Fourth Quarter of Fiscal Year 2023 – Consolidated Earnings

Highlights

- Revenue of $221.8 million

- Net loss of $(47.8) million

- Adjusted EBITDA* of $(5.8) million

Fiscal Year 2024 Guidance Ranges:

- Revenue expected in a range of $1.05 billion to $1.2

billion

- Net loss expected in a range of $50 million to $22 million

- Adjusted EBITDA* expected in a range of $80 million to $105

million

Fourth Quarter Fiscal Year 2023 – Segment Highlights

Senior

- Revenue of $103.6 million

- Adjusted EBITDA* of $16.1 million

- Approved Medicare Advantage policies of 110,027

Healthcare Services

- Revenue of $82.8 million

- Adjusted EBITDA* of $1.7 million

- Approximately 49,000 SelectRx members

Life

- Revenue of $38.1 million

- Adjusted EBITDA* of $6.7 million

Auto & Home

- Revenue of $(1.3) million

- Adjusted EBITDA* of $(7.2) million

- Excluding the $10.4 million(1) change in estimate, Revenue of

$9.2 million

- Excluding the $10.4 million(1) change in estimate, Adjusted

EBITDA* of $3.2 million

SelectQuote, Inc. (NYSE: SLQT) reported consolidated revenue for

the fourth quarter of fiscal year 2023 of $221.8 million compared

to consolidated revenue for the fourth quarter of fiscal year 2022

of $139.4 million. Consolidated net loss for the fourth quarter of

fiscal year 2023 was $47.8 million compared to consolidated net

loss for the fourth quarter of fiscal year 2022 of $104.7 million.

Finally, consolidated Adjusted EBITDA* for the fourth quarter of

fiscal year 2023 was $(5.8) million compared to consolidated

Adjusted EBITDA* for the fourth quarter of fiscal year 2022 of

$(60.8) million.

Consolidated revenue for the fiscal year ended June 30, 2023,

was $1.0 billion compared to consolidated revenue for the fiscal

year ended June 30, 2022, of $764.0 million. Consolidated net loss

for the fiscal year ended June 30, 2023, was $58.5 million compared

to consolidated net loss for the fiscal year ended June 30, 2022,

of $297.5 million. Finally, consolidated Adjusted EBITDA* for the

fiscal year ended June 30, 2023, was $74.3 million compared to

consolidated Adjusted EBITDA* of $(260.5) million for the fiscal

year ended June 30, 2022.

*See “Non-GAAP Financial Measures” below. 1) $10.4 million

change in estimate related to the mutual termination of a contract

with a certain Auto & Home carrier to provide for the ability

to migrate the book of business to other carriers.

SelectQuote Chief Executive Officer, Tim Danker, remarked,

“SelectQuote completed a highly successful fiscal 2023 with another

strong quarter of results across each of our businesses. In total,

our full year results significantly surpassed our initial forecasts

driven by both higher growth, but most importantly, with

outstanding operational execution against our paramount goal to

optimize profitability and cash flow. The most stark example is

nearly $80 million of outperformance in full-year Adjusted EBITDA

versus our initial guidance. Similarly, excluding our investment in

the growth of SelectRx, the SelectQuote model would have produced

positive operating cash flow for the year, which we plan to scale

in the quarters and years ahead.”

Mr. Danker continued, “Looking toward the future, our teams are

excited to leverage our strategic redesign across each of our

businesses, and we believe there is significant opportunity in our

Healthcare Services segment. We can, and will, reproduce the

success we have achieved in SelectRx with additional value-add

services needed by seniors, healthcare providers, and our insurance

carrier partners. We believe strongly that SelectQuote is unique in

our ability to provide and optimize these services given the

information and the leverage we can create via our role as the

connective tissue between those in need and the providers of care

and coverage. To say it more directly, SelectQuote is not just a

Medicare Advantage distribution company, and we plan to decisively

demonstrate that through our results in the coming years.”

Segment Results

We currently report on four segments: 1) Senior, 2) Healthcare

Services, 3) Life, and 4) Auto & Home. The performance measures

of the segments include total revenue and Adjusted EBITDA.* Costs

of revenue, cost of goods sold-pharmacy revenue, marketing and

advertising, selling, general, and administrative, and technical

development operating expenses that are directly attributable to a

segment are reported within the applicable segment. Indirect costs

of revenue, marketing and advertising, selling, general, and

administrative, and technical development operating expenses are

allocated to each segment based on varying metrics such as

headcount. Adjusted EBITDA is calculated as total revenue for the

applicable segment less direct and allocated costs of revenue, cost

of goods sold, marketing and advertising, technical development,

and selling, general, and administrative operating costs and

expenses, excluding depreciation and amortization expense; gain or

loss on disposal of property, equipment, and software; share-based

compensation expense; and non-recurring expenses such as severance

payments and transaction costs. Adjusted EBITDA Margin is

calculated as Adjusted EBITDA divided by revenue.

