false

0000726728

0000726728

2024-01-22

2024-01-22

0000726728

us-gaap:CommonStockMember

2024-01-22

2024-01-22

0000726728

o:Series6.000PercentACumulativeRedeemablePreferredStock0.01ParValueMember

2024-01-22

2024-01-22

0000726728

o:Notes1.125PercentDue2027Member

2024-01-22

2024-01-22

0000726728

o:Notes1.875PercentDue2027Member

2024-01-22

2024-01-22

0000726728

o:Notes1.625PercentDue2030Member

2024-01-22

2024-01-22

0000726728

o:Notes4.875PercentDue2030Member

2024-01-22

2024-01-22

0000726728

o:Notes5.750PercentDue2031Member

2024-01-22

2024-01-22

0000726728

o:Notes1.750PercentDue2033Member

2024-01-22

2024-01-22

0000726728

o:Notes5.125PercentDue2034Member

2024-01-22

2024-01-22

0000726728

o:Notes6.000PercentDue2039Member

2024-01-22

2024-01-22

0000726728

o:Notes2.500PercentDue2042Member

2024-01-22

2024-01-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

Securities

and Exchange Commission

Washington, D.C. 20549

Form 8-K/A

(Amendment No. 1)

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report: January 22, 2024

(Date of Earliest Event Reported)

REALTY

INCOME CORPORATION

(Exact name of registrant as specified in

its charter)

| Maryland |

|

1-13374 |

|

33-0580106 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File Number) |

|

(IRS

Employer Identification No.) |

11995 El Camino Real, San Diego, California 92130

(Address of principal executive offices)

(858) 284-5000

(Registrant’s telephone number, including area code)

N/A

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

symbol |

|

Name

of Each Exchange On Which

Registered |

| Common

Stock, $0.01 Par Value |

|

O |

|

New York Stock Exchange |

| 6.000% Series A Cumulative Redeemable Preferred Stock, $0.01 Par Value |

|

O PR |

|

New York Stock Exchange |

| 1.125% Notes due 2027 |

|

O27A |

|

New York Stock Exchange |

| 1.875% Notes due 2027 |

|

O27B |

|

New York Stock Exchange |

| 1.625% Notes due 2030 |

|

O30 |

|

New York Stock Exchange |

| 4.875% Notes due 2030 |

|

O30A |

|

New York Stock Exchange |

| 5.750% Notes due 2031 |

|

O31A |

|

New York Stock Exchange |

| 1.750% Notes due 2033 |

|

O33A |

|

New York Stock Exchange |

| 5.125% Notes due 2034 |

|

O34 |

|

New York Stock Exchange |

| 6.000% Notes due 2039 |

|

O39 |

|

New York Stock Exchange |

| 2.500% Notes due 2042 |

|

O42 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

On January 24, 2024, Realty Income Corporation

(“Realty Income”) filed with the Securities and Exchange Commission a Current Report on Form 8-K (the “Original

Form 8-K”) reporting, among other events and pursuant to Items 1.01, 2.01, 2.03, 3.03, 5.03 and 9.01 of Form 8-K, the

consummation of the transactions contemplated by that certain Agreement and Plan of Merger, dated October 29, 2023, by and among

Realty Income, Saints MD Subsidiary, Inc., a Maryland corporation (“Merger Sub”), and Spirit Realty Capital, Inc.,

a Maryland corporation (“Spirit”). Pursuant to the Merger Agreement, upon the terms and subject to the conditions set forth

in the Merger Agreement, among other things, Spirit has merged with and into Merger Sub, with Merger Sub continuing as the surviving corporation

(the “Merger” and the effective time of the Merger, the “Effective Time”). This Current Report on Form 8-K/A

amends the Original Form 8-K to include an updated Item 9.01(b) Pro Forma Financial Information, which Realty Income indicated

would be provided no later than 71 days from the date on which the Original Form 8-K was required to be filed.

Item 9.01 of the Original Form 8-K is hereby

amended and restated in its entirety as set forth below. The Original Form 8-K otherwise remains unchanged.

Item 9.01 Financial Statements

and Exhibits

(a) Financial Statements and Exhibits.

The audited consolidated financial statements

of Spirit as of December 31, 2022 and 2021, and for each of the years in the three year period ended December 31, 2022 are incorporated

by reference to Exhibit 99.1 to the Current Report on Form 8-K filed by Realty Income on November 27, 2023.

The unaudited consolidated financial statements

of Spirit as of September 30, 2023 and for the nine month periods ended September 30, 2023 and 2022 are incorporated by reference

to Exhibit 99.2 to the Current Report on Form 8-K filed by Realty Income on November 27, 2023.

(b) Pro Forma Financial Information.

The unaudited pro forma condensed combined balance

sheet of Realty Income as of September 30, 2023 and the unaudited pro forma condensed combined statements of operations for the nine

months ended September 30, 2023 and the year ended December 31, 2022, giving effect to the Merger, are filed as Exhibit 99.1

to this Current Report on Form 8-K and are incorporated by reference herein.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: February 16, 2024 |

REALTY INCOME CORPORATION |

| |

|

|

| |

By: |

|

| |

|

/s/ Jonathan Pong |

| |

|

Jonathan Pong |

| |

|

Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 99.1

UNAUDITED PRO FORMA

CONDENSED COMBINED FINANCIAL STATEMENTS

The

following unaudited pro forma condensed combined financial statements and notes thereto present the unaudited pro forma condensed combined

balance sheet as of September 30, 2023 and the unaudited pro forma condensed combined statements of operations for the nine months

ended September 30, 2023 and the year ended December 31, 2022. The unaudited pro forma condensed combined financial information

was prepared in accordance with Article 11 of Regulation S-X as amended by the final rule, Release No. 33-10786 “Amendments

to Financial Disclosures about Acquired and Disposed Businesses”, in order to give effect to the Pro Forma Transactions (as defined

and described below) and the assumptions and adjustments described in the accompanying notes to the unaudited pro forma condensed combined

financial statements.

On

October 29, 2023, Realty Income Corporation (“Realty Income”) entered into an Agreement and Plan of Merger (as amended

from time to time, the “Merger Agreement”) with Saints MD Subsidiary, Inc., (“Merger Sub”) a Maryland corporation

and direct wholly owned subsidiary of Realty Income, and Spirit Realty Capital, Inc. (“Spirit”). Pursuant to the terms

and conditions of the Merger Agreement, upon the closing, Spirit merged with and into Merger Sub, with Merger Sub continuing as the surviving

corporation (the “Merger”). At the time the Merger became effective (the “Effective Time”), (i) each outstanding

share of Spirit common stock, par value $0.05 per share was converted into 0.762 (the “Exchange Ratio”) shares of Realty Income

common stock, par value $0.01 per share, and (ii) each outstanding share of Spirit Series A preferred stock, par value $0.01

per share was converted into one share of newly created Realty Income Series A preferred stock, par value $0.01 per share having

substantially the same terms as the Spirit Series A preferred stock. Holders of shares of Spirit common stock and Spirit Series A

preferred stock (other than those held by Spirit, Realty Income or their respective affiliates) received cash in lieu of fractional shares.

At the Effective Time, each award of outstanding restricted Spirit common stock (a “Spirit Restricted Stock Award”), was cancelled

and automatically converted into Realty Income common stock using the Exchange Ratio as a multiplier and cash consideration in respect

of any fractional shares, and each outstanding vested or unvested Spirit performance share award (a “Spirit Performance Share

Award”) whether or not then vested, was cancelled and automatically converted into Realty Income common stock in accordance with

the Merger Agreement based on the greater of target level of achievement of the applicable performance goals and actual level of achievement

of the applicable performance goals as of immediately prior to the Effective Time, and cash consideration in lieu of any fractional share

of Realty Income common stock, and the amount of any accrued and unpaid cash dividend equivalents corresponding to each such Spirit Performance

Share Award.

