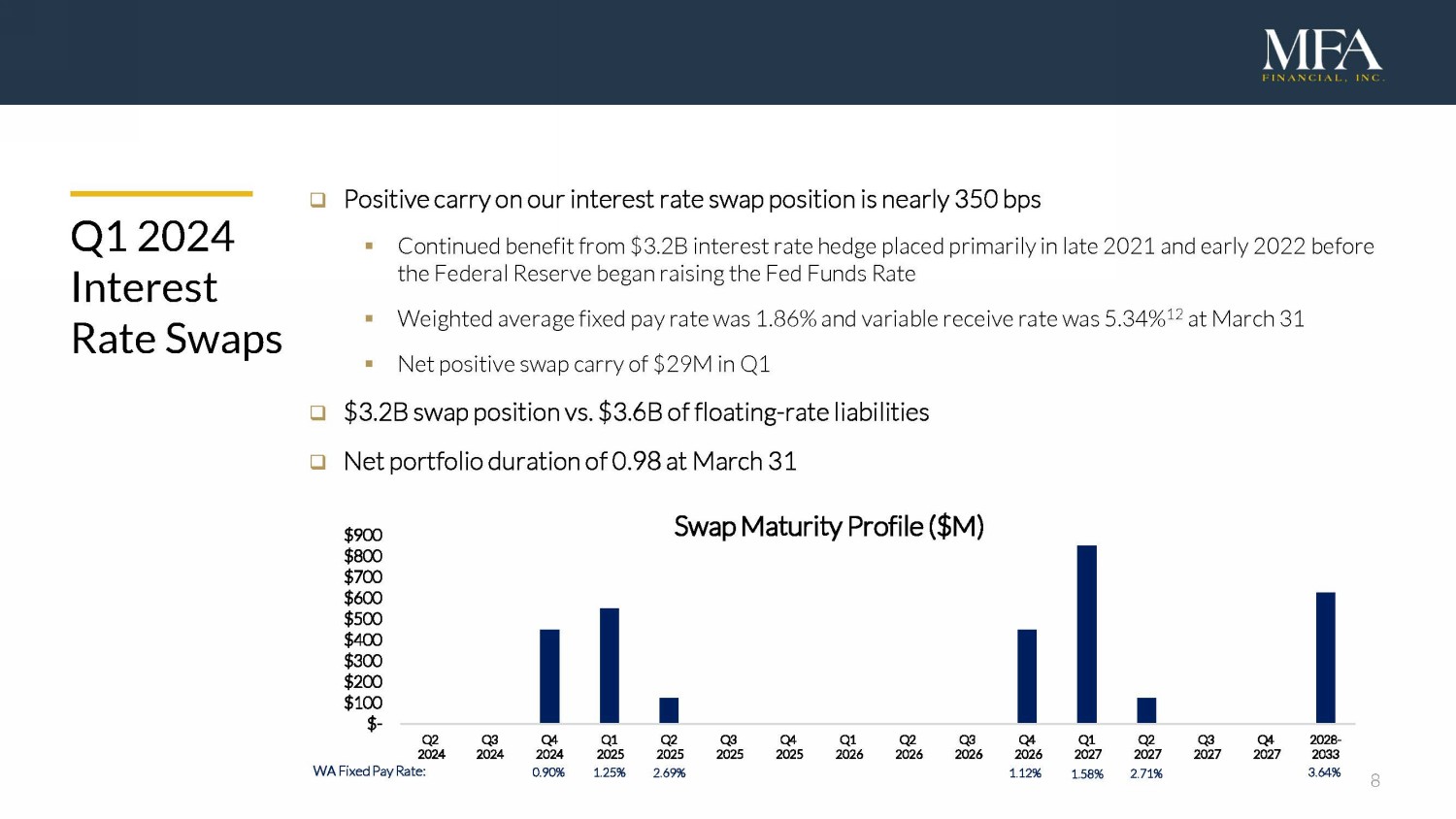

| · | MFA

maintained its position in interest rate swaps at a notional amount of approximately $3.2

billion. At March 31, 2024, these swaps had a weighted average fixed pay interest rate

of 1.86% and a weighted average variable receive interest rate of 5.34%. |

| · | MFA

estimates the net effective duration of its investment portfolio at March 31, 2024 rose

to 0.98 from 0.91 at December 31, 2023. |

| · | MFA’s

Debt/Net Equity Ratio was 4.6x and recourse leverage was 1.8x at March 31, 2024. |

Webcast

MFA Financial, Inc.

plans to host a live audio webcast of its investor conference call on Monday, May 6, 2024, at 11:00 a.m. (Eastern Time) to

discuss its first quarter 2024 financial results. The live audio webcast will be accessible to the general public over the internet at

http://www.mfafinancial.com through the “Webcasts & Presentations” link on MFA’s home page. Earnings presentation

materials will be posted on the MFA website prior to the conference call and an audio replay will be available on the website following

the call.

About MFA

Financial, Inc.

MFA Financial, Inc.

(NYSE: MFA) is a leading specialty finance company that invests in residential mortgage loans, residential mortgage-backed securities

and other real estate assets. Through its wholly-owned subsidiary, Lima One Capital, MFA also originates and services business purpose

loans for real estate investors. MFA has distributed $4.7 billion in dividends to stockholders since its initial public offering in 1998.

MFA is an internally-managed, publicly-traded real estate investment trust.

The following table

presents MFA’s asset allocation as of March 31, 2024, and the first quarter 2024 yield on average interest-earning assets,

average cost of funds and net interest rate spread for the various asset types.

Table 1 - Asset Allocation

| At March 31,

2024 | |

Purchased

Performing

Loans (1) | | |

Purchased

Credit

Deteriorated

Loans (2) | | |

Purchased

Non-

Performing

Loans | | |

Securities,

at fair value | | |

Real Estate

Owned | | |

Other,

net (3) | | |

Total | |

| (Dollars in Millions) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fair Value/Carrying Value | |

$ | 8,025 | | |

$ | 412 | | |

$ | 682 | | |

$ | 737 | | |

$ | 106 | | |

$ | 607 | | |

$ | 10,569 | |

| Financing Agreements with Non-mark-to-market

Collateral Provisions | |

| (1,102 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (1,102 | ) |

| Financing Agreements with Mark-to-market

Collateral Provisions | |

| (1,519 | ) | |

| (139 | ) | |

| (222 | ) | |

| (606 | ) | |

| (23 | ) | |

| — | | |

| (2,509 | ) |

| Securitized Debt | |

| (4,300 | ) | |

| (228 | ) | |

| (257 | ) | |

| — | | |

| (9 | ) | |

| — | | |

| (4,794 | ) |

| Senior Notes | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (280 | ) | |

| (280 | ) |

| Net Equity Allocated | |

$ | 1,104 | | |

$ | 45 | | |

$ | 203 | | |

$ | 131 | | |

$ | 74 | | |

$ | 327 | | |

$ | 1,884 | |

| Debt/Net

Equity Ratio (4) | |

| 6.3 | x | |

| 8.2 | x | |

| 2.4 | x | |

| 4.6 | x | |

| 0.4 | x | |

| | | |

| 4.6 | x |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| For the

Quarter Ended March 31, 2024 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Yield on

Average Interest Earning Assets (5) | |

| 6.50 | % | |

| 5.95 | % | |

| 8.91 | % | |

| 7.24 | % | |

| N/A | | |

| | | |

| 6.58 | % |

| Less Average Cost of Funds

(6) | |

| (4.56 | ) | |

| (2.87 | ) | |

| (3.78 | ) | |

| (4.00 | ) | |

| (6.40 | ) | |

| | | |

| (4.52 | ) |

| Net Interest Rate Spread | |

| 1.94 | % | |

| 3.08 | % | |

| 5.13 | % | |

| 3.24 | % | |

| (6.40 | )% | |

| | | |

| 2.06 | % |

| (1) | Includes

$3.8 billion of Non-QM loans, $2.5 billion of Transitional loans, $1.6 billion of Single-family

rental loans, $66.0 million of Seasoned performing loans, and $54.7 million of

Agency eligible investor loans. At March 31, 2024, the total fair value of these loans

is estimated to be $8.0 billion. |

| (2) | At

March 31, 2024, the total fair value of these loans is estimated to be $431.3 million. |

| (3) | Includes

$306.3 million of cash and cash equivalents, $222.9 million of restricted cash, and $19.8

million of capital contributions made to loan origination partners, as well as other assets

and other liabilities. |

| (4) | Total

Debt/Net Equity ratio represents the sum of borrowings under our financing agreements as

a multiple of net equity allocated. |

| (5) | Yields

reported on our interest earning assets are calculated based on the interest income recorded

and the average amortized cost for the quarter of the respective asset. At March 31,

2024, the amortized cost of our Securities, at fair value, was $715.4 million. In addition,

the yield for residential whole loans was 6.62%, net of one basis point of servicing fee

expense incurred during the quarter. For GAAP reporting purposes, such expenses are included

in Loan servicing and other related operating expenses in our statement of operations. |

| (6) | Average

cost of funds includes interest on financing agreements, Convertible Senior Notes, 8.875%

Senior Notes, and securitized debt. Cost of funding also includes the impact of the net carry

(the difference between swap interest income received and swap interest expense paid) on

our interest rate swap agreements (or Swaps). While we have not elected hedge accounting

treatment for Swaps and accordingly net carry is not presented in interest expense in our

consolidated statement of operations, we believe it is appropriate to allocate net carry

to the cost of funding to reflect the economic impact of our Swaps on the funding costs shown

in the table above. For the quarter ended March 31, 2024, this decreased the overall

funding cost by 131 basis points for our overall portfolio, 132 basis points for our Residential

whole loans, 134 basis points for our Purchased Performing Loans, 129 basis points for our

Purchased Credit Deteriorated Loans, 102 basis points for our Purchased Non-Performing Loans

and 179 basis points for our Securities, at fair value. |

The following table

presents the activity for our residential mortgage asset portfolio for the three months ended March 31, 2024:

Table 2 - Investment

Portfolio Activity Q1 2024

| (In Millions) | |

December 31,

2023 | | |

Runoff

(1) | | |

Acquisitions

(2) | | |

Other

(3) | | |

March 31,

2024 | | |

Change | |

| Residential whole loans and REO | |

$ | 9,151 | | |

$ | (414 | ) | |

$ | 652 | | |

$ | (164 | ) | |

$ | 9,225 | | |

$ | 74 | |

| Securities, at fair value | |

| 746 | | |

| (8 | ) | |

| — | | |

| (1 | ) | |

| 737 | | |

| (9 | ) |

| Totals | |

$ | 9,897 | | |

$ | (422 | ) | |

$ | 652 | | |

$ | (165 | ) | |

$ | 9,962 | | |

$ | 65 | |

| (1) | Primarily

includes principal repayments and sales of REO. |

| (2) | Includes

draws on previously originated Transitional loans. |

| (3) | Primarily

includes sales, changes in fair value and changes in the allowance for credit losses. |

The following tables

present information on our investments in residential whole loans:

Table 3 - Portfolio Composition/Residential

Whole Loans

| | |

Held at Carrying Value | | |

Held at Fair Value | | |

Total | |

| (Dollars

in Thousands) | |

March 31,

2024 | | |

December 31,

2023 | | |

March 31,

2024 | | |

December 31,

2023 | | |

March 31,

2024 | | |

December 31,

2023 | |

| Purchased Performing Loans: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-QM loans | |

$ | 816,617 | | |

$ | 843,884 | | |

$ | 3,021,769 | | |

$ | 2,961,693 | | |

$ | 3,838,386 | | |

$ | 3,805,577 | |

| Transitional

loans (1) | |

| 29,098 | | |

| 35,467 | | |

| 2,465,674 | | |

| 2,326,029 | | |

| 2,494,772 | | |

| 2,361,496 | |

| Single-family rental loans | |

| 148,943 | | |

| 172,213 | | |

| 1,430,021 | | |

| 1,462,583 | | |

| 1,578,964 | | |

| 1,634,796 | |

| Seasoned performing loans | |

| 66,065 | | |

| 68,945 | | |

| — | | |

| — | | |

| 66,065 | | |

| 68,945 | |

| Agency eligible investor loans | |

| — | | |

| — | | |

| 54,654 | | |

| 55,779 | | |

| 54,654 | | |

| 55,779 | |

| Total Purchased Performing Loans | |

$ | 1,060,723 | | |

$ | 1,120,509 | | |

$ | 6,972,118 | | |

$ | 6,806,084 | | |

$ | 8,032,841 | | |

$ | 7,926,593 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Purchased Credit Deteriorated Loans | |

$ | 423,647 | | |

$ | 429,726 | | |

$ | — | | |

$ | — | | |

$ | 423,647 | | |

$ | 429,726 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allowance for Credit Losses | |

$ | (19,612 | ) | |

$ | (20,451 | ) | |

$ | — | | |

$ | — | | |

$ | (19,612 | ) | |

$ | (20,451 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Purchased Non-Performing Loans | |

