False000155227500015522752024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Act of 1934

May 8, 2024

Date of Report (Date of earliest event reported)

SUNOCO LP

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | 001-35653 | 30-0740483 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 8111 Westchester Drive, Suite 400 |

| Dallas | , | Texas | 75225 |

(Address of principal executive offices, including zip code) |

(214) 981-0700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Units Representing Limited Partner Interests | SUN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The following information is furnished under Item 2.02, “Results of Operations and Financial Condition.” This information, including the information contained in Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On May 8, 2024, Sunoco LP issued a news release announcing its results for the first fiscal quarter ended March 31, 2024 and providing access information for an investor conference call to discuss those results. A copy of the news release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference into this Item 2.02. The conference call will be available for replay approximately 365 days following the date of the call at www.SunocoLP.com.

Item 7.01. Regulation FD Disclosure.

On May 8, 2024, Sunoco LP issued a press release to announce first quarter 2024 financial and operating results. A copy of the press release is set forth in Exhibit 99.1 and is incorporated herein by reference. In accordance with General Instruction B.2 of Form 8-K, the information set forth in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

In accordance with General Instruction B.2 of Form 8-K, the information set forth in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act.

| | | | | | | | |

Exhibit Number | | Exhibit Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| SUNOCO LP |

| By: | Sunoco GP LLC, its general partner |

Date: May 8, 2024 | By: | /s/ Rick Raymer |

| | Rick Raymer |

| | Vice President, Controller and Principal Accounting Officer |

Sunoco LP Announces First Quarter 2024 Financial and Operating Results

•Reports record first quarter net income of $230 million and Adjusted EBITDA(1) of $242 million

•Increases full year 2024 Adjusted EBITDA(1)(2) guidance to $1.46 billion to $1.52 billion, to include the acquisition of NuStar Energy L.P.

•Increases quarterly distribution by 4%

DALLAS, May 8, 2024 - Sunoco LP (NYSE: SUN) (“SUN” or the “Partnership”) today reported financial and operating results for the quarter ended March 31, 2024.

Financial and Operational Highlights

Net income for the first quarter of 2024 was $230 million compared to net income of $141 million in the first quarter of 2023.

Adjusted EBITDA(1) for the first quarter of 2024 was $242 million compared to $221 million in the first quarter of 2023.

Distributable Cash Flow, as adjusted(1), for the first quarter of 2024 was $176 million compared to $160 million in the first quarter of 2023.

The Partnership sold over 2.1 billion gallons of fuel in the first quarter of 2024, an increase of 9% from the first quarter of 2023. Fuel margin for all gallons sold was 11.7 cents per gallon for the first quarter of 2024 compared to 12.9 cents per gallon in the first quarter of 2023.

Distribution

On May 3, 2024, the Board of Directors of SUN’s general partner declared a distribution for the first quarter of 2024 of $0.8756 per unit, or $3.5024 per unit on an annualized basis, a 4% increase over the fourth quarter of 2023. The distribution will be paid on May 20, 2024, to common unitholders of record on May 13, 2024.

Building on the 2% increase last year, this 4% increase demonstrates the Partnership’s continued confidence in the business.

Liquidity, Leverage and Credit

At March 31, 2024, SUN had long-term debt of $3.8 billion. The Partnership maintained liquidity of approximately $870 million at the end of the quarter under its $1.5 billion revolving credit facility. SUN’s leverage ratio of net debt to Adjusted EBITDA(1), calculated in accordance with its credit facility, was 3.7 times at the end of the first quarter.

On May 3, 2024, S&P Global Ratings raised the Partnership’s issuer credit rating to BB+ and on May 6, 2024, Moody’s Ratings raised the Partnership’s Corporate Family Rating to Ba1.

Capital Spending

SUN's total capital expenditures for the first quarter were $41 million, which included $27 million for growth capital and $14 million for maintenance capital.

Recent Developments

•On March 13, 2024, completed the acquisition of liquid fuels terminals in Amsterdam, Netherlands and Bantry Bay, Ireland from Zenith Energy for €170 million, including working capital.

•On April 16, 2024, completed the divestiture of 204 convenience stores to 7-Eleven, Inc. for approximately $1.0 billion.

•On May 3, 2024, completed the acquisition of NuStar Energy L.P.

•On April 30, 2024, issued $1.5 billion in unsecured notes. The proceeds from this offering will be used to fund the repayment of NuStar’s credit and receivables facilities, and redeem NuStar’s preferred equity and subordinated notes.