The

following unaudited pro forma condensed combined financial statements have been prepared by applying the acquisition method of accounting

with Realty Income treated as the acquiror. The unaudited pro forma condensed combined financial statements are based on the historical

consolidated financial statements of Realty Income and historical consolidated financial statements of Spirit as adjusted to give effect

to the following (collectively referred to as the “Pro Forma Transactions”):

| · | Merger transaction costs specifically related to the Merger; |

| · | Adjustments to reflect compensation expense as a result of the acceleration of certain pre-existing Spirit

stock-based compensation awards in connection with the Merger; |

| · | Adjustments to reflect Spirit’s additional $200 million term loan draw in December 2023 prior

to the Merger; and |

| · | Adjustments to reflect hedge accounting assessment and redesignation related to the existing interest

rate swaps of Spirit. |

The

unaudited pro forma condensed combined balance sheet as of September 30, 2023 gives effect to the Pro Forma Transactions as if they

had occurred on September 30, 2023. The unaudited pro forma condensed combined statements of operations for the nine months ended

September 30, 2023, and the year ended December 31, 2022, give effect to the Pro Forma Transactions as if they had occurred

on January 1, 2022.

These

unaudited pro forma condensed combined financial statements are prepared for informational purposes only and are based on assumptions

and estimates considered appropriate by Realty Income’s management. The unaudited pro forma adjustments represent Realty Income’s

management’s estimates based on information available as of the date of the unaudited pro forma condensed combined financial statements

and are subject to change as additional information becomes available and additional analyses are performed. However, Realty Income’s

management believes that the assumptions provide a reasonable basis for presenting the significant effects that are directly attributable

to the Pro Forma Transactions, and that the pro forma adjustments give appropriate effect to those assumptions and are properly applied

in the unaudited pro forma condensed combined financial statements. The unaudited pro forma condensed combined financial statements do

not purport to be indicative of what Realty Income’s financial condition or results of operations actually would have been if the

Pro Forma Transactions had been consummated as of the dates indicated, nor do they purport to represent Realty Income’s financial

position or results of operations for future periods.

Additionally,

these unaudited pro forma condensed combined financial statements do not include any adjustments not otherwise described herein,

including such adjustments associated with: (1) Realty Income or Spirit’s real estate acquisitions that have closed after

September 30, 2023 or the related financing of those acquisitions, (2) Realty Income or Spirit’s real estate

dispositions that have closed after September 30, 2023 or the application or use of those disposition proceeds, (3) certain Realty Income or Spirit rental rate increases that

occurred after September 30, 2023, (4) potential synergies that may be achieved following the Merger, including potential

overall savings in general and administrative expense, or any strategies that Realty Income’s management may consider in order

to continue to efficiently manage Realty Income’s operations, (5) any one-time integration and other costs (including

estimated transaction expenses) related to the Merger that may be incurred following the Merger closing, including those that may be

necessary to achieve the potential synergies, since the extent of such costs is not reasonably certain, and (6) any debt or

equity issuances, repayments, or redemptions, by Realty Income or Spirit, which occurred subsequent to the Merger closing.

REALTY

INCOME CORPORATION

UNAUDITED

PRO FORMA CONDENSED COMBINED BALANCE SHEET

AS OF SEPTEMBER 30,

2023

(in thousands)

| | |

Realty Income

Historical | | |

Spirit Historical,

As Reclassified

(Note 3) | | |

Pro Forma

Transactions

Adjustments (Note 4) | | |

Item in

Note

4 | |

Pro Forma Combined | |

| ASSETS | |

| | | |

| | | |

| | | |

| |

| | |

| Real estate held for investment, at cost: | |

| | | |

| | | |

| | | |

| |

| | |

| Land | |

$ | 14,408,324 | | |

$ | 1,808,364 | | |

$ | 55,089 | | |

[1] | |

$ | 16,271,777 | |

| Buildings and improvements | |

| 33,606,951 | | |

| 7,015,086 | | |

| (1,744,133 | ) | |

[1] | |

| 38,877,904 | |

| Total real estate held for investment, at cost | |

| 48,015,275 | | |

| 8,823,450 | | |

| (1,689,044 | ) | |

| |

| 55,149,681 | |

| Less accumulated depreciation and amortization | |

| (5,781,056 | ) | |

| (1,354,807 | ) | |

| 1,354,807 | | |

[2] | |

| (5,781,056 | ) |

| Real estate held for investment, net | |

| 42,234,219 | | |

| 7,468,643 | | |

| (334,237 | ) | |

| |

| 49,368,625 | |

| Real estate and lease intangibles held for sale, net | |

| 19,927 | | |

| 61,545 | | |

| 18,509 | | |

[3] | |

| 99,981 | |

| Cash and cash equivalents | |

| 344,129 | | |

| 134,166 | | |

| 10,612 | | |

[4] | |

| 488,907 | |

| Accounts receivable, net | |

| 678,441 | | |

| 199,826 | | |

| (185,245 | ) | |

[5] | |

| 693,022 | |

| Lease intangible assets, net | |

| 5,089,293 | | |

| 389,100 | | |

| 1,358,707 | | |

[6] | |

| 6,837,100 | |

| Goodwill | |

| 3,731,478 | | |

| 225,600 | | |

| 721,739 | | |

[7] | |

| 4,678,817 | |

| Other assets, net | |

| 3,239,433 | | |

| 171,328 | | |

| (32,624 | ) | |

[8] | |

| 3,378,137 | |

| Total assets | |

$ | 55,336,920 | | |

$ | 8,650,208 | | |

$ | 1,557,461 | | |

| |

$ | 65,544,589 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | | |

| | | |

| |

| | |

| Distributions payable | |

$ | 187,288 | | |

$ | 99,571 | | |

$ | (99,571 | ) | |

[4] | |

$ | 187,288 | |

| Accounts payable and accrued expenses | |

| 660,366 | | |

| 69,045 | | |

| 40,225 | | |

[9] | |

| 769,636 | |

| Lease intangible liabilities, net | |

| 1,426,264 | | |

| 106,814 | | |

| 35,510 | | |

[10] | |

| 1,568,588 | |

| Other liabilities | |

| 786,437 | | |

| 61,737 | | |

| - | | |

| |

| 848,174 | |

| Line of credit payable and commercial paper | |

| 858,260 | | |

| - | | |

| - | | |

| |

| 858,260 | |

| Term loan, net | |

| 1,287,995 | | |

| 1,090,198 | | |

| 208,167 | | |

[11] | |

| 2,586,360 | |

| Mortgages payable, net | |

| 824,240 | | |

| 4,545 | | |

| (4,545 | ) | |

[11] | |

| 824,240 | |

| Notes payable, net | |

| 17,482,652 | | |

| 2,725,505 | | |

| (246,741 | ) | |

[11] | |

| 19,961,416 | |

| Total liabilities | |

| 23,513,502 | | |

| 4,157,415 | | |

| (66,955 | ) | |

| |

| 27,603,962 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Commitments and contingencies | |

| - | | |

| - | | |

| - | | |

| |

| - | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| STOCKHOLDERS’ EQUITY: | |

| | | |

| | | |

| | | |

| |

| | |

| Preferred stock and paid-in capital | |

| - | | |

| 166,177 | | |

| 1,217 | | |

[12] | |

| 167,394 | |

| Common stock and paid-in capital | |

| 38,031,829 | | |

| 7,307,795 | | |

| (1,264,205 | ) | |

[12] | |

| 44,075,419 | |

| Distributions in excess of net income | |

| (6,416,534 | ) | |

| (3,036,475 | ) | |

| 2,942,700 | | |

[12] | |

| (6,510,309 | ) |

| Accumulated other comprehensive income | |

| 41,849 | | |

| 55,296 | | |

| (55,296 | ) | |

[12] | |

| 41,849 | |

| Total stockholders’ equity | |

| 31,657,144 | | |

| 4,492,793 | | |

| 1,624,416 | | |

| |

| 37,774,353 | |

| Noncontrolling interests | |

| 166,274 | | |

| - | | |

| - | | |

| |

| 166,274 | |

| Total equity | |

| 31,823,418 | | |

| 4,492,793 | | |

| 1,624,416 | | |

| |

| 37,940,627 | |

| Total liabilities and equity | |

$ | 55,336,920 | | |

$ | 8,650,208 | | |

$ | 1,557,461 | | |

| |

$ | 65,544,589 | |

REALTY

INCOME CORPORATION

UNAUDITED

PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2023

(in thousands, except per share data)