Senior

Financial Results

The following table provides the financial results for the

Senior segment for the periods presented:

(in thousands)

4Q 2023

4Q 2022

% Change

FY 2023

FY 2022

% Change

Revenue

$

103,592

$

68,452

51

%

$

590,131

$

527,907

12

%

Adjusted EBITDA*

16,147

(32,574

)

150

%

155,077

(161,702

)

196

%

Adjusted EBITDA Margin*

16

%

(48

)%

26

%

(31

)%

Operating Metrics

Submitted Policies

Submitted policies are counted when an individual completes an

application with our licensed agent and provides authorization to

the agent to submit the application to the insurance carrier

partner. The applicant may have additional actions to take before

the application will be reviewed by the insurance carrier.

*See “Non-GAAP Financial Measures” below.

The following table shows the number of submitted policies for

the periods presented:

4Q 2023

4Q 2022

% Change

FY 2023

FY 2022

% Change

Medicare Advantage

114,383

129,289

(12

)%

652,630

808,116

(19

)%

Medicare Supplement

539

890

(39

)%

3,444

7,208

(52

)%

Dental, Vision and Hearing

14,668

23,502

(38

)%

74,181

145,716

(49

)%

Prescription Drug Plan

351

649

(46

)%

2,433

6,842

(64

)%

Other

2,099

3,340

(37

)%

7,501

14,776

(49

)%

Total

132,040

157,670

(16

)%

740,189

982,658

(25

)%

Approved Policies

Approved policies represents the number of submitted policies

that were approved by our insurance carrier partners for the

identified product during the indicated period. Not all approved

policies will go in force.

The following table shows the number of approved policies for

the periods presented:

4Q 2023

4Q 2022

% Change

FY 2023

FY 2022

% Change

Medicare Advantage

110,027

115,707

(5

)%

577,567

661,738

(13

)%

Medicare Supplement

435

807

(46

)%

2,619

5,461

(52

)%

Dental, Vision and Hearing

12,884

23,738

(46

)%

60,824

124,989

(51

)%

Prescription Drug Plan

350

809

(57

)%

2,144

6,124

(65

)%

Other

1,356

3,208

(58

)%

5,288

12,407

(57

)%

Total

125,052

144,269

(13

)%

648,442

810,719

(20

)%

Lifetime Value of Commissions per Approved Policy

Lifetime value of commissions per approved policy represents

commissions estimated to be collected over the estimated life of an

approved policy based on multiple factors, including but not

limited to, contracted commission rates, carrier mix and expected

policy persistency with applied constraints. The lifetime value of

commissions per approved policy is equal to the sum of the

commission revenue due upon the initial sale of a policy, and when

applicable, an estimate of future renewal commissions.

The following table shows the lifetime value of commissions per

approved policy for the periods presented:

(dollars per policy):

4Q 2023

4Q 2022

% Change

FY 2023

FY 2022

% Change

Medicare Advantage

$

830

$

877

(5

)%

$

877

$

925

(5

)%

Medicare Supplement

1,207

1,236

(2

)%

1,030

1,270

(19

)%

Dental, Vision and Hearing

121

122

(1

)%

100

123

(19

)%

Prescription Drug Plan

185

225

(18

)%

207

234

(12

)%

Other

105

64

64

%

101

73

38

%

Healthcare Services

Financial Results

The following table provides the financial results for the

Healthcare Services segment for the periods presented:

(in thousands)

4Q 2023

4Q 2022

% Change

FY 2023

FY 2022

% Change

Revenue

$

82,803

$

30,036

176

%

$

252,075

$

70,035

260

%

Adjusted EBITDA*

1,685

(11,800

)

114

%

(22,769

)

(32,097

)

29

%

Adjusted EBITDA Margin*

2

%

(39

)%

(9

)%

(46

)%

Operating Metrics

Members

The total number of SelectRx members represents the amount of

active customers to which an order has been shipped, as this is the

primary key driver of revenue for Healthcare Services.

