TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company)

will host its annual Investor Day today. The event will reaffirm

the Company’s long-standing value proposition and demonstrate that,

by maximizing its business leadership positions, TC Energy and

South Bow can deliver superior, long-term shareholder value.

TC Energy has made significant progress against its 2023

priorities, including project execution, deleveraging and

maximizing the value of its asset base, which continues to generate

excellent operational and financial results through all points in

the economic cycle. After a strong October and reflecting strength

in the U.S. dollar, 2023 comparable EBITDA is now expected to be

approximately eight per cent higher than 2022. The Company will

reaffirm its priority areas for 2024 and provide its expected

comparable EBITDA growth outlook of five to seven per cent from

2023 to 2024, excluding any potential impact of its announced asset

divestiture program, and prior to giving effect to the spinoff,

which is expected to take place in the second half of 2024.

“Over the past few years, TC Energy has been strategically

pivoting capital to optimize our portfolio, leverage our core

competencies and capture the long-term growth potential we see in

our natural gas and power businesses,” said François Poirier,

President and CEO, TC Energy. “Focusing on the value that can be

delivered with two distinct strategies, the spinoff will unlock the

evident value we see from each company’s unique opportunity

set. TC Energy will continue to cultivate a highly regulated,

low-risk and utility-like portfolio with a balance of income and

growth. Subject to the requisite shareholder and regulatory

approvals, upon closing of the spinoff transaction, South Bow is

poised to be a low-risk liquids transportation and storage

business, and with its anticipated investment-grade credit ratings,

it can respond quickly in a market where it holds significant

competitive advantages.”

TC Energy also expects to advance an incremental $3 billion of

asset sales next year and reaffirms its commitments to achieve its

4.75x debt-to-EBITDA upper limit by the end of 2024 and maintain

its targeted $6 to $7 billion annual net capital spending in 2025

and beyond. The Company will further high-grade its capital

allocation toward low-risk opportunities that strengthen its core

businesses, including developing commercial constructs with risk

mitigations and appropriately sharing cost, schedule and regulatory

risk. The Company expects to deliver approximately seven per cent

comparable EBITDA(3) growth from its natural gas and power

businesses between 2023 and 2026.

“South Bow will be positioned as a low-risk vehicle with a

strong and sustainable base common share dividend. With increased

access to capital, we can accelerate our deleveraging while funding

opportunistic growth to build-out our strategic corridor and

enhance our ability to recontract our highly competitive, full-path

service from Canada to the U.S. Gulf Coast,” said Bevin Wirzba,

intended President and CEO, South Bow. “With a unique value

proposition and total shareholder return, our expected long-term

comparable EBITDA growth rate of two to three per cent will be

commensurate with our dividend growth outlook. We also see the

opportunity for incremental upside and have tools to optimize our

capital structure as we look to advance the spinoff in 2024.”

TC Energy’s Investor Day event is scheduled from 8 to 10 a.m.

EST (6 to 8 a.m. MST) on Nov. 28, 2023. Connect to the live event

webcast by registering through the TC Energy website Investors

section, TC Energy 2023 Investor Day – Toronto or at the webcast

link, TC Energy Investor Day webcast 2023. Presentation materials

will be available at TC Energy 2023 Investor Day – Toronto at 6

a.m. EST (4 a.m. MST), Nov. 28, 2023, and a recording will be

posted following the event.

About TC EnergyWe’re a team of 7,000+ energy

problem solvers working to move, generate and store the energy

North America relies on. Today, we’re taking action to make that

energy more sustainable and more secure – while innovating and

modernizing to reduce emissions from our business. Along the way,

we invest in communities and partner with our neighbours, customers

and governments to build the energy system of the future.

TC Energy’s common shares trade on the Toronto (TSX) and New

York (NYSE) stock exchanges under the symbol TRP. To learn more,

visit us at TCEnergy.com.