•On May 3, 2024, amended and extended the Partnership’s revolving credit facility. The new $1.5 billion revolving credit facility is unsecured and matures in May 2029.

Revised 2024 Business Outlook

As a result of the NuStar and Zenith acquisitions and divestiture to 7-Eleven, Inc., the Partnership is revising its 2024 guidance as follows:

•Full Year 2024 Adjusted EBITDA(1)(2): In a range of $1.46 billion to $1.52 billion.

◦Reaffirm legacy SUN full year 2024 Adjusted EBITDA(1)(2): In a range of $975 million to $1 billion.

◦Prorated portion of the 2024 Adjusted EBITDA(1)(2) guidance NuStar provided in February 2024: In a range of $480 million to $520 million.

◦Full year Adjusted EBITDA(1)(2) guidance excludes the impact from synergies or transaction-related expenses.

The Partnership will provide a more comprehensive update to its 2024 outlook on or before its second quarter earnings call.

(1) Adjusted EBITDA and Distributable Cash Flow, as adjusted, are non-GAAP financial measures of performance that have limitations and should not be considered as a substitute for net income. Please refer to the discussion and tables under "Reconciliation of Non-GAAP Measures" later in this news release for a discussion of our use of Adjusted EBITDA and Distributable Cash Flow, as adjusted, and a reconciliation to net income.

(2) A reconciliation of non-GAAP forward looking information to corresponding GAAP measures cannot be provided without unreasonable efforts due to the inherent difficulty in quantifying certain amounts due to a variety of factors, including the unpredictability of commodity price movements and future charges or reversals outside the normal course of business which may be significant.

Earnings Conference Call

Sunoco LP management will hold a conference call on Wednesday, May 8, 2024, at 9:00 a.m. Central Daylight Time (10:00 a.m. Eastern Daylight Time) to discuss results and recent developments. To participate, dial 877-407-6184 (toll free) or 201-389-0877 approximately 10 minutes before the scheduled start time and ask for the Sunoco LP conference call. The call will also be accessible live and for later replay via webcast in the Investor Relations section of Sunoco’s website at www.sunocolp.com under Webcasts and Presentations.

About Sunoco LP

Sunoco LP (NYSE: SUN) is a leading energy infrastructure and fuel distribution master limited partnership operating across 47 U.S. states, Puerto Rico, Europe, and Mexico. The Partnership's midstream operations include an extensive network of approximately 9,500 miles of pipeline and over 100 terminals. This critical infrastructure complements the Partnership's fuel distribution operations, which serve approximately 10,000 convenience stores, independent dealers, commercial customers, and distributors. SUN's general partner is owned by Energy Transfer LP (NYSE: ET).

Forward-Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results are discussed in the Partnership’s Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. The Partnership undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at www.sunocolp.com

Contacts

Investors:

Scott Grischow, Treasurer, Senior Vice President – Finance

(214) 840-5660, scott.grischow@sunoco.com

Media:

Vicki Granado, Vice President – Media & Communications

(214) 981-0761, vicki.granado@energytransfer.com

– Financial Schedules Follow –

SUNOCO LP

CONSOLIDATED BALANCE SHEETS

(Dollars in millions)

(unaudited)

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 215 | | | $ | 29 | |

| | | |

| Accounts receivable, net | 893 | | | 856 | |

| Accounts receivable from affiliates | 26 | | | 20 | |

| Inventories, net | 953 | | | 889 | |

| Other current assets | 125 | | | 133 | |

| Assets held for sale | 511 | | | — | |

| Total current assets | 2,723 | | | 1,927 | |

| | | |

| Property and equipment | 2,820 | | | 2,970 | |

| Accumulated depreciation | (960) | | | (1,134) | |

| Property and equipment, net | 1,860 | | | 1,836 | |

| Other assets: | | | |

| | | |

| Operating lease right-of-use assets, net | 422 | | | 506 | |

| Goodwill | 1,461 | | | 1,599 | |

| Intangible assets, net | 523 | | | 544 | |

| Other non-current assets | 278 | | | 290 | |

| Investment in unconsolidated affiliates | 125 | | | 124 | |

| | | |

| Total assets | $ | 7,392 | | | $ | 6,826 | |

| LIABILITIES AND EQUITY |

| Current liabilities: | | | |

| Accounts payable | $ | 1,022 | | | $ | 828 | |

| Accounts payable to affiliates | 170 | | | 170 | |

| | | |

| Accrued expenses and other current liabilities | 302 | | | 353 | |

| Operating lease current liabilities | 23 | | | 22 | |

| | | |

| Liabilities associated with assets held for sale | 130 | | | — | |

| Total current liabilities | 1,647 | | | 1,373 | |

| | | |

| Operating lease non-current liabilities | 431 | | | 511 | |

| | | |

| Long-term debt, net | 3,795 | | | 3,580 | |

| Advances from affiliates | 98 | | | 102 | |

| Deferred tax liabilities | 181 | | | 166 | |

| Other non-current liabilities | 119 | | | 116 | |

| | | |

| Total liabilities | 6,271 | | | 5,848 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Equity: | | | |

