ABM Amro Profit Surges

21 Agosto 2015 - 11:40AM

Dow Jones News

AMSTERDAM—ABN Amro Group NV on Friday recorded a sharp increase

in second-quarter net profit, thanks to a sharp decline in

provisions for bad loans as the state-owned lender continues to

work toward its initial public offering.

Net profit surged to €600 million ($674 million), an improvement

from €39 million in the same period a year earlier. Loan-loss

provisions fell 90% to €34 million, which the bank called

exceptionally low but not representative for the remainder of this

year.

Chief Executive Gerrit Zalm said the period was the most

profitable quarter since ABN Amro was created in 2010 from the

remnants of Fortis SA/NV, the Belgian-Dutch lender that collapsed

during the global financial crisis.

ABN Amro's IPO is expected to take place before the end of the

year. The Dutch state is planning to sell a stake of 20% to 30% in

the lender, and the deal could be one of the biggest-ever listings

in Amsterdam. ABN Amro has a book value of nearly €16 billion.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 21, 2015 05:25 ET (09:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

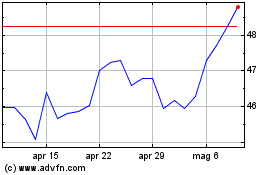

Grafico Azioni Ageas (PK) (USOTC:AGESY)

Storico

Da Apr 2024 a Mag 2024

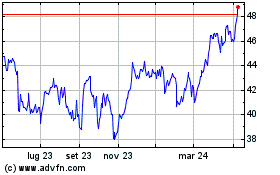

Grafico Azioni Ageas (PK) (USOTC:AGESY)

Storico

Da Mag 2023 a Mag 2024

Notizie in Tempo Reale relative a Ageas (PK) (OTCMarkets): 0 articoli recenti

Più Ageas N.V. ADR Articoli Notizie