NON-GAAP MEASURES This release refers to

comparable EBITDA which does not have any standardized meaning as

prescribed by U.S. GAAP and therefore may not be comparable to

similar measures presented by other entities. The most directly

comparable measure presented in the financial statements is

segmented earnings. For reconciliations of comparable EBITDA to

segmented earnings for the years ended Dec. 31, 2022 and 2021,

refer to the applicable business segment in our management’s

discussion and analysis (MD&A) for such periods, which sections

are incorporated by reference herein. Refer to the non-GAAP

measures section of the MD&A in our most recent quarterly

report for more information about the non-GAAP measures we use,

which section of the MD&A is incorporated by reference herein.

The MD&A can be found on SEDAR+ at www.sedarplus.ca under TC

Energy’s profile.

The presentation also contains references to debt-to-EBITDA, a

non-GAAP ratio, which is calculated using adjusted debt and

adjusted comparable EBITDA, each of which are non-GAAP measures. We

believe debt-to-EBITDA ratios provide investors with a useful

credit measure as they reflect our ability to service our debt and

other long-term commitments.

Adjusted debt is defined as the sum of Reported total debt,

including Notes payable, Long-Term Debt, Current portion of

long-term debt and Junior Subordinated Notes, as reported on our

Consolidated balance sheet as well as Operating lease liabilities

recognized on our Consolidated balance sheet and 50 per cent of

Preferred Shares as reported on our Consolidated balance sheet due

to the debt-like nature of their contractual and financial

obligations, less Cash and cash equivalents as reported on our

Consolidated balance sheet and 50 per cent of Junior Subordinated

Notes as reported on our Consolidated balance sheet due to the

equity-like nature of their contractual and financial

obligations.

Adjusted comparable EBITDA is calculated as comparable EBITDA

excluding Operating lease costs recorded in Plant operating costs

and other in our Consolidated statement of income and adjusted for

Distributions received in excess of income from equity investments

as reported in our Consolidated statement of cash flows which is

more reflective of the cash flows available to TC Energy to service

our debt and other long-term commitments.

See “Reconciliation” for the reconciliation of adjusted debt and

adjusted comparable EBITDA for the years ended Dec. 31, 2021 and

2022.

FORWARD-LOOKING INFORMATIONThis release

contains certain information that is forward-looking and is subject

to important risks and uncertainties (such statements are usually

accompanied by words such as “anticipate”, “expect”, “believe”,

“may”, “will”, “should”, “estimate”, “intend” or other similar

words). Forward-looking statements in this document may include,

but are not limited to, statements on our projected comparable

EBITDA and debt-to-EBITDA leverage metrics for 2023 and 2024, our

targeted leverage metrics, our expected capital expenditures and

divestiture program, our dividend outlook and expected attributes

and intentions of TC Energy and South Bow following the completion

of the spinoff, including in relation to future dividends,

financial performance, shareholder value, access to capital and

growth rate. Forward-looking statements in this document are

intended to provide TC Energy security holders and potential

investors with information regarding TC Energy and its

subsidiaries, including management’s assessment of TC Energy’s and

its subsidiaries’ future plans and financial outlook. All

forward-looking statements reflect TC Energy’s beliefs and

assumptions based on information available at the time the

statements were made and as such are not guarantees of future

performance. As actual results could vary significantly from the

forward-looking information, you should not put undue reliance on

forward-looking information and should not use future-oriented

information or financial outlooks for anything other than their

intended purpose. We do not update our forward-looking information

due to new information or future events, unless we are required to

by law. For additional information on the assumptions made, and the

risks and uncertainties which could cause actual results to differ

from the anticipated results, refer to the most recent Quarterly

Report to Shareholders and Annual Report filed under TC Energy’s

profile on SEDAR+ at www.sedarplus.ca and with the U.S. Securities

and Exchange Commission at www.sec.gov.