$ | — | | |

$ | — | | |

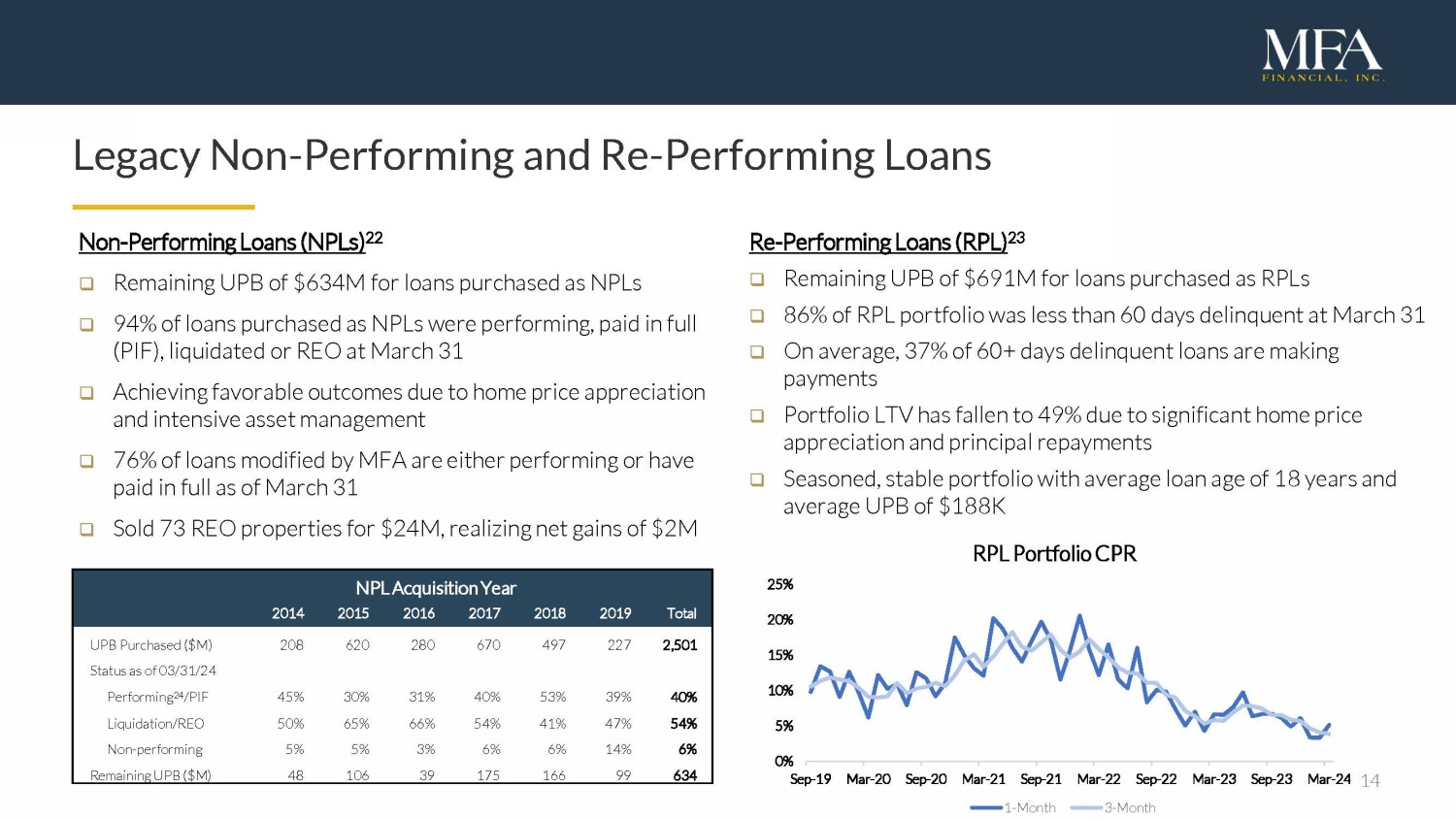

$ | 681,789 | | |

$ | 705,424 | | |

$ | 681,789 | | |

$ | 705,424 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Residential Whole Loans | |

$ | 1,464,758 | | |

$ | 1,529,784 | | |

$ | 7,653,907 | | |

$ | 7,511,508 | | |

$ | 9,118,665 | | |

$ | 9,041,292 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Number of loans | |

| 6,148 | | |

| 6,326 | | |

| 19,561 | | |

| 19,075 | | |

| 25,709 | | |

| 25,401 | |

| (1) | As

of March 31, 2024 includes $1.3 billion of loans collateralized by one-to-four

family residential properties, including $506.5 million of loans collateralized by new

construction projects at origination, and $1.2 billion of loans collateralized by multi-family

properties. As of December 31, 2023 includes $1.2 billion of loans collateralized

by one-to-four family residential properties and $1.2 billion of loans collateralized

by multi-family properties. |

Table 4 - Yields and Average Balances/Residential

Whole Loans

| | |

For

the Three-Month Period Ended | |

| | |

March 31,

2024 | | |

December 31,

2023 | | |

March 31,

2023 | |

| (Dollars in Thousands) | |

Interest | | |

Average

Balance | | |

Average

Yield | | |

Interest | | |

Average

Balance | | |

Average

Yield | | |

Interest | | |

Average

Balance | | |

Average

Yield | |

| Purchased Performing Loans: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

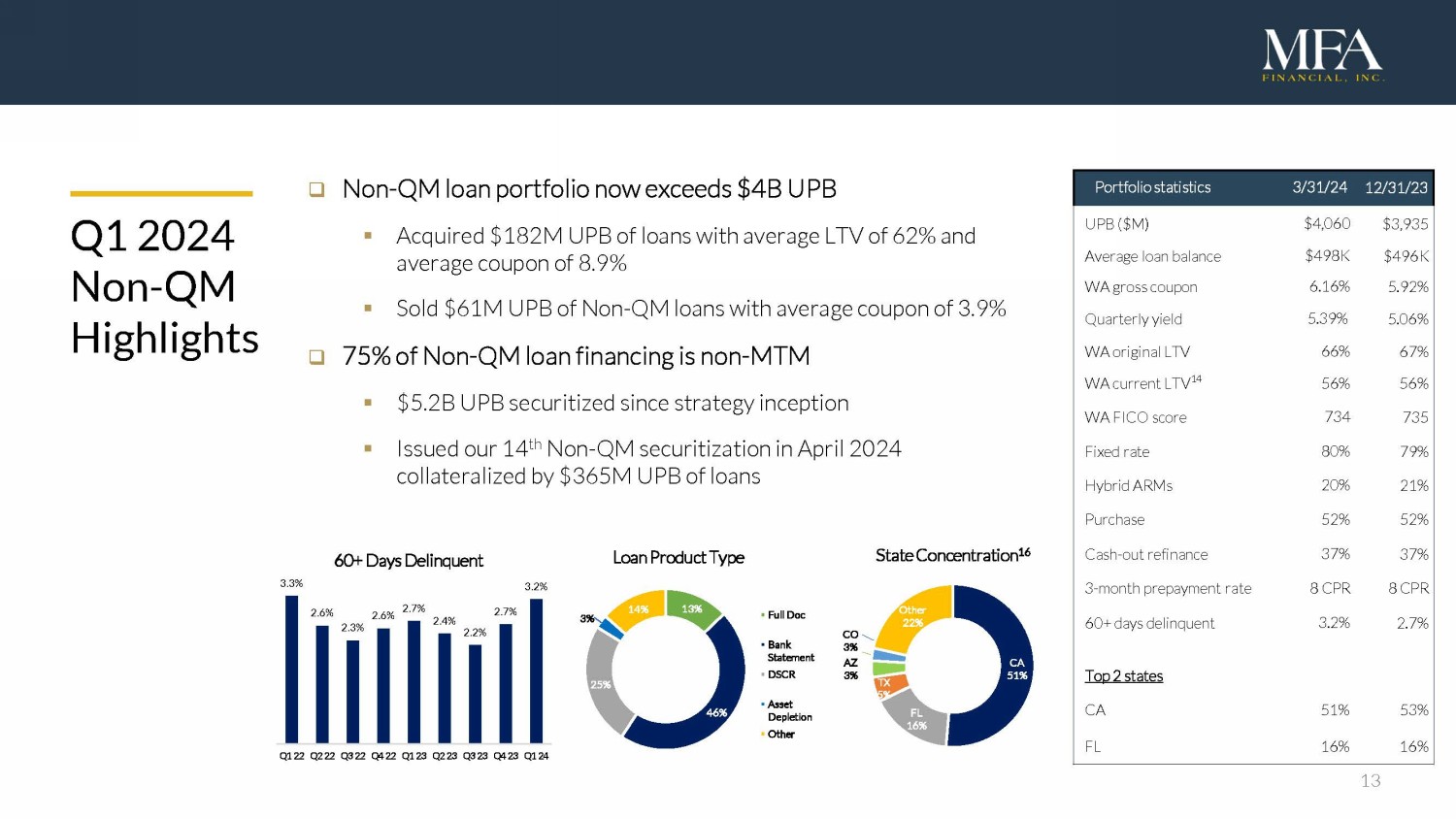

| Non-QM loans | |

$ | 55,861 | | |

$ | 4,149,257 | | |

| 5.39 | % | |

$ | 51,997 | | |

$ | 4,111,425 | | |

| 5.06 | % | |

$ | 44,089 | | |

$ | 3,803,154 | | |

| 4.64 | % |

| Transitional loans | |

| 53,216 | | |

| 2,448,951 | | |

| 8.69 | % | |

| 48,358 | | |

| 2,249,974 | | |

| 8.60 | % | |

| 28,227 | | |

| 1,473,420 | | |

| 7.66 | % |

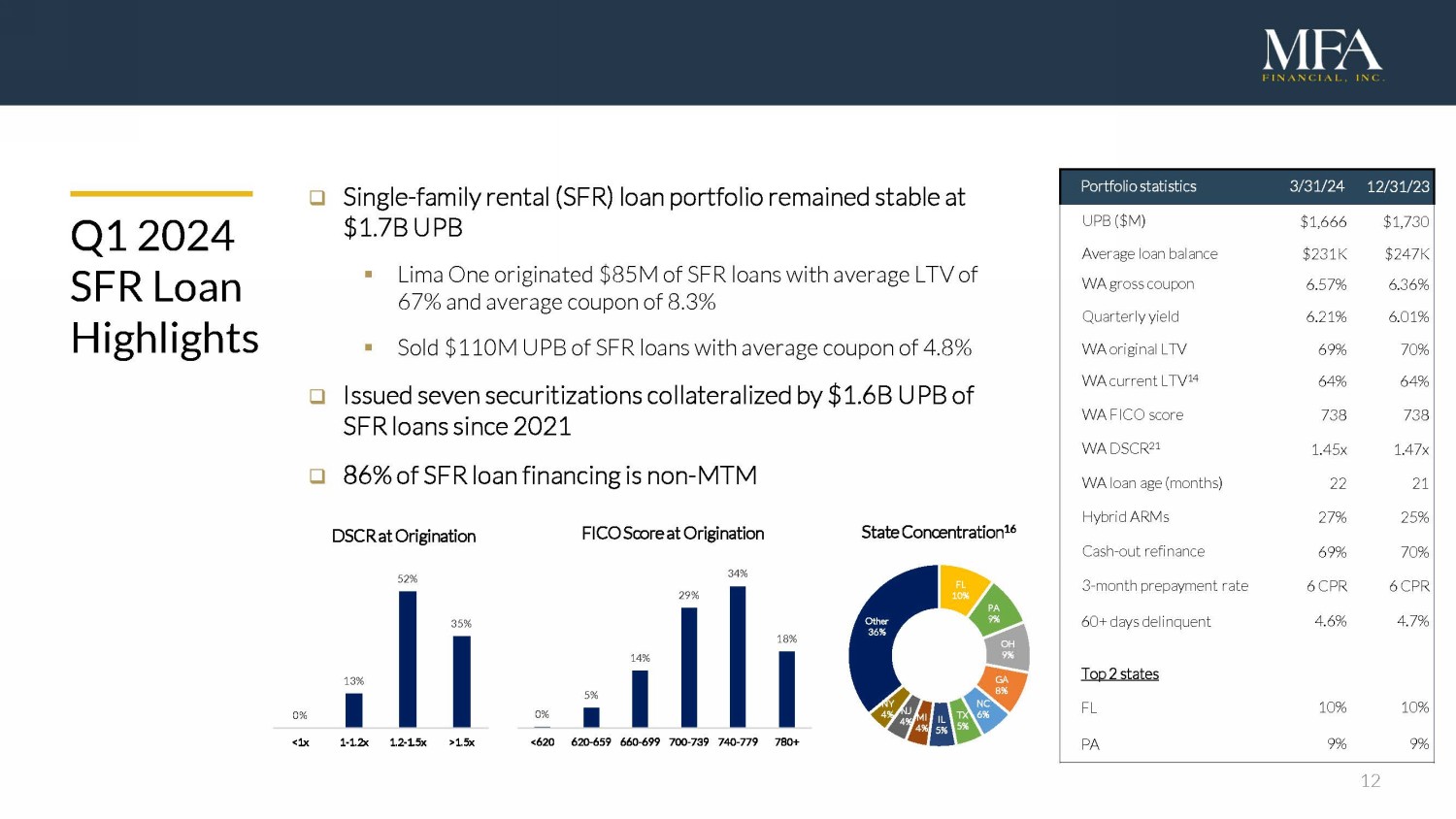

| Single-family rental loans | |

| 27,102 | | |

| 1,746,058 | | |

| 6.21 | % | |

| 25,598 | | |

| 1,702,940 | | |

| 6.01 | % | |

| 21,313 | | |

| 1,518,741 | | |

| 5.61 | % |

| Seasoned performing loans | |

| 1,124 | | |

| 67,713 | | |

| 6.64 | % | |

| 1,191 | | |

| 71,207 | | |

| 6.69 | % | |

| 1,090 | | |

| 81,388 | | |

| 5.36 | % |

| Agency eligible investor loans | |

| 517 | | |

| 68,490 | | |

| 3.02 | % | |

| 512 | | |

| 69,436 | | |

| 2.95 | % | |

| 2,857 | | |

| 380,763 | | |

| 3.00 | % |

| Total Purchased Performing Loans | |

| 137,820 | | |

| 8,480,469 | | |

| 6.50 | % | |

| 127,656 | | |

| 8,204,982 | | |

| 6.22 | % | |

| 97,576 | | |

| 7,257,466 | | |

| 5.38 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Purchased Credit Deteriorated Loans | |

| 6,355 | | |

| 427,267 | | |

| 5.95 | % | |

| 7,051 | | |

| 434,650 | | |

| 6.49 | % | |

| 7,138 | | |

| 466,123 | | |

| 6.13 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Purchased Non-Performing Loans | |

| 13,490 | | |

| 605,573 | | |

| 8.91 | % | |

| 15,080 | | |

| 624,910 | | |

| 9.65 | % | |

| 14,796 | | |

| 699,730 | | |

| 8.46 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Residential Whole Loans | |