| Limited partners: | | | |

Common unitholders

(84,428,109 units issued and outstanding as of March 31, 2024 and

84,408,014 units issued and outstanding as of December 31, 2023) | 1,121 | | | 978 | |

Class C unitholders - held by subsidiaries

(16,410,780 units issued and outstanding as of March 31, 2024 and

December 31, 2023) | — | | | — | |

| Total equity | 1,121 | | | 978 | |

| Total liabilities and equity | $ | 7,392 | | | $ | 6,826 | |

SUNOCO LP

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Dollars in millions, except per unit data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | | |

| | | | | 2024 | | 2023 | | | | |

| REVENUES: | | | | | | | | | | | |

Motor fuel sales | | | | | $ | 5,366 | | | $ | 5,239 | | | | | |

Non-motor fuel sales | | | | | 95 | | | 86 | | | | | |

Lease income | | | | | 38 | | | 37 | | | | | |

| Total revenues | | | | | 5,499 | | | 5,362 | | | | | |

| COST OF SALES AND OPERATING EXPENSES: | | | | | | | | | | | |

Cost of sales | | | | | 5,015 | | | 4,987 | | | | | |

General and administrative | | | | | 36 | | | 29 | | | | | |

Other operating | | | | | 88 | | | 82 | | | | | |

Lease expense | | | | | 18 | | | 16 | | | | | |

Loss on disposal of assets | | | | | 2 | | | 1 | | | | | |

Depreciation, amortization and accretion | | | | | 43 | | | 48 | | | | | |

| Total cost of sales and operating expenses | | | | | 5,202 | | | 5,163 | | | | | |

| OPERATING INCOME | | | | | 297 | | | 199 | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | | | | | |

| Interest expense, net | | | | | (63) | | | (53) | | | | | |

| Other income, net | | | | | 1 | | | — | | | | | |

| Equity in earnings of unconsolidated affiliates | | | | | 2 | | | 2 | | | | | |

| | | | | | | | | | | |

| INCOME BEFORE INCOME TAXES | | | | | 237 | | | 148 | | | | | |

| Income tax expense | | | | | 7 | | | 7 | | | | | |

| NET INCOME AND COMPREHENSIVE INCOME | | | | | $ | 230 | | | $ | 141 | | | | | |

| | | | | | | | | | | |

| NET INCOME PER COMMON UNIT: | | | | | | | | | | | |

Basic | | | | | $ | 2.29 | | | $ | 1.43 | | | | | |

Diluted | | | | | $ | 2.26 | | | $ | 1.41 | | | | | |

| | | | | | | | | | | |

| WEIGHTED AVERAGE COMMON UNITS OUTSTANDING: | | | | | | | | | | | |

Basic | | | | | 84,424,748 | | | 84,058,716 | | | | | |

Diluted | | | | | 85,259,238 | | | 84,970,826 | | | | | |

| | | | | | | | | | | |

| CASH DISTRIBUTIONS PER UNIT | | | | | $ | 0.8756 | | | $ | 0.8420 | | | | | |

Key Operating Metrics

The following information is intended to provide investors with a reasonable basis for assessing our historical operations, but should not serve as the only criteria for predicting our future performance.

The key operating metrics by segment and accompanying footnotes set forth in the following table are presented for the three months ended March 31, 2024 and 2023 and have been derived from our historical consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | | 2023 |

| Fuel Distribution and Marketing | | All Other | | Total | | | Fuel Distribution and Marketing | | All Other | | Total |

| (dollars and gallons in millions, except profit per gallon) |

| Revenues: | | | | | | | | | | | | |

| Motor fuel sales | $ | 5,234 | | | $ | 132 | | | $ | 5,366 | | | | $ | 5,103 | | | $ | 136 | | | $ | 5,239 | |