The following table shows the total number of SelectRx members

as of the periods presented:

June 30, 2023

June 30, 2022

Total SelectRx Members

49,044

25,503

Combined Senior and Healthcare Services - Consumer Per Unit

Economics

The opportunity to leverage our existing database and

distribution model to improve access to healthcare services for our

consumers has created a need for us to review our key metrics

related to our per unit economics. As we think about the revenue

and expenses for Healthcare Services, we note that they are derived

from the marketing acquisition costs associated with the sale of an

MA or MS policy, some of which costs are allocated directly to

Healthcare Services, and therefore determined that our per unit

economics measure should include components from both Senior and

Healthcare Services. See details of revenue and expense items

included in the calculation below.

Combined Senior and Healthcare Services consumer per unit

economics represents total MA and MS commissions; other product

commissions; other revenues, including revenues from Healthcare

Services; and operating expenses associated with Senior and

Healthcare Services, each shown per number of approved MA and MS

policies over a given time period. Management assesses the business

on a per-unit basis to help ensure that the revenue opportunity

associated with a successful policy sale is attractive relative to

the marketing acquisition cost. Because not all acquired leads

result in a successful policy sale, all per-policy metrics are

based on approved policies, which is the measure that triggers

revenue recognition.

The MA and MS commission per MA/MS policy represents the LTV for

policies sold in the period. Other commission per MA/MS policy

represents the LTV for other products sold in the period, including

DVH prescription drug plan, and other products, which management

views as additional commission revenue on our agents’ core function

of MA/MS policy sales. Pharmacy revenue per MA/MS policy represents

revenue from SelectRx, and other revenue per MA/MS policy

represents revenue from Population Health, production bonuses,

marketing development funds, lead generation revenue, and

adjustments from the Company’s reassessment of its cohorts’

transaction prices. Total operating expenses per MA/MS policy

represents all of the operating expenses within Senior and

Healthcare Services. The revenue to customer acquisition cost

(“CAC”) multiple represents total revenue as a multiple of total

marketing acquisition cost, which represents the direct costs of

acquiring leads. These costs are included in marketing and

advertising expense within the total operating expenses per MA/MS

policy.

The following table shows combined Senior and Healthcare

Services consumer per unit economics for the periods presented.

Based on the seasonality of Senior and the fluctuations between

quarters, we believe that the most relevant view of per unit

economics is on a rolling 12-month basis. All per MA/MS policy

metrics below are based on the sum of approved MA/MS policies, as

both products have similar commission profiles.

*See “Non-GAAP Financial Measures” below.

Twelve Months Ended June

30,

(dollars per approved policy):

2023

2022

MA and MS approved policies

580,186

667,199

MA and MS commission per MA / MS

policy

$

877

$

928

Other commission per MA/MS policy

12

27

Pharmacy revenue per MA/MS policy

413

89

Other revenue per MA/MS policy

149

(147

)

Total revenue per MA / MS policy

1,451

897

Total operating expenses per MA / MS

policy

(1,224

)

(1,187

)

Adjusted EBITDA per MA/MS policy *

$

227

$

(290

)

Adjusted EBITDA Margin per MA/MS policy

*

16

%

(32

)%

Revenue / CAC multiple

4.1X

1.7X

Total revenue per MA/MS policy increased 62% for the twelve

months ended June 30, 2023 compared to the twelve months ended June

30, 2022, primarily due to the increase in pharmacy revenue. Total

operating expenses per MA/MS policy increased 3% for the twelve

months ended June 30, 2023 compared to the twelve months ended June

30, 2022, driven by an increase in cost of goods sold-pharmacy

revenue for Healthcare Services due to the growth of the business,

offset by a decrease in our marketing and advertising costs.

Life

Financial Results

The following table provides the financial results for the Life

segment for the periods presented:

(in thousands)

4Q 2023

4Q 2022

% Change

FY 2023

FY 2022

% Change

Revenue

$

38,052

$

37,331

2

%

$

145,832

$

153,973

(5

)%

Adjusted EBITDA*

6,702

576

1064

%

23,073

(129

)

NM

Adjusted EBITDA Margin*

18

%

2

%

16

%

—

%

Operating Metrics

Life premium represents the total premium value for all policies

that were approved by the relevant insurance carrier partner and

for which the policy document was sent to the policyholder and

payment information was received by the relevant insurance carrier

partner during the indicated period. Because our commissions are

earned based on a percentage of total premium, total premium volume

for a given period is the key driver of revenue for our Life

segment.

*See “Non-GAAP Financial Measures” below.

