While pandemic impact persists, Elior Group is squarely

focused on the future, controlling costs and bolstering

liquidity

Regulatory News:

Elior Group (Paris:ELIOR) (Euronext Paris – ISIN: FR

0011950732), one of the world’s leading operators in catering and

support services, announces its first half results for fiscal

2020-2021, ended March 31, 2021.

First half 2020-2021 figures

- Revenues of €1.869 billion, down 22.3% on an organic basis

year-on-year,

- Sustained business development, strong increase in new business

pipeline and a stable year-on-year retention rate of 91%,

- Adjusted EBITA loss from continuing activities of €25 million,

compared with a profit of €52 million a year earlier,

- The adjusted EBITA impact from lost revenue (drop-through) was

14% at constant exchange rates, substantially better than 22% in

the second half of last year;

- Positive first half free cash flow of €31 million,

- Available liquidity at March 31, 2021 of €819 million after

obtaining a French State Guaranteed Loan (PGE) for €225 million

compared with €630 million at September 30, 2020.

Philippe Guillemot, Elior Group’s Chief Executive Officer,

said: “The Covid-19 pandemic has been impacting our businesses

since the first lockdowns were imposed in Europe and the US over a

year ago. Given that our volume trends currently depend on the

public health situation, we continue to focus our efforts on

operating costs and available liquidity. Our teams on the ground

are poised to adapt to our clients’ needs.

We are squarely focused on the future and continue to accelerate

our transformation. For example, we have just acquired Nestor, a

start-up that prepares high-quality menus for grouped delivery in

urban areas. By anticipating tomorrow’s needs, we will be well

positioned to benefit fully from the post-crisis rebound.

In the short term, with vaccination numbers rising and public

health restrictions easing to different degrees, we expect to see

contrasting business trends in the second half of the fiscal year

in the various countries where we operate.

In the medium term, once Covid-19 restrictions are lifted, I am

confident that our excellent positioning and streamlined operating

cost structure will enable us to return to solid growth and

generate even better margins than before the crisis.”

Business development

During the first half, Elior Group signed or renewed a number of

major catering and services contracts, notably:

- in France, additional Amazon site, for a total of 7, the French

Alternative Energies and Atomic Energy Commission (CEA) site in

Grenoble, the Paris offices of the National Center for Scientific

Research (CNRS) and the Ferrandi French School of Culinary Arts and

Hotel Management; Elior Services: Auvergne-Rhône-Alpes region,

Airbus University and public hospitals in Grenoble and Reims

- in the UK, with all 49 British Telecom group sites, numerous

primary and secondary schools and universities (we notably renewed

our contract with the London Business School), and the Hammerson

House residential care facility in London;

- in the US, with Western Asset Management, the Allegheny County

detention center in Pittsburgh, the Greater Springfield Senior

Services network in Massachusetts, and the various campuses of the

Texas School of Science & Technology;

- in Italy, with the WPP communication group, XPO Logistics

(Kering group partner), Balenciaga, and two hotels: Tocq in Milan

and Baia Scarlino Resort on the Tuscan coast;

- in Spain, with renewable energy group Siemens Gamesa, 53 public

schools in the Murcia region and 12 in Aragon, and the CETI migrant

reception center on the island of Tenerife.

The overall retention rate at March 31, 2021, was 91%, stable

compared with March 20201.

_____________________ 1 See definition in Appendix 6 of this

press release

Revenues

Consolidated revenue from continuing operations totaled

€1.869 billion for the first half of 2020-2021, compared with

€2.459 billion a year earlier. The 24% year-on-year decrease

reflects the 22.3% organic decline and a 1.7% currency headwind,

notably attributable to the US dollar and the pound sterling. There

was no material impact from acquisitions or divestments.

International operations accounted for 52% of revenues in the

six months ended March 31, 2021, compared with 56% a year ago.

Revenue trends by geography:

International revenue declined 28.4% to €979 million.

This change comprised a 25.3% organic decline compared with a year

earlier and a 3.1% currency headwind notably attributable to the US

dollar and the pound sterling. There was no material impact from

acquisitions or divestments. All the countries where we operate

were affected by the stricter public health measures taken since

last fall to stem a spike in the global pandemic. The UK was

particularly impacted by the strict lockdown imposed on January 4,

2021 and still mostly in place on March 31, although schools were

reopened in early March. Italy was also affected but proved more

resilient than other countries thanks to a B&I client mix

largely skewed towards the industrial sector, thus less exposed to

those working-from-home.

