B2Gold Completes Upsized Offering of Convertible Senior Notes

28 Gennaio 2025 - 11:00PM

B2Gold Corp. (TSX: BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold” or

the “Company”) has closed its previously announced offering of

2.75% convertible senior unsecured notes due 2030 (the “Notes”) in

an aggregate principal amount of US$460 million (the “Offering”),

which includes exercise of the full amount of the option to

purchase an additional US$60 million aggregate principal amount of

Notes. The initial conversion rate for the Notes is 315.2088 common

shares of the Company (“Shares”) per US$1,000 principal amount of

Notes, equivalent to an initial conversion price of approximately

US$3.17 per Share.

The Company intends to use the net proceeds from

the Offering to fund working capital requirements and for general

corporate purposes. In order to reduce interest expense, the

Company will initially apply the net proceeds to pay down the

outstanding balance under the Company’s revolving credit facility

(the “Revolving Credit Facility”) and then subsequently use future

draws on the Revolving Credit Facility to fund such working capital

requirements and for general corporate purposes.

In connection with the Offering, B2Gold entered

into a cash settled total return swap with respect to approximately

US$50 million of Shares with one of the initial purchasers of the

Notes. The total return swap is intended to give B2Gold economic

exposure to its Shares during the term of the total return swap,

which is expected to be approximately one month. In connection with

establishing its initial hedge of the total return swap, B2Gold has

been advised that the total return swap counterparty or its

affiliate has purchased Shares at the close of trading on January

23, 2025. Such purchases may have, or have had, the effect of

increasing (or reducing the size of any decrease in) the market

price of the Shares. Any unwind of such hedge positions, including

at settlement of the total return swap, may have the effect of

decreasing (or reducing the size of any increase in) the market

price of the Shares or the Notes.

The Notes and the Shares issuable upon the

conversion thereof have not been and will not be registered under

the U.S. Securities Act of 1933, as amended (the “Securities Act”),

or qualified by a prospectus in Canada. The Notes and the Shares

may not be offered or sold in the United States absent registration

under the Securities Act or an applicable exemption from

registration under the Securities Act.

This news release is neither an offer to sell

nor the solicitation of an offer to buy the Notes or any other

securities and shall not constitute an offer to sell or

solicitation of an offer to buy, or a sale of, the Notes or any

other securities in any jurisdiction in which such offer,

solicitation or sale is unlawful. The Notes were offered only to

“qualified institutional buyers” (as defined in Rule 144A under the

Securities Act). Offers and sales in Canada were made only pursuant

to exemptions from the prospectus requirements of applicable

Canadian securities laws.

About B2Gold

B2Gold is a low-cost international senior gold

producer headquartered in Vancouver, Canada. Founded in 2007,

today, B2Gold has operating gold mines in Mali, Namibia and the

Philippines, the Goose Project under construction in northern

Canada and numerous development and exploration projects in various

countries including Mali, Colombia and Finland.

ON BEHALF OF B2GOLD CORP.

“Clive T.

Johnson”President and Chief Executive

Officer

Source: B2Gold Corp.

This news release contains forward-looking

statements which constitute “forward-looking information” within

the meaning of applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995 (collectively, “Forward-looking Statements”). All

statements included herein, other than statements of historical

fact, are Forward-looking Statements and are subject to a variety

of known and unknown risks and uncertainties which could cause

actual events or results to differ materially from those reflected

in the Forward-looking Statements. The Forward-looking Statements

in this news release include, without limitation, statements

relating to the Offering, the anticipated use of proceeds and

certain statements related to the total return swap. These

Forward-looking Statements are based on certain assumptions that

B2Gold has made in respect thereof as at the date of this news

release. Often, but not always, these Forward-looking Statements

can be identified by the use of words such as “estimated”,

“potential”, “open”, “future”, “assumed”, “projected”, “used”,

“detailed”, “has been”, “gain”, “planned”, “reflecting”, “will”,

“anticipated”, “estimated” “containing”, “remaining”, “to be”, or

statements that events, “could” or “should” occur or be achieved

and similar expressions, including negative variations.

Forward-looking Statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of B2Gold to be

materially different from any results, performance or achievements

expressed or implied by the Forward-looking Statements. Such

uncertainties and factors include, without limitation, risks

relating to the need to satisfy the conditions set forth in the

purchase agreement for the Notes; the need to satisfy regulatory

and legal requirements with respect to the Offering; as well as

those factors discussed under “Risk Factors” in B2Gold’s Annual

Information Form for the fiscal year ended December 31, 2023, a

copy of which can be found on the Company’s profile on the SEDAR+

website at www.sedarplus.ca and on EDGAR at www.sec.gov/edgar.

Although B2Gold has attempted to identify important factors that

could cause actual actions, events or results to differ materially

from those described in Forward-looking Statements, there may be

other factors that cause actions, events or results to differ from

those anticipated, estimated or intended.

B2Gold’s forward-looking statements are based on

the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management at such time. B2Gold’s forward-looking

statements are based on the opinions and estimates of management

and reflect their current expectations regarding future events and

operating performance and speak only as of the date hereof. B2Gold

does not assume any obligation to update forward-looking statements

if circumstances or management's beliefs, expectations or opinions

should change other than as required by applicable law. There can

be no assurance that forward-looking statements will prove to be

accurate, and actual results, performance or achievements could

differ materially from those expressed in, or implied by, these

forward-looking statements. Accordingly, no assurance can be given

that any events anticipated by the forward-looking statements will

transpire or occur, or if any of them do, what benefits or

liabilities B2Gold will derive therefrom. For the reasons set forth

above, undue reliance should not be placed on forward-looking

statements.

Investor Relations:

Michael McDonald

VP, Investor Relations & Corporate Development

+1 604-681-8371

investor@b2gold.com

Cherry DeGeer

Director, Corporate Communications

+1 604-681-8371

investor@b2gold.com

Grafico Azioni B2Gold (TSX:BTO)

Storico

Da Dic 2024 a Gen 2025

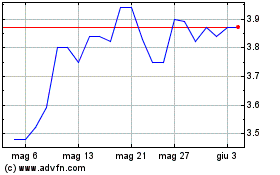

Grafico Azioni B2Gold (TSX:BTO)

Storico

Da Gen 2024 a Gen 2025