The following table shows term and final expense premiums for

the periods presented:

(in thousands)

4Q 2023

4Q 2022

% Change

FY 2023

FY 2022

% Change

Term Premiums

$

20,507

$

16,374

25

%

$

68,941

$

62,364

11

%

Final Expense Premiums

18,960

25,500

(26

)%

77,725

109,218

(29

)%

Total

$

39,467

$

41,874

(6

)%

$

146,666

$

171,582

(15

)%

Auto & Home

Financial Results

The following table provides the financial results for the Auto

& Home segment for the periods presented:

(in thousands)

4Q 2023

4Q 2022

% Change

FY 2023

FY 2022

% Change

Revenue

$

(1,266

)

(1

)

$

7,126

(118

)%

$

21,862

(1

)

$

27,881

(22

)%

Adjusted EBITDA*

(7,235

)

(1

)

1,476

(590

)%

81

(1

)

5,433

(99

)%

Adjusted EBITDA Margin*

NM

21

%

—

%

19

%

(1) Decrease is due to the impact of the

$10.4 million change in estimate related to the mutual termination

of a contract with a certain Auto & Home carrier to provide for

the ability to migrate the book of business to other carriers.

Operating Metrics

Auto & Home premium represents the total premium value of

all new policies that were approved by our insurance carrier

partners during the indicated period. Because our commissions are

earned based on a percentage of total premium, total premium volume

for a given period is the key driver of revenue for our Auto &

Home segment.

The following table shows premiums for the periods

presented:

(in thousands):

4Q 2023

4Q 2022

% Change

FY 2023

FY 2022

% Change

Premiums

$

14,460

$

13,756

5

%

$

50,917

$

50,114

2

%

*See “Non-GAAP Financial Measures” below.

Earnings Conference Call

SelectQuote, Inc. will host a conference call with the

investment community on September 13, 2023, beginning at 8:30 a.m.

ET. To register for this conference call, please use this link:

https://www.netroadshow.com/events/login?show=c37e5fba&confId=54604Avoid.

After registering, a confirmation will be sent via email, including

dial-in details and unique conference call codes for entry.

Registration is open through the live call, but to ensure you are

connected for the full call we suggest registering at least 10

minutes before the start of the call. The event will also be

webcasted live via our investor relations website

https://ir.selectquote.com/investor-home/default.aspx.

Non-GAAP Financial Measures

This release includes certain non-GAAP financial measures

intended to supplement, not substitute for, comparable GAAP

measures. To supplement our financial statements presented in

accordance with GAAP and to provide investors with additional

information regarding our GAAP financial results, we have presented

in this release Adjusted EBITDA and Adjusted EBITDA Margin, which

are non-GAAP financial measures. These non-GAAP financial measures

are not based on any standardized methodology prescribed by GAAP

and are not necessarily comparable to similarly titled measures

presented by other companies. We define Adjusted EBITDA as net

income (loss) before interest expense, income tax expense

(benefit), depreciation and amortization, and certain add-backs for

non-cash or non-recurring expenses, including restructuring and

share-based compensation expenses. The most directly comparable

GAAP measure is net income (loss). We define Adjusted EBITDA Margin

as Adjusted EBITDA divided by revenue. The most directly comparable

GAAP measure is net income margin. We monitor and have presented in

this release Adjusted EBITDA and Adjusted EBITDA Margin because

they are key measures used by our management and Board of Directors

to understand and evaluate our operating performance, to establish

budgets, and to develop operational goals for managing our

business. In particular, we believe that excluding the impact of

these expenses in calculating Adjusted EBITDA can provide a useful

measure for period-to-period comparisons of our core operating

performance.

We believe that these non-GAAP financial measures help identify

underlying trends in our business that could otherwise be masked by

the effect of the expenses that we exclude in the calculations of

these non-GAAP financial measures. Accordingly, we believe that

these financial measures provide useful information to investors

and others in understanding and evaluating our operating results,

enhancing the overall understanding of our past performance and

future prospects.

Reconciliations of net income (loss) to Adjusted EBITDA are

presented below beginning on page 12.

Forward Looking Statements

This release contains forward-looking statements. These

forward-looking statements reflect our current views with respect

to, among other things, future events and our financial

performance. These statements are often, but not always, made

through the use of words or phrases such as “may,” “should,”

“could,” “predict,” “potential,” “believe,” “will likely result,”

“expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,”

“intend,” “plan,” “projection,” “would” and “outlook,” or the

negative version of those words or other comparable words or

phrases of a future or forward-looking nature. These

forward-looking statements are not historical facts, and are based

on current expectations, estimates and projections about our

industry, management’s beliefs and certain assumptions made by

management, many of which, by their nature, are inherently

uncertain and beyond our control. Accordingly, we caution you that

any such forward-looking statements are not guarantees of future

performance and are subject to risks, assumptions and uncertainties

that are difficult to predict. Although we believe that the

expectations reflected in these forward-looking statements are

reasonable as of the date made, actual results may prove to be

materially different from the results expressed or implied by the

forward-looking statements.