| | |

Realty Income

Historical | | |

Spirit

Historical, As

Reclassified

(Note 3) | | |

Pro Forma

Transactions Adjustments (Note 4) | | |

Item in

Note 4 | |

Pro Forma

Combined | |

| REVENUE | |

| | | |

| | | |

| | | |

| |

| | |

| Rental (including reimbursable) | |

$ | 2,929,440 | | |

$ | 561,765 | | |

$ | 2,685 | | |

[13] | |

$ | 3,493,890 | |

| Other | |

| 73,268 | | |

| 9,200 | | |

| 961 | | |

[14] | |

| 83,429 | |

| Total revenue | |

| 3,002,708 | | |

| 570,965 | | |

| 3,646 | | |

| |

| 3,577,319 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| EXPENSES | |

| | | |

| | | |

| | | |

| |

| | |

| Depreciation and amortization | |

| 1,419,321 | | |

| 236,527 | | |

| 31,342 | | |

[15] | |

| 1,687,190 | |

| Interest | |

| 522,110 | | |

| 104,993 | | |

| 59,511 | | |

[16] | |

| 686,614 | |

| Property (including reimbursable) | |

| 235,081 | | |

| 24,077 | | |

| 80 | | |

[17] | |

| 259,238 | |

| General and administrative | |

| 106,521 | | |

| 46,190 | | |

| - | | |

| |

| 152,711 | |

| Provisions for impairment | |

| 59,801 | | |

| 36,052 | | |

| - | | |

| |

| 95,853 | |

| Merger and integration-related costs | |

| 4,532 | | |

| - | | |

| - | | |

| |

| 4,532 | |

| Total expenses | |

| 2,347,366 | | |

| 447,839 | | |

| 90,933 | | |

| |

| 2,886,138 | |

| Gain on sales of real estate | |

| 19,675 | | |

| 66,450 | | |

| - | | |

| |

| 86,125 | |

| Foreign currency and derivative gain, net | |

| 4,957 | | |

| - | | |

| - | | |

| |

| 4,957 | |

| Equity in income and impairment of investment in unconsolidated entities | |

| 411 | | |

| - | | |

| - | | |

| |

| 411 | |

| Other income, net | |

| 12,985 | | |

| - | | |

| - | | |

| |

| 12,985 | |

| Income before income taxes | |

| 693,370 | | |

| 189,576 | | |

| (87,287 | ) | |

| |

| 795,659 | |

| Income taxes | |

| (36,218 | ) | |

| (754 | ) | |

| - | | |

| |

| (36,972 | ) |

| Net income | |

| 657,152 | | |

| 188,822 | | |

| (87,287 | ) | |

| |

| 758,687 | |

| Net income attributable to noncontrolling interests | |

| (3,248 | ) | |

| - | | |

| - | | |

| |

| (3,248 | ) |

| Dividends paid to preferred stockholders | |

| - | | |

| (7,763 | ) | |

| - | | |

| |

| (7,763 | ) |

| Net income available to common stockholders | |

$ | 653,904 | | |

$ | 181,059 | | |

$ | (87,287 | ) | |

| |

$ | 747,676 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Amounts available to common stockholders per common share: | |

| | | |

| | | |

| | | |

| |

| (Note 5) | |

| Net income, basic and diluted | |

$ | 0.96 | | |

$ | 1.28 | | |

| | | |

| |

$ | 0.95 | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| |

| (Note 5) | |

| Basic | |

| 681,419 | | |

| 141,095 | | |

| | | |

| |

| 789,727 | |

| Diluted | |

| 682,129 | | |

| 141,103 | | |

| | | |

| |

| 790,437 | |

REALTY

INCOME CORPORATION

UNAUDITED

PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2022

(in thousands, except per share data)

| | |

Realty Income

Historical | | |

Spirit Historical,

As Reclassified (Note 3) | | |

Pro Forma

Transactions

Adjustments (Note 4) | | |

Item in

Note 4 | |

Pro Forma

Combined | |

| REVENUE | |

| | | |

| | | |

| | | |

| |

| | |

| Rental (including reimbursable) | |

$ | 3,299,657 | | |

$ | 703,029 | | |

$ | 8,030 | | |

[13] | |

$ | 4,010,716 | |

| Other | |

| 44,024 | | |

| 6,600 | | |

| 1,281 | | |

[14] | |

| 51,905 | |

| Total revenue | |

| 3,343,681 | | |

| 709,629 | | |

| 9,311 | | |

| |

| 4,062,621 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| EXPENSES | |

| | | |

| | | |

| | | |

| |

| | |

| Depreciation and amortization | |

| 1,670,389 | | |

| 292,985 | | |

| 64,173 | | |

[15] | |

| 2,027,547 | |

| Interest | |

| 465,223 | | |

| 117,622 | | |

| 121,580 | | |

[16] | |

| 704,425 | |

| Property (including reimbursable) | |

| 226,330 | | |

| 29,837 | | |

| 106 | | |

[17] | |

| 256,273 | |

| General and administrative | |

| 138,459 | | |

| 62,023 | | |

| - | | |

| |

| 200,482 | |

| Provisions for impairment | |

| 25,860 | | |

| 37,156 | | |

| - | | |

| |

| 63,016 | |

| Merger and integration-related costs | |

| 13,897 | | |

| - | | |

| 92,550 | | |

[18] | |

| 106,447 | |

| Total expenses | |

| 2,540,158 | | |

| 539,623 | | |

| 278,409 | | |

| |

| 3,358,190 | |

| Gain on sales of real estate | |

| 102,957 | | |

| 110,900 | | |

| - | | |

| |

| 213,857 | |

| Foreign currency and derivative (loss), net | |

| (13,311 | ) | |

| - | | |

| - | | |

| |

| (13,311 | ) |

| Gain (loss) on extinguishment of debt | |

| 367 | | |

| (172 | ) | |

| - | | |

| |

| 195 | |

| Equity in income and impairment of investment in unconsolidated entities | |

| (6,448 | ) | |

| - | | |

| - | | |

| |

| (6,448 | ) |

| Other income, net | |

| 30,511 | | |

| 5,679 | | |

| - | | |

| |

| 36,190 | |

| Income before income taxes | |

| 917,599 | | |

| 286,413 | | |

| (269,098 | ) | |

| |

| 934,914 | |

| Income taxes | |

| (45,183 | ) | |

| (897 | ) | |

| - | | |

| |

| (46,080 | ) |

| Net income | |

| 872,416 | | |

| 285,516 | | |

| (269,098 | ) | |

| |

| 888,834 | |

| Net income attributable to noncontrolling interests | |

| (3,008 | ) | |

| - | | |

| - | | |

| |

| (3,008 | ) |

| Dividends paid to preferred stockholders | |

| - | | |

| (10,350 | ) | |

| - | | |

| |

| (10,350 | ) |

| Net income available to common stockholders | |

$ | 869,408 | | |

$ | 275,166 | | |

$ | (269,098 | ) | |

| |

$ | 875,476 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Amounts available to common stockholders per common share: | |

| | | |

| | | |

| | | |

| |

| (Note 5) | |

| Net income, basic and diluted | |

$ | 1.42 | | |

$ | 2.04 | | |

| | | |

| |

$ | 1.22 | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| |

| (Note 5) | |

| Basic | |

| 611,766 | | |

| 134,548 | | |

| | | |

| |

| 720,074 | |

| Diluted | |

| 612,181 | | |

| 134,646 | | |

| | | |

| |

| 720,489 | |

NOTES TO UNAUDITED

PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

Note 1 – Basis of Presentation

The Realty Income and Spirit

historical financial information has been derived from, in the case of Realty Income, its consolidated financial statements included in

its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, and Annual Report on Form 10-K for the year

ended December 31, 2022, and, in the case of Spirit, its consolidated financial statements included as Exhibits 99.1 and 99.2 to

Realty Income’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on

November 27, 2023 (the “Form 8-K”). Certain historical amounts of Spirit have been reclassified to conform to Realty

Income’s financial statement presentation, as discussed further in Note 3. The unaudited pro forma condensed combined financial

statements should be read in conjunction with Realty Income’s and Spirit’s consolidated financial statements and the notes

thereto. The unaudited pro forma condensed combined balance sheet gives effect to the Pro Forma Transactions as if they had been completed

on September 30, 2023. The unaudited pro forma condensed combined statements of operations give effect to the Pro Forma Transactions

as if they had been completed on January 1, 2022.