Revenue generated in France totaled €890 million, an

18.1% organic contraction (no material impact from acquisitions or

divestments). Business & Industry held up better than in most

other countries. Although working-from-home remains the norm when

possible, we have seen service-sector workers desire to return to

the office. The Education market stayed relatively well oriented in

the first half of the current fiscal year as the public authorities

kept schools open throughout the period.

The Corporate & Other segment, which includes the

Group’s remaining concession catering activities not sold with

Areas, generated very weak first half revenue due to state-enforced

business closures.

Revenue by market:

Business & Industry generated revenue of €618

million, a 41.5% year-on-year decline. This market remains

particularly impacted by public health measures that recommend, or

even require, working-from-home. The 36.9% organic decline in the

second quarter was smaller than in the first (-43.5%), mainly

reflecting a more favorable year-on-year comparison in the second

quarter as we lapped the one-year anniversary of the first lockdown

measures.

The Education market generated revenue of €679 million,

down 13.8% on the first half 2019-2020. This market is more

resilient than Business & Industry yet has still been impacted

by stricter public health measures in all the countries where we

operate.

The Health & Welfare market generated revenue of €572

million, down 7.0% year-on-year. Contract catering continues to

suffer from the closure of areas usually open to the public, such

as hospital cafeterias. On the other hand, Elior Services remains

resilient, thanks to solutions specifically adapted to the Covid-19

pandemic.

Adjusted EBITA and operating income from continuing

operations

Consolidated adjusted EBITA from continuing operations

for first half 2020-2021 was a loss of €25 million compared with a

€52 million profit a year earlier. Adjusted EBITA margin was -1.3%

compared with +2.1% in first half 2019-2020, reflecting the ongoing

impact of the pandemic.

Adjusted EBITA drop-through was 14% (at constant exchange

rates), a significant improvement compared to 22% in the second

half of 2019-2020, attributable to our rigorous focus and agility

in controlling operating costs.

In the International segment, adjusted EBITA was a loss

of €12 million compared with a €26 million profit in first half

2019-2020. The adjusted EBITA margin was -1.2%, compared with +1.9%

a year earlier.

In France, adjusted EBITA was a loss of €4 million

compared with a €37 million profit a year earlier. The Education

and Health & Welfare markets proved more resilient to the

pandemic than the Business & Industry market.

The Corporate & Other segment’s adjusted EBITA was a

loss of €9 million, an improvement on the €11 million loss in the

first half of last year.

Recurring operating result from continuing operations

(including the share of net result of equity-accounted investees),

came to a loss of €34 million for first half 2020-2021 compared

with a profit of €40 million a year ago.

Net financial result represents a loss of €20 million

compared with €17 million a year earlier, due to a higher average

level of debt in the first half of 2021 than in the first half of

the previous year and the cost related to the covenant holiday

obtained in November 2020.

Income tax produced a net gain of €4 million compared

with a charge of €15 million in first half 2019-2020. This is

mostly due to a €74 million decline in pretax profit year-on-year

and to a decrease in the CVAE from €9 million to €7 million.

As a result of the above factors, the net loss from

continuing operations amounted to €53 million compared with a

€2 million profit a year earlier.

The net result Group share was a €53 million loss

in first half 2020-2021 compared with a €17 million loss a year

ago.

Cash flow, debt, and liquidity

Free cash flow for the first half of 2020-2021 was €31

million compared with €42 million a year ago. The decline in EBITDA

was partly offset by lower investment expenses as well as a

positive change in working capital requirement.

Net financial debt before IFRS 16 stood at €796 million

at March 31, 2021, compared with €767 million at the end of

September 2020. Including the impact from IFRS 16, Elior Group’s

net debt was €1.038 billion compared with €995 million at September

30, 2020. The next test of the covenants governing the Group’s

senior debt and the French State Guaranteed Loan will take place at

end-2022 based on the financial results at September 30, 2022.