$ | 157,665 | | |

$ | 9,513,309 | | |

| 6.63 | % | |

$ | 149,787 | | |

$ | 9,264,542 | | |

| 6.47 | % | |

$ | 119,510 | | |

$ | 8,423,319 | | |

| 5.68 | % |

Table 5 - Net Interest Spread/Residential

Whole Loans

| | |

For the Three-Month

Period Ended | |

| | |

March 31,

2024 | | |

December 31,

2023 | | |

March 31,

2023 | |

| Purchased Performing Loans | |

| | | |

| | | |

| | |

| Net Yield (1) | |

| 6.50 | % | |

| 6.22 | % | |

| 5.38 | % |

| Cost of Funding (2) | |

| 4.56 | % | |

| 4.43 | % | |

| 3.95 | % |

| Net Interest Spread | |

| 1.94 | % | |

| 1.79 | % | |

| 1.43 | % |

| | |

| | | |

| | | |

| | |

| Purchased Credit Deteriorated Loans | |

| | | |

| | | |

| | |

| Net Yield (1) | |

| 5.95 | % | |

| 6.49 | % | |

| 6.13 | % |

| Cost of Funding (2) | |

| 2.87 | % | |

| 2.68 | % | |

| 2.23 | % |

| Net Interest Spread | |

| 3.08 | % | |

| 3.81 | % | |

| 3.90 | % |

| | |

| | | |

| | | |

| | |

| Purchased Non-Performing Loans | |

| | | |

| | | |

| | |

| Net Yield (1) | |

| 8.91 | % | |

| 9.65 | % | |

| 8.46 | % |

| Cost of Funding (2) | |

| 3.78 | % | |

| 3.63 | % | |

| 3.53 | % |

| Net Interest Spread | |

| 5.13 | % | |

| 6.02 | % | |

| 4.93 | % |

| | |

| | | |

| | | |

| | |

| Total Residential Whole Loans | |

| | | |

| | | |

| | |

| Net Yield (1) | |

| 6.63 | % | |

| 6.47 | % | |

| 5.68 | % |

| Cost of Funding (2) | |

| 4.43 | % | |

| 4.29 | % | |

| 3.82 | % |

| Net Interest Spread | |

| 2.20 | % | |

| 2.18 | % | |

| 1.86 | % |

| (1) | Reflects

annualized interest income on Residential whole loans divided by average amortized cost of

Residential whole loans. Excludes servicing costs. |

| (2) | Reflects

annualized interest expense divided by average balance of agreements with mark-to-market

collateral provisions (repurchase agreements), agreements with non-mark-to-market collateral

provisions, and securitized debt. Cost of funding shown in the table above includes the impact

of the net carry (the difference between swap interest income received and swap interest

expense paid) on our Swaps. While we have not elected hedge accounting treatment for Swaps,

and, accordingly, net carry is not presented in interest expense in our consolidated statement

of operations, we believe it is appropriate to allocate net carry to the cost of funding

to reflect the economic impact of our Swaps on the funding costs shown in the table above.

For the quarter ended March 31, 2024, this decreased the overall funding cost by 132

basis points for our Residential whole loans, 134 basis points for our Purchased Performing

Loans, 129 basis points for our Purchased Credit Deteriorated Loans, and 102 basis points

for our Purchased Non-Performing Loans. For the quarter ended December 31, 2023, this

decreased the overall funding cost by 140 basis points for our Residential whole loans, 142

basis points for our Purchased Performing Loans, 143 basis points for our Purchased Credit

Deteriorated Loans, and 102 basis points for our Purchased Non-Performing Loans. For the

quarter ended March 31, 2023, this decreased the overall funding cost by 127 basis points

for our Residential whole loans, 129 basis points for our Purchased Performing Loans, 171

basis points for our Purchased Credit Deteriorated Loans, and 77 basis points for our Purchased

Non-Performing Loans. |

Table 6 - Credit-related

Metrics/Residential Whole Loans

March 31,

2024

| | |

Fair

Value / | | |

Unpaid

Principal | | |

Weighted | | |

Weighted

Average

Term to | |

Weighted

Average | | |

Weighted

Average | |

Aging

by UPB | | |

| | |

| |

| | |

Carrying | | |

Balance | | |

Average | | |

Maturity | |

LTV | | |

Original | |

| |

Past

Due Days | | |

60+ | | |

60+ | |

| (Dollars In Thousands) | |

Value | | |

(“UPB”) | | |

Coupon

(2) | | |

(Months) | |

Ratio

(3) | | |

FICO

(4) | |

Current | |

30-59 | | |

60-89 | | |

90+ | | |

DQ

% | | |

LTV

(3) | |

| Purchased

Performing Loans: | |

| | | |

| | | |

| | |

| |

| | |

| |

| | |

| | | |

| | | |

| | | |

| | |

| |

| Non-QM

loans | |

$ | 3,836,705 | | |

$ | 4,059,991 | | |

6.02 | % | |

342 | |

65 | % | |

734 | |

$ | 3,814,533 | |

$ | 115,484 | | |

$ | 41,428 | | |

$ | 88,546 | | |

3.2 | % | |

65.2 | % |

| Transitional

loans (1) | |

| 2,493,073 | | |

| 2,502,067 | | |

9.45 | | |

9 | |

64 | | |

747 | |

| 2,306,508 | |

| 44,621 | | |

| 18,459 | | |

| 132,479 | | |

6.0 | | |

65.9 | |

| Single-family

rental loans | |

| 1,574,322 | | |

| 1,665,788 | | |

6.52 | | |

331 | |

69 | | |

738 | |

| 1,571,772 | |

| 17,395 | | |

| 6,452 | | |

| 70,169 | | |

4.6 | | |

111.0 | |

| Seasoned

performing loans | |

| 66,045 | | |

| 72,658 | | |

4.77 | | |

140 | |

28 | | |

725 | |

| 70,016 | |

| 1,271 | | |

| 43 | | |

| 1,328 | | |

1.9 | | |

24.6 | |

| Agency

eligible investor loans | |

| 54,654 | | |

| 66,297 | | |

3.44 | | |

329 | |

66 | | |

757 | |

| 65,064 | |

| 523 | | |

| 223 | | |

| 487 | | |

1.1 | | |

71.7 | |

| Total

Purchased Performing Loans | |

$ | 8,024,799 | | |

$ | 8,366,801 | | |

7.11 | % | |

238 | |

| | |

| |

| | |

| | | |

| | | |

| | | |

4.3 | % | |

| |

| | |

| | | |

| | | |

| | |

| |

| | |

| |

| | |

| | | |

| | | |

| | | |

| | |

| |

| Purchased

Credit Deteriorated Loans | |

$ | 412,077 | | |

$ | 499,761 | | |

4.85 | % | |

265 | |

58 | % | |

N/A | |

$ | 373,341 | |

$ | 46,972 | | |

$ | 16,784 | | |

$ | 62,664 | | |

15.9 | % | |

64.3 | % |

| | |

| | | |

| | | |

| | |

| |

| | |

| |

| | |

| | | |

| | | |

| | | |

| | |

| |

| Purchased

Non-Performing Loans | |

$ | 681,789 | | |

$ | 753,035 | | |

5.24 | % | |

268 | |

60 | % | |

N/A | |

$ | 437,507 | |

$ | 90,223 | | |

$ | 31,434 | | |

$ | 193,871 | | |

29.9 | % | |

69.6 | % |

| | |

| | | |

| | | |

| | |

| |

| | |

| |

| | |

| | | |

| | | |

| | | |

| | |

| |

| Residential

whole loans, total or weighted average | |

$ | 9,118,665 | | |

$ | 9,619,597 | | |

6.21 | % | |

227 | |

| | |

| |

| | |

| | | |

| | | |

| | | |

6.9 | % | |

| |

| (1) | As

of March 31, 2024 Transitional loans includes $1.2 billion of loans collateralized

by multi-family properties with a weighted average term to maturity of 12 months and a weighted

average LTV ratio of 63%. |

| (2) | Weighted

average is calculated based on the interest bearing principal balance of each loan within

the related category. For loans acquired with servicing rights released by the seller, interest

rates included in the calculation do not reflect loan servicing fees. For loans acquired

with servicing rights retained by the seller, interest rates included in the calculation

are net of servicing fees. |

| (3) | LTV

represents the ratio of the total unpaid principal balance of the loan to the estimated value

of the collateral securing the related loan as of the most recent date available, which may

be the origination date. For Transitional loans, the LTV presented is the ratio of the maximum

unpaid principal balance of the loan, including unfunded commitments, to the estimated “after

repaired” value of the collateral securing the related loan, where available. For certain

Transitional loans, totaling $608.9 million at March 31, 2024, an after repaired valuation

was not obtained and the loan was underwritten based on an “as is” valuation.

The weighted average LTV of these loans based on the current unpaid principal balance and

the valuation obtained during underwriting, is 67% at March 31, 2024. Excluded from

the calculation of weighted average LTV are certain low value loans secured by vacant lots,

for which the LTV ratio is not meaningful. 60+ LTV has been calculated on a consistent basis. |

| (4) | Excludes

loans for which no Fair Isaac Corporation (“FICO”) score is available. |

Table 7 - Shock Table

The information

presented in the following “Shock Table” projects the potential impact of sudden parallel changes in interest rates on the

value of our portfolio, including the impact of Swaps and securitized debt, based on the assets in our investment portfolio at March 31,

2024. Changes in portfolio value are measured as the percentage change when comparing the projected portfolio value to the base interest

rate scenario at March 31, 2024.

| Change in Interest Rates |

|

Percentage

Change

in Portfolio Value |

|

|

Percentage

Change

in Total Stockholders’ Equity |

|

| +100 Basis Point Increase |

|

|

(1.22 |

)% |

|

|

(6.96 |

)% |

| + 50 Basis Point Increase |

|

|

(0.55 |

)% |

|

|

(3.15 |

)% |

| Actual at March 31, 2024 |

|

|

— |

% |

|

|

— |

% |

| - 50 Basis Point Decrease |

|

|

0.43 |

% |

|

|

2.47 |

% |

| -100 Basis Point Decrease |

|

|

0.75 |

% |

|

|

4.28 |

% |

MFA FINANCIAL, INC.

CONSOLIDATED

BALANCE SHEETS

| (In Thousands, Except Per Share Amounts) | |

March 31,

2024 | | |

December 31,

2023 | |

| | |

| (unaudited) | | |

| | |

| Assets: | |

| | | |

| | |

| Residential

whole loans, net ($7,653,907 and $7,511,508 held at fair value, respectively) (1) | |

$ | 9,118,665 | | |

$ | 9,041,292 | |

| Securities, at fair value | |

| 736,950 | | |

| 746,090 | |

| Cash and cash equivalents | |

| 306,266 | | |

| 318,000 | |

| Restricted cash | |

| 222,905 | | |

| 170,211 | |

| Other assets | |

| 489,344 | | |

| 497,097 | |

| Total Assets | |

$ | 10,874,130 | | |

$ | 10,772,690 | |

| | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Financing agreements ($4,641,438 and

$4,633,660 held at fair value, respectively) | |

$ | 8,685,916 | | |

$ | 8,536,745 | |

| Other liabilities | |

| 304,027 | | |

| 336,030 | |

| Total Liabilities | |

$ | 8,989,943 | | |

$ | 8,872,775 | |

| | |

| | | |

| | |

| Stockholders’

Equity: | |

| | | |

| | |

| Preferred stock, $0.01 par value; 7.5%

Series B cumulative redeemable; 8,050 shares authorized; 8,000 shares issued and outstanding ($200,000 aggregate liquidation

preference) | |

$ | 80 | | |

$ | 80 | |

| Preferred stock, $0.01 par value; 6.5%

Series C fixed-to-floating rate cumulative redeemable; 12,650 shares authorized; 11,000 shares issued and outstanding ($275,000

aggregate liquidation preference) | |

| 110 | | |

| 110 | |

| Common stock, $0.01 par value; 874,300

and 874,300 shares authorized; 102,082 and 101,916 shares issued and outstanding, respectively | |

| 1,021 | | |

| 1,019 | |

| Additional paid-in capital, in excess

of par | |

| 3,703,242 | | |

| 3,698,767 | |

| Accumulated deficit | |

| (1,839,792 | ) | |

| (1,817,759 | ) |

| Accumulated other comprehensive income | |

| 19,526 | | |

| 17,698 | |

| Total Stockholders’ Equity | |

$ | 1,884,187 | | |

$ | 1,899,915 | |

| Total Liabilities and Stockholders’

Equity | |

$ | 10,874,130 | | |

$ | 10,772,690 | |

| (1) | Includes

approximately $5.7 billion and $5.7 billion of Residential whole loans transferred to consolidated

variable interest entities (“VIEs”) at March 31, 2024 and December 31,

2023, respectively. Such assets can be used only to settle the obligations of each respective