The historical financial statements of Realty

Income and Spirit have been adjusted in the unaudited pro forma condensed combined financial statements to give pro forma effect to the

accounting for the Pro Forma Transactions under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) (“Pro Forma

Transactions Adjustments”). The unaudited pro forma condensed combined financial statements and related notes were prepared using

the acquisition method of accounting in accordance with Financial Accounting Standards Board Accounting Standards Codification 805, Business

Combinations (“ASC 805”), with Realty Income treated as the acquiror of Spirit. ASC 805 requires, among other things, that

the assets acquired and liabilities assumed in a business combination be recognized at their fair values as of the acquisition date. For

purposes of the unaudited pro forma condensed combined financial statements, the estimated preliminary purchase consideration in the Merger

has been allocated to the assets acquired and liabilities assumed of Spirit based upon Realty Income management’s preliminary estimate

of their fair values as of September 30, 2023. The allocations of the purchase price reflected in these unaudited pro forma condensed

combined financial statements have not been finalized and are based upon the best available information at the current time. A final determination

of the fair values of the assets and liabilities is anticipated to occur during the first quarter of 2024, will be based on the actual

valuations of the tangible and intangible assets and liabilities that exist as of the date of completion of the Merger. The completion

of the final valuations, the allocations of the purchase price, the impact of ongoing integration activities and other changes in tangible

and intangible assets and liabilities that occur prior to the completion of the Merger could cause material differences in the information

presented.

The unaudited pro forma condensed

combined financial statements and related notes herein present unaudited pro forma condensed combined financial condition and results

of operations of Realty Income, after giving pro forma effect to the Pro Forma Transactions, which include the issuance of Realty Income

common stock to Spirit stockholders, the assumption of Spirit’s outstanding debt, the conversion of each outstanding Spirit Series A

preferred stock outstanding into newly issued shares of Realty Income Series A preferred stock, and related transactions.

The Merger, the Pro Forma

Transactions and the related adjustments are described in these accompanying notes to the unaudited pro forma condensed combined financial

statements.

In the opinion of Realty Income’s

management, all material adjustments have been made that are necessary to present fairly, in accordance with Article 11 of Regulation

S-X of the SEC, the unaudited pro forma condensed combined financial statements. The unaudited pro forma condensed combined financial

statements do not purport to be indicative of the combined company’s financial position or results of operations of the combined

company that would have occurred if the Pro Forma Transactions had been completed on the dates indicated, nor are they indicative of the

combined company’s financial position or results of operations that may be expected for any future period or date. In addition,

future results may vary significantly from those reflected in the unaudited pro forma condensed combined financial statements due to factors

discussed in the “Supplemental Risk Factors” in Exhibit 99.4 to the November 27 Form 8-K.

Note 2 – Significant Accounting Policies

The accounting policies used in the preparation of these unaudited

pro forma condensed combined financial statements are those set out in Realty Income’s audited consolidated financial statements

as of and for the year ended December 31, 2022, and Realty Income’s unaudited consolidated financial statements as of and for

the nine months ended September 30, 2023. During the preparation of this unaudited pro forma condensed combined financial information,

management performed a preliminary analysis of Spirit’s financial information to identify differences in accounting policies as

compared to those of Realty Income. With the information currently available, Realty Income’s management has determined that there

were no significant accounting policy differences between Realty Income and Spirit and, therefore, no adjustments were made to conform

Spirit’s financial statements to the accounting policies used by Realty Income in the preparation of the unaudited pro forma condensed

combined financial statements. This conclusion is subject to change as further assessment will be performed and finalized for purchase

accounting.

As part of the application of ASC 805, Realty Income will continue

to conduct a more detailed review of Spirit’s accounting policies in an effort to determine if differences in accounting policies

require further reclassification or adjustment of Spirit’s results of operations or reclassification or adjustment of assets or

liabilities to conform to Realty Income’s accounting policies and classifications. Therefore, Realty Income may identify additional

differences between the accounting policies of the two companies that, when conformed, could have a material impact on the unaudited pro

forma condensed combined financial information.

Note 3 – Reclassification Adjustments

Spirit’s

historical financial statement line items include the reclassification of certain historical balances to conform to the post-combination

Realty Income presentation of these unaudited pro forma condensed combined financial statements, as described below. These reclassifications

have no effect on previously reported total assets, total liabilities, stockholders’ equity or net income available to common stockholders

of Spirit.

Balance Sheet

| · | The components of Spirit’s September 30, 2023 Land and improvements on Spirit’s consolidated

balance sheet have been reclassified to Realty Income’s (i) Land and (ii) Building and improvements, as follows (in thousands): |

| | |

September 30, 2023 | |

| Land and improvements: | |

$ | 2,742,072 | |

| Land (as presented) | |

| 1,808,364 | |

| Building and improvements | |

| 933,708 | |

| · | Spirit’s September 30, 2023 balance of $1.4 billion previously classified as Accumulated depreciation

on Spirit's consolidated balance sheet, has been reclassified to Realty Income’s Accumulated depreciation and amortization. |

| · | Spirit’s September 30, 2023 balance of $61.5 million previously classified as Real estate assets

held for sale, net on Spirit’s consolidated balance sheet, has been reclassified to Realty Income’s Real estate and lease

intangibles held for sale, net. |

| · | Spirit’s September 30, 2023 balances for the accounts previously classified as Loan receivables,

net, components of Deferred costs and other assets, net (as shown in table below) and Real estate assets under direct financing leases,

net have been reclassified to Realty Income’s Other assets, net, as follows (in thousands): |

| | |

September 30, 2023 | |

| Loans receivable, net | |

$ | 52,949 | |

| Portion of deferred costs and other assets, net | |

| 110,975 | |

| Real estate assets under direct financing leases, net | |

| 7,404 | |

| Other assets, net (as presented) | |

$ | 171,328 | |

| · | $199.8 million of Spirit’s September 30, 2023 receivables and straight-line rent previously

classified by Spirit as Deferred costs and other assets, net have been reclassified from Deferred costs and other assets, net to Realty

Income’s Account receivable, net. |

| · | Spirit’s September 30, 2023 balance of $2.7 billion previously classified as Senior unsecured

notes, net on Spirit’s consolidated balance sheet, has been reclassified to Realty Income’s Notes payable, net. |

| · | The components of Spirit’s September 30, 2023 Accounts payable, accrued expenses and other

liabilities on Spirit’s consolidated balance sheet, have been reclassified to Realty Income’s (i) Distributions payable,

(ii) Accounts payable and accrued expenses, and (iii) Other liabilities, as follows (in thousands): |

| | |

September 30, 2023 | |

| Accounts payable, accrued expenses and other liabilities: | |

$ | 230,353 | |

| Distributions payable (as presented) | |

| 99,571 | |

| Accounts payable and accrued expenses (as presented) | |

| 69,045 | |

| Other liabilities (as presented) | |

| 61,737 | |

| · | Spirit’s September 30, 2023 balance of $3.0 billion previously classified as Accumulated deficit

has been reclassified to Realty Income’s Distributions in excess of net income. |

| · | Spirit’s September 30, 2023 balances previously classified as Common stock and Capital in excess

of common stock par value have been reclassified to Realty Income’s Common stock and paid-in capital, as follows (in thousands): |

| | |

September 30, 2023 | |

| Common stock | |

$ | 7,067 | |

| Capital in excess of common stock par value | |

| 7,300,728 | |

| Common stock and paid-in capital (as presented) | |

$ | 7,307,795 | |

Income Statement

| · | Spirit’s balances for Interest income on loans receivable, Earned income from direct financing leases and Other operating income

previously classified as separate components of Spirit’s Revenues, have been reclassified to Realty Income’s Other revenue,

as follows (in thousands): |

| | |

For the nine months ended

September 30, 2023 | | |

For the year ended

December 31, 2022 | |

| Interest income on loans receivable | |

$ | 3,919 | | |

$ | 1,884 | |

| Earned income from direct financing leases | |

| 393 | | |

| 525 | |

| Other operating income | |

| 4,888 | | |

| 4,191 | |

| Other revenue (as presented) | |

$ | 9,200 | | |

$ | 6,600 | |

| · | Spirit’s balances of Deal pursuit costs of $1.2 million and $4.7 million for the nine months ended