At end-March 2021, Elior’s available liquidity amounted to €819

million after obtaining a French State Guaranteed Loan (PGE) for

€225 million, compared with €630 million at September 30, 2020.

This includes €30 million in cash and all available undrawn

revolving credit facilities of €450 million and US$250 million

(€213 million). Remaining available credit lines amount to €126

million.

Outlook

Elior Group’s business trends remain contingent upon public

health conditions and governments’ efforts to stem the spread of

the Covid-19 pandemic. Uneven vaccination rollouts since late 2020,

mean public health restrictions are being eased at varying speeds

in the countries where we operate. For example, we foresee more

favorable conditions in the US and the UK, where first-dose

vaccination levels are well ahead of France, Italy, and Spain.

Based on what we know to date, we have used the following

assumptions for the current fiscal year to plan and make

decisions:

- Business and Industry: vaccination campaigns will

dictate when public health restrictions are relaxed and thus

determine the extent to which our volumes rebound. We already know

that any easing will be very gradual. This is a seasonal market, so

we are unlikely to see a material recovery before September. Last

year, rules were not very strict in September, so operating

performances were relatively satisfactory.

- Education: in France, the second half of this fiscal

year will be affected by the stricter health protocols imposed in

late March (entire classes are sent home as soon as 1 student tests

positive for Covid-19), by the longer spring break vacation for

primary schools, and secondary schools running at half-capacity.

The current health protocols have led to volumes dropping without

warning, which makes it hard to adjust costs. In the US, depending

on the school district, back-to-school is expected to resume

earlier than usual, while some schools may continue to use a hybrid

model of in-person and online learning.

- Health & Welfare: business is expected to remain

relatively stable through the second half. The postponement of

elective surgery, closure of hospital cafeterias, and slow recovery

in nursing home occupancy rates will remain a drag on our volumes.

Our Services business in France is expected to remain on the right

track, notably thanks to an adapted offering well-suited to health

and safety requirements.

In conclusion, we are more attentive than ever to our operating

costs; the task is more complex in the second half than in the

first half due to the strict Covid-19 protocols impacting the

Education market in France. Considering the timelines announced for

an easing of restrictions and our businesses’ inherent seasonality,

our performance in the second half will depend mainly on whether

the conditions are in place for a recovery in September. Looking to

the future, we have a streamlined business model, we continue to

accelerate our transformation by rolling out new offerings and

maintain ample liquidity—all of which will enable us to fully

benefit from the expected post-crisis recovery.

Events after the reporting date

On April 30, 2021, Elior India sold its majority stake (51%) in

CRCL to the minority shareholders of CRCL.

A conference call is scheduled for Wednesday, May 20 at 9:00 am

Paris time. The call will also be accessible by webcast on the

Elior Group website and by telephone by dialing one of the

following numbers:

France: + 33 (0) 1 33 70 37 71 66 UK: + 44 (0) 33 0551 0200 US:

+ 1 212 999 6659 Access code: Elior

Financial calendar:

- July 28, 2021: Revenue for the first nine months of fiscal

2020-2021 - press release published before the start of

trading

- November 24, 2021: Full-year 2020-2021 results - press release

published before the start of trading, conference call to

follow

Appendix 1: Revenue trends by geography Appendix 2: Revenue

trends by market Appendix 3: Adjusted EBITA by geography Appendix

4: Condensed cash flow statement Appendix 5: Consolidated financial

statements Appendix 6: Definition of alternative performance

indicators

About Elior Group

Founded in 1991, Elior Group has grown into one of the world's

leading operators in contract catering and support services and has

become a benchmark player in the business & industry,

education, healthcare and leisure markets. With strong positions in

6 countries, the Group generated €3.967 billion in revenue in

fiscal 2019-2020.

Our 105,000 employees feed over 5 million people on a daily

basis in 22,700 restaurants on three continents, and offer services

on 2,300 sites in France.

Innovation and social responsibility are at the core of our

business model. Elior Group has been a member of the United Nations

Global Compact since 2004, reaching the GC Advanced Level in

2015.

For further information please visit our website

http://www.eliorgroup.com or follow us on Twitter

@Elior_GroupFR.

Appendix 1: Revenue by geographic

segment

Q1.

Q1.

