REPEAT: Treasury Metals' Preliminary Economic Assessment Confirms Potential Economic Viability for Goliath Gold Project

14 Luglio 2010 - 1:01PM

Marketwired Canada

Treasury Metals Inc. ("Treasury" or the "Company") (TSX:TML) is pleased to

announce the results of a National Instrument 43-101 ("NI 43-101") compliant

Preliminary Economic Assessment ("PEA") on its wholly-owned Goliath Gold Project

located about 20 kilometres east of the City of Dryden, Ontario. The PEA was

completed by independent consultant A.C.A. Howe International Limited ("Howe").

Scott Jobin-Bevans, Treasury's President and CEO, commented, "I am very pleased

that Howe has validated the Project and our exploration efforts to date. This

initial analysis of the Thunder Lake gold deposit, which only contemplates about

50% of the current contained ounces, already demonstrates its economic potential

and provides us with the parameters necessary to develop the Project and

increase its economic profile." He added, "In anticipation of the positive

results from this study, we began targeted infill drilling during the recent

drilling program in order to upgrade the inferred resources to the indicated

category. Our focus will now turn to implementing the recommendations contained

in the PEA in an effort to move the Project towards development and ultimately

into production."

Goliath Gold PEA Highlights

- Howe concludes that the Project has potential economic viability under

base case assumptions.

- Surface and underground mining operations with stand-alone

gravity/flotation milling complex.

- Approximately 390,000 ounces Au recovered over 8 1/2 years at a production

rate of 1,500 tonnes per day; average annual recovery of 48,000 ounces Au.

- At US$850 per oz (base case gold spot price): after-tax NPV@5% of $23

million and IRR of 15%.

- At US$1,200 per oz (current gold spot price): after-tax NPV@5% of $91

million and IRR of 43%.

- Estimated initial capital expenditure of $76 million; Life of Mine capital

expenditure of $117 million; and, payback period of 4 years at US$850 per

ounce gold, or 2 1/2 years at US$1,200 per ounce gold.

Howe concludes that Treasury should continue to advance the Project toward

Pre-Feasibility, recommending:

- Infill drilling to upgrade Inferred Resources to Indicated Resources,

aimed at increasing total gold ounces to be considered in future

economic/production models.

- Collect material for further metallurgical test work to include gravity,

flotation and cyanidation mineral processing, optimised to confirm

recoveries used in the economic model.

- Collect geotechnical information to be used for surface and underground

mine planning.

- Optimization of economic model by investigating purchase of a used mill

instead of construction of new mill.

- Initiation of Environmental Baseline studies as soon as possible.

Dr. Jobin-Bevans continued, "Drill results to date have been consistent in

substantiating the potential of the deposit and our plan is to further evaluate

and develop the known gold resources on the Goliath Gold project. In addition to

the recommendations outlined in the PEA, we will work to expand the surface and

underground resources along strike to the west and northeast of the deposit

where we have seen excellent historical high-grade intercepts. We will also

continue to target the potential high-grade underground resources below 800

metres depth where our recent drilling has shown excellent potential."

Commenting on the region, he added, "We have long believed in the potential of

the Kenora Gold District and we look forward to potentially building a mill and

mine in the area as we also work towards realizing the benefits of consolidating

this extensive and prospective gold region in northwestern Ontario."

Economic Sensitivity

The base case considers the development of surface and underground mining

operations on the Thunder Lake gold deposit and a stand-alone gravity/flotation

milling complex at the Goliath Gold Project. Howe concludes that under base case

assumptions of 1,500 tonnes per day production and US$850 per ounce gold, and

assuming 100% equity financing and an even exchange rate against the US$, the

Project has potential economic viability with an after-tax Internal Rate of

Return ("IRR") of 15%, a 5% discounted Net Present Value ("NPV") of $23 million

and an estimated payback period of four years.

The following table summarizes the results of the PEA, assuming a production

rate of 1,500 tonnes per day:

----------------------------------------------------------------------------

Gold Price NPV (0%)(i) NPV (5%) NPV (10%)

(US$/oz) (CDN$M) (CDN$M) (CDN$M) IRR

----------------------------------------------------------------------------

$850 $43 $23 $10 15%

----------------------------------------------------------------------------

$1,000 $81 $52 $33 28%

----------------------------------------------------------------------------

$1,200 $132 $91 $63 43%

----------------------------------------------------------------------------

$1,400 $182 $129 $93 57%

----------------------------------------------------------------------------

(i) Equivalent to cumulative after-tax profit.

The PEA is an estimate of the economic viability of the Project and does not

contemplate the full spectrum of engineering and regulatory factors, which would

be required prior to making a production decision. All amounts are in Canadian

Dollars except the gold price, which is quoted in US dollars.

Mineral Resource Estimate - Updated

The PEA also includes an updated Mineral Resource Estimate ("Resource Estimate")

for the Thunder Lake gold deposit, based on diamond drilling completed as at

December 2009. This Resource Estimate does not take into account the results

from the +10,000 metres completed in 2010 and does not incorporate potential

metal credits from silver and by-product metals of lead, zinc and copper; these

metals are also not included in the current PEA.

