Strong operational performance and profitable

growth driven by a rebound of NLA activity and acquisition of PRT

Offshore.

Revenue of $407 million for the fourth quarter,

up 10% sequentially. Revenue of $1,513 million for the full year,

up 18% year-over-year.

Net loss of $12 million for the fourth quarter

as compared to net loss of $14 million for the third quarter of

2023. Net loss of $23 million for the full year as compared to net

loss of $20 million for 2022.

Adjusted EBITDA1 of $85 million for the fourth

quarter, up 70% sequentially. Adjusted EBITDA margin1 of 21%, up

sequentially from 14%. Adjusted EBITDA of $249 million for the full

year as compared to $206 million for 2022. Adjusted EBITDA margin1

of approximately 16% for both 2023 and 2022.

Provides 2024 revenue and Adjusted EBITDA

margin outlook

Expro Group Holdings N.V. (NYSE: XPRO) (the “Company” or

“Expro”) today reported financial and operational results for the

three months and year ended December 31, 2023.

Fourth Quarter 2023 Financial Highlights

•

Revenue was $407 million compared to

revenue of $370 million in the third quarter of 2023, a sequential

increase of $37 million, or 10%, primarily driven by a rebound of

activity in North and Latin America (“NLA”) and the acquisition of

PRT Offshore in the beginning of the fourth quarter.

•

Net loss for the fourth quarter of 2023

was $12 million, or $0.11 per diluted share, compared to a net loss

of $14 million, or $0.13 per diluted share, for the third quarter

of 2023. Adjusted net income1 for the fourth quarter of 2023 was $7

million, or $0.06 per diluted share, compared to an adjusted net

loss for the third quarter of 2023 of $6 million, or $0.06 per

diluted share. Results for the fourth and third quarter of 2023

include foreign exchange losses of $5 million and $4 million,

respectively, or approximately $0.04 per diluted share, for both

periods.

•

Adjusted EBITDA was $85 million, a

sequential increase of $35 million, or 70%, driven by higher

activity during the fourth quarter and lower unrecoverable costs

within our light well intervention (“LWI”) business. Adjusted

EBITDA margin for the fourth and third quarter of 2023 was 21% and

14%, respectively. Excluding $4 million and $15 million of

unrecoverable LWI-related costs during the three months ended

December 31, 2023 and September 30, 2023, respectively, Adjusted

EBITDA would have been $89 million and $65 million and Adjusted

EBITDA margin would have been 22% and 18%.

The Company suspended vessel-deployed LWI

operations during the third quarter of 2023 following a wire

failure on the main crane of a third-party owned vessel working

with Expro while the crane was suspending the subsea module of

Expro’s vessel-deployed LWI system. We are continuing to work with

the relevant stakeholders and independent experts to assess the

incident. The well control package and lubricator components of

this vessel-deployed LWI system have been safely recovered, but we

have determined not to participate in the recovery of the subsea

module from the seabed. We are continuing to determine the path

forward for our vessel-deployed LWI operations, including what

alternative service delivery options and service partner options

are available to the Company, and the timing and cost (including

potential damage claims) of completing customer work scopes for

which our vessel-deployed LWI system was integral. At this time, we

are not able to assess the timing and potential cost of completing

customer work scopes but do not expect such costs to be material to

Expro’s financial results.

•

Net cash provided by operating activities

for the fourth quarter of 2023 was $33 million compared to net cash

provided by operating activities of $59 million for the third

quarter of 2023. The decrease was primarily due to an increase in

working capital of $60 million, partially offset by an increase in

Adjusted EBITDA of $35 million. Adjusted cash flow from operations1

for the fourth quarter of 2023 was $43 million compared to $64

million for the third quarter of 2023.

1. A non-GAAP measure.

Full Year 2023 Financial Highlights

•

Revenue was $1,513 million for the year

ended December 31, 2023, an increase of $234 million, or 18%,

compared to $1,279 million for the year ended December 31, 2022.

Activity and revenue across all geography-based operating segments

increased during the year ended December 31, 2023, most notably in

Europe and Sub-Saharan Africa (“ESSA”).

•

Net loss was $23 million for the year

ended December 31, 2023, or $0.21 per diluted share, compared to a

net loss of $20 million, or $0.18 per diluted share, for the year

ended December 31, 2022. Adjusted net income for the year ended

December 31, 2023 was $20 million, or $ 0.19 per diluted share,

compared to adjusted net income for the year ended December 31,

2022 of $19 million, or $ 0.18 per diluted share.

•

Adjusted EBITDA increased by $43 million,

or 21%, to $249 million for the year ended December 31, 2023 from

$206 million for the prior year. The increase in Adjusted EBITDA is

primarily attributable to higher revenue and a more favorable

activity mix. Adjusted EBITDA margin was approximately 16% for both

2023 and 2022, respectively. Adjusted EBITDA for the year ended

December 31, 2023 includes unrecoverable LWI-related costs in Asia

Pacific (“APAC”) of $36 million. Adjusted EBITDA for the year ended

December 31, 2022 includes unrecoverable LWI-related costs of $28

million. Excluding unrecoverable LWI-related costs, Adjusted EBITDA

for the years ended December 31, 2023 and 2022 would have been $285

million and $234 million, and Adjusted EBITDA margin would have

been 19% and 18%, respectively.

•

Net cash provided by operating activities

for the year ended December 31, 2023 was $138 million compared to

$80 million for year ended December 31, 2022, primarily due to an

increase in Adjusted EBITDA (as referenced above) and favorable

movement in working capital, partially offset by higher payments

for income taxes. Adjusted cash flow from operations for the year

ended December 31, 2023 was $170 million compared to $115 million

for year ended December 31, 2022.