Organic

Change in scope of

Currency

Total

(in € millions)

2020-2021

2019-2020

growth

consolidation

effect

Growth

France

447

573

-22.0%

-

-

-22.0%

International

498

731

-29.1%

0.1%

-2.9%

-31.9%

Contract catering & Services

945

1,304

-26.0%

-

-1.6%

-27.5%

Corporate & Other

0

4

-89.3%

-

-

-89.3%

GROUP TOTAL

945

1,308

-26.1%

-

-1.6%

-27.7%

Q2.

Q2.

Organic

Change in scope of

Currency

Total

(in € millions)

2020-2021

2019-2020

growth

consolidation

effect

Growth

France

443

513

-13.8%

-

-

-13.8%

International

481

636

-20.9%

-

-3.5%

-24.4%

Contract catering & Services

924

1,149

-17.7%

-

-2.0%

-19.7%

Corporate & Other

0

2

-100.0%

-

-

-100.0%

GROUP TOTAL

924

1,151

-17.8%

-

-2.0%

-19.8%

H1.

H1.

Organic

Change in scope of

Currency

Total

(in € millions)

2020-2021

2019-2020

growth

consolidation

effect

Growth

France

890

1,086

-18.1%

-

-

-18.1%

International

979

1,367

-25.3%

-

-3.1%

-28.4%

Contract catering & Services

1,869

2,453

-22.1%

-

-1.7%

-23.8%

Corporate & Other

0

6

-93.3%

-

-

-93.3%

GROUP TOTAL

1,869

2,459

-22.3%

-

-1.7%

-24.0%

Appendix 2: Revenue by market

Q1.

Q1.

Organic

Change in scope of

Currency

Total

(in € millions)

2020-2021

2019-2020

growth

consolidation

effect

Growth

Business & Industry

316

570

-43.5%

-

-1.0%

-44.5%

Education

341

423

-17.7%

0.1%

-1.8%

-19.4%

Health & Welfare

288

315

-6.1%

-

-2.4%

-8.5%

GROUP TOTAL

945

1,308

-26.1%

-

-1.6%

-27.7%

Q2.

Q2.

Organic

Change in scope of

Currency

Total

(in € millions)

2020-2021

2019-2020

growth

consolidation

effect

Growth

Business & Industry

301

486

-36.9%

-

-1.1%

-38.0%

Education

339

365

-4.9%

-

-2.5%

-7.4%

Health & Welfare

284

300

-2.7%

-

-2.7%

-5.4%

GROUP TOTAL

924

1,151

-17.8%

-

-2.0%

-19.8%

H1.

H1.

Organic

Change in scope of

Currency

Total

(in € millions)

2020-2021

2019-2020

growth

consolidation

effect

Growth

Business & Industry

618

1,056

-40.4%

-

-1.1%

-41.5%

Education

679

788

-11.8%

0.1%

-2.1%

-13.8%

Health & Welfare

572

615

-4.5%

-

-2.5%

-7.0%

GROUP TOTAL

1,869

2,459

-22.3%

-

-1.7%

-24.0%

Appendix 3: Adjusted EBITA by geographic

segment

Six months ended

Adjusted EBITDA

(in € millions)

March 31

Change in

margin

2021

2020

Adjusted EBITA

2021

2020

France

(4)

37

(41)

(0.4)%

3.4%

International

(12)

26

(38)

(1.2)%

1.9%

Contract Catering & Services

(16)

63

(79)

(0.8)%

2.6%

Corporate & Others

(9)

(11)

2

-

-

TOTAL GROUP

(25)

52

(77)

(1.3)%

2.1%

Appendix 4: Condensed cash flow

statement

(in € millions)

Six months ended March 31,

2021 Non audited

Six months ended March 31,

2020 Non audited

EBITDA

57

135

Purchases of and proceeds from sale of

property, plant and equipment and intangible assets

(29)

(53)

Change in operating working capital

12

(38)

Other cash flows from operating

activities

(11)

(4)

Operational Free cash flow

29

40

Tax reimbursed (paid)

2

2

Free cash flow

31

42

Appendix 5: Consolidated financial

statements

Consolidated Income Statement

(in € millions)

Six months ended March 31,

2021 Non audited

Six months ended March 31,

2020 Non audited

Revenue

1,869

2,459

Purchase of raw materials and

consumables

(578)

