Guardian Capital LP (the “

Manager”) announces the

completion of certain fund mergers (the

“

Mergers”). At the close of business on November

3, 2023, the ETF series units of each fund identified as a Merging

ETF in the following table were exchanged for equivalent ETF series

units of the corresponding Continuing Fund and the ETF series units

of each Merging ETF were delisted from the Toronto Stock Exchange

(“

TSX”). Today, November 6, 2023, the ETF series

units of each Continuing Fund will be substitutionally listed on

the TSX under the same ticker.

|

Merging ETF |

Continuing Fund |

TSX Ticker(s) |

|

Guardian Directed Equity Path ETF |

Guardian Directed Equity Path Portfolio |

GDEP, GDEP.B |

|

Guardian Directed Premium Yield ETF |

Guardian Directed Premium Yield Portfolio |

GDPY, GDPY.B |

|

Guardian Canadian Bond ETF |

Guardian Canadian Bond Fund |

GCBD |

In each Merger, each Merging ETF transferred all

of its net assets to the corresponding Continuing Fund in return

for ETF series units of the Continuing Fund having an aggregate net

asset value equal to the value of the assets transferred to the

Continuing Fund. Immediately thereafter, each Merging ETF caused

all of its outstanding securities to be redeemed in exchange for

ETF series units of the corresponding Continuing Fund on a

one-for-one basis. This resulted in each unitholder of the Merging

ETF receiving the exact same number of equivalent ETF series units

of the Continuing Fund as it held in the Merging ETF prior to the

Merger. The Mergers occurred on a tax-deferred basis.

As a result of the Mergers, each Continuing Fund

now offers both mutual fund series units and ETF series units. In

each case, the investment objectives and the portfolio management

team for the Continuing Fund remain unchanged.

In addition, the Manager confirms that, on

November 3, 2023, unitholders of record in the Merging ETFs

received the final distributions shown in the following table (the

“Distributions”). This is an update to the

estimated final distributions previously announced on October 30,

2023.

|

Merging ETF |

Series of ETF Units |

TSX Ticker |

Final Distribution Amount (per ETF

Unit) |

|

Guardian Directed Equity Path ETF |

Hedged ETF Units |

GDEP |

$0 |

|

Guardian Directed Equity Path ETF |

Unhedged ETF Units |

GDEP.B |

$0 |

|

Guardian Directed Premium Yield ETF |

Hedged ETF Units |

GDPY |

$0 |

|

Guardian Directed Premium Yield ETF |

Unhedged ETF Units |

GDPY.B |

$0 |

|

Guardian Canadian Bond ETF |

ETF Units |

GCBD |

$0.0697 |

The Distributions were not paid in cash, but

were reinvested and the resulting ETF units immediately

consolidated so that the number of ETF units held by each

unitholder did not change. Unitholders who held their ETF units

outside of registered plans will have taxable amounts to report and

will have an increase in the adjusted cost base of their

investment.

About Guardian Capital

LPGuardian Capital LP is the manager and portfolio manager

of the Guardian Capital Funds and Guardian Capital ETFs, with

capabilities that span a range of asset classes, geographic regions

and specialty mandates. Additionally, Guardian Capital LP manages

portfolios for institutional clients such as defined benefit and

defined contribution pension plans, insurance companies,

foundations, endowments and investment funds. Guardian Capital LP

is a wholly owned subsidiary of Guardian Capital Group Limited and

the successor to its original investment management business, which

was founded in 1962. For further information on Guardian Capital

LP, please call 416-350-8899 or visit www.guardiancapital.com.

About Guardian Capital Group LimitedGuardian

Capital Group Limited (“Guardian”) is a global

financial services company, which provides extensive investment

management services to institutional, retail and private high and

ultra-high-net worth clients through its subsidiaries. As at June

30, 2023, Guardian had C$56.5 billion of total client assets, while

managing a proprietary investment portfolio with a fair market

value of C$1.27 billion. Founded in 1962, Guardian’s reputation for

steady growth, long-term relationships and its core values of

trustworthiness, integrity and stability have been key to its

success over six decades. Its Common and Class A shares are listed

on the Toronto Stock Exchange as GCG and GCG.A, respectively. To

learn more about Guardian, visit www.guardiancapital.com.