| Non-motor fuel sales | 40 | | | 55 | | | 95 | | | | 29 | | | 57 | | | 86 | |

| Lease income | 35 | | | 3 | | | 38 | | | | 34 | | | 3 | | | 37 | |

| Total revenues | $ | 5,309 | | | $ | 190 | | | $ | 5,499 | | | | $ | 5,166 | | | $ | 196 | | | $ | 5,362 | |

| Cost of sales: | | | | | | | | | | | | |

| Motor fuel sales | $ | 4,865 | | | $ | 124 | | | $ | 4,989 | | | | $ | 4,835 | | | $ | 125 | | | $ | 4,960 | |

| Non-motor fuel sales | 7 | | | 19 | | | 26 | | | | 4 | | | 23 | | | 27 | |

| Lease | — | | | — | | | — | | | | — | | | — | | | — | |

| Total cost of sales | $ | 4,872 | | | $ | 143 | | | $ | 5,015 | | | | $ | 4,839 | | | $ | 148 | | | $ | 4,987 | |

| Net income and comprehensive income | | | | | $ | 230 | | | | | | | | $ | 141 | |

Adjusted EBITDA (1) | $ | 219 | | | $ | 23 | | | $ | 242 | | | | $ | 195 | | | $ | 26 | | | $ | 221 | |

| Operating data: | | | | | | | | | | | | |

| Motor fuel gallons sold | | | | | 2,105 | | | | | | | | 1,930 | |

Motor fuel profit cents per gallon (2) | | | | | 11.7 | ¢ | | | | | | | 12.9 | ¢ |

Reconciliation of Non-GAAP Measures

The following table presents a reconciliation of net income to Adjusted EBITDA and Distributable Cash Flow, as adjusted, for the three months ended March 31, 2024 and 2023:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| (in millions) |

| Net income and comprehensive income | $ | 230 | | | $ | 141 | |

| Depreciation, amortization and accretion | 43 | | | 48 | |

| Interest expense, net | 63 | | | 53 | |

| Non-cash unit-based compensation expense | 4 | | | 5 | |

| Loss on disposal of assets | 2 | | | 1 | |

| | | |

| Unrealized (gains) losses on commodity derivatives | 13 | | | (11) | |

| Inventory valuation adjustments | (130) | | | (29) | |

| Equity in earnings of unconsolidated affiliates | (2) | | | (2) | |

| Adjusted EBITDA related to unconsolidated affiliates | 3 | | | 3 | |

| Other non-cash adjustments | 9 | | | 5 | |

| Income tax expense | 7 | | | 7 | |

Adjusted EBITDA (1) | $ | 242 | | | $ | 221 | |

| | | |

Adjusted EBITDA (1) | $ | 242 | | | $ | 221 | |

| Adjusted EBITDA related to unconsolidated affiliates | (3) | | | (3) | |

| Distributable cash flow from unconsolidated affiliates | 3 | | | 3 | |

| Cash interest expense | (54) | | | (51) | |

| Current income tax expense | (3) | | | (3) | |

| | | |

| Maintenance capital expenditures | (14) | | | (8) | |

| Distributable Cash Flow | 171 | | | 159 | |

| Transaction-related expenses | 5 | | | 1 | |

Distributable Cash Flow, as adjusted (1) (3) | $ | 176 | | | $ | 160 | |

| | | |

Distributions to Partners (3): | | | |

| Limited Partners | $ | 119 | | | $ | 71 | |

| General Partner | 36 | | | 19 | |

| Total distributions to be paid to partners | $ | 155 | | | $ | 90 | |

| Common Units outstanding - end of period | 84.4 | | | 84.1 | |

(1)Adjusted EBITDA is defined as earnings before net interest expense, income taxes, depreciation, amortization and accretion expense, allocated non-cash compensation expense, unrealized gains and losses on commodity derivatives and inventory valuation adjustments, and certain other operating expenses reflected in net income that we do not believe are indicative of ongoing core operations, such as gains or losses on disposal of assets and non-cash impairment charges. We define Distributable Cash Flow as Adjusted EBITDA less cash interest expense, including the accrual of interest expense related to our long-term debt which is paid on a semi-annual basis, current income tax expense, maintenance capital expenditures and other non-cash adjustments. For Distributable Cash Flow, as adjusted, certain transaction-related adjustments and non-recurring expenses are excluded.