VIE. |

MFA FINANCIAL, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

| | |

Three

Months Ended March 31, | |

| (In Thousands, Except Per Share Amounts) | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Interest Income: | |

| | | |

| | |

| Residential whole loans | |

$ | 157,665 | | |

$ | 119,510 | |

| Securities, at fair value | |

| 12,992 | | |

| 7,308 | |

| Other interest-earning assets | |

| 1,163 | | |

| 2,351 | |

| Cash and cash equivalent investments | |

| 5,011 | | |

| 3,036 | |

| Interest Income | |

$ | 176,831 | | |

$ | 132,205 | |

| | |

| | | |

| | |

| Interest Expense: | |

| | | |

| | |

| Asset-backed and other collateralized

financing arrangements | |

$ | 123,442 | | |

$ | 88,880 | |

| Other interest expense | |

| 5,575 | | |

| 3,956 | |

| Interest Expense | |

$ | 129,017 | | |

$ | 92,836 | |

| | |

| | | |

| | |

| Net Interest Income | |

$ | 47,814 | | |

$ | 39,369 | |

| | |

| | | |

| | |

| Reversal/(Provision)

for Credit Losses on Residential Whole Loans | |

$ | 460 | | |

$ | 13 | |

| Reversal/(Provision)

for Credit Losses on Other Assets | |

| (1,109 | ) | |

| — | |

| Net Interest Income

after Reversal/(Provision) for Credit Losses | |

$ | 47,165 | | |

$ | 39,382 | |

| | |

| | | |

| | |

| Other Income/(Loss),

net: | |

| | | |

| | |

| Net gain/(loss) on residential whole

loans measured at fair value through earnings | |

$ | (11,513 | ) | |

$ | 129,174 | |

| Impairment and other net gain/(loss)

on securities and other portfolio investments | |

| (4,776 | ) | |

| 2,931 | |

| Net gain/(loss) on real estate owned | |

| 991 | | |

| 3,942 | |

| Net gain/(loss) on derivatives used for

risk management purposes | |

| 49,941 | | |

| (21,208 | ) |

| Net gain/(loss) on securitized debt measured

at fair value through earnings | |

| (22,462 | ) | |

| (51,725 | ) |

| Lima One - origination, servicing and

other fee income | |

| 7,928 | | |

| 8,976 | |

| Net realized gain/(loss) on residential

whole loans held at carrying value | |

| 418 | | |

| — | |

| Other, net | |

| 1,875 | | |

| 3,014 | |

| Other Income/(Loss),

net | |

$ | 22,402 | | |

$ | 75,104 | |

| | |

| | | |

| | |

| Operating and Other

Expense: | |

| | | |

| | |

| Compensation and benefits | |

$ | 25,468 | | |

$ | 20,630 | |

| Other general and administrative expense | |

| 13,044 | | |

| 10,233 | |

| Loan servicing, financing and other related

costs | |

| 7,042 | | |

| 9,539 | |

| Amortization of intangible assets | |

| 800 | | |

| 1,300 | |

| Operating and Other

Expense | |

$ | 46,354 | | |

$ | 41,702 | |

| | |

| | | |

| | |

| Net Income/(Loss) | |

$ | 23,213 | | |

$ | 72,784 | |

| Less Preferred Stock Dividend Requirement | |

$ | 8,219 | | |

$ | 8,219 | |

| Net Income/(Loss) Available

to Common Stock and Participating Securities | |

$ | 14,994 | | |

$ | 64,565 | |

| | |

| | | |

| | |

| Basic Earnings/(Loss) per Common Share | |

$ | 0.14 | | |

$ | 0.63 | |

| Diluted Earnings/(Loss) per Common Share | |

$ | 0.14 | | |

$ | 0.62 | |

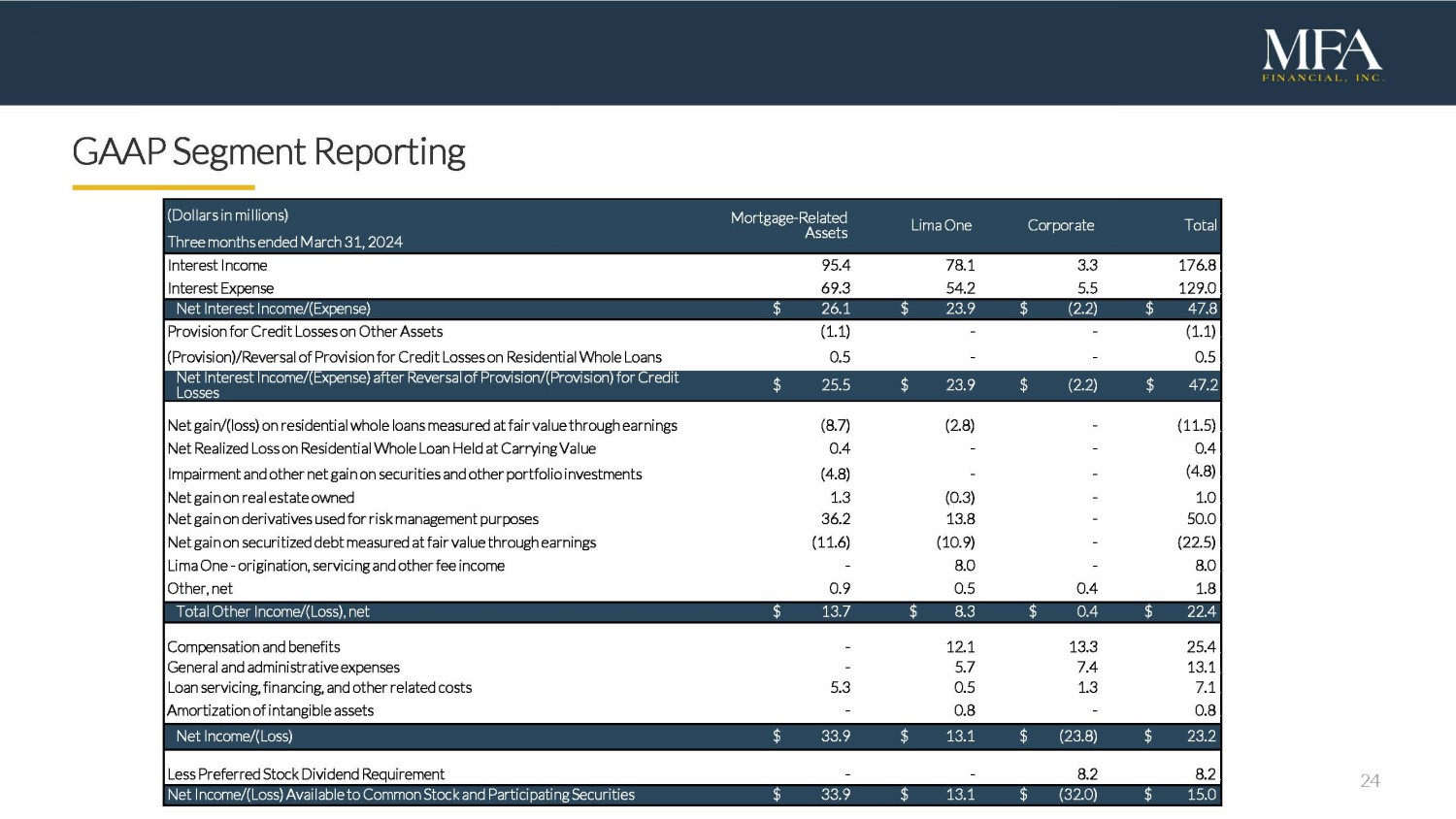

Segment Reporting

At March 31,

2024, the Company’s reportable segments include (i) mortgage-related assets and (ii) Lima One. The Corporate column in

the table below primarily consists of corporate cash and related interest income, investments in loan originators and related economics,

general and administrative expenses not directly attributable to Lima One, interest expense on unsecured convertible senior notes, securitization

issuance costs, and preferred stock dividends.

The following tables

summarize segment financial information, which in total reconciles to the same data for the Company as a whole:

| (Dollars

in Thousands) | |

Mortgage-

Related Assets | | |

Lima One | | |

Corporate | | |

Total | |

| Three months ended March 31, 2024 | |

| | | |

| | | |

| | | |

| | |

| Interest Income | |

$ | 95,400 | | |

$ | 78,089 | | |

$ | 3,342 | | |

$ | 176,831 | |

| Interest Expense | |

| 69,259 | | |

| 54,183 | | |

| 5,575 | | |

| 129,017 | |

| Net Interest Income/(Expense) | |

$ | 26,141 | | |

$ | 23,906 | | |

$ | (2,233 | ) | |

$ | 47,814 | |

| Reversal/(Provision) for Credit Losses

on Residential Whole Loans | |

| 460 | | |

| — | | |

| — | | |

| 460 | |

| Reversal/(Provision) for Credit Losses

on Other Assets | |

| (1,109 | ) | |

| — | | |

| — | | |

| (1,109 | ) |

| Net Interest Income/(Expense) after Reversal/(Provision)

for Credit Losses | |

$ | 25,492 | | |

$ | 23,906 | | |

$ | (2,233 | ) | |

$ | 47,165 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net gain/(loss) on residential whole

loans measured at fair value through earnings | |

$ | (8,699 | ) | |

$ | (2,814 | ) | |

$ | — | | |

$ | (11,513 | ) |

| Impairment and other net gain/(loss)

on securities and other portfolio investments | |

| (4,776 | ) | |

| — | | |

| — | | |

| (4,776 | ) |

| Net gain on real estate owned | |

| 1,256 | | |

| (265 | ) | |

| — | | |

| 991 | |

| Net gain/(loss) on derivatives used for

risk management purposes | |

| 36,158 | | |

| 13,783 | | |

| — | | |

| 49,941 | |

| Net gain/(loss) on securitized debt measured

at fair value through earnings | |

| (11,576 | ) | |

| (10,886 | ) | |

| — | | |

| (22,462 | ) |

| Lima One - origination, servicing and

other fee income | |

| — | | |

| 7,928 | | |

| — | | |

| 7,928 | |

| Net realized gain/(loss) on residential

whole loans held at carrying value | |

| 418 | | |

| — | | |

| — | | |

| 418 | |

| Other, net | |

| 959 | | |

| 504 | | |

| 412 | | |

| 1,875 | |

| Other Income/(Loss), net | |

$ | 13,740 | | |

$ | 8,250 | | |

$ | 412 | | |

$ | 22,402 | |

| | |

| | | |

| | | |

| | | |

| | |

| Compensation and benefits | |

$ | — | | |

$ | 12,124 | | |

$ | 13,344 | | |

$ | 25,468 | |

| Other general and administrative expense | |

| 6 | | |

| 5,637 | | |

| 7,401 | | |

| 13,044 | |

| Loan servicing, financing and other related

costs | |

| 5,270 | | |

| 519 | | |

| 1,253 | | |

| 7,042 | |

| Amortization of intangible assets | |

| — | | |

| 800 | | |

| — | | |

| 800 | |

| Net Income/(Loss) | |

$ | 33,956 | | |

$ | 13,076 | | |

$ | (23,819 | ) | |

$ | 23,213 | |

| | |

| | | |

| | | |

| | | |

| | |

| Less Preferred Stock Dividend Requirement | |

$ | — | | |

$ | — | | |

$ | 8,219 | | |

$ | 8,219 | |

| Net Income/(Loss) Available to Common

Stock and Participating Securities | |

$ | 33,956 | | |

$ | 13,076 | | |

$ | (32,038 | ) | |

$ | 14,994 | |

| (Dollars in Thousands) | |

Mortgage-

Related

Assets | | |

Lima One | | |

Corporate | | |

Total | |

| March 31, 2024 | |

| | | |

| | | |

| | | |

| | |

| Total Assets | |

$ | 6,319,998 | | |

$ | 4,196,761 | | |

$ | 357,371 | | |

$ | 10,874,130 | |

| | |

| | | |

| | | |

| | | |

| | |

| December 31, 2023 | |

| | | |

| | | |

| | | |

| | |

| Total Assets | |

$ | 6,370,237 | | |

$ | 4,000,932 | | |

$ | 401,521 | | |

$ | 10,772,690 | |

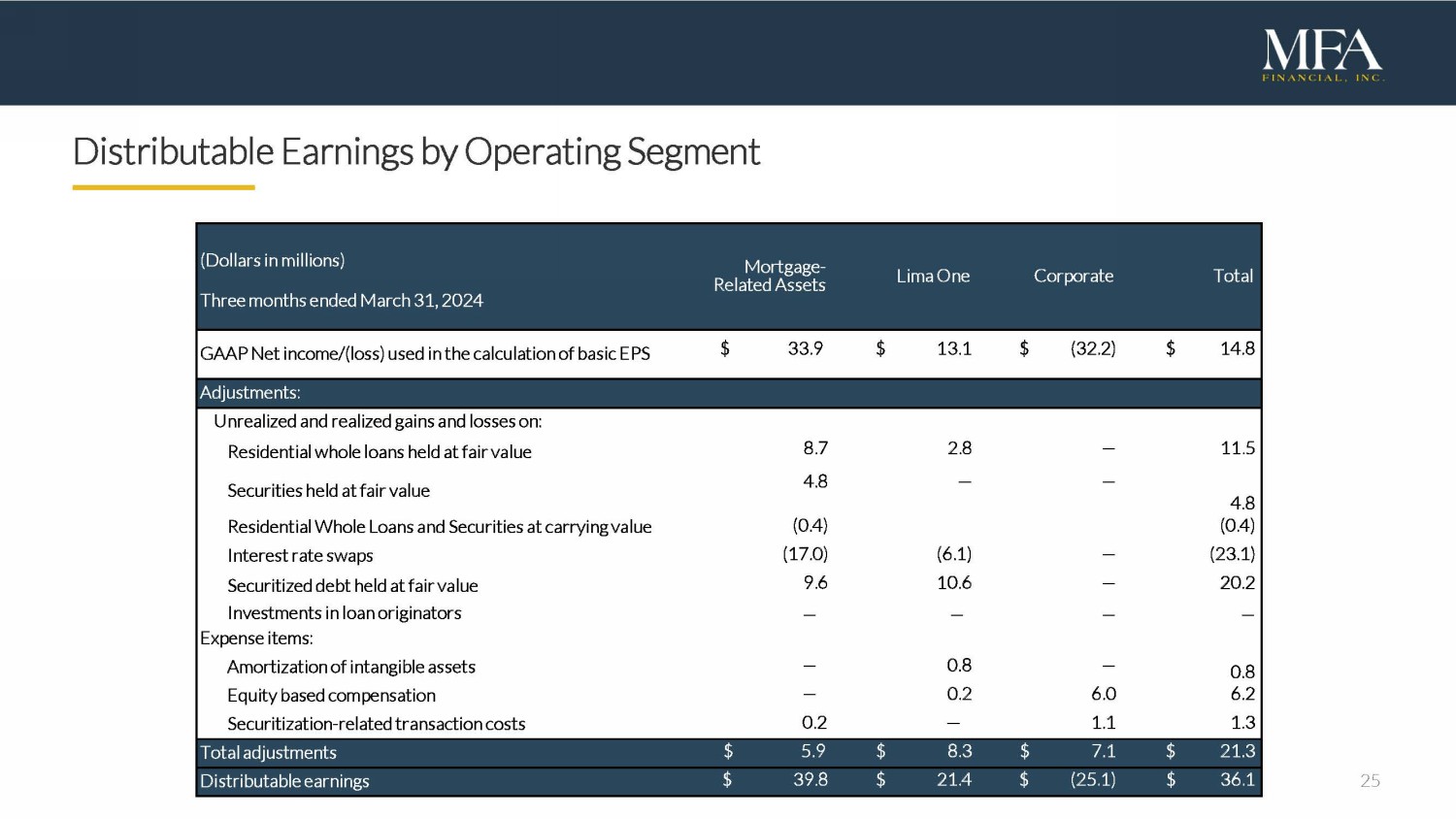

Reconciliation of GAAP Net Income

to non-GAAP Distributable Earnings

“Distributable

earnings” is a non-GAAP financial measure of our operating performance, within the meaning of Regulation G and Item 10(e) of

