Baytex Announces Approval by Aurora Shareholders of its Acquisition

and Management Appointments

CALGARY, ALBERTA--(Marketwired - May 21, 2014) - Baytex Energy

Corp. ("Baytex") (TSX:BTE)(NYSE:BTE) provides an update on the

status of its proposed acquisition of all of the shares of Aurora

Oil & Gas Limited ("Aurora") pursuant to a scheme of

arrangement under Australian law (the "Arrangement"). At the scheme

meeting held on May 21, 2014 at 9:30 a.m. (Perth time), the

requisite majority of Aurora shareholders approved the

Arrangement.

Commenting on the shareholder vote, James Bowzer, President and

Chief Executive Officer, said: "We are very pleased to see that 88%

of Aurora shareholders voted in favor of the Arrangement and we

look forward to closing the Arrangement in the first half of

June."

Aurora will now apply to the Federal Court of Australia for

orders approving the Arrangement at a hearing scheduled for May 26,

2014. If the Arrangement is approved by the Court, Aurora expects

to lodge the Court orders approving the Arrangement with the

Australian Securities Investment Commission on Tuesday, May 27,

2014. Once this has occurred, trading in Aurora shares is expected

to cease at the close of trade on May 27, 2014 on the Australian

Securities Exchange and at the open of trade on May 27, 2014 on the

Toronto Stock Exchange.

Based on cash consideration payable for Aurora of A$4.20

(Australian dollars) per share, the total purchase price is

estimated at $2.8 billion (including the assumption of

approximately $0.9 billion of indebtedness). The acquisition

enhances our growth and income business model, delivers production

and reserves per share growth and provides attractive capital

efficiencies for future investment. The acquisition is accretive to

our funds from operations while maintaining a strong balance

sheet.

We are acquiring premier acreage in the core of the liquids-rich

Eagle Ford, one of the leading shale oil plays in North America.

Aurora's primary asset consists of 22,200 net contiguous acres in

the prolific Sugarkane Field located in South Texas. Aurora's first

quarter 2014 gross production was 28,671 boe/d (81% liquids) of

predominantly light, high-quality crude oil.

The Sugarkane Field has been largely delineated with

infrastructure in place which is expected to facilitate future

annual production growth. In addition, these assets have

significant future reserves upside potential from well downspacing,

improving completion techniques and new development targets in

additional zones.

To finance the acquisition of Aurora, we completed the issuance

of 38,433,000 subscription receipts at $38.90 each on February 24,

2014, raising gross proceeds of approximately $1.5 billion. The

subscription receipts currently trade on the Toronto Stock Exchange

under the symbol BTE.R.

Each subscription receipt entitles the holder thereof to

receive, on closing of the acquisition of Aurora, one common share

of Baytex. Upon closing of the acquisition, the holders of the

subscription receipts will be entitled to receive an amount per

subscription receipt equal to the dividends declared per common

share from the date of closing of the financing to the date of

closing of the acquisition. That amount is expected to be $0.88 per

subscription receipt, representing the four dividends declared from

the date of closing of the financing to the date of anticipated

closing of the acquisition.

We are committed to a growth and income model and its three

fundamental principles: delivering organic production growth,

paying a meaningful dividend and maintaining capital discipline.

Through the combination of an expanded inventory of high capital

efficiency projects and an improved outlook for heavy oil

differentials, we remain confident in our business plan going

forward. Accordingly, we have committed to increase the monthly

dividend on our common shares by 9% to $0.24 from $0.22 per share,

subject to the completion of the Arrangement. Based on the

anticipated closing date, the dividend increase is expected to take

effect for the dividend payable to holders of record on June 30,

2014.

Management Appointments

Baytex announces that Mr. Raymond Chan is appointed

non-executive Chairman of the Board of Directors. Mr. Chan will

continue to assist management in key strategic issues and

facilitate operations of the board of directors.

The Board of Directors is pleased to announce the promotion of

Mr. Richard Ramsay to the position of Chief Operating Officer. Mr.

Ramsay joined Baytex as Vice President, Heavy Oil in January 2010,

with responsibilities for all heavy oil assets in Saskatchewan and

Alberta, including the company's core activities in the Peace River

region. In January 2012, Mr. Ramsay was appointed Vice President,

Alberta / B.C. Business Unit, which resulted in the combination of

the companies Peace River heavy oil assets with its conventional

properties in Alberta and British Columbia.

Mr. Ramsay is an accomplished executive, with over 25 years of

extensive experience in technical and managerial roles in oil and

gas development, operations, marketing and acquisitions. Under his

direction, production at Peace River has increased substantially

from 9,000 Bbl/d to its current level of approximately 26,000

Bbl/d. Mr. Ramsay has a Bachelor of Science degree with Distinction

in Mechanical Engineering from the University of Saskatchewan and

is a practicing member of the Association of Professional

Engineers, Geologists and Geophysicists of Alberta.

