Bank Smartly products offer up to 4% cash back on card purchases

and up to 4.10% APY on savings with qualifying balances of $100,000

or more.

U.S. Bank is introducing two new U.S. Bank Smartly® products

designed to work together to maximize credit card rewards while

also helping clients earn more on their savings balances.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240904863280/en/

U.S. Bank is introducing U.S. Bank

Smartly™ Visa Signature® Card and U.S. Bank Smartly® Savings, two

new U.S. Bank Smartly® products designed to work together to

maximize credit card rewards while also helping clients earn more

on their savings balances. (Photo: Business Wire)

The U.S. Bank Smartly™ Visa Signature® Card is a credit card

that offers up to 4% cash back on every purchase, and U.S. Bank

Smartly® Savings is a competitive rate savings account. The

combination provides an everyday banking solution that empowers

clients to manage their money easily, while maximizing cash back

rewards based on total eligible balances with U.S. Bank.

“There has never been a better time to become a U.S. Bank

client,” said Arijit Roy, head of consumer and business banking

products for U.S. Bank. “U.S. Bank Smartly provides a simple,

rewarding experience for our clients, with additional benefits

based on their total relationship with us. Now, with the Bank

Smartly Card and Bank Smartly Savings, clients can enjoy even more

rewards that are focused on savings rates and making the most of

credit card purchases.”

Bank Smartly credit cardholders can earn an unlimited 2% cash

back on every purchase as a baseline*. When paired with a Bank

Smartly Savings account and average daily combined balances in U.S.

Bank deposit, trust or investment accounts, clients can increase

their earning opportunities up to as much as 4% cash back on all

purchases – the highest level of cash back rewards in the market.

Reward levels increase with the cardholder’s combined average daily

eligible balance.

For example, clients with an average daily combined qualifying

balance of:

- $5,000 - $49,999 can earn 2.5% total cash back.

- $50,000 - $99,999 can earn 3% total cash back.

- $100,000 or more can earn 4% total cash back.

For savers, Bank Smartly Savings is a new competitive rate

savings account that empowers clients to earn more on their savings

balances, with the flexibility of a traditional savings account at

U.S. Bank. When paired with the Bank Smartly Card, or an eligible

checking account, account holders can earn rates up to 4.10% APY**

on their savings balance, with earning potential and rewards that

grow as their balances and accounts grow with the bank.

Available in all 50 states, the Bank Smartly Savings account and

Bank Smartly Card offerings are the newest additions to follow the

launch of Bank Smartly® Checking and U.S. Bank Smartly®

Rewards.

“Not only is it more rewarding to be a U.S. Bank client, but

it’s also now easier and more convenient than ever to become a U.S.

Bank client and manage your money,” said Roy.

- Through the No. 1 rated U.S. Bank Mobile App, clients and

non-clients can quickly open new deposit accounts, apply for a

mortgage loan, home equity line of credit or apply for and receive

a personal loan in minutes and more.

- With cobrowse, clients can share their screen and get

step-by-step guidance from their local banker via the mobile app

and online banking through industry-leading cobrowse

technology.

- Clients can quickly and conveniently switch their paycheck

direct deposit when opening a new account through the DIY direct

deposit feature.

- For families with kids and teens, U.S. Bank recently partnered

with Greenlight to offer complimentary access to the Greenlight

debit card and money app – all within the U.S. Bank Mobile

App.

Learn more about U.S. Bank Smartly Savings at

usbank.com/smartlysavings, or sign up at usbank.com/smartlycard to

preregister for the Bank Smartly Card.

About U.S. Bank

U.S. Bancorp, with more than 70,000 employees and $680 billion

in assets as of June 30, 2024, is the parent company of U.S. Bank

National Association. Headquartered in Minneapolis, the company

serves millions of customers locally, nationally and globally

through a diversified mix of businesses including consumer banking,

business banking, commercial banking, institutional banking,

payments and wealth management. U.S. Bancorp has been recognized

for its approach to digital innovation, community partnerships and

customer service, including being named one of the 2024 World’s

Most Ethical Companies and Fortune’s most admired superregional

bank. Learn more at usbank.com/about.

Disclosures:

Deposit products are offered by U.S. Bank National Association.

Member FDIC. The creditor and issuer of this card is U.S. Bank

National Association, pursuant to a license from Visa U.S.A. Inc.,

and the card is available to United States residents only.

* Rewards earned on the card are in Points. The baseline rewards

earned are 2 Points for every $1 in eligible Net purchases.

Cardmembers can earn up to a total of 4 points (a base of 2 Points

plus a Smartly Earning Bonus of up to 2 Points) depending on the

average daily qualifying balances maintained in eligible U.S. Bank

accounts. The maximum rewards value can be obtained when Points are

redeemed into an eligible U.S. Bank deposit account. The redemption

value may be different if you choose to redeem your Points for

other rewards such as travel, merchandise, gift cards, and/or

statement credit. Minimum redemption amounts may vary and are

subject to change without notice.

** You must maintain the minimum balance needed for each tier in

order to earn the Annual Percentage Yield (APY) disclosed. The

advertised APY is accurate as of 9.4.2024, All rates and APYs are

subject to change after the account is opened. Fees could reduce

earnings on the account. Interest rates currently offered on

applicable deposit accounts are determined at the bank's discretion

and may change daily. The minimum balance for opening an account is

$25.

Investment and Insurance products and

services including annuities are: NOT A DEPOSIT • NOT FDIC INSURED

• MAY LOSE VALUE • NOT BANK GUARANTEED • NOT INSURED BY ANY FEDERAL

GOVERNMENT AGENCY

For U.S. Bancorp Investments: Investment and insurance

products and services including annuities are available through

U.S. Bancorp Investments, the marketing name for U.S. Bancorp

Investments, Inc., member FINRA and SIPC, an investment adviser and

a brokerage subsidiary of U.S. Bancorp and affiliate of U.S. Bank.

Insurance products are available through various affiliated

non-bank insurance agencies, which are U.S. Bancorp subsidiaries.

Products may not be available in all states. CA Insurance License#

0E24641.

For U.S. Bancorp Advisors: Brokerage and investment

advisory products and services are offered by U.S. Bancorp

Advisors, LLC, an SEC-registered broker-dealer, investment adviser,

member FINRA/SIPC, and subsidiary of U.S. Bancorp and affiliate of

U.S. Bank National Association. Insurance products are offered by

USBA Insurance Services, a dba of U.S. Bancorp Advisors, having a

California domicile and principal place of business at 800 N. Brand

Blvd., 16th Floor, Glendale, CA 91203. CA Insurance License

#6011694. Products may not be available in all states.

For U.S. Bank: U.S. Bank is not responsible for and does

not guarantee the products, services, or performance of U.S.

Bancorp Investments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904863280/en/

Evan Lapiska, U.S. Bank Public Affairs & Communications

evan.lapiska@usbank.com

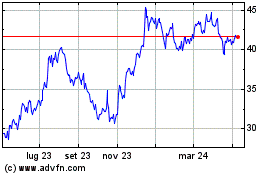

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Gen 2025 a Feb 2025

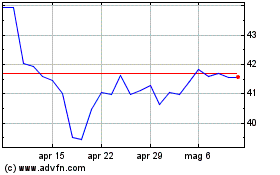

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Feb 2024 a Feb 2025