There are or will be important factors that could cause our

actual results to differ materially from those indicated in these

forward-looking statements, including, but not limited to, the

following: the ultimate duration and impact of the ongoing COVID-19

pandemic and any other public health events, our reliance on a

limited number of insurance carrier partners and any potential

termination of those relationships or failure to develop new

relationships; existing and future laws and regulations affecting

the health insurance market; changes in health insurance products

offered by our insurance carrier partners and the health insurance

market generally; insurance carriers offering products and services

directly to consumers; changes to commissions paid by insurance

carriers and underwriting practices; competition with brokers,

including exclusively online brokers and carriers who opt to sell

policies directly to consumers; competition from government-run

health insurance exchanges; developments in the U.S. health

insurance system; our dependence on revenue from carriers in our

senior segment and downturns in the senior health as well as life,

automotive and home insurance industries; our ability to develop

new offerings and penetrate new vertical markets; risks from

third-party products; failure to enroll individuals during the

Medicare annual enrollment period; our ability to attract,

integrate and retain qualified personnel; our dependence on lead

providers and ability to compete for leads; failure to obtain

and/or convert sales leads to actual sales of insurance policies;

access to data from consumers and insurance carriers; accuracy of

information provided from and to consumers during the insurance

shopping process; cost-effective advertisement through internet

search engines; ability to contact consumers and market products by

telephone; global economic conditions, including inflation;

disruption to operations as a result of future acquisitions;

significant estimates and assumptions in the preparation of our

financial statements; impairment of goodwill; potential litigation

and other legal proceedings or inquiries; our existing and future

indebtedness; our ability to maintain compliance with our debt

covenants; access to additional capital; failure to protect our

intellectual property and our brand; fluctuations in our financial

results caused by seasonality; accuracy and timeliness of

commissions reports from insurance carriers; timing of insurance

carriers’ approval and payment practices; factors that impact our

estimate of the constrained lifetime value of commissions per

policyholder; changes in accounting rules, tax legislation and

other legislation; disruptions or failures of our technological

infrastructure and platform; failure to maintain relationships with

third-party service providers; cybersecurity breaches or other

attacks involving our systems or those of our insurance carrier

partners or third-party service providers; our ability to protect

consumer information and other data; and failure to market and sell

Medicare plans effectively or in compliance with laws. For a

further discussion of these and other risk factors that could

impact our future results and performance, see the section entitled

“Risk Factors” in the most recent Annual Report on Form 10-K (the

“Annual Report”) and subsequent periodic reports filed by us with

the Securities and Exchange Commission. Accordingly, you should not

place undue reliance on any such forward-looking statements. Any

forward-looking statement speaks only as of the date on which it is

made, and, except as otherwise required by law, we do not undertake

any obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise.

About SelectQuote:

Founded in 1985, SelectQuote (NYSE: SLQT) provides solutions

that help consumers protect their most valuable assets: their

families, health, and property. The company pioneered the model of

providing unbiased comparisons from multiple, highly-rated

insurance companies allowing consumers to choose the policy and

terms that best meet their unique needs. Two foundational pillars

underpin SelectQuote’s success: a strong force of highly-trained

and skilled agents who provide a consultative needs analysis for

every consumer, and proprietary technology that sources and routes

high-quality leads.

With an ecosystem offering high touchpoints for consumers across

Insurance, Medicare, Pharmacy, and Value-Based Care, the company

now has four core business lines: SelectQuote Senior, SelectQuote

Healthcare Services, SelectQuote Life, and SelectQuote Auto and

Home. SelectQuote Senior serves the needs of a demographic that

sees around 10,000 people turn 65 each day with a range of Medicare

Advantage and Medicare Supplement plans. SelectQuote Healthcare

Services is comprised of the SelectRx Pharmacy, a specialized

medication management pharmacy, and Population Health which

proactively connects its members with best-in-class healthcare

services that fit each member's unique healthcare needs. The

platform improves health outcomes and lowers healthcare costs

through proactive engagement and access to high-value healthcare

solutions.

