State Street Corporation Announces Planned 10% Dividend Increase and Preliminary Stress Capital Buffer Requirement

28 Giugno 2024 - 10:30PM

Business Wire

State Street Corporation (NYSE: STT) today announced its

intention to increase its per share common stock dividend by 10% to

$0.76 in the third quarter of 2024, subject to consideration and

approval by its Board of Directors. State Street continues to be

authorized to repurchase common shares under its existing share

repurchase program previously approved by its Board of

Directors.

The Company also announced today that it had completed the

Federal Reserve’s 2024 Comprehensive Capital Analysis and Review

(CCAR) stress test process. State Street’s calculated Stress

Capital Buffer (SCB) under this year’s supervisory stress test was

well below the 2.5% minimum, preliminarily resulting in a continued

SCB at that floor, which maintains its common equity tier 1 (CET1)

ratio requirement at 8%1. The Federal Reserve will release the

firm’s final SCB requirement by August 31, 2024, which will become

effective on October 1, 2024 and remain in effect through September

30, 2025. The results of the firm’s 2024 annual stress test, with

its disclosure, are available on the Investor Relations section of

its website at http://investors.statestreet.com.

“We are pleased with the outcome of the 2024 CCAR process, as it

once again confirms the financial strength and resiliency of State

Street under severely adverse economic conditions,” said Chairman

and Chief Executive Officer Ron O’Hanley. “In addition, our

earnings and balance sheet capacity have enabled us to announce

another planned increase to our quarterly common dividend, as we

continue to deliver value for our shareholders,” O’Hanley

added.

State Street’s Board of Directors will consider the common stock

dividend at a regularly scheduled board meeting in the third

quarter of 2024. State Street’s third quarter 2024 common stock and

other stock dividends, including the declaration, timing and

amount, remain subject to consideration and approval by State

Street’s Board of Directors at the relevant times.

Stock purchases under State Street’s common share repurchase

program may be made using various types of transactions, including

open-market purchases, accelerated share repurchases or other

transactions off the market, and may be made under Rule 10b5-1

trading programs. The timing and amount of any stock purchases and

the type of transaction may not be ratable over the duration of the

program, may vary from reporting period to reporting period and

will depend on several factors, including State Street’s capital

position and financial performance, investment opportunities,

market conditions, the nature and timing of implementation of

revisions to the Basel III framework and the amount of common stock

issued as part of employee compensation programs. The common share

repurchase program does not have specific price targets and may be

suspended at any time.

About State Street Corporation

State Street Corporation (NYSE: STT) is one of the world's

leading providers of financial services to institutional investors

including investment servicing, investment management and

investment research and trading. With $43.9 trillion in assets

under custody and/or administration and $4.3 trillion* in assets

under management as of March 31, 2024, State Street operates

globally in more than 100 geographic markets and employs

approximately 46,000 worldwide as of March 31, 2024. For more

information, visit State Street's website at

www.statestreet.com.

* Assets under management as of March 31, 2024 includes

approximately $66 billion of assets with respect to SPDR® products

for which State Street Global Advisors Funds Distributors, LLC

(SSGA FD) acts solely as the marketing agent. SSGA FD and State

Street Global Advisors are affiliated.

Forward Looking Statements

This News Release contains forward-looking statements within the

meaning of United States securities laws, including statements

about our intentions, plans and expectations regarding our

quarterly common stock dividends, our share repurchase program and

results of regulatory evaluations of our capital. Forward looking

statements are often, but not always, identified by such

forward-looking terminology as “plan,” “intend,” “will,” “outlook,”

“priority,” “expect,” “aim,” “outcome,” “future,” “strategy,”

“pipeline,” “trajectory,” “target,” “guidance,” “objective,”

“forecast,” “believe,” “anticipate,” “estimate,” “seek,” “may,”

“trend,” and “goal,” or similar statements or variations of such

terms. These statements are not guarantees of future performance,

are inherently uncertain, are based on current assumptions that are

difficult to predict and involve a number of risks and

uncertainties. Therefore, actual outcomes and results may differ

materially from what is expressed in those statements.

This News Release references important factors that may affect

future results and outcomes .In addition to those factors, other

important factors that could cause actual results to differ

materially from those indicated by any forward-looking statements

are set forth in our 2023 Annual Report on Form 10-K and our

subsequent SEC filings. We encourage investors to read these

filings, particularly the sections on risk factors, for additional

information with respect to any forward-looking statements and

prior to making any investment decision. The forward-looking

statements contained in this News Release should not by relied on

as representing our expectations or beliefs as of any time

subsequent to the time this News Release is first issued, and we do

not undertake efforts to revise those forward-looking statements to

reflect events after that time.

________________________ 1 8.0% CET1 requirement effective as of

October 1, 2024 is composed of the 4.5% minimum regulatory

requirement, 2.5% SCB, and the current 1% G-SIB surcharge.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240628316815/en/

Investor Contact: Elizabeth Lynn +1 617 664 3477

Media Contact: Carolyn Cichon +1 617 664 8672

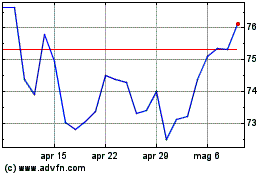

Grafico Azioni State Street (NYSE:STT)

Storico

Da Dic 2024 a Gen 2025

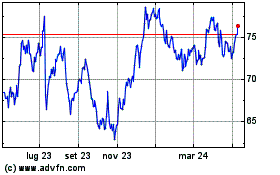

Grafico Azioni State Street (NYSE:STT)

Storico

Da Gen 2024 a Gen 2025