Eyewear Makers Rethink Smart Glasses

09 Marzo 2017 - 11:59AM

Dow Jones News

By Manuela Mesco

MILAN -- Several years after the failure of Google's smart

glasses, eyewear makers and tech companies -- encouraged by the

arrival of a giant new player in the eyewear sector -- are taking

another crack at a product they hope can compete in the market for

wearable technology.

The recentEUR50 billion ($53 billion) Italian-French merger

between eyewear manufacturers Luxottica SpA and Essilor

International SA could revive a market that, according to bullish

estimates, could approach 55 million units by 2022. But while

eyewear groups enjoy an edge when it comes to style and

distribution heft, they may struggle to succeed where even the

biggest tech giants have so far stumbled.

The 2012 launch of Google Glass was largely a flop, sunk by

concerns over privacy, competition from other wearable devices and

poor aesthetics that left wearers looking like cyborgs. Today,

Google sells the product mostly for business use and has put aside

the idea of pitching it to a mass audience for now.

After Google, tech companies ranging from startups to the likes

of Microsoft Corp. and Seiko Epson Corp. have all tried new

versions of connected eyewear. But none of them has stood out as a

major commercial success, in many cases because the monitor on the

lenses are too intrusive. Their functions are too similar to

smartphones or the designs too nerdy, analysts say. Privacy

concerns -- such as the problem of using the glasses to take videos

without the subjects' knowledge -- were also a deterrent.

Instead, some tech companies are concentrating on a narrower

audience. U.S.-based Vuzix Corp., a smart-glasses specialist, has

eyewear aimed at business use, such as allowing remote technical

support or training, while Sony Corp. is providing technology for

developers who want to make apps that can be installed in smart

glasses. Snapchat parent company Snap Inc. recently launched

glasses that allow wearers to take photos and videos.

"Phase one...has unquestionably been a flop" in creating a mass

market for smartglasses, said Steven Waltzer, analyst at Strategy

Analytics.

Meanwhile, the eyewear industry -- under pressure to feed

younger customers' desire for new technology -- is instead pressing

to find products that could help carve out a mass market that has

eluded smart glasses so far.

Eyewear maker Safilo SpA turned down an offer in 2014 from

Google to make wired frames because "Google's philosophy was to

bring all the functions of a smartphone into the eyeglasses," said

Nicola Belli, head of innovation at the Italian company. When his

team tested Google's prototypes, "the feeling was of too much

information," he recalled. Google didn't respond to requests for

comment on the project.

Instead, Safilo is now working on its own smart glasses that it

claims can read brain waves and help wearers concentrate, with an

app that guides the person through exercises aimed at regaining

focus. Other eyewear makers are working on overcoming basic

problems such as making the technology smaller, the battery last

longer and the display inside the glasses easier to see in

daylight.

By combining their strengths, the new Essilor-Luxottica group is

aiming high, seeking to put together "our researchers, our frame

designers, all our strengths," Essilor Chairman Hubert Sagnières

said soon after the deal was announced.

Essilor, a major lens manufacturer, is making lenses that

recognize faces and everyday objects. In turn, Luxottica, which

brings expertise in manufacturing frames and had joined with Google

on Google Glass, is working on lighter materials, such as graphite,

that can hold the technology needed for smart glasses without

weighing them down.

The Italian company, which makes stylish glasses for the likes

of Chanel, Giorgio Armani and Prada, can also make a sleeker design

-- thus addressing a major deterrent to the early models of smart

glasses.

"Smart glasses must first be functional, desirable, wearable,"

said Federico Buffa, R&D director for Luxottica. "Then it can

offer useful (smart glasses) functions."

Luxottica already has launched a smart-glasses model under its

sports brand Oakley, with technology from Intel Corp., that it

hopes can compete with other sports wearables.

For instance, the lenses help monitor a wearer's heart rate,

track routes, give feedback on performance and provide customized

training programs. To resolve the issue of images popping out on

the lenses, a voice drives the wearer through the information

needed. Luxottica's enormous distribution heft -- it owns Sunglass

Hut and LensCrafters -- could also help bring smart glasses into

the mainstream, analysts said.

Write to Manuela Mesco at manuela.mesco@wsj.com

(END) Dow Jones Newswires

March 09, 2017 05:44 ET (10:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

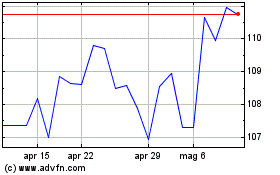

Grafico Azioni Essilor Luxottica (PK) (USOTC:ESLOY)

Storico

Da Giu 2024 a Lug 2024

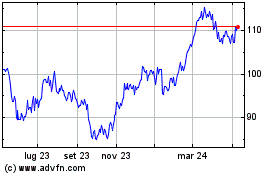

Grafico Azioni Essilor Luxottica (PK) (USOTC:ESLOY)

Storico

Da Lug 2023 a Lug 2024