SELECTQUOTE, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands)

June 30, 2023

June 30, 2022

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

83,156

$

140,997

Accounts receivable, net of allowances of

$2.7 million and $0.6 million, respectively

154,565

129,748

Commissions receivable-current

111,148

116,277

Other current assets

14,355

15,751

Total current assets

363,224

402,773

COMMISSIONS RECEIVABLE—Net

729,350

722,349

PROPERTY AND EQUIPMENT—Net

27,452

41,804

SOFTWARE—Net

14,740

16,301

OPERATING LEASE RIGHT-OF-USE ASSETS

23,563

28,016

INTANGIBLE ASSETS—Net

10,200

31,255

GOODWILL

29,136

29,136

OTHER ASSETS

21,586

18,418

TOTAL ASSETS

$

1,219,251

$

1,290,052

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

27,577

$

24,766

Accrued expenses

16,993

26,002

Accrued compensation and benefits

49,966

42,150

Operating lease liabilities—current

5,175

5,261

Current portion of long-term debt

33,883

7,169

Contract liabilities

1,691

3,404

Other current liabilities

1,972

4,761

Total current liabilities

137,257

113,513

LONG-TERM DEBT, NET—less current

portion

664,625

698,423

DEFERRED INCOME TAXES

39,581

50,080

OPERATING LEASE LIABILITIES

27,892

33,946

OTHER LIABILITIES

2,926

2,985

Total liabilities

872,281

898,947

COMMITMENTS AND CONTINGENCIES

SHAREHOLDERS’ EQUITY:

Common stock, $0.01 par value

1,669

1,644

Additional paid-in capital

567,266

554,845

Accumulated deficit

(235,644)

(177,100)

Accumulated other comprehensive income

13,679

11,716

Total shareholders’ equity

346,970

391,105

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

1,219,251

$

1,290,052

SELECTQUOTE, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE LOSS

(Unaudited)

(In thousands)

Three Months Ended June

30,

Year Ended June 30,

2023

2022

2023

2022

REVENUE:

Commission

$

119,844

$

94,809

$

653,470

$

587,518

Pharmacy

79,905

27,929

239,547

59,460

Other

22,029

16,656

109,831

117,067

Total revenue

221,778

139,394

1,002,848

764,045

OPERATING COSTS AND EXPENSES:

Cost of revenue

65,697

37,722

301,524

391,528

Cost of goods sold—pharmacy revenue

71,211

64,172

225,963

64,172

Marketing and advertising

63,521

75,080

301,245

484,084

Selling, general, and administrative

49,856

30,449

136,518

100,945

Technical development

7,154

6,054

26,015

24,729

Goodwill impairment

—

44,596

—

44,596

Total operating costs and expenses

257,439

258,073

991,265

1,110,054

INCOME (LOSS) FROM OPERATIONS

(35,661)

(118,679)

11,583

(346,009)

INTEREST EXPENSE, NET

(21,721)

(12,295)

(80,606)

(43,595)

OTHER EXPENSE, NET

(3)

(26)

(121)

(202)

LOSS BEFORE INCOME TAX BENEFIT

(57,385)

(131,000)

(69,144)

(389,806)

INCOME TAX BENEFIT

(9,547)

(26,318)

(10,600)

(92,302)

NET LOSS

$

(47,838)

$

(104,682)

$

(58,544)

$

(297,504)

NET LOSS PER SHARE:

Basic

$

(0.29)

$

(0.64)

$

(0.35)

$

(1.81)

Diluted

$

(0.29)

$

(0.64)

$

(0.35)

$

(1.81)

WEIGHTED-AVERAGE COMMON STOCK OUTSTANDING

USED IN PER SHARE AMOUNTS:

Basic

166,709

164,427

166,140

164,042

Diluted

166,709

164,427

166,140

164,042

OTHER COMPREHENSIVE INCOME NET OF TAX:

Gain on cash flow hedge

605

2,129

1,963

11,487

OTHER COMPREHENSIVE INCOME

605

2,129

1,963

11,487

COMPREHENSIVE LOSS

$

(47,233)

$

(102,553)

$

(56,581)

$

(286,017)

SELECTQUOTE, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

(In thousands)

Three Months Ended June

30,

Year Ended June 30,

2023

2022

2023

2022

CASH FLOWS FROM OPERATING ACTIVITIES:

Net loss

$

(47,838)

(104,682)

$

(58,544)

(297,504)

Adjustments to reconcile net loss to net

cash and cash equivalents used in operating activities:

Depreciation and amortization

6,794

6,768

27,881

24,724

Goodwill impairment

—

44,596

—

44,596

Loss on disposal of property, equipment,

and software

364

717

754

1,458

Impairment of long-lived assets

17,332

3,147

17,332

3,147

Share-based compensation expense

2,785

800

11,310

7,052

Deferred income taxes

(9,760)

(26,338)

(11,176)