Michael Jardon, Chief Executive Officer, noted, “Expro has

delivered strong fourth quarter financial results with revenue and

Adjusted EBITDA exceeding our most recent guidance ranges. We begin

2024 in a strong position. As activity is strengthening, we are

continuing to see a positive demand trend for our services and

solutions and believe that the energy services sector and Expro's

business are in the early phase of a multi-year growth cycle.

“Earlier this month we announced that Expro has entered into a

definitive agreement to acquire Coretrax, a technology leader in

performance drilling tools and wellbore cleanup, well integrity and

production optimization solutions. Coretrax has a complementary

offering to Expro with little overlap and will bolster the

portfolio of technology-enabled services and solutions offered

through our Well Construction and Well Intervention & Integrity

product lines, adding significant value to our clients from

innovative technologies that reduce risk and cost, optimize

drilling efficiency, extend the life of existing well stock, and

optimize production.

“We also celebrated 40 years since the launch of our first

subsea test tree system. Since then Expro has remained at the

forefront of subsea landing string technology. Recognizing our

dedication to subsea well access applications, Expro was named

Intervention Champion of the Year at the OWI Global Awards 2023

that was held in November. Our capabilities in this space have also

been bolstered with the recent acquisition of PRT Offshore at the

beginning of the fourth quarter of 2023 and we are already making

significant progress on our integration.

“We built a healthy order book in 2023, capturing strategically

important contract wins. As we look ahead, we are well positioned

to support our customers as activity ramps up across our regions

and product lines. I am very proud of the team of experts

throughout the company and what they have accomplished. We believe

our business is well positioned to be a leading provider of

services and solutions in the international and offshore markets

while delivering on the financial and other objectives of the

company in the years to follow.

“For 2024, we expect improving profitability to drive improved

cash flow generation as we capitalize on tailwinds in our industry.

Based on our strong performance in 2023 and a positive activity

outlook, we currently anticipate generating revenues of between

$1,600 million to $1,700 million in 2024. Adjusted EBITDA in 2024

is expected to be between $325 million and $375 million, and

Adjusted EBITDA margin is expected to be between 20% and 22%.

Full-year guidance assumes our proposed acquisition of Coretrax

will be completed at the beginning of the third quarter. Consistent

with historical patterns, revenue and profitability in the first

quarter of 2024 are expected to be negatively impacted by the

winter season in the Northern Hemisphere and the budget cycles of

our national oil company customers. First quarter revenue is

expected to be within a range of $365 million and $375 million.

First quarter Adjusted EBITDA is expected to be within a range of

$63 million and $73 million and Adjusted EBITDA margin is expected

to be approximately 18%.”

Notable Awards and

Achievements

Expro was named Energy Transition Pioneer of the Year at the OWI

Global Awards 2023, recognizing its commitment to sustainable

energy solutions. This recognition reflects Expro’s proactive

efforts to contribute to a cleaner and more sustainable future. The

company also won Intervention Champion of the Year recognizing

Expro's commitment to Subsea Well Access. In 2023 we achieved over

40 years of Subsea Test Tree Assemblies (“SSTTA”) operations and

more than 3,000 subsea deployments across exploration and

appraisal, completion, and intervention applications, building a

strong reputation and market share that is supported by the

industry’s largest large-bore global SSTTA fleet.

Expro’s Tubular Running Services (“TRS”) business accomplished

an industry milestone in the U.S. Gulf of Mexico by successfully

completing an operator’s well using a fully non-marking completion

running package – a significant achievement in the field.

This tubular running package provides the industry’s only truly

non-marking tubular running solution, which helps preserve well

integrity and extends the life cycle of the well. This was also the

first deployment of the Collar Load Support (CLS™) System for

Stands in the region, in which the performance of the system

exceeded customer expectations. The success of this completion run

was the culmination of extensive planning and testing and is

another example of Expro’s ability to provide solutions and

positive results for the industry’s most complex wells.

Expro has been awarded a Corporate Frame Agreement to deliver

well testing services for Equinor in the Norwegian Continental

Shelf. The four-year contract, with the potential of three two-year

options, builds on Expro’s previous seven-year agreement. The scope

of work includes well flow management and production optimization

services to enhance Equinor’s assets across completion,

intervention, production, and abandonment operations.

Building on the Corporate Frame Agreement, the work scope will

see the delivery of hydraulic intervention well services using

Expro’s innovative CoilHose™ Light Well Circulation System (“LWCS”)

that is designed to provide a more efficient and lower operational

carbon footprint approach to operations. A significant portion of

the contract is directly linked to a demonstrable commitment to a

low carbon plan, allowing Expro to implement its environmental

capabilities with Equinor and further enhance the strength and

depth of this partnership.

In the Middle East and North Africa, Expro’s Automated Bucking

and Catwalk system delivered improved safety and record efficiency

at one of its client’s challenging wells. Expro was contracted to

provide a high quality, low risk tubular running services to its

clients’ onshore fleet of drilling rigs. Marking an operational

first for the triple catwalk in the United Arab Emirates, on the

first deployment of its TRS system, Expro set a record for

instantaneous tripping speed and the second-best performance

overall tripping speed on 18 5/8” tubulars. The overall rate was

more than twice that of the average run in the same field. The

client extended their appreciation to the TRS crew along with the

rig team for concluding a very challenging 18 5/8” job with reduced

safety exposure to personnel and a green safety record.

