FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of November, 2023

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its

charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal

executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Banco Santander,

S.A.

TABLE OF CONTENTS

Item |

|

| |

|

| 1

|

Report of Other Relevant Information dated November 16, 2023 |

Item

1

Banco Santander,

S.A. (“Banco Santander” or the “Bank”), in compliance with

the Securities Market legislation, hereby announces the following:

OTHER RELEVANT INFORMATION

Banco

Santander announces that it has completed the placement of two series of preferred securities contingently convertible into newly issued

ordinary shares of the Bank, excluding the pre-emptive subscription rights of its shareholders, for a total nominal amount of two

billion five hundred million U.S. dollars ($ 2,500,000,000) (the

“Issue” and the “CoCos”). The total nominal amount of the Issue is divided as follows between each

of the two series:

| (i) | Series 13: with a nominal amount of one billion one hundred and fifty million U.S. dollars ($ 1,150,000,000). |

| (ii) | Series 14: with a nominal amount of one billion three hundred and fifty million U.S. dollars ($ 1,350,000,000). |

The placement of the Issue has been carried out

through an accelerated book-building targeted at professional investors and eligible counterparties only.

The CoCos are issued at par and its remuneration,

the payment of which is subject to certain conditions and to the discretion of the Bank, has been set as follows for each of the two series:

| (i) | Series 13: at 9.625% on an annual basis for the first 5 years and 6 months, which will be reviewed every

5 years thereafter, in accordance with the terms and conditions of the CoCos, by applying a margin of 530.60 basis points to the rate

resulting from the applicable 5-year UST. |

| (ii) | Series 14: at 9.625% on an annual basis for the first 10 years, which will be reviewed every 5 years thereafter,

in accordance with the terms and conditions of the CoCos, by applying a margin of 529.80 basis points to the rate resulting from the applicable

5-year UST. |

Once issued, the CoCos will be eligible as additional

tier 1 capital of Banco Santander in accordance with Regulation (EU) No. 575/2013 of the European Parliament and of the Council of 26

June 2013 on prudential requirements for credit institutions and investment firms (“CRR”). The CoCos are perpetual,

but they may be called under certain circumstances and would be converted into newly issued ordinary shares of Banco Santander if the

common equity tier 1 (CET1) ratio of the Bank or its consolidated group, calculated in accordance with CRR, were to fall below 5.125%.

As of 30 September 2023, the fully loaded consolidated CET1 ratio of the Bank was 12.3%.

The Bank will request the admission of the CoCos

to trading on the New York Stock Exchange.

The Bank also announces that, as of today, the

report of the directors of the Bank concerning the basis and rules for the conversion of the CoCos and the exclusion of pre-emptive subscription

rights, issued in accordance with articles 414.2, 417.2 and 510 of the Spanish Companies Act (Ley de Sociedades de Capital), will

be available on the Bank’s website (www.santander.com). The aforementioned report will also

be provided to the shareholders at the first general shareholders’ meeting to be held after the Issue.

Boadilla del Monte (Madrid), 16 November 2023

Banco Santander, S.A. - Domicilio Social: Paseo

de Pereda, 9-12. 39004 SANTANDER - R. M. de Santander, Hoja 286, Folio 64, Libro 5º de Sociedades, Inscripción 1ª. NIF

A-39000013

IMPORTANT INFORMATION

This other relevant information notice does not

constitute an offer to sell, or the solicitation of an offer to buy these securities, nor shall there be any sale of such securities in

any state of the United States or in any other jurisdiction in which such offer, solicitation or sale would not be permitted before registration

or qualification under the securities laws of such state or jurisdiction. This document may not be distributed, directly or indirectly,

in any jurisdiction in which said distribution is contrary to applicable laws.

No action has been made or will be taken that would

permit a public offering of any securities described herein in any jurisdiction in which action for that purpose is required. No offers,

sales, resales or delivery of any securities described herein or distribution of any offering material relating to any such securities

may be made in or from any jurisdiction except in circumstances which will result in compliance with any applicable laws and regulations

and which will not impose any obligation on the Bank or the underwriters of the Issue or any of their respective affiliates.

