Uniper Shares Rise After Hedging Activities Boost Performance

25 Ottobre 2023 - 10:26AM

Dow Jones News

By Giulia Petroni

Shares in Uniper rose on Wednesday after the bailed-out utility

said hedging transactions boosted performance in the first nine

months of the year and refined its outlook.

At 0734 GMT, the stock traded 6.2% higher at EUR4.33 after

soaring 11% at opening.

Based on preliminary results, the energy company expects to post

an adjusted net income of 3.74 billion euros ($3.96 billion) for

the period ended Sept. 30, while adjusted earnings before interest

and taxes are seen at EUR5.48 billion.

For the full year, Uniper now sees adjusted net income between

EUR4 billion and EUR5 billion, and adjusted EBIT in a range of EUR6

billion to EUR7 billion.

The utility said performance is benefiting from hedging

transactions tied to coal and gas power generation and its gas

midstream businesses.

Uniper was bailed out by the German government last year after

booking record losses due to Russian gas curtailments and

sky-rocketing prices on the spot market. It has since then taken

steps that pave the way to exit government ownership, including a

capital reduction to eliminate accumulated loss from 2022.

The state currently owns a 99.12% stake in the company.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

October 25, 2023 04:11 ET (08:11 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

Grafico Azioni Uniper (TG:UN01)

Storico

Da Mar 2024 a Apr 2024

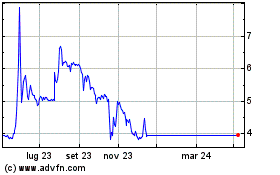

Grafico Azioni Uniper (TG:UN01)

Storico

Da Apr 2023 a Apr 2024