Finally, in the Asia Pacific region, Expro completed the deepest

deployment of MK VI CoilHose™, coupled with a successful N2 lifting

application in a remote location offshore New Zealand. This marked

the first-ever MK VI CoilHose™ deployment in APAC, reaching an

impressive depth of 8,650 feet (2,637 meters), surpassing depths

achieved globally by 25%. The CoilHose™ solution provided a swift

rig-up time compared to traditional coil tubing, minimizing

planning and operational duration. This streamlined approach not

only reduces safety risks but also lessens the environmental impact

during well interventions.

Segment Results

Unless otherwise noted, the following discussion compares the

quarterly results for the fourth quarter of 2023 to the results for

the third quarter of 2023.

North and Latin America (NLA)

Revenue for the NLA segment was $145 million for the three

months ended December 31, 2023, an increase of $40 million, or 38%,

compared to $105 million for the three months ended September 30,

2023. The increase was primarily due to additional subsea well

access revenue following the acquisition of PRT Offshore at the

beginning of the fourth quarter, higher well flow management

revenue in Mexico, and higher well construction revenue in the U.S.

due to increased customer activity.

Segment EBITDA for the NLA segment was $44 million, or 30% of

revenues, during the three months ended December 31, 2023, compared

to $20 million, or 19% of revenues, during the three months ended

September 30, 2023. The increase of $24 million in Segment EBITDA

was attributable to higher activity and the increase in Segment

EBITDA margin was attributable to a more favorable activity mix

during the three months ended December 31, 2023.

Europe and Sub-Saharan Africa (ESSA)

Revenue for the ESSA segment was $134 million for the three

months ended December 31, 2023, a decrease of $1 million, or 1%,

compared to $135 million for the three months ended September 30,

2023. The decrease in revenues was primarily driven by lower well

flow management revenue in Congo, partially offset by higher well

flow management and subsea well access revenue in Equatorial

Guinea.

Segment EBITDA for the ESSA segment was $41 million, or 31% of

revenues, for the three months ended December 31, 2023, an increase

of $2 million, or 5%, compared to $39, or 29% of revenues, for the

three months ended September 30, 2023. The increase in Segment

EBITDA and Segment EBITDA margin was primarily attributable to a

more favorable activity mix during the three months ended December

31, 2023.

Middle East and North Africa (MENA)

Revenue for the MENA segment was $65 million for the three

months ended December 31, 2023, an increase of $7 million, or 13%,

compared to $58 million for the three months ended September 30,

2023. The increase in revenue was driven by higher well flow

management services revenue in Algeria and the Kingdom of Saudi

Arabia and by higher well construction revenue in Morocco.

Segment EBITDA for the MENA segment was $21 million, or 33% of

revenues, for the three months ended December 31, 2023, an increase

of $4 million, or 26%, compared to $17 million, or 29% of revenues,

for the three months ended September 30, 2023. The increase in

Segment EBITDA and Segment EBITDA margin was primarily due to

higher activity and a more favorable activity mix during the three

months ended December 31, 2023.

Asia Pacific (APAC)

Revenue for the APAC segment was $62 million for the three

months ended December 31, 2023, a decrease of $9 million, or 13%,

compared to $71 million for the three months ended September 30,

2023. The decrease in revenue was primarily due to lower subsea

well access revenue in Australia, where we suspended

vessel-deployed LWI operations, and China, partially offset by

higher subsea well access revenue in Malaysia and well flow

management revenue in Malaysia and Australia.

Segment EBITDA for the APAC segment was $5 million, or 9% of

revenues, for the three months ended December 31, 2023, an increase

of $9 million compared to ($4) million, or (6)% of revenues, for

the three months ended September 30, 2023. The increase in Segment

EBITDA (despite the decrease in revenues) was primarily due to

lower costs within our LWI business during the three months ended

December 31, 2023 compared to the three months ended September 30,

2023. For the three months ended December 31, 2023, APAC Segment

EBITDA includes unrecoverable LWI-related costs of $4 million.

Segment EBITDA for the three months ended September 31, 2023

includes unrecoverable LWI-related costs of $15 million. Excluding

unrecoverable LWI-related costs, Segment EBITDA for the fourth and

third quarter of 2023 would have been $9 million or 15% of revenue

and $11 million or 15% of revenue, respectively.

Other Financial

Information

The Company’s capital expenditures totaled $37 million in the

fourth quarter of 2023 and approximately $122 million for the full

year 2023. Expro plans for capital expenditures in the range of

approximately $130 million to $140 million for 2024.

As of December 31, 2023, Expro’s consolidated cash and cash

equivalents, including restricted cash, totaled $152 million. The

Company had outstanding debt of $20 million as of December 31,

2023. The Company’s total liquidity as of December 31, 2023 was

$299 million. Total liquidity includes $147 million available for

drawdowns as loans under the Company’s revolving credit

facility.

Depreciation and amortization expense was $63 million for the

fourth quarter of 2023 compared to $37 million for the third

quarter of 2023. The increase was primarily due to $19 million of

accelerated depreciation expense related to the subsea module

(“SSM”) of Expro’s vessel-deployed LWI system and related

equipment.

On October 25, 2023, the Company’s Board of Directors (the

“Board”) approved an extension to the stock repurchase program

first approved on June 16, 2022. Pursuant to the extended stock

repurchase program, the Company is authorized to acquire up to $100

million of its outstanding common stock from October 25, 2023

through November 24, 2024. During the year ended December 31, 2023,

under the Stock Repurchase Program we repurchased approximately 1

million shares of our common stock at an average price of $16.70

for a total cost of approximately $20 million, including shares

repurchased prior to the extension of the Stock Repurchase Program.