(797)

Personnel costs

(1,003)

(1,232)

Share-based compensation expense

-

(2)

Other operating expenses

(195)

(250)

Taxes other than on income

(36)

(43)

Depreciation, amortization and provisions

for recurring operating items

(81)

(84)

Net amortization of intangible assets

recognized on consolidation

(9)

(10)

Recurring operating profit/(loss)from

continued operations

(33)

41

Share of profit/(loss) of equity-accounted

investees

(1)

(1)

Recurring operating profit/(loss) from

continued operations including share of profit/(loss) of

equity-accounted investees

(34)

40

Non-recurring income and expenses, net

(3)

(6)

Operating profit/(loss) from continued

operations including share of profit/(loss) of equity-accounted

investees

(37)

34

Financial expenses

(26)

(20)

Financial income

6

3

Profit/(loss) from continued operations

before income tax

(57)

17

Income tax

4

(15)

Net profit/(loss) for the period from

continued operations

(53)

2

Net loss for the period from

discontinued operations

(3)

(20)

Net loss for the period

(56)

(18)

Attributable to:

Owners of the parent

(53)

(17)

Non-controlling interests

(3)

(1)

(in €)

Six months ended March 31,

2021 Non audited

Six months ended March 31,

2020 Non audited

Earnings/(loss) per share

Earnings/(loss) per share for the

period from continued operations

basic

(0.29)

0.02

diluted

(0.29)

0.02

Earnings/(loss) per share the period

from discontinued operations or being sold

basic

(0.02)

(0.12)

diluted

(0.02)

(0.12)

Total Earnings/(loss) per share

basic

(0.31)

(0.10)

diluted

(0.31)

(0.10)

Consolidated Balance sheet - Assets

(in € millions)

At March 31, 2021 Non

audited

At September 30, 2020

Audited

Goodwill

1,720

1,719

Intangible assets

210

221

Property, plant and equipment

295

314

Right of Use Asset

248

238

Other non-current assets

4

6

Non-current financial assets

111

111

Equity-accounted investees

-

-

Fair value of derivative financial

instruments (*)

-

-

Deferred tax assets

82

74

Total non-current assets

2,670

2,683

Inventories

92

102

Trade and other receivables

583

625

Contract assets

-

-

Current income tax assets

10

14

Other current assets

58

54

Short-term financial receivables

4

3

Cash and cash equivalents (*)

32

41

Assets classified as held for sale

23

17

Total current assets

802

856

Total assets

3,472

3,539

(*) Included in the calculation of net

debt

Consolidated Balance sheet: Equity and

liabilities

(in € millions)

At March 31, 2021 Non

audited

At September 30, 2020

Audited

Share capital

2

2

Retained earnings and other reserves

1,106

1,152

Translation reserve

(23)

(19)

Non-controlling interests

(5)

(3)

Total equity

1,080

1,132

Long-term debt (*)

803

781

Lease Liabilities - IFRS 16 (*)

201

192

Fair value of derivative financial

instruments (*)

3

6

Non-current liabilities relating to share

acquisitions

14

18

Deferred tax liabilities

-

-

Provisions for pension and other

post-employment benefit obligations

91

96

Other long-term provisions

24

23

Other non-current liabilities

-

-

Total non-current liabilities

1,136

1,116

Trade and other payables

486

448

Due to suppliers of non-current assets

11

11

Accrued taxes and payroll costs

484

536

Current income tax liabilities

6

1

Short-term debt (*)

3

2

Lease Liabilities - IFRS 16 (*)

61

58

Current liabilities relating to share

acquisitions

2

2

Short-term provisions

118

130

Contract liabilities

41

62

Other current liabilities

17

21

Liabilities classified as held for

sale

27

20

Total current liabilities

1,256

1,291

Total liabilities

2,392

2,407

Total equity and liabilities

3,472

3,539

(*) Included in the calculation of net

debt

1,038

998

Net debt excluding fair value of

derivative financial instruments and debt issuance costs

1,038

995

Consolidated cash flow statement

(in € millions)

Six months ended March 31,

2021 Non audited

Six months ended March 31,

2020 Non audited

Cash flows from operating activities –

continuing operations

Recurring operating profit/(loss)

including share of profit/(loss) of equity-accounted investees

(34)