Regulation S-K, as promulgated by the Securities and Exchange Commission. Distributable earnings is determined by adjusting GAAP net

income/(loss) by removing certain unrealized gains and losses, primarily on residential mortgage investments, associated debt, and hedges

that are, in each case, accounted for at fair value through earnings, certain realized gains and losses, as well as certain non-cash

expenses and securitization-related transaction costs. The transaction costs are primarily comprised of costs only incurred at the time

of execution of our securitizations and include costs such as underwriting fees, legal fees, diligence fees, bank fees and other similar

transaction related expenses. These costs are all incurred prior to or at the execution of our securitizations and do not recur. Recurring

expenses, such as servicing fees, custodial fees, trustee fees and other similar ongoing fees are not excluded from distributable earnings.

Management believes that the adjustments made to GAAP earnings result in the removal of (i) income or expenses that are not reflective

of the longer term performance of our investment portfolio, (ii) certain non-cash expenses, and (iii) expense items required

to be recognized solely due to the election of the fair value option on certain related residential mortgage assets and associated liabilities.

Distributable earnings is one of the factors that our Board of Directors considers when evaluating distributions to our shareholders.

Accordingly, we believe that the adjustments to compute Distributable earnings specified below provide investors and analysts with additional

information to evaluate our financial results.

Distributable

earnings should be used in conjunction with results presented in accordance with GAAP. Distributable earnings does not represent and

should not be considered as a substitute for net income or cash flows from operating activities, each as determined in accordance with

GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies.

The

following table provides a reconciliation of our GAAP net income/(loss) used in the calculation of basic EPS to our non-GAAP Distributable

earnings for the quarterly periods below:

| | |

Quarter Ended | |

| (In Thousands, Except Per Share Amounts) | |

March 31,

2024 | | |

December 31,

2023 | | |

September 30,

2023 | | |

June 30,

2023 | | |

March 31,

2023 | |

| GAAP Net income/(loss) used in

the calculation of basic EPS | |

$ | 14,827 | | |

$ | 81,527 | | |

$ | (64,657 | ) | |

$ | (34,146 | ) | |

$ | 64,565 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unrealized and realized gains and losses on: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Residential whole loans held at fair value | |

| 11,513 | | |

| (224,272 | ) | |

| 132,894 | | |

| 130,703 | | |

| (129,174 | ) |

| Securities held at fair value | |

| 4,776 | | |

| (21,371 | ) | |

| 13,439 | | |

| 3,698 | | |

| (2,931 | ) |

| Residential whole loans and securities at

carrying value | |

| (418 | ) | |

| 332 | | |

| — | | |

| — | | |

| — | |

| Interest rate swaps | |

| (23,182 | ) | |

| 97,400 | | |

| (9,433 | ) | |

| (37,018 | ) | |

| 40,747 | |

| Securitized debt held at fair value | |

| 20,169 | | |

| 108,693 | | |

| (40,229 | ) | |

| (30,908 | ) | |

| 48,846 | |

| Investments in loan origination partners | |

| — | | |

| 254 | | |

| 722 | | |

| 872 | | |

| — | |

| Expense items: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Amortization of intangible assets | |

| 800 | | |

| 800 | | |

| 800 | | |

| 1,300 | | |

| 1,300 | |

| Equity based compensation | |

| 6,243 | | |

| 3,635 | | |

| 4,447 | | |

| 3,932 | | |

| 3,020 | |

| Securitization-related transaction costs | |

| 1,340 | | |

| 2,702 | | |

| 3,217 | | |

| 2,071 | | |

| 4,602 | |

| Total adjustments | |

| 21,241 | | |

| (31,827 | ) | |

| 105,857 | | |

| 74,650 | | |

| (33,590 | ) |

| Distributable earnings | |

$ | 36,068 | | |

$ | 49,700 | | |

$ | 41,200 | | |

$ | 40,504 | | |

$ | 30,975 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP earnings/(loss)

per basic common share | |

$ | 0.14 | | |

$ | 0.80 | | |

$ | (0.64 | ) | |

$ | (0.34 | ) | |

$ | 0.63 | |

| Distributable earnings

per basic common share | |

$ | 0.35 | | |

$ | 0.49 | | |

$ | 0.40 | | |

$ | 0.40 | | |

$ | 0.30 | |

| Weighted average common shares for basic

earnings per share | |

| 103,173 | | |

| 102,266 | | |

| 102,255 | | |

| 102,186 | | |

| 102,155 | |

The

following table presents our non-GAAP Distributable earnings by segment for the quarterly periods below:

| (Dollars in Thousands) | |

Mortgage-

Related Assets | | |

Lima One | | |

Corporate | | |

Total | |

| Three months ended March 31, 2024 | |

| | | |

| | | |

| | | |

| | |

| GAAP Net income/(loss) used in

the calculation of basic EPS | |

$ | 33,956 | | |

$ | 13,062 | | |

$ | (32,191 | ) | |

$ | 14,827 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Unrealized and realized gains and losses on: | |

| | | |

| | | |

| | | |

| | |

| Residential whole loans held at fair value | |

| 8,699 | | |

| 2,814 | | |

| — | | |

| 11,513 | |

| Securities held at fair value | |

| 4,776 | | |

| — | | |

| — | | |

| 4,776 | |

| Residential whole loans and securities at carrying value | |

| (418 | ) | |

| — | | |

| — | | |

| (418 | ) |

| Interest rate swaps | |

| (17,068 | ) | |

| (6,114 | ) | |

| — | | |

| (23,182 | ) |

| Securitized debt held at fair value | |

| 9,591 | | |

| 10,578 | | |

| — | | |

| 20,169 | |

| Investments in loan origination partners | |

| — | | |

| — | | |

| — | | |

| — | |

| Expense items: | |

| | | |

| | | |

| | | |

| | |

| Amortization of intangible assets | |

| — | | |

| 800 | | |

| — | | |

| 800 | |

| Equity based compensation | |

| — | | |

| 261 | | |

| 5,982 | | |

| 6,243 | |

| Securitization-related transaction costs | |

| 197 | | |

| — | | |

| 1,143 | | |

| 1,340 | |

| Total adjustments | |

$ | 5,777 | | |

$ | 8,339 | | |

$ | 7,125 | | |

$ | 21,241 | |

| Distributable earnings | |

$ | 39,733 | | |

$ | 21,401 | | |

$ | (25,066 | ) | |

$ | 36,068 | |

| (Dollars in Thousands) | |

Mortgage-

Related

Assets | | |

Lima One | | |

Corporate | | |

Total | |

| Three Months Ended December 31, 2023 | |

| | | |

| | | |

| | | |

| | |

| GAAP Net income/(loss) used in

the calculation of basic EPS | |

$ | 93,071 | | |

$ | 14,111 | | |

$ | (25,655 | ) | |

$ | 81,527 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Unrealized and realized gains and losses on: | |

| | | |

| | | |

| | | |

| | |

| Residential whole loans held at fair value | |

| (170,935 | ) | |

| (53,337 | ) | |

| — | | |

| (224,272 | ) |

| Securities held at fair value | |

| (21,371 | ) | |

| — | | |

| — | | |

| (21,371 | ) |

| Residential whole loans and securities at carrying value | |

| 332 | | |

| — | | |

| — | | |

| 332 | |

| Interest rate swaps | |

| 72,741 | | |

| 24,659 | | |

| — | | |

| 97,400 | |

| Securitized debt held at fair value | |

| 73,779 | | |

| 34,914 | | |

| — | | |

| 108,693 | |

| Investments in loan origination partners | |

| — | | |

| — | | |

| 254 | | |

| 254 | |

| Expense items: | |

| | | |

| | | |

| | | |

| | |

| Amortization of intangible assets | |

| — | | |

| 800 | | |

| — | | |

| 800 | |

| Equity based compensation | |

| — | | |

| 132 | | |

| 3,503 | | |

| 3,635 | |

| Securitization-related transaction costs | |

| 145 | | |

| — | | |

| 2,557 | | |

| 2,702 | |

| Total adjustments | |

$ | (45,309 | ) | |

$ | 7,168 | | |

$ | 6,314 | | |

$ | (31,827 | ) |

| Distributable earnings | |

$ | 47,762 | | |

$ | 21,279 | | |

$ | (19,341 | ) | |

$ | 49,700 | |

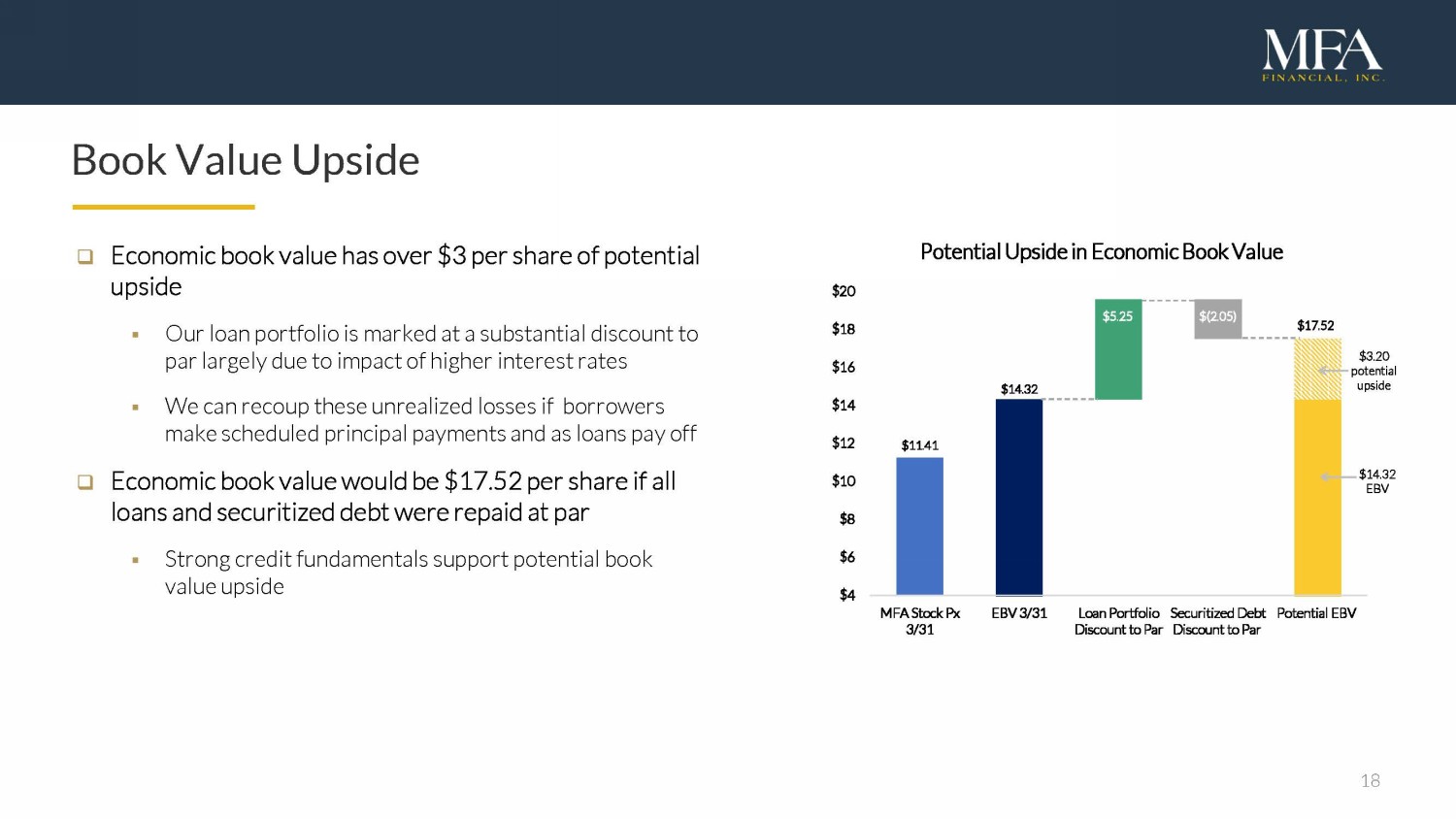

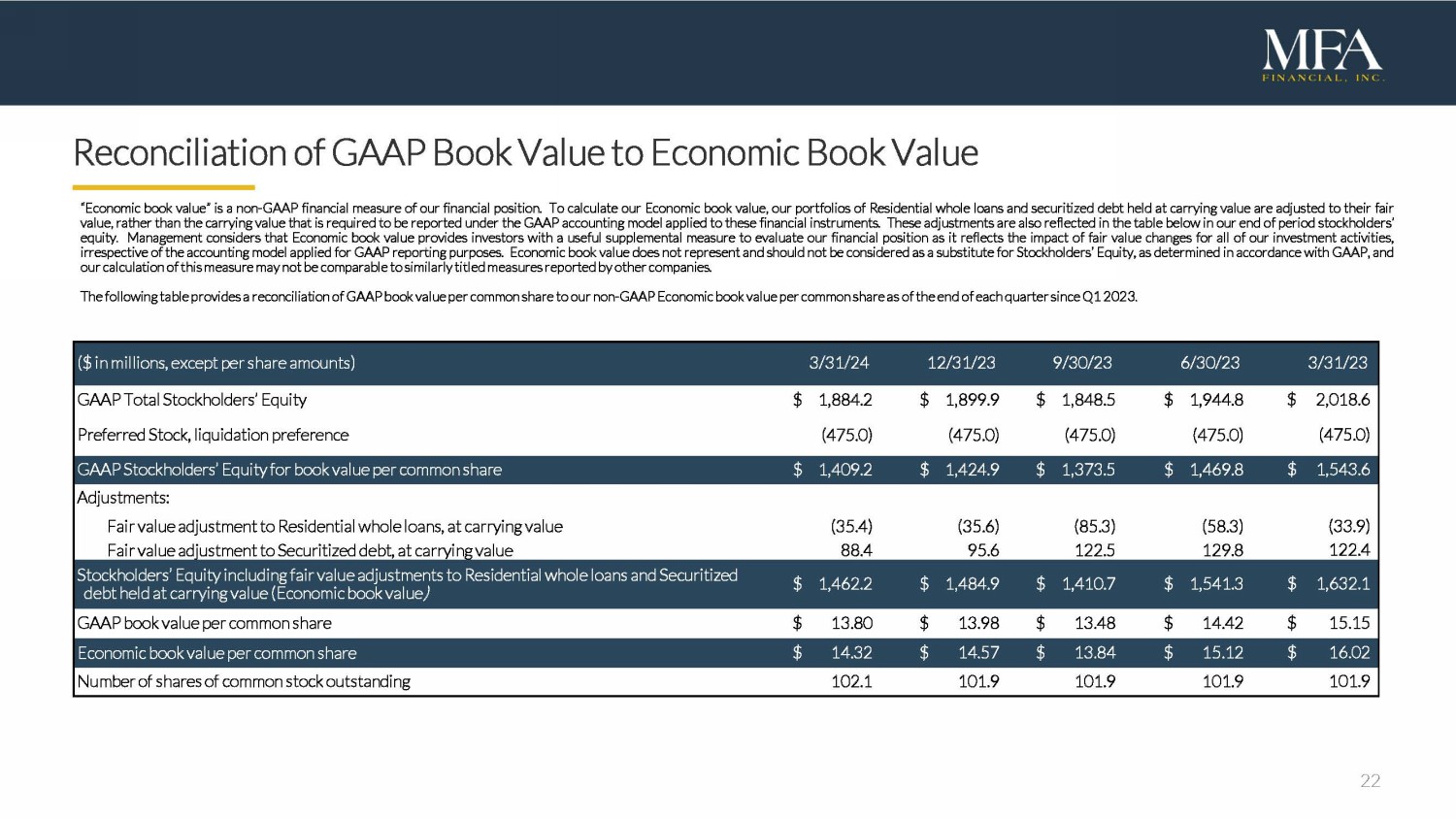

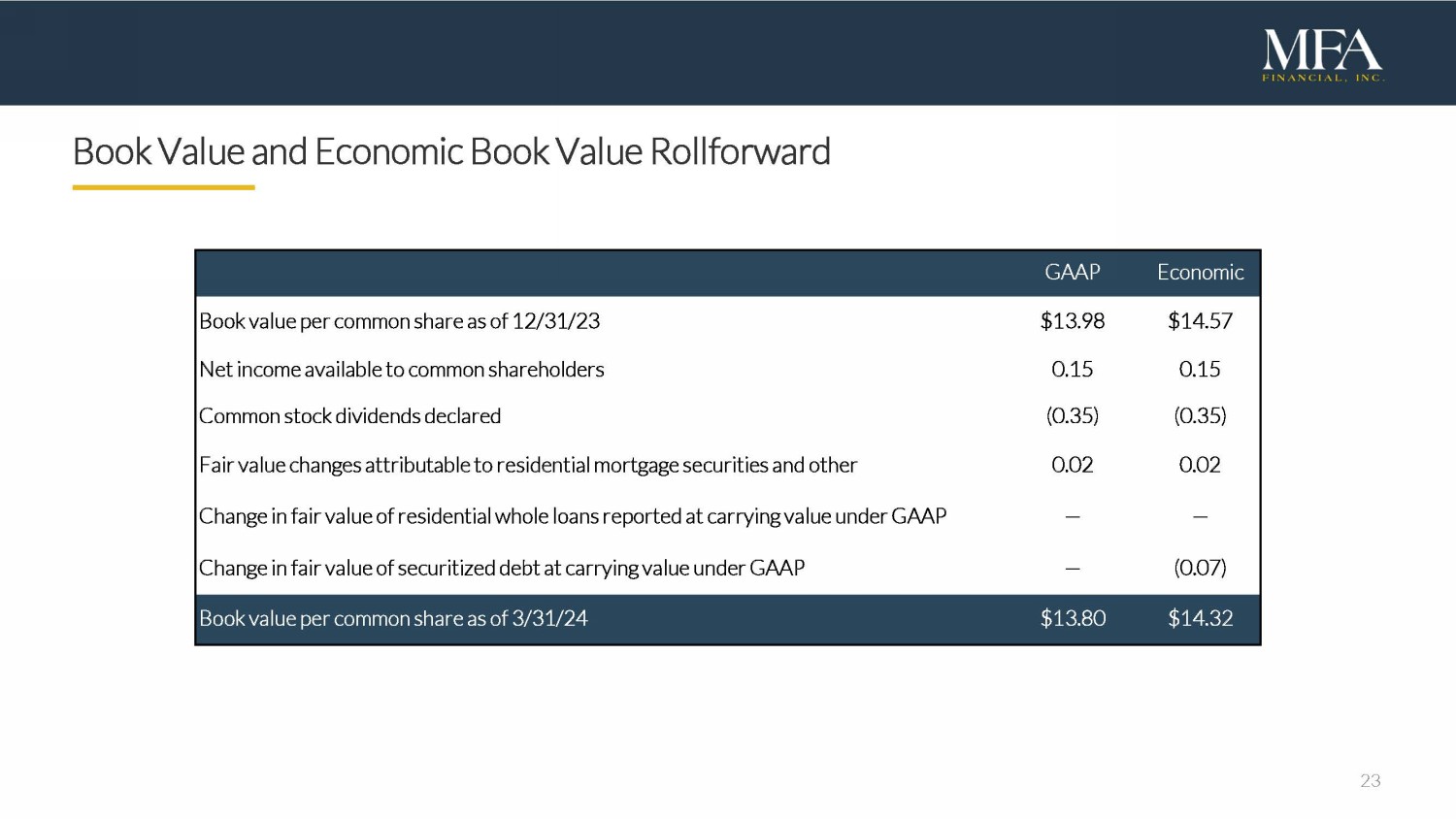

Reconciliation of GAAP Book Value

per Common Share to non-GAAP Economic Book Value per Common Share

“Economic

book value” is a non-GAAP financial measure of our financial position. To calculate our Economic book value, our portfolios of

Residential whole loans and securitized debt held at carrying value are adjusted to their fair value, rather than the carrying value

that is required to be reported under the GAAP accounting model applied to these financial instruments. These adjustments are also reflected

in the table below in our end of period stockholders’ equity. Management considers that Economic book value provides investors

with a useful supplemental measure to evaluate our financial position as it reflects the impact of fair value changes for all of our

investment activities, irrespective of the accounting model applied for GAAP reporting purposes. Economic book value does not represent

and should not be considered as a substitute for Stockholders’ Equity, as determined in accordance with GAAP, and our calculation

of this measure may not be comparable to similarly titled measures reported by other companies.

The

following table provides a reconciliation of our GAAP book value per common share to our non-GAAP Economic book value per common share

as of the quarterly periods below:

| | |

Quarter Ended: | |

| (In

Millions, Except Per Share Amounts) | |

March 31,

2024 | | |

December 31,

2023 | | |

September 30,

2023 | | |

June 30,

2023 | | |

March 31,

2023 | |

| GAAP Total Stockholders’

Equity | |

$ | 1,884.2 | | |

$ | 1,899.9 | | |

$ | 1,848.5 | | |

$ | 1,944.8 | | |

$ | 2,018.6 | |

| Preferred Stock, liquidation preference | |

| (475.0 | ) | |

| (475.0 | ) | |

| (475.0 | ) | |

| (475.0 | ) | |

| (475.0 | ) |

| GAAP Stockholders’ Equity for book

value per common share Adjustments: | |

| 1,409.2 | | |

| 1,424.9 | | |

| 1,373.5 | | |

| 1,469.8 | | |

| 1,543.6 | |

| Fair value adjustment to Residential

whole loans, at carrying value | |

| (35.4 | ) | |

| (35.6 | ) | |

| (85.3 | ) | |

| (58.3 | ) | |

| (33.9 | ) |

| Fair value adjustment to Securitized

debt, at carrying value | |

| 88.4 | | |

| 95.6 | | |

| 122.5 | | |

| 129.8 | | |

| 122.4 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stockholders’ Equity including

fair value adjustments to Residential whole loans and Securitized debt held at carrying value (Economic book value) | |

$ | 1,462.2 | | |

$ | 1,484.9 | | |

$ | 1,410.7 | | |

$ | 1,541.3 | | |

$ | 1,632.1 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP book value per common share | |

$ | 13.80 | | |

$ | 13.98 | | |

$ | 13.48 | | |

$ | 14.42 | | |

$ | 15.15 | |

| Economic book value per common share | |

$ | 14.32 | | |

$ | 14.57 | | |

$ | 13.84 | | |

$ | 15.12 | | |

$ | 16.02 | |

| Number of shares of common stock outstanding | |

| 102.1 | | |

| 101.9 | | |

| 101.9 | | |

| 101.9 | | |

| 101.9 | |

Cautionary

Note Regarding Forward-Looking Statements

When used in this

press release or other written or oral communications, statements that are not historical in nature, including those containing words

such as “will,” “believe,” “expect,” “anticipate,” “estimate,” “plan,”

“continue,” “intend,” “should,” “could,” “would,” “may,” the

negative of these words or similar expressions, are intended to identify “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

and, as such, may involve known and unknown risks, uncertainties and assumptions. These forward-looking statements include information

about possible or assumed future results with respect to MFA’s business, financial condition, liquidity, results of operations,

plans and objectives. Among the important factors that could cause our actual results to differ materially from those projected in any

forward-looking statements that we make are: general economic developments and trends and the performance of the housing, real estate,

mortgage finance, broader financial markets; inflation, increases in interest rates and changes in the market (i.e., fair) value of MFA’s

residential whole loans, MBS, securitized debt and other assets, as well as changes in the value of MFA’s liabilities accounted

for at fair value through earnings; the effectiveness of hedging transactions; changes in the prepayment rates on residential mortgage

assets, an increase of which could result in a reduction of the yield on certain investments in its portfolio and could require MFA to

reinvest the proceeds received by it as a result of such prepayments in investments with lower coupons, while a decrease in which could

result in an increase in the interest rate duration of certain investments in MFA’s portfolio making their valuation more sensitive

to changes in interest rates and could result in lower forecasted cash flows; credit risks underlying MFA’s assets, including changes

in the default rates and management’s assumptions regarding default rates on the mortgage loans in MFA’s residential whole

loan portfolio; MFA’s ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any

such borrowings; implementation of or changes in government regulations or programs affecting MFA’s business; MFA’s estimates

regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the

amount of interest income and financing costs, the method elected by MFA to accrete the market discount on residential whole loans and

the extent of prepayments, realized losses and changes in the composition of MFA’s residential whole loan portfolios that may occur

during the applicable tax period, including gain or loss on any MBS disposals or whole loan modifications, foreclosures and liquidations;

the timing and amount of distributions to stockholders, which are declared and paid at the discretion of MFA’s Board of Directors

and will depend on, among other things, MFA’s taxable income, its financial results and overall financial condition and liquidity,

maintenance of its REIT qualification and such other factors as MFA’s Board of Directors deems relevant; MFA’s ability to

maintain its qualification as a REIT for federal income tax purposes; MFA’s ability to maintain its exemption from registration

under the Investment Company Act of 1940, as amended (or the “Investment Company Act”), including statements regarding the

concept release issued by the Securities and Exchange Commission (“SEC”) relating to interpretive issues under the Investment

Company Act with respect to the status under the Investment Company Act of certain companies that are engaged in the business of acquiring

mortgages and mortgage-related interests; MFA’s ability to continue growing its residential whole loan portfolio, which is dependent

on, among other things, the supply of loans offered for sale in the market; targeted or expected returns on our investments in recently-originated

mortgage loans, the performance of which is, similar to our other mortgage loan investments, subject to, among other things, differences

in prepayment risk, credit risk and financing costs associated with such investments; risks associated with the ongoing operation of

Lima One Holdings, LLC (including, without limitation, unanticipated expenditures relating to or liabilities arising from its operation

(including, among other things, a failure to realize management’s assumptions regarding expected growth in business purpose loan

(BPL) origination volumes and credit risks underlying BPLs, including changes in the default rates and management’s assumptions

regarding default rates on the BPLs originated by Lima One)); expected returns on MFA’s investments in nonperforming residential

whole loans (“NPLs”), which are affected by, among other things, the length of time required to foreclose upon, sell, liquidate

or otherwise reach a resolution of the property underlying the NPL, home price values, amounts advanced to carry the asset (e.g., taxes,

insurance, maintenance expenses, etc. on the underlying property) and the amount ultimately realized upon resolution of the asset;

risks associated with our investments in MSR-related assets, including servicing, regulatory and economic risks; risks associated with

our investments in loan originators; risks associated with investing in real estate assets generally, including changes in business conditions

and the general economy; and other risks, uncertainties and factors, including those described in the annual, quarterly and current reports

that we file with the SEC. These forward-looking statements are based on beliefs, assumptions and expectations of MFA’s future

performance, taking into account information currently available. Readers and listeners are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date on which they are made. New risks and uncertainties arise over time

and it is not possible to predict those events or how they may affect MFA. Except as required by law, MFA is not obligated to, and does

not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Exhibit 99.2

Company Update FIRST QUARTER 2024

2 Q3 202 2 Financial Snapshot Forward - looking statements When used in this presentation or other written or oral communications, statements that are not historical in nature, including those containing words such as “will,” “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “could,” “would,” “may,” the negative of these words or similar expressions, are intended to identify “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, and, as such, may involve known and unknown risks, uncertainties and assumptions . These forward - looking statements include information about possible or assumed future results with respect to MFA’s business, financial condition, liquidity, results of operations, plans and objectives . Among the important factors that could cause our actual results to differ materially from those projected in any forward - looking statements that we make are : general economic developments and trends and the performance of the housing, real estate, mortgage finance, broader financial markets ; inflation, increases in interest rates and changes in the market (i . e . , fair) value of MFA’s residential whole loans, MBS, securitized debt and other assets, as well as changes in the value of MFA’s liabilities accounted for at fair value through earnings ; the effectiveness of hedging transactions ; changes in the prepayment rates on residential mortgage assets, an increase of which could result in a reduction of the yield on certain investments in its portfolio and could require MFA to reinvest the proceeds received by it as a result of such prepayments in investments with lower coupons, while a decrease in which could result in an increase in the interest rate duration of certain investments in MFA’s portfolio making their valuation more sensitive to changes in interest rates and could result in lower forecasted cash flows ; credit risks underlying MFA’s assets, including changes in the default rates and management’s assumptions regarding default rates on the mortgage loans in MFA’s residential whole loan portfolio ; MFA’s ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowings ; implementation of or changes in government regulations or programs affecting MFA’s business ; MFA’s estimates regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by MFA to accrete the market discount on residential whole loans and the extent of prepayments, realized losses and changes in the composition of MFA’s residential whole loan portfolios that may occur during the applicable tax period, including gain or loss on any MBS disposals or whole loan modifications, foreclosures and liquidations ; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of MFA’s Board of Directors and will depend on, among other things, MFA’s taxable income, its financial results and overall financial condition and liquidity, maintenance of its REIT qualification and such other factors as MFA’s Board of Directors deems relevant ; MFA’s ability to maintain its qualification as a REIT for federal income tax purposes ; MFA’s ability to maintain its exemption from registration under the Investment Company Act of 1940 , as amended (or the “Investment Company Act”), including statements regarding the concept release issued by the Securities and Exchange Commission (“SEC”) relating to interpretive issues under the Investment Company Act with respect to the status under the Investment Company Act of certain companies that are engaged in the business of acquiring mortgages and mortgage - related interests ; MFA’s ability to continue growing its residential whole loan portfolio, which is dependent on, among other things, the supply of loans offered for sale in the market ; targeted or expected returns on our investments in recently - originated mortgage loans, the performance of which is, similar to our other mortgage loan investments, subject to, among other things, differences in prepayment risk, credit risk and financing costs associated with such investments ; risks associated with the ongoing operation of Lima One Holdings, LLC (including, without limitation, unanticipated expenditures relating to or liabilities arising from its operation (including, among other things, a failure to realize management’s assumptions regarding expected growth in business purpose loan (BPL) origination volumes and credit risks underlying BPLs, including changes in the default rates and management’s assumptions regarding default rates on the BPLs originated by Lima One) ; expected returns on MFA’s investments in nonperforming residential whole loans (“NPLs”), which are affected by, among other things, the length of time required to foreclose upon, sell, liquidate or otherwise reach a resolution of the property underlying the NPL, home price values, amounts advanced to carry the asset (e . g . , taxes, insurance, maintenance expenses, etc . on the underlying property) and the amount ultimately realized upon resolution of the asset ; risks associated with our investments in MSR - related assets, including servicing, regulatory and economic risks ; risks associated with our investments in loan originators ; risks associated with investing in real estate assets generally, including changes in business conditions and the general economy ; and other risks, uncertainties and factors, including those described in the annual, quarterly and current reports that we file with the SEC . These forward - looking statements are based on beliefs, assumptions and expectations of MFA’s future performance, taking into account information currently available . Readers and listeners are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date on which they are made . New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect MFA . Except as required by law, MFA is not obligated to, and does not intend to, update or revise any forward - looking statements, whether as a result of new information, future events or otherwise .

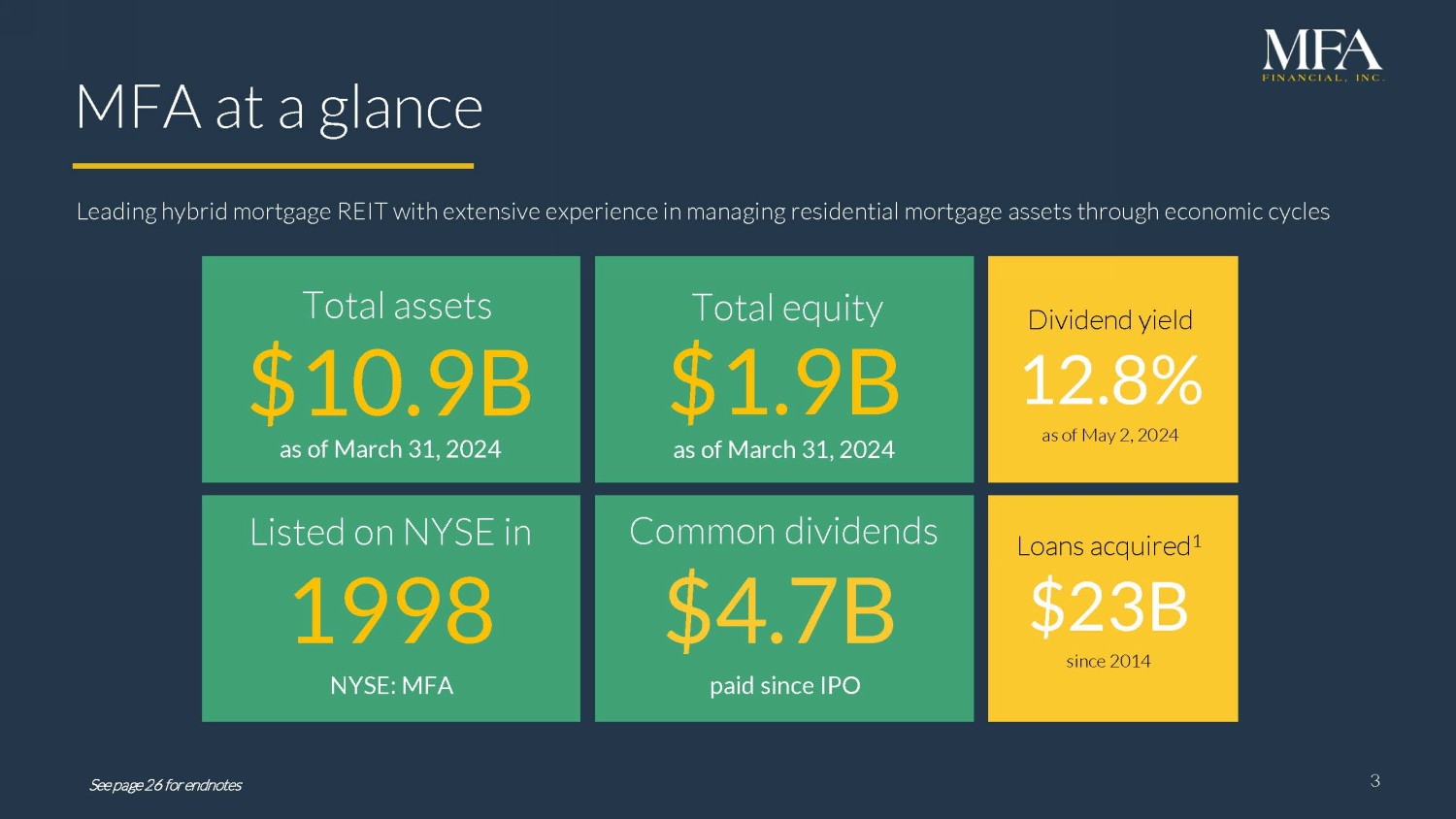

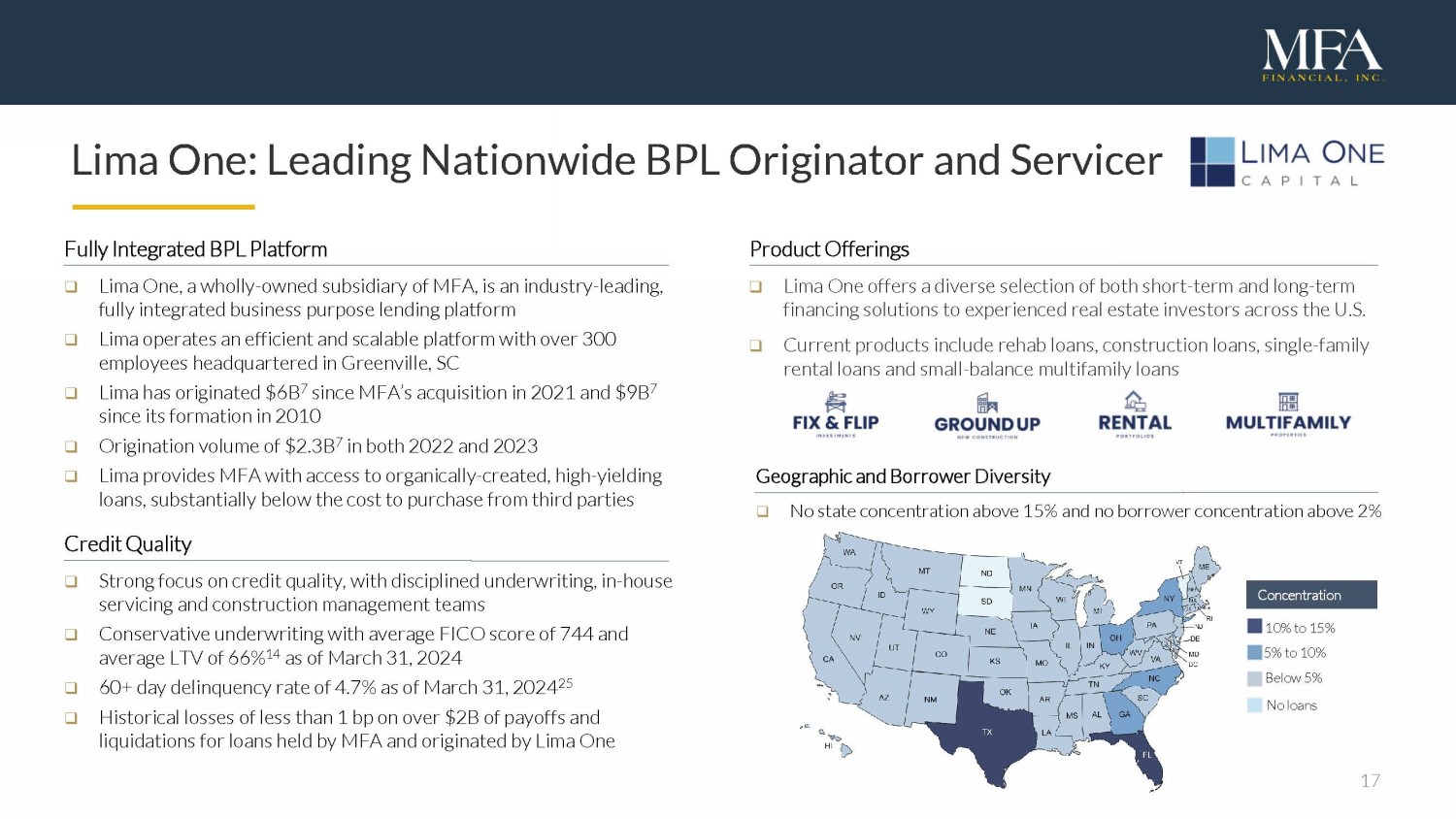

3 v MFA at a glance 3 $1.9B Total equity 1998 Listed on NYSE in Leading hybrid mortgage REIT with extensive experience in managing residential mortgage assets through economic cycles $10.9B Total assets NYSE: MFA $4.7B Common dividends as of March 31, 2024 as of March 31, 2024 paid since IPO See page 26 for endnotes Dividend yield 12.8% as of May 2, 2024 Loans acquired 1 $23B since 2014

4 Q 1 202 4 financial snapshot $13.80 $14.32 GAAP net income 3 $0.14 per basic common share Distributable earnings 4 $0.35 per common share GAAP book value Economic book value 2 per common share per common share $306M Unrestricted cash 1.8x Recourse leverage 5 4 Q1 Dividend $0.35 per common share Total economic return 6 0.7% Q1 2024

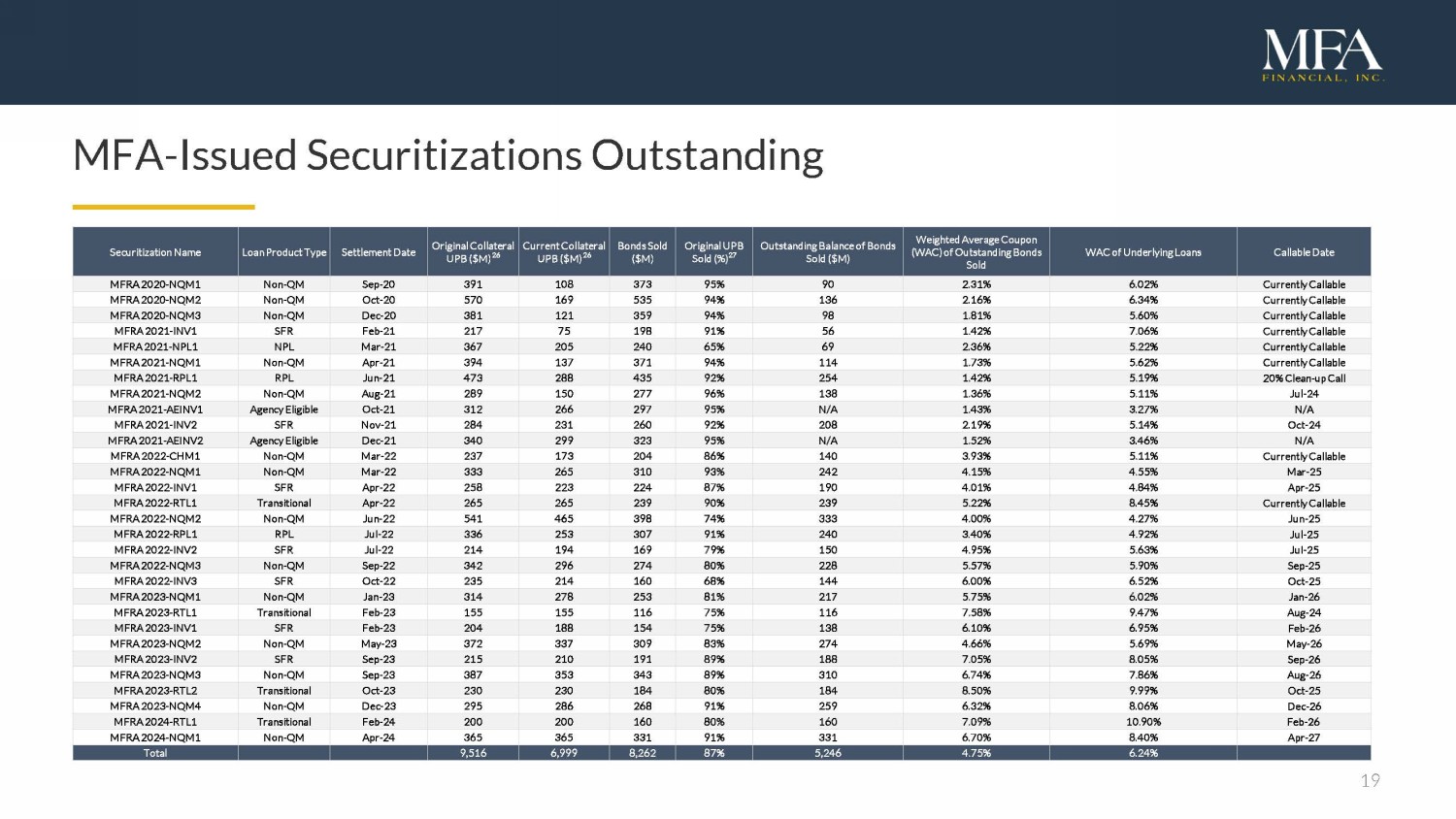

5 Q1 2024 Company Highlights □ Higher interest rates modestly impacted book value ▪ GAAP and Economic book value declined by 1.3% and 1.7%, respectively □ Distributable earnings of $0.35 per share ▪ Declared $0.35 dividend ▪ Net interest spread averaged 2.06% and net interest margin was 2.88% ▪ Ended Q1 with $306M of unrestricted cash □ Acquired or originated $652M of high - yielding loans ▪ Lima One originated loans with a maximum UPB of $430M 7 at average coupon of 10.4% □ Continued to prioritize term, non - mark - to - market (non - MTM) 8 borrowing ▪ Issued one securitization collateralized by $193M UPB of Transitional loans ▪ Issued $115M of 8.875% senior unsecured notes due in February 2029 ▪ Issued additional $75M of 9.00% senior unsecured notes due in August 2029 after quarter - end

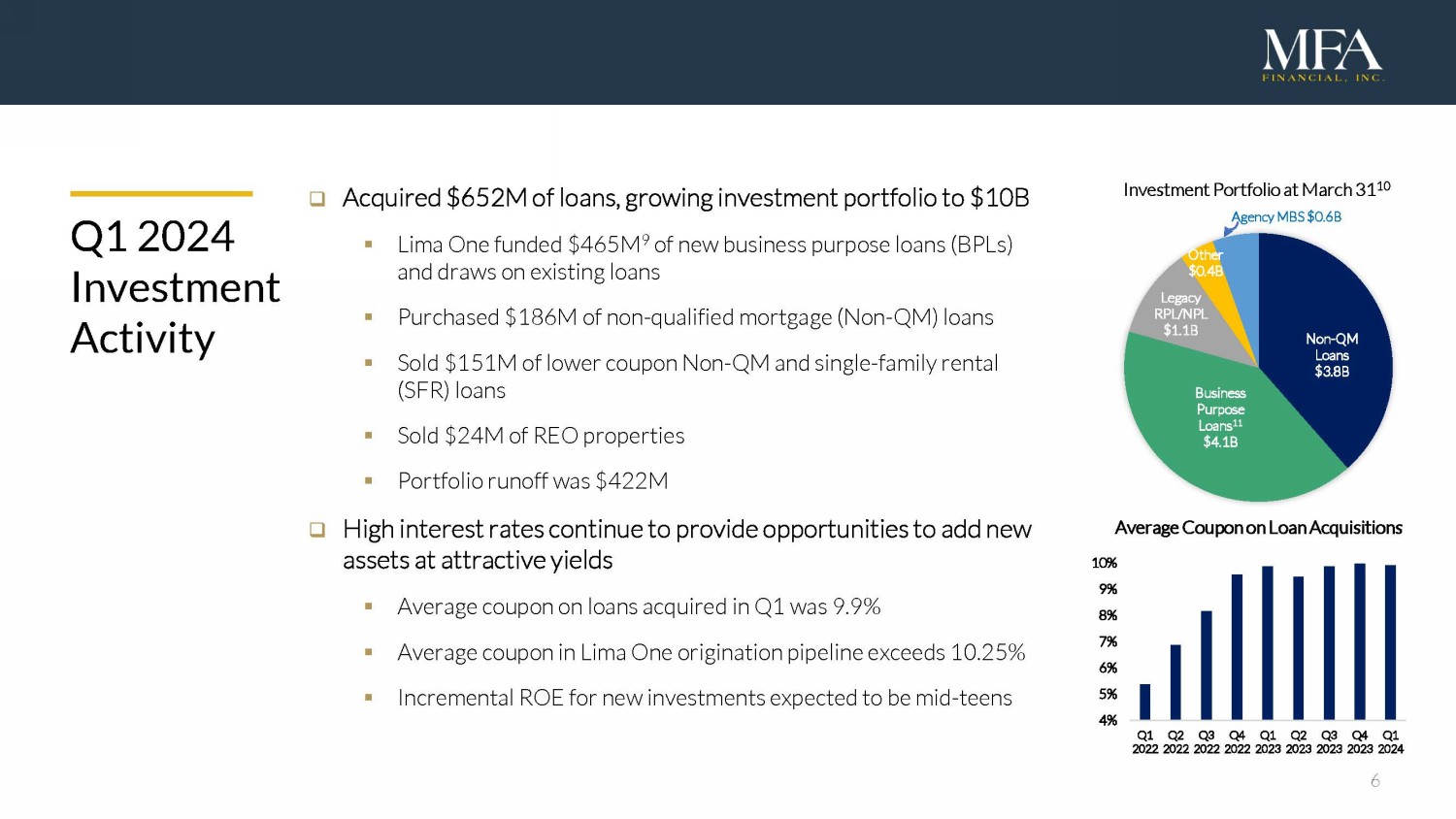

6 □ Acquired $652M of loans, growing investment portfolio to $10B ▪ Lima One funded $465M 9 of new business purpose loans (BPLs) and draws on existing loans ▪ Purchased $186M of non - qualified mortgage (Non - QM) loans ▪ Sold $151M of lower coupon Non - QM and single - family rental (SFR) loans ▪ Sold $24M of REO properties ▪ Portfolio runoff was $422M □ High interest rates continue to provide opportunities to add new assets at attractive yields ▪ Average coupon on loans acquired in Q1 was 9.9% ▪ Average coupon in Lima One origination pipeline exceeds 10.25% ▪ Incremental ROE for new investments expected to be mid - teens Q1 2024 Investment Activity Investment Portfolio at March 31 10 Agency MBS $0.6B Average Coupon on Loan Acquisitions Non - QM Loans $3.8B Business Purpose Loans 11 $4.1B Legacy RPL/NPL $1.1B Other $0.4B 4% 5% 6% 7% 8% 9% 10% Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024

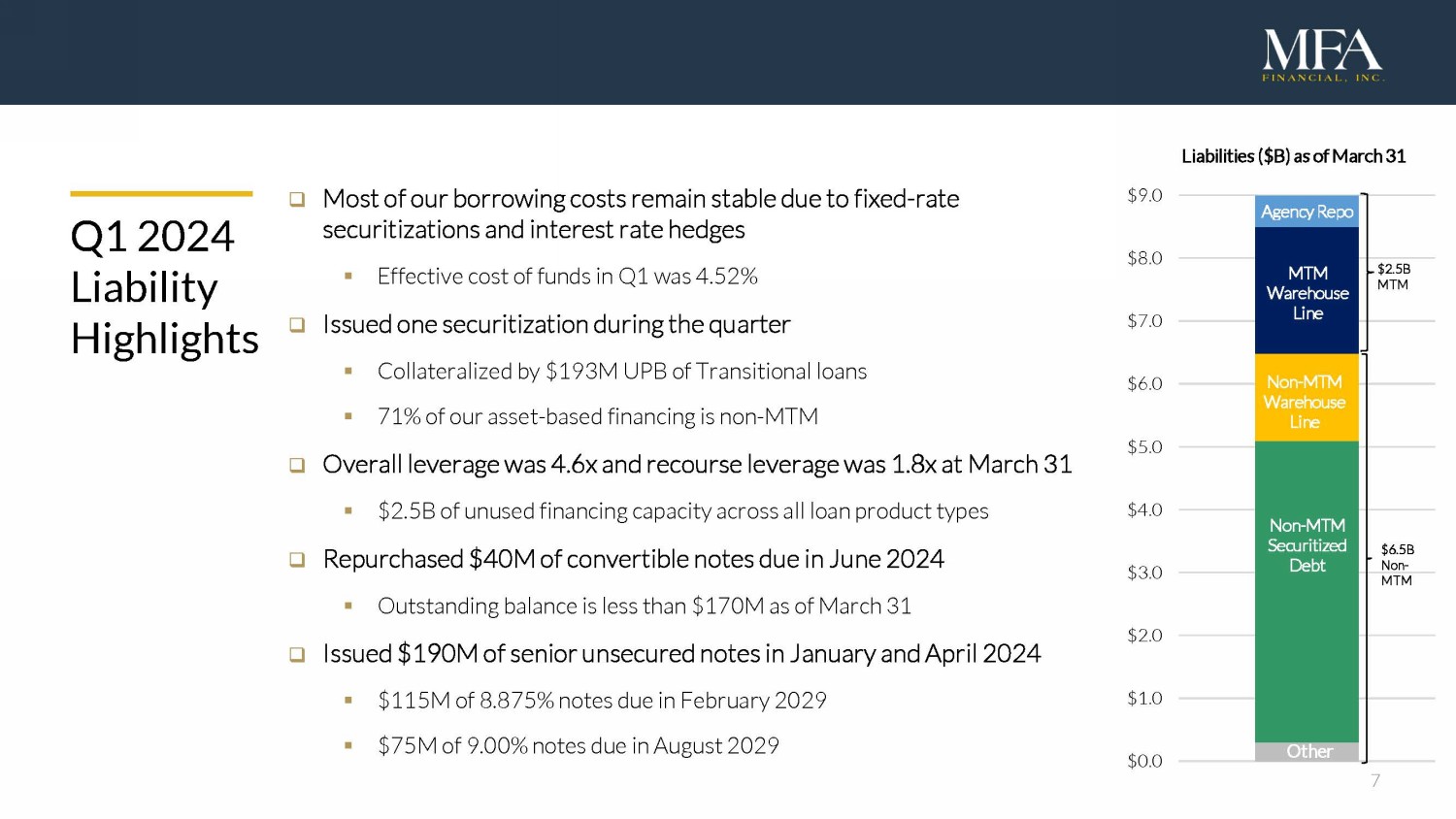

7 Q1 2024 Liability Highlights □ Most of our borrowing costs remain stable due to fixed - rate securitizations and interest rate hedges ▪ Effective cost of funds in Q1 was 4.52% □ Issued one securitization during the quarter ▪ Collateralized by $193M UPB of Transitional loans ▪ 71% of our asset - based financing is non - MTM □ Overall leverage was 4.6x and recourse leverage was 1.8x at March 31 ▪ $2.5B of unused financing capacity across all loan product types □ Repurchased $40M of convertible notes due in June 2024 ▪ Outstanding balance is less than $170M as of March 31 □ Issued $190M of senior unsecured notes in January and April 2024 ▪ $115M of 8.875% notes due in February 2029 ▪ $75M of 9.00% notes due in August 2029 MTM Warehouse Line Non - MTM Warehouse Line Non - MTM Securitized Debt Other MTM Warehouse Lines Non - MTM Warehouse Lines Other $2.5B MTM $6.5B Non - MTM $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 Liabilities ($B) as of March 31 Agency MTM Warehouse Line Non - MTM Warehouse Line Non - MTM Securitized Debt Other