During the year ended December 31, 2022, we repurchased 1 million

shares at an average price of $11.81 per share, for a total cost of

$13 million under the preceding program.

Expro’s provision for income taxes was $13 million for both the

fourth quarter of 2023 and the prior quarter primarily due to a

similar mix of taxable profits between jurisdictions. The Company’s

effective tax rate on a U.S. generally accepted accounting

principles (“GAAP”) basis for the three months and year ended

December 31, 2022 also reflects liability for taxes in certain

jurisdictions that tax on an other than pre-tax profits basis,

including so-called “deemed profits” regimes.

The financial measures provided that are not presented in

accordance with GAAP are defined and reconciled to their most

directly comparable GAAP measures. Please see “Use of Non-GAAP

Financial Measures” and the reconciliations to the nearest

comparable GAAP measures.

Additionally, downloadable financials are available on the

Investor section of www.expro.com.

Conference Call

The Company will host a conference call to discuss fourth

quarter 2023 results on Wednesday, February 21, 2024, at 12:00 p.m.

Central Time (1:00 p.m. Eastern Time).

Participants may also join the conference call by dialing:

US: +1 (833) 470-1428 International: +1 (929)

526-1599 Access ID: 108879

To listen via live webcast, please visit the Investor section of

www.expro.com.

The fourth quarter 2023 Investor Presentation is available on

the Investor section of www.expro.com.

An audio replay of the webcast will be available on the Investor

section of the Company’s website approximately three hours after

the conclusion of the call and will remain available for a period

of approximately 12 months.

To access the audio replay telephonically:

Dial-In: US +1 (866) 813-9403 or +1 (929)

458-6194 Access ID: 849637 Start Date: February 21, 2024, 1:00 p.m.

CT End Date: March 6, 2024, 10:59 p.m. CT

A transcript of the conference call will be posted to the

Investor relations section of the Company’s website after the

conclusion of the call.

ABOUT EXPRO

Working for clients across the entire well life cycle, Expro is

a leading provider of energy services, offering cost-effective,

innovative solutions and best-in-class safety and service quality.

The Company’s extensive portfolio of capabilities spans well

construction, well flow management, subsea well access, and well

intervention and integrity.

With roots dating to 1938, Expro has more than 8,000 employees

and provides services and solutions to leading energy companies in

both onshore and offshore environments in approximately 60

countries.

For more information, please visit: www.expro.com and connect

with Expro on X (formerly Twitter) @ExproGroup and LinkedIn

@Expro.

Forward Looking

Statements

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. All statements, other

than statements of historical facts, included in this release that

address activities, events or developments that the Company

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Without limiting the generality of

the foregoing, forward-looking statements contained in this release

include statements, estimates and projections regarding the

Company’s future business strategy and prospects for growth, cash

flows and liquidity, financial strategy, budget, projections,

guidance, operating results, environmental, social and governance

goals, targets and initiatives, estimates and projections regarding

the outcome and benefits of the proposed Coretrax acquisition, the

Company’s ability to achieve the anticipated synergies as a result

of the proposed Coretrax acquisition and the timing of the closing

of the proposed Coretrax acquisition. These statements are based on

certain assumptions made by the Company based on management’s

experience, expectations and perception of historical trends,

current conditions, anticipated future developments and other

factors believed to be appropriate. Forward-looking statements are

not guarantees of performance. Although the Company believes the

expectations reflected in its forward-looking statements are

reasonable and are based on reasonable assumptions, no assurance

can be given that these assumptions are accurate or that any of

these expectations will be achieved (in full or at all) or will

prove to have been correct. Moreover, such statements are subject

to a number of assumptions, risks and uncertainties, many of which

are beyond the control of the Company, which may cause actual

results to differ materially from those implied or expressed by the

forward-looking statements. Such assumptions, risks and

uncertainties include the amount, nature and timing of capital

expenditures, the availability and terms of capital, the level of

activity in the oil and gas industry, volatility of oil and gas

prices, unique risks associated with offshore operations (including

the ability to recover, and to the extent necessary, service and/or

economically repair any equipment located on the seabed),

political, economic and regulatory uncertainties in international

operations, the ability to develop new technologies and products,

the ability to protect intellectual property rights, the ability to

employ and retain skilled and qualified workers, the level of

competition in the Company’s industry, global or national health

concerns, including health epidemics, the possibility of a swift

and material decline in global crude oil demand and crude oil

prices for an uncertain period of time, future actions of foreign

oil producers such as Saudi Arabia and Russia, inflationary

pressures, the impact of current and future laws, rulings,

governmental regulations, accounting standards and statements, and

related interpretations, and other guidance.

Such assumptions, risks and uncertainties also include the

factors discussed or referenced in the “Risk Factors” section of

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023 that will be filed with the SEC, as well as other

risks and uncertainties set forth from time to time in the reports

the Company files with the SEC. Any forward-looking statement

speaks only as of the date on which such statement is made, and the

Company undertakes no obligation to correct or update any

forward-looking statement, whether as a result of new information,

future events, historical practice or otherwise, except as required

by applicable law, and we caution you not to rely on them

unduly.

Use of Non-GAAP Financial

Measures

This press release and the accompanying schedules include the

non-GAAP financial measures of Adjusted EBITDA, Adjusted EBITDA

margin, contribution, contribution margin, support costs, adjusted

cash flow from operations, cash conversion, adjusted net income

(loss), and adjusted net income (loss) per diluted share, which may

be used periodically by management when discussing financial

results with investors and analysts. The accompanying schedules of

this press release provide a reconciliation of these non-GAAP

financial measures to their most directly comparable financial

measure calculated and presented in accordance with GAAP. These

non-GAAP financial measures are presented because management

believes these metrics provide additional information relative to

the performance of the business. These metrics are commonly

employed by the management, financial analysts and investors to

evaluate the operating and financial performance of Expro from

period to period and to compare such performance with the

performance of other publicly traded companies within the industry.