September 30, 2023, and year ended December 31, 2022, respectively, have been reclassified to Realty Income’s General

and administrative. |

| · | Spirit’s balances for Gain on disposition of assets of $66.5 million and $110.9 million for the

nine months ended September 30, 2023, and year ended December 31, 2022, respectively, have been reclassified to Realty Income’s

Gain on sales of real estate. |

Note

4 – Preliminary Purchase Price Allocation and Pro Forma Transactions Adjustments

Estimated Preliminary

Purchase Price

The

unaudited pro forma condensed combined financial statements reflect the preliminary allocation of the purchase consideration to Spirit’s

identifiable net assets acquired. The preliminary allocation of purchase consideration in these unaudited pro forma condensed combined

financial statements is based upon an estimated preliminary purchase price of approximately $6.2 billion. The calculation of the estimated

preliminary-purchase price related to the Merger is as follows (in thousands, except share and per share data):

| | |

Amount | |

| Shares of Spirit’s common stock exchanged (a) | |

| 140,851,483 | |

| Exchange Ratio | |

| 0.762 | |

| Shares of Realty Income common stock issued | |

| 107,328,830 | |

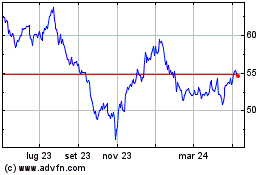

| Opening price of Realty Income common stock on January 23, 2024 | |

$ | 55.80 | |

| Fair value of Realty Income common stock issued to the former holders of Spirit common stock | |

$ | 5,988,949 | |

| Shares of Realty Income Series A preferred stock issued in exchange for Spirit Series A preferred stock (b) | |

| 6,900,000 | |

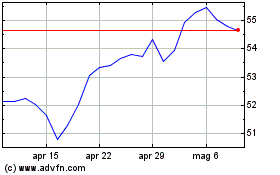

| Opening price of Realty Income Series A preferred stock on January 23, 2024 (b) | |

$ | 24.26 | |

| Fair value of Realty Income Series A preferred stock issued to the former holders of Spirit Series A preferred stock | |

$ | 167,394 | |

| Estimated fair value of Spirit’s Performance Share Awards attributable to pre-combination services (c) | |

$ | 28,197 | |

| Cash payment for accrued and unpaid dividend equivalents to Spirit Performance Share Awards holders settled by Realty Income (d) | |

$ | 6,338 | |

| Less: estimated fair value of Spirit Restricted Stock Awards attributable to post-combination costs (e) | |

$ | (5,560 | ) |

| Total estimated preliminary purchase price | |

$ | 6,185,318 | |

| a) | Includes 140,851,483 shares of Spirit common stock outstanding as of September 30, 2023, inclusive

of 206,817 unvested Restricted Stock Awards which were converted into Realty Income common stock at the Effective Time. The portion of

the converted unvested Restricted Stock Awards related to post-combination expense is removed in footnote (e) below. Under the Merger

Agreement, these shares and units were converted to Realty Income common stock at an Exchange Ratio of 0.762 per share of Spirit’s

common stock. |

| b) | Includes 6,900,000 shares of Spirit Series A preferred stock outstanding as of September 30,

2023. Under the Merger Agreement, these shares were converted to the newly issued Realty Income Series A preferred stock at an exchange

ratio of 1.0 per share of Spirit Series A preferred stock at the Effective Time. |

| c) | Represents the estimated fair value of fully vested Spirit Performance Share Awards that were converted into Realty Income common

stock at the Merger Effective Time that are attributable to pre-combination services. |

| d) | Represents the amount of -accrued and unpaid cash dividend equivalents corresponding to each Spirit Performance Share Award that were

settled by Realty income in cash. |

| e) | Represents the estimated fair value of Spirit Restricted Stock Awards that were accelerated and converted into Realty Income common

stock upon the Effective Time, reflecting the value attributable to post-combination services. |

Preliminary Purchase

Price Allocation

The

preliminary purchase price allocation to assets acquired and liabilities assumed is provided throughout these notes to the unaudited pro

forma condensed combined financial statements. The following table provides a summary of the preliminary purchase price allocation by

major categories of assets acquired and liabilities assumed based on Realty Income management’s preliminary estimate of their respective

fair values as of September 30, 2023 (in thousands):

| | |

Amount | |

| Total estimated preliminary purchase price | |

$ | 6,185,318 | |

| Assets: | |

| | |

| Real estate held for investment | |

$ | 7,134,406 | |

| Real estate and lease intangibles held for sale | |

| 80,054 | |

| Lease intangible assets | |

| 1,747,807 | |

| Cash and cash equivalents (a) | |

| 239,531 | |

| Accounts receivable | |

| 14,581 | |

| Other assets | |

| 139,885 | |

| Total assets acquired | |

$ | 9,356,264 | |

| | |

| | |

| Liabilities: | |

| | |

| Accounts payable and accrued expenses (b) | |

$ | 132,738 | |

| Lease intangible liabilities | |

| 142,324 | |

| Other liabilities | |

| 61,737 | |

| Term loan | |

| 1,300,000 | |

| Mortgages payable | |

| - | |

| Notes payable | |

| 2,481,486 | |

| Total liabilities assumed | |

$ | 4,118,285 | |

| Estimated preliminary fair value of net assets acquired | |

$ | 5,237,979 | |

| Goodwill | |

$ | 947,339 | |

| a) | This balance does not include $6.3 million of the Pro Forma Transactions Adjustments related to Realty

Income’s cash payment for accrued and unpaid dividend equivalents to Performance Share Award holders, that is included in the Total

estimated preliminary purchase price. The balance also does not include the Pro Forma Transactions Adjustment related to the settlement

of $63.7 million of Spirit’s estimated transaction-related costs following the Effective Time and the severance payment of $17.4

million in connection with employment arrangements with certain executive officers and employees of Spirit which were settled by Spirit

in cash before the Effective Time. |

| b) | This balance includes $63.7

million of estimated transaction-related costs incurred by Spirit which have not yet been reflected in the historical consolidated financial

statements of Spirit and were settled by Realty Income following the Effective Time. |

The preliminary fair values of

identifiable assets acquired, and liabilities assumed are based on an estimated valuation as of an assumed date upon which the

Effective Time occurred that was prepared by Realty Income with the assistance of a third-party valuation advisor. For the

preliminary estimate of fair values of assets acquired and liabilities assumed of Spirit, Realty Income performed a preliminary

valuation by utilizing market participant assumptions. The allocation is dependent upon certain valuation and other studies that

have not yet been finalized. Accordingly, the pro forma preliminary purchase price allocation is subject to further adjustment as

additional information becomes available and as additional analyses and final valuations are completed, and such differences could

be material.

In determining the estimated fair value of

Spirit’s assets and liabilities, Realty Income utilized customary methods, including the income, market, and cost approaches. For

commercial properties reliance is placed on the income approach. For certain specialized retail properties, the cost approach is relied

upon. Real estate components include land, building improvements, site improvements, leases in place, above-market and below-market leases,

and the avoided lease origination costs. These components were valued individually by utilizing one or more of the three approaches to

value. Construction in progress is valued using cost as a primary indicator of fair value. The Notes payable and Term loan were valued

based on available market data. Loans receivables were valued using market based yields for loans with a similar credit ratings and weighted

average life. The CECL provision associated with each individual loan was calculated based on an estimated lifetime probability of default

and loss given default. The fair values of interest rate swaps are determined using the market standard methodology of netting the

discounted future fixed cash receipts (or payments) and the discounted expected variable cash payments (or receipts). The variable cash

payments (or receipts) are based on an expectation of future interest rates (forward curves) derived from observable market interest rate

curves.

