UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO-C

(Rule 14d-100)

TENDER OFFER STATEMENT

UNDER SECTION 14(D)(1) OR (13)(E)(1)

OF THE SECURITIES EXCHANGE

ACT OF 1934

MORPHOSYS

AG

(Name of Subject Company (Issuer))

NOVARTIS

DATA42 AG

an indirect wholly owned subsidiary of

NOVARTIS

AG

(Name of Filing Persons (Offerors))

American

Depositary Shares, each representing ¼ of an Ordinary Shares, no-par value

Ordinary Shares, no-par value

(Title of Class of Securities)

617760202

(CUSIP Number of Class of Securities)

Karen L. Hale

Chief Legal Officer

Novartis

AG

Lichstrasse 35

CH-4056 Basel

Switzerland

Telephone: +41-61-324-1111

(Name, Address, and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With a copy to:

Jenny Hochenberg

Freshfields Bruckhaus Deringer US LLP

601 Lexington Avenue

New York, NY 10022

Telephone: +1 212-277-4000

CALCULATION OF FILING

FEE

| Transaction Valuation |

|

Amount of Filing Fee* |

| Not applicable |

|

Not applicable |

| * |

Pursuant to General Instruction D to Schedule TO, a filing fee is not required in connection with this filing because it relates solely to preliminary communications made before the commencement of a tender offer. |

| ¨ |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount Previously Paid: None |

|

Filing Party: N/A |

| Form of Registration No.: N/A |

|

Date Filed: N/A |

| x |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate

any transactions to which the statement relates:

| |

x |

Third-party tender offer subject to Rule 14d-1. |

| |

¨ |

Issuer tender offer subject to Rule 13e-4. |

| |

¨ |

Going-private transaction subject to Rule 13e-3. |

| |

¨ |

Amendment to Schedule 13D under Rule 13d-2. |

Check the following

box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es)

below to designate the appropriate rule provision(s) relied upon:

| |

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

The pre-commencement communication filed under cover of this

Tender Offer Statement on Schedule TO is being filed by Novartis AG, a company organized under the laws of Switzerland (the

“Parent” or “Novartis”), and Novartis data42 AG (the

“Bidder”), an indirect wholly owned subsidiary of the Parent, related to a planned tender offer by the Bidder for all of

the outstanding ordinary shares, no-par value, of MorphoSys AG, a publicly listed stock corporation (Aktiengesellschaft)

incorporated under the laws of Germany (the “Company”), at an offer price of EUR 68.00 per share in cash, without

interest, pursuant to the Business Combination Agreement, dated as of February 5, 2024, by and among the Parent, the Bidder and

the Company.

Forward Looking Statements

This communication contains statements of historical fact or “forward

looking statements” including with respect to the proposed acquisition of the Company by Novartis. Forward-looking statements can

generally be identified by words such as “potential,” “can,” “will,” “plan,” “may,”

“could,” “would,” “expect,” “anticipate,” “look forward,” “believe,”

“committed,” “investigational,” “pipeline,” “launch,” or similar terms, or by express

or implied discussions regarding the ability of Novartis and the Company to complete the transactions contemplated by the business combination

agreement (including the parties’ ability to satisfy the conditions to the consummation of the offer contemplated thereby and the

other conditions set forth in the business combination agreement), the expected timetable for completing the transaction, the benefits

sought to be achieved in the proposed transaction, the potential effects of the proposed transaction on Novartis and the Company, the

potential marketing approvals, new indications or labeling for the product candidates the Company is developing, including Pelabresib,

or regarding expected benefits and success of, or potential future revenues from such products. You should not place undue reliance on

these statements. Such forward-looking statements are based on our current beliefs and expectations regarding future events, and are subject

to significant known and unknown risks and uncertainties. Such risks and uncertainties include, but are not limited to: the risk that

the closing conditions for the proposed transaction will not be satisfied, including the risk that the necessary regulatory approvals