You should not consider Adjusted EBITDA, Adjusted EBITDA margin,

contribution, contribution margin, support costs, adjusted cash

flow from operations, cash conversion, adjusted net income (loss)

and adjusted net income (loss) per diluted share in isolation or as

a substitute for analysis of Expro’s results as reported under

GAAP. Because Adjusted EBITDA, Adjusted EBITDA margin,

contribution, contribution margin, support costs, adjusted cash

flow from operations, cash conversion, adjusted net income (loss)

and adjusted net income (loss) per diluted share may be defined

differently by other companies in the industry, the presentation of

these non-GAAP financial measures may not be comparable to

similarly titled measures of other companies, thereby diminishing

their utility.

Expro defines Adjusted EBITDA as net income (loss) adjusted for

(a) income tax expense (benefit), (b) depreciation and amortization

expense, (c) impairment expense, (d) severance and other expense,

net, (e) stock-based compensation expense, (f) merger and

integration expense, (g) (gain) loss on disposal of assets, (h)

other (income) expense, net, (i) interest and finance (income)

expense, net and (j) foreign exchange (gain) loss. Adjusted EBITDA

margin reflects Adjusted EBITDA expressed as a percentage of

revenue.

Contribution is defined as total revenue less cost of revenue

excluding depreciation and amortization expense, adjusted for

indirect support costs and stock-based compensation expense

included in cost of revenue. Contribution margin is defined as

contribution divided by total revenue, expressed as a percentage.

Support costs is defined as indirect costs attributable to

supporting the activities of the operating segments, research and

engineering expenses and product line management costs included in

cost of revenue, excluding depreciation and amortization expense,

and general and administrative expense, excluding depreciation and

amortization expense, which represent costs of running the

corporate head office and other central functions, including

logistics, sales and marketing and health and safety, and does not

include foreign exchange gains or losses and other non-routine

expenses. Adjusted cash flow from operations is defined as net cash

provided by (used in) operating activities adjusted for cash paid

during the period for interest, net, severance and other expense

and merger and integration expense. Cash conversion is defined as

Adjusted cash flow from operations divided by Adjusted EBITDA.

The Company defines adjusted net income (loss) as net income

(loss) before merger and integration expense, severance and other

expense, stock-based compensation expense, and gain (loss) on

disposal of assets, adjusted for corresponding tax benefits of

these items. The Company defines adjusted net income (loss) per

diluted share as net income (loss) per diluted share before merger

and integration expense, severance and other expense, stock-based

compensation expense, and gain on disposal of assets, adjusted for

corresponding tax benefits of these items, divided by diluted

weighted average common shares.

Please see the accompanying financial tables for a

reconciliation of these non-GAAP measures to their most directly

comparable GAAP measures.

EXPRO GROUP HOLDINGS

N.V.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2023

2023

2022

2023

2022

Total revenue

$

406,750

$

369,818

$

350,966

$

1,512,764

$

1,279,418

Operating costs and expenses:

Cost of revenue, excluding depreciation

and amortization

(316,875

)

(315,825

)

(277,548

)

(1,241,295

)

(1,057,356

)

General and administrative expense,

excluding depreciation and amortization

(19,346

)

(15,437

)

(10,444

)

(64,254

)

(58,387

)

Depreciation and amortization expense

(62,874

)

(37,414

)

(34,538

)

(172,260

)

(139,767

)

Merger and integration expense

(5,432

)

(817

)

(4,996

)

(9,764

)

(13,620

)

Severance and other expense

(8,901

)

(1,897

)

(2,411

)

(14,388

)

(7,825

)

Total operating cost and expenses

(413,428

)

(371,390

)

(329,937

)

(1,501,961

)

(1,276,955

)

Operating (loss) income

(6,678

)

(1,572

)

21,029

10,803

2,463

Other income (expense), net

4,774

(1,129

)

1,477

1,234

3,149

Interest and finance expense, net

(2,255

)

(373

)

(3,468

)

(3,943

)

(241

)

(Loss) income before taxes and equity

in income of joint ventures

(4,159

)

(3,074

)

19,038

8,094

5,371

Equity in income of joint ventures

5,117

2,495

5,590

12,853

15,731

Income (loss) before income

taxes

958

(579

)

24,628

20,947

21,102

Income tax expense

(13,376

)

(13,307

)

(11,697

)

(44,307

)

(41,247

)

Net (loss) income

$

(12,418

)

$

(13,886

)

$

12,931

$

(23,360

)

$

(20,145

)

Net (loss) income per common

share:

Basic

$

(0.11

)

$

(0.13

)

$

0.12

$

(0.21

)

$

(0.18

)

Diluted

$

(0.11

)

$

(0.13

)

$

0.12

$

(0.21

)

$

(0.18

)

Weighted average common shares

outstanding:

Basic

110,325,863

108,777,429

108,743,078

109,161,453

109,072,761

Diluted

110,325,863

108,777,429

109,348,871

109,161,453

109,072,761

EXPRO GROUP HOLDINGS

N.V.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

December 31,

December 31,

2023

2022

Assets

Current assets

Cash and cash equivalents

$

151,741

$

214,788

Restricted cash

1,425

3,672

Accounts receivable, net

469,119

419,237

Inventories

143,325

153,718

Assets held for sale

-

2,179

Income tax receivables

27,581

26,938

Other current assets

58,409

44,975

Total current assets

851,600

865,507

Property, plant and equipment, net

513,222

462,316

Investments in joint ventures

66,402

66,038

Intangible assets, net

239,716

229,504

Goodwill

247,687

220,980

Operating lease right-of-use assets

72,310

74,856

Non-current accounts receivable, net

9,768

9,688

Other non-current assets

12,302

8,263

Total assets

$

2,013,007

$

1,937,152

Liabilities and stockholders’

equity

Current liabilities

Accounts payable and accrued

liabilities

$

326,125

$

272,704

Income tax liabilities

45,084

37,151

Finance lease liabilities

1,967

1,047

Operating lease liabilities

17,531

19,057

Other current liabilities

98,144

107,750

Total current liabilities

488,851

437,709

Long-term borrowings

$

20,000

-

Deferred tax liabilities, net

22,706

30,419

Post-retirement benefits

10,445

11,344

Finance lease liabilities

16,410

13,773

Operating lease liabilities

54,976

60,847

Uncertain tax positions

59,544

58,036

Other non-current liabilities

44,202

39,129

Total liabilities

717,134

651,257

Stockholders’ equity:

Common stock

8,062

7,911

Treasury Stock

(64,697

)

(40,870

)

Additional paid-in capital

1,909,323

1,847,078

Accumulated other comprehensive loss

22,318

27,549

Accumulated deficit

(579,133

)

(555,773

)

Total stockholders’ equity

1,295,873

1,285,895

Total liabilities and stockholders’

equity

$

2,013,007

$

1,937,152

EXPRO GROUP HOLDINGS

N.V.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Year Ended

December 31,

2023

2022

Cash flows from operating

activities:

Net loss

$

(23,360

)

$

(20,145

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization expense

172,260

139,767

Equity in income of joint ventures

(12,853

)

(15,731

)

Stock-based compensation expense

19,574

18,486

Changes in fair value of investments

-

1,199

Elimination of unrealized profit on sales

to joint ventures

4,159

-

Deferred taxes

(10,478

)

(1,326

)

Unrealized foreign exchange losses

5,658

6,116

Changes in fair value of contingent

consideration

576

-

Changes in assets and liabilities:

Accounts receivable, net

(34,895

)

(97,758

)

Inventories

10,575

(26,037

)

Other assets

(16,745

)

4,365

Accounts payable and accrued

liabilities

34,600

35,491

Other liabilities

(18,275

)

31,435

Income taxes, net

8,798

10,209

Dividends received from joint ventures

8,329

7,283

Other

(9,614

)

(13,185

)

Net cash provided by operating

activities

138,309

80,169

Cash flows from investing

activities:

Capital expenditures

(122,110

)

(81,904

)

Payment for acquired businesses, net of

cash acquired

(28,707

)

-

Acquisition of technology

-

(7,967

)

Proceeds from disposal of assets

2,013

7,279

Proceeds from sale / maturity of

investments

572

11,386

Net cash used in investing

activities

(148,232

)

(71,206

)

Cash flows from financing

activities:

Cash pledged for collateral deposits

(217

)

(70

)

Payments of loan issuance and other

transaction costs

-

(132

)

Proceeds from long-term borrowings

50,000

-

Repayment of long-term borrowings

(65,096

)

-

Repurchase of common stock

(20,024

)

(12,996

)

Payment of withholding taxes on

stock-based compensation plans

(2,559

)

(4,168

)

Repayment of financed insurance

premium

(9,317

)

(7,245

)

Repayments of finance leases

(2,126

)

(1,001

)

Net cash used in financing

activities

(49,339

)

(25,612

)

Effect of exchange rate changes on cash

and cash equivalents

(6,032

)

(4,738

)

Net decrease to cash and cash

equivalents and restricted cash

(65,294

)

(21,387

)

Cash and cash equivalents and restricted

cash at beginning of year

218,460

239,847

Cash and cash equivalents and

restricted cash at end of year

$

153,166

$

218,460

Supplemental disclosure of cash flow

information:

Cash paid for income taxes net of

refunds

$

(44,268

)

$

(33,171

)

Cash paid for interest, net

(2,177

)

(3,851

)

Change in accounts payable and accrued

expenses related to capital expenditures

(7,926

)

(14,721

)

EXPRO GROUP HOLDINGS

N.V.

SELECTED OPERATING SEGMENT

DATA

(In thousands)

(Unaudited)

Segment Revenue and Segment Revenue as

Percentage of Total Revenue:

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2023

2023

2022

2023

2022

NLA

$

145,490

36

%

$

105,252

28

%

$

131,684

38

%

$

511,800

34

%

$

499,813

39

%

ESSA

133,846

33

%

135,395

37

%

117,344

33

%

520,951

34

%

389,342

30

%

MENA

65,363

16

%

58,057

16

%

55,387

16

%

233,528

15

%

201,495

16

%

APAC

62,051

15

%

71,114

19

%

46,551

13

%

246,485

16

%

188,768

15

%

Total

$

406,750

100

%

$

369,818

100

%

$

350,966

100

%

$

1,512,764

100

%

$

1,279,418

100

%

Segment EBITDA(1), Segment EBITDA

Margin(2), Adjusted EBITDA and Adjusted EBITDA Margin(3):

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2023

2023

2022

2023

2022

NLA

$

44,325

30

%

$

19,967

19

%

$

35,153

27

%

$

132,869

26

%

$

135,236

27

%

ESSA

40,990

31

%

39,268

29

%

30,179

26

%

136,007

26

%

74,681

19

%

MENA

21,271

33

%

16,871

29

%

19,433

35

%

71,201

30

%

63,315

31

%

APAC (5)