After over five years with Baytex, Marty Proctor the company's

COO will be leaving to pursue other opportunities. We appreciate

Mr. Proctor's significant contributions and wish him the best in

his future endeavors.

The Board of Directors is also pleased to announce the promotion

of Mr. Ryan Johnson to the position of Vice President, Alberta /

B.C. Business Unit. Mr. Johnson joined Baytex in 2007 focusing on

technical responsibilities in northeast Alberta and southern

Saskatchewan, including the planning and execution of the company's

successful thermal SAGD project at Kerrobert. In January 2011, he

was appointed Senior Geologist of the Peace River region and has

been an integral member of the team responsible for the planning,

coordination and execution of multi-lateral exploitation and

thermal development of this top tier resource. In mid-2013, Mr.

Johnson was appointed Lead Geologist and charged with managing all

key activities across the entire Alberta / B.C. business unit.

Mr. Johnson is an accomplished leader with over fifteen years of

extensive technical and managerial roles in oil and gas

exploration, development, operations and prospect identification.

Mr. Johnson has a Bachelor of Science Degree (Honours) in Geology

and Oceanography from the University of British Columbia and is a

practicing member of the Association of Professional Engineers and

Geoscientists of Alberta.

The Board of Directors is also pleased to announce that Mr.

Michael Verm, current Chief Operating Officer of Aurora, will be

joining Baytex contingent on the closing of the acquisition of

Aurora, as Vice President and Managing Director of our Eagle Ford

operations. Mr. Verm has over 30 years of experience within the oil

and gas industry and has held a number of senior executive

positions in North America and internationally. Mr. Verm, a

registered professional engineer in Texas, graduated from Texas

A&M with a petroleum engineering degree and received his MBA

from Oklahoma City University. The addition of Mr. Verm to the

Baytex leadership team will help to ensure a smooth transition with

the Eagle Ford asset and personnel on closing of the Aurora

acquisition.

In addition, Mr. Geoffrey Darcy has been promoted to the

position of Senior Vice President, Marketing and Mr. Brian Ector

has been promoted to the position of Senior Vice President, Capital

Markets and Public Affairs. Mr. Darcy joined Baytex in 2011 and was

previously Vice President, Marketing. Mr. Ector joined Baytex in

2009 and was previously Vice President, Capital Markets.

Advisory Regarding

Forward-Looking Statements

All amounts are in Canadian dollars unless otherwise

noted.

In the interest of providing Baytex's shareholders and

potential investors with information regarding Baytex, including

management's assessment of Baytex's future plans and operations,

certain statements in this press release are "forward-looking

statements" within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and "forward-looking

information" within the meaning of applicable Canadian securities

legislation (collectively, "forward-looking statements"). In some

cases, forward-looking statements can be identified by terminology

such as "anticipate", "believe", "continue", "could", "estimate",

"expect", "forecast", "intend", "may", "objective", "ongoing",

"outlook", "potential", "project", "plan", "should", "target",

"would", "will" or similar words suggesting future outcomes, events

or performance. The forward-looking statements contained in this

press release speak only as of the date thereof and are expressly

qualified by this cautionary statement.

Specifically, this press release contains forward-looking

statements relating to but not limited to: our business strategies,

plans and objectives; the anticipated benefits from the acquisition

of Aurora, including our beliefs that the acquisition will be an

excellent fit with our business model and will provide shareholders

with exposure to projects with attractive capital efficiencies; our

expectations that the Aurora assets have infrastructure in place

that support future annual production growth and that such assets

will provide material production, long-term growth and high quality

reserves with upside potential; anticipated effect of the

acquisition of Aurora on us, including our funds from operations;

our expectations regarding the effect of well downspacing,

improving completion techniques and new development targets on the

reserves potential of the Aurora assets; the timing of completion

of the acquisition of Aurora; our plans to establish new revolving

credit facilities and a term loan for us and a borrowing base

facility for Aurora's U.S. subsidiary following

closing of the Arrangement; payment of the purchase price for the

acquisition of Aurora, including the use of proceeds from the

subscription receipt financing and our plans to draw on the new

revolving credit facilities and term loan; and our plan to increase

the dividend on our common shares upon completion of the

acquisition of Aurora. Cash dividends on our common shares are paid

at the discretion of our Board of Directors and can fluctuate. In

establishing the level of cash dividends, the Board of Directors

considers all factors that it deems relevant, including, without

limitation, the outlook for commodity prices, our operational

execution, the amount of funds from operations and capital

expenditures and our prevailing financial circumstances at the

time.