40

Amortization and depreciation (1)

93

95

Provisions

(2)

-

EBITDA

57

135

Change in operating working capital

12

(38)

Interest and other financial expenses

paid

(18)

(11)

Tax reimbursed (paid)

2

2

Other

(11)

(4)

Net cash from operating activities -

continuing operations

42

84

Cash flows from investing activities -

continuing operations

Purchases of property, plant and equipment

and intangible assets

(32)

(55)

Proceeds from sale of property, plant and

equipment and intangible assets

3

2

Purchases of financial assets

(1)

(1)

Proceeds from sale of financial assets

-

-

Acquisitions of shares in consolidated

companies, net of cash acquired

-

(4)

Other cash flows related to investing

activities

-

-

Net cash used in investing activities –

continuing operations

(30)

(58)

Cash flows from financing activities –

continuing operations

Dividends paid to owners of the parent

-

-

Purchases of own shares

-

(21)

Proceeds from borrowings

231

732

Repayments of borrowings

(215)

(3)

Repayments of lease liabilities

(32)

(28)

Net cash from/(used in) financing

activities – continuing operations

(16)

680

Effect of exchange rate and other

changes

(2)

-

Net increase/(decrease) in cash from

continued operations

(6)

706

Net increase/(decrease) in cash from

discontinued operations

(4)

(6)

Net cash and cash equivalents at

beginning of period

40

76

Net cash and cash equivalents at end of

period

30

776

(1) Including €1 million in amortization

of advances on customer contracts for the six months ended March

31, 2021 and March 31, 2020.

Appendix 6: Definition of Alternative

Performance Indicators

Organic growth in consolidated revenue: as described in

Chapter 4, Section 4.2 of the fiscal 2018-2019 Universal

Registration Document, growth in consolidated revenue expressed as

a percentage and adjusted for the impact of (i) changes in exchange

rates, (ii) changes in accounting policies and (iii) changes in

scope of consolidation.

Retention rate: percentage of revenues retained from the

previous year, adjusted for the cumulative year-on-year change in

revenues attributable to contracts or sites lost since the

beginning of the previous year.

Adjusted EBITA: Recurring operating result reported

including the share of net result of equity-accounted investees

adjusted for the impact of share-based compensation expense (stock

options and performance shares granted by Group companies) and net

amortization of intangible assets recognized on consolidation.

The Group considers that this indicator best reflects the

operating performance of its businesses as it includes the

depreciation and amortization arising as a result of the capex

inherent to the Group’s business model. It is also the most

commonly used indicator in the industry and therefore permits

comparisons between the Group and its peers.

Adjusted EBITA margin: Adjusted EBITA as a percentage of

consolidated revenue.

Operating free cash flow: The sum of the following items

as defined in the 2018-2019 Universal Registration Document and

recorded either as individual line items or as the sum of several

individual line items in the consolidated cash flow statement:

- EBITDA.

- Net capital expenditure (i.e. amounts paid as consideration for

property, plant and equipment and intangible assets used in

operations less the proceeds received from sales of these types of

assets).

- Change in net operating working capital.

- Other cash movements, which primarily comprise cash outflows

related to (i) non-recurring items in the income statement and (ii)

provisions recognized for liabilities resulting from fair value

adjustments recognized on the acquisition of consolidated

companies.

This indicator reflects cash generated by operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210519005911/en/

Press Thibault Joseph – Thibault.Joseph@eliorgroup.com /

+33 (0)6 23 00 16 93

Investor relations Kimberly Stewart –

Kimberly.Stewart@eliorgroup.com / +33 (0)1 71 06 70 13

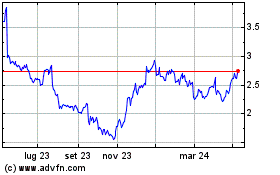

Grafico Azioni Elior (EU:ELIOR)

Storico

Da Mar 2024 a Apr 2024

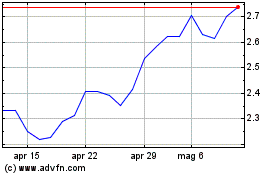

Grafico Azioni Elior (EU:ELIOR)

Storico

Da Apr 2023 a Apr 2024