5,337

9

%

(4,286

)

(6

)%

3,673

8

%

1,805

1

%

4,850

3

%

111,923

71,820

88,438

341,882

278,082

Corporate costs (4)

(31,894

)

(24,070

)

(23,954

)

(105,855

)

(87,580

)

Equity in income of joint ventures

5,117

2,495

5,590

12,853

15,731

Adjusted EBITDA

$

85,146

21

%

$

50,245

14

%

$

70,074

20

%

$

248,880

16

%

$

206,233

16

%

(1)

Expro evaluates its business segment

operating performance using Segment Revenue, Segment EBITDA and

Segment EBITDA Margin. Expro’s management believes Segment EBITDA

and Segment EBITDA Margin are useful operating performance measures

as they exclude transactions not related to its core operating

activities, corporate costs and certain non-cash items and allows

Expro to meaningfully analyze the trends and performance of its

core operations by segment as well as to make decisions regarding

the allocation of resources to segments.

(2)

Expro defines Segment EBITDA Margin as

Segment EBITDA divided by Segment Revenue, expressed as a

percentage.

(3)

Expro defines Adjusted EBITDA Margin as

Adjusted EBITDA divided by total revenue, expressed as a

percentage.

(4)

Corporate costs include the costs of

running our corporate head office and other central functions that

support the operating segments, including research, engineering and

development, logistics, sales and marketing and health and safety

and are not attributable to a particular operating segment.

(5)

APAC Segment EBITDA, excluding $4 million,

$15 million and $5 million, respectively, of unrecoverable

LWI-related costs during the three months ended December 31, 2023,

September 30, 2023 and December 31, 2022, would have been $9

million, $11 million, and $9 million, respectively, and APAC

Segment EBITDA margin would have been 15%, 15% and 18%,

respectively. APAC Segment EBITDA, excluding $36 million of

unrecoverable LWI-related costs during the year ended December 31,

2023 and $28 million of unrecoverable LWI-related costs during the

year ended December 31, 2022, would have been $38 million and $33

million, respectively, and APAC Segment EBITDA margin would have

been 15% and 17%, respectively.

EXPRO GROUP HOLDINGS

N.V.

REVENUE BY AREAS OF

CAPABILITIES

(In thousands)

(Unaudited)

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2023

2023

2022

2023

2022

Well construction

$

145,279

36

%

$

116,293

31

%

$

137,754

39

%

$

533,556

35

%

$

500,438

39

%

Well management (1)

261,471

64

%

253,525

69

%

213,212

61

%

979,208

65

%

778,980

61

%

Total

$

406,750

100

%

$

369,818

100

%

$

350,966

100

%

$

1,512,764

100

%

$

1,279,418

100

%

(1)

Well management consists of well flow

management, subsea well access, and well intervention and

integrity.

EXPRO GROUP HOLDINGS

N.V.

CONTRIBUTION, CONTRIBUTION

MARGIN AND SUPPORT COSTS

(In thousands)

(Unaudited)

Contribution(1) and Contribution

Margin(2):

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2023

2023

2022

2023

2022

Total revenue

$

406,750

$

369,818

$

350,966

$

1,512,764

$

1,279,418

Cost of revenue, excluding depreciation

and amortization

(316,875

)

(315,825

)

(277,548

)

(1,241,295

)

(1,057,356

)

Indirect costs (included in cost of

revenue)

67,175

62,772

60,324

251,373

238,846

Stock-based compensation expense

1,755

1,789

1,466

6,967

7,658

Direct costs (excluding depreciation and

amortization) (3)

(247,945

)

(251,264

)

(215,758

)

(982,955

)

(810,852

)

Contribution (5)

$

158,805

$

118,554

$

135,208

$

529,809

$

468,566

Contribution margin

39

%

32

%

39

%

35

%

37

%

Support Costs(4):

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2023

2023

2022

2023

2022

Cost of revenue (excluding depreciation

and amortization)

$

316,875

$

315,825

$

277,548

$

1,241,295

$

1,057,356

Direct costs (excluding depreciation and

amortization)

(247,945

)

(251,264

)

(215,758

)

(982,955

)

(810,852

)

Stock-based compensation expense

(1,755

)

(1,789

)

(1,466

)

(6,967

)

(7,658

)

Indirect costs (included in cost of

revenue)

67,175

62,772

60,324

251,373

238,846

General and administrative, (excluding

depreciation and amortization expense, foreign exchange, and other

non-routine costs)

11,782

7,961

10,333

42,531

39,030

Total support costs

$

78,957

$

70,733

$

70,657

$

293,904

$

277,876

Total support costs as a percentage of

revenue

19

%

19

%

20

%

19

%

22

%

(1)

Expro defines Contribution as Total

Revenue less Cost of Revenue, excluding depreciation and

amortization expense, adjusted for indirect support costs and

stock-based compensation expense included in Cost of Revenue.

(2)

Contribution margin is defined as

Contribution as a percentage of Revenue.

(3)

Direct costs include personnel costs,

sub-contractor costs, equipment costs, repairs and maintenance,

facilities, and other costs directly incurred to generate

revenue.

(4)

Support costs includes indirect costs

attributable to support the activities of the operating segments,

research and engineering expenses and product line management costs

included in Cost of revenue, and General and administrative

expenses representing costs of running our corporate head office

and other central functions, including, logistics, sales and

marketing and health and safety and does not include foreign

exchange gains or losses and other non-routine expenses.