These forward-looking statements are based on certain key

assumptions regarding, among other things: the receipt of

regulatory, court and shareholder approvals for the Arrangement;

our ability to execute and realize on the anticipated benefits of

the acquisition of Aurora; petroleum and natural gas prices and

pricing differentials between light, medium and heavy gravity crude

oil; well production rates and reserve volumes; our ability to add

production and reserves through our exploration and development

activities; capital expenditure levels; the receipt, in a timely

manner, of regulatory and other required approvals for our

operating activities; the availability and cost of labour and other

industry services; the amount of future cash dividends that we

intend to pay; interest and foreign exchange rates; the continuance

of existing and, in certain circumstances, proposed tax and royalty

regimes; our ability to develop our crude oil and natural gas

properties in the manner currently contemplated; and current

industry conditions, laws and regulations continuing in effect (or,

where changes are proposed, such changes being adopted as

anticipated). Readers are cautioned that such assumptions, although

considered reasonable by Baytex at the time of preparation, may

prove to be incorrect.

Actual results achieved will vary from the information

provided herein as a result of numerous known and unknown risks and

uncertainties and other factors. Such factors include, but are not

limited to: the acquisition of Aurora may not be completed on the

terms contemplated or at all; failure to realize the anticipated

benefits of the acquisition of Aurora; closing of the acquisition

of Aurora could be delayed or not completed if we are unable to

obtain the necessary regulatory, court and shareholder approvals

for the Arrangement or any other approvals required for completion

or, unless waived, some other condition to closing is not

satisfied; failure to put in place a borrowing base facility for

Aurora's U.S. subsidiary following completion of the Arrangement;

declines in oil and natural gas prices; risks related to the

accessibility, availability, proximity and capacity of gathering,

processing and pipeline systems; variations in interest rates and

foreign exchange rates; risks associated with our hedging

activities; uncertainties in the credit markets may restrict the

availability of credit or increase the cost of borrowing;

refinancing risk for existing debt and debt service costs; a

downgrade of our credit ratings; the cost of developing and

operating our assets; risks associated with the exploitation of our

properties and our ability to acquire reserves; changes in

government regulations that affect the oil and gas industry;

changes in income tax or other laws or government incentive

programs; uncertainties associated with estimating petroleum and

natural gas reserves; risks associated with acquiring, developing

and exploring for oil and natural gas and other aspects of our

operations; risks associated with large projects or expansion of

our activities; risks related to heavy oil projects; changes in

environmental, health and safety regulations; the implementation of

strategies for reducing greenhouse gases; depletion of our

reserves; risks associated with the ownership of our securities,

including the discretionary nature of dividend payments and changes

in market-based factors; risks for United States and other

non-resident shareholders, including the ability to enforce civil

remedies, differing practices for reporting reserves and

production, additional taxation applicable to non-residents and

foreign exchange risk; and other factors, many of which are beyond

our control. These and additional risk factors are discussed in our

Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2013, as filed with Canadian securities regulatory authorities

and the U.S. Securities and Exchange Commission.

The above summary of assumptions and risks related to

forward-looking statements in this press release has been provided

in order to provide shareholders and potential investors with a

more complete perspective on Baytex's current and future operations

(if the acquisition of Aurora is completed) and such information

may not be appropriate for other purposes. There is no

representation by Baytex that actual results achieved will be the

same in whole or in part as those referenced in the forward-looking

statements and Baytex does not undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities

law.

Baytex Energy Corp.

Baytex Energy Corp. is a dividend-paying oil and gas corporation

based in Calgary, Alberta. The company is engaged in the

acquisition, development and production of crude oil and natural

gas in the Western Canadian Sedimentary Basin and in the Williston

Basin in the United States. Approximately 89% of Baytex's

production is weighted toward crude oil. Baytex pays a monthly

dividend on its common shares which are traded on the Toronto Stock

Exchange and the New York Stock Exchange under the symbol BTE. The

subscription receipts issued by Baytex to fund a portion of the

purchase price for Aurora Oil & Gas Limited trade on the

Toronto Stock Exchange under the symbol BTE.R.

Baytex Energy Corp.Brian EctorSenior Vice President, Capital

Markets and Public AffairsToll Free Number:

1-800-524-5521investor@baytexenergy.comwww.baytexenergy.com

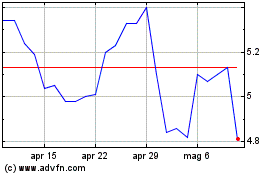

Grafico Azioni Baytex Energy (TSX:BTE)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Baytex Energy (TSX:BTE)

Storico

Da Feb 2024 a Feb 2025