CONTACT INFORMATION Guardian Capital LP Richard

BritnellTelephone: +1-416-350-3117 Email:

rbritnell@guardiancapital.com

Guardian Capital LP Commerce Court West Suite

2700, 199 Bay Street PO Box 201 Toronto, Ontario M5L 1E8

Caution Concerning Forward-Looking

StatementsCertain information included in this press

release constitutes forward-looking information within the meaning

of applicable Canadian securities laws. All information other than

statements of historical fact may be forward-looking information.

Forward-looking information is often, but not always, identified by

the use of forward-looking terminology such as “outlook”,

“objective”, “may”, “will”, “would”, “expect”, “intend”,

“estimate”, “anticipate”, “believe”, “should”, “plan”, “continue”,

or similar expressions suggesting future outcomes or events or the

negative thereof. Forward-looking information in this press release

includes, but is not limited to, statements with respect to

management’s beliefs, plans, estimates, and intentions, and similar

statements concerning anticipated future events, results,

circumstances, performance or expectations. Such forward-looking

information reflects management’s beliefs and is based on

information currently available. Certain material factors and

assumptions were applied in providing this forward-looking

information. All forward-looking information in this press release

is qualified by the following cautionary statements.

Although the Manager believes that the

expectations reflected in such forward-looking information are

reasonable, such information involves known and unknown risks and

uncertainties which may cause the Manager’s actual performance and

results in future periods to differ materially from any estimates

or projections of future performance or results expressed or

implied by such forward-looking information. Important factors that

could cause actual results to differ materially include but are not

limited to: general economic and market conditions, including

interest rates, business competition, changes in government

regulations or in tax laws, the ongoing conflict in the Ukraine,

the failure to satisfy any applicable stock exchange requirements,

as well as those risk factors discussed or referred to in the

Continuing Funds’ prospectus and the disclosure documents filed by

the Manager with the securities regulatory authorities in certain

provinces of Canada and available at www.sedarplus.ca. The reader

is cautioned to consider these factors, uncertainties and potential

events carefully and not to put undue reliance on forward-looking

information, as there can be no assurance that actual results will

be consistent with such forward-looking information.

The forward-looking information contained in

this press release is presented as of the preparation date of this

press release and should not be relied upon as representing the

Manager’s views as of any date subsequent to the date of this press

release. The Manager undertakes no obligation, except as required

by applicable law, to publicly update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise.

This communication is intended for informational

purposes only and does not constitute an offer to sell or the

solicitation of an offer to purchase Continuing Funds and is not,

and should not be construed as, investment, tax, legal or

accounting advice, and should not be relied upon in that regard.

Commissions, management fees and expenses all may be associated

with investments in Continuing Funds. Please read the prospectus

before investing. Exchange-traded funds (“ETFs”)

and mutual funds are not guaranteed, their values change frequently

and past performance may not be repeated. You will usually pay

brokerage fees to your dealer if you purchase or sell units of an

ETF on the TSX. If the units are purchased or sold on the TSX,

investors may pay more than the current net asset value when buying

units of the ETF and may receive less than the current net asset

value when selling them.

All trademarks, registered and unregistered, are owned by

Guardian Capital Group Limited and are used under licence.

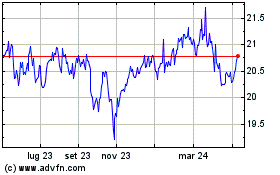

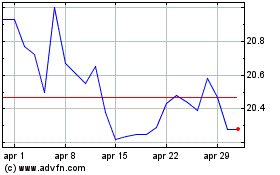

Grafico Azioni Guardian Directed Premiu... (TSX:GDPY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Guardian Directed Premiu... (TSX:GDPY)

Storico

Da Apr 2023 a Apr 2024