The purchase price allocation presented above

is preliminary and it has not been finalized. The final determination of the allocation of the purchase price will be completed no later

than twelve months following the Effective Time. These final fair values will be determined based on Realty Income’s management’s

judgment, which is based on various factors, including (1) market conditions, (2) the industry in which the client operates,

(3) the characteristics of the real estate (i.e., location, size, demographics, value and comparative rental rates), (4) the

client credit profile, (5) store profitability metrics and the importance of the location of the real estate to the operations of

the client’s business, and/or (6) real estate valuations. The final determination of these estimated fair values, the assets’

useful lives and the depreciation and amortization methods are dependent upon certain valuations and other analyses that have not yet

been completed, and as previously stated could differ materially from the amounts presented in the unaudited pro forma condensed combined

financial statements. The final determination will be completed as soon as practicable but no later than one year after the consummation

of the Merger. Any increase or decrease in the fair value of the net assets acquired, as compared to the information shown herein, could

change the portion of the purchase consideration allocable to goodwill and could impact the operating results of the combined company

following the Merger due to differences in the allocation of the purchase consideration, as well as changes in the depreciation and amortization

related to some of the acquired assets.

Balance Sheet

The

pro forma adjustments reflect the effect of the Pro Forma Transactions on Realty Income’s and Spirit’s historical consolidated

balance sheets as if the Pro Forma Transactions occurred on September 30, 2023.

Assets

| 1) | The pro forma adjustments for Land and Buildings and improvements reflect: (i) the elimination of

Spirit's historical carrying values of $1.8 billion for Land and $7.0 billion for Buildings and improvements, and (ii) the recognition

of the fair value of these assets of $1.9 billion for Land and $5.3 billion for Buildings and improvements, based upon the preliminary

valuation of the tangible real estate assets acquired. For information regarding the valuation methodology applied to the tangible real

estate assets, refer to the Preliminary Purchase Price Allocation section of Note 4. The pro forma adjustments are presented as follows

(in thousands): |

| | |

Estimated fair

value | | |

Less: Elimination

of historical gross

carrying value | | |

Total pro forma

adjustment | |

| Land | |

$ | 1,863,453 | | |

$ | (1,808,364 | ) | |

$ | 55,089 | |

| Buildings and improvements | |

| 5,270,953 | | |

| (7,015,086 | ) | |

| (1,744,133 | ) |

| 2) | Accumulated depreciation and amortization were adjusted to eliminate Spirit’s historical accumulated

depreciation balance of $1.4 billion. |

| 3) | Spirit's Real estate and lease intangibles held for sale, net was adjusted to remove the historical carrying

value of $61.5 million, and reflect its assets at fair value, less estimated selling expenses, on those assets, totaling $80.1 million.

The fair value was determined based on the contractual sale prices from executed sale agreements. |

| 4) | Pro forma adjustment to Cash and cash equivalents and Distributions Payable includes a $101.0 million

payment of dividends declared, but not paid, as of the Effective Date to Spirit's common stock, Restricted Stock Award, and Performance

Stock Award holders. The Cash and cash equivalents line also includes (i) a settlement of Spirit’s estimated transaction-related

costs of $63.7 million, (ii) a new draw down on Spirit’s term loan of $200.0 million, (iii) debt issuance costs of $7.3

million, $2.9 million of which is assumed to be immediately expensed as third party fees in connection with the assumed debt that was

exchanged and $4.4 million of which are capitalized as fees paid to lenders in a debt modification, and (iv) of $17.4 million related

to certain severance payments in connection with certain executive officers and employees of Spirit in accordance with the terms of their

employment agreements. |

| 5) | Accounts receivable, net was adjusted to eliminate Spirit’s historical straight-line rent receivable,

net, of $185.2 million, which is not treated as a separately recognized asset on the combined company’s balance sheet. |

| 6) | The pro forma adjustments for Lease intangible assets, net reflect: (i) the elimination of Spirit’s

historical carrying values for these assets, net of the associated accumulated amortization, of $389.1 million and (ii) the recognition

of the fair value of these assets of $1.7 billion, based upon the preliminary valuation of the intangible real estate assets acquired.

For information regarding the valuation methodology applied to the lease intangible assets, refer to the Preliminary Purchase Price Allocation

section of Note 4. The following table summarizes the major classes of lease intangible assets acquired and the total pro forma adjustment

to Lease intangible assets, net (in thousands): |

| | |

Amount | |

| Preliminary allocation of fair value: | |

| | |

| In-place leases | |

$ | 1,137,278 | |

| Leasing commissions, legal and marketing costs | |

| 386,953 | |

| Above-market lease assets | |

| 223,576 | |

| Less: Elimination of historical carrying value of lease intangible assets, net | |

| (389,100 | ) |

| Total pro forma adjustment | |

$ | 1,358,707 | |

| 7) | The pro forma adjustments for Goodwill reflect: (i) the elimination of Spirit’s historical

goodwill balance of $225.6 million, and (ii) the recognition of the preliminary goodwill balance associated with the Merger of $947.3

million based on the preliminary purchase price allocation. For additional information, refer to the Preliminary Purchase Price Allocation

section of Note 4. |

| 8) | Other assets, net was adjusted to reflect (i) the elimination of Spirit’s deferred financing

costs, net and capitalized lease transaction costs, (ii) the elimination of Spirit’s historical carrying value for Loans receivable,

net, (iii) the settlement of Spirit's non-cash related transaction costs, (iv) the recognition of the ground leases right of

use assets, (v) the recognition of the fair value of purchased with credit deterioration (“PCD”) loans and Non-PCD loans,

respectively, and (vi) the fair value adjustment to mark-to-market the interest rate swaps currently held, including the interest

rate swaps entered concurrently with new draw term loan. |

The following

table summarizes the pro forma adjustments to Other assets, net (in thousands):

| | |

Amount | |

| Elimination of Spirit's deferred financing costs, net and capitalized lease transaction costs | |

$ | (9,179 | ) |

| Elimination Spirit's historical carrying value for Loans receivable, net | |

| (52,949 | ) |

| Elimination of certain non-cash assets associated with Spirit's transaction costs | |

| (227 | ) |

| Recognition of the fair value of ground leases | |

| 2,625 | |

| Fair Value of Non-PCD loans and allowance for loan losses | |

| 40,617 | |

| Fair Value of PCD loans, net of allowance for loan losses | |

| 6,984 | |

| Fair value adjustment to interest rate swaps | |

| (20,495 | ) |

| Total pro forma adjustment | |

$ | (32,624 | ) |

Liabilities

| 9) | The pro forma adjustment for Accounts payable and accrued expenses represents: (i) $40.2 million

of estimated transaction-related costs to be incurred by Realty Income which have not yet been reflected in the historical consolidated

financial statements of Realty Income. This line item also contains an accrual of $63.7 million of the estimated transaction-related costs

to be incurred by Spirit which have not yet been reflected in the historical consolidated financial statements, as well as the assumed

settlement of this amount. See Note 4 for additional details. |

| 10) | The pro forma adjustments for Lease intangible liabilities, net reflect: (i) the elimination of Spirit’s

historical carrying values for the intangible lease liabilities, net of the associated accumulated amortization, of $106.8 million, and