(92,716)

Amortization of debt issuance costs and

debt discount

2,426

1,243

8,676

5,461

Write-off of debt issuance costs

—

—

710

—

Accrued interest payable in kind

3,565

—

12,015

—

Non-cash lease expense

1,070

1,002

4,185

4,067

Changes in operating assets and

liabilities:

Accounts receivable, net

37,921

34,085

(24,817)

(25,749)

Commissions receivable

(18,964)

(329)

(1,872)

7,271

Other assets

(2,997)

(2,641)

169

(10,915)

Accounts payable and accrued expenses

(10,089)

(12,559)

(3,649)

(4,464)

Operating lease liabilities

(1,312)

(1,274)

(5,643)

(5,143)

Other liabilities

12,161

1,513

3,292

401

Net cash used in operating activities

(6,542)

(53,952)

(19,377)

(338,314)

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property and equipment

(391)

(283)

(1,447)

(24,798)

Purchases of software and capitalized

software development costs

(1,874)

(2,280)

(7,678)

(9,851)

Acquisition of business

—

—

—

(6,927)

Investment in equity securities

—

—

—

(1,000)

Net cash used in investing activities

(2,265)

(2,563)

(9,125)

(42,576)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from Revolving Credit

Facility

—

—

—

50,000

Payments on Revolving Credit Facility

—

—

—

(50,000)

Proceeds from Term Loans

—

—

—

242,000

Payments on Term Loans

—

(1,793)

(17,833)

(3,585)

Payments on other debt

(35)

(54)

(158)

(184)

Proceeds from common stock options

exercised and employee stock purchase plan

—

—

1,187

3,179

Payments of tax withholdings related to

net share settlement of equity awards

—

—

(40)

(148)

Payments of debt issuance costs

—

—

(10,110)

(328)

Payment of acquisition holdback

(50)

—

(2,385)

(5,501)

Net cash (used in) provided by financing

activities

(85)

(1,847)

(29,339)

235,433

NET DECREASE IN CASH AND CASH

EQUIVALENTS

(8,892)

(58,362)

(57,841)

(145,457)

CASH AND CASH EQUIVALENTS—Beginning of

period

92,048

199,359

140,997

286,454

CASH AND CASH EQUIVALENTS—End of

period

$

83,156

$

140,997

$

83,156

$

140,997

SELECTQUOTE, INC. AND

SUBSIDIARIES

Net Loss to Adjusted EBITDA

Reconciliation

(Unaudited)

Three Months Ended June 30,

2023

(in thousands)

Senior

Healthcare Services

Life

Auto & Home

Corp & Elims

Consolidated

Revenue

$

103,592

$

82,803

$

38,052

$

(1,266)

$

(1,403)

$

221,778

Operating expenses

(87,445)

(81,118)

(31,350)

(5,970)

(21,715)

(227,598)

Other income (expense), net

—

—

—

1

(4)

(3)

Adjusted EBITDA

$

16,147

$

1,685

$

6,702

$

(7,235)

$

(23,122)

(5,823)

Share-based compensation expense

(2,785)

Transactions costs

(2,568)

Depreciation and amortization

(6,793)

Loss on disposal of property, equipment,

and software

(363)

Impairment of long-lived assets

(17,332)

Interest expense, net

(21,721)

Income tax benefit

9,547

Net loss

$

(47,838)

Change in estimate from structured book of

business migration for Auto & Home

$

10,427

Adjusted consolidated net loss

$

(37,411)

Three Months Ended June 30,

2022

(in thousands)

Senior

Healthcare Services

Life

Auto & Home

Corp & Elims

Consolidated

Revenue

$

68,452

$

30,036

$

37,331

$

7,126

$

(3,551)

$

139,394

Operating expenses

(101,026)

(41,836)

(36,755)

(5,650)

(14,905)

(200,172)

Other expenses, net

—

—

—

—

(26)

(26)

Adjusted EBITDA

$

(32,574)

$

(11,800)

$

576

$

1,476

$

(18,482)

(60,804)

Share-based compensation expense

(800)

Non-recurring expenses

(1,873)

Depreciation and amortization

(6,768)

Loss on disposal of property, equipment,

and software

(717)

Goodwill impairment

(44,596)

Impairment of long-lived assets

(3,147)

Interest expense, net

(12,295)

Income tax benefit

26,318

Net loss

$

(104,682)

Year Ended June 30,

2023

(in thousands)

Senior

Healthcare Services

Life

Auto & Home

Corp & Elims

Consolidated

Revenue

$

590,131

$

252,075

$

145,832

$

21,862

$

(7,052)