may not be obtained or may be obtained subject to conditions that are not anticipated; uncertainty as to the percentage of the Company

shareholders that will support the proposed transaction and tender their shares in the offer; the risk of shareholder litigation relating

to the proposed transaction, including resulting expense or delay; the possibility that the proposed transaction will not be completed

in the expected timeframe or at all, potential adverse effects to the businesses of Novartis or the Company during the pendency of the

proposed transaction, such as employee departures or distraction of management from business operations, the potential that the expected

benefits and opportunities of the proposed transaction, if completed, may not be realized or may take longer to realize than expected,

risks related to the integration of the Company into Novartis subsequent to the closing of the proposed transaction and the timing of

such integration. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual

results may vary materially from those set forth in the forward-looking statements. A further list and descriptions of these risks uncertainties

and other factors can be found in the current Form 20-F filed by Novartis with the U.S. Securities and Exchange Commission (the “SEC”).

Novartis is providing the information in this communication as of this

date and does not undertake any obligation to update any forward-looking statements contained in this communication as a result of new

information, future events or otherwise.

Important Information about the Tender Offer

The tender offer described in this communication has not yet commenced,

and this communication is neither an offer to purchase nor a solicitation of an offer to sell securities. The terms and conditions of

the tender offer will be published in, and the offer to purchase ordinary shares of the Company will be made only pursuant to, the offer

document and related offer materials prepared by Novartis and the Bidder and as approved by the German Federal Financial Supervisory Authority

(Bundesanstalt für Finanzdienstleistungsaufsicat or “BaFin”). Once the necessary permission from BaFin has been

obtained, the offer document and related offer materials will be published in Germany and also filed with the SEC on Schedule TO at the

time the tender offer is commenced. The Company intends to file a solicitation/recommendation statement on Schedule 14D-9 with the SEC

with respect to the tender offer and to publish a recommendation statement pursuant to Sec. 27 of the German Securities Acquisition and

Takeover Act.

INVESTORS AND SECURITY HOLDERS ARE STRONGLY ADVISED TO READ THE

TENDER OFFER STATEMENT, INCLUDING AN OFFER TO PURCHASE, MEANS TO TENDER AND RELATED TENDER OFFER DOCUMENTS THAT WILL BE FILED BY

NOVARTIS AND THE BIDDER WITH THE SEC AND THE RELATED SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 THAT WILL BE FILED BY THE

COMPANY WITH THE SEC, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Once

filed, these documents will be available at no charge on the SEC’s website at www.sec.gov. In addition, a copy of the offer to purchase,

means to tender and certain other related tender offer documents (once they become available) may also be obtained for free on Novartis’

website at www.novartis.com/investors/morphosys-acquisition. A copy of the solicitation/recommendation statement will be made available

by the Company at www.morphosys.com/en/investors/Novartis-TakeoverOffer or by contacting the Company’s investor relations

department at +49 89 89927 179. These materials may also be obtained through the information agent for the tender offer, which will be

named in the tender offer materials.

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

| |

|

| 99.1 |

|

Email message to MorphoSys AG Employees from Shreeram Aradhye, M.D., President, Development and Chief Medical Officer, Patrick Horber, M.D., President, International, and Victor Bulto, President, US, on behalf of the Executive Committee of Novartis AG, dated February 6, 2024. |

Exhibit 99.1

Subject: A message from

Novartis regarding the recently announced transaction between MorphoSys and Novartis

Dear MorphoSys team,

Following yesterday’s announcement, we are reaching out to express

our excitement to build on our long-standing development partnership.

You have built a world-class company whose purpose is rooted in aspiring

to redefine how cancer is treated. At Novartis, our mission is to reimagine medicine to improve and extend people’s lives. We firmly

believe that our companies strategically and culturally are aligned. We are especially excited by MorphoSys’ progress, hard work

and dedication in advancing its early and late-stage oncology pipeline, including pelabresib, a potential next-generation treatment for

myelofibrosis.