(5)

Contribution, excluding $4 million, $15

million and $5 million, respectively, of unrecoverable LWI-related

costs during the three months ended December 31, 2023, September

30, 2023 and December 31, 2022, would have been $163 million, $134

million and $140 million respectively, and Contribution margin

would have been 40%, 36% and 40%, respectively. Contribution,

excluding $36 million of unrecoverable LWI-related costs during the

year ended December 31, 2023 and $28 million of unrecoverable

LWI-related costs during the year ended December 31, 2022, would

have been $566 million and $496 million, respectively, and

Contribution margin would have been 37% and 39%, respectively.

EXPRO GROUP HOLDINGS

N.V.

NON-GAAP FINANCIAL MEASURES

AND RECONCILIATION

(In thousands)

(Unaudited)

Adjusted EBITDA Reconciliation and

Adjusted EBITDA Margin:

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2023

2023

2022

2023

2022

Total revenue

$

406,750

$

369,818

$

350,966

$

1,512,764

$

1,279,418

Net (loss) income

$

(12,418

)

$

(13,886

)

$

12,931

$

(23,360

)

$

(20,145

)

Income tax expense

13,376

13,307

11,697

44,307

41,247

Depreciation and amortization expense

62,874

37,414

34,538

172,260

139,767

Severance and other expense

8,901

1,897

2,411

14,388

7,825

Merger and integration expense

5,432

817

4,996

9,764

13,620

Other (income) expense, net

(4,774

)

1,129

(1,477

)

(1,234

)

(3,149

)

Stock-based compensation expense

4,892

4,934

3,554

19,574

18,486

Foreign exchange loss (gain)

4,608

4,260

(2,044

)

9,238

8,341

Interest and finance expense, net

2,255

373

3,468

3,943

241

Adjusted EBITDA (1)

$

85,146

$

50,245

$

70,074

$

248,880

$

206,233

Adjusted EBITDA margin (1)

21

%

14

%

20

%

16

%

16

%

(1)

Excluding $4 million, $15 million and $5

million, respectively, of unrecoverable LWI-related costs during

the three months ended December 31, 2023, September 30, 2023 and

December 31, 2022, Adjusted EBITDA would have been $89 million, $65

million and $75 million, respectively, and Adjusted EBITDA margin

would have been 22%, 18%, and 21%, respectively. Excluding $36

million of unrecoverable LWI-related costs during the year ended

December 31, 2023 and $28 million of unrecoverable

LWI-related costs during the year ended December 31, 2022, Adjusted

EBITDA Margin would have been $285 million and $234 million,

respectively, and Adjusted EBITDA margin would have been 19% and

18%, respectively

EXPRO GROUP HOLDINGS

N.V.

NON-GAAP FINANCIAL MEASURES

AND RECONCILIATION

(In thousands)

(Unaudited)

Adjusted Cash Flow from Operations

Reconciliation:

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2023

2023

2022

2023

2022

Net cash provided by (used in) operating

activities

$

32,781

$

58,841

$

92,943

$

138,309

$

80,169

Cash paid during the period for interest,

net

721

910

961

2,177

3,851

Cash paid during the period for severance

and other expense

5,525

2,208

697

12,304

3,970

Cash paid during the period for merger and

integration expense

4,389

1,614

4,350

17,403

27,344

Adjusted Cash Flow from

Operations

$

43,416

$

63,573

$

98,951

$

170,193

$

115,334

Adjusted EBITDA

$

85,146

$

50,245

$

70,074

$

248,880

$

206,233

Cash conversion (1)

51

%

127

%

141

%

68

%

56

%

(1)

Expro defines Cash Conversion as Adjusted

Cash Flow from Operations divided by Adjusted EBITDA, expressed as

a percentage.

EXPRO GROUP HOLDINGS

N.V.

NON-GAAP FINANCIAL MEASURES

AND RECONCILIATION

(In thousands, except per

share amounts)

(Unaudited)

Reconciliation of Adjusted Net Income

(Loss) and Adjusted Net Income (Loss) per Diluted Share:

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

2023

2023

2022

2023

2022

Net (loss) income

$

(12,418

)

$

(13,886

)

$

12,931

$

(23,360

)

$

(20,145

)

Adjustments:

Merger and integration expense

5,432

817

4,996

9,764

13,620

Severance and other expense

8,901

1,897

2,411

14,388

7,825

Stock-based compensation expense

4,892

4,934

3,554

19,574

18,486

Total adjustments, before taxes

19,225

7,648

10,961

43,726

39,931

Tax benefit

-

-

(70

)

(43

)

(524

)

Total adjustments, net of taxes

19,225

7,648

10,891

43,683

39,407

Adjusted net income (loss) attributable

to company

$

6,807

$

(6,238

)

$

23,822

$

20,323

$

19,262

As reported diluted weighted average

common shares outstanding

110,325,863

108,777,429

109,348,871

109,161,453

109,072,761

As reported net loss per diluted share

$

(0.11

)

$

(0.13

)

$

0.12

$

(0.21

)

$

(0.18

)

Adjusted net income (loss) per diluted

share

$

0.06

$

(0.06

)

$

0.22

$

0.19

$

0.18

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221547118/en/

Chad Stephenson - Director Investor Relations +1 (713)

463-9776 InvestorRelations@expro.com

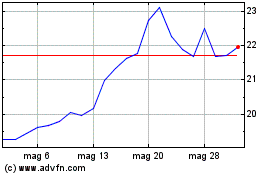

Grafico Azioni Expro Group Holdings NV (NYSE:XPRO)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Expro Group Holdings NV (NYSE:XPRO)

Storico

Da Gen 2024 a Gen 2025