(ii) the recognition of the fair value of these intangible liabilities of $142.3 million, based upon the preliminary valuation of

the intangible lease liabilities assumed. For information regarding the valuation methodology applied to the lease intangible liabilities,

refer to the Preliminary Purchase Price Allocation section of Note 4. |

| 11) | In connection with the Merger, Realty Income assumed $4.1 billion of total historical cost debt

outstanding as of September 30, 2023 with a weighted average interest rate of 5.8% and weighted average remaining term of 4.3

years. The pro forma adjustments for Term loan, net, Mortgages payable, net and Notes payable, net reflect: (i) the elimination

of Spirit's historical carrying values of the Term loan, net, Mortgages payable, net and Notes payables, net including the

associated unamortized deferred financing costs and net discounts, of $1.1 billion, $4.5 million and $2.7 billion for the Term loan,

net, Mortgages payable, net and Notes payable, net respectively, (ii) the recognition of the fair value of $1.1 billion and

$2.5 billion for the Term loan, net and Notes payable, net respectively, based upon the valuation of these liabilities,

(iii) the recognition of the fair value of $0.2 billion the Term loan, net (new draw) entered prior the Merger and

(iv) capitalized debt issuance costs of $4.4 million associated with the exchange. The fair value of Term loan, net and Notes

payable, net is derived either based on (i) market quotes for identical or similar instruments in markets or

(ii) discounted cash flow analyses using estimates of the amount and timing of future cash flows, market rates and credit

spreads. The following table summarizes the pro forma adjustments to the Term loan, Mortgages payable, net and Notes payable, net

(in thousands): |

| | |

Term loan, net | | |

Mortgages payable, net | | |

Notes payable, net | |

| Elimination of historical carrying value of the remaining debt instruments, including unamortized deferred financing costs and net discounts | |

$ | (1,090,198 | ) | |

$ | (4,545 | ) | |

$ | (2,725,505 | ) |

| Estimated pro forma fair value of liabilities assumed in the Merger | |

| 1,100,000 | | |

| - | | |

| 2,481,486 | |

| Estimated pro forma fair value of additional draw on the term loan (new draw) entered prior to the Merger | |

| 200,000 | | |

| - | | |

| - | |

| Capitalized debt issuance costs incurred in conjunction with the exchange of the notes | |

| (1,635 | ) | |

| | | |

| (2,722 | ) |

| Total pro forma adjustment | |

$ | 208,167 | | |

$ | (4,545 | ) | |

$ | (246,741 | ) |

Equity

| 12) | The following table summarizes the pro forma adjustments for equity (in thousands): |

| | |

Preferred stock

and paid-in

capital | | |

Common stock

and paid-in capital | | |

Distributions in

excess of net

income | | |

Accumulated

other

comprehensive

loss | |

| Issuance of Realty Income common stock (a) | |

$ | - | | |

$ | 6,011,586 | | |

$ | - | | |

$ | - | |

| Issuance of Realty Income Series A preferred stock (b) | |

| 167,394 | | |

| - | | |

| - | | |

| - | |

| Settlement of Spirit’s equity-based awards (c) | |

| - | | |

| 32,004 | | |

| (32,004 | ) | |

| - | |

| Spirit transaction-related costs (d) | |

| - | | |

| - | | |

| (63,920 | ) | |

| - | |

| Elimination of Spirit’s historical equity balances (e) | |

| (166,177 | ) | |

| (7,307,795 | ) | |

| 3,100,395 | | |

| (55,296 | ) |

| Realty Income transaction- related costs (f) | |

| - | | |

| - | | |

| (40,225 | ) | |

| - | |

| Debt issuance costs (g) | |

| - | | |

| - | | |

| (2,944 | ) | |

| - | |

| Provision for loan losses for Non-PCD loans (h) | |

| - | | |

| - | | |

| (1,181 | ) | |

| - | |

| Spirit severance payment (i) | |

| - | | |

| - | | |

| (17,421 | ) | |

| - | |

| Total pro forma adjustment | |

$ | 1,217 | | |

$ | (1,264,205 | ) | |

$ | 2,942,700 | | |

$ | (55,296 | ) |

| a) | The pro forma adjustment represents the issuance of Realty Income common stock as consideration for the

Merger, as described in the Estimated Preliminary Purchase Price section of Note 4. The fair value of Realty Income common stock issued

to former holders of Spirit’s common stock is based on the adjusted per share opening price of Realty Income common stock of $55.80

on January 23, 2024. |

| b) | The pro forma adjustment represents the issuance of Realty Income Series A preferred stock as consideration

for the Merger, as described in the Estimated Preliminary Purchase Price section of Note 4. The fair value of Realty Income Series A

preferred stock issued to former holders of Spirit Series A preferred stock is based on the fair value of Spirit Series A preferred

stock, which is based on the opening price of Realty Income Series A preferred stock of $24.26 on January 23, 2024. |

| c) | Represents the estimated fair value of fully vested Spirit Restricted Stock Awards and Spirit Performance

Share Award units of $32.0 million which were converted into Realty Income common stock upon the Effective Time. The vesting of these

awards was discretionarily accelerated and they were converted into Realty Income common stock upon the Effective Time, reflecting the

value attributable to the post-combination services. |

| d) | The pro forma adjustment to distributions in excess of net income includes $63.9 million of estimated

transaction-related costs to be incurred by Spirit which have not yet been reflected in the historical consolidated financial statements

of Spirit and which was settled by Realty Income following the Effective Time. |

| e) | The pro forma adjustment represents the elimination of Spirit’s historical equity balances and the

$63.9 million of estimated transaction-related costs to be incurred by Spirit which have not yet been reflected in the historical consolidated

financial statements of Spirit. Refer to note (d) above. |

| f) | The pro forma adjustment to distributions in excess of net income includes $40.2 million of estimated

transaction costs to be incurred by Realty Income as a result of the Merger, which have not yet been reflected in Realty Income's historical

consolidated financial statements. |

| g) | The pro forma adjustment to distributions in excess of net income represents a pro forma adjustment of

debt exchange costs of $2.9 million, which represents fees paid to third parties assumed to be immediately expensed in connection with

the assumed and then exchanged debt as the debt is deemed to be modified. |

| h) | The pro forma adjustment to distributions in excess of net income includes an adjustment for the Current

Expected Credit Losses (CECL) allowance for credit losses of $1.2 million for Non-PCD loans. The pro forma statements of operations does

not include this one-time provision expense. |

| i) | To reflect post-combination expense of $17.4 million related to certain severance payments in

connection with certain executive officers and employees of Spirit in accordance with the terms of their employment agreements. |

Statements of Operations

The

pro forma adjustments reflect the effect of the Pro Forma Transactions on Realty Income’s and Spirit’s historical consolidated

statements of operations as if the Pro Forma Transactions occurred on January 1, 2022.

Revenues

| 13) | Rental (including reimbursable) |

The historical

rental revenues for Realty Income and Spirit represent contractual and straight-line rents and amortization of above-market and below-market

lease intangibles associated with the leases in effect during the periods presented. The adjustments included in the unaudited pro forma

condensed combined statements of operations are presented to: (i) eliminate the historical straight-line rents and amortization of

above-market and below-market lease intangibles for the real estate properties of Spirit acquired as part of the Merger, and (ii) adjust

contractual rental property revenue for the acquired properties to a straight-line basis and amortize above-market and below-market lease

intangibles recognized as a result of the Merger.

The pro forma

adjustment for the amortization of above-market and below-market lease intangibles recognized as a result of the Merger was estimated

based on a straight-line methodology and the estimated remaining weighted average contractual, in-place lease term of 10.2 years. The

lease intangible asset and liability fair values and estimated amortization expense may differ materially from the preliminary determination

within these unaudited pro forma condensed combined financial statements. The pro forma adjustments to rental revenues do not purport

to be indicative of the expected change in rental revenues of the combined company in any future periods.