$

1,002,848

Operating expenses

(435,054)

(274,844)

(122,759)

(21,782)

(73,985)

(928,424)

Other expenses, net

—

—

—

1

(122)

(121)

Adjusted EBITDA

$

155,077

$

(22,769)

$

23,073

$

81

$

(81,159)

74,303

Share-based compensation expense

(11,310)

Transaction costs

(5,569)

Depreciation and amortization

(27,881)

Loss on disposal of property, equipment,

and software

(749)

Impairment of long-lived assets

(17,332)

Interest expense, net

(80,606)

Income tax benefit

10,600

Net loss

$

(58,544)

Change in estimate from structured book of

business migration for Auto & Home

$

10,427

Adjusted consolidated net loss

$

(48,117)

Year Ended June 30,

2022

(in thousands)

Senior

Healthcare Services

Life

Auto & Home

Corp & Elims

Consolidated

Revenue

$

527,907

$

70,035

$

153,973

$

27,881

$

(15,751)

$

764,045

Operating expenses

(689,609)

(102,132)

(154,102)

(22,448)

(56,058)

(1,024,349)

Other expenses, net

—

—

—

—

(202)

(202)

Adjusted EBITDA

$

(161,702)

$

(32,097)

$

(129)

$

5,433

$

(72,011)

(260,506)

Share-based compensation expense

(7,052)

Non-recurring expenses

(4,730)

Depreciation and amortization

(24,724)

Loss on disposal of property, equipment,

and software

(1,456)

Goodwill impairment

(44,596)

Impairment of long-lived assets

(3,147)

Interest expense, net

(43,595)

Income tax benefit

92,302

Net loss

$

(297,504)

SELECTQUOTE, INC. AND

SUBSIDIARIES

Revenue to Adjusted EBITDA -

Revenue Adjustments

(Unaudited)

Three Months Ended June 30,

2023

(in thousands)

Senior

Healthcare Services

Life

Auto & Home

Corp & Elims

Consolidated

Revenue

$

103,592

$

82,803

$

38,052

$

(1,266)

$

(1,403)

$

221,778

Change in estimate from structured book of

business migration for Auto & Home

—

—

—

10,427

—

10,427

Revenue, excluding change in estimate from

structured book of business migration for Auto & Home

103,592

82,803

38,052

9,161

(1,403)

232,205

Operating expenses

(87,445)

(81,118)

(31,350)

(5,970)

(21,715)

(227,598)

Other expenses, net

—

—

—

1

(4)

(3)

Adjusted EBITDA

$

16,147

$

1,685

$

6,702

$

3,192

$

(23,122)

$

4,604

Year Ended June 30,

2023

(in thousands)

Senior

Healthcare Services

Life

Auto & Home

Corp & Elims

Consolidated

Revenue

$

590,131

$

252,075

$

145,832

$

21,862

$

(7,052)

$

1,002,848

Change in estimate from structured book of

business migration for Auto & Home

—

—

—

10,427

—

10,427

Revenue, excluding change in estimate from

structured book of business migration for Auto & Home

590,131

252,075

145,832

32,289

(7,052)

1,013,275

Operating expenses

(435,054)

(274,844)

(122,759)

(21,782)

(73,985)

(928,424)

Other expenses, net

—

—

—

1

(122)

(121)

Adjusted EBITDA

$

155,077

$

(22,769)

$

23,073

$

10,508

$

(81,159)

$

84,730

SELECTQUOTE, INC. AND

SUBSIDIARIES

Net Loss to Adjusted EBITDA

Reconciliation

(Unaudited)

Guidance net loss to Adjusted EBITDA

reconciliation, year ending June 30, 2024:

(in thousands)

Range

Net loss

$

(50,000)

$

(22,000)

Income tax benefit

(18,000)

(8,000)

Interest expense, net

102,000

97,000

Depreciation and amortization

24,000

22,000

Share-based compensation expense

14,000

12,000

Transaction costs

8,000

4,000

Adjusted EBITDA

$

80,000

$

105,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230913075508/en/

Investor Relations: Sloan Bohlen 877-678-4083

investorrelations@selectquote.com

Media: Matt Gunter 913-286-4931 matt.gunter@selectquote.com

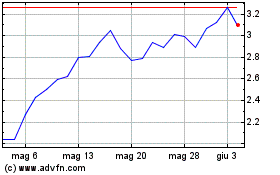

Grafico Azioni SelectQuote (NYSE:SLQT)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni SelectQuote (NYSE:SLQT)

Storico

Da Dic 2023 a Dic 2024