Santander Issues $2.5 Billion in New AT1 Bonds

17 Novembre 2023 - 10:52AM

Dow Jones News

By Miriam Mukuru

Santander said it has issued $2.5 billion in Additional Tier 1

bonds, following recent similar issuances by other European banks

including UBS Group, Societe Generale and Barclays.

AT1 bonds are risky debt created after the global financial

crisis which act as safety buffers if a bank's capital levels fall

below a certain threshold. They can be converted into equity or

written down if the bank runs into trouble.

The issuance comprises two parts, consisting of $1.15 billion in

five-year call bonds and $1.35 billion in 10-year call bonds, both

priced at 9.625%.

Market sources say the total book size was around $8 billion,

$3.25 billion for the five-year call bonds and $4.75 billion for

the 10-year call bonds.

As with other recently-issued AT1 bonds, Santander said the

bonds would be convertible into shares upon a trigger event--in

this case, the bank's common equity Tier 1 ratio falling below

5.125%.

Write to Miriam Mukuru at miriam.mukuru@wsj.com

(END) Dow Jones Newswires

November 17, 2023 04:37 ET (09:37 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

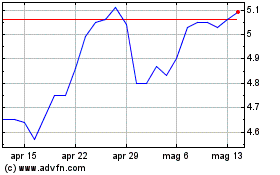

Grafico Azioni Banco Santander (NYSE:SAN)

Storico

Da Mar 2024 a Apr 2024

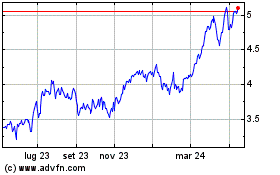

Grafico Azioni Banco Santander (NYSE:SAN)

Storico

Da Apr 2023 a Apr 2024