The following

table summarizes the adjustments made to rental revenues for the nine months ended September 30, 2023, and year ended December 31,

2022 (in thousands):

| | |

Elimination of

historical

amounts | | |

Recognition of

post-combination

amounts(a) | | |

Total pro forma

adjustment | |

| For the nine months ended September 30, 2023 | |

| | | |

| | | |

| | |

| Straight-line rent, net | |

$ | (26,127 | ) | |

$ | 35,555 | | |

$ | 9,428 | |

| Amortization of above-market and below-market lease intangibles and deferred lease incentives, net | |

| (767 | ) | |

| (5,976 | ) | |

| (6,743 | ) |

| Total pro forma adjustment | |

$ | (26,894 | ) | |

$ | 29,579 | | |

$ | 2,685 | |

| | |

| | | |

| | | |

| | |

| For the year ended December 31, 2022 | |

| | | |

| | | |

| | |

| Straight-line rent, net | |

$ | (36,902 | ) | |

$ | 55,090 | | |

$ | 18,188 | |

| Amortization of above-market and below-market lease intangibles and deferred lease incentives, net | |

| (2,190 | ) | |

| (7,968 | ) | |

| (10,158 | ) |

| Total pro forma adjustment | |

$ | (39,092 | ) | |

$ | 47,122 | | |

$ | 8,030 | |

| a) | Recognition of post-combination amounts excludes amounts related to Spirit properties that were sold between

January 1, 2022 and September 30, 2023, because such properties were not a part of the net assets acquired in the Merger. |

| 14) | The pro forma adjustment to Other Revenue of $(1.0) million and $(1.3) million for the nine months ended

September 30, 2023 and year ended December 31, 2022, respectively, reflects the impact of the Merger on the amount recognized

in Spirit's historical consolidated statements of operations for the periods presented from the amortization of the fair value adjustment

on Spirit's Loans Receivables assumed. |

Expenses

| 15) | The adjustments included in the unaudited pro forma condensed combined statements of operations are presented

to: (i) eliminate the historical depreciation and amortization of real estate properties of Spirit acquired as part of the Merger,

and (ii) to recognize additional depreciation and amortization expense associated with the fair value of acquired real estate tangible

and intangible assets. |

The pro forma

adjustment for the depreciation and amortization of acquired assets is calculated using a straight-line methodology and is based on estimated

useful lives for building and site improvements, the remaining contractual, in-place lease term for intangible lease assets, and the lesser

of the estimated useful life and the remaining contractual, in-place lease term for tenant improvements. The useful life of a particular

building depends upon a number of factors including the condition of the building upon acquisition. For purposes of the unaudited pro

forma condensed combined statements of operations, the weighted average useful life for buildings and site improvements is 29.3 years;

the weighted average useful life for tenant improvements is 10.2 years; and the weighted average remaining contractual, in-place lease

term is 10.2 years. The fair value of acquired real estate tangible and intangible assets, estimated useful lives of such assets, and

estimated depreciation and amortization expense may differ materially from the preliminary determination within these unaudited pro forma

condensed combined financial statements. The pro forma adjustments to depreciation and amortization expense are not necessarily indicative

of the expected change in depreciation and amortization expense of the combined company in any future periods.

The following

table summarizes adjustments made to depreciation and amortization expense by asset category for Spirit’s real estate properties

acquired as part of the Merger for the nine months ended September 30, 2023, and year ended December 31, 2022 (in thousands):

| | |

For the nine months

ended September 30, 2023 | | |

For the year ended

December 31, 2022 | |

| Buildings and improvements (a) | |

$ | 132,231 | | |

$ | 176,308 | |

| Tenant improvements (a) | |

| 23,525 | | |

| 31,366 | |

| In-place leases and leasing commissions and marketing costs (a) | |

| 112,113 | | |

| 149,484 | |

| Less: Elimination of historical depreciation and amortization | |

| (236,527 | ) | |

| (292,985 | ) |

| Total pro forma adjustment | |

$ | 31,342 | | |

$ | 64,173 | |

| a) | Recognition of post-combination amounts excludes amounts related to Spirit properties that were sold between

January 1, 2022 and September 30, 2023, because such properties were not a part of the net assets acquired in the Merger. |

| 16) | The pro forma adjustments to interest expense reflect the impact of the Merger on the amounts recognized

in Spirit’s historical consolidated statements of operations for the periods presented from: (i) the elimination of historical

interest expense including deferred financing cost amortization, historical amortization on net premiums/discounts, and historical interest

expense on the revolver, term loan, mortgages payable, and notes payable, (ii) the recognition of interest expense of assumed existing

term loan and notes payable inclusive of the amortization of fair value adjustment and the interest expense on the additional draw on

term loan (new draw), which has a term of approximately 17 months, and (iii) the amortization of the fair value adjustment on Spirit’s

interest swap assets assumed in the Merger.. The following table summarizes the pro forma adjustments to interest expense for the nine

months ended September 30, 2023, and year ended December 31, 2022 (in thousands): |

| | |

For the nine months

ended September 30, 2023 | | |

For the year ended

December 31, 2022 | |

| Elimination of historical interest expense on the revolver, term loan, mortgages payable and notes payable | |

$ | (102,887 | ) | |

$ | (114,815 | ) |

| Recognition of interest expense of assumed existing and new draw term loan and notes payable inclusive of the amortization of any fair value adjustment | |

| 150,553 | | |

| 220,601 | |

| Amortization of the fair value adjustment on swap assets | |

$ | 11,845 | | |

| 15,794 | |

| Total pro forma adjustment | |

$ | 59,511 | | |

$ | 121,580 | |

The pro forma

adjustments for the amortization of the fair value adjustment on Spirit’s interest rate swaps, term loan, and notes payable assumed

in the Merger were estimated based on effective interest rate approach and the weighted average remaining contractual term of 2.7 years

for the interest rate swaps, remaining contractual term of 2.3 years for term loan and 5.4 years for notes payable. The fair value adjustment

on Spirit’s interest rate swaps, term loan and notes payable and estimated amortization expense may differ materially from the preliminary

determination within these unaudited pro forma condensed combined financial statements. The pro forma adjustments to interest expense

do not purport to be indicative of the expected change in interest expense of the combined company in any future periods.

| 17) | Represents an adjustment to increase ground leases rent expense by $0.1 million for the nine months ended

September 30, 2023, and $0.1 million for the year ended December 31, 2022 as a result of the revaluation of operating lease

right-of-use assets and recognition of the above-market and below-market ground lease intangible assets. The adjustment is computed based

on a straight-line approach and using a weighted average remaining lease term of 8.0 years. The fair value adjustment on Spirit’s

ground leases may differ materially from the preliminary determination within these unaudited pro forma condensed combined financial statements.

The pro forma adjustments to property (including reimbursable) expense do not purport to be indicative of the expected change in ground

rent expense of the combined company in any future periods. |

| 18) | Represents the adjustment to Merger and integration-related costs of $92.5 million for the year ended

December 31, 2022 to recognize (i) additional post-combination compensation expense of $ 32.0 million associated with the fair

value of Realty Income common stock issued to the holders of Spirit’s restricted stock awards and performance stock awards. The

pro forma adjustments to Merger and integration-related costs do not purport to be indicative of the expected change in compensation expense

of the combined company in any future periods, (ii) estimated transaction-related costs of $40.2 million that are not currently reflected

in the historical consolidated financial statements of Realty Income. These estimated transaction-related costs consist primarily of transfer

taxes, advisor, legal, and accounting fees. It is assumed that these costs will not affect the combined statements of operations beyond

twelve months after the closing date of the Merger, (iii) post-combination expenses of $17.4 million related to severance payments

in connection with the certain executive officers and employees of Spirit in accordance with the terms of their employment agreements

with Spirit and (iv) debt exchange costs of $2.9 million assumed to be immediately expensed in connection with the assumed debt which

was immediately exchanged. |

Note 5

– Pro Forma Net Income Available to Common Stockholders per Common Share

The following table summarizes

the unaudited pro forma net income from continuing operations per common share for the nine months ended September 30, 2023, and

the year ended December 31, 2022, as if the Pro Forma Transactions occurred on January 1, 2022 (in thousands, except per share

data):

| | |

For the nine months ended

September 30, 2023 | | |

For the year ended

December 31, 2022 | |

| Numerator | |

| | | |

| | |

| Pro forma net income available to common stockholders | |

$ | 747,676 | | |

$ | 875,476 | |

| Denominator | |

| | | |

| | |

| Realty Income historical weighted average common shares outstanding | |

| 681,419 | | |

| 611,766 | |