ReconciliationThe following is a reconciliation

of adjusted debt and adjusted comparable EBITDAi for leverage

metric purposes.

|

(millions of Canadian $) |

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

| Reported total

debt |

|

58,300 |

|

|

52,766 |

|

| Management adjustments: |

|

|

|

|

| Debt treatment of preferred

sharesii |

|

1,250 |

|

|

1,744 |

|

| Equity treatment of junior

subordinated notesiii |

|

(5,248 |

) |

|

(4,470 |

) |

| Cash and cash equivalents |

|

(620 |

) |

|

(673 |

) |

|

Operating lease liabilities |

|

433 |

|

|

429 |

|

|

Adjusted debt |

|

54,115 |

|

|

49,796 |

|

| |

|

|

|

|

| Comparable EBITDAiv |

|

9,901 |

|

|

9,368 |

|

| Operating lease cost |

|

106 |

|

|

105 |

|

|

Distributions received in excess of (income) loss from equity

investments |

|

(29 |

) |

|

77 |

|

|

Adjusted Comparable EBITDA |

|

9,978 |

|

|

9,550 |

|

|

|

|

|

|

|

|

Adjusted Debt/Adjusted Comparable EBITDAi |

|

5.4 |

|

|

5.2 |

|

i Comparable EBITDA is a

non-GAAP measure. Management methodology. Individual rating agency

calculations will differ.ii 50 per

cent debt treatment on $2.5 billion of preferred shares as of

December 31, 2022.iii 50 per cent equity

treatment on $10.5 billion of junior subordinated notes as of

December 31, 2022. U.S. dollar-denominated notes translated at

December 31, 2022, U.S./Canada foreign exchange rate of

1.35.iv Comparable EBITDA is a

non-GAAP financial measure. See the Forward-looking information and

Non-GAAP measures sections for more information.

1) Comparable EBITDA is a

non-GAAP measure used throughout this news release. This measure

does not have any standardized meaning under GAAP and therefore is

unlikely to be comparable to similar measures presented by other

companies. The most directly comparable GAAP measure is Segmented

earnings. For more information on non-GAAP measures, refer to the

“Non-GAAP Measures” section of this news release.2)

Debt-to-EBITDA is a non-GAAP ratio. Adjusted debt and

adjusted comparable EBITDA are non-GAAP measures used to calculate

debt-to-EBITDA. See the “Forward-looking information”, “Non-GAAP

measures” and “Reconciliation” sections for more

information.3) Comparable EBITDA referenced here

assumes post-Liquids Pipelines spinoff and excludes Liquids

Pipelines contributions. Comparable EBITDA is a non-GAAP measure

used throughout this news release. This measure does not have any

standardized meaning under GAAP and therefore is unlikely to be

comparable to similar measures presented by other companies. The

most directly comparable GAAP measure is Segmented earnings. Our

full-year segmented earnings, excluding our Liquids Pipelines

business segment, for 2022 and 2021 were $2.5 billion and $5.7

billion, respectively. Our full-year comparable EBITDA, excluding

our Liquids Pipelines business segment, for 2022 and 2021 were $8.5

billion and $7.8 billion, respectively. For more information on

non-GAAP measures, refer to the “Non-GAAP Measures” section of this

news release.

Media Inquiries:Media

Relationsmedia@tcenergy.com 403-920-7859 or 800-608-7859

Investor & Analyst Inquiries:Gavin Wylie /

Hunter Mauinvestor_relations@tcenergy.com403-920-7911 or

800-361-6522

PDF

available: http://ml.globenewswire.com/Resource/Download/e7f6fe3b-1c5f-4fe3-92d6-a4fa01f7eb7b

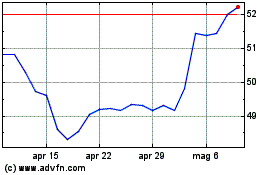

Grafico Azioni TC Energy (TSX:TRP)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni TC Energy (TSX:TRP)

Storico

Da Nov 2023 a Nov 2024