Expro (NYSE: XPRO), a leading provider of energy services, today

announced it had entered into a definitive agreement (subject to

customary closing conditions and working capital adjustments) to

acquire Coretrax, a technology leader in performance drilling tools

and wellbore cleanup, well integrity and production optimization

solutions, from an investment group led by Buckthorn Partners.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240212889637/en/

Total consideration to be paid at closing is approximately $210

million, including at least $75 million of cash and up to 6.75

million newly issued Expro common shares. The cash component of the

proposed transaction may be increased at Expro’s election, and the

notional value of any equity consideration will be unitized based

on Expro’s thirty trading day volume weighted average price

(“VWAP”) prior to closing, which is expected to occur in the second

quarter of 2024. Excluding possible cost and revenue synergies,

total consideration is approximately 4.7x Coretrax’s estimated 2024

Adjusted EBITDA. Expro is targeting up to $10 million of annual

run-rate cost synergies to be achieved in the first 18 months.

The acquisition of Coretrax will enable Expro to expand its

portfolio of cost-effective, technology-enabled Well Construction

and Well Intervention & Integrity solutions, particularly

across the North and Latin America (NLA), Europe and Sub-Saharan

Africa (ESSA) and Middle East and North Africa (MENA) regions.

Building on Coretrax’s successful 15-year history, the acquisition

will accelerate the availability of the company’s innovative, high

value-adding tools by leveraging Expro’s global operating

footprint.

Within Well Construction, the combination of Coretrax’s field

proven technology offering with Expro’s existing drilling

optimization portfolio provides a comprehensive solutions toolbox.

These solutions include the DAV-MX downhole circulation tool, the

HyPR Holesaver hydraulic pipe recovery system, and the Activated

Drilling Scrapper (ADS) debris recovery system. Within Well

Intervention & Integrity, Coretrax’s brings its best-in-class

expandables business, which includes the only expandables solution

that can be deployed on any of three conveyance systems (coil

tubing, wireline or drill pipe).

Michael Jardon, Expro Chief Executive Officer, said: “We are

thrilled to announce our proposed acquisition of Coretrax, and look

forward to welcoming John Fraser and his teammates to the Expro

family. Coretrax has a complementary offering to Expro with little

overlap and will bolster the portfolio of technology-enabled

services and solutions offered through our Well Construction and

Well Intervention & Integrity product lines, adding significant

value to our clients from innovative technologies that reduce risk

and cost, optimize drilling efficiency, extend the life of existing

well stock, and optimize production.

“The integration of Coretrax’s leading technologies will

strengthen our foothold in ESSA and MENA where both companies have

strong, established positions, and is expected to open new avenues

for growth in NLA and Asia-Pacific. We look forward to leveraging

the complementary capabilities and customer relationships of Expro

and Coretrax to deliver additional value to our customers and other

stakeholders."

John Fraser, CEO at Coretrax said: “I’m excited about the

opportunities the acquisition brings for Coretrax and our team. The

synergies between our respective technology portfolios will enable

us to grow our market share while significantly increasing our

capabilities to tackle the most complex well challenges. We are

proud of the innovation-led approach, strong customer base and

performance history that we developed over the last 15 years, and

we look forward to joining forces with Expro to create greater

value for our customers globally.”

Wells Fargo Securities, LLC is serving as financial advisor to

Expro and CMS Cameron McKenna Nabarro Olswang LLP is acting as

legal counsel on the transaction.

Evercore is serving as financial advisor, Blackwoods is acting

as legal counsel to Coretrax, and Sidley Austin is acting as legal

counsel to Buckthorn Partners on the transaction.

Notes to Editors:

Expro

Working for clients across the entire well life cycle, Expro is

a leading provider of energy services, offering cost-effective,

innovative solutions and what the Company considers to be

best-in-class safety and service quality. The Company’s extensive

portfolio of capabilities spans well construction, well flow

management, subsea well access, and well intervention and integrity

solutions.

With roots dating to 1938, Expro has approximately 8,000

employees and provides services and solutions to leading

exploration and production companies in both onshore and offshore

environments in approximately 60 countries.

For more information, please visit expro.com and connect with

Expro on X (formerly Twitter) @ExproGroup and LinkedIn @Expro.

Coretrax

Headquartered in Aberdeen, UK, Coretrax operates globally with

over 50 technologies and an intellectual property portfolio of 280+

patents across the full lifecycle of the well. These

technology-enabled services provide cost-effective, high impact,

safe solutions to the customer. Coretrax employs approximately 320

people across 11 global locations.

For more information visit coretrax.com

Buckthorn

Buckthorn Partners is a UK investment company focused on

acquiring and growing energy products and services businesses

involved in the energy transition. Since 2014 Buckthorn has made 18

investments across six platforms, providing portfolio companies

with industry experience, a broad industry network, primary

capital, M&A expertise and strategic advice. Working in

partnership with experienced management teams, Buckthorn helps

build successful companies both organically and through

M&A.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release, and oral statements made from time to time

by representatives of Expro Group Holdings N.V. (“the Company”),

may contain certain "forward-looking statements" within the meaning

of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements regarding, among

other things, the estimates and projections regarding the outcome

and benefits of the proposed Coretrax acquisition, Coretrax’s

estimated Adjusted EBITDA for 2024, the Company’s ability to

achieve the anticipated synergies as a result of the proposed

Coretrax acquisition, the timing of the closing of the proposed

Coretrax acquisition and the Company’s future business strategy and

prospects for growth, and are indicated by words or phrases such as

“anticipate,” “outlook,” “estimate,” “expect,” “project,”

“believe,” “envision,” “goal,” “target,” “can,” “will,” and similar

words or phrases. These forward-looking statements involve known

and unknown risks, uncertainties and other factors which may cause

actual results, performance or achievements to be materially

different from the future results, performance or achievements

expressed in or implied by such forward-looking statements.

Forward-looking statements are based largely on the Company’s

expectations and judgments and are subject to certain risks and

uncertainties, many of which are unforeseeable and beyond our

control. The factors that could cause actual results, performance

or achievements to materially differ include, among others the risk

factors identified in the Company’s Annual Report on Form 10-K,

Form 10-Q and Form 8-K reports filed with the Securities and

Exchange Commission. The Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events, historical practice,

or otherwise.

The Company is not able to provide a reconciliation of

Coretrax’s forward-looking Adjusted EBITDA to the most directly

comparable measure in accordance with U.S. generally accepted

accounting principles without unreasonable effort because of the

inherent difficulty in forecasting and quantifying certain amounts

necessary for such a reconciliation, including net income

(loss).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240212889637/en/

InvestorRelations@expro.com MediaRelations@expro.com

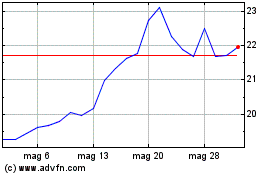

Grafico Azioni Expro Group Holdings NV (NYSE:XPRO)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Expro Group Holdings NV (NYSE:XPRO)

Storico

Da Gen 2024 a Gen 2025