Resources were defined using a block cut-off grade of 0.5 g/t Au for surface

resources (less than 100 metres deep) and 2.0 g/t Au for underground resources

(greater than 100 metres deep). Surface plus underground Indicated Resources

total 3.4 million tonnes with an average grade of 2.5 g/t Au, for 270,000

ounces. Surface plus underground Inferred Resources total 10.6 million tonnes

with an average grade of 2.7 g/t Au, for 930,000 ounces. The Main Zone contained

the majority of resources from both categories and is the primary target for

underground mining. A summary of mineral resources by resource category is as

follows:

----------------------------------------------------------------------------

Block Cut-off

Grade Tonnes Above Average Au Grade Contained Au

Category (g/tonne) Cut-off (g/tonne) (ounces)

----------------------------------------------------------------------------

Indicated

----------------------------------------------------------------------------

Surface 0.5 2,900,000 1.9 180,000

----------------------------------------------------------------------------

Underground 2.0 490,000 5.7 90,000

----------------------------------------------------------------------------

Subtotal,

Indicated 3,400,000 2.5 270,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Inferred

----------------------------------------------------------------------------

Surface 0.5 5,400,000 1.1 190,000

----------------------------------------------------------------------------

Underground 2.0 5,200,000 4.4 740,000

----------------------------------------------------------------------------

Subtotal,

Inferred 10,600,000 2.7 930,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Average Ag Average Cu Average Pb Average Zn

Category Grade (g/tonne) Grade (ppm) Grade (ppm) Grade (ppm)

----------------------------------------------------------------------------

Indicated

----------------------------------------------------------------------------

Surface 5.4 86 820 1,700

----------------------------------------------------------------------------

Underground 13.8 100 710 1,500

----------------------------------------------------------------------------

Subtotal,

Indicated 6.6 88 800 1,670

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Inferred

----------------------------------------------------------------------------

Surface 2.5 72 360 880

----------------------------------------------------------------------------

Underground 14.7 90 630 1,220

----------------------------------------------------------------------------

Subtotal,

Inferred 8.5 81 490 1,050

----------------------------------------------------------------------------

Notes:

1. Cut-off grade for mineralised zone interpretation was 0.5 g/tonne.

2. Block cut-off grade for surface resources (less than 100 metres deep)

was 0.5 g/tonne.

3. Block cut-off grade for underground resources (more than 100 metres

deep) was 2 g/tonne.

4. Gold price was US$850 per troy ounce.

5. Zones extended up to 150 metres down-dip from last intercept. Along

strike, zones extended halfway to the next cross-section.

6. Minimum width was 2 metres.

7. Non-diluted resources.

8. Mineral resources that are not mineral reserves do not have demonstrated

economic viability.

9. A specific gravity (bulk density) value of 2.78 was applied to all

blocks (based on 30 samples).

10. Un-cut. Top-cut analysis of sample data suggested no top cut was needed

and removal of high grade outliers would not materially affect the

global block model grade.

The Resource Estimate, which uses a combination of historical and current

drilling results, includes 41 additional holes up to drill hole TL09-86, drilled

in late 2009 with results reported in early 2010. The Resource Estimate was

prepared by Doug Roy, M.A.Sc., P.Eng., Associate Mining Engineer with Howe.

Qualified Person

Technical information related to the PEA contained in this news release has been

reviewed and approved by Doug Roy, an independent Qualified Person as defined by

NI 43-101, with the ability and authority to verify the authenticity and

validity of this data. The report titled "Technical Report and Preliminary

Economic Assessment on the Goliath Gold Project", with an effective date of July

9th, 2010 has been prepared by Doug Roy, Patrick Hannon, Ed Thornton and Ian D.

Trinder of A.C.A. Howe International Limited.

About Treasury Metals

Treasury Metals Inc. is a Canadian mining company that is focussed on expanding

the Company's gold resources and developing its 100% owned flagship Goliath Gold

Project located in the Kenora Gold District of northwestern Ontario. Treasury

Metals obtains significant royalty revenue from an NSR on Goldgroup Mining

Inc.'s Cerro Colorado Mine located in Mexico.

For additional information on Treasury Metals and its projects, including

updated technical information as it pertains to this news release, please visit

the Company's website at www.treasurymetals.com.

Forward-looking Statements

Securities regulators encourage companies to disclose forward-looking

information to help investors understand a company's future prospects. This

press release contains statements about our future financial condition, results

of operations and business. These are "forward-looking" because we have used

what we know and expect today to make a statement about the future.

Forward-looking statements usually include words such as may, expect,

anticipate, believe or other similar words. We believe the expectations

reflected in these forward-looking statements are reasonable. However, actual

events and results could be substantially different because of the risks and

uncertainties associated with our business or events that happen after the date

of this press release. You should not place undue reliance on forward-looking

statements. As a general policy, we do not update forward-looking statements

except as required by securities laws and regulations.

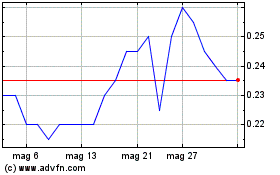

Grafico Azioni Treasury Metals (TSX:TML)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Treasury Metals (TSX:TML)

Storico

Da Lug 2023 a Lug 2024