CNO Financial Ends on a High Note - Analyst Blog

12 Febbraio 2013 - 11:40AM

Zacks

CNO Financial Group Inc. (CNO) reported

fourth-quarter 2012 adjusted operating earnings of 25 cents per

share, surpassing the Zacks Consensus Estimate of 23 cents. Results

also surpassed 18 cents earned in the year-ago quarter.

Adjusted operating income in the quarter was $60.0 million, up 18%

from $51.0 million in the fourth quarter of 2011.

Apart from improved operating performance of most segments,

better-than-expected call and prepayment income and favorable

mortality in the universal life and traditional life businesses

drove operating earnings.

Including net realized investment gains of $10.8 million, fair

value changes in embedded derivative liabilities of $2.6 million,

loss on extinguishment of debt of $0.7 million and decrease in

valuation allowance for deferred tax assets of $25.8 million, the

company reported net income of $101.2 million or 41 cents per

share, comparing favorably with net income of $64.4 million or 23

cents per share.

CNO Financial’s revenues inched up 1% to $1.06 billion from

$1.05 billion in the prior-year quarter. Total revenue also

surpassed the Zacks Consensus Estimate of $1.03 billion. Total new

annualized premium increased 2% year over year to $105.7 million.

Total benefits and expenses declined 0.6% year over year to $943.1

million.

Segment Update

Pre-tax operating earnings in the Bankers Life

segment declined 4.5% year over year to $73.7 million in the

reported quarter.

Washington National’s pre-tax operating

earnings were $34.6 million in the quarter, surging 20% from the

year-ago quarter.

Pre-tax operating income of Colonial Penn

increased to $3.2 million from $1.8 million in the comparable

quarter last year. The adoption of the new accounting standard

related to deferred acquisition costs had a material impact on the

results of this segment as CNO Financial could not defer the

segment’s advertising costs. Consequently, the company expects a

pre-tax loss of $5–$10 million in 2013 based on its advertising

plan. Most of this loss is expected in the first quarter of

2013.

Other CNO Business reported pre-tax operating

income of $5.2 million in the quarter.

Corporate Operations, which includes investment

advisory subsidiary and corporate expenses, narrowed pre-tax loss

to $2.7 million from $8.4 million in the year-ago quarter, on the

basis of improved investment income.

Full Year 2012 Highlights

Full-year operating earnings came in at 69 cents, a cent ahead

of the Zacks Consensus Estimate of 68 cents and 13% above 61 cents

earned in 2011. Operating earnings in 2012 were $180.4 million, up

19% over the prior year.

The company reported net income of $221.0 million or 83 cents

per share compared with $335.7 million or $1.15 per share in

2011.

Full-year revenue grossed $4.34 billion, increasing 5% over

2011. Total revenue also surpassed the Zacks Consensus Estimate of

$4.26 billion. Full-year total benefits and expenses increased 10%

over 2011 to $4.2 billion.

Financial Update

During 2012, the consolidated statutory risk-based capital ratio

of CNO Financial’s insurance subsidiaries increased 9 percentage

points to 367%, driven by statutory earnings of $337 million and

dividend of $265 million paid to non-insurance holding

companies.

In addition, unrestricted cash and investments held by CNO

Financial’s non-insurance subsidiaries decreased to $294 million as

of Dec 31, 2012 from 313.6 million as of Sep 30, 2012 due to share

buyback, dividend payment and debt repayment.

CNO Financial bought back 21.5 million shares for $180 million

in 2012. The company also redeemed $200 million worth of

convertible debentures for $355 million during the year.

As of Dec 31, 2012, debt-to-total capital ratio, excluding

accumulated other comprehensive income (loss), increased 240 basis

points over 2011 end to 20.7% due to the company’s recent

recapitalization plan. Book value per common share, excluding

accumulated other comprehensive income (loss), increased to $17.39

as of Dec 31, 2012 from $15.88 as of Dec 31, 2011.

As of Dec 31, 2012, CNO Financial had total assets worth $34.1

billion and shareholders’ equity stood at $5.0 billion.

Zacks Rank

CNO Financial carries a Zacks Rank #3 (Hold). Other

multi-line insurers worth considering are Ageas

SA/NV (AGESY), Assured Guaranty Ltd.

(AGO) and AXA Group (AXAHY). All these companies

carry a Zacks Rank #1 (Strong Buy).

(AGESY): ETF Research Reports

ASSURED GUARNTY (AGO): Free Stock Analysis Report

AXA SA -SP ADR (AXAHY): Free Stock Analysis Report

CNO FINL GRP (CNO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

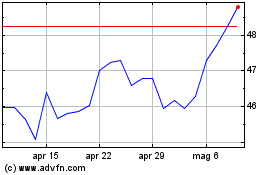

Grafico Azioni Ageas (PK) (USOTC:AGESY)

Storico

Da Apr 2024 a Mag 2024

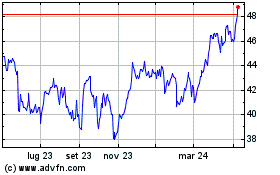

Grafico Azioni Ageas (PK) (USOTC:AGESY)

Storico

Da Mag 2023 a Mag 2024