By Alice Uribe

SYDNEY -- After wildfires burned through his timber plantation

on southern Australia's Kangaroo Island, Keith Lamb gauged what

could be saved and called his insurer. The conversation didn't go

well: The insurer declined to renew his policy.

As the forestry industry faces increased fire risk amid a

warming climate, companies around the world, including in the U.S.,

are more exposed to losses from blazes than ever before and are

struggling to get insured. Some owners, such as Mr. Lamb, are

paying sharply higher prices to stay protected. Others are buying

insurance for part of their landholdings, while others can't get

coverage at all.

"We got a very, very slim offering," said Mr. Lamb, 54 years

old. "We were successful in obtaining coverage, but it was much

more expensive."

Around 95% of Kangaroo Island Plantation Timber's 14,500 hectare

plantation had been ravaged by fires over a year ago, cutting its

value to around $5 million, from $87 million beforehand. When Mr.

Lamb, KIPT's managing director, found a new insurance policy, fewer

insurers were offering coverage for forests.

Fires have been growing more intense around the world, and the

blazes in Australia in the 2019-2020 summer were unprecedented in

scale, devastating an area the size of Arizona. In New South Wales

state, home to Sydney, more than a quarter of timber plantations

managed by Forestry Corporation NSW on behalf of the government

were damaged. The industry, which typically generates more than

$3.6 billion in annual revenue and is a major exporter to Asia,

will take years to recover.

In California, wildfires burned through 1.7 million hectares

last year, including 60,000 hectares of commercial forests,

according to data from Calforests, which represents the state's

timber industry.

"Most insurance companies are currently writing 'wildfire

exclusions' into any liability coverage, so this insurance has

become very difficult to get," said Rich Gordon, Calforests'

president. "When such insurance is available, the coverage has gone

down and the price has gone up."

Mr. Gordon said U.S. timber companies are absorbing the

additional cost of insurance without laying off workers, but are

fearful of the future if the price of coverage continues to

rise.

It is a warning sign for other industries and communities that

face rising risks from climate change. Agriculture is another

sector on the front lines because a warming climate changes where

farmers can plant crops, while higher carbon dioxide levels can

affect the growth and value of produce, said Australia's Department

of Agriculture, Water and the Environment.

Forestry owners are especially exposed. While livestock farmers

can buy more animals after a fire or crop growers can wait for a

new season, it takes years before seedlings turn into mature

trees.

At KIPT's plantation, pine trees typically take 30 years to

grow. The blue gum trees, a native Australian variety, which made

up most of the estate, more easily adapt to fires and have regrown

shoots. Still, they are harvested 10 years after planting.

In Australia, the mean temperature from 2011 to 2020 was the

highest on record, at nearly a full degree Celsius above average,

Bureau of Meteorology data show. Australia's warmest-ever spring

happened last year. Fires are more likely to start, and continue to

burn, in hot, dry and windy weather because vegetation turns

tinder-dry and is more flammable, the bureau says.

Noticing these trends, insurers are pulling back from providing

coverage. With wildfire seasons lasting longer, Allianz SE last

year changed its approach to Australian homes and businesses such

as timber plantations in high-risk areas.

"The resulting change in Allianz's bush-fire risk appetite has

resulted in a reduction in our willingness to insure higher-risk

properties located in bush-fire-prone areas or the need to increase

premiums for such properties to better reflect their bush-fire

risk," the insurer said.

Across the industry, insurers have estimated losses at $1.78

billion from claims to date from households and businesses affected

by Australia's 2019-2020 fire season.

In the U.S., forest owners have historically been able to buy

insurance that gives them liability coverage for fires that start

on their land and then spread to neighboring properties, but they

aren't covered for fires that start outside their property and

encroach on their lands, said Mr. Gordon, of Calforests.

That is a concern as fire seasons become more intense. Wildfires

throw off hot embers that can start spot blazes several miles away.

Lightning strikes are another threat.

Industrial timber plantations aren't protected under U.S.

government insurance plans that protect other agricultural

operations, such as corn destroyed by a tornado, Mr. Gordon said.

No such insurance pools exist in Australia.

Many forestry owners haven't been able to get insurance as it

isn't widely available, and have relied on strategies such as

carving deep gaps between tree clusters to create fire breaks and

spacing water tanks around plantations, said Brian Shillinglaw,

managing director of New Forests Assets Management Pty Ltd.'s North

American division.

Self-insurance is another tactic, with companies setting aside

capital that can be reclaimed when they suffer losses from fires.

But that is often beyond the finances of smaller forestry

companies.

Hancock Victorian Plantations said it was becoming harder and

more expensive to insure against fire losses in its 240,000

hectares of forest in Australia's Victoria state. The company said

it expects to spend roughly $6.5 million on fire-prevention

measures, excluding insurance costs, in the 12 months through

June.

Even timber companies that have been largely untouched by

wildfires are paying for the risk. New Forests said its insurance

premiums in Australia have nearly doubled over the past two years.

For the current fire season it was able to secure coverage for its

Australian forests, but with tighter terms and conditions.

Jon Gapes, managing director of underwriter Insurance

Facilitators, said smaller plantation owners in Australia were most

at risk of being left without cover. "The cost of it all has just

become too much for some of these," he said.

For Mr. Lamb, losses from the Kangaroo Island fires have been

cushioned by a $49 million payout under his old insurance policy.

Getting coverage again has meant paying a 400% increase on that

policy relative to the value of the remaining trees.

Still, he thinks any coverage is worthwhile given increasing

fire risk and his front-line experience battling the flames a year

ago, a fire in which two firefighters died.

"That day was one of the worst days I've dealt with," Mr. Lamb

said.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

February 26, 2021 08:14 ET (13:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

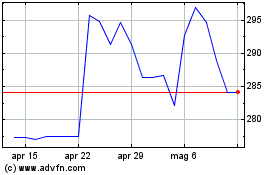

Grafico Azioni Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Storico

Da Mar 2024 a Mar 2025