In connection with the Issue of the CoCos, the Bank

has filed a registration statement (including a prospectus), and a prospectus supplement with the US Securities and Exchange Commission

(the “SEC”). Before you invest, you should read the prospectus and prospectus supplement included in that registration

statement and the other documents the Bank has filed with the SEC for more complete information about the Bank and the offer of the CoCos.

You may obtain these documents for free by visiting the SEC’s web site at www.sec.gov.

This notice is an announcement and not a prospectus,

and investors should not subscribe for or purchase any securities referred to herein except on the basis of the information included in

the prospectus and the prospectus supplement and the other documents filed by the Bank with the SEC that are incorporated by reference

in the registration statement.

This notice does not constitute an offer document

or an offer of transferable securities to the public in the United Kingdom in accordance with the Financial Services and Markets Act 2000

(“FSMA”) and should not be considered as a recommendation that any person should subscribe for or purchase any of the

securities described herein. These securities will not be offered or sold to any person in the United Kingdom except in circumstances

which have not resulted and will not result in an offer to the public in the United Kingdom in contravention of the FSMA.

This notice does not constitute an offer to the

public in Italy of financial products, as defined under legislative decree no. 58 of 24 February 1998, as amended (the “Financial

Services Act”). The offering of the preferred securities has not been registered with the Commissione Nazionale per le Società

e la Borsa (“CONSOB”) pursuant to Italian securities legislation and, accordingly, the securities described herein

may not be offered, sold or delivered, nor any copies of the prospectus, the prospectus supplement or of any other document relating to

the preferred securities be distributed in Italy, except: (a) to qualified investors (investitori qualificati), as defined pursuant

to Article 2 of the Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus to be published

when securities are offered to the public or admitted to trading on a regulated market (the “Prospectus Regulation”)

and any other applicable regulation of the Financial Services Act and the Italian CONSOB Regulation (“CONSOB Regulation”);

or (b) in any other circumstances which are exempted from the rules on public offerings pursuant to Article 1 of the Prospectus Regulation,

Article 100 of the Financial Services Act, Article 34ter of the CONSOB Regulation No. 11971 of 14 May 1999, as amended from time to time,

and the applicable Italian laws.

The offer, sale or distribution of CoCos, as well

as any subsequent resale, cannot be carried out in Spain unless it complies with all legal and regulatory requirements under Spanish securities

laws or in circumstances that do not require the registration of a prospectus in Spain.

This notice is for information purposes only and

does not constitute and shall not, in any circumstances, constitute a public offering or an invitation to the public in connection with

any offer within the meaning of the Prospectus Regulation.

As set out in the CoCos’ prospectus and prospectus

supplement, there are further restrictions to offer, sale or distribute in different jurisdictions, including Canada, Hong Kong, Japan,

the People’s Republic of China, Republic of Korea, Taiwan, Singapore, Switzerland and Australia.

Restrictions on marketing and sale and resale

to retail investors

The CoCos are not intended to be offered, sold or

otherwise made available and should not be offered, sold or otherwise made available to retail clients (as defined in Directive 2014/65/EU

of the European Parliament and of the Council of 15 May 2014 on Markets in Financial Instruments and amending Directive 2002/92/EC and

Directive 2011/61/EU (MiFID II), as amended or replaced from time to time, and Regulation (EU) 2017/565 as it forms part of domestic law

by virtue of the European Union (Withdrawal) Act of 2018 (EUWA)). Prospective investors are referred to the section headed “Important

Information” of the prospectus supplement for further information.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

Banco Santander, S.A. |

| |

|

|

| |

|

|

| Date: |

November 16, 2023 |

|

By: |

/s/ Pedro de Mingo Kaminouchi |

| |

|

|

|

Name: |

Pedro de Mingo Kaminouchi |

| |

|

|

|

Title: |

Head of Regulatory Compliance |

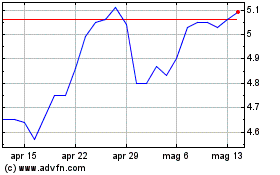

Grafico Azioni Banco Santander (NYSE:SAN)

Storico

Da Mar 2024 a Apr 2024

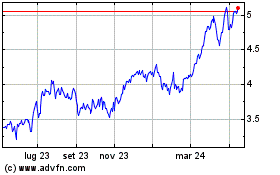

Grafico Azioni Banco Santander (NYSE:SAN)

Storico

Da Apr 2023 a Apr 2024