We believe Adjusted EBITDA and Distributable Cash Flow, as adjusted, are useful to investors in evaluating our operating performance because:

•Adjusted EBITDA is used as a performance measure under our revolving credit facility;

•securities analysts and other interested parties use such metrics as measures of financial performance, ability to make distributions to our unitholders and debt service capabilities;

•our management uses them for internal planning purposes, including aspects of our consolidated operating budget, and capital expenditures; and

•Distributable Cash Flow, as adjusted, provides useful information to investors as it is a widely accepted financial indicator used by investors to compare partnership performance, and as it provides investors an enhanced perspective of the operating performance of our assets and the cash our business is generating.

Adjusted EBITDA and Distributable Cash Flow, as adjusted, are not recognized terms under GAAP and do not purport to be alternatives to net income as measures of operating performance or to cash flows from operating activities as a measure of liquidity. Adjusted EBITDA and Distributable Cash Flow, as adjusted, have limitations as analytical tools, and one should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Some of these limitations include:

•they do not reflect our total cash expenditures, or future requirements for capital expenditures or contractual commitments;

•they do not reflect changes in, or cash requirements for, working capital;

•they do not reflect interest expense or the cash requirements necessary to service interest or principal payments on our revolving credit facility or senior notes;

•although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect cash requirements for such replacements; and

•as not all companies use identical calculations, our presentation of Adjusted EBITDA and Distributable Cash Flow, as adjusted, may not be comparable to similarly titled measures of other companies.

Adjusted EBITDA reflects amounts for the unconsolidated affiliates based on the same recognition and measurement methods used to record equity in earnings of unconsolidated affiliates. Adjusted EBITDA related to unconsolidated affiliates excludes the same items with respect to the unconsolidated affiliates as those excluded from the calculation of Adjusted EBITDA, such as interest, taxes, depreciation, depletion, amortization and other non-cash items. Although these amounts are excluded from Adjusted EBITDA related to unconsolidated affiliates, such exclusion should not be understood to imply that we have control over the operations and resulting revenues and expenses of such affiliates. We do not control our unconsolidated affiliates; therefore, we do not control the earnings or cash flows of such affiliates. The use of Adjusted EBITDA or Adjusted EBITDA related to unconsolidated affiliates as an analytical tool should be limited accordingly. Inventory valuation adjustments that are excluded from the calculation of Adjusted EBITDA represent changes in lower of cost or market reserves on the Partnership's inventory. These amounts are unrealized valuation adjustments applied to fuel volumes remaining in inventory at the end of the period.

(2)Excludes the impact of inventory valuation adjustments consistent with the definition of Adjusted EBITDA.

(3)The Partnership’s Distributable Cash Flow, as adjusted, for the three months ended March 31, 2024 does not include the consolidated results of NuStar, because the NuStar merger occurred after the end of the reporting period. However, because the NuStar merger closed prior to the record date for the first quarter 2024 distribution, the distributions reported above reflect the impact of the SUN common units issued in connection with the merger.

Some investors and other users of SUN's financial information may compare Distributable Cash Flow, as adjusted, to the distributions to be paid by the Partnership for the respective quarter. To aid in such comparison, the Partnership is supplementing the information above with the following, which reflects separate historical data for (i) the Partnership and its legacy unitholders and (ii) NuStar and its legacy unitholders. NuStar’s results for the three months ended March 31, 2024 do not represent the historical or future performance of SUN. Furthermore, Distributable Cash Flow, as adjusted, for NuStar reported below is calculated based on SUN’s methodology for calculating such measure and therefore may not be consistent with the approach that NuStar historically used to calculate a similar measure in its standalone reporting prior to the merger.

| | | | | |

| Three Months Ended March 31, 2024 |

| (in millions) |

| Distributable Cash Flow, as adjusted: | |

| SUN | $ | 176 | |

| NuStar (calculated based on SUN's methodology) | 94 | |

| |

| Distributions related to legacy SUN unitholders | |

| Limited Partners | $ | 74 | |

| General Partner | 22 | |

| |

| Incremental distributions related to SUN common units issued in connection with the NuStar acquisition | |

| Limited Partners | $ | 45 | |

| General Partner | 14 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

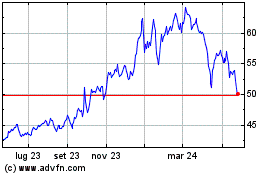

Grafico Azioni Sunoco (NYSE:SUN)

Storico

Da Feb 2025 a Mar 2025

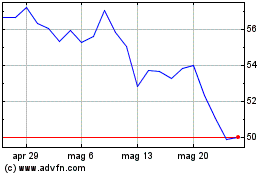

Grafico Azioni Sunoco (NYSE:SUN)

Storico

Da Mar 2024 a Mar 2025