Hartford Financial Services Group Inc. (HIG)

reported fourth-quarter 2012 operating earnings of $265 million or

54 cents per share, significantly lagging the Zacks Consensus

Estimate of 30 cents. Operating earnings also lagged the year-ago

earnings of $301 million or 61 cents per share.

Higher catastrophe losses in the Property & Casualty segment

due to Hurricane Sandy was the chief reason for the decline in

earnings, partially offset by improvements in the Group Benefits,

Talcott Resolution and Corporate segments.

Hartford’s net loss in the reported quarter was $46 million or

13 cents per share, compared with net income of $118 million or 23

cents per share in the comparable quarter last year.

Results for the reported quarter include post-tax catastrophe

loss of $218 million, unfavorable prior-year development of $6

million and tax benefits of $17 million related to the retiree

prescription drug benefits.

The year-over-year decline in net results was attributable to

increased catastrophe losses, primarily due to Hurricane Sandy,

restructuring and other costs, hedging losses on runoff annuity

blocks and higher net realized capital losses as a result of the

divestiture of the Retirement Plans and Individual Life

businesses.

Total revenue for the reported quarter stood at $7.74 billion,

increasing from $5.64 billion in the year-ago quarter. Total

revenue surpassed the Zacks Consensus Estimate of $5.61

billion.

Segment Results

Hartford reorganized its reporting segments in the fourth

quarter of 2012. As a result, the company now consists of Property

& Casualty (P&C), Group Benefits, Mutual Funds, Talcott

Resolution and Corporate segments.

Property & Casualty: This segment covers

the P&C Commercial, Consumer Markets and P&C Other

businesses. The segment generated core earnings of $54 million,

down 58% from $130 million in the fourth quarter of 2012. P&C

reported net income of $80 million in the reported quarter, down

42% from $137 million in the year-ago period.

P&C written premiums declined 1% over the year-ago quarter

level to $2.31 billion. The combined ratio, excluding catastrophes

and prior-year development, improved to 95.4 from 98.2 in the

prior-year quarter.

Investment income witnessed a 3% rise to $301 million, while

underwriting loss widened to $229 million from $67 million in the

year-ago quarter. The segment witnessed catastrophe loss of $335

million, compared with $14 million in the fourth quarter of

2011.

Meanwhile, combined ratio deteriorated to 109.2 from 102.7 in

the year-ago quarter.

Group Benefits: This segment generated core

earnings of $39 million in the reported quarter, surging 129% from

$17 million in the year-ago quarter due to improved results in the

group long-term disability business, partially offset by a

year-over-year decline in group life mortality results. Net income

came in at $46 million, increasing from $15 million in the

prior-year quarter, driven by higher core earnings and realized

capital gains.

Group Benefits’ fully insured premiums declined 8% to $915

million from $995 million in the comparable quarter of 2011.

Meanwhile, loss ratio improved to 77.0% from 80.5% in the year-ago

quarter.

Mutual Funds: Core earnings declined 20% to $16

million from $20 million in the prior-year quarter. Net income of

this segment declined 21% to $15 million from $19 million in the

prior-year. Asset under management was $87.6 billion as of Dec 31,

2012, decreasing marginally from $85.5 billion as of Dec 31,

2011.

Talcott Resolution: Hartford established this

segment to cover the legacy Wealth Management runoff and sold

businesses, including U.S. Annuity, International Annuity,

Institutional, Private Placement Life Insurance, and the former

Individual Life and Retirement Plans businesses.

Talcott Resolution’s core earnings came in at $211 million, up

7% from $197 million in the forth quarter of 2011. The segment

reported net loss of $148 million, compared with net income of $37

million in the year-ago quarter.

Corporate: This segment’s core loss amounted to

$55 million, shrinking 13% from $63 million incurred in the

prior-year quarter due to improved investment income and reduced

interest expenses due to the debt refinancing in the second quarter

of 2012. Corporate segment’s net loss was reported at $39 million,

contracting from $90 million in the year-ago quarter.

Restructuring and other costs amounted to $43 million, surging

from $7 million in the fourth quarter of 2011. Interest expenses

declined 12% to $109 million from $124 million in the year-ago

quarter.

Full Year Results

For full-year 2012, Hartford’s core earnings came in at $1.4

billion or $2.88 per share, beating the Zacks Consensus Estimate of

$2.59. Results also surpassed the prior-year earnings of $1.1

billion or $2.24 per share.

Hartford reported net income of $350 million or 66 cents per

share, declining from $712 million or $1.40 per share in 2011.

Total revenue for 2012 was $26.41 billion, improving from $21.86

billion in 2011.

Gross losses due to Hurricane Sandy amounted to $370 million and

net losses after reinsurance amounted to $350 million.

Financial Update

Hartford's total invested assets, excluding trading securities,

were $105.3 billion on Dec 31, 2012, compared with $104.4 billion

on Dec 31, 2011. Net investment income, excluding trading

securities, for the reported quarter was about $1.04 billion, up 4%

year over year.

Shareholders’ equity stood at $22.8 billion as of Dec 31, 2012,

up 6% from $21.5 billion as of Dec 31, 2011. Book value per share

improved to $46.59 as of Dec 31, 2012 from $44.31 as of Dec 31,

2011. Excluding accumulated other comprehensive income (AOCI),

Hartford’s book value decreased to $40.79 per share as of Dec 31,

2012 from $41.73 per share as of Dec 31, 2011.

Capital Management Plans

Hartford reviewed its capital management plans with the

Connecticut Insurance Department and received the approval for an

extraordinary dividend of $1.2 billion from its Conn.-based life

insurance companies, which is expected to be paid in the first

quarter of 2013.

The company also expects to dissolve its Vermont life

reinsurance captive in the first quarter of 2013, which should

release a surplus capital of about $300 million to the holding

company.

Hartford also plans to reduce its outstanding debt by $1

billion, including debt worth $520 million due in 2013 and 2014.

Additionally, the board authorized a $500 million share repurchase

program, which will expire in 2014-end.

Outlook for 2013

Hartford expects core earnings in the range of $1.38–$1.48

billion in 2013. Combined ratio, excluding catastrophes and

prior-year development, for the P&C Commercial business is

expected to range between 92.5–95.5, and that for the Commercial

markets business is expected to stay in the range of 89.5–92.5.

Catastrophe loss ratio is expected to be around 4.8%, while Group

Benefits loss ratio is expected to range within 77–80.

Core earnings in the Group Benefits segment are expected to grow

in the mid to high teens over $101 million in 2012. Talcott

Resolution’s core earnings are projected to decline $260–$280

million from $827 million in 2012.

Zacks Rank

Hartford carries a Zacks Rank #3 (Hold). Other multi-line

insurers worth considering are Ageas SA/NV

(AGESY), Assured Guaranty Ltd. (AGO) and

Radian Group Inc. (RDN). All these companies carry

a Zacks Rank #1 (Strong Buy).

(AGESY): ETF Research Reports

ASSURED GUARNTY (AGO): Free Stock Analysis Report

HARTFORD FIN SV (HIG): Free Stock Analysis Report

RADIAN GRP INC (RDN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

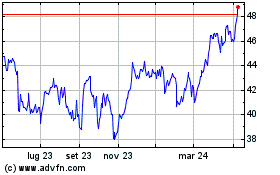

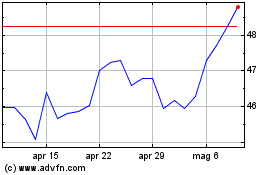

Grafico Azioni Ageas (PK) (USOTC:AGESY)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Ageas (PK) (USOTC:AGESY)

Storico

Da Mag 2023 a Mag 2024