We appreciate your patience and understanding as we work to finalize

the transaction. We want to assure you that we recognize the importance of clear, timely and open communication and emphasize that our

priority is to minimize disruption and to ensure successful business continuity. At the same time, until formal completion of the transaction,

we know we must continue to operate as separate and independent companies.

After the closing, we look forward to learning from you, supporting

you and working together on our joint purpose to improve people’s lives and reach more patients.

We express our sincere gratitude for all your commitment and resilience

in the meantime.

Best regards,

| Shreeram Aradhye, M.D. |

Patrick Horber, M.D. |

Victor Bulto |

| President,

Development and |

President, International |

President, US |

| Chief Medical Officer |

|

|

On behalf of Executive Committee of Novartis

###

Forward Looking Statements

This communication contains statements of historical fact or

“forward looking statements”, including with respect to the proposed acquisition of MorphoSys by Novartis AG.

Forward-looking statements can generally be identified by words such as “potential,” “can,”

“will,” “plan,” “may,” “could,” “would,” “expect,”

“anticipate,” “look forward,” “believe,” “committed,” “investigational,”

“pipeline,” “launch,” or similar terms, or by express or implied discussions regarding the ability of

Novartis AG and MorphoSys to complete the transactions contemplated by the business combination agreement (including the

parties’ ability to satisfy the conditions to the consummation of the offer contemplated thereby and the other conditions set

forth in the business combination agreement), the expected timetable for completing the transaction, the benefits sought to be

achieved in the proposed transaction, the potential effects of the proposed transaction on Novartis AG and MorphoSys, the potential

marketing approvals, new indications or labeling for the product candidates MorphoSys is developing, including Pelabresib, or

regarding expected benefits and success of, or potential future revenues from such products. You should not place undue reliance on

these statements. Such forward-looking statements are based on our current beliefs and expectations regarding future events, and are

subject to significant known and unknown risks and uncertainties. Such risks and uncertainties include, but are not limited to: the

risk that the closing conditions for the proposed transaction will not be satisfied, including the risk that the necessary

regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated; uncertainty as to the

percentage of MorphoSys shareholders that will support the proposed transaction and tender their shares in the offer; the risk of

shareholder litigation relating to the proposed transaction, including resulting expense or delay; the possibility that the proposed

transaction will not be completed in the expected timeframe or at all, potential adverse effects to the businesses of Novartis AG or

MorphoSys during the pendency of the proposed transaction, such as employee departures or distraction of management from business

operations, the potential that the expected benefits and opportunities of the proposed transaction, if completed, may not be

realized or may take longer to realize than expected, risks related to the integration of the MorphoSys into Novartis AG subsequent

to the closing of the proposed transaction and the timing of such integration. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those set forth in the

forward-looking statements. A further list and descriptions of these risks uncertainties and other factors can be found in the

current Form 20-F filed by Novartis AG with the U.S. Securities and Exchange Commission (the “SEC”).

Novartis AG is providing the information in this communication as of

this date and does not undertake any obligation to update any forward-looking statements contained in this communication as a result of

new information, future events or otherwise.

Important Information about the Tender Offer

This communication is neither an offer to sell or purchase nor a solicitation

of an offer to sell or purchase MorphoSys shares. Moreover, this announcement is neither an offer to purchase nor a solicitation to purchase

shares of Novartis data42 AG. The final terms and further provisions regarding the takeover offer (also referred to a tender offer) will

be in the offer document once its publication has been approved by the German Federal Financial Supervisory Authority (Bundesanstalt

für Finanzdienstleistungsaufsicat or “BaFin”). Novartis data42 AG reserves the right to deviate from the basic terms

presented herein in the final terms and provisions. Investors and holders of MorphoSys shares are strongly recommended to read the offer

document and all other documents in connection with the public takeover offer as soon as they are published, as they will contain important

information.

Subject to the exceptions described in the offer document and any exceptions

granted by the relevant regulatory authorities, a public takeover offer is not being made, directly or indirectly, in or into those jurisdictions

where to do so would constitute a violation pursuant to the laws of such jurisdiction.

The tender offer described in this communication has not yet commenced,

and this communication is neither an offer to purchase nor a solicitation of an offer to sell securities. The terms and conditions of

the tender offer will be published in, and the offer to purchase ordinary shares of MorphoSys will be made only pursuant to, the offer

document and related offer materials prepared by Novartis AG and Novartis data42 AG and as approved by BaFin. Once the necessary permission

from BaFin has been obtained, the offer document and related offer materials will be published in Germany and also filed with the SEC

on Schedule TO at the time the tender offer is commenced. MorphoSys intends to file a solicitation/recommendation statement on Schedule

14D-9 with the SEC with respect to the tender offer and to publish a recommendation statement pursuant to Sec. 27 of the German Securities

Acquisition and Takeover Act.

In order to reconcile certain areas where German law and U.S. law conflict,

Novartis AG and Novartis data42 AG expect to request no-action and exemptive relief from the SEC to conduct the tender in the manner described

in the offer document.

Novartis AG and its affiliates or brokers (acting as agents of Novartis

data42 AG or its affiliates, if any) may, to the extent permitted by applicable laws or regulations, directly or indirectly, acquire shares

in MorphoSys or enter into agreements to acquire shares outside of the tender offer before, during or after the term of the tender offer.

This also applies to other securities convertible into, exchangeable for or exercisable for shares of MorphoSys. These purchases may be

concluded via the stock exchange at market prices or outside the stock exchange on negotiated terms. If such purchases or agreements to

purchase are made, they will be made outside the United States and will comply with applicable law, including, to the extent applicable,

the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder (including pursuant to any requested no-action

and exemptive relief from the SEC).

All information regarding such purchases will be disclosed in accordance

with the laws or regulations applicable in Germany or any other relevant jurisdiction. In addition, the financial advisors of Novartis

AG may also act in the ordinary course of trading in securities of MorphoSys, which may include purchases or agreements to purchase such

securities.

INVESTORS AND SECURITY HOLDERS ARE STRONGLY ADVISED TO READ THE

TENDER OFFER STATEMENT, INCLUDING AN OFFER TO PURCHASE, MEANS TO TENDER AND RELATED TENDER OFFER DOCUMENTS THAT WILL BE FILED BY

NOVARTIS AG AND NOVARTIS DATA42 AG WITH THE SEC AND THE RELATED SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 THAT WILL BE FILED

BY MORPHOSYS WITH THE SEC, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Once filed, these documents will be available

at no charge on the SEC’s website at www.sec.gov. In addition, a copy of the offer to purchase, means to tender and certain

other related tender offer documents (once they become available) may also be obtained for free on Novartis AG’s website at www.novartis.com/investors/morphosys-acquisition.

A copy of the solicitation/recommendation statement will be made available by MorphoSys at morphosys.com/en/investors/Novartis-TakeoverOffer

or by contacting MorphoSys’ investor relations department at +49 89 89927 179. These materials may also be obtained through the

information agent for the tender offer, which will be named in the tender offer materials.

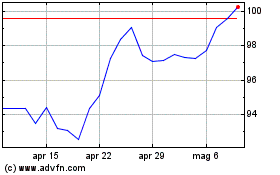

Grafico Azioni Novartis (NYSE:NVS)

Storico

Da Dic 2024 a Gen 2025

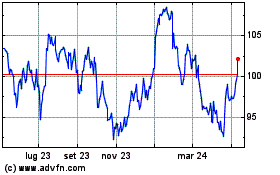

Grafico Azioni Novartis (NYSE:NVS)

Storico

Da Gen 2024 a Gen 2025