Employers Expect Third Consecutive Year of Health Benefit Cost Increases Above 5% in 2025, According to Mercer

12 Settembre 2024 - 3:00PM

Business Wire

Today, Mercer, a business of Marsh McLennan (NYSE: MMC) and a

global leader in helping clients realize their investment

objectives, shape the future of work and enhance health and

retirement outcomes for their people, released preliminary results

from its 2024 National Survey of Employer-Sponsored Health

Plans.

According to an analysis of responses from over 1,800 US

employers, total health benefit cost per employee is expected to

rise 5.8% on average in 2025, even after accounting for planned

cost-reduction measures. Employers estimated that their cost would

rise by about 7%, on average, if they took no action to lower cost.

Smaller employers (those with 50-499 employees), which typically

have fully insured health plans, have been hit the hardest. They

reported that cost would rise by about 9% on average if they took

no action to lower cost.

Based on these projections, 2025 would be the third consecutive

year of health benefit cost increases above 5%, following a decade

of cost increases averaging only around 3%. Meanwhile, general

inflation has cooled, suggesting that other factors are

contributing to the higher health benefit cost trend.

Complex forces driving higher cost trend

According to Sunit Patel, Mercer’s US Chief Actuary for Health

and Benefits, several factors are contributing to faster cost

growth. Mr. Patel said, “While we’ve seen significant increases in

utilization in a few areas, such as for behavioral healthcare and

GLP-1 medications, overall utilization has had a relatively modest

impact on trend this year. The biggest driver of higher costs is

price dynamics, some of which are macro in nature.”

One source of pricing pressure is the widening gap between the

supply of healthcare workers and the demand for healthcare

services, which is building as older Americans become a larger part

of the population. Another is the continuing consolidation of

health systems – which shows no sign of slowing down. Mr. Patel

notes, “Consolidation may generate savings in the future through

increased efficiency and improved integration, but there is

evidence it is putting pressure on pricing, as larger health

systems have greater negotiating power than smaller systems.”

Spending on prescription drugs remains the fastest-growing

component of health benefit cost. Employers reported that drug

benefit cost per employee rose 7.2% in 2024. The ongoing

introduction of very high-cost gene and cellular therapies is

contributing to this higher cost growth.

The employer response to faster cost growth

The survey results suggest that about half of employers (53%)

will make cost-cutting changes to their plans in 2025, an increase

from 44% in 2024. Generally, these changes involve raising

deductibles and other cost-sharing provisions and result in higher

out-of-pocket costs for plan members when they seek care. In recent

years, many employers have avoided making these types of changes,

but this becomes more difficult in a period of sustained higher

cost growth.

According to Tracy Watts, Mercer’s National Leader of US Health

Policy, “Employers are still concerned about healthcare

affordability and ensuring that employees can afford the

out-of-pocket costs when they seek care. But they also need to

manage the overall cost of healthcare coverage to achieve a

sustainable level of spending for the organization. Balancing these

competing priorities will be a challenge over the next few

years.”

Because the cost of healthcare coverage is typically shared

between the employer and employee, managing cost is also important

to minimize growth in employee premium contributions. On average,

employees will pay for 21% of health insurance premiums through

paycheck deductions in 2025, the same as in 2024.

About Mercer’s National Survey of Employer-Sponsored Health

Plans

The 2024 National Survey of Employer-Sponsored Health Plans

launched on June 12. The preliminary results are based on responses

from over 1,800 employers through August 12. The final survey

results, which will include about 2,200 employers, will be released

later this year.

About Mercer

Mercer, a business of Marsh McLennan (NYSE: MMC), is a global

leader in helping clients realize their investment objectives,

shape the future of work and enhance health and retirement outcomes

for their people. Marsh McLennan is a global leader in risk,

strategy and people, advising clients in 130 countries across four

businesses: Marsh, Guy Carpenter, Mercer and Oliver Wyman. With

annual revenue of $23 billion and more than 85,000 colleagues,

Marsh McLennan helps build the confidence to thrive through the

power of perspective. For more information, visit mercer.com, or

follow on LinkedIn and X.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240912355491/en/

Media: Ashleigh Jang Mercer +1 917 647 0070

Ashleigh.Jang@mercer.com

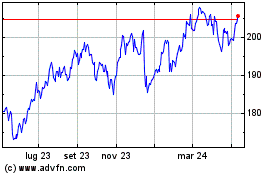

Grafico Azioni Marsh and McLennan Compa... (NYSE:MMC)

Storico

Da Ott 2024 a Nov 2024

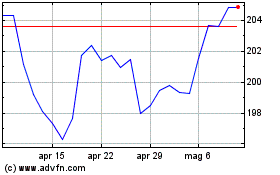

Grafico Azioni Marsh and McLennan Compa... (NYSE:MMC)

Storico

